The AI image generator Midjourney has rapidly shifted from a niche tool to a mainstream creative engine. Artists and brands alike now use it for concept art, marketing visuals, and rapid prototyping, while design teams employ it to streamline workflows and reduce production time. In this article, you’ll find detailed statistics that highlight Midjourney’s adoption, demographics, usage patterns, and growth, revealing how the platform is transforming visual content creation and what that means for industries now and ahead.

Editor’s Choice

- ~21 million registered users on Discord by May 2025.

- Daily active users commonly range between 1.2 million and 2.5 million.

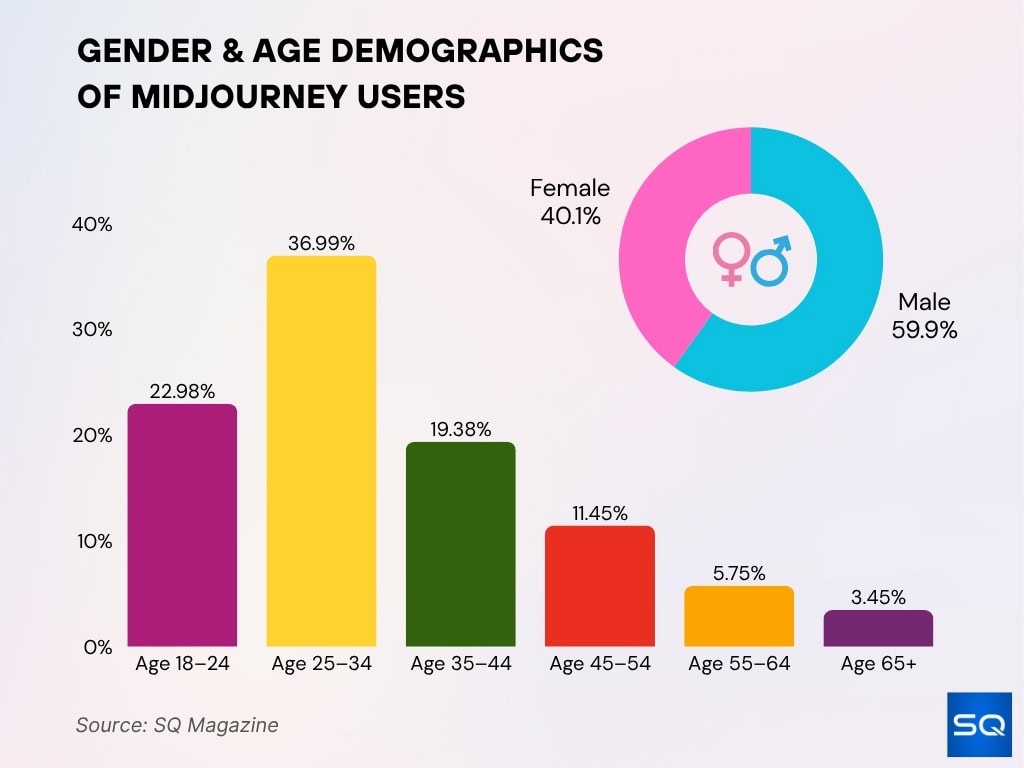

- User base is roughly 59.9% male / 40.1% female.

- The largest user age-group is 25–34 years at ~37%.

