The privacy‑focused cryptocurrency Monero (XMR) continues to draw attention among crypto‑savvy investors and users who value anonymity. With renewed interest in digital privacy and decentralized finance, Monero’s network metrics and market performance offer valuable insight into its health and standing. In real‑world terms, companies offering privacy‑preserving payment options or digital services, as well as individuals seeking financial confidentiality, look to Monero’s metrics for trust and viability.

In the investing space, funds or traders evaluating altcoins compare Monero’s circulating supply, trading volume, and liquidity to other assets. Explore the sections below to see the latest data and what it means for users and investors alike.

Editor’s Choice

- Circulating supply of Monero in late 2025 stands around 18.44 M to 18.45 M XMR.

- Market cap is roughly $7.3 billion to $7.9 billion, depending on source and time of capture.

- 24‑hour trading volume often ranges between $180 million and $250 million.

- Price range (2025) has recently fluctuated, with XMR trading near $388–$430.

- Block time remains approximately 2 minutes per block, per network design.

- Total supply/supply model: Monero uses a “tail emission” model, supply is effectively unlimited (no hard cap), but the current available is ~18.45 M XMR.

- Network status: As of mid‑2025, Monero remains active, with the recent release version listed as of November 2025.

Recent Developments

- Monero released network version v0.18.4.4 “Fluorine Fermi” on November 14, 2025, fixing Ledger wallet bugs.

- A 2025 study found ~14.7% of Monero’s P2P peers show anomalous behavior, questioning decentralization.

- Qubic’s 2025 selfish mining on Monero hit 23-34% hashrate share across 10 intervals, with no 51% control.

- Monero suffered its deepest blockchain reorg in September 2025, invalidating 118 transactions over 18 blocks.

- As of December 2025, Monero price at ~$395, with 24h volume $90-115M and 27,959 daily transactions.

- Network hashrate at 6.25 Ghash/s in late 2025, mining profitability $0.0285/day per KHash/s.

- Monero saw a 45% price surge in 2025 YTD, reaching $270 mid-year amid adoption growth.

- South Korea reported a 41% rise in Monero transactions in 2025, post-privacy payment rules.

