Meta Platforms continues to define the global social media landscape, shaping how billions connect, share, and consume content online. With its family of apps, Facebook, Instagram, WhatsApp, Messenger, and Threads, Meta influences commerce, communication, and digital interaction worldwide. From advertising strategies that drive digital economies to AI-powered tools that enhance user experiences, Meta’s reach remains both vast and dynamic.

Real-world applications include marketers targeting audiences across billions of users and businesses leveraging WhatsApp for customer engagement. Explore this report to understand Meta’s current footprint and trends driving its evolution.

Editor’s Choice

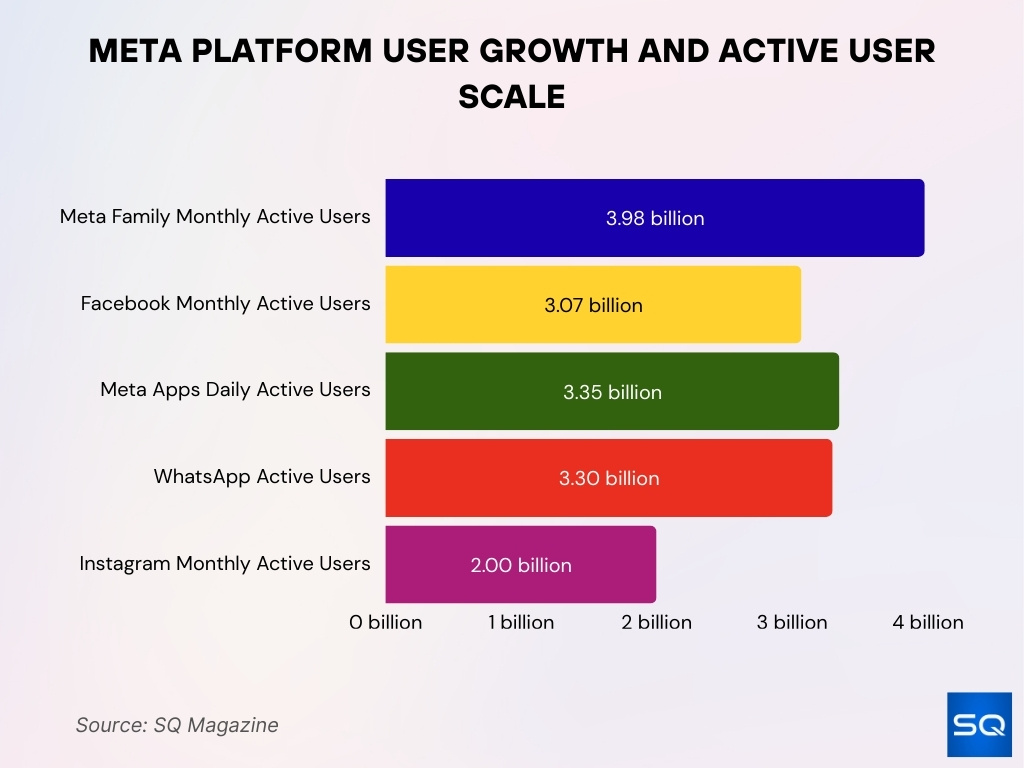

- Meta’s family of apps reached 3.98 billion monthly active users as of early 2025.

- Facebook alone maintains about 3.07 billion monthly active users in 2025.

- WhatsApp surpassed 3.3 billion active users globally in 2025.

- Instagram reported 2 billion monthly active users in 2025.

- Meta’s annual revenue for 2024 reached $164.5 billion.

- 2025 revenue guidance suggests strong year-over-year growth with Q4 estimates of $56–$59 billion.

- Over 80% of Meta’s monthly users engage daily with its products.

Recent Developments

- Meta’s advertising revenue in China exceeded $18 billion in 2024, despite internal concerns about fraudulent ads.

- Austria’s Supreme Court ruled Meta’s ad-targeting model illegal under EU privacy law, requiring significant data-practice changes.

- Meta announced ads in WhatsApp’s Updates tab in 2025, marking a major monetization shift.

- Despite efforts to curb fraud, internal figures suggested up to 19% of Chinese ad revenue came from questionable ads.

