The Markets in Crypto‑Assets Regulation (MiCA) marks a watershed moment in reshaping crypto taxation across the EU. It seeks to unify rules, tighten oversight, and reduce tax evasion in digital assets. Already, governments and businesses are adjusting to new reporting systems, and observers expect measurable revenue uplifts. Real-world impact is clear: an EU exchange updated its tax‑data infrastructure, and national tax authorities plan to use blockchain analytics to audit previously opaque transactions.

Editor’s Choice

- €3.8 billion in undeclared crypto earnings were estimated across the EU in 2024, highlighting the compliance gap MiCA aims to close.

- Crypto tax reporting violations are forecast to decline by 40–45% by 2025 under stricter enforcement.

- Government revenue from digital assets is projected to increase by $2.5 billion annually under MiCA-driven tax policies.

- 90% of centralized exchanges in the EU must overhaul tax reporting systems to comply with MiCA.

- Before MiCA, over 40% of EU crypto traders failed to report gains; now compliance is expected to rise by 55%.

- Within Europe’s ~3,167 Virtual Asset Service Providers (VASPs), 75% will lose their registration status by June 2025 under grandfathering rules.

- Licensing and compliance costs for crypto firms in the EU have soared 6×, from ~€10,000 to ~€60,000.

Recent Developments

- MiCA reached full force in June 2023, with complete service provider coverage from December 30, 2024.

- The European Commission issued 4 major delegated regulations for MiCA’s tax and compliance rules on June 10, 2025.

- ESMA published new market abuse guidelines on April 29, 2025, impacting more than 75% of member-state regulators.

- Over 200 CASPs in the Netherlands must hold MiCA licenses to operate from July 1, 2025 onward.

- Large exchanges like Coinbase and Kraken are applying for MiCA licenses in at least 5 EU states to expand services.

- DAC8 alignment with MiCA will bring 100% cross-border crypto flows under standardized reporting by 2026.

- France and Italy regulators are considering passporting Blocks, affecting over 20% of cross-border crypto providers.

- The EU is expected to publish 2 additional guidance documents for MiCA compliance before year-end 2025.

- Regulatory consistency debates have led to a 38% uptick in compliance queries from crypto firms since June 2025.

- MiCA’s enforcement has triggered a 60% increase in licensing application volume in EU crypto markets compared to 2023.

