The hardware wallet market is gaining traction as crypto users and institutions seek safer ways to store digital assets offline. From supply chain upgrades to regulatory shifts, recent developments are reshaping how people and enterprises view custody tools. In financial services, firms are embedding hardware wallets into treasury operations, in decentralized finance (DeFi) platforms, and self-custody mandates push growth. Read on to explore key metrics, segments, and trends shaping this space.

Editor’s Choice

- The hardware wallet market is projected to grow at a compound annual growth rate (CAGR) between 18.93% and 31.96% from 2025 to 2033.

- USB‑connected wallets held ~47.52% share of the connectivity segment in 2024.

- The individual (retail) end‑user segment accounted for ~72.31% of revenue in 2024.

- The NFC wallet segment is estimated to grow at a 30.54% CAGR through 2030.

- In 2025, USB is forecasted to command 44.67% of the connectivity share.

- More than 5.8 million hardware wallets were shipped globally as of 2024.

- An estimated 2–3% of global crypto users currently rely on hardware wallets as their primary storage solution, despite increasing concerns over software wallet vulnerabilities.

Recent Developments

- Cold wallet usage among retail users increased by 34% year over year entering 2025.

- Institutional cold storage adoption surged as much as 50% YoY in 2025 due to regulatory and risk drivers.

- Block, Inc. launched Bitkey, a multisignature hardware wallet, available in over 95 countries in 2024.

- Tangem rolled out an NFC-based card wallet, bridging custody and payment functionality for crypto holders.

- Hardware wallet makers are increasingly localizing secure element production; over 27% of manufacturers adopted this strategy to mitigate supply chain disruptions in 2025.

- Venture capital investment in crypto hardware design grew by 28% in 2025, fueling innovation and rapid iteration cycles.

- Demand for noncustodial offline devices rose sharply after several publicized exchange hacks and bankruptcies in late 2024 and 2025.

- Around 30% of enterprise-focused firms now bundle hardware wallets with firmware support, service contracts, and real-time audit tools to meet corporate needs.

