A snapshot of the PC gaming market in 2025 reveals vibrant growth and evolving player behavior. From soaring revenue figures to shifting preferences in hardware and game genres, the platform remains a dynamic segment of the broader gaming industry. In the U.S., developers now release title launches simultaneously on PC and console to maximize reach and ROI, while globally, cloud services are lowering hardware barriers. Stay with us to explore the latest figures that define today’s PC gaming landscape.

Editor’s Choice

- Industry estimates suggest there were approximately 1.8 to 1.86 billion PC gamers globally in 2024, depending on the definition used, with annual growth rates ranging between 1.6% and 3%.

- The global PC gaming market (including software, hardware, and accessories) was estimated at around $76–77 billion in 2024, with projections of approximately $85–87 billion in 2025; figures vary depending on whether hardware revenues are included.

- PC segment accounted for roughly 23% of total gaming revenue in 2024 (~$43 billion).

- PC game content revenue in Q1 2025 declined approximately 9–10% year-on-year, from around $41.5 billion to $37–38 billion, reflecting post-pandemic spending normalization and fewer blockbuster releases.

- Asia‑Pacific led the regional PC market share with 46.7% in 2024.

- Steam hit a record 40 million concurrent users in early 2025.

- Japan’s PC gaming segment grew by roughly 15–17% in 2024 (JPY terms), outperforming both console and mobile segments in percentage growth.

Recent Developments

- PC gaming has reached mainstream acceptance in 2025, aided by portable options like the Steam Deck that bridge the gap between consoles and traditional PCs.

- Developers now favor simultaneous PC and console launches, maximizing audience reach amid rising AAA production costs.

- Steam registration of over 100,000 titles maintains its dominant distribution presence, estimated at 70% market share.

- Concurrent player peak on Steam reached 40 million in early 2025, a new record.

- Japan’s PC gaming revenue grew 7.8% in USD terms in 2024, bucking declines in other platforms.

- AMD achieved a 32% year‑over‑year revenue rise, led by strong demand for Ryzen CPUs and Radeon GPUs in the PC/gaming division.

- Amid broader gaming revenue declines, PC gaming revenues dropped 10%, signaling cooling momentum for early 2025.