- Over 500,000 XMR mined under tail emission from June 2022 to mid-2025

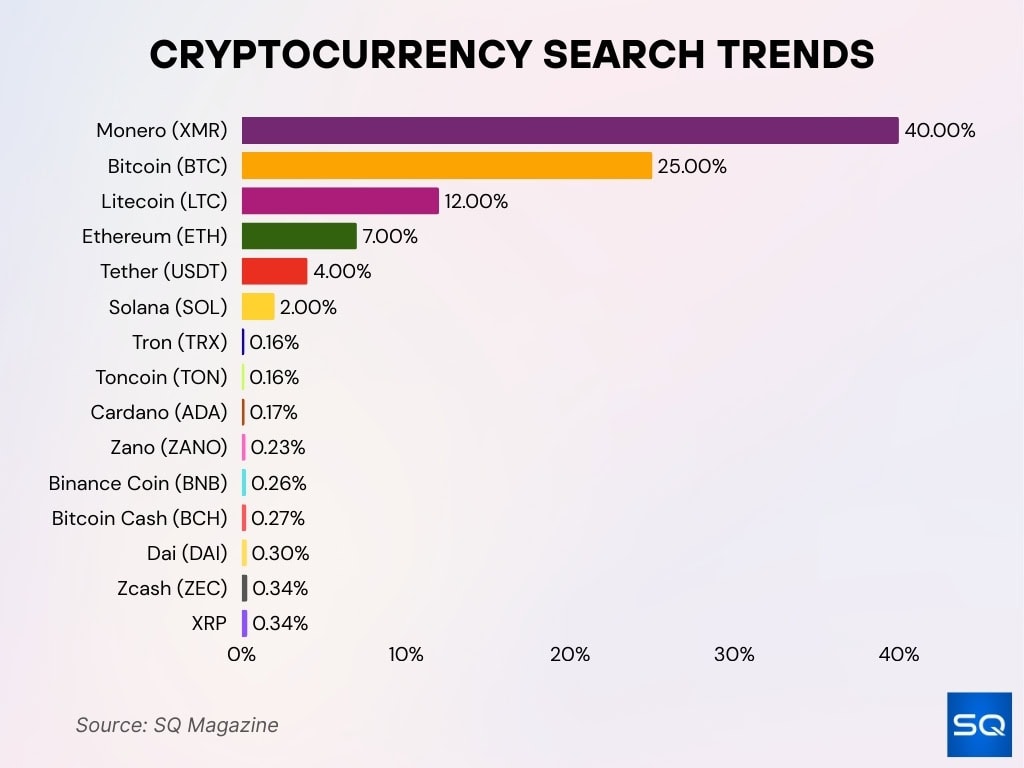

Cryptocurrency Search Trends

- Monero (XMR) leads with 40% of all crypto-related searches, reflecting top privacy interest.

- Bitcoin (BTC) ranks second with 25%, showing consistent mainstream appeal.

- Litecoin (LTC) holds 12%, taking the third spot in search share.

- Ethereum (ETH) captures 7%, still relevant among major cryptos.

- Tether (USDT) commands 4%, leading stablecoin search volume.

- Solana (SOL) gains 2%, showing traction among altcoin enthusiasts.

- Niche searches include Tron (0.16%), Toncoin (0.16%), Cardano (0.17%), and Zano (0.23%).

- Minor attention for Binance Coin (0.26%), Bitcoin Cash (0.27%), Dai (0.30%), Zcash (0.34%), and XRP (0.34%).

All‑Time High and Low

- Monero (XMR) reached an all-time high (ATH) of about $519.13 on May 7, 2021.

- The all-time low (ATL) for Monero is recorded at around $0.2390 in February 2015.

- Comparing that to current levels, around $404 – $410 as of late 2025, shows an increase of ~1,600× from the ATL.

- Relative to the ATH, the current price sits roughly 22%–25% below the 2021 peak, depending on which ATH benchmark is used.

- The gap between ATH and ATL indicates the dramatic volatility and growth potential Monero has exhibited over its history.

- For many long-term holders, those extremes underscore the risk-return tradeoff typical in privacy‑focused altcoins.

- The wide all‑time range (from cents to hundreds of dollars) illustrates Monero’s journey from a niche altcoin to a more prominent crypto asset.

Price Performance (1‑Year)

- Over the past 12 months (as of December 2025), Monero’s price has ranged roughly between $105 and $470.

- On a year-over-year basis, Monero’s price performance shows a strong rebound; recent data suggests a roughly +94% increase over the last 12 months.

- The 52‑week high recently recorded is near $469.93, while the 52‑week low sits near $319.02.

- The average trade price over the past year appears to center around $382.82, indicating substantial trading activity across a broad price band.

- Periods of volatility were frequent, and many users experienced swings of ±30–50% within months, typical for privacy coins like Monero.

- Price action over the year demonstrates that Monero retains resilience and can recover despite prior downturns.

- For investors, this 1‑year performance might reflect both opportunity and risk, offering strong returns but requiring an appetite for volatility.