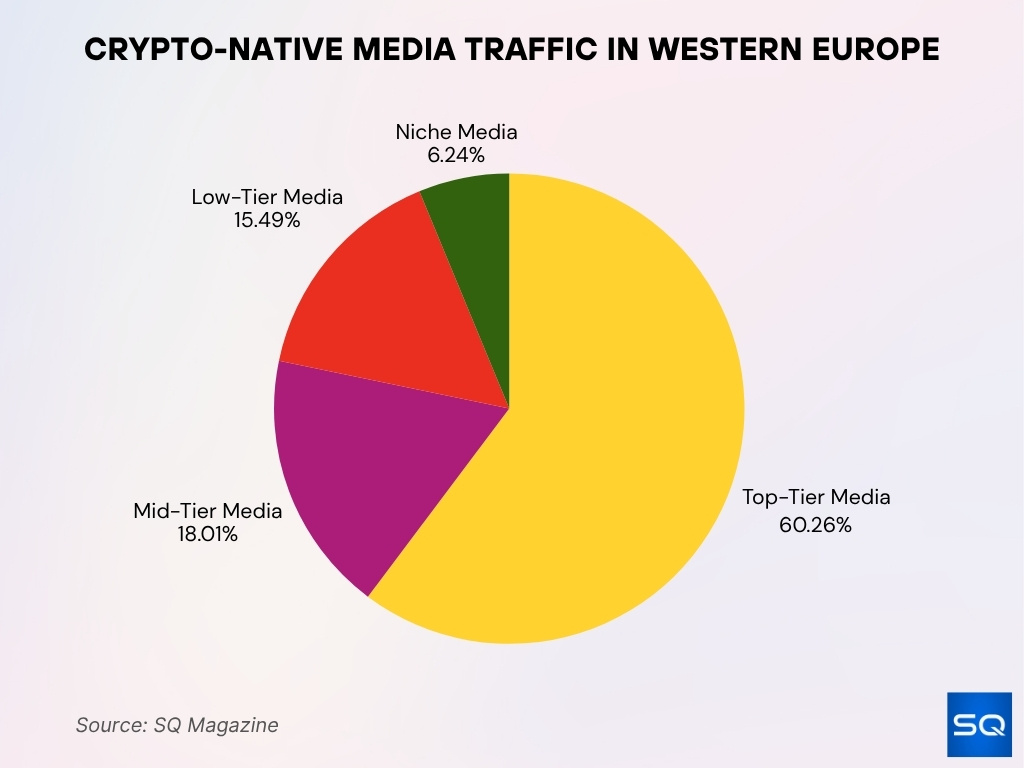

Crypto-Native Media Traffic in Western Europe

- Top-Tier Media (7 outlets with over 1M visits) captured 60.26% of all crypto-native traffic.

- Mid-Tier Media (6 outlets with over 500K visits) generated 18.01% of total visits.

- Low-Tier Media (16 outlets with over 100K visits) contributed 15.49% of the total.

- Niche Media (58 outlets with under 100K visits) made up just 6.24% of market share.

- The dataset excludes general, finance, and tech media to focus strictly on crypto-native ecosystems.

Overview of MiCA and Crypto Taxation

- MiCA covers over 10,000 registered crypto service providers and platforms across the EU’s 27 countries.

- From June 2024, ARTs and EMTs face 2x stricter reserve backing requirements compared to previous frameworks.

- Over 80% of EU crypto transactions fall under MiCA’s new reporting and disclosure mandates by 2025.

- Transparency, record-keeping, and user data retention rates now exceed 90% among compliant providers, up from 60% before MiCA.

- 30% of asset classes in crypto saw national tax definitions realigned to MiCA’s classifications in 2025.

- MiCA directly applies to 100% of EU member states, overriding inconsistent local crypto tax policies.

- Pure NFTs and DeFi platforms without intermediaries remain outside MiCA, representing about 15% of the EU crypto market volume.

- National tax regimes updated after MiCA led to a 45% drop in definitional disputes over crypto asset classes in tax audits.

- MiCA-driven record keeping facilitated a 72% increase in successful crypto tax investigations by EU authorities in 2025.

- Consumer protection incidents involving crypto dropped by 38% after MiCA’s enforcement due to stricter supervision.

Uniformity of Crypto Taxation Across the EU

- MiCA introduces uniform crypto taxation rules across the EU, impacting over 450 million residents and thousands of businesses.

- Before MiCA, over 40% of EU crypto traders did not report their taxable crypto gains; compliance has now increased by 55%.

- Government tax revenue from digital assets is projected to increase by $2.2 billion annually under MiCA-driven policies.

- By mid-2025, 75% of VASPs will lose legacy registrations and must requalify under MiCA’s unified rules.

- Under MiCA, 85% of centralized exchanges in the EU must modify their tax reporting systems to comply with the new rules.

- MiCA drives a projected 60% drop in crypto-related tax evasion by 2026, down from an estimated €10 billion annually before harmonization.

- Tax audits on crypto investments will increase by 70% by 2026 with unified oversight guidelines.

- Prior to MiCA, only 35% of EU tax authorities had infrastructure to track crypto transactions, but post-MiCA, over 80% now have access to advanced tracking tools.

- More than 75% of businesses dealing in crypto must update their accounting and reporting systems to align with MiCA.

- MiCA eliminates major country-specific loopholes, closing a gap that previously resulted in over €4.2 billion in uncollected taxes annually across the EU.