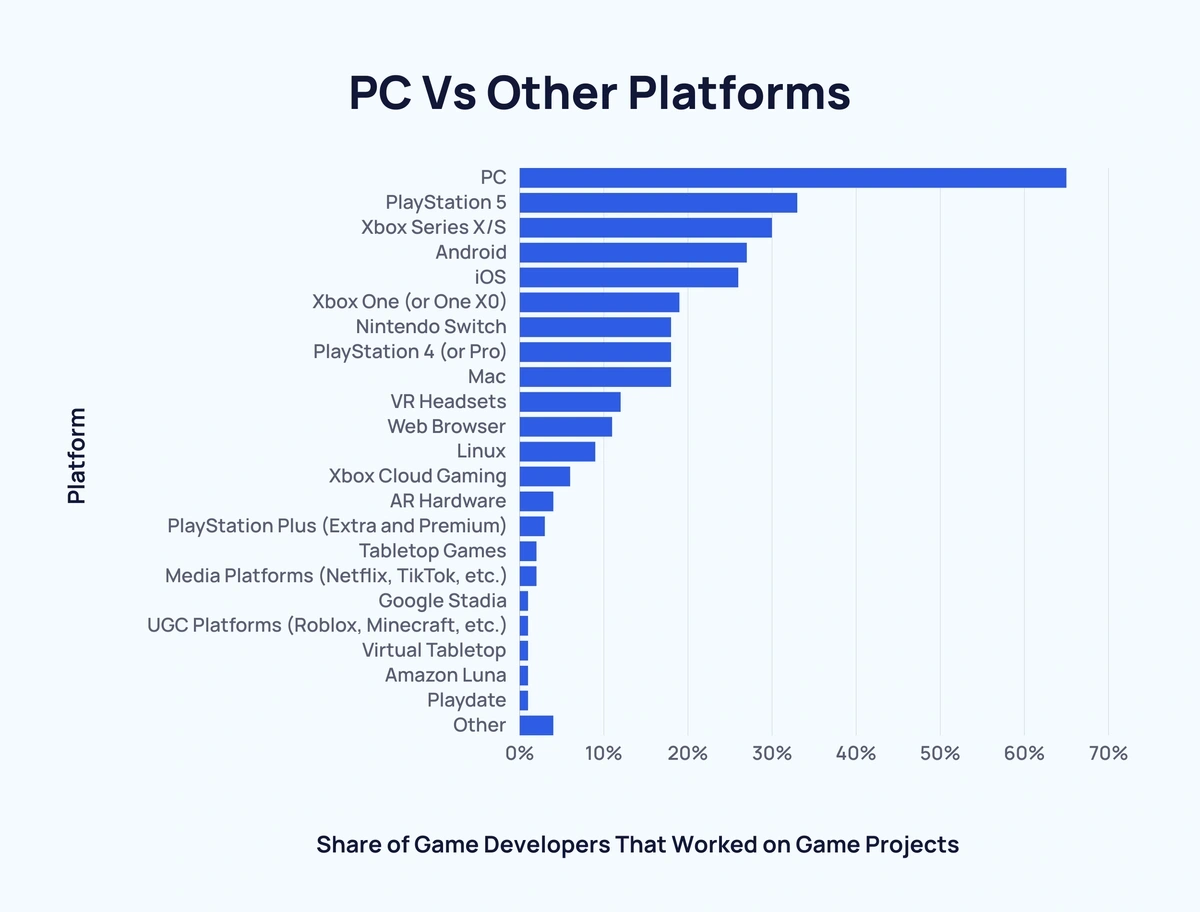

Game Developer Platform Preferences

- PC leads all platforms with 65% of game developers having worked on it.

- PlayStation 5 comes next at 33%, followed by Xbox Series X/S at 30%.

- Mobile platforms show strong representation: Android (27%) and iOS (26%).

- Older consoles like Xbox One (19%), Nintendo Switch (18%), and PlayStation 4 (18%) remain relevant.

- Mac matches legacy console support at 18%.

- VR headsets saw developer engagement from 12%, indicating niche but notable interest.

- Web browsers were used by 11% of developers.

- Linux accounted for 9%, still minor but active.

- Cloud and emerging platforms had lower shares:

- Xbox Cloud Gaming: 6%

- AR Hardware: 4%

- PlayStation Plus (Extra and Premium): 3%

- Minor platform engagement (each 2% or below):

- Tabletop Games and Media Platforms (Netflix, TikTok, etc.): 2% each.

- Google Stadia, UGC Platforms (Roblox, Minecraft), Virtual Tabletop, Amazon Luna, and Playdate all sit at 1%.

- Other platforms were mentioned by 4% of developers.

Global PC Gaming Market Size and Growth

- The global PC gaming market will expand from $76.7 billion in 2024 to approximately $152 billion by 2032, at a CAGR of about 8–9%, though other forecasters place CAGR between 6% and 8% depending on scope and methodology.

- Another estimate puts PC gaming at $33.47 billion in 2025, forecasted to reach $45.18 billion by 2030 (CAGR ~6.2%).

- PC share of total gaming revenue stood at 23% in 2024 (~$43 billion).

- However, Q1 2025 saw a decline in PC revenues from $41.5 billion to $37.3 billion.

- Asia-Pacific dominated the PC market with nearly 47% share in 2024.

- In Japan, PC gaming alone posted ¥240 billion in 2024, up 15-17% from the prior year.

- The forecast for Japan shows PC growth slowing to ~5.1% through 2027, while consoles rebound at 6.3%.

Regional Market Share Breakdown

- Asia‑Pacific claimed 46.7% of the global PC gaming market in 2024.

- In the U.S., PC remains a significant segment of the ~$50 billion North American gaming market.

- Japan’s PC gaming stood out with 15-17% growth in 2024, contrasting declines in console/mobile.

- Europe’s contribution to PC gaming is implied through its share of total gaming (~$33.6 billion market in 2024).

- Latin America and MEA regions are rising, despite smaller bases, e.g., Turkey’s gaming spending rose 28% in 2024.

- Japan leads in PC growth, but the console resurgence forecast suggests shifting regional dynamics soon.