Hardware Wallet Market Outlook

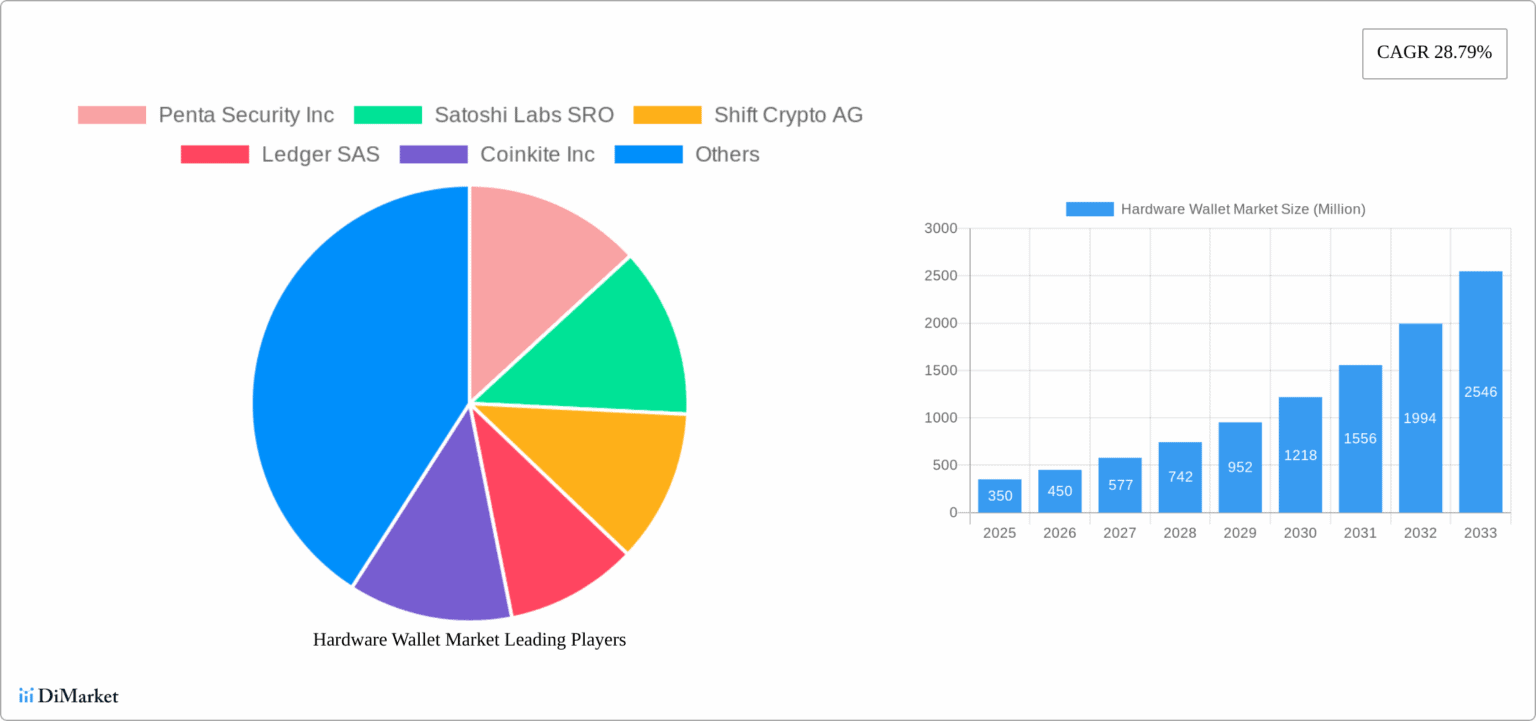

- Market size will hit $350 million in 2025 and rise to $2.55 billion by 2033.

- CAGR is projected at 28.79% over the forecast period, signaling strong growth.

- Major players include Ledger, Coinkite, Satoshi Labs, Shift Crypto, and Penta Security, plus a dominant “Others” segment.

- Market more than doubles from $952M in 2029 to $1.99B in 2032, highlighting rapid adoption.

- By 2030, the market will exceed $1.2 billion, showing sustained demand for offline crypto security.

Connection Type (USB, NFC, Bluetooth)

- In 2024, USB wallets held 47.52% of the connectivity segment.

- USB share is forecast to decline to ~44.67% in 2025 as wireless options gain ground.

- NFC is estimated to grow at a 30.54% CAGR through 2030.

- Combined NFC + Bluetooth could capture ~30% of connectivity share in the coming years.

- Bluetooth and NFC bring portability and mobile usability advantages, appealing to users who value convenience.

- Wireless connectivity invites higher certification and security costs, which slow earlier adoption.

- Some hardware wallet models now offer tri‑modal connectivity (USB + NFC + Bluetooth) to cover multiple use cases.

- The rise of contactless payments and mobile wallets nudges NFC into more mainstream use for crypto transactions.

End User (Individual vs Commercial)

- Institutional adoption of hardware wallets is forecast to grow at a remarkable 31.05% CAGR through 2030.

- By 2025, retail still accounts for the majority share, but the institutional/commercial segment has increased by over 12% YoY.

- Institutional per-unit deal sizes can reach 5–20× typical retail transactions due to bulk and custom requirements.

- More than 18% of vendors now offer enterprise models with audit logs, SLAs, and multi-user key management.

- The perception shift of crypto as a corporate treasury asset is driving over 38% of surveyed enterprises to deploy self-custody solutions.

- North American institutions lead globally in institutional hardware wallet adoption, while retail users dominate emerging market usage by ~68%.

- Custom enterprise wallet features are requested in 23% of new B2B wallet deployments in 2025.

