Picture a high school hallway during lunch break. Heads down, thumbs scrolling, earbuds in. This isn’t boredom, it’s engagement. For Generation Z, social media isn’t just a way to stay connected; it’s how they navigate identity, find entertainment, and even make purchasing decisions. Born between 1997 and 2012, Gen Z is the first cohort to grow up entirely in a digital world, and in 2025, their digital footprint is larger and more influential than ever.

In this article, we’ll break down the latest Gen Z social media statistics for 2025, helping marketers, brands, and curious minds understand what’s trending, where attention is going, and how this generation is shaping the online world one tap at a time.

Editor’s Choice

- 94% of Gen Z report using at least one social media platform daily in 2025.

- TikTok remains the #1 platform, with over 83% of Gen Z users logging in at least once a day.

- Instagram usage among Gen Z has declined by 9% YoY, with a shift toward short-form video platforms.

- YouTube remains the second most-used platform, engaging 78% of Gen Z daily, especially for long-form content.

- Threads by Meta, introduced in late 2023, now captures 27% of Gen Z users weekly in 2025.

- BeReal’s daily usage dropped by 40%, showing trend fatigue and a shift toward more dynamic platforms.

- 85% of Gen Z prefer brands that use memes or cultural references appropriately in social media advertising.

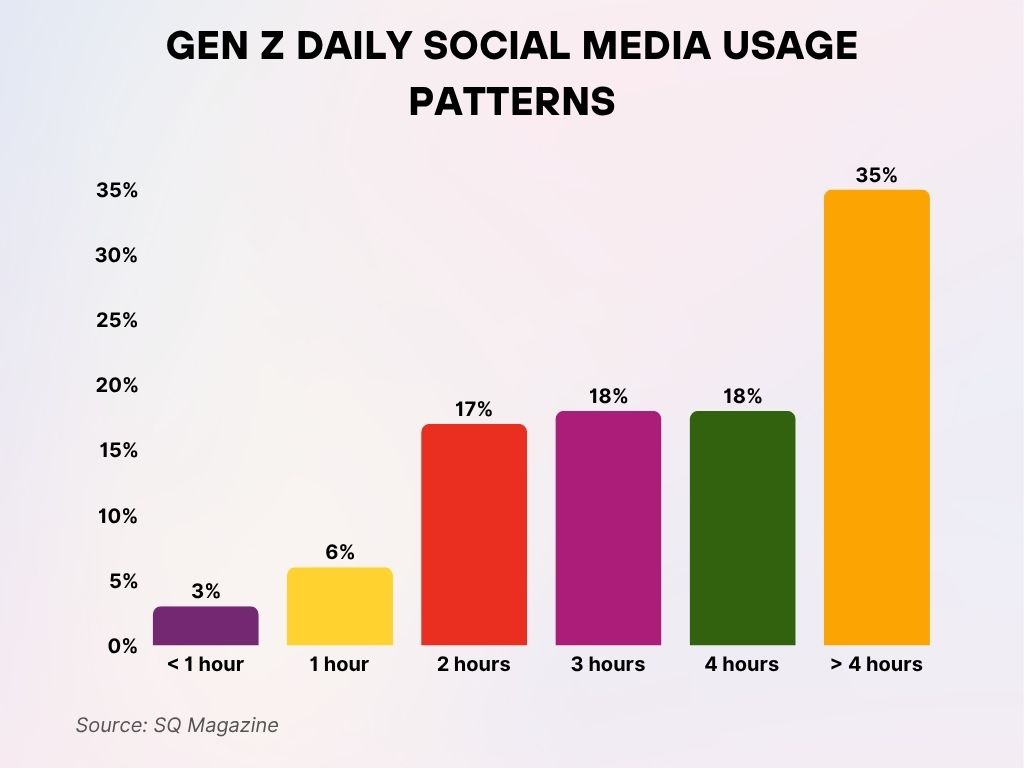

Gen Z Daily Social Media Usage Patterns

- Only 3% of Gen Z spend less than 1 hour per day on social media.

- 6% of Gen Z users limit their daily usage to 1 hour.

- A notable 17% spend 2 hours on social media each day.

- Both 3-hour and 4-hour daily usage are tied, with 18% of Gen Z reporting each duration.

- The largest group, 35%, spends more than 4 hours per day on social media, highlighting heavy usage among Gen Z.

Most Popular Social Media Platforms Among Gen Z

- TikTok leads with 83% daily active Gen Z users in 2025, dominating video-first social engagement.