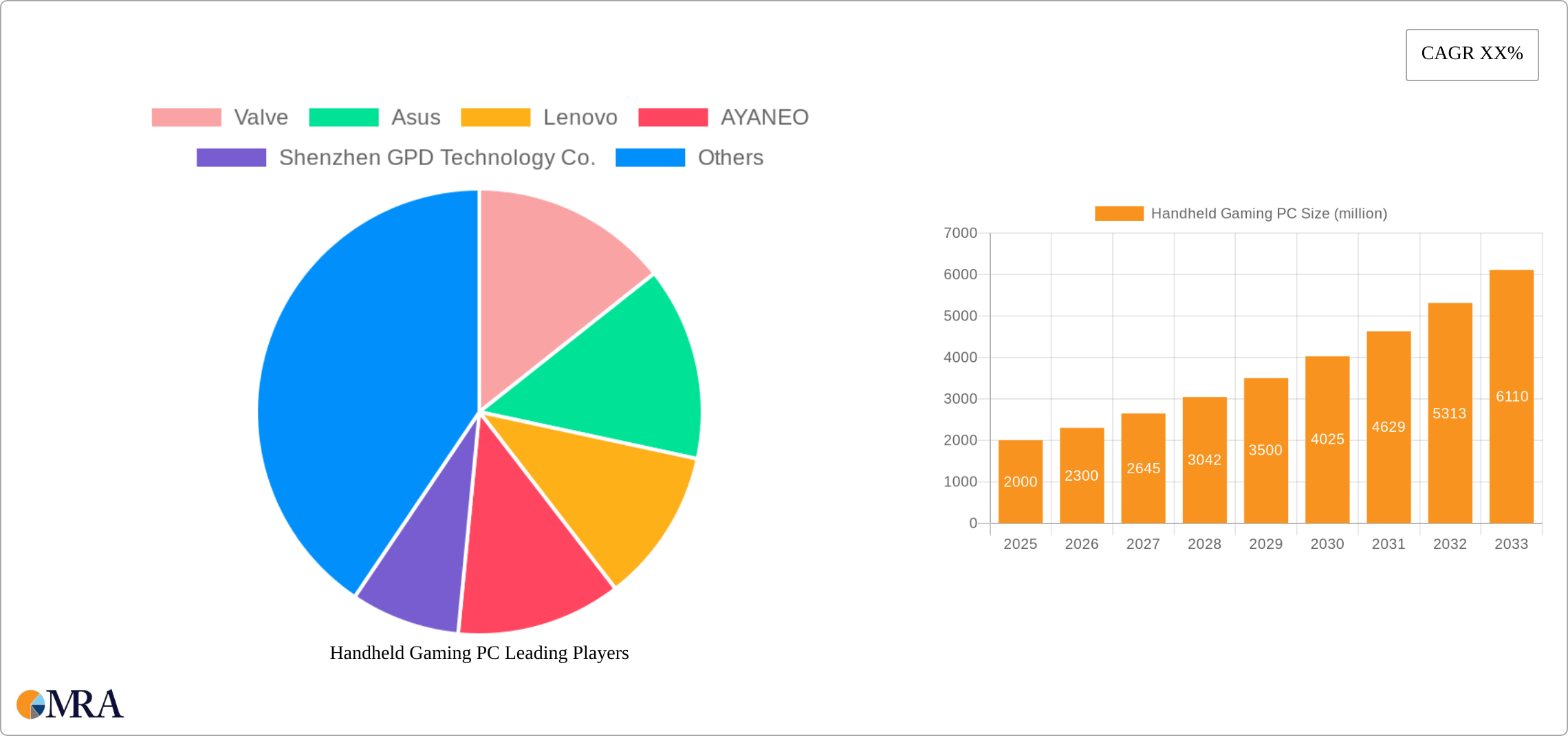

Handheld Gaming PC Market Outlook and Key Players

- The handheld gaming PC market is projected to grow steadily from $2.0 billion in 2025 to $6.11 billion by 2033.

- Growth trends show consistent year-on-year increases:

- 2025: $2,000 million

- 2026: $2,300 million

- 2027: $2,645 million

- 2028: $3,042 million

- 2029: $3,500 million

- 2030: $4,025 million

- 2031: $4,629 million

- 2032: $5,313 million

- 2033: $6,110 million

- CAGR (Compound Annual Growth Rate) is unspecified in the chart but implied to be strong and upward.

- Leading companies in the handheld gaming PC sector include:

- Valve

- Asus

- Lenovo

- AYANEO

- Shenzhen GPD Technology Co.

