The cryptocurrency exchange MEXC continues to grow, expanding its user base, trading volume, and global footprint. Its broad selection of assets and deep liquidity make it a key player in both spot and derivatives markets. This article traces MEXC’s recent performance through fresh data, highlighting how its growth affects both traders and the broader crypto ecosystem. Read on to see why MEXC has become a crucial platform for global crypto activity.

Editor’s Choice

- MEXC logged $150.4 billion in July 2025 spot trading volume, signalling a 61.8% month-over-month increase.

- MEXC currently has 36 million registered users worldwide.

- MEXC supports 2,017+ coins and 2,448+ trading pairs.

- The platform processes daily futures trading volumes that exceed $20 billion, placing it among the global top‑3 exchanges for derivatives liquidity.

- A wide selection of futures and spot trading pairs: over 2,600 spot pairs and 1,600+ futures pairs available.

- MEXC offers highly competitive fee rates on futures: 0.00% for makers, 0.02% for takers.

- In 2025, MEXC introduced a “Proof‑of‑Trust” initiative, including a Guardian Fund to protect user assets and increased transparency on reserves.

Recent Developments

- In a Q3 2025 report, MEXC noted that new token‑trading participants grew by 16% quarter-over-quarter, while trading volume jumped 97% versus Q2.

- MEXC moved from being ranked eighth among centralized exchanges earlier this year to second globally by spot trading volume by August 2025.

- The surge in volume and ranking reflects strong listing activity. In May 2025 alone, MEXC reportedly listed over 214 new tokens, boosting trading volume tied to those listings by 46.7%.

- MEXC announced enhancements under its “Proof of Trust” initiative, including regular public reporting of reserves and a $100 million Guardian Fund to reimburse users in case of technical failures or security incidents.

- Along with the Guardian Fund, MEXC unveiled a $300 million Ecosystem Development Fund to invest in Web3 projects over the next five years, signaling a long-term commitment to ecosystem growth.

- The platform expanded its global reach, claiming to operate in more than 170 jurisdictions with support for numerous languages, allowing a diverse international user base.