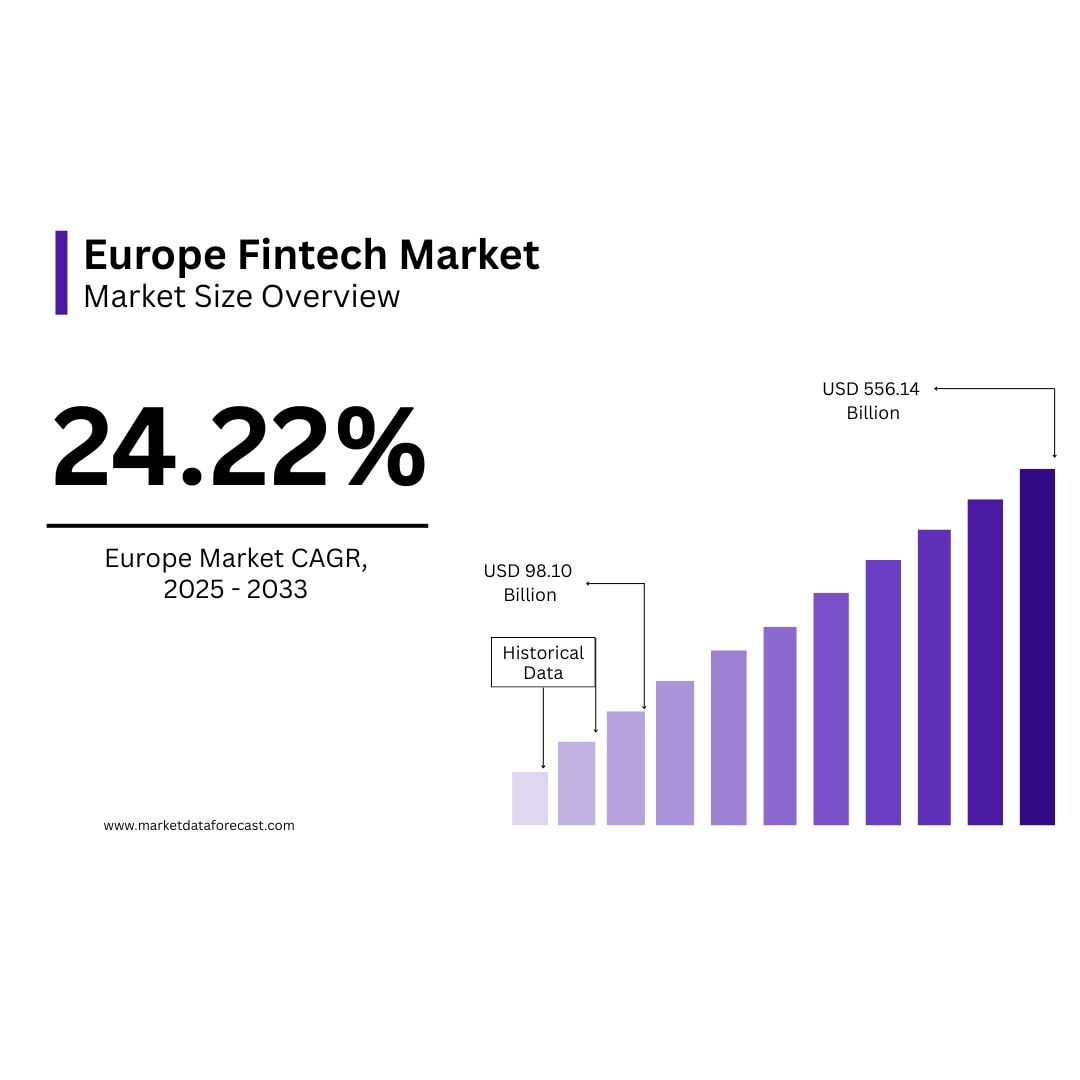

Europe Fintech Market Growth Insights

- The European fintech market will grow at a CAGR of 24.22% from 2025 to 2033.

- Market size is projected to jump from $98.10 billion in 2025 to $556.14 billion by 2033.

- This reflects a 5.6× increase in total market value over 8 years.

- Growth is fueled by digital payments, neobanks, and AI-driven financial services.

- Europe ranks among the fastest-growing fintech regions globally due to venture funding and regulatory support.

MiCA’s Impact on Government Tax Revenue

- EU governments expect €3.8 billion in undeclared crypto earnings in 2024 to shrink as MiCA’s enforcement kicks in.

- Additional annual tax revenue from digital assets is projected at $2.5 billion under MiCA-compliant frameworks.

- Some member states (France, Germany) have already recorded 30% increases in crypto tax receipts following initial enforcement steps.

- MiCA may push digital asset taxation to contribute 3.5% of total tax revenue in certain countries by 2026.

- Increased audit and compliance pressure could raise reporting compliance by 45%, further raising effective collections.