- The “Others” segment holds the largest share, indicating a fragmented and emerging market with various niche players.

PC Gaming Revenue Statistics

- PC revenue reached $41.5 billion in 2024 but declined to $37.3 billion in Q1 2025.

- PC made up 23–28% of the total gaming revenue mix (~$43 billion).

- Forecasts point to $76.7-77 billion in 2024, rising to $86.1 billion in 2025, then $152 billion by 2032.

- Other estimates put PC games at $33.5 billion in 2025, growing to $45.2 billion by 2030.

- Japan’s PC sector alone generated ¥240 billion (~7.8% YoY in USD) in 2024.

- Global industry remains in flux, with temporary downturns but longer-term upward trends.

Number of PC Gamers Worldwide

- 1.86 billion PC gamers globally in 2024, growing 1.6–3% annually.

- Roughly 1.9 billion by early 2025, with 300 million using high-end systems.

- Steam reports peak concurrent users reached 40 million in February 2025.

- Other data shows 907.5 million PC gamers in 2024, suggesting variation in definition across sources.

- Global active gamers across all platforms hit 3.32 billion in 2024.

- PC accounts for well over half of that base, underscoring its enduring scale.

PC Gaming vs Console and Mobile Market Share

- In 2024, PC games represented about 23% of global gaming revenue (~$43 billion), while consoles accounted for roughly 28% ($51 billion).

- Mobile gaming dominates in many regions, e.g., in Thailand, mobile claims 61% market share, PC 25%, and console 14%.

- Globally, desktop platforms account for about 40% market share, mobile nearly 58%, while console share hovers close to 0.03%.

- Overall gaming software revenue across PC and console is forecast at $85.2 billion in 2025, with console growing at a 7% CAGR through 2027, compared to 2.6% for PC.

- PC gaming content revenue growth has significantly outpaced consoles since 2011, with some analyses suggesting cumulative revenue advantages of over 200%, though definitions and included segments vary.

- While mobile outpaces both, PC maintains a strong niche, especially among dedicated or high-end gaming segments.

- In China, the 2025 market is projected at around $50 billion, with two-thirds coming from mobile, implying the remaining $16–17 billion is split between PC and console.