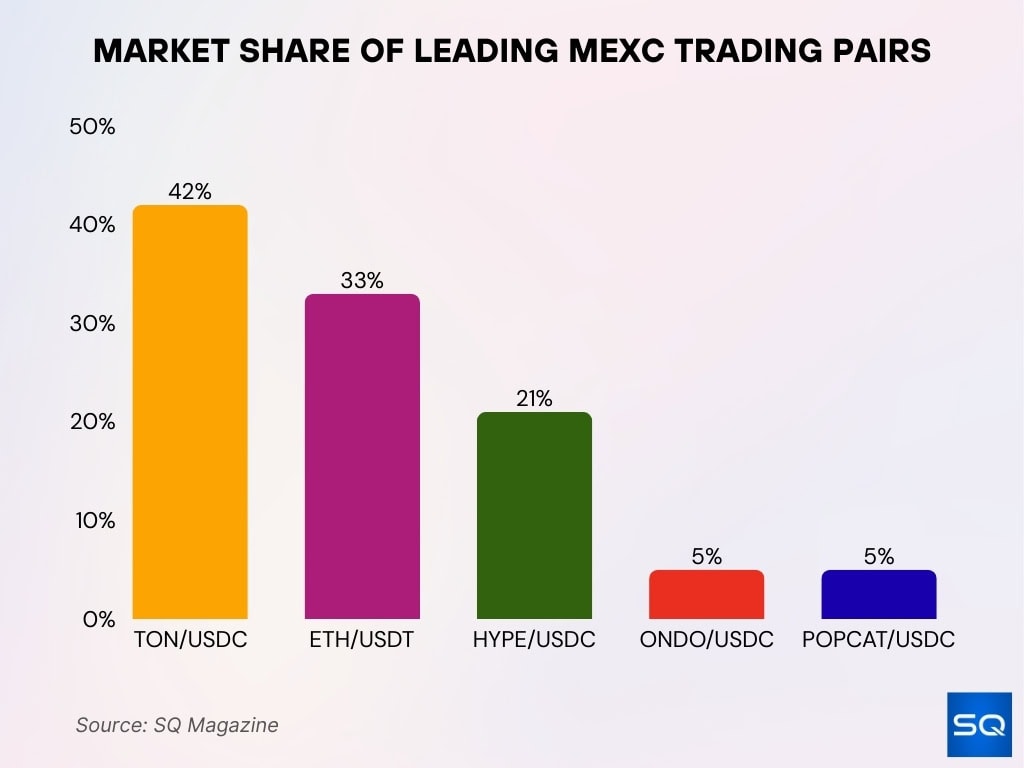

Most Popular Trading Pairs

- TON/USDC led with 42% market share in Q2 2025, driven by zero-fee futures promotions.

- ETH/USDT followed with a strong 33% share, maintaining high trader activity.

- HYPE/USDC surged to 21%, gaining momentum during MEXC’s campaign.

- ONDO/USDC and POPCAT/USDC each captured 5%, rounding out the top pairs.

MEXC Global User Statistics

- In 2025, MEXC claims to have more than 30 million registered users worldwide.

- The user‑base expansion is global, and MEXC serves clients in over 170 countries and regions.

- The diversity of supported assets, over 2,017 coins, caters to a wide variety of user preferences, from mainstream cryptos to niche altcoins.

- MEXC provides more than 2,448 trading pairs, enabling users to access a vast range of spot trading combinations.

- The broad derivative offering includes more than 1,600 futures pairs, giving users ample options beyond just spot trading.

Year‑on‑Year Growth Figures

- Spot trading volume surged, from about $93 billion in June 2025 to $150.4 billion in July 2025, a 61.8% increase month-over-month.

- The jump in volume also reflects increased user activity per capita; average trading volume per user reportedly jumped 45.09% in the same period.

- Listing velocity grew; in May 2025, MEXC added over 214 new tokens, compared with fewer listings in earlier months, indicating an accelerated rollout pace.

- On the derivatives side, MEXC maintained daily futures trading volumes above $20 billion, consistent with a sustained high‑volume environment.

- MEXC’s ranking among top centralized exchanges improved; it climbed from outside the top 5 to #2 globally by spot volume as of mid‑2025.

- The expansion of supported assets, from prior years’ ~2,000 coins to 2,017+, trading pairs now exceed 2,448, indicating consistent growth in listing and pair creation.

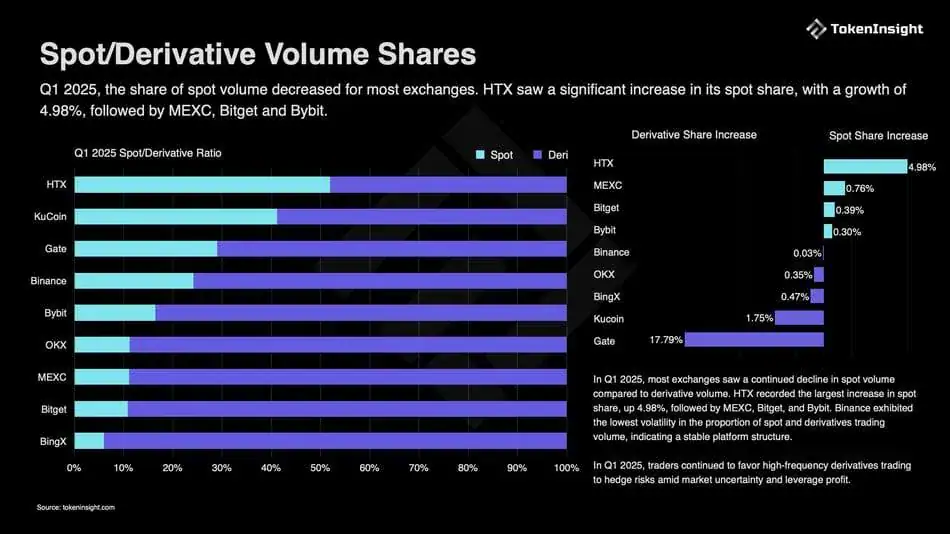

Spot/Derivative Volume Shares

- HTX posted the highest spot share growth at +4.98%, raising its spot ratio to nearly 46%.