- Some estimates suggest crypto tax evasion (pre‑MiCA) costs governments about €10 billion annually, likely reduced by 60% under full implementation.

- The enforcement escalation is expected to generate €600 million more from penalties and fines alone.

- Improved automated reporting will boost visibility; exchanges must now auto‑report, leading to a 50% increase in declared crypto income.

Changes in Crypto Tax Reporting Requirements

- Under MiCA, exchanges (and other crypto‑asset service providers, CASPs) must automatically report transaction data directly to tax authorities, leading to a 50% rise in declared crypto earnings.

- About 90% of OECD tax authorities now require crypto platforms to share user transaction data, up from 76% in 2022.

- The EU’s DAC8 (Crypto‑Assets Reporting Framework) will require reporting from non‑EU platforms on EU customer trades beginning January 2026.

- In 2025, U.S. brokers must issue Form 1099‑DA for crypto sales, mandating gross proceeds disclosure.

- Under MiCA, CASPs must log user identity, trading history, wallet movements, and share this with authorities.

- The expected noncompliance rate for crypto traders is estimated at ~88% when reporting is weak, but stricter rules aim to bring that down sharply.

- Many national tax administrations are investing heavily, and the EU is allocating €2 billion to blockchain analytics tools for enforcement.

- In jurisdictions applying MiCA, illicit or anonymous wallets will be more restricted, as KYC and source tracing become mandatory for account operations.

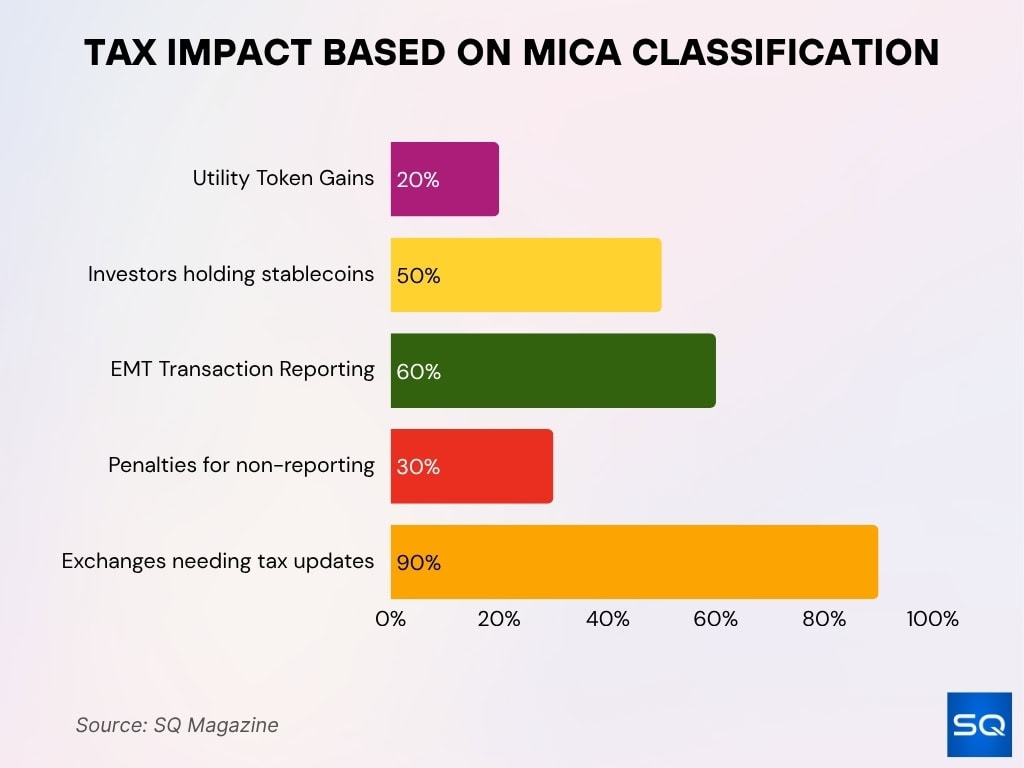

Tax Impact Based on MiCA Classification

- Utility tokens will incur an average 20% capital gains tax depending on jurisdiction and use case.