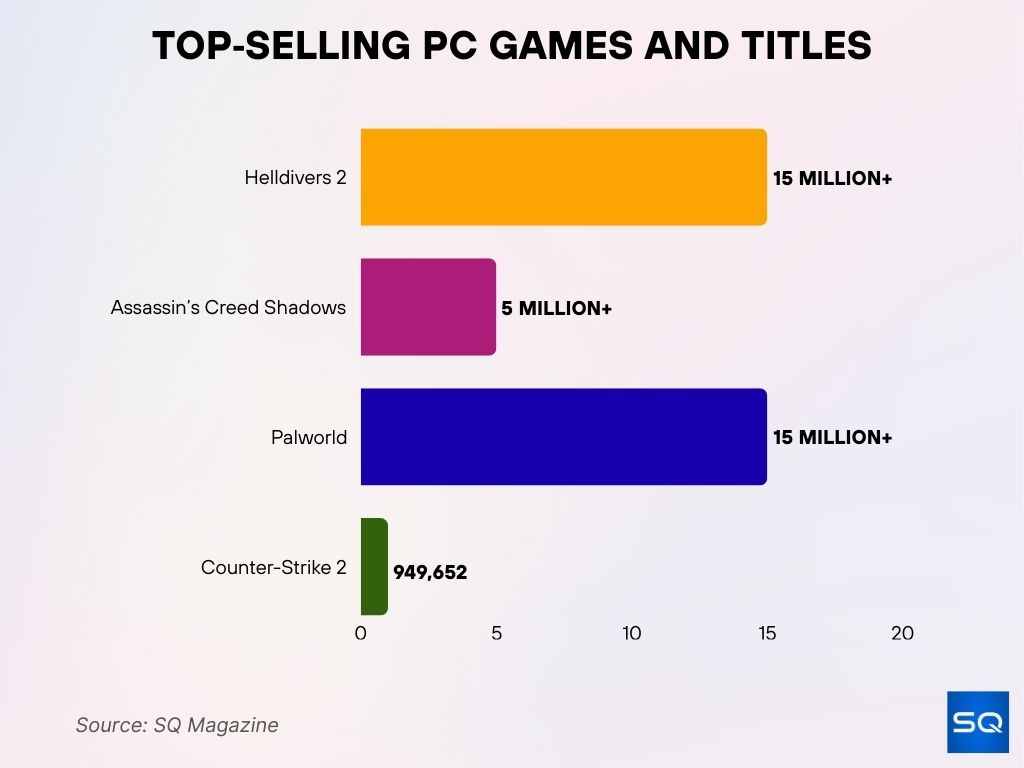

Top‑Selling PC Games and Titles

- Helldivers 2 exceeded 15 million units sold by November 2024, securing its spot as PlayStation’s fastest-selling game on PC.

- Assassin’s Creed Shadows hit 1 million players on launch day, grew to 3 million within a week, and surpassed 5 million unique players by July 2025.

- Counter‑Strike 2 & GO remained top in May 2025 for monthly active users.

- Counter‑Strike 2 averaged about 949,652 concurrent players in January 2025, leading the pack.

- Palworld, released in 2025, sold over 15 million copies on Steam within 45 days.

- Dota 2 followed closely behind CS2 in average concurrent players.

- R.E.P.O., Valorant, and Modern Warfare II/III ranked among the top-10 MAU titles.

Most Popular PC Game Genres

- Most popular game genres in 2025 include action RPGs, shooters, and adventure games.

- In game revenue rankings, adventure led, followed by battle royale, sports, shooter, and role-playing genres.

- Cozy games are surging, with listings growing from 15 in 2020 to 373 in 2024.

- These cozy titles attracted a 7.58% increase in gamers since 2022, including more women and older adults.

- Popular sub-genres include farming sims, narrative-driven adventures, and world-building games.

- Puzzle, strategy, and sports games remain regionally popular.

- Cross-genre innovation is on the rise, showcasing genre fluidity.

Monthly Active Users on PC Games

- Steam recorded 147 million monthly active users (MAU) in Q1 2025, up from 132 million in early 2024.

- Counter‑Strike 2 & GO held the top MAU position globally in May 2025.

- Fortnite and The Sims 4 ranked among the top places in the MAU rankings.

- Helldivers 2 rose 11 spots into the top 20 MAU games.

- Classic titles like Minecraft, LoL, and Dota 2 remain consistently strong.

- Steam’s MAU growth suggests a ~11% annual increase.

- These figures reinforce PC’s resilience and user engagement.

Gaming Subscription and Service Statistics

- In mid-2025, Xbox Game Pass passed 35 million subscribers, reaching 37 million by Q1.

- Game Pass Ultimate claims 68% of subscribers.

- Annual Game Pass revenue hit nearly $5 billion in FY25 Q4.

- Subscription pricing ranges from $10 to $20, generating over $340 million monthly.

- U.S. game subscription spending reached $0.6 billion in May 2025.

- The global subscription gaming market reached $11.53 billion in 2024, forecasted to hit $12.94 billion in 2025, with PC worth $7.32 billion.

- Online gaming subscriptions may grow from $11.4 billion in 2024 to $46.52 billion by 2034, CAGR 15.1%.

- Asia-Pacific contributed 41.2% of the total revenue in 2024.