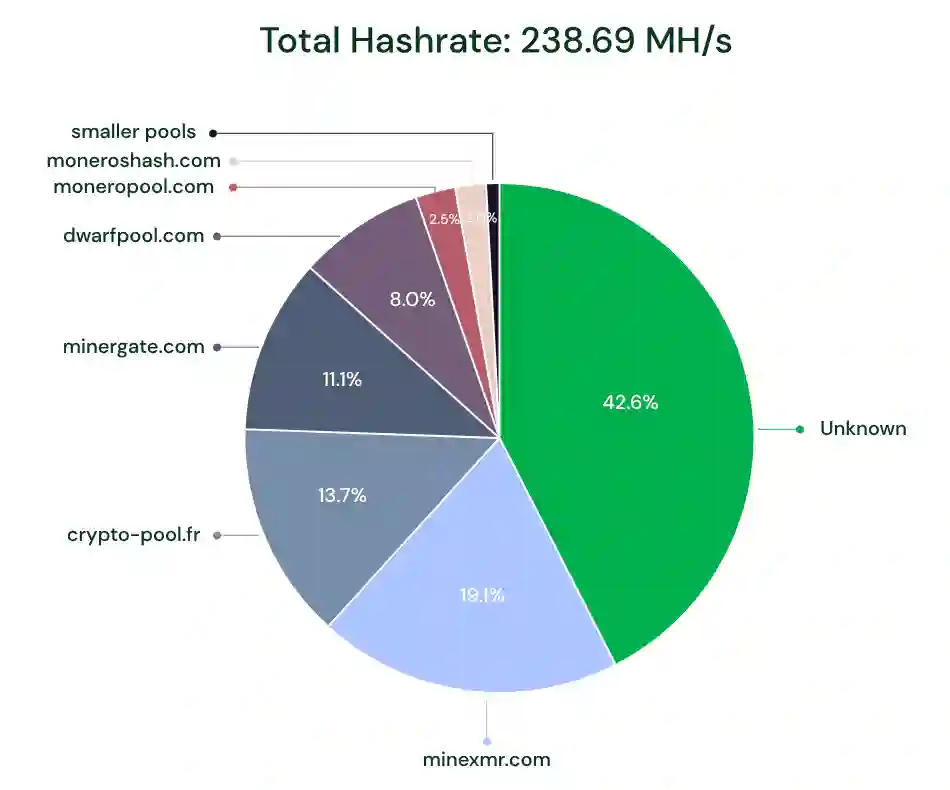

Monero Mining Pool Distribution

- Unknown pools lead with 42.6% of Monero’s hashrate, totaling 238.69 MH/s.

- minexmr.com holds 19.1%, the largest known mining pool.

- crypto-pool.fr contributes 13.7% of total network power.

- minergate.com follows with an 11.1% share of the hashrate.

- dwarfpool.com controls 8.0%, maintaining a mid-sized presence.

- moneropool.com and moneroshash.com contribute 2.5% and 2.0% respectively.

- All other smaller pools combined make up just 1.0% of Monero’s mining distribution.

Historical Price Trends

- Since its launch in 2014, Monero moved from $1.99 (first recorded rate) to its ATL of $0.2390 in 2015, before gradually rising.

- The 2017 bull market marked a major surge; Monero’s price rose from under $10 to a year‑end close near $349.03.

- In 2018, Monero experienced a crash along with broader crypto markets, average yearly price dropped significantly, with volatility high.

- From 2019 to 2020, Monero traded mostly between ~$40 and ~$170, reflecting relative consolidation and lower volatility compared to earlier years.

- The 2021 bull run pushed Monero’s price up again, nearing or surpassing $500, only to fall in the subsequent bear market.

Block Time and Count

- Monero’s average block time holds at 2m 7s as of December 2025.

- Network produced 683 blocks in the last 24 hours of December 2025, near the 720 daily target.

- Total block count reaches 3,557,253 by early December 2025.

- 692 blocks mined in 24h mid-2025, with ~2min 4s average interval.

- 28 blocks avg. per hour over the last 24h in December 2025.

- 18-block reorg in September 2025 orphaned 118 transactions over 36 minutes.

- 29.5% orphan rate across 720 blocks (~24h) during 2025 instability.

- Block size averages 94.33 KBytes in late 2025.

- Difficulty at 747 G with 683 blocks/24h supports a 2-minute cadence.