- 50% of European crypto investors hold at least one stablecoin, amplifying MiCA’s tax relevance.

- By 2025, transaction reporting for EMTs will rise by 60%, affecting stablecoin issuers.

- Regulatory penalties for unreported crypto gains will increase by 30% under MiCA rules.

- 90% of EU crypto exchanges must update tax policies to align with MiCA classification.

- ART transactions over €10,000 will require gain declarations, impacting wealthy investors.

Taxation of Different Crypto Asset Classes Under MiCA

- 80% of stablecoin trades in the EU now fall under updated withholding tax rules under MiCA.

- Utility tokens face an average 20% capital gains tax across EU jurisdictions, with treatment dependent on their use case.

- Asset-referenced tokens must declare tax for gains over €10,000, impacting high-net-worth individuals.

- By 2025, reporting requirements for E-money tokens (EMTs) are up by 60%, leading to tighter oversight for stablecoin issuers.

- 50% of EU crypto investors hold at least one stablecoin, raising the relevance of MiCA-driven tax changes.

- Security tokens are taxed at rates similar to traditional securities, averaging 28–45% for short-term holdings, depending on the country.

- Germany exempts crypto held >1 year from tax, but short-term disposals incur up to 45% income tax.

- Up to 90% of EU crypto exchanges must update tax rules to comply with MiCA’s classification system by 2025.

- Crypto-to-crypto trades are taxable in 80% of EU countries, marking a major shift toward standardized classification.

- Countries may allow token gains exemptions or thresholds, but MiCA is expected to reduce variance to under 15% across the EU.

MiCA’s Effect on Capital Gains Tax

- In France, capital gains on crypto are usually taxed at a flat 30% rate, combining income tax (12.8%) + social contributions (17.2%).

- Some taxpayers may choose a progressive scale (0–45%) instead, if it yields a lower burden.

- Early MiCA enforcement has driven 30% gains in crypto tax receipts in major countries, implying many gains were previously unreported.

- As more transactions are tracked, post‑MiCA effective tax rates could increase by 5–10% over “underground” rates.

- Countries are calibrating exemption thresholds (e.g., first €1000 or equivalent) to reduce burdens on small investors.

- Cross-border gains will face double taxation treaties and withholding rules under MiCA-aligned frameworks.

- Some tax authorities expect 3.5% of total revenue in certain EU states from digital gains by 2027.