- YouTube is used by 92% of Gen Z monthly, and its premium tier adoption is up 19% YoY.

- Instagram holds 71% weekly engagement from Gen Z, though its relevance is declining in the face of newer apps.

- Snapchat continues strong with 68% of Gen Z using it weekly, particularly for direct communication.

- Threads by Meta is gaining momentum, now with 42 million active Gen Z users in the U.S. alone.

- X (formerly Twitter) sees limited traction, only 22% of Gen Z use it regularly in 2025.

- Reddit usage among Gen Z rose 14% in 2024–25, especially for niche communities and meme culture.

- Pinterest is used by 38% of Gen Z females, mostly for fashion, wellness, and home inspiration.

- Discord remains popular, especially among Gen Z males, with over 40 million U.S.-based users engaging weekly.

- LinkedIn is growing quietly, with a 12% increase in Gen Z users, mostly driven by internship seekers and new grads.

Daily Usage Statistics by Platform

- TikTok users aged 13–24 spend an average of 89 minutes per day on the app in 2025.

- YouTube clocks in at 76 minutes daily, with Gen Z preferring “multi-hour scroll sessions” on weekends.

- Snapchat stories and chat features pull in an average of 52 minutes/day from Gen Z users.

- Instagram’s daily usage among Gen Z dropped to 45 minutes/day.

- Threads users spend 22 minutes/day on average, signaling moderate stickiness for a new platform.

- Reddit usage time among Gen Z is around 31 minutes/day, with spikes during gaming or entertainment news cycles.

- Discord users average 61 minutes/day, often spread across multiple niche servers.

- BeReal’s daily user session time plummeted to under 5 minutes, making it one of the least sticky apps in 2025.

- Facebook sees just 16% daily usage from Gen Z, mainly for group interactions and legacy family connections.

- WhatsApp usage is growing slowly, with 28% of U.S.-based Gen Z now using it daily.

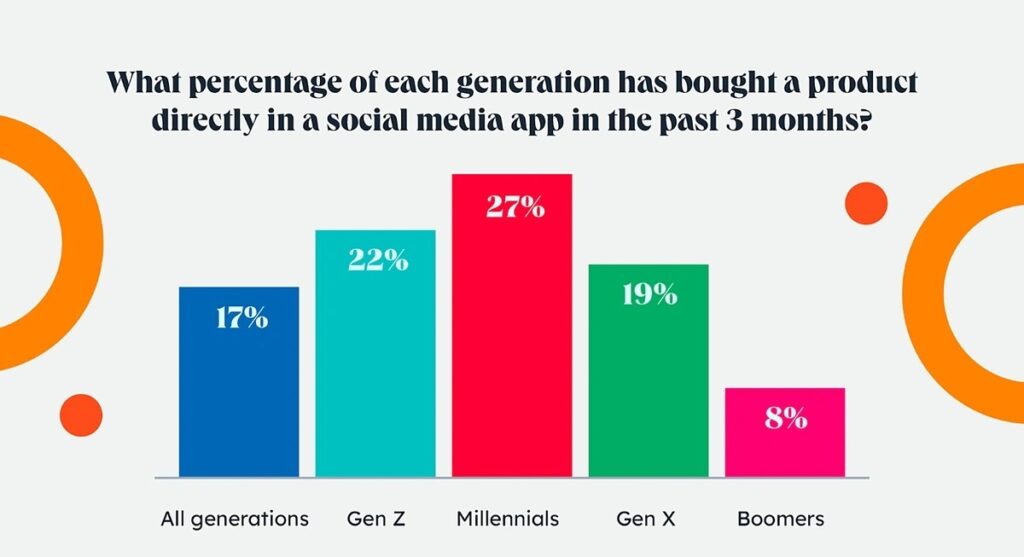

Social Media Purchases by Generation

- 27% of Millennials have made purchases directly within social media apps, the highest among all age groups.

- 22% of Gen Z have also bought products on social platforms, reflecting strong adoption.

- 19% of Gen X consumers made purchases via social apps, showing moderate engagement.

- Only 8% of Boomers used social media apps to shop, indicating low digital commerce activity.

- Across all generations, the average stands at 17% engaging in social media shopping.

Gen Z Preferences: Video Content vs. Static Posts

- 81% of Gen Z say they prefer short-form video over images or text content.

- Loopable, sound-on videos perform 42% better with Gen Z than traditional videos without interactivity.