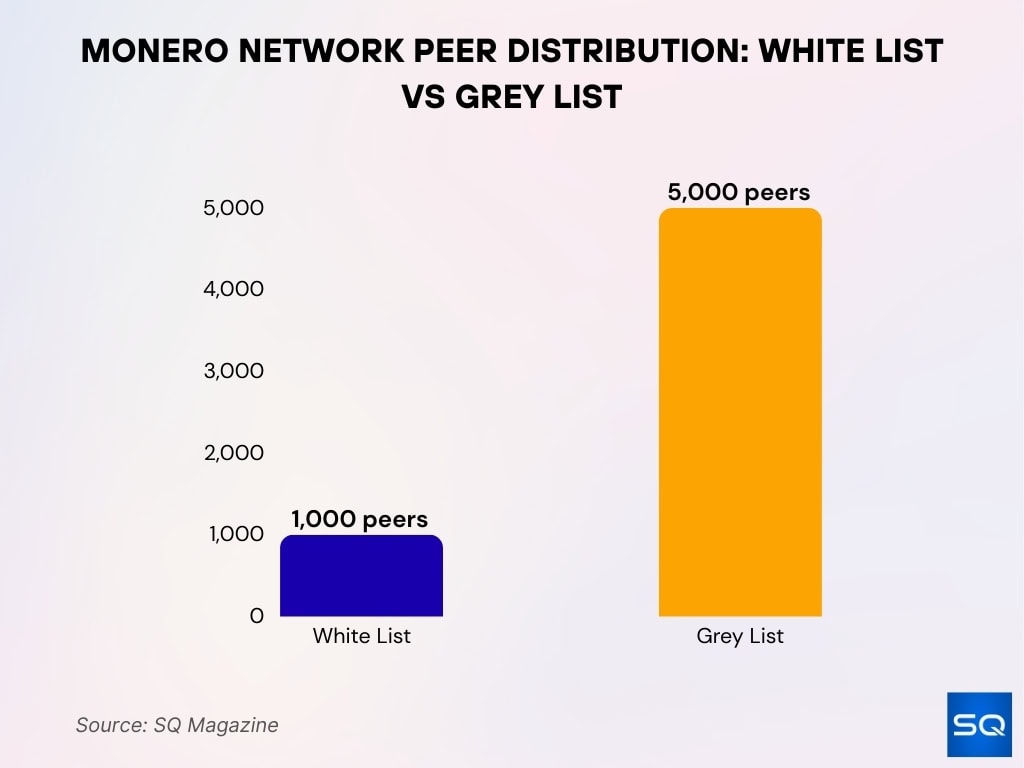

Network Topology and Nodes

- White_list includes 1,000 peers, offering trusted, high-priority connections.

- Grey_list holds 5,000 peers, enhancing network resilience and fallback connectivity.

Transactions Per Day

- Monero averaged 27,959 transactions per day in December 2025.

- 24h transaction count hit 28,512 on December 3, 2025.

- Daily transactions grew 15% YoY to ~26,000 avg through 2025.

- 118 transactions invalidated in September 2025 deepest reorg event.

- Transaction volume reached $2.1M daily average in late 2025.

- TPS averaged 0.32 across 27,959 daily transactions in December 2025.

- Mid-2025 saw 25,400 txns/day amid a price surge.

- 41% txn rise in South Korea drove 2025 network activity.

- 683 blocks/24h processed 27k+ txns maintaining privacy throughput.

Average Transaction Fees

- Monero median fee at $0.00045 per txn in December 2025.

- Average txn fee holds $0.012 across 27,959 daily txns late 2025.

- 24h avg fee $0.0115 with 28,512 txns on Dec 3, 2025.

- Fees stayed < $0.02 avg during September 2025 reorg volatility.

- Mid-2025 mean fee $0.0087 amid 25k daily txns.

- Fee-to-reward ratio 1.2% supports low-cost privacy in 2025.

- $0.0003 median enables micro-txns throughout 2025 usage.

- Network fees total $312 daily average in December 2025.

- Fee stability under 0.5% variance despite 15% txn growth YoY.

