In 2018, the word “metaverse” still belonged to the realm of science fiction and ambitious tech demos. Fast forward to 2025, and it’s now a vibrant and fast-expanding digital frontier where people are buying homes, attending classes, working, and socializing, all in virtual environments. From Meta’s persistent push into immersive experiences to gaming ecosystems like Roblox and Decentraland reshaping user interactions, the metaverse has matured rapidly.

But where does it stand now? With more businesses, consumers, and governments engaging in digital experiences, understanding the metaverse statistics for 2025 is key to navigating its real-world impacts.

Editor’s Choice

- The global metaverse market is projected to reach $507.8 billion in 2025, growing at a compound annual growth rate (CAGR) of 37.4%.

- Over 65% of Gen Z and Millennials in the US report engaging with metaverse platforms weekly in 2025.

- Gaming continues to dominate, contributing $183 billion to the metaverse economy in 2025 alone.

- The education sector now accounts for $21 billion in metaverse-based learning tools and virtual campuses.

- As of 2025, the average daily time spent by users on metaverse platforms is 1 hour and 48 minutes.

- 65 million virtual reality (VR) headsets have been sold worldwide in 2025, with Meta Quest devices leading the market.

- North America retains the largest user base in the metaverse, but Asia-Pacific shows the fastest adoption, with a 41% YoY growth rate in active users.

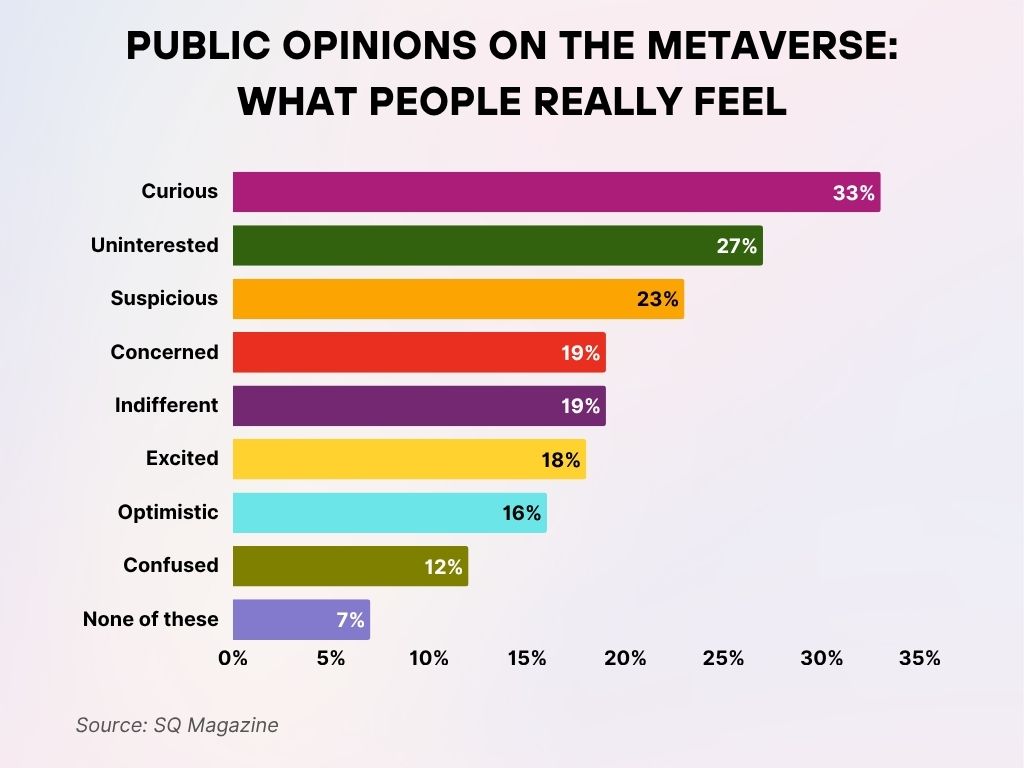

Public Opinions on the Metaverse: What People Really Feel

- 33% of respondents feel curious about the metaverse, making it the most common sentiment.

- 27% are uninterested, suggesting a significant portion doesn’t currently see value or relevance in the concept.

- 23% feel suspicious, indicating trust concerns around how the metaverse might affect privacy or society.

- Both concerned and indifferent feelings were reported by 19% of participants each, showing mixed levels of emotional detachment and apprehension.

- 18% of people are excited, reflecting a smaller yet enthusiastic group looking forward to the metaverse’s potential.