- Static image posts receive 50% fewer likes and 38% fewer shares from Gen Z audiences in 2025.

- Live video content on TikTok and Instagram is favored by 61% of Gen Z, especially during Q&A or product demos.

- User-generated content (UGC) is twice as effective with Gen Z as brand-produced studio footage.

- GIF-style motion graphics still engage Gen Z, especially in stories and micro-content formats.

- 85% of Gen Z engage more with authentic, lo-fi videos compared to polished corporate clips.

- Brands using meme formats see a 23% lift in organic reach with Gen Z audiences in 2025.

- Gen Z males prefer gaming and tech content, while Gen Z females lean toward wellness and fashion reels.

- Educational short-form content grew by 18% YoY, with platforms like TikTok EDU emerging as content leaders.

Platform Engagement Rates for Gen Z Users

- TikTok boasts a 73% engagement rate among Gen Z users, the highest across all platforms in 2025.

- Instagram reels see a 51% engagement rate, though overall platform engagement has dipped slightly since 2024.

- YouTube Shorts’ average watch-through rate is 61% among Gen Z, outperforming long-form videos in engagement.

- Snapchat stories have a 67% open rate, while its Discover section garners 42% swipe-through engagement.

- Discord’s server participation rate is 82% among Gen Z members active in two or more communities.

- Reddit’s upvote/comment ratio has increased by 17% YoY, with Gen Z driving content in meme, finance, and tech subs.

- BeReal’s re-engagement rate fell to 19%, reflecting user fatigue and a return to more dynamic platforms.

- Threads by Meta holds a 34% reply/comment engagement rate, higher than Twitter’s 26% from previous years.

- Facebook groups used by Gen Z have a consistent 48% weekly engagement, largely for college and local communities.

- Pinterest pins by Gen Z creators saw a 24% rise in saves, particularly in DIY, beauty, and style categories.

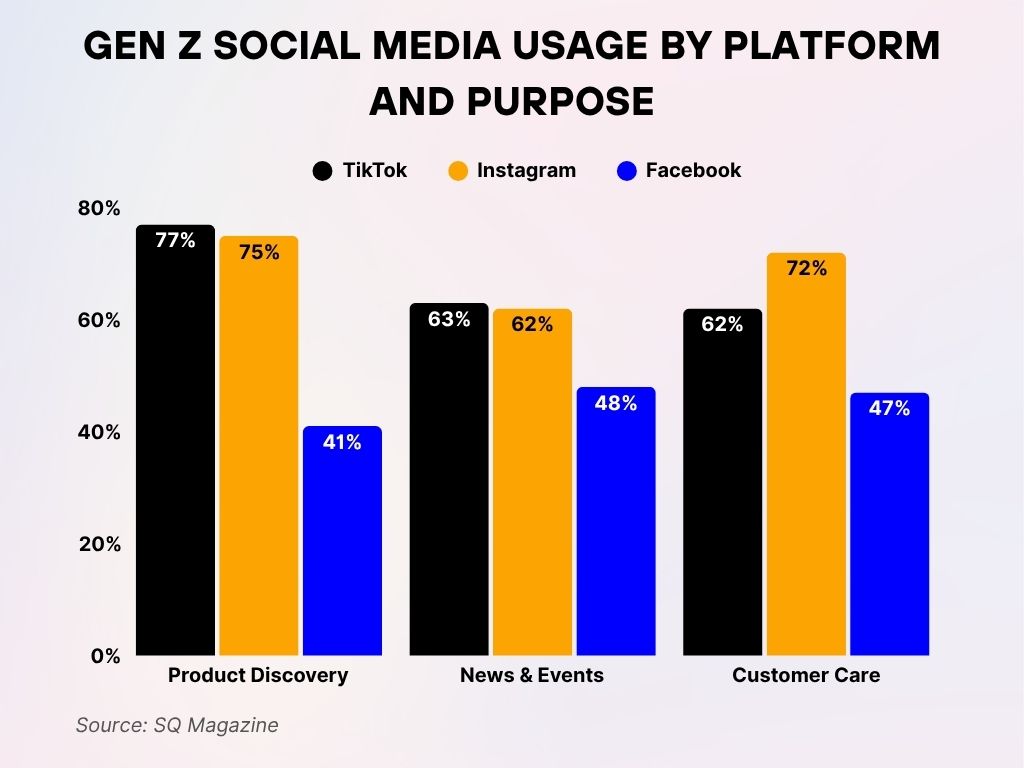

Gen Z Social Media Usage by Platform and Purpose

- For product discovery, TikTok leads with 77%, closely followed by Instagram at 75%, while Facebook lags at 41%.