- U.S. regulators and lawmakers have increased scrutiny of Meta’s ad systems due to fraud and safety concerns.

- Meta expanded advertising access on Threads, leveraging its rising active users globally.

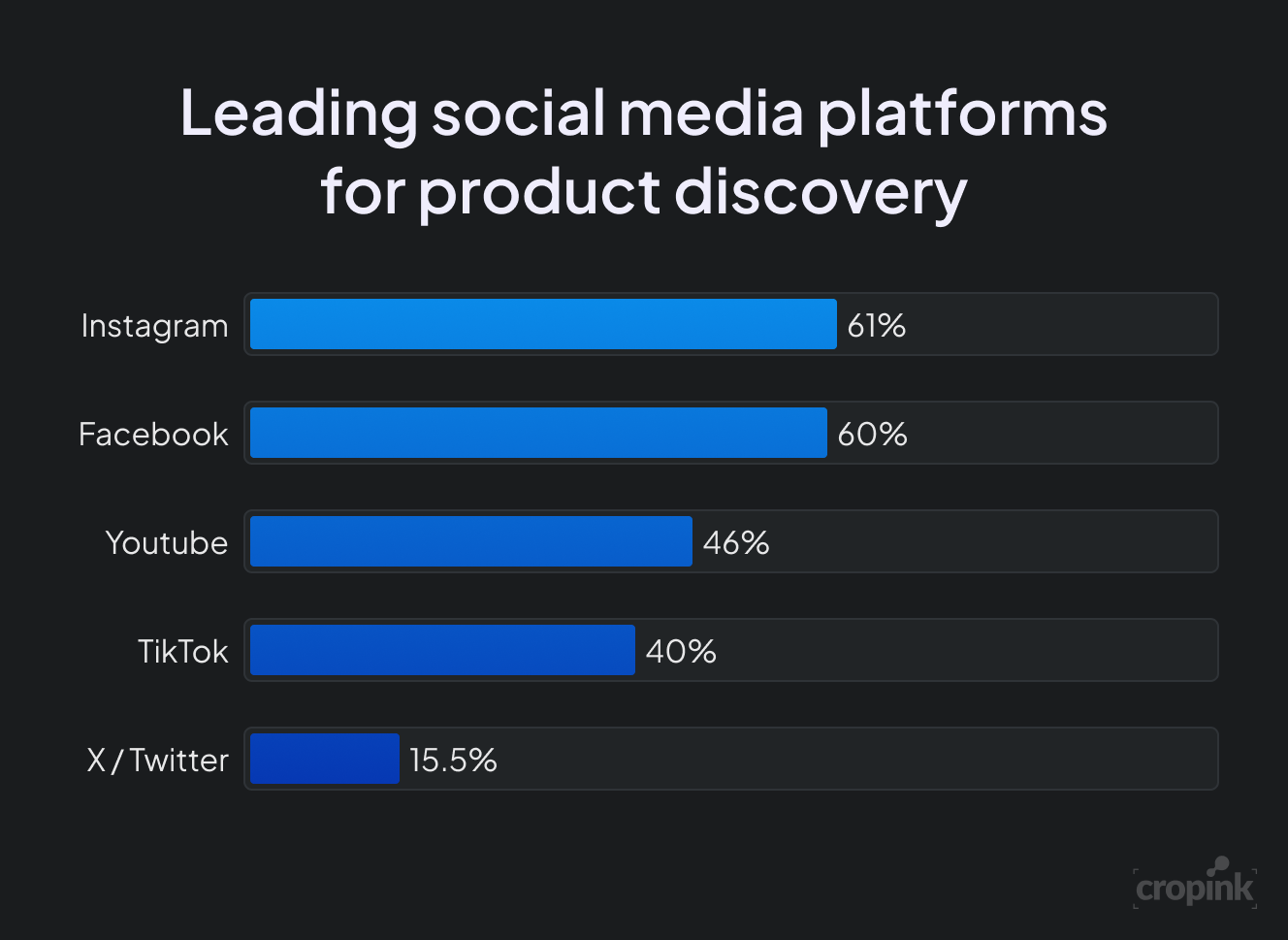

Leading Social Media Platforms for Product Discovery

- Instagram leads product discovery, with 61% of users finding new products through the platform.

