Estimating how many people work at Notion is tricky, but data from multiple sources suggest the company is scaling rapidly. Across public filings, recruitment signals, and third-party aggregators, Notion’s workforce size offers insight into how the company balances growth, product development, and support. In real-world use, headcount affects Notion’s ability to roll out new AI features or manage enterprise clients, and it also signals to investors and competitors alike how aggressively Notion is betting on expansion. Read on to see how those numbers evolve, where employees are located, and how Notion’s team compares itself to peers in tech.

How Many People Work At Notion?

- Notion is reported to have ~4,800 employees per PitchBook’s 2025 profile.

- Some sources still list ≈ 800 employees as of 2025, reflecting possible data inconsistencies.

- According to Unify, Notion’s headcount is 1,217 employees, up 7.2% year over year.

- Engineering accounts for 374 employees, about 30% of the reported workforce.

- The San Francisco office houses 462 employees, the most of any location.

- The New York location holds 209 employees under that same breakdown.

- Dublin, Ireland, hosts 77 employees in Notion’s European operations.

Recent Developments

- In April 2025, Notion launched Notion Mail, integrating email drafting and search via Notion AI.

- Throughout 2024, Notion introduced Forms, Layouts, and extended automation tools, expanding its platform beyond core notes and databases.

- AI enhancements now support PDF analysis, context-aware suggestions, and deeper content drafting.

- In 2023, enterprise accounts received multi-factor authentication and audit log features to meet security demands.

- Notion’s integrations now exceed 70+ SaaS tools, including Slack, GitHub, Zoom, and Typeform.

- Expanded language support now includes Japanese, Korean, and multiple European languages.

- The company’s product roadmap increasingly emphasizes AI + automation, likely driving hiring in machine learning, backend systems, and security domains.

Notion’s Current Team (Key People)

- Ivan Zhao, Co-Founder & CEO. Leads vision, product strategy, and overall company direction.

- Akshay Kothari, Co-Founder & COO. Oversees day-to-day operations, product execution, and internal scaling.

- Rama Katkar, Chief Financial Officer. Manages financial planning, capital allocation, and fiscal stewardship.

- Erica Anderson, Chief Revenue Officer. Heads revenue, sales, and go-to-market strategy.

- Joy Ho, Chief of Staff. Coordinates across Engineering, Product, and Design teams to ensure alignment and execution.

- Fuzzy Khosrowshahi, Chief Technology Officer (appointed December 2023). Previously led product engineering roles at Slack and Google; now in charge of Notion’s engineering org.

- Katy Shields, Chief People Officer (joined May 2025). Brings experience from Google X, VSCO, and DoorDash, focusing on culture, hiring, and people operations.

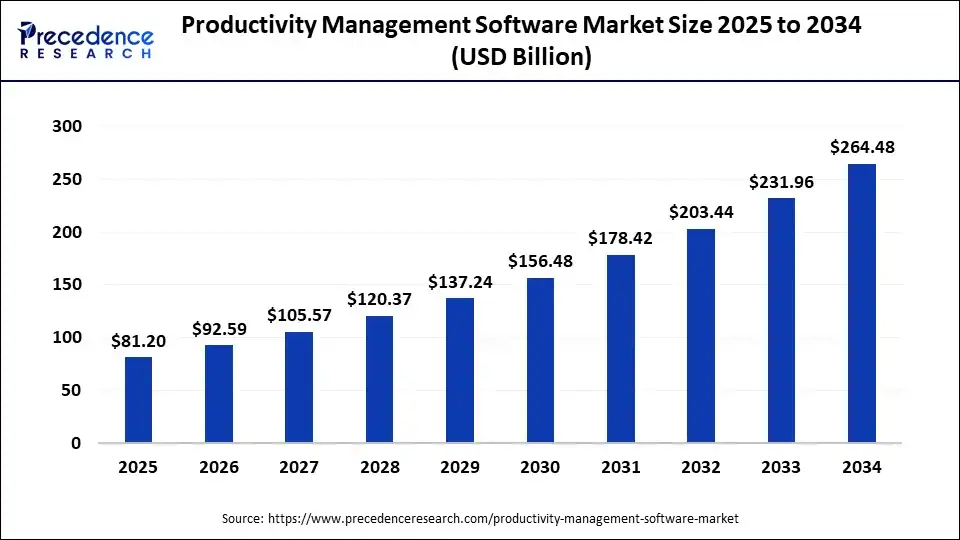

Productivity Management Software Market Growth

- The global productivity management software market is valued at $81.20 billion in 2025.