- When it comes to news and events, TikTok (63%) and Instagram (62%) are nearly tied, outperforming Facebook’s 48%.

- For customer care, Instagram ranks highest at 72%, ahead of TikTok (62%) and Facebook (47%).

These figures highlight TikTok and Instagram as Gen Z’s top platforms for engaging with brands, staying informed, and seeking support.

Gen Z and Influencer Interaction Trends

- 74% of Gen Z follow at least one micro-influencer, defined as creators with fewer than 100K followers.

- Only 18% trust celebrity endorsements, preferring creators perceived as relatable and authentic.

- Gen Z values transparency, with 72% more likely to trust influencers who disclose sponsorships clearly.

- Influencers on TikTok drive 43% of Gen Z’s product discovery, surpassing Instagram for the first time.

- YouTube creators lead in trust, with 62% of Gen Z saying they “feel connected” to long-form content influencers.

- Gen Z’s interaction with live shopping streams jumped 29% YoY, especially through TikTok Shop and YouTube Live.

- Beauty and fashion influencers receive the highest engagement, with a 6.1% average engagement rate per post.

- Influencers who engage via comments and Q&As see a 45% boost in follower loyalty.

- Podcasters on Spotify and YouTube are gaining traction, with 27% of Gen Z following influencers who host shows.

- AI-generated influencers, such as digital avatars, are followed by 13% of Gen Z, marking an experimental but growing trend.

Privacy Concerns and Platform Trust Among Gen Z

- 81% of Gen Z are concerned about data privacy on social media in 2025.

- Only 14% say they fully trust social platforms to handle their personal information responsibly.

- TikTok ranks lowest in trust among major platforms, with 38% expressing active concern over its data policies.

- Instagram and Facebook are seen as “data exploitative” by 67% of Gen Z, contributing to declining engagement.

- Gen Z prefers platforms with better transparency, like Discord and Reddit, both viewed as more community-driven.

- 54% of Gen Z users now use ad blockers or privacy tools.

- More than 40% of Gen Z have adjusted privacy settings within the first week of joining a new platform.

- End-to-end encryption awareness rose significantly, with 61% of Gen Z favoring encrypted messaging platforms.

- 70% of Gen Z users read at least part of a privacy policy before accepting terms, a notable cultural shift from Millennials.

- Platforms offering anonymous browsing options like Reddit and Telegram saw a 25% increase in Gen Z usage.