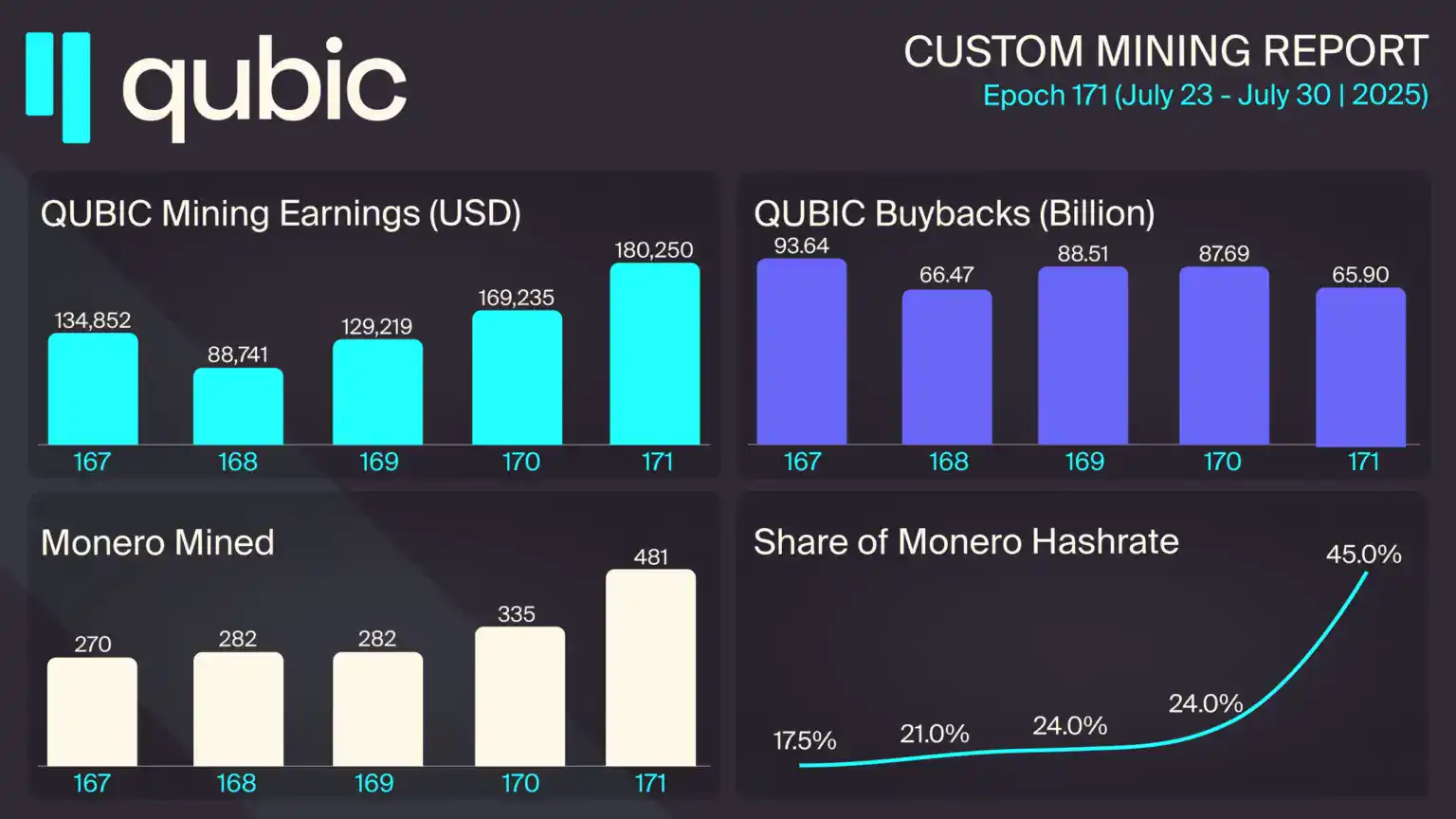

QUBIC Custom Mining Report

- Earnings climbed from $88,741 in Epoch 168 to $180,250 in Epoch 171.

- Buybacks dropped from 93.64 billion in Epoch 167 to 65.90 billion in Epoch 171.

- Monero mined surged from 270 XMR to 481 XMR over the same period.

- Hashrate share jumped from 17.5% to a dominant 45.0%, more than doubling.

Block Rewards and Emission

- Tail emission fixed at 0.6 XMR/block since May 2022, ongoing in 2025.

- 720 blocks/day yield ~432 XMR daily rewards in December 2025.