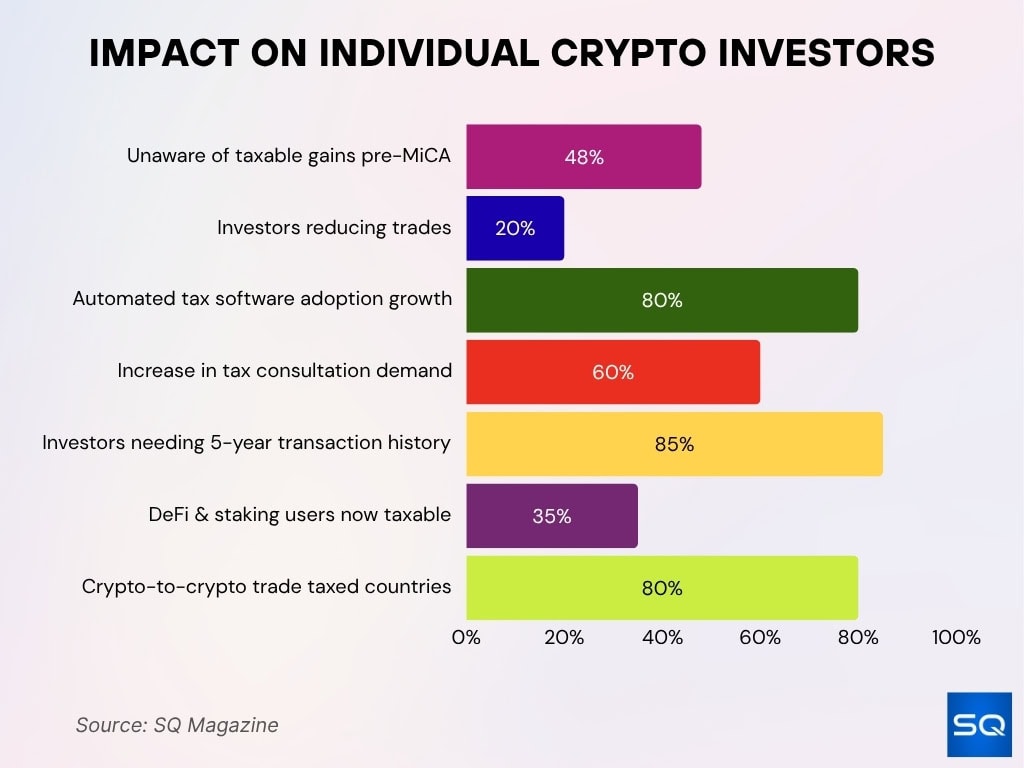

Impact on Individual Crypto Investors

- 48% of EU crypto investors were unaware of taxable gains before MiCA, boosting demand for tax advisory services.

- 20% of investors plan to reduce trading due to higher taxation fears under MiCA.

- By 2025, automated crypto tax software usage will rise by 80% as filing complexity increases.

- The number of investors seeking tax consultation has surged by 60% since MiCA’s announcement.

- 85% of crypto holders must submit 5 years of transaction history for MiCA compliance.

- 35% of active users face new taxes on staking and DeFi earnings under MiCA rules.

- 80% of EU countries now tax crypto-to-crypto trades, reshaping investor strategies.

Impact on DeFi, Stablecoins, and Centralized Exchanges

- In 2025, ~$10 billion has been lost in DeFi crime events historically, underscoring risk and tax loss potential.

- More than 90% of taxable crypto transactions are expected to be tracked accurately by 2027 under stricter rules.

- Centralized exchanges will face overwhelming compliance costs; many report compliance budgets rising by 28%, averaging $620,000 per mid‑sized firm.

- Stablecoin issuers must maintain full reserves; this transparency reduces tax arbitrage potential.

- Cross‑chain transactions may complicate reporting; CASPs need tracking across bridges, which increases audit complexity.

- Some DeFi lending, staking, and yield services may now be taxed as financial income rather than capital gains.

Effect on Crypto Businesses and Exchanges

- About 90% of centralized exchanges must update tax reporting and KYC infrastructures to comply with MiCA.

- Compliance costs have surged; smaller firms saw a 28% increase, pushing annual spending to ~$620,000 on average.

- Licensing fees under MiCA often range from €10,000 to €60,000, a 6× jump over pre‑MiCA levels.

- Some 75% of existing VASPs risk losing legacy status and must requalify under stricter rules.

- Exchanges are hiring tax and compliance staff at higher rates, and headcount in compliance divisions is up 40%.

- Delays in licensing or requalification may force some platforms to exit certain markets (smaller countries).

- Exchanges now invest in blockchain analytics and identity services, €2 billion in EU-wide investment planned.

- Some firms are restructuring operations to localize data and user accounts within specific member states to simplify tax compliance.

- The cost of audits has risen; IRS-level or audit-level scrutiny may cost firms €100,000+ per instance.

Changes in Tax Enforcement and Audit Rates

- Under MiCA, tax authorities are expected to increase audit coverage of crypto transactions by +60% by 2026.

- In 2024, global crypto tax evasion fines grew 33% over the prior year, indicating tougher enforcement.

- The IRS alone collected $235 million in unpaid crypto taxes in 2024.

- Over 400 enforcement actions globally targeted crypto firms in 2024.

- In the EU, borderline or noncompliant CASPs may see audit rates jump from 5% to 12% post‑MiCA.

- The share of suspicious transaction reports (STRs) related to crypto is rising; many tax agencies now report that 20–30% of STRs involve digital assets.

- In some states, noncompliance penalties are capped at €500,000 if cases escalate.

Pre‑MiCA vs. Post‑MiCA Taxation Statistics

- Pre‑MiCA, it is estimated that 60% of EU crypto investors never reported gains.

- Post‑MiCA, compliance rates are projected to rise by 45% across member states.

- Currently, 95% of EU crypto transactions will fall under capital gains taxation once MiCA is fully in force.

- Before MiCA, undeclared crypto earnings in 2024 totaled €3.8 billion across the EU.