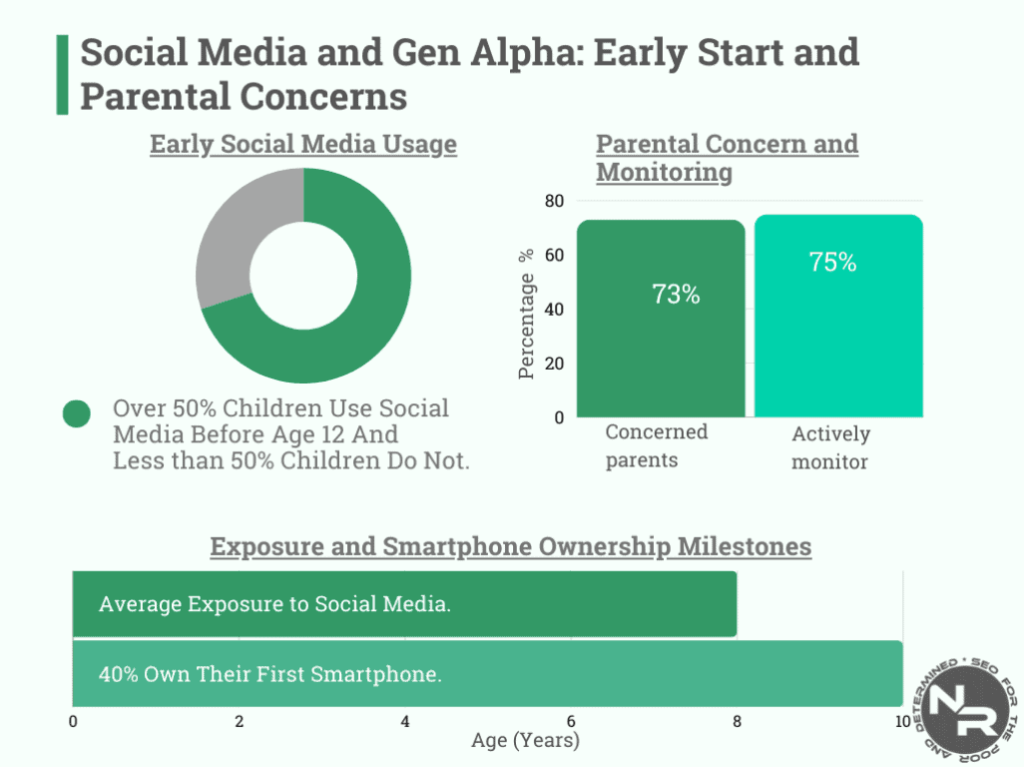

Gen Alpha: Social Media Exposure and Parental Concerns

- Over 50% of children begin using social media before age 12, indicating early digital exposure.

- 73% of parents express concern about their child’s social media use.

- 75% of parents say they actively monitor their children’s online activities.

- On average, children are exposed to social media by age 8.

- 40% of Gen Alpha own their first smartphone by age 8, marking an early tech milestone.

Social Media’s Role in Gen Z Purchasing Decisions

- 77% of Gen Z made a purchase influenced by social media in the past 6 months.

- TikTok leads product influence, with 52% of Gen Z discovering products through viral trends and creator reviews.

- Instagram Stories and Shop features drive 38% of Gen Z purchases, mostly in fashion, beauty, and home goods.

- YouTube unboxing and review videos influence 44% of Gen Z buying decisions, especially in electronics and tech.

- Snapchat’s AR filters contributed to $1.2 billion in direct Gen Z-driven purchases in the past year alone.

- Gen Z trusts peer reviews more than traditional ads, with 69% citing user comments and ratings as deciding factors.

- Live commerce events prompted 31% of Gen Z to make impulse purchases, especially during creator-hosted events.

- Pinterest influences 21% of Gen Z purchasing in the lifestyle and decor categories.

- Over 40% of Gen Z use social platforms to compare brands before purchasing, valuing community opinions over SEO content.

- Buy-now-pay-later options embedded in social shopping features were used by 27% of Gen Z in 2025.

Mental Health and Social Media Use Among Gen Z

- 66% of Gen Z report that social media impacts their mental health, with varying effects depending on platform use.

- Instagram and TikTok are most associated with negative self-image, especially among females aged 13–20.

- 55% have taken at least one “social media detox” in the past year to manage anxiety and digital fatigue.

- Reddit and YouTube are rated as the least stressful platforms, offering more long-form and passive content.

- Mental health hashtags like #mentalhealthmatters and #digitalwellness saw a 21% rise in 2025.

- Apps with screen-time limit tools are favored by 32% of Gen Z, especially among younger teens.

- Sleep disruption due to late-night scrolling is reported by 61% of Gen Z.

- Therapists and wellness influencers on TikTok see strong followings, with therapy-themed accounts averaging 5.3% engagement.

- 27% of Gen Z follow mental health-focused accounts, using content for both inspiration and coping tools.

- Online communities promoting body neutrality and emotional validation continue to grow, offering safer spaces for expression.