- It is projected to rise to $92.59 billion in 2026, reflecting steady early growth.

- By 2027, the market size will reach $105.57 billion, crossing the $100 billion mark.

- In 2028, the sector expands further to $120.37 billion.

- Growth continues in 2029, hitting $137.24 billion.

- By 2030, the market is expected to surpass $156.48 billion.

- In 2031, projections indicate a jump to $178.42 billion.

- The market crosses the $200 billion milestone in 2032, reaching $203.44 billion.

- By 2033, the value climbs to $231.96 billion.

- The forecast ends with a peak of $264.48 billion in 2034, more than triple the 2025 size.

Notion Headcount Growth Trends

- Unify reports a 7.2% year-over-year growth in headcount to 1,217 employees.

- That same source notes 74 recorded departures and 218 new hires (YTD), showing turnover is part of scaling.

- If we assume earlier reports (800 employees in 2024) are correct, rising toward 1,200+ suggests ~50% growth in one year.

- However, PitchBook’s 4,800 figure suggests a much larger base; this could include contractors or external roles.

- Some media sources continue referencing 800 employees as a base case, likely from older or lower veracity data.

- The discrepancy across sources suggests Notion’s disclosed headcount fluctuates depending on whether contractors, part-time employees, or remote employees are included.

- In tech firms, headcount often jumps in phases, e.g. post post-funding rounds or product launches, so growth may be lumpy rather than linear.

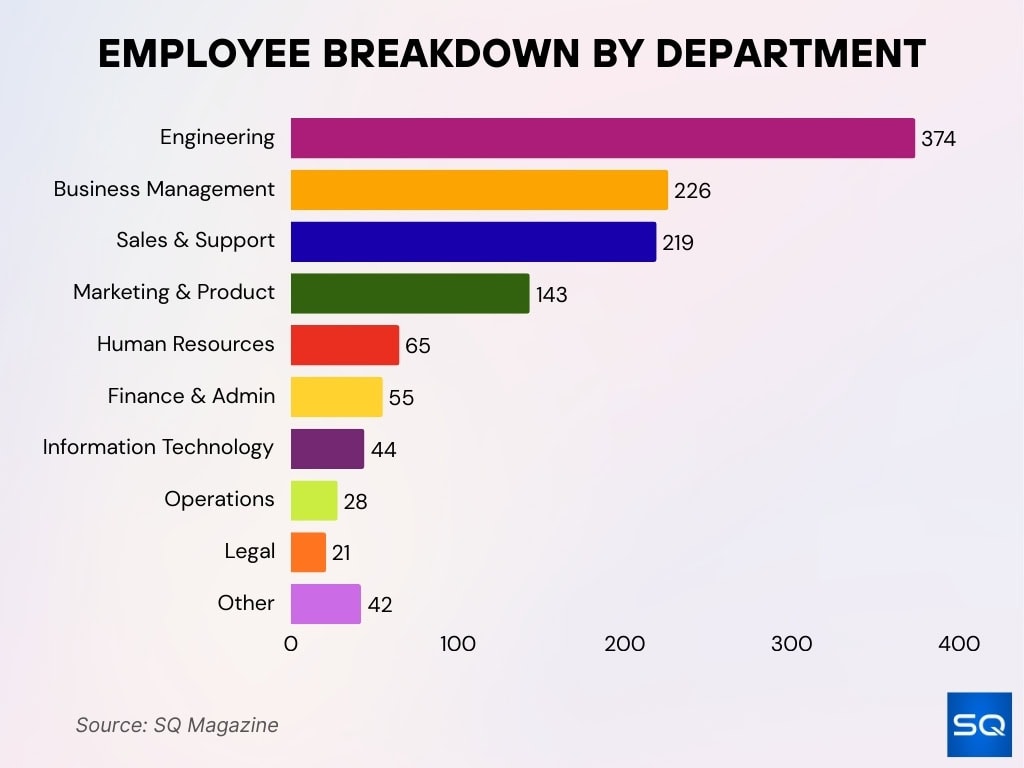

Employee Breakdown by Department

- Engineering: 374 employees (≈ 30% of the 1,217 figure).