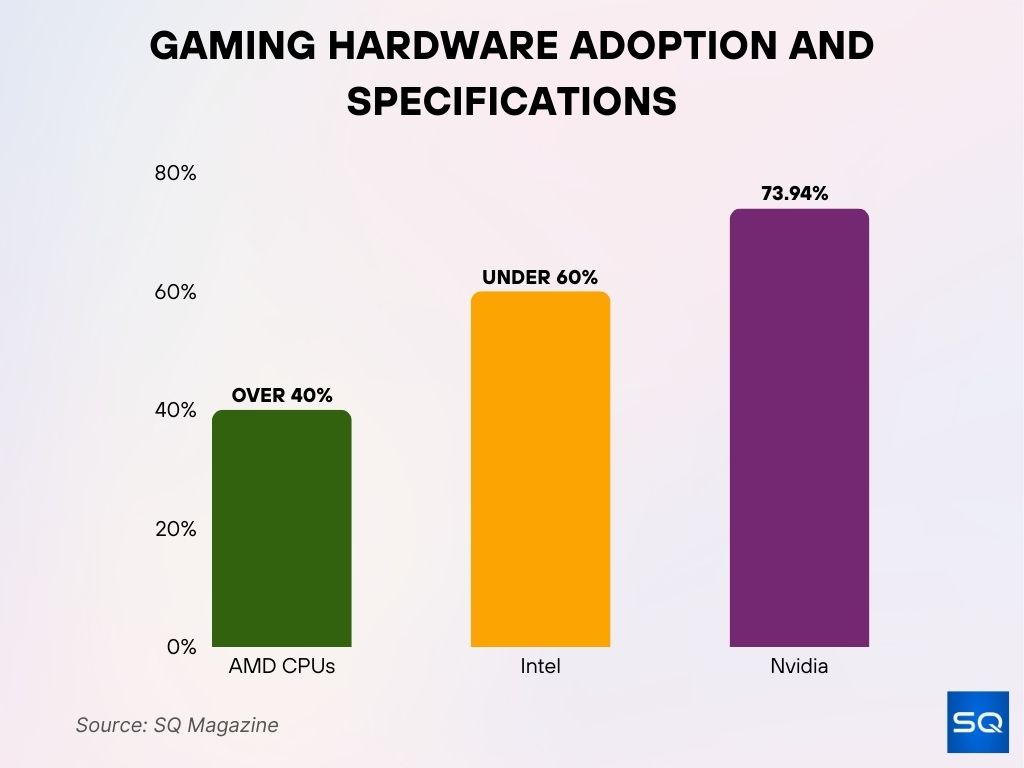

Gaming Hardware Adoption and Specifications

- As of July 2025, AMD CPUs account for over 40% of gaming systems on Steam, up from just 23% five years ago.

- Intel holds slightly under 60%, showing a steady decline in market share.

- Nvidia dominates discrete GPU share at 73.94%, with the mid-range RTX 5070 as the fastest-growing model.

- About 42% of PCs use 16 GB RAM, with 32 GB setups at 35.15%, signaling a growing demand for higher memory configurations.

- The most common GPU memory is 8 GB VRAM (33.66%), but 12 GB cards are rising (19.22%).

- Most gamers still play at 1080p resolution, supporting demand for budget-friendly options like 8 GB GPUs.

- High-end hardware like Nvidia’s RTX 50-series (Blackwell architecture) and AMD’s Radeon RX 9000-series are entering the ecosystem, offering GDDR7 support, ray tracing, and AI-accelerated features for enthusiasts.

PC Gaming Usage Patterns and Average Playtime

- The global average is about 8.45 hours of gaming per week, with U.S. players at 7.71 hours, and China leading at 12.39 hours/week.

- On average, gamers spend approximately 1.2 hours per day, or 33.8 hours per month, totaling 439.4 hours per year.

- In the U.S., 212.6 million people play video games at least one hour per week, with 75% logging four or more hours weekly.

- Engagement increased +6% year‑over‑year in 2024, though PC and Xbox playtime remained stable.

- Only 12% of total gaming hours came from new releases, with the rest driven by established franchises.

- Among Steam users, 67% of playtime was spent on games over six years old, 25% on titles aged 2–5 years, and just 8% on games under two years old.

- Weekly U.S. gamer breakdown: 28% play 1–5 hours, 25% play 6–10 hours, and 8% exceed 20 hours.

- Younger gamers (ages 18–24) average around 12 hours/week, while those over 45 play about 5 hours/week.

Trends in Digital Distribution Platforms (Steam, Epic, etc.)

- Steam reached 40 million concurrent users online in early 2025.

- Over 100,000 titles are available across platforms.

- Steam holds roughly a 70% share in digital PC distribution.

- Epic Games Store remains a top alternative.

- Ubisoft+ offers access to 100+ PC titles under a subscription.

- Boosteroid serves 6.8 million users as of October 2024.

- Boosteroid supports AV1 codec for efficient streaming.