- Facebook follows closely at 60%, highlighting its continued strength in social commerce and recommendations.

- YouTube supports product discovery for 46% of users, driven by video reviews, tutorials, and creator content.

- TikTok influences purchasing decisions for 40% of users, reflecting the growing impact of short-form video and viral trends.

- X (Twitter) trails significantly, with only 15.5% of users using the platform for product discovery, indicating a weaker commerce role compared to visual platforms.

Meta Platforms Overview

- Meta Platforms, Inc. is headquartered in Menlo Park, California, and operates the largest suite of social apps globally.

- Facebook, WhatsApp, Instagram, Messenger, and Threads are part of its core ecosystem.

- Meta Platforms holds a market capitalization of $1.66 trillion as of December 2025.

- Family of Apps averaged 3.43 billion daily active users in March 2025.

- Platforms generated $51.24 billion in Q3 revenue, up 26% year-over-year.

- Q1 revenue reached $42.31 billion, reflecting 16% year-over-year growth.

- Trailing twelve-month revenue totals $189.45 billion.

- Capital expenditures are projected at $66–72 billion for full‑year 2025, reflecting updated AI infrastructure guidance.

- Reality Labs posted $73 billion cumulative losses over five years through 2025.

- Threads surpassed 350 million monthly active users in Q1 2025.

- Meta AI reached almost 1 billion monthly active users by March 2025, before surpassing 1 billion MAUs in May 2025.

- Q3 operating income hit $20.5 billion with a 40% margin.

Geographic Distribution of Users

- India represents the largest country user base for Facebook, with roughly 384 million active users in 2025.

- The United States ranks second with nearly 280 million Facebook users in 2025.

- Much of Meta’s user base is in Asia-Pacific, followed by Europe and the U.S. and Canada.

- Facebook’s daily active users in Asia-Pacific total about 914 million.

- Daily active users in the U.S. and Canada for Facebook number around 205 million.

- Meta’s family reaches significant regions worldwide, with broad penetration across emerging markets.

User Growth and Active Users

- The Meta family had 3.98 billion monthly active users in early 2025.

- Facebook contributed about 3.07 billion MAUs in 2025.

- Daily active people across Meta apps reached 3.35 billion, underscoring frequent engagement.

- WhatsApp’s active user base reached 3.3 billion in 2025.

- Instagram maintained 2 billion monthly users in 2025.

- 70% of the world’s active internet users access at least one Meta app monthly.

Revenue and Financial Statistics

- In Q3 2025, Meta reported $51.24 billion in revenue, a 26% increase year-over-year compared to Q3 2024.

- Total revenue for the first nine months of 2025 hit $141.07 billion, surpassing $116.12 billion for the same period in 2024.

- In Q1 2025, Meta generated $42.31 billion in revenue, up about 16% YoY.

- Net income in Q1 2025 was $16.64 billion, up ~35% YoY.

- Meta’s advertising segment accounted for nearly all revenue, contributing roughly 97%+ of total revenue.

- Meta held ~$77.81 billion in cash and equivalents at the end of 2024, providing strong liquidity.

- Capital expenditures for 2025 are expected to reach between $66 billion–$72 billion, aimed at AI and data center infrastructure.

- Meta’s free cash flow for 2024 was $52.10 billion, with $13.15 billion generated in the fourth quarter.

- Long‑term debt stood at $28.83 billion as of Dec 31, 2024.

- Meta continues focusing R&D spending, with $48.45 billion invested in the year ending June 30, 2025, a 20% YoY increase.

Advertising Reach and Spend

- Advertising revenue reached $46.6 billion in Q2, comprising 98% of total revenue.

- Ad impressions grew 14% year-over-year in Q3 across Family of Apps.

- Average price per ad increased 10% year-over-year in Q3.

- Family ARPP rose to $13.65 in Q2, up 14.8% year-over-year.

- Chinese advertisers generated over $18 billion annually, 10%+ of total revenue.

- 19% of Chinese ad revenue is linked to fraudulent or prohibited content.

- WhatsApp Updates ads projected to generate $3-5 billion annually.