- MEXC added +0.76% spot share, maintaining a 20% spot / 80% derivatives mix.

- Bitget rose by +0.39%, holding a 17% spot share overall.

- Bybit saw +0.30% growth, with a heavily derivatives-skewed market at 86%.

- Binance remained nearly unchanged with just +0.03% spot share growth.

- OKX increased its spot share by +0.35%, reaching approximately 23%.

- BingX gained +0.47% spot share, though still 88% derivatives-focused.

- KuCoin boosted its derivatives share by +1.75%, leaving spot at 32%.

- Gate made the biggest pivot toward derivatives with +17.79%, dropping its spot share to 27%.

Futures Trading Data

- MEXC maintains a daily average futures trading volume above $20 billion.

- The exchange ranks among the top 3 globally for cryptocurrency derivatives trading volume.

- For major contracts, the BTC/USDT perpetual contract routinely sees daily average volumes exceeding $5 billion.

- The ETH/USDT perpetual contract similarly posts strong liquidity, with daily volumes exceeding $3 billion.

- MEXC supports a broad selection of derivative instruments, including more than 1,200 perpetual contracts across USDT‑M, Coin‑M, and USDC‑M settlement types.

- The platform offers high leverage; futures traders can access up to 125× leverage.

- MEXC’s order book depth for futures is substantial. For large ETH orders (1,000+ ETH), slippage remains low at less than ~0.08%.

- Altcoin futures contracts, not just BTC or ETH, contribute meaningfully, with over 1,000 trading pairs for altcoins, which make up roughly 40% of total futures volume on the platform.

Listed Assets and Supported Cryptocurrencies

- MEXC supports over 2,000 active listed cryptocurrencies across spot and futures markets, per internal stats.

- The platform offers thousands of trading pairs. By early 2025, there were 2,908 spot pairs and 1,136 futures pairs.

- The “coins listed / trading pairs” count underscores the diversity of assets, from major coins to small‑cap altcoins, DeFi tokens, and niche projects.

- MEXC reportedly added 680 new tokens in Q3 2025, a 17% increase compared with the previous quarter.

- For tokens listed in Q3, user participation climbed by 16% quarter-over-quarter.

- Trading volume for newly listed tokens in Q3 jumped by 97% QoQ, highlighting strong demand for fresh asset offerings.

- These listings cover a wide range of sectors and token types, from memecoins, AI + Web3, to Layer‑2 and NFT‑related tokens.

- MEXC’s fast listing policy makes it particularly attractive for “altcoin‑gem hunters”, users seeking early access to emerging projects.