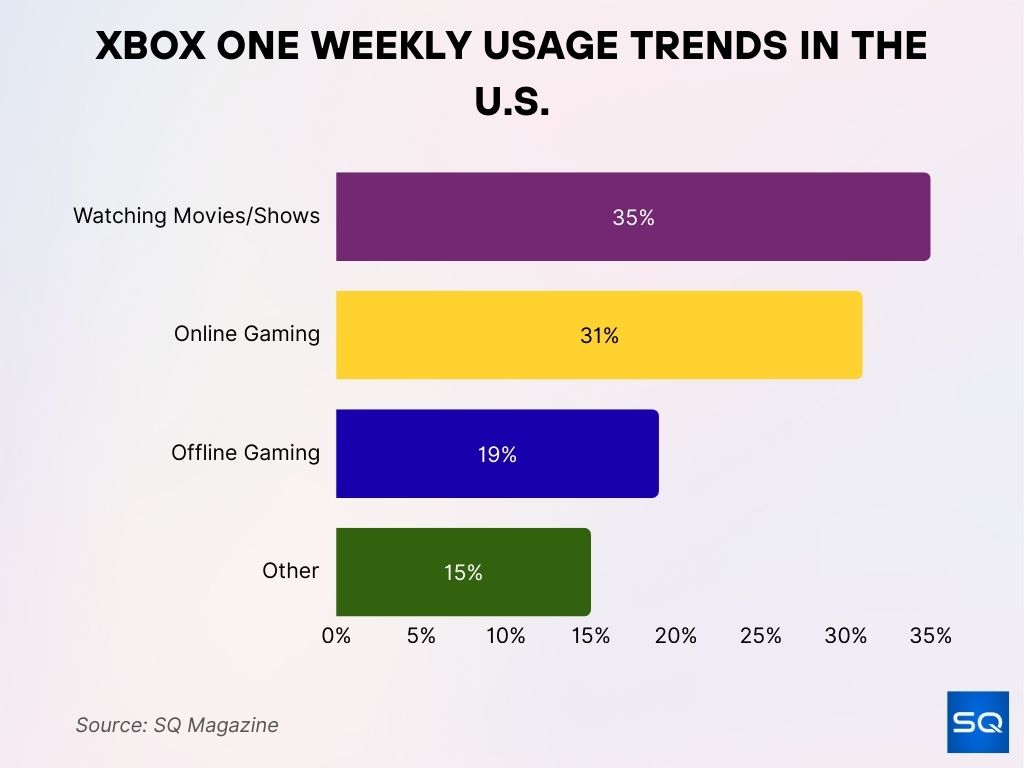

Xbox One Weekly Usage Trends in the U.S.

- Watching movies and shows accounts for the largest share of weekly Xbox One usage at 35%, highlighting its role as an entertainment hub beyond gaming.

- Online gaming follows closely, capturing 31% of weekly activity, showing strong engagement with multiplayer and connected experiences.

- Offline gaming makes up 19%, indicating continued interest in single-player or non-networked play.

- 15% of usage falls under “Other” activities, which may include browsing, apps, or system customization.

Esports and Competitive PC Gaming Statistics

- 2025 Esports World Cup includes 26 events across 25 games, with a $71.5 million prize pool.

- Global esports audience expected to hit 640.8 million in 2025.

- Market size projected to rise from $560.6 million in 2024 to $649.4 million in 2025, and $2.07 billion by 2032.

- Counter‑Strike leads all-time prize rankings.

- Sponsorship revenue to surpass $1 billion in 2025.

- EWC 2024 had 500 million online viewers.

- 2025 event expects 200+ teams and 2,000+ players.

Impact of Game Streaming and Cloud Gaming on the PC Market

- Boosteroid supports 6.8 million users.

- Cloud services allow gaming through Smart TV and browsers.

- Microsoft includes cloud gaming tools in its Ultimate tier.

- AAA titles can be streamed without high-end hardware.

Spending on In‑Game Purchases and Microtransactions

- The F2P PC market is estimated at $25.22 billion in 2024.

- 1.8 billion GaaS users reflect microtransaction prevalence.

- Pay-to-play low-end users: 297.6 million; premium: 179.5 million.

- Microtransactions dominate in shooters, RPGs, and MMOs.