- 83% of marketers worldwide use Facebook for advertising.

- Meta is projected to capture 23% of global digital ad spend.

- Q1 ad impressions increased ~5% YoY with prices up 10%.

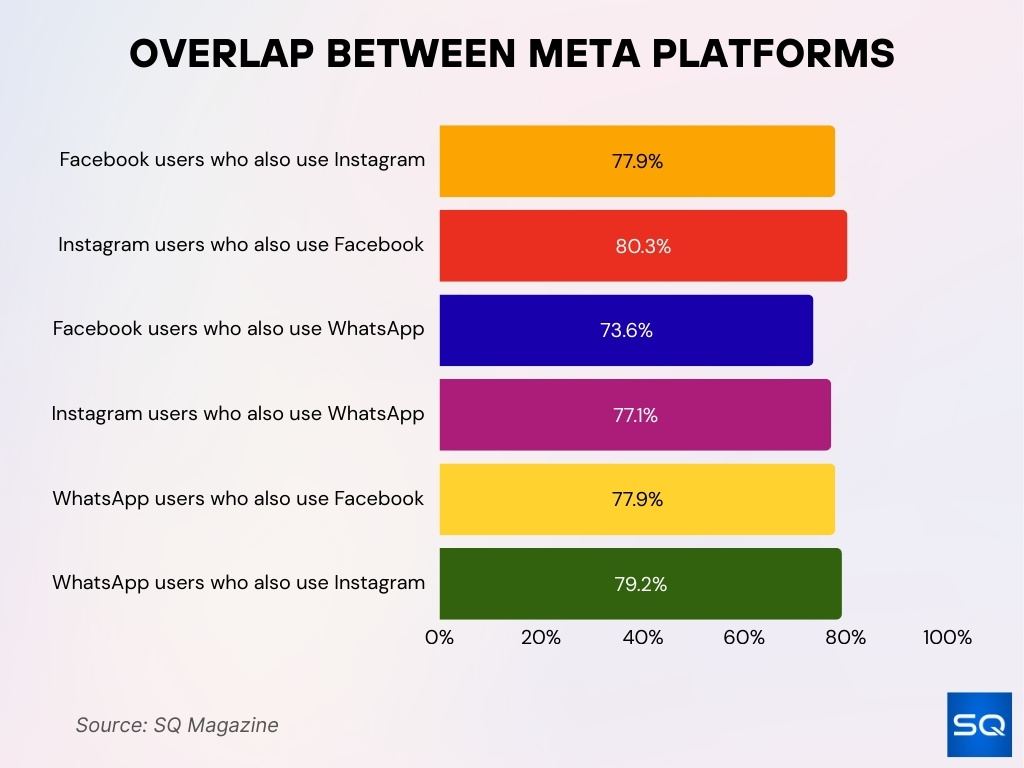

Overlap Between Meta Platforms

- 77.9% of Facebook users also use Instagram.

- 80.3% of Instagram users also use Facebook.

- 73.6% of Facebook users also use WhatsApp.

- 77.1% of Instagram users also use WhatsApp.

- 77.9% of WhatsApp users also use Facebook.

- 79.2% of WhatsApp users also use Instagram.

- Multi-platform users spend 63 minutes daily across Meta apps.

- 84.17% of monthly active Meta users access platforms daily.

- Instagram Stories sync achieves a 96% data rate with 68% user overlap.

- WhatsApp Status shows an 88% sync rate with 54% user overlap.

Market Capitalization and Valuation

- Market capitalization stands at $1.66 trillion as of December 19.

- Enterprise value measures $1.67 trillion.

- P/E ratio registers at 26.69 based on TTM EPS of $23.19.

- EV/EBITDA multiple calculated at 17.71.

- The stock price closed at $658.77 on December 19.

- Market cap ranks Meta as the world’s 6th most valuable company.

- One-year market cap growth achieved 7.16%.

- Nasdaq-100 weight positions Meta among top holdings.

- Shares outstanding support 2.52 billion total.

Meta AI and Artificial Intelligence Statistics

- Meta AI reached 1 billion monthly active users across apps.

- Capex investments range $64-72 billion for AI infrastructure.