- 16% are optimistic, hinting at some positive expectations despite broader skepticism.

- 12% admitted feeling confused, which suggests a need for more public education and clarity around the metaverse.

- Only 7% said none of these sentiments applied to them, showing that the vast majority hold a distinct opinion.

Revenue Breakdown by Industry (Gaming, Retail, Education, etc.)

- Gaming leads the metaverse revenue with $183 billion in 2025.

- The virtual retail sector is expected to generate $54 billion, as digital fashion and avatar accessories grow in popularity.

- Metaverse-based education platforms report $21 billion in revenue, with universities and training academies expanding virtual course offerings.

- The corporate collaboration segment reached $33 billion, driven by immersive meeting tools and enterprise hubs.

- Entertainment and live events, including virtual concerts and shows, amassed $25 billion, led by artists hosting VR-exclusive tours.

- Healthcare and teletherapy applications account for $12.8 billion in metaverse revenue, including VR-based mental health treatments.

- Real estate within virtual worlds such as Decentraland and The Sandbox produced $9.1 billion in transaction volume in 2025.

- Automotive brands have generated over $6.5 billion via virtual showrooms and driving experiences.

- Financial services using metaverse platforms (e.g., banking avatars, insurance consultations) earned $4.3 billion in 2025.

- Marketing and brand activation campaigns through immersive ads reached $11.7 billion this year.

Hardware and Device Usage

- As of 2025, VR headset shipments reached 65 million units globally, led by Meta, Sony, and Apple.

- The Meta Quest 4 is the top-selling VR headset of 2025, capturing 31% of the global market share.

- AR glasses adoption increased by 47% YoY, with over 18 million units sold in 2025.

- Smart haptic wearables, including vests and gloves, now account for $3.2 billion in annual consumer spending.

- 60% of metaverse users access content through mobile devices, emphasizing cross-platform compatibility.

- The average cost of a mid-range VR headset in 2025 dropped to $399, enhancing accessibility.

- Eye-tracking tech is present in 40% of newly sold headsets, improving interaction fidelity.

- Cloud-based XR streaming now supports over 85% of enterprise metaverse platforms, eliminating hardware bottlenecks.

- Global household penetration of VR/AR devices has reached 13.2% in 2025.

- Voice-command adoption in metaverse interfaces is up by 35%, enhancing accessibility for disabled users.

Metaverse Market Size Projections

- The metaverse market size in 2024 is valued at $227.05 billion.

- By 2025, it is projected to grow to $316.34 billion, marking a strong upward trend.

- The growth continues in 2026, with the market expected to surpass previous years significantly.

- A compound annual growth rate (CAGR) of 43.3% is forecasted between 2024 and 2029.

- By 2028, the market will near the trillion-dollar mark.

- The global metaverse market is estimated to reach a staggering $1,334.18 billion by 2029, showcasing its massive future potential.

Regional Trends and Demographics

- North America leads with 38% of global metaverse users, while Asia-Pacific shows the fastest growth at 41% YoY.

- India, Indonesia, and Vietnam emerge as new adoption hotspots, with user bases doubling in the past 12 months.

- Europe’s metaverse user base grew by 28% in 2025, with Germany and the UK at the forefront.

- Latin America’s adoption rate rose by 19%, driven by mobile-friendly platforms and entertainment content.

- Gen Z (ages 10–25) makes up 45% of global metaverse users in 2025, followed by Millennials at 34%.

- Female users now account for 43% of total metaverse engagement.

- Urban residents are three times more likely to use metaverse services daily compared to rural users.

- The average age of a metaverse user in 2025 is 28.7 years.

- English and Mandarin remain the most commonly used languages in metaverse interfaces.

- Digital inclusion programs in low-income regions have introduced over 7 million users to metaverse education tools in 2025.

Investment and Funding in the Metaverse Space

- In 2025, global investment in metaverse technologies exceeded $98 billion.

- Venture capital funding alone amounted to $36 billion, with early-stage startups in AI-driven avatars and XR software gaining traction.

- Meta and Microsoft together invested over $23 billion in immersive R&D this year.

- Over 60 SPACs and IPOs were launched globally in the XR and metaverse sectors in 2025.

- Japan’s SoftBank invested $1.2 billion in virtual world startups across Asia and the US.

- Corporate M&A activity in metaverse tech jumped 31% YoY, with an average deal size of $422 million.

- Blockchain-based metaverse startups raised over $15 billion, especially in gamified finance and identity management.

- US-based startups received 47% of global metaverse investment capital in 2025.