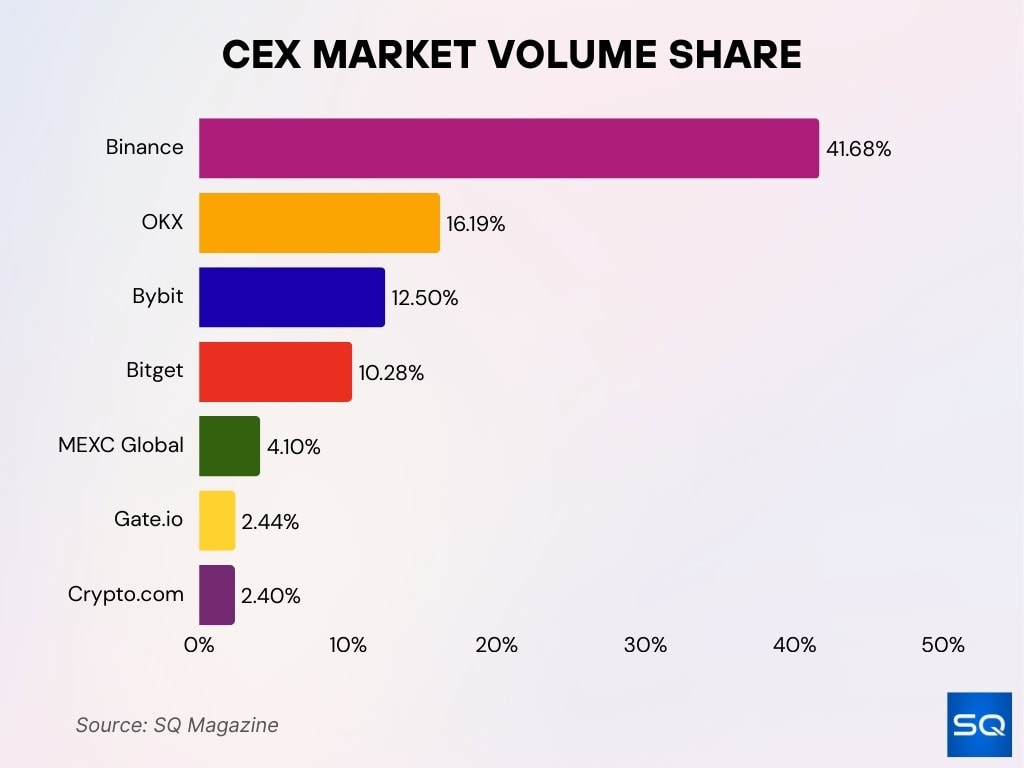

CEX Market Volume Share

- Binance led with a dominant 41.68% share, reaffirming its top exchange status.

- OKX came second at 16.19%, reflecting strong global positioning.

- Bybit followed with 12.50%, showing steady derivatives-driven growth.

- Bitget claimed 10.28%, gaining traction in the futures trading space.

- MEXC Global held 4.10%, boosted by active listings and zero-fee strategies.

- Gate.io contributed 2.44%, staying competitive in niche segments.

- Crypto.com captured 2.40%, supported by a retail-focused ecosystem.

- Other exchanges made up 10.41%, pointing to a fragmented but vibrant market.

Exchange Liquidity Metrics

- MEXC’s spot market delivers a daily average trading volume of $8–12 billion.

- Combined spot and futures trading on MEXC amounts to roughly $28–32 billion daily.

- MEXC supports 2,600+ trading pairs across spot and futures.

- For BTC/USDT spot, the order book within a ±0.1% price range holds over 500 BTC, and within ±0.5% holds over 2,000 BTC.

- Slippage for big trades is low; the platform reports ~0.1% average slippage for large spot orders.

- For new‑coin listings, average order‑book depth outperforms peers by 30–50%.

- MEXC maintains a network of over 100 professional market‑makers, offering fee rebates and API support.

Fee Structure Statistics

- Futures maker fees on MEXC can be as low as 0.0%, with taker fees around 0.01%.

- Spot trading typically charges 0% maker fees and 0.05% taker fees.

- MX token holders with 500+ tokens get a 50% discount on taker fees, lowering them to 0.025%.

- Over 140 futures pairs had zero maker and taker fees during promotional periods in 2025.

- MEXC offers trading fees around 2.25x to 3x lower than many competitors.

- The platform supports thousands of trading pairs, reducing conversion costs and fees.

- MEXC futures leverage can go up to 500x, with fee policies remaining competitive.

- Slippage for large mainstream cryptocurrency orders typically ranges between 0.05% to 0.2%, maintaining execution quality.