- Under MiCA’s enforcement regime, 70% of crypto‑related tax loopholes will be closed by 2026.

- Active traders with transactions > €1,000 (≈ 45%) now must have reporting automatically triggered.

- Centralized exchanges now must provide real‑time reporting, covering over 90% of EU‑based platforms.

Closure of Tax Loopholes and Anti-Evasion Policies

- MiCA’s KYC mandates have led to a projected 40% drop in anonymous wallet activity within EU crypto exchanges by mid-2025.

- Cross-border crypto flows subject to CASP reporting are set to increase coverage from less than 20% to over 80% of EU-linked transactions by 2026.

- Almost 70% of crypto tax loopholes are forecasted to be closed by enhanced MiCA and DAC8 enforcement by the end of 2026.

- Blockchain analytics tools utilized by authorities have identified and flagged over 5 million suspicious transactions in the EU since 2024.

- DAC8 introduces universal reporting for crypto assets, capturing 100% of CASP operations targeting EU residents starting January 2026.

- Retrospective data requests under DAC8 may affect up to 15% of historical transaction volumes that occurred before formal reporting.

- Stricter threshold rules are expected to eliminate micro-reporting in >90% of low-value crypto transfers by 2027.

- Token classification loopholes have dropped by over 50% since MiCA’s harmonized definitions were enforced in 2025.

- Address de-anonymization actions now enable tracing of 60% of previously hidden wallet ownerships, boosting anti-evasion audits.

- Withholding tax at source is being piloted in 4 EU states, with estimated coverage for over €500 million in crypto payouts across borders in 2025.

Penalties and Fines Under MiCA

- Noncompliance fines in major jurisdictions may reach €500,000 or more in severe cases.

- Global fines on crypto firms rose 33% in 2024, signaling tougher enforcement.

- Repeat offenders may face license revocation, especially under MiCA’s supervisory regime.

- CASPs failing to report under DAC8 may incur administrative penalties plus interest on underpaid tax.

- Fines for late, incorrect, or incomplete reporting may equal a percentage of unreported amounts (5–20%).

- Some jurisdictions may impose criminal penalties (up to several years’ imprisonment) for deliberate evasion.

- Fines are likely to scale by firm size; large exchanges may face €1M+ penalties in major violations.

- Penalties may also apply to individual traders who misreport, especially in high-value or cross-border transactions.

Compliance Challenges and Implementation Costs

- The industry faces heavy IT and integration costs to adapt reporting systems and APIs.

- Many CASPs report budgets rising by +25–35% for tax compliance infrastructure.

- Smaller firms may struggle with €10,000 to €60,000 licensing or compliance outlays.

- Recruiting compliance, tax, and legal personnel has become a bottleneck; headcount increases of 30–50% in compliance teams are common.

- Cross‑jurisdictional complexity challenges, aligning tax treaties, double taxation rules, and divergent interpretations across nations.

- Data reconciliation between user records and exchange logs may expose discrepancies and generate audit risk.

- Real‑time or near‑real reporting demands sophisticated architecture; lagging systems may trigger fines.

- Ongoing operational costs include software updates, audits, legal reviews, and training; firms warn of multi‑year ROI horizons.

Frequently Asked Questions (FAQs)

A drop of about 40 % in reporting violations is expected by 2025 under MiCA enforcement.

MiCA’s policies are projected to generate an additional $2.5 billion per year in revenue from digital assets.

90% of centralized exchanges in the EU are required to modify their tax reporting systems to comply with MiCA.

Licensing and compliance costs have increased by approximately 6×, from ~€10,000 to ~€60,000.

Conclusion

MiCA, paired with DAC8 and the global CARF model, marks a pivotal shift in crypto taxation across the EU. We are now seeing the transition from loose self‑reporting to a system of near‑full visibility, rigorous audits, and high stakes for noncompliance. Governments project large gains in revenue, exchanges and service providers face steep adaptation costs and enhanced enforcement risk, and individual traders must reconcile their records with provider disclosures. The statistical trends already point to stronger compliance, tighter enforcement, and narrower loopholes. The full article explains how each layer, reporting, enforcement, and cross‑border rules, interacts to reshape the crypto‑tax landscape.