- User base doubled from 500 million to 1 billion in eight months.

- 4 million advertisers use generative AI ad tools.

- Superintelligence Labs consolidates Llama models and FAIR research.

- Advantage campaigns show 70% year-over-year growth.

- 40 million daily active users for Meta AI.

- AI shopping campaigns exceed $20 billion annual run rate.

- Meta AI is available in 22 countries with rapid expansion.

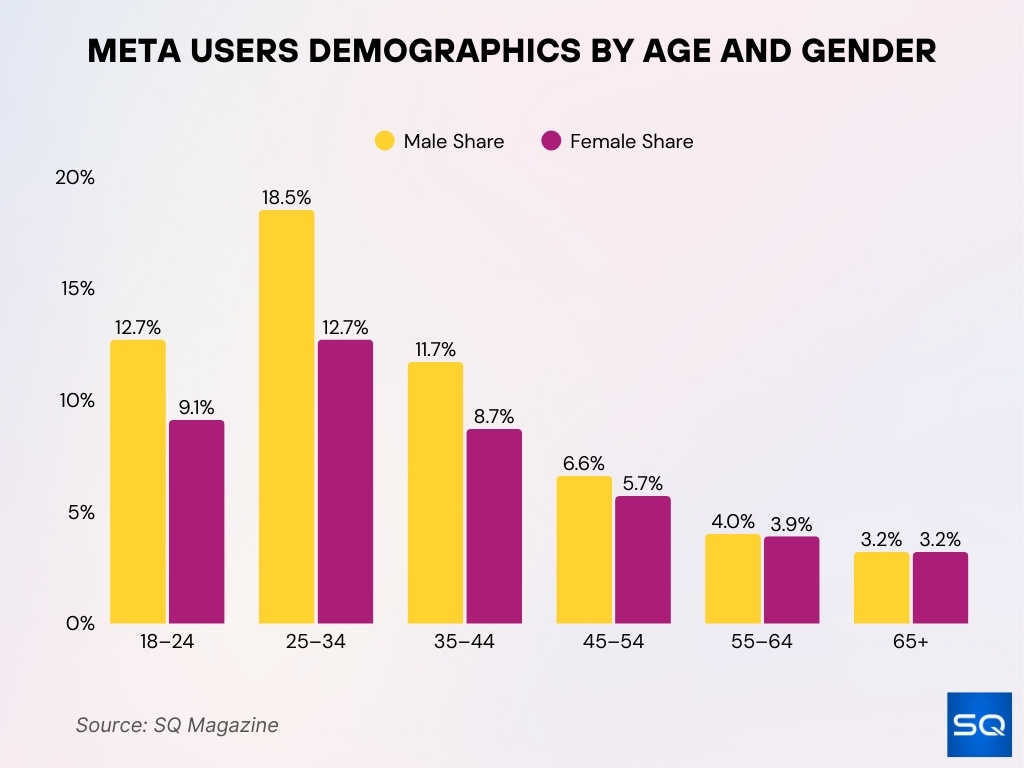

Meta Users Demographics by Age and Gender

- Ages 25–34 dominate Facebook’s global ad audience, with 18.5% male and 12.7% female representation, making this the most commercially valuable segment.

- Young adults aged 18–24 remain highly active, accounting for 12.7% of male and 9.1% of female users in the global Facebook ad audience.

- The 35–44 age group shows a strong mid-career presence, with 11.7% male and 8.7% female share worldwide.

- Engagement declines steadily after age 45, dropping to 6.6% male and 5.7% female among users aged 45–54.

- Older audiences contribute smaller but stable shares, with 4.0% male and 3.9% female in the 55–64 segment.

- Gender parity appears in the 65+ group, where both male and female users account for 3.2% of the global Facebook ad audience.

Reality Labs, VR/AR and Metaverse Statistics

- Reality Labs recorded $4.53 billion Q2 operating loss with $370 million in revenue.

- Q3 losses reached $4.4 billion on $470 million in sales.

- Cumulative losses total $73 billion through 2025.

- Meta Quest captured 74.6% global VR headset market share.

- Ray-Ban Meta smart glasses sold 2 million units worldwide.

- Smart glasses sales tripled in Q2 with strong holiday demand.