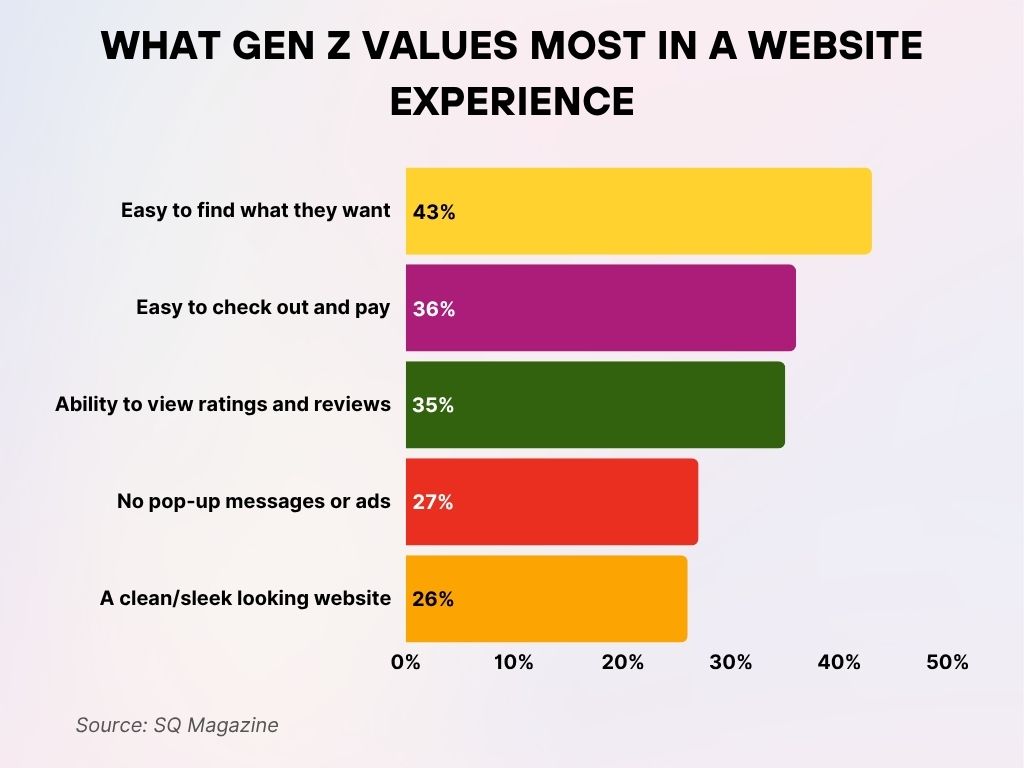

What Gen Z Values Most in a Website Experience

- 43% of Gen Z say it’s most important that websites are easy to navigate and help them find what they want quickly.

- 36% prioritize a smooth checkout and payment process, emphasizing convenience.

- 35% value the ability to view ratings and reviews, reflecting their need for trust and social proof.

- 27% prefer sites with no pop-up messages or ads, showing a dislike for distractions.

- 26% appreciate a clean and sleek design, underlining the importance of visual appeal and simplicity.

Regional Differences in Gen Z Social Media Usage

- In the U.S., 93% of Gen Z are active on at least three platforms, with TikTok, Instagram, and YouTube leading the pack.

- Gen Z in Canada shows higher reliance on Reddit and Discord, especially among male users aged 18–24.

- UK Gen Z users spend the most time on TikTok (95 mins/day), with strong engagement in creator-led challenges.

- Australia’s Gen Z users favor Instagram reels and YouTube Shorts, with a noted 8% decline in Snapchat use.

- India’s Gen Z population leans heavily on YouTube and WhatsApp, with short-form video usage up 22% YoY.

- Brazilian Gen Z users prefer visual-first content, with Instagram Stories and TikTok usage topping 80% penetration.

- In Germany, Telegram and Signal are gaining popularity among Gen Z for privacy-centric messaging.

- Japan’s Gen Z favors Twitter (X) for real-time news and commentary, despite the global decline in usage.

- South Korea’s Gen Z is driving a resurgence in community-based apps, including local SNS platforms like KakaoStory.

- Middle Eastern Gen Z users are engaging more with Snapchat AR and TikTok Shop, especially in Saudi Arabia and the UAE.

Advertising Effectiveness on Gen Z Through Social Platforms

- 67% of Gen Z skip or scroll past ads unless they are entertaining, relatable, or educational.

- User-generated ads (UGAs) receive 4.2x more engagement than traditional branded content in 2025.

- In-feed video ads on TikTok show 72% higher click-through rates compared to static Instagram ads.

- Interactive ad formats, like polls or quizzes on Instagram Stories, see a 40% engagement boost with Gen Z.

- Over 58% of Gen Z trust recommendations made by influencers more than brand ads.

- Snapchat AR lens ads have driven over $1 billion in Gen Z purchases this year, up 15% YoY.

- Gen Z expects personalization, and 62% are more likely to engage with ads tailored to their interests or behaviors.

- Audio ads on Spotify and YouTube are gaining ground, with 25% of Gen Z listening through to the end of promoted content.

- Brands using social justice messaging authentically saw a 22% increase in Gen Z brand loyalty, while performative ads backfired.

- 70% of Gen Z are annoyed by retargeting that feels invasive, preferring subtle value-driven content marketing.