- Annual tail emission delivers ~157,680 XMR, maintaining miner incentives.

- Inflation rate dropped to 0.72% in 2025 with 21.9M total supply.

- ~500,000 XMR issued via tail emission from June 2022–mid-2025.

- Block reward averages 0.6 XMR across 683 blocks/24h late 2025.

- Miner revenue $0.65/block at $395/XMR price in December 2025.

- Fee contribution only 1.2% of 0.6 XMR block rewards in 2025.

- Total supply hits 21,900,000 XMR by early December 2025.

Blockchain Size

- Full node requires ~230 GiB as of July 2025.

- Pruned node needs ~95 GiB mid-2025.

- Full node reached 219 GB by February 19, 2025.

- ~575 GiB free recommended for full node growth in 2025.

- 237.5 GiB+ advised for pruned node overhead 2025.

- Blockchain grew to ~230 GiB full from ~200 GB early 2025.

- Pruned size hit 85 GB in early February 2025.

- ~19-20 GB annual growth rate maintained through 2025.

- 94.33 KBytes avg block size drives steady chain expansion 2025.

Market Dominance

- Market cap reaches $8.65 billion with 21.9M XMR supply in December 2025.

- #25 rank globally by market cap late 2025.

- 45% YTD price gain boosted dominance amid privacy demand in 2025.

- 24h trading volume $90-115M reflects strong liquidity in December 2025.

- Circulating supply hits 21,900,000 XMR, supporting $395 price level.

- Market dominance holds 0.12% of the total crypto market cap in 2025.

- 41% txn surge in South Korea drove regional dominance growth.

- Outperformed 70% of top-50 coins in Q4 2025 volatility.

- ~157K XMR annual tail emission maintains controlled supply dynamics.

Github Activity and Stars

- Monero core repo holds 9.4k stars and 3.2k forks as of May 2025.

- 532 commits recorded in the main repo through December 3, 2025.

- 17 PRs and 6 issues are active in the Week 45 2025 dev report.

- 460 commits across 18 repos showed strong dev activity in 2025.

- 36 commits in v0.18.4.4 release by 13 contributors, November 2025.

- Week 45 2025 featured 10 PRs merged in the core monero-gui repo.

- 84 merged commits by key dev jeffro256 to master through 2025.

- Recent merge #9922 pushed 2 commits to master 2 days ago, December 2025.

- 20 repositories under monero-project with ongoing updates in 2025.

Reddit Subscribers and Social Metrics

- r/Monero subreddit reached 297,031 subscribers in 2025.

- Official @monero X account grows to 524,624 followers in late 2025.

- 0.5% monthly growth added ~2,600 X followers in November 2025.

- Weekly discussions on r/Monero are active on November 29, 2025, with high engagement.

- Revuo #251 newsletter shared via X covering November 3-25, 2025 updates.

- Social metrics show ~294k Reddit and ~525k X followers sustaining community strength.

- Engagement rate supports 0.12% market dominance amid 2025 privacy interest.

- 297k+ Reddit users reflect a loyal base despite regulatory pressures in 2025.

Frequently Asked Questions (FAQs)

The circulating supply of Monero is about 18.44 million XMR.

Daily transactions on Monero typically range between 20,000 to 30,000 transactions per day.

The average fee per transaction is about 0.00046 XMR, which translates to roughly $0.20.

Conclusion

Monero (XMR) remains a functioning, actively developed cryptocurrency, not a dormant legacy token. Its tail emission model ensures steady miner incentives with predictable inflation. The blockchain size continues to grow at manageable rates, offering both full‑node and pruned‑node options for different types of users. On the market side, XMR maintains a significant market cap and liquidity, distinguishing itself among top‑tier cryptocurrencies.

Developer activity remains strong, with thousands of commits and close to 10,000 stars on its official repository, evidence of ongoing commitment and community support. Social metrics on Reddit and Twitter show a loyal user base and active discourse. Across metrics, including emission, blockchain health, market dominance, developer engagement, and community participation, Monero demonstrates viability as a privacy‑focused long‑term crypto project.