By Wallet Type: Hot vs Cold Wallets

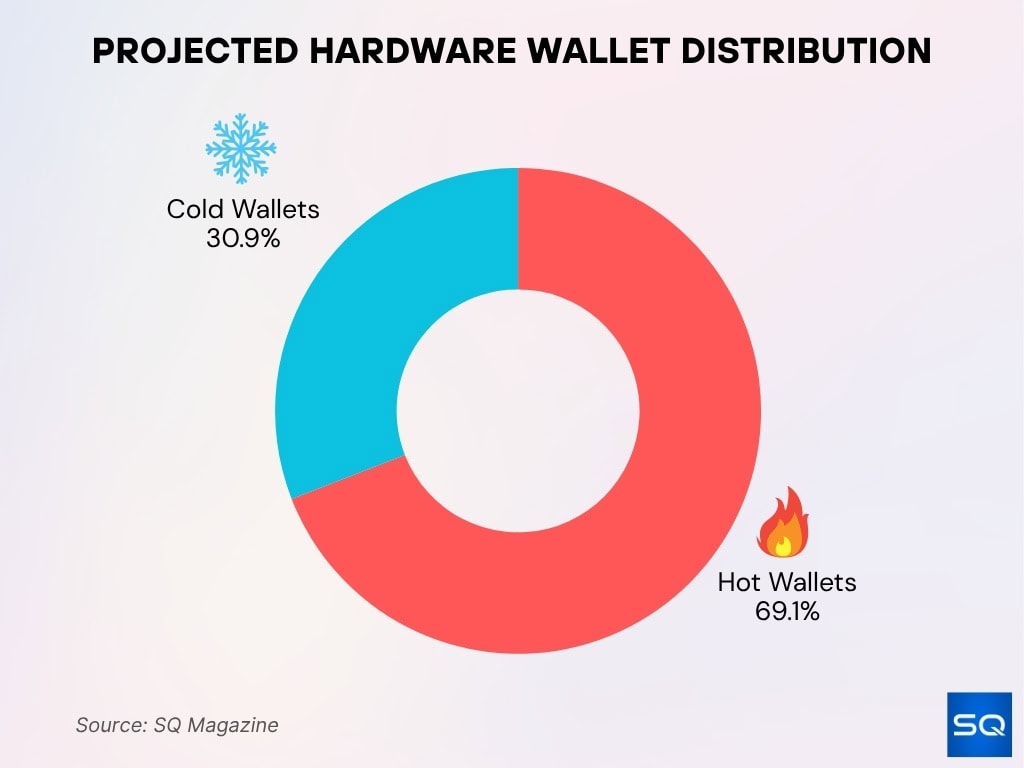

- Hot wallets will capture 69.1% of the hardware wallet segment in 2025.

- Cold wallets account for ~30.9% of the hardware wallet segment in 2025.

- Among all crypto wallets, hot wallets dominate with ~78% user share in 2025.

- Cold wallets hold 22% of the overall wallet market in 2025.

- Cold wallet market (hardware-focused) is forecast to grow at a ~30.76% CAGR through 2033.

- In 2024, hot wallets held ~56% of total wallet market revenue, while hardware wallets trailed but expanded.

- Cold storage hardware wallets stand out from hot wallets due to self-custody and offline security.

- User migration to self-custody boosts demand for hardware wallet cold storage solutions.

Key Market Drivers

- 58% of surveyed crypto users in 2025 cite rising security awareness as their top reason for moving to hardware wallets.

- After major hacks, hardware wallet searches spike by 42% and sales climb by 36% following high-profile incidents.

- Regulatory guidance in the US and EU has raised self-custody adoption rates by 19% among institutional actors.

- Multi-chain device compatibility requests increased by 32%, driven by expanded DeFi and NFT activity.

- Secure element chip manufacturing is localized for over 27% of wallet brands, reducing cross-border risk and tariffs.

- Venture capital funding in crypto hardware firms surged by 28% in 2025, allowing faster product development cycles.

- 51% of new hardware wallet releases now feature built-in integration with DeFi dashboards and multisig APIs.

- Over 40% of large enterprises treat crypto assets as balance sheet items, demanding deterministic key management.

- The proportion of active users (signing transactions) on hardware wallets grew to 61%, up from 44% in 2024.