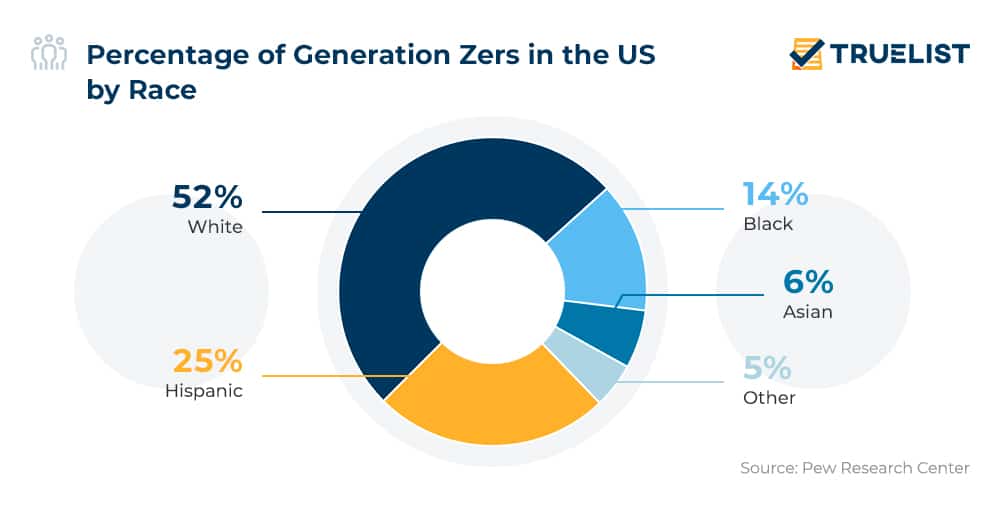

Racial Composition of Gen Z in the US

- 52% of Gen Z in the US identify as White, making up the majority.

- 25% are Hispanic, representing the second-largest racial group.

- 14% identify as Black, showing significant representation.

- 6% of Gen Z are Asian, reflecting growing diversity.

- 5% fall into the Other racial category, highlighting additional multicultural backgrounds.

Gen Z Usage Trends: Messaging Apps vs. Traditional Platforms

- Messaging apps now dominate over traditional social platforms in time spent, especially WhatsApp, Discord, and iMessage.

- WhatsApp’s Gen Z usage grew 18% YoY, with business chat features increasing brand-user interactions.

- Discord is the top messaging app for Gen Z in the U.S., with 41% of users spending over 1 hour daily in topic-specific servers.

- Snapchat remains a hybrid, serving both content consumption and direct messaging needs for 69% of Gen Z users.

- Telegram adoption among Gen Z surged 21%, particularly in regions concerned with privacy and censorship.

- Facebook Messenger usage dropped below 20%, with younger Gen Z users abandoning it for newer platforms.

- Group chats dominate daily communication, with 72% of Gen Z participating in at least two.

- Voice messaging is up 37%, largely driven by WhatsApp, iMessage, and Telegram features that offer convenience.

- AI chat assistants in messaging apps are being used by 26% of Gen Z for recommendations, planning, and even therapy support.

Recent Developments

- TikTok’s integration with generative AI tools in 2025 allows creators to auto-edit, voice-over, and subtitle videos, adopted by 55% of Gen Z creators.

- Instagram rolled out AI-powered content filters, allowing Gen Z users to suppress content that triggers anxiety or comparison stress.

- YouTube launched “QuickWatch,” a 60-second AI-summarized highlight tool now used by 27% of Gen Z viewers.

- Meta introduced “Smart Threads,” an AI-generated thread suggestion engine that recommends content ideas based on user history.

- Pinterest’s new “Inspire Me” AI mode customizes style boards using voice prompts, popular with Gen Z females and creatives.

- Snapchat’s Bitmoji avatars gained AI-generated wardrobe and setting options, boosting engagement in Snap Maps and stories.

- BeReal added time-flexible posting, but Gen Z adoption remains low at under 20% active users.

- X (Twitter) has launched “XSpaces 2.0” with co-hosting and monetization features, but traction among Gen Z remains limited.

- Gen Z creators are driving the micro-content economy, with 1-2 minute content now outperforming both long-form and static media.

Conclusion

Gen Z isn’t just shaping the social media landscape, they’re building it. In 2025, this generation continues to redefine how we connect, advertise, and communicate online. From short-form videos to AI-enhanced messaging apps, their behaviors are clear: authenticity matters, privacy is non-negotiable, and entertainment needs to be on-demand. As brands and platforms adapt, those that listen, truly listen, to Gen Z will find themselves not just surviving, but thriving in the digital future.