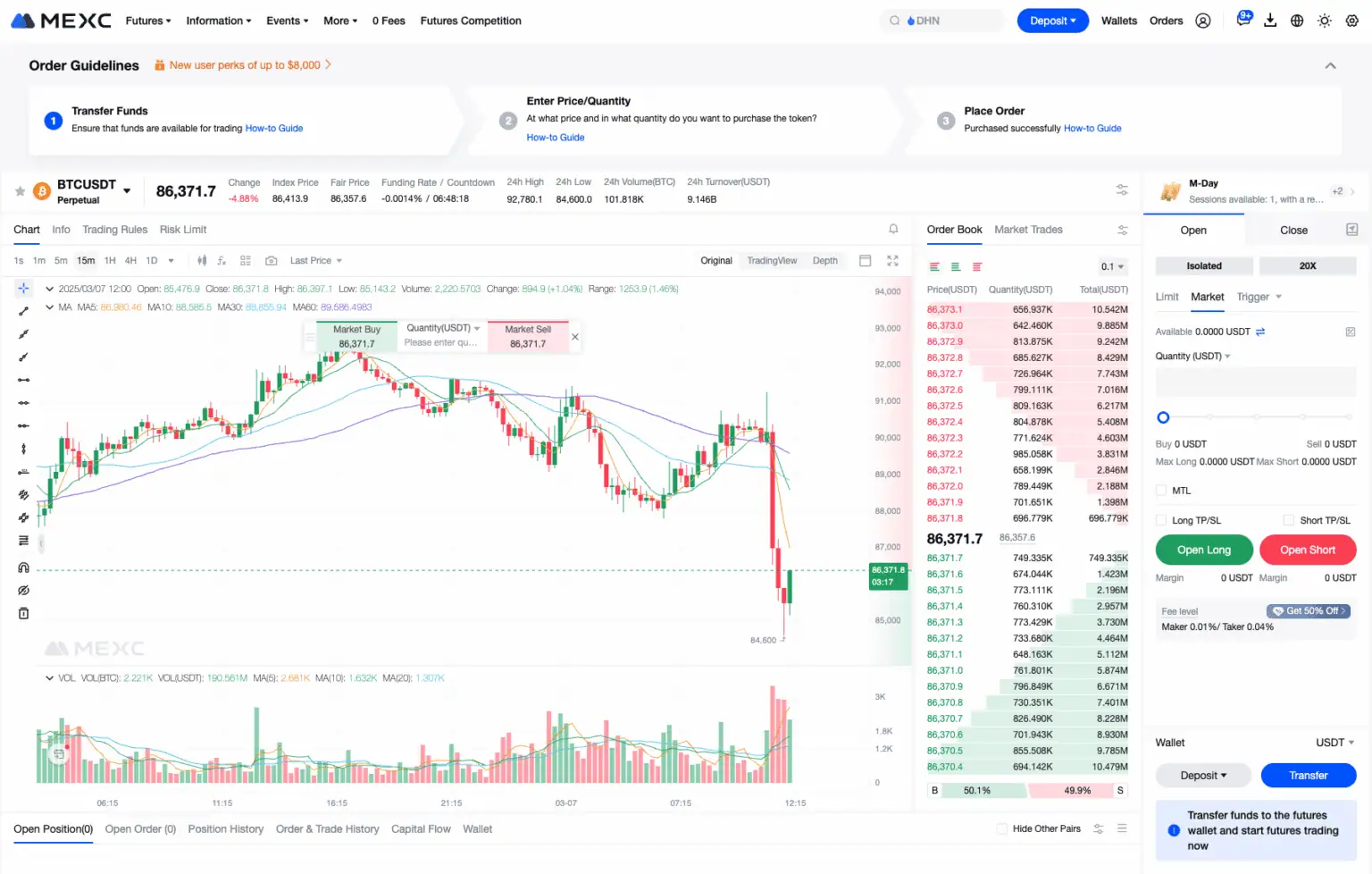

BTC/USDT Futures Snapshot on MEXC

- Last traded price was 86,371.7 USDT, showing real-time market execution.

- 24h change registered a -4.88% drop, indicating strong bearish sentiment.

- 24h high hit 92,780.1 USDT, while the low fell to 84,600.0 USDT.

- 24h volume reached 84,600 BTC, with a turnover of 9.146B USDT.

- Funding rate was -0.0014%, reflecting short-side dominance.

- Index price was 86,413.9 USDT, closely matching the fair price of 86,371.6 USDT.

- Order book revealed strong sell walls above 86,373 USDT and buy support near 86,371 USDT.

Proof of Reserves Data

- All major assets remain fully backed, with reserve ratios exceeding 100%.