Market Restraints & Challenges

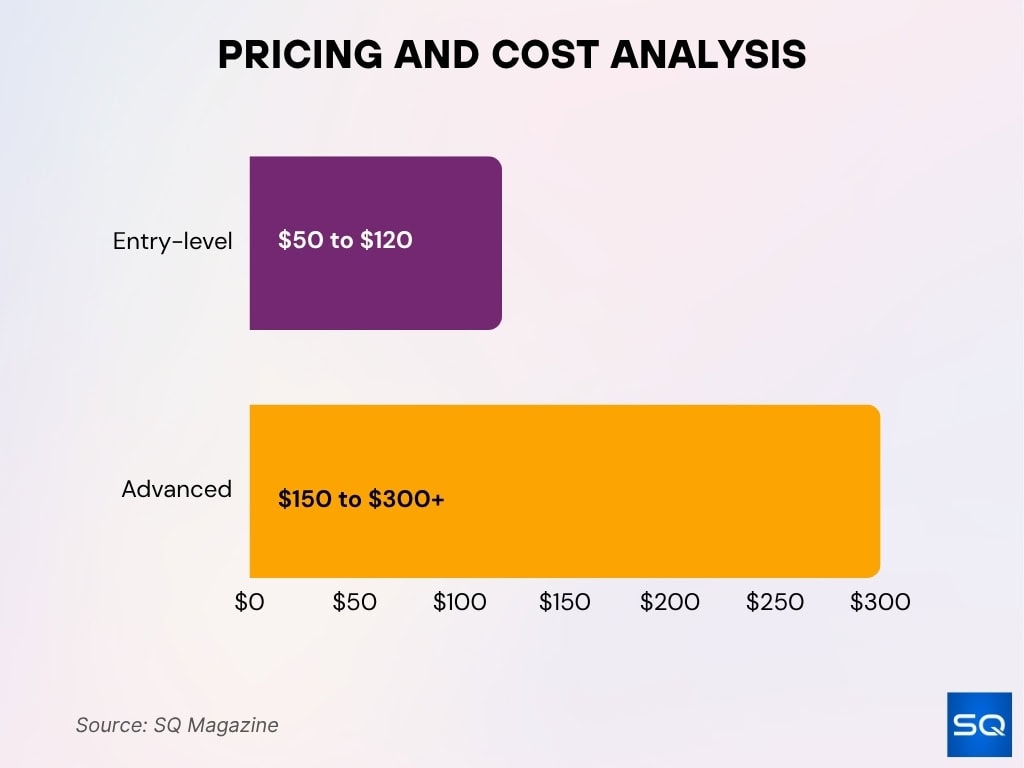

- Hardware wallets cost $50–$120+ for entry models, with advanced units reaching $150–$300+, while most software wallets remain free to download.

- Seed phrase backup and firmware update steps are required on all major hardware wallets; over 68% of users cite this as usability friction.

- Certification and audit compliance can add $50,000–$250,000+ to the cost for each new model launch.

- Physical risks remain: ~19% of wallet owners report concern about loss, theft, or irrecoverable device damage.

- The lack of full interoperability with new blockchains or standards affects 14–18% of users, slowing upgrade cycles.

- Regulatory ambiguity has limited the institutional deployment of hardware wallets in over 25% of surveyed enterprises.

- Software-based custody and multisig wallets have absorbed 13% market share that may have otherwise moved to hardware solutions.

- Supply chain issues, including chip shortages, have delayed hardware wallet launches or restocks for up to 7 months in 2025.

- If crypto prices stagnate, nearly 30% of planned hardware upgrades are being deferred or paused by retail buyers.

Pricing and Cost Analysis of Hardware Wallets

- Entry-level hardware wallets cost $50–$120 in 2025, depending on brand and features.

- Premium models range from $150 to over $300, offering advanced security and multi-asset support.

- Some vendors use subscription or firmware contract models instead of one-time pricing.

- Key cost drivers include secure chips, compliance, R&D, and after-sales support.

- Tariffs and import duties can inflate regional prices by 10%–25%.

- Enterprise orders often get 15%–40% volume discounts, especially for bulk institutional purchases.

- Total cost of ownership includes updates, support, and warranty replacements over time.

- Shift from hardware-only pricing to bundled service models is reshaping vendor strategies.

Competitive Landscape & Major Players

- Ledger has shipped over 7.5 million devices since launch, now securing about 20% of global crypto user assets.

- Trezor holds a leading position for open-source firmware and enjoys high community trust in the hardware wallet market.

- Vendors like CoolWallet, BitLox, Casa, ELLIPAL, and KeepKey maintain recognition in specialized and full-feature wallet segments.

- Tangem AG manufactures NFC card-style wallets, merging payment utility and secure digital custody.