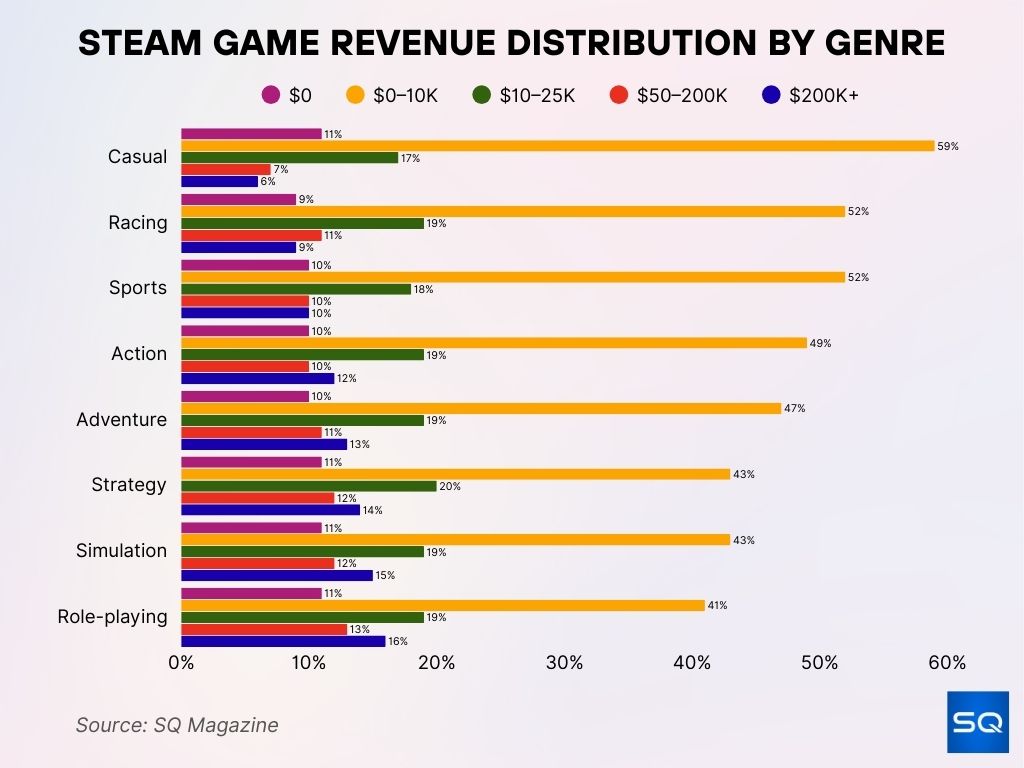

Steam Game Revenue Distribution by Genre

- Casual games are heavily concentrated in the low-earning bracket, with 59% earning under $10K, and only 6% surpassing $200K.

- Racing titles show moderate distribution: 52% under $10K, while 9% exceed $200K.

- Sports games have 52% earning less than $10K, but 10% break into the $200K+ range.

- Action games perform better than average in higher tiers: 12% exceed $200K, and 49% earn under $10K.

- Adventure games are similar, with 13% earning $200K+, and 47% in the $0–10K range.

- Strategy games show strong revenue spread: 20% in the $10–25K bracket, 14% above $200K, and only 43% below $10K.

- Simulation games have 15% of titles crossing $200K, with 43% still earning less than $10K.

- Role-playing games (RPGs) top the list in high earners, with 16% making $200K+, and 13% in the $50–200K range, indicating strong monetization potential despite 41% in the lowest tier.

Market Share by Gaming Hardware Manufacturer

- Steam Deck and cloud devices expand options.

- AMD and Nvidia remain dominant hardware suppliers.

- Cloud platforms reduce the need for high-end PCs.

Demographics of the PC Gamer Community

- 1.86 billion PC gamers globally in 2024.

- 1.8 billion use GaaS, highlighting subscription preference.

- 297.6 million low-end and 179.5 million premium P2P users.

- Cozy games attract more women and older adults.

Conclusion

The PC gaming market in 2025 remains a powerhouse, anchored by nearly 1.9 billion active gamers, robust subscription services, and expanding digital and cloud platforms. While PC revenues dipped slightly early in the year, long-term forecasts show growth, especially in emerging areas like esports, GaaS models, and streaming. Subscription models like Xbox Game Pass have reshaped value expectations, even as cloud gaming democratizes access. Competitive gaming continues to captivate millions, elevating PC’s cultural and economic impact.

As the ecosystem evolves, PC gaming stays at the forefront of innovation, delivering flexibility, reach, and immersion. For a deeper dive into specific segments or trends, I’d be glad to expand further.