- European governments, including France and Germany, committed €3.4 billion in public R&D for immersive education and digital sovereignty.

- Over 1,200 investment rounds were recorded in Q1–Q3 2025, making it the most active funding period since 2021.

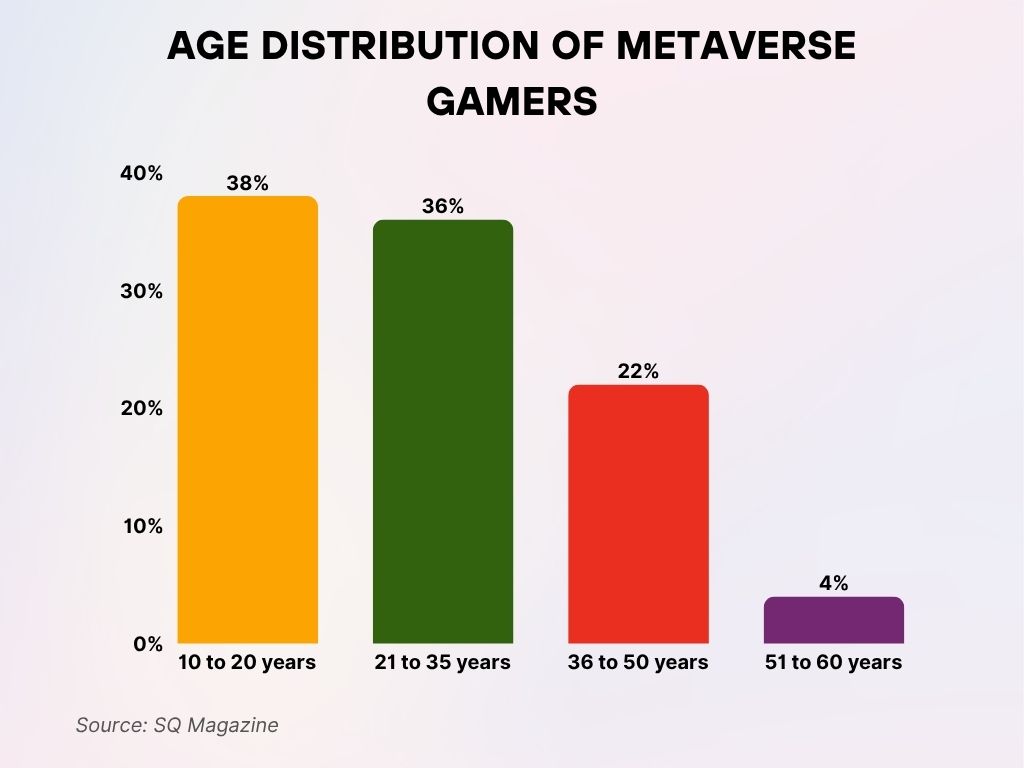

Age Distribution of Metaverse Gamers

- The largest segment of metaverse gamers falls within the 10 to 20 years age group, accounting for 38% of users. This highlights the strong appeal of virtual worlds among Gen Z and teens.

- Close behind are gamers aged 21 to 35 years, making up 36% of the total. This group includes millennials who are both tech-savvy and early adopters.

- 22% of metaverse gamers are aged 36 to 50 years, indicating notable interest from older, more financially independent users.

- Only 4% of users are in the 51 to 60 years range, suggesting limited adoption among older generations.

Business Applications and Enterprise Adoption

- 83% of Fortune 500 companies have launched metaverse initiatives in 2025.

- Corporate training programs in VR environments now reach over 34 million employees globally.

- Digital twins in manufacturing and construction saved enterprises an estimated $11.6 billion in prototyping costs.

- Enterprise collaboration platforms like Microsoft Mesh and Meta Workrooms have a combined user base of 42 million.

- Virtual storefronts have been adopted by 52% of global retail brands, including Walmart and Nike.

- Remote onboarding via VR/AR increased by 64%, with higher retention and faster integration rates.

- Immersive data visualization tools are now used by 28% of tech and finance firms.

- HR departments increasingly use metaverse simulations to assess soft skills during hiring, with 42% adoption in tech companies.

- Architecture and engineering firms are using spatial modeling in VR to reduce design errors by up to 40%.

- Customer support avatars, powered by AI and deployed in metaverse spaces, handle over 2 million queries daily across the retail and telecom sectors.

Virtual Real Estate Market Trends

- $9.1 billion in virtual real estate transactions took place across platforms like Decentraland, Somnium Space, and The Sandbox in 2025.