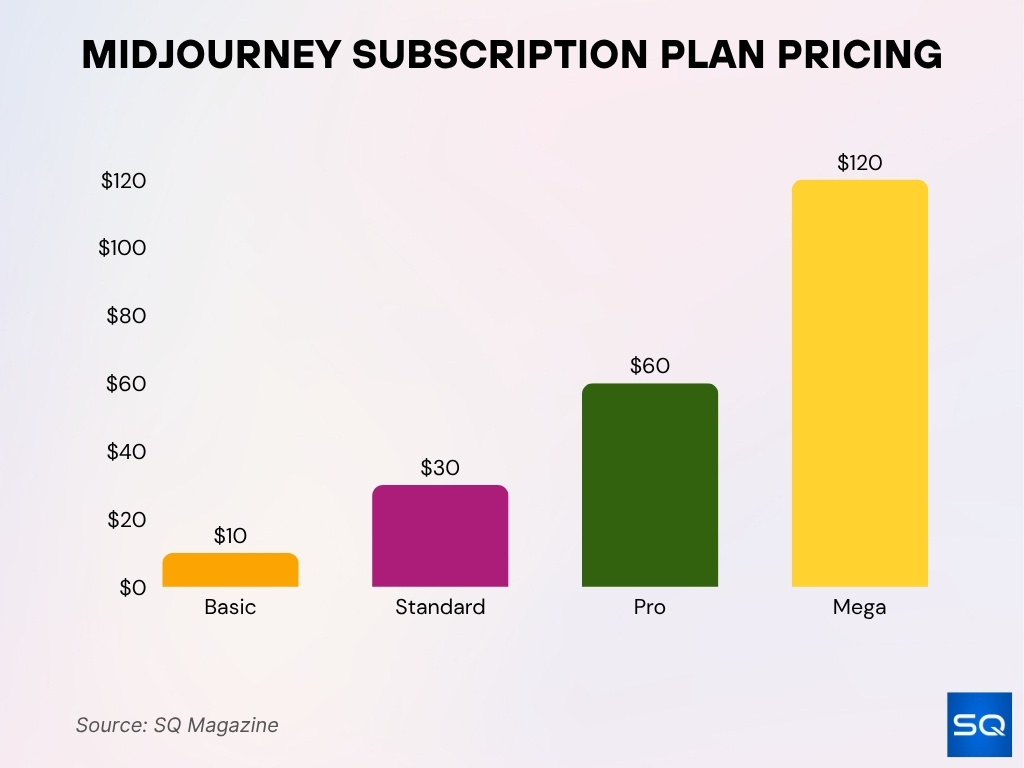

- Basic subscription pricing begins at $10/month in 2025.

- Estimated revenue reached $300 million in 2024.

- Midjourney holds >25% market share in generative image platforms, ahead of many competitors.

Recent Developments

- Midjourney’s Discord community reached around 21 million members by mid-2025.

- The platform launched its first video-generation tool, V1, in June 2025, enabling 5-20 second video clips.

- Midjourney’s version V7, released in April 2025, became the default model by June, expanding creative features.

- Subscription tiers in 2025 range from $10 to $120 per month with varying GPU hours and features.

- Midjourney has generated over $300 million in revenue by mid-2025 without major advertising spend.

- Meta partnered with Midjourney in August 2025 to license AI image and video tech for its products.

- Subscription plans include a 20% discount for annual billing options as of 2025.

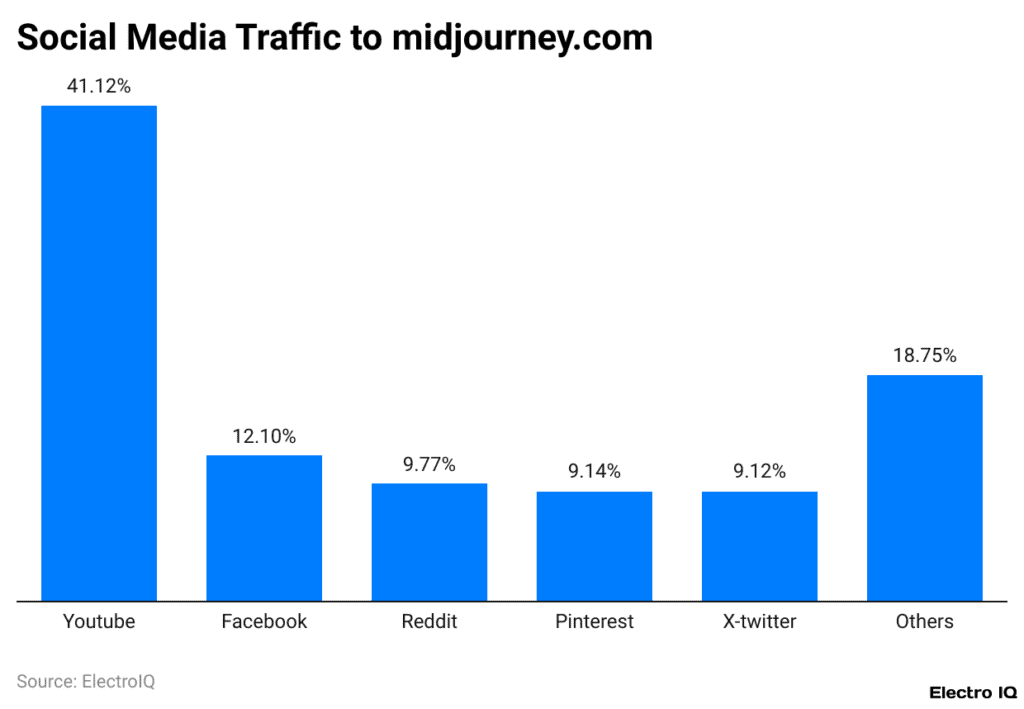

Social Media Traffic to Midjourney.com

- YouTube drives the largest share of traffic to Midjourney.com, accounting for 41.12% of all social media referrals, highlighting the platform’s strong influence in visual and AI-generated content communities.