- Business Management: 226 employees.

- Sales & Support: 219 employees.

- Marketing & Product: 143 employees.

- Human Resources: 65 employees.

- Finance & Administration: 55 employees.

- Information Technology: 44 employees.

- Operations: 28 employees.

- Legal: 21 employees.

- Other (misc functions): 42 employees.

Gender Distribution of Notion Employees

- In 2022, men reportedly made up 71% of Notion’s workforce, and women 29%.

- By 2023, that proportion is said to have shifted to 66% male / 34% female.

- Glassdoor’s DEI rating page shows that among reviewers, ratings by women are 4.9★ vs men 4.3★, suggesting women in the company perceive inclusion positively.

- Notion states on its Careers page that it values diversity across “race, age, … gender identity, ethnicity, perspectives” in hiring.

- No reliable public data is available for nonbinary/trans/gender nonconforming representation at Notion, so those categories remain unquantified.

- Without internal disclosures, it’s unclear how gender ratios break down by level (individual contributor, manager, executive).

- The shift from 29% to 34% women suggests modest progress, though the pace is slow for an organization scaling in 2024–2025.

- Because gender data is self-reported or HR gathered, there may be gaps or undercounts.

Team Size Over the Years

- As of mid-2025, Unify reports 1,217 total employees, up 7.2% year over year.

- That increase corresponds to 218 new hires YTD and 74 departures.

- In some earlier media, Notion was said to have 650 employees across the U.S., Ireland, India, Korea, and Japan in 2024.

- However, older sources quoted ~800 employees in 2025.

- The wide spread in reported numbers (650 to 1,200+) suggests differences in counting method (full-time vs. contractors vs. remote).

- Historically, in 2019, Notion had ~12–20 staff (early stage), ramping through 2020–2021.

- After the 2021 Series D, growth likely accelerated, though public metrics don’t fully disclose each year’s hiring.

- The 7.2% growth in 2025 is modest compared to hyper-growth stage startups, indicating more measured scaling.

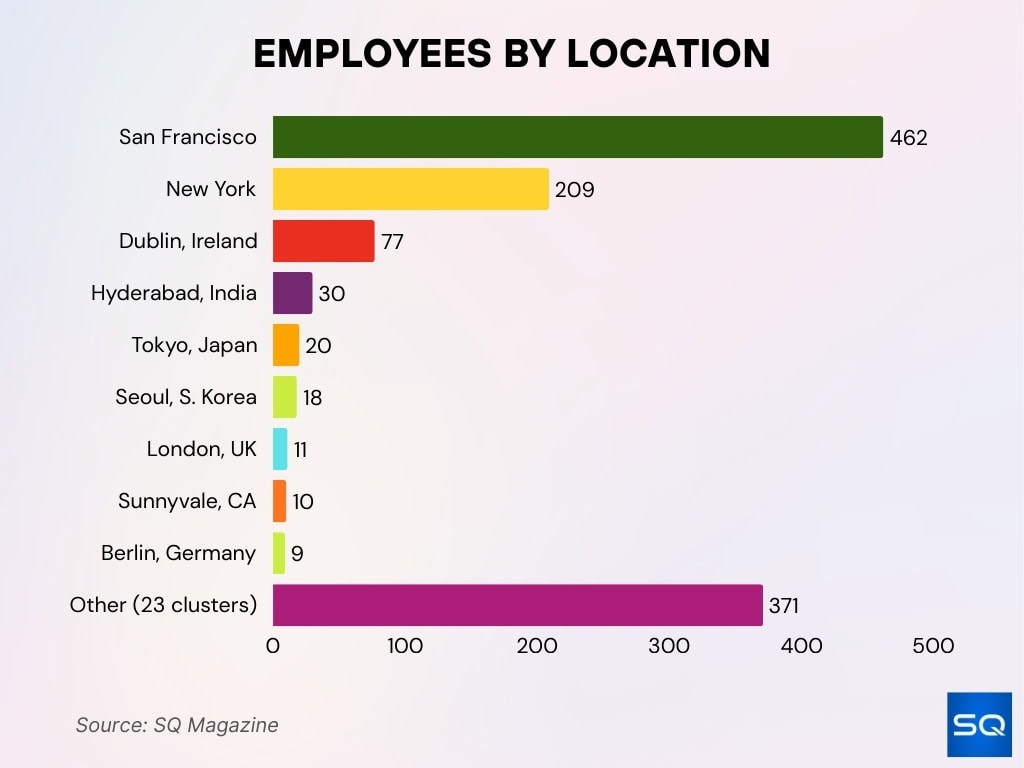

Employees by Location

- San Francisco, CA: 462 employees (largest share).