- Land parcel prices in high-traffic metaverse zones rose by 18% YoY, despite market corrections.

- Over 75,000 new virtual properties were purchased by individuals and brands in 2025.

- Branded virtual headquarters now exist for companies like Adidas, JPMorgan, and Samsung.

- Rental income from virtual real estate exceeded $1.2 billion in 2025, largely from hosting events and storefronts.

- Speculative trading remains high, with 15% of buyers reselling properties within 3 months.

- Top real estate markets in the metaverse include Fashion Street (Decentraland) and Crypto Valley (The Sandbox).

- Real estate tokenization is gaining popularity, allowing fractional ownership of high-value virtual land plots.

- Virtual architecture services are a booming niche, with over 2,000 active firms designing for the metaverse.

- Commercial virtual districts focused on fintech, health, and entertainment now make up 26% of total land development.

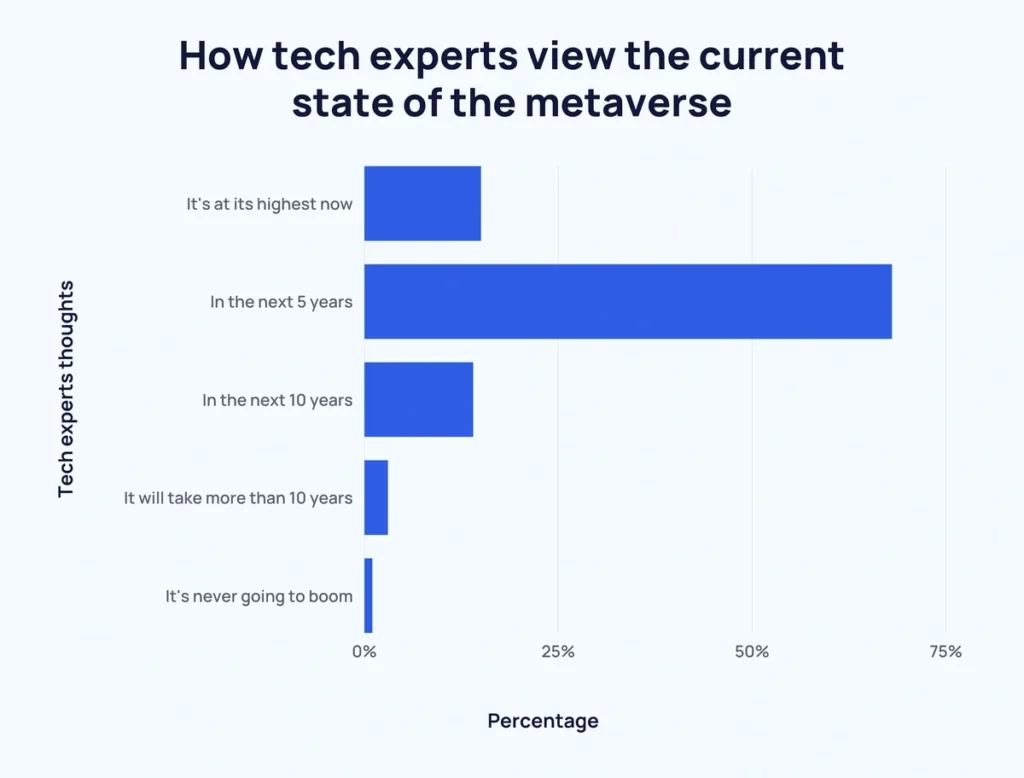

Tech Experts’ Predictions on the Metaverse’s Future

- A majority of tech experts (over 70%) believe the metaverse will boom within the next 5 years, showing strong confidence in short-term growth.

- About 15% think the metaverse will reach its peak in the next 10 years, indicating expectations for a more gradual evolution.

- Roughly 10% say the metaverse is at its highest point now, suggesting skepticism about future expansion.

- A small portion, around 3%, believe it will take more than 10 years to boom, reflecting a long-term outlook.

- Only about 1% feel it’s never going to boom, signaling minimal pessimism among tech experts.

NFT and Digital Asset Utilization in the Metaverse

- In 2025, NFT sales within the metaverse surpassed $42 billion.

- Avatar customization assets, such as skins and accessories, account for 31% of total NFT transactions.

- Over 80% of Gen Z metaverse users have purchased or traded at least one NFT this year.

- Decentralized identity (DID) NFTs are used by 22 million users to verify and protect their online identities.

- Gaming NFTs are the most actively traded, with titles like Illuvium and Star Atlas driving $7.6 billion in volume.