- Facebook contributes around 12.10% of traffic, showing continued relevance among broader creative audiences and community groups.

- Reddit generates 9.77%, reflecting active discussions in AI art and prompt-sharing subreddits.

- Pinterest follows closely with 9.14%, benefiting from the visual discovery nature of Midjourney outputs.

- X (Twitter) accounts for 9.12%, used mainly for AI art showcases, quick tips, and creative trends.

- Other sources collectively represent 18.75%, including niche platforms, forums, and Discord shares.

Daily Active Users Statistics

- Some estimates report about 1.1 million concurrent active users online at any moment.

- Website visits to midjourney.com exceed 500,000 daily on peak days.

- High engagement is indicated by millions of images generated daily and active community participation.

- Strong DAU supports Midjourney’s subscription revenue, contributing to over $300 million in 2025.

- DAU spikes by 20-30% on new version releases and major community events.

Geographic Distribution of Users

- The U.S. contributes about 17.58% of traffic to Midjourney’s website in 2025.

- In September 2025, the U.S. share was approximately 18.55% of traffic.

- Top countries by traffic share include: United States (~16.28%), India ~8.07%, United Kingdom ~4.33%, Germany ~4.07%, Brazil ~3.98%.

- Over the period March-May 2025, American users made up approximately 18.78% of global traffic.

- The geographic spread suggests strong global interest, with the U.S. leading but a significant share in Asia, Europe, and Latin America.

Age Demographics of Users

- According to data for 2025, ~59.9% of Midjourney visitors are male, ~40.1% female.

- The largest age bracket using Midjourney is 25-34 years, accounting for about 36.99% of users in 2025.

- Users aged 18-24 years comprise approximately 22.98% of the user base.

- Those in the 35-44 years group make up about 19.38% of users.

- The 45-54 years group represents ~11.45% of users.

- Users aged 55-64 years are about 5.75%.

- Those 65 years and above account for around 3.45% of users.

- These numbers suggest Midjourney is strongly adopted by younger, digital-native users.

Device Usage (Desktop vs Mobile)

- ~72% of desktop users of Midjourney reported using Windows, ~29% using Mac, and ~4% using Linux.

- Among mobile users, approximately 54% used Android devices and ~46% used iOS (as of mid-2025).

- For the Midjourney website, the average visit duration on mobile decreased from ~5 min 44 sec in March 2025 to ~3 min 44 sec in May 2025.

- Pages per visit for midjourney.com were reported at ~35.36 pages per visit (Sep 2025).

- Bounce rate for the website stood at ~22.53% in September 2025.

- The dominance of desktop usage (especially Windows) suggests a large professional or serious-user base, while mobile use remains substantial for casual or entry-level access.

- Device usage trends point to continued investment in desktop tool capabilities (e.g., high-GPU use) alongside mobile accessibility.

Subreddit Members Growth

- The Midjourney subreddit had grown to approximately 1.7 million members by October 2025.

- Members increased from about 936,516 in November 2023 to 1.1 million by February 2024.

- The subreddit growth reflects interest beyond Discord’s 20 million users, capturing public and engaged audiences.

- Daily posting and commenting activity averages around 4,000 posts and comments combined.

- Engagement per user varies, with active contributors estimated at about 15-20% of total members.

- The subreddit serves as a public showcase and prompt-sharing forum for the AI tool.

- Growth rate averaged about a 15% increase per quarter in 2024-2025.

Subscription Plans and Pricing

- In 2025, pricing (monthly) begins at $10 for Basic, ~$30 for Standard, ~$60 for Pro, and ~$120 for Mega.

- Midjourney offers four subscription tiers: Basic, Standard, Pro, and Mega.

- Annual payment discounts: Basic at ~$96/year (≈ $8/month) in 2025.

- Plans differ on GPU time (fast vs relax), number of concurrent jobs, and features like Stealth Mode (privately generated images).

- Commercial use guidelines: If a company makes over $1 million in gross revenue annually, it must use the Pro or Mega plan.

- Pricing reflects a tiered model that accommodates hobbyists, professionals, and agencies.

- The pricing structure indicates conversion pathways from low-cost entry to higher tiers as users increase usage or commercialize their output.

Revenue Growth by Year

- Midjourney’s recorded revenue: ~$50 million in 2022, ~$200 million in 2023, ~$300 million in 2024, and projected ~$500 million in 2025.

- The growth from 2024 to 2025 (~66.7% increase) underscores accelerating monetization.