- New York, NY: 209 employees.

- Dublin, Ireland: 77 employees.

- Hyderabad, India: 30 employees.

- Tokyo, Japan: 20 employees.

- Seoul, South Korea: 18 employees.

- London, UK: 11 employees.

- Sunnyvale, CA: 10 employees.

- Berlin, Germany: 9 employees.

- Other locations (23 additional offices or remote clusters): 371 employees.

Recent Hiring and Attrition Statistics

- In 2025, among the 1,217 employees, 218 were new hires YTD (≈ 18% of base).

- Also, 74 departures (≈ 6% of base) were recorded in the same period.

- That yields a net addition of 144 employees, or ~11.8% net growth to date.

- The departure/hire differential suggests Notion is consciously retaining more than it is losing.

- While aggregate attrition is known, breakdown by department or seniority is not publicly available.

- It is unclear how many departures were voluntary vs involuntary.

- Compared to broader industry norms, many tech firms see ~10–20% annual turnover. Notion’s current ~6% departure YTD is comparatively moderate.

- Without quarterly disclosures, we can’t see seasonal or team-level fluctuation.

Comparison With Competitors

- Coda, ClickUp, and Airtable are frequently cited as peers or adjacent tools; however, public employee counts vary and aren’t always up to date.

- For instance, Airtable reportedly had ~300 employees a few years ago, though current data is scarce.

- Some companies like Asana and Notion’s parent category peers often disclose headcounts as part of their public filings, but Notion, being private, makes direct comparison harder.

- Notion’s 1,217 is smaller than giants like Microsoft, but comparable to mid-size SaaS firms.

- Compared to pure note-taking or collaboration tools, Notion likely sits above many boutique tools in headcount.

- Because many SaaS firms include contract, remote, and outsourced hires, direct apples-to-apples is challenging.

- The disciplined ~7% growth rate suggests Notion is not hyper-scaling recklessly relative to competitors who sometimes double headcount year over year.

- In terms of team structure, Notion’s heavy investment in engineering aligns with peers, but its relatively lean support/ops functions suggest it remains more product-focused than enterprise-heavy.