- Music and entertainment NFTs grew by 49% YoY, enabling direct fan engagement and revenue for artists.

- Virtual property deeds represented 12% of all NFT sales, with blockchain-backed proof of ownership gaining legal traction in some regions.

- The average value of a metaverse-linked NFT in 2025 is $317, reflecting increased accessibility.

- Ethereum and Solana remain the top blockchains powering metaverse NFTs, although Polygon’s adoption has surged by 65% this year.

- Corporate NFT launches, including branded wearables and digital collectibles, now make up 18% of the total NFT market share.

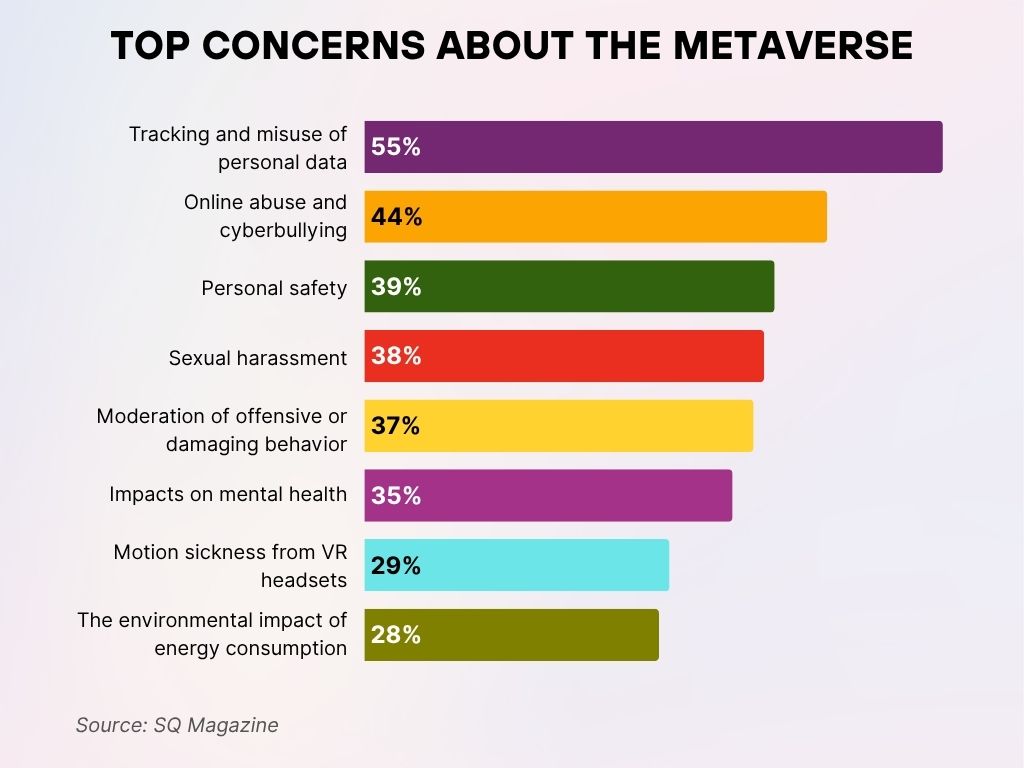

Top Concerns About the Metaverse

- 55% of consumers are most concerned about tracking and misuse of personal data, emphasizing serious privacy risks in virtual environments.

- 44% cite online abuse and cyberbullying as a major worry, highlighting the need for stronger digital safety protocols.

- 39% are anxious about personal safety, showing that physical and psychological security remains a key issue.

- 38% are troubled by sexual harassment, revealing vulnerabilities users may face in immersive platforms.

- 37% express concern about the moderation of offensive or damaging behavior, calling for better governance in virtual spaces.

- 35% are worried about the impacts on mental health, reflecting unease about prolonged exposure to digital realities.

- 29% mention motion sickness from VR headsets, pointing to the need for more user-friendly hardware.

- 28% are concerned about the environmental impact of energy consumption, especially with growing infrastructure demands.

Metaverse Platform Popularity Rankings

- Roblox maintains its lead as the most-used metaverse platform globally, with 287 million monthly active users (MAUs).

- Meta’s Horizon Worlds reached 98 million MAUs, doubling its base from the previous year.

- Fortnite Creative Mode engages over 160 million players monthly via immersive co-creation experiences.

- Zepeto and VRChat both boast 60+ million MAUs, driven by social interaction and user-generated fashion content.

- The Sandbox reported active wallet connections from 4.8 million users per month, focusing on gamified real estate.