- Steady and rapid revenue growth despite minimal external funding suggests strong product-market fit.

- Revenue growth aligns with user base expansion, higher plan adoption, and commercial usage.

- The subscription model provides recurring revenue and scales with user engagement, a positive signal for sustainability.

- Given large user counts, conversion of free/trial to paid plans appears to be effective.

- The rising revenue also creates potential for further investment, feature expansion, and enterprise adoption.

Company Valuation and Funding

- The company behind Midjourney remains entirely self-funded, having raised zero external venture capital funding as of May 2025.

- Despite this, Midjourney has achieved profitability and claims to have built a sustainable business model around its subscription tiers.

- Revenue estimates show a progression from roughly $50 million in 2022 to around $200 million in 2023, then up to ~$300 million in 2024, with projections nearing $500 million in 2025.

- Some sources estimate a valuation framework based on revenue, suggesting a potential worth of $10 billion or more.

- Because the company is privately held, transparency around ownership, investor returns, and future fundraising remains limited.

- The self-funded route allows for more independence, but also means that scaling and capital access might be constrained relative to VC-backed rivals.

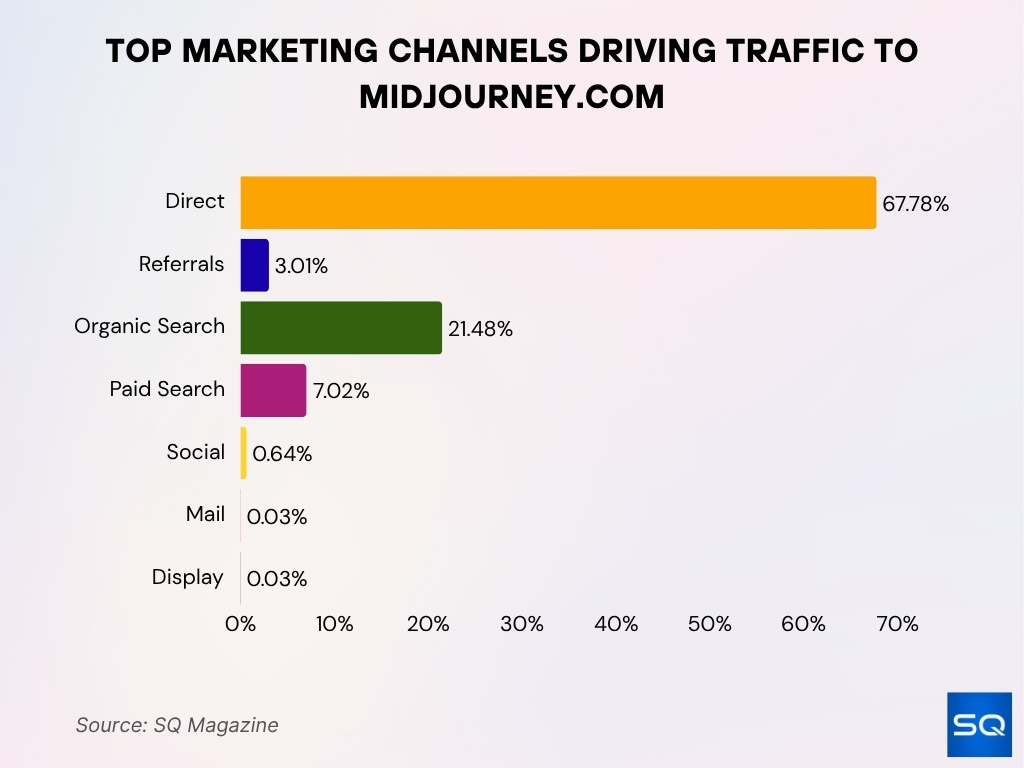

Top Marketing Channels Driving Traffic to Midjourney.com

- Direct traffic dominates Midjourney’s marketing performance, contributing 67.78% of total visits, showing the platform’s strong brand recognition and loyal user base.

- Organic search accounts for 21.48%, highlighting steady inbound interest from users searching for AI art tools, prompt guides, and visual creation trends.

- Paid search contributes 7.02%, reflecting targeted campaigns likely aimed at converting new users or promoting premium tiers.

- Referrals generate 3.01% of total traffic, driven mainly by content partnerships, blog mentions, and community sites.

- Social media represents a small share at 0.64%, despite Midjourney’s strong creative presence on YouTube and Reddit.

- Email (Mail) and Display ads each bring in just 0.03%, suggesting minimal reliance on outbound or display-based marketing efforts.