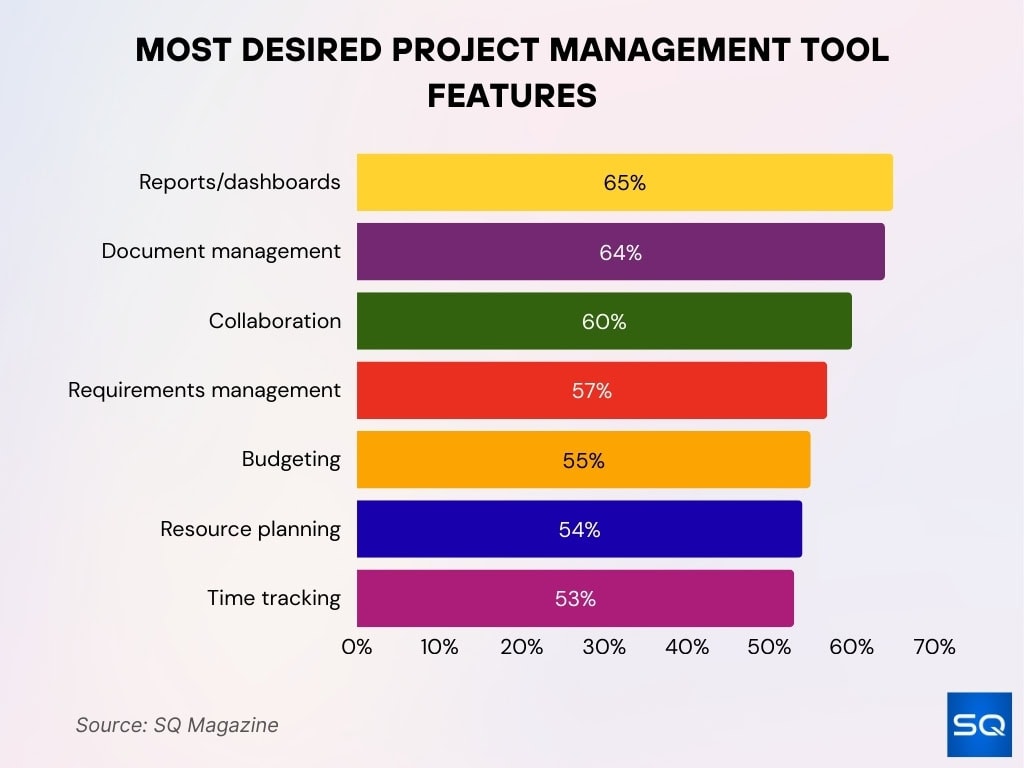

Most Desired Project Management Tool Features

- 65% of users prioritize reports and dashboards, making them the most desired feature.

- 64% consider document management essential for effective project workflows.

- 60% highlight the importance of collaboration tools for team efficiency.

- 57% look for strong requirements management capabilities.

- 55% of users value budgeting features to control project costs.

- 54% emphasize the need for resource planning tools.

- 53% want built-in time tracking to monitor productivity and deadlines.

Notion’s Global Workforce Distribution

- Unify reports operations in 23 locations (offices or major clusters) globally.

- Of the 1,217 employees, 462 are in San Francisco, making it the largest single office.

- 209 in New York, 77 in Dublin are the next largest hubs.

- Asia clusters, 30 in Hyderabad, 20 in Tokyo, 18 in Seoul.

- London (11), Sunnyvale (10), and Berlin (9) host smaller hubs.

- 371 other employees are distributed across further remote or small offices.

- That means about 30% of the workforce sits outside the main hubs.

- The geographic spread shows a push to access global talent, especially in Asia and Europe.

- Such a distribution implies Notion must manage cross-zone collaboration, local labor laws, and remote culture challenges.

- The “Other” category likely includes remote first roles or satellite offices not publicly named.

Notion Ambassadors and Influencers

- Notion’s Ambassador Program reportedly has ~200+ ambassadors across 23 countries.

- Ambassadors are users who teach, host events, create content, or advocate for Notion in local communities.

- Requirements historically included devoting 2–3 hours per quarter in service to the community.

- Ambassadors are often leveraged to help with onboarding, local events, feedback loops, and template creation.

- While not employees, they function as an extended “team” for brand growth.

- Notion also engages influencers (paid or organic) for B2B marketing, e.g., promoting new products or features.

- The influencer program has been used to highlight product launches or reach enterprise audiences on LinkedIn.

- As community content spreads, ambassadors help scale support, reducing load on internal teams.

- The precise count of ambassadors fluctuates and is not published in recent official reports.

Training Hours and Workforce Development

- Notion won a Transform Awards spotlight for its learning & development (L&D) strategy, implying formal training frameworks.

- The awards case describes blending creativity, culture, and connection in L&D as a strategic priority.

- No specific number of training hours or per-employee L&D investment is publicly disclosed as of 2025.

- Ambassador programs sometimes feed into internal learning, e.g., ambassadors helping staff with features or product use.

- Given Notion’s rapid growth and evolving product (AI, integrations), internal upskilling in ML, infrastructure, and security is likely but opaque.

- Cultures that prioritize training often correlate with lower attrition. Notion’s moderate departure rate may reflect that.

- Without internal HR memos or reports, we can’t estimate average training hours per person.

- If Notion were to publish an annual report, L&D metrics often include hours per person, training spend as % of payroll, etc., so watch for future disclosures.

Funding and Valuation Overview

- As of 2025, Notion’s total funding is widely reported at $352.7 million, led by the $275 million Series D in October 2021.

- Its valuation post Series D was pegged at $10 billion.

- Earlier rounds included ~$50 million in April 2020 and ~$18.2 million in 2019.

- Some sources claim total funding may reach $343 million, depending on the inclusion of bridge rounds.

- Notion’s revenue in 2024 is reported at $400 million, up from $250 million in 2023 (a 60% increase).

- The revenue jump from 2022 ($67 million) to 2024 represents nearly 500% growth in two years.

- Notion claims over 4 million paying customers globally.