- Block, Inc.’s Bitkey multisig hardware wallet is available in over 95 countries, with cross-device compatibility.

- About 30% of major hardware wallet firms now bundle firmware licensing, compliance support, or managed services alongside devices.

- At least 10% of new entrants are piloting wearable or card-form factor wallet designs to differentiate products.

- High barriers to entry persist due to costly security audits, intellectual property, and supply chain certification demands.

- Nearly 18% of top vendors have formed co-branding partnerships with crypto exchanges or DeFi platforms for bundled sales.

Adoption and Usage Rates

- In 2025, hot wallets hold about 78% market share, while hardware wallets comprise nearly 22% of all crypto wallets.

- Hardware wallet sales increased by 31% compared to 2024, marking strong yearly growth.

- Globally, over 5.8 million hardware wallets were shipped by the end of 2024.

- More than 71% of crypto users now show a preference for hardware wallets due to security concerns.

- Just ~2.5% of total crypto holders use a hardware wallet as their primary storage method.

- The hardware wallet adoption rate is now outpacing software wallet download growth for the first time.

- Desktop wallet usage among hot wallets has dropped to 9% in 2025 as mobile dominance grows.

- North America leads hardware wallet usage, but the Asia Pacific region records the fastest growth rate in 2025.

- A rising share of users, now over 20%, combine hardware and software wallets for hybrid storage.

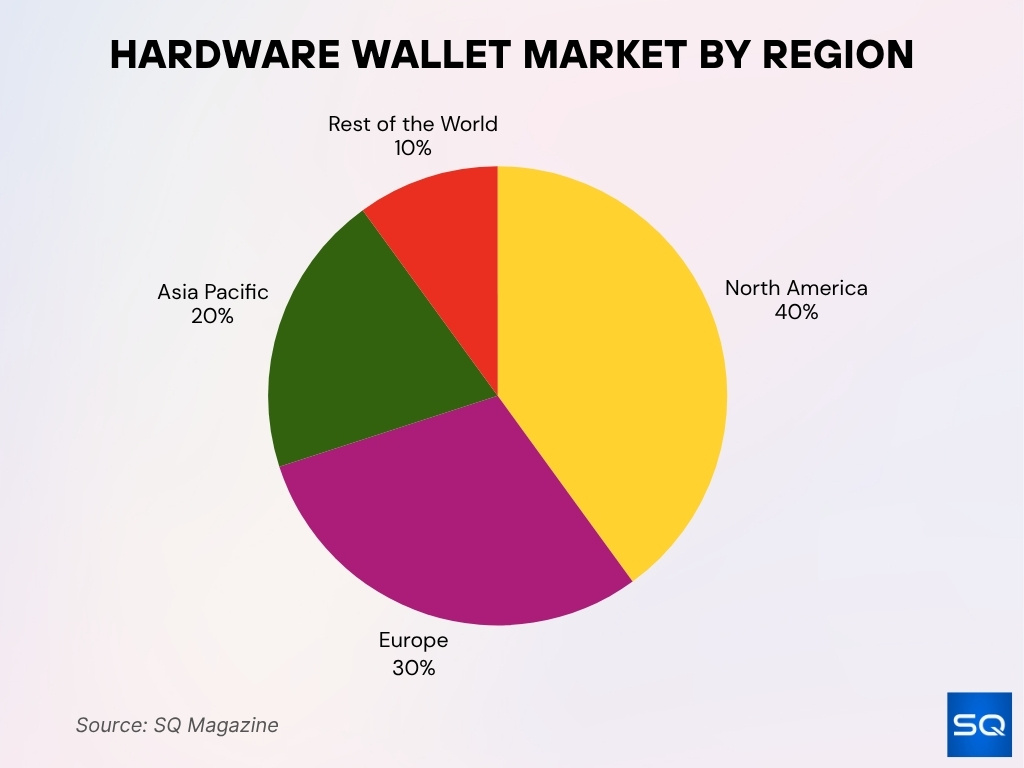

Hardware Wallet Market by Region

- North America holds 40% of the global hardware wallet market.

- Europe captures 30% driven by regulation and strong crypto adoption.

- Asia Pacific accounts for 20% boosted by demand in emerging tech hubs.