Market Share Compared to Competitors

- Midjourney holds just over 25% market share in the global generative AI image-tool sector, placing it ahead of competitors such as DALL·E 3 (~24.4%) and NightCafe (~23.2%).

- Midjourney’s community on Discord, approaching ~21 million users in 2025, supports its large-scale presence in the field.

- Midjourney’s design focus on creative-artistry (versus purely photorealistic output) gives it a distinct niche compared to some competitors that emphasise realism or business integration.

- The generative-image market continues to expand rapidly, meaning that holding ~25% share today still leaves significant room for growth and competition.

- Given the subscription model and community-based adoption (via Discord), Midjourney may have a stronger share of active “creator-artists” compared to business-users, though detailed segmentation data is scarce.

- As newer tools and models emerge (e.g., video generation, 3D output, enterprise APIs), maintaining or increasing share will likely depend on feature evolution and business-market fit.

User Engagement Metrics

- Midjourney’s Discord community includes about 21 million members as of 2025.

- Many engaged users generate 10+ images per session on average.

- Public sharing of generated images increases network visibility by an estimated 30-40%.

- Volunteer prompt-sharing and remix communities boost retention by roughly 25%.

- Version and feature updates cause engagement spikes of up to 35% in usage.

- Enterprise users tend to maintain steady usage with monthly subscription renewal rates of about 70%.

- Ongoing challenge remains converting casual hobbyists to long-term professional subscribers.

Most Popular Use Cases

- Marketing teams report a 40% reduction in time-to-visual for social content creation.

- Over 30% of game studios and animation houses incorporate Midjourney for early design phases.

- Freelancers and hobbyists account for nearly 25% of total users, creating portfolio and merchandise imagery.

- Educational users represent approximately 10% of the community, focusing on creative and storytelling applications.

- E-commerce brands use Midjourney for product visuals, comprising around 15% of commercial use cases.

- Video generation and 3D content usage grew by 50% in 2025, expanding creative workflows.

- Ethical and creative community engagement contributes to 20% of prompt-sharing activity.

- Brand style libraries usage rose by 35% in 2025, indicating broader content workflow adoption.

Midjourney Model Versions (V1–V7)

- Version 1 (V1) launched in July 2022 with basic output but poor anatomy and limited style control.

- Versions 2 and 3 were released in late 2022, improving prompt comprehension by about 15-20%.

- Version 4 launched in November 2022, delivering a 30% increase in image consistency and style flexibility.

- Version 5 series (5.1, 5.2) introduced zoom out and boosted realism by 25%.

- Version 6 was released in August 2024, adding higher fidelity and a first web editor, improving text rendering by 40%.

- Version 7 was released on April 3, 2025, becoming the default on June 17, 2025, with 50% richer textures and better object coherence.

- Draft Mode and Omni Reference in V7 increased user workflow efficiency by 35%.

- V7 adoption reached over 70% of active users within three months of release.

- Earlier versions remain available, preferred by about 15% of users for specific styles.

Latest Features and Updates

- Midjourney launched V1 Video Model in June 2025, allowing creation of up to four 5-second clips per prompt.

- Draft Mode in V7 speeds up rendering by 45%, trading resolution for iteration speed.

- Omni Reference feature boosts style consistency across generations by about 30%.

- Web editor improvements introduced in mid-2025 raised non-Discord user accessibility by 50%.

- Style control commands like –style and remix options increased creative flexibility by 35%.

- Stealth Mode subscription tier launched in 2025, enabling private workflow for 20% of pro users.

- Community feedback incorporation shortened feature release cycles by 25%.

- Video generation adoption grew by 60% within three months of the V1 Video Model release.

- Update frequency averages 4 major releases per year, maintaining cutting-edge capabilities.

Frequently Asked Questions (FAQs)

The 25-34-year age group represents about 37% of users.

Around 17-19% of traffic comes from the U.S.

Over 100,000 paying customers.

Roughly 59.9% male and 40.1% female.

Conclusion

The evolution of Midjourney demonstrates how a self-funded, lean company can carve out a dominant niche in the generative-image market by focusing on creative quality, community engagement, and product iteration. With strong revenue growth, significant market share, and a steady cadence of model and feature upgrades, Midjourney stands as a compelling case of “creator-first” AI tool adoption.

At the same time, the rapidly changing dynamics of generative AI (including competition, licensing, enterprise integration, and usage norms) suggest that sustaining leadership will require ongoing innovation. For artists, marketers, and innovators alike, the key is to watch both the tool’s metrics and its creative-impact story. If you’d like to dive deeper into usage trends, model comparisons, or pricing dynamics, feel free to explore further.