- The global metaverse market is valued at $154.6 billion.

- AR glasses shipments surged 180% in Q3.

- Quest’s monthly usage grew 30% year-over-year.

Usage Trends and Engagement Rates

- As of January 2025, 84.17% of Meta’s monthly active users engage with at least one Meta app every day, highlighting user dependence on the platform family.

- Meta’s core apps (Facebook, Instagram, WhatsApp, Messenger) together see more than 3.35 billion daily active users (DAUs).

- Facebook itself has about 2.11 billion DAUs in 2025, representing roughly 69% of its monthly active user base.

- Average daily time spent on social media globally (including Meta platforms) is roughly 2 hours and 21 minutes per user.

- Facebook ads reached 2.28 billion people in January 2025, up ~4.3% year-over-year, showing continued advertiser interest in user activity.

- Meta’s suite of apps continues to retain users because of interconnected features like cross‑app sharing and messaging, which boost session frequency.

- Instant messaging trends still favor Meta, with WhatsApp and Messenger among the top global IM apps by user count.

- User engagement on newer platforms like Threads has seen fluctuation post‑launch, but growth strategies continue to evolve.

- Globally, social media use continues rising, with 259 million new users added year-over-year as of late 2025.

Mobile App Downloads and Rankings

- Worldwide mobile apps are projected to reach around 299 billion downloads by the end of 2025, up from 277 billion in 2024.

- Social media and entertainment apps account for over 40% of total mobile app usage globally, making them among the most downloaded categories.

- Meta’s family of apps, particularly Facebook, Instagram, and WhatsApp, consistently rank within the top charts for downloads across major app stores.

- Facebook has historically registered hundreds of millions of installs across platforms, with strong repeat engagement.

- Instagram and WhatsApp remain among the most installed social apps in both iOS and Android markets year-to-year.

- Meta’s mobile apps maintain high retention, with many users updating apps weekly or more often to access new features.

- With 78% of the global population owning a smartphone in 2025, mobile remains the leading channel for Meta engagement.

- App usage patterns show shorter, more frequent sessions, averaging just over 4 minutes per app, but cumulative engagement remains strong.

- Mobile revenue from app stores is projected to hit about $190 billion in 2025, further underlining the value of high‑ranking social apps.

Top Markets and Countries by User Base

- India leads with 581.6 million Facebook users.

- United States follows with 279.8 million Facebook users.

- Brazil records 175.1 million Facebook users.

- Indonesia has 174 million Facebook users.

- Mexico has 111.4 million Facebook users.

- India dominates WhatsApp with 853.8 million users.

- Brazil secures 148 million WhatsApp users.

- Indonesia registers 112 million WhatsApp users.

- United States holds 98 million WhatsApp users.

- Philippines has a total of 102.3 million Facebook users.

Safety, Security, and User Experience Statistics

- Meta removed 635,000 accounts targeting children with predatory content.

- Teens blocked 1 million accounts and reported another 1 million via Safety Notices.

- 135,000 Instagram accounts eliminated for sexualizing teen profiles.

- 500,000 accounts flagged for inappropriate child interactions.

- Enforcement errors dropped 50% in the U.S. from Q4 2024 to Q1.

- 500,000 accounts were actioned for spammy behavior in the first half.

- Nudity protection was activated by 99% of users, with 40% images remaining blurred.

- Location Notices shown to teens 1 million times in June.

- China scam ads represent 25% of global fraudulent advertising.

Frequently Asked Questions (FAQs)

Meta’s Family of Apps has 3.98 billion monthly active users as of January 2025

Meta platforms average 3.35 billion daily active users worldwide.

Facebook had 3.07 billion monthly active users in 2025.

Meta AI reached 1 billion monthly active users in early 2025.

Conclusion

Meta Platforms’ digital ecosystem shows sustained user engagement, massive mobile presence, and global reach across its family of apps. With billions of daily interactions and evolving mobile behaviors, Meta remains central to how people socialize, communicate, and consume online content. Yet, safety and regulatory challenges reflect the ongoing balance between growth and user trust. As Meta continues to innovate and adapt, understanding these trends is critical for businesses, policymakers, and everyday users alike.