- Decentraland’s user retention rate increased to 52% after introducing role-based economies.

- Improbable’s MSquared network now powers over 75 white-labeled metaverse experiences for enterprise and gaming.

- Spatial and Breakroom lead in B2B and event-centric metaverses, with growing adoption by media and conferencing firms.

- Niantic’s Lightship platform, centered around geospatial AR, supports 130 million global users interacting with digital overlays.

- Top-rated platforms for education include Virbela and ENGAGE XR, with 40% YoY growth in institutional deployments.

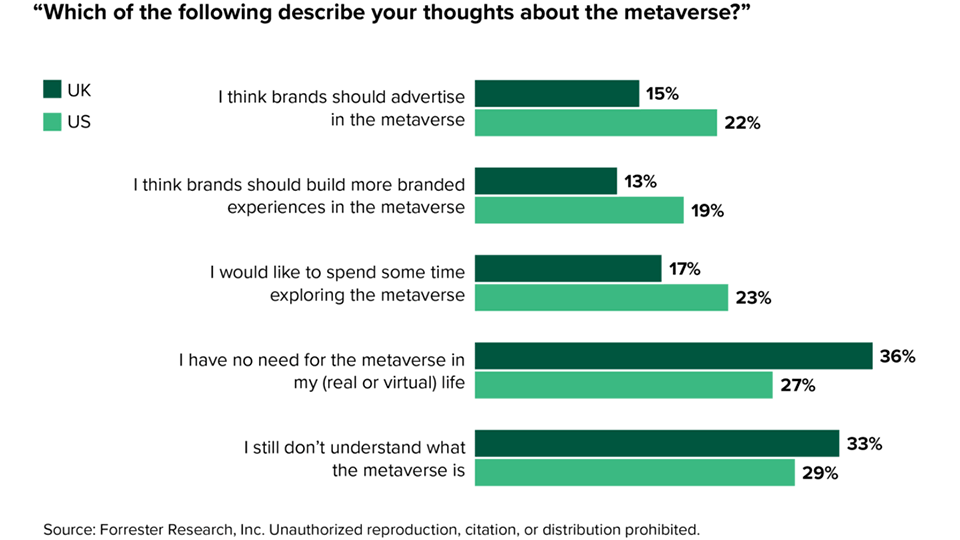

Comparing UK vs. US Perceptions of the Metaverse

- 22% of US respondents think brands should advertise in the metaverse, compared to just 15% in the UK.

- 19% of US consumers believe in building more branded experiences, while only 13% in the UK agree.

- 23% of Americans express interest in exploring the metaverse, slightly higher than 17% of Brits.

- A significant 36% in the UK say they have no need for the metaverse, versus 27% in the US.

- 33% of UK respondents admit they don’t understand the metaverse, compared to 29% in the US, revealing widespread confusion in both regions.

Recent Developments in the Metaverse Industry

- Apple Vision Pro entered the metaverse space in 2025 with real-time mixed-reality integrations for productivity and entertainment.

- Meta’s AI avatars now offer real-time multilingual translation, reshaping global collaboration inside Horizon Worlds.

- Google launched “Project Mirror”, a spatial computing platform focused on digital twins and immersive search.

- Samsung’s metaverse marketplace now supports 5G-enabled streaming of VR experiences for home and retail.

- Tencent launched a creator fund worth $2.5 billion to support Chinese metaverse content developers.

- UNESCO introduced a metaverse curriculum pilot across 12 countries, focusing on digital citizenship and ethics.

- Amazon debuted “MetaMart”, a VR shopping platform integrated with Prime, allowing users to browse and buy via 3D interfaces.

- Zoom and Unity partnered to launch a business-oriented XR conferencing suite with spatial audio and holographic projections.

- Netflix released an immersive metaverse series, enabling interactive storyline branching based on user actions.

- The global metaverse labor force now exceeds 1.4 million professionals, including designers, developers, content creators, and strategists.

Conclusion

The metaverse in 2025 is no longer a speculative buzzword; it’s a complex, multifaceted ecosystem reshaping how people live, work, play, and learn. From $507.8 billion in global market value to millions of daily users engaging across industries, the metaverse has cemented itself as a digital pillar of modern society. Yet with growth comes responsibility, as issues like privacy, inclusivity, and regulation demand immediate and thoughtful solutions.

As we look ahead, success in the metaverse will hinge not just on technology but on the ability to build safe, scalable, and meaningful experiences that bridge the virtual and real worlds.