- Because Notion is still private, valuation and funding data come from leaks, third-party databases, and news, rather than audited SEC filings.

- The strong funding and valuation provide capital runway for headcount expansion, product development, and acquisitions.

Company Milestones and Key Events

- 2013: Notion was founded by Ivan Zhao and Simon Last.

- 2016: First known funding round (~$9.5 million seed).

- 2019: $18.2 million round, valuation ~ $800 million.

- April 2020: $50 million round, valuation jumps to ~$2 billion.

- October 2021: $275 million Series D, valuation reaches $10 billion.

- 2022–2024: Product expansions, Calendar, AI features, acquisitions of Cron, Flowdash, Skiff.

- 2024: Notion Mail launched, AI draft/search integrated.

- 2025: Public metrics from Unify showing headcount at 1,217 and continued hiring.

- Future milestone potential, IPO, broader global offices, or further acquisitions.

Official Statements vs Third-Party Sources

- Notion’s official pages do not publish full headcount or detailed diversity stats publicly; they focus more on values and culture.

- Third parties like Unify provide specific numbers (1,217 employees, departmental breakdowns) based on external signals and estimates.

- Some media recount “650 employees in 2024,” which appears lower than Unify’s 2025 figure, suggesting possible undercounting or outdated reporting.

- The 800 employee figure in 202,5 repeated in some sources, likely stems from stale data or earlier reporting cycles.

- Valuation and funding figures are fairly consistent in third-party sources, though small differences appear ($343 million vs $352.7 million).

- Without official transparency, external sources may misclassify contractors, remote staff, or include/exclude certain roles.

- Readers should treat all headcount figures as approximations until Notion publishes audited company metrics or annual reports.

Challenges in Headcount Estimation

- Lack of transparency: Notion does not publicly release full headcounts or demographic reports.

- Contractors vs full-time: Some aggregators may include contractors, part-time, or freelancers; others don’t.

- Remote and distributed workers: Remote employees may not be tied to a known office location, making source tracking harder.

- Lag in data refresh: Public databases often update slowly, thus data may be months stale.

- OR misreporting: Some sources rely on self-reported LinkedIn profiles or job boards, which may misstate role dates.

- Different definitions of “employee”: Some count only full-time, some include interns or affiliate roles.

- Attrition and churn within a year: People join and leave constantly; static snapshots don’t reflect dynamic flux.

- Discrepancies between sources: As seen, Unify’s 1,217 vs media’s 800 vs older 650, differences of 30–50% are possible.

Implications of Team Size for Product and Culture

- A larger engineering team enables faster feature rollout, deeper infrastructure investment, and more capacity for internal tools.

- But increased headcount raises coordination complexity, communication overhead, and potential for silos.

- The moderate growth rate (~7% in 2025) may help Notion retain agility while scaling.

- Global distribution fosters access to diverse talent and time-zone coverage, but also poses challenges in alignment and cultural consistency.

- A smaller HR/operations ratio suggests Notion still leans product-first, trusting core teams to carry the load.

- The existence of ambassadors and external influencers helps amplify internal resources; they extend product adoption and education without being full-time staff.

- Training and L&D investments (though not fully disclosed) become more crucial as complexity rises.

- Culture can drift if growth is unmanaged; headcount growth must come with cultural guardrails (values, onboarding, peer norms).

- If attrition spikes or hiring slows, capacity for innovation or maintenance may erode.

- Ultimately, the number of people is a lever, not an end. How that team is deployed, organized, and led matters more than pure size.

Frequently Asked Questions (FAQs)

Notion is listed as having 4,800 employees in 2025 according to PitchBook’s company profile.

Notion’s total funding is reported at $352.7 million.

After the Series D, Notion was valued at $10 billion.

Notion’s revenue per employee at $207,350.

Conclusion

Estimating how many people work at Notion is an exercise in triangulation; third-party aggregators, media leaks, and internal metrics each tell parts of the story. With modest growth, relatively low attrition, a geographically distributed workforce, and a community augmented outreach model (ambassadors/influencers), Notion appears to be scaling thoughtfully rather than recklessly.

Still, key unknowns remain, gender ratios beyond simple binaries, training hour investments, internal attrition breakdowns, and whether the headcount includes contractors and remote-only roles. For readers, the takeaway is to treat these numbers as directional, not definitive, and to monitor future official disclosures when they arrive.