- The rest of the world holds 10% representing smaller but fast-growing markets.

Institutional vs Retail Adoption

- Institutional deployments are forecasted to grow at ~31.05% CAGR through 2030.

- The number of institutional wallets increased by 51% year‑on‑year in 2025.

- Retail users still dominate the total wallet base, with ~82% of crypto wallet holders as individuals.

- The average retail user now holds 2.7 wallets.

- Institutional wallets are more active, with ~52% interacting with smart contracts monthly.

- Enterprise-grade multisignature wallet deployments reached 9 million in 2025.

- Institutions often place larger orders, driving disproportionate revenue.

- Institutional adoption decisions are tied to compliance, auditability, and treasury integration.

Technological Innovations & Feature Trends

- Over 60% of new hardware wallets launched in 2025 offer some form of biometric authentication, such as fingerprint or facial recognition.

- More than 40% of premium wallets feature air-gapped architectures to prevent remote hacking attempts.

- USB, NFC, and Bluetooth tri-modal connectivity is included in around 55% of flagship hardware wallet models released this year.

- At least 25% of wallet brands are actively investing in quantum-resistant encryption protocols, anticipating future threats.

- Solutions built on MPC hybrids account for nearly 18% of enterprise-grade wallet deployments, minimizing single points of compromise.

- Real-time audit logs and API-based recovery are available in 30% of wallets targeting institutional clients in 2025.

- Integration with DeFi dashboards, staking, and dApp access is a standard feature for 65% of newly launched wallets.

- Tamper-detection features like epoxy resin sealing and hardware intrusion sensors now cover 80% of new wallet designs.

- Approximately 15% of hardware wallets have wallet-to-wallet payment support, enabling direct crypto spending without conversion.

Security & Risk Statistics

- From 2020–2025, over $7.5 billion has been stolen from crypto wallets and exchanges.

- In 2025, ~23.35% of thefts targeted personal wallets.

- The Bybit hack in early 2025 resulted in $1.5 billion in losses.

- Hardware wallets are under‑adopted, with only ~2% of users leveraging them.

- Clipboard malware attacks can spoof addresses, even for hardware wallets.

- Address poisoning attacks have compromised >100 million USD on Ethereum.

- Mis‑verification of addresses due to similarity attacks remains a real threat.

- Some manufacturers have months-long delays in patching firmware vulnerabilities.

- 231 offline attacks involving crypto extortion occurred in 18 months.

Future Outlook & Emerging Opportunities

- The market is forecasted to grow from $582.98 million in 2025 to $3,300.86 million by 2033, at a 24.2% CAGR.

- Others project $2,435.1 million by 2033 at a CAGR of 18.93%.

- One model sees $1,527.6 million by 2032, growing from $348.4 million in 2025, at 23.5% CAGR.

- Another forecast estimates $2,732 million by 2031 with a 31.96% CAGR.

- Growth opportunities lie in emerging markets where adoption is rising but wallet penetration is low.

- Embedded custody in banking systems may unlock new B2B models.

- Tokenized real-world assets (RWA) may need integrated hardware wallet solutions.

- Custody as a service could appeal to institutions wary of operational complexity.

- Post‑quantum cryptography will be a differentiator as quantum risk rises.

- Partnerships with exchanges and DeFi apps may drive bundled hardware wallet adoption.

Frequently Asked Questions (FAQs)

It is forecast to grow at a CAGR of 18.93 % between 2025 and 2033.

It is expected to reach $2,435.1 million by 2033.

USB wallets held 47.52 % of the connectivity segment share in 2024.

The individual (retail) segment accounted for 72.31% of revenue in 2024.

Conclusion

The hardware wallet market today is at an inflection point. Retail users still dominate in numbers, but institutions are scaling fast, shifting revenue dynamics. Technological innovation, from biometric and air‑gapped architectures to MPC and quantum defenses, is required just to stay relevant. Security threats remain complex and evolving, proving that hardware is necessary but not sufficient. As crypto becomes more embedded in real‑world assets and regulated finance, hardware wallets are no longer niche gear; they will be foundational infrastructure. Dive deeper into each segment ahead to understand where the real opportunity lies.