- Reserve ratios: BTC at 129.85%, ETH at 104.05%, USDT at 113.23%, USDC at 105.74%.

- Audits are conducted bi‑monthly and verified on‑chain.

- Users can verify holdings against on‑chain wallet assets.

- In April 2025, MEXC increased on‑chain assets by $389 million.

- That included 1,649.72 BTC and 21,264.46 ETH.

- The reserve policy is part of a broader transparency framework.

- MEXC’s Proof‑of‑Reserves program is a differentiator in the crypto space.

Insurance Fund Statistics

- MEXC’s futures insurance fund reached $ 559 million.

- The fund covers deficits from liquidations exceeding the margin.

- Over 17,000 collusive accounts and 2,000 bot-trading accounts were restricted.

- 48 fraud cases were intercepted, freezing $ 4.97 million in funds.

- $ 902,815 was recovered from 2,211 user error cases.

- A separate $ 100 million “Guardian Fund” also exists.

- Users can access current and historical fund balances.

- The fund reduces forced deleveraging risk during volatile markets.

Ecosystem Development Initiatives

- A $ 300 million Ecosystem Development Fund was launched.

- A $ 30 million MEXC Foundation supports Web3 education and adoption.

- Focus areas include Education, Empowerment, and Community Giving.

- $ 30 million was invested in a stablecoin project, total commitment now $ 66 million.

- MEXC is evolving into an ecosystem builder.

- The fund supports public chains, wallets, media, and infrastructure.

- These initiatives help MEXC lead in both financial and developmental roles.

Community and CSR Initiatives

- The MEXC Foundation hosted 8 CSR events across Southeast Asia, the Middle East, Africa, and Australia in 2025.

- These CSR events engaged over 1,600 participants, focused on education and empowerment.

- The Blockchain Certificate Quiz program involved 725 participants, with 334 awarded official certificates.

- The Foundation runs a $30 million CSR program supporting blockchain education, empowerment, and community giving.

- The F.I.R.E Scholarship provides full tuition support to up to 20 students at six Indonesian universities.

- MEXC’s CSR initiatives focus on long-term blockchain education access in underrepresented regions.

- The Foundation’s events and partnerships extend Web3 access to global communities beyond marketing efforts.

- MEXC’s community exceeds 15 million users worldwide, fueling educational and empowerment programs.

Industry Partnerships & Collaborations

- MEXC Ventures committed $66 million to the Ethena stablecoin ecosystem, becoming a major institutional backer.

- The $66 million includes a $30 million investment in ENA governance tokens and $20 million in USDe stablecoin holdings.

- Over 40 projects have received investments from MEXC Ventures, totaling more than $100 million.

- MEXC partnered with Story Network (IP) for a $1 million prize pool campaign, attracting over 220,000 participants.

- MEXC collaborated with Solana for Solana Eco Month, featuring a $1 million prize pool and zero-fee SOL trading.

- The exchange serves as a Platinum Sponsor at TOKEN2049 Singapore, Diamond Sponsor at GM Vietnam 2025, and Titanium Sponsor at Blockchain Rio.

Frequently Asked Questions (FAQs)

MEXC claims to have more than 36 million registered users globally in 2025.

According to the Q3 2025 report, MEXC AI recorded an average of 44,400 daily active users.

MEXC supports over 2,600 spot trading pairs and over 1,600 futures trading pairs.

Conclusion

MEXC’s performance underscores how the exchange has evolved beyond simply facilitating trades. With full reserve backing and a transparent asset‑protection framework, MEXC has strengthened its foundation for long-term user trust and resilience. At the same time, its Ecosystem Development Fund and the establishment of the MEXC Foundation signal a strategic shift, from exchange to ecosystem builder. Through targeted investments, global CSR initiatives, education efforts, and collaboration with new blockchain projects, MEXC is helping shape the broader Web3 landscape.

For traders, developers, and observers, these developments matter; they point to an exchange committed to stability, transparency, and growth. As MEXC continues expanding its role, it may influence not only where people trade but also how the next generation of blockchain infrastructure and communities develop.