Gen Z is reshaping the gaming landscape with bold preferences and habits. They flock to mobile for convenience, lean into PCs and consoles for depth, and thrive in cross-platform worlds that offer choice and social sync. Real-world use cases span everything from mobile esports viewership rising 340% since 2022 to platforms like Roblox blending gaming with commerce, like Shopify integrations and virtual avatars, encouraging brands to meet Gen Z where they are. Dive into the full article to discover how these trends are shaping the gaming ecosystem.

Editor’s Choice

- 87% of Gen Z (ages 13–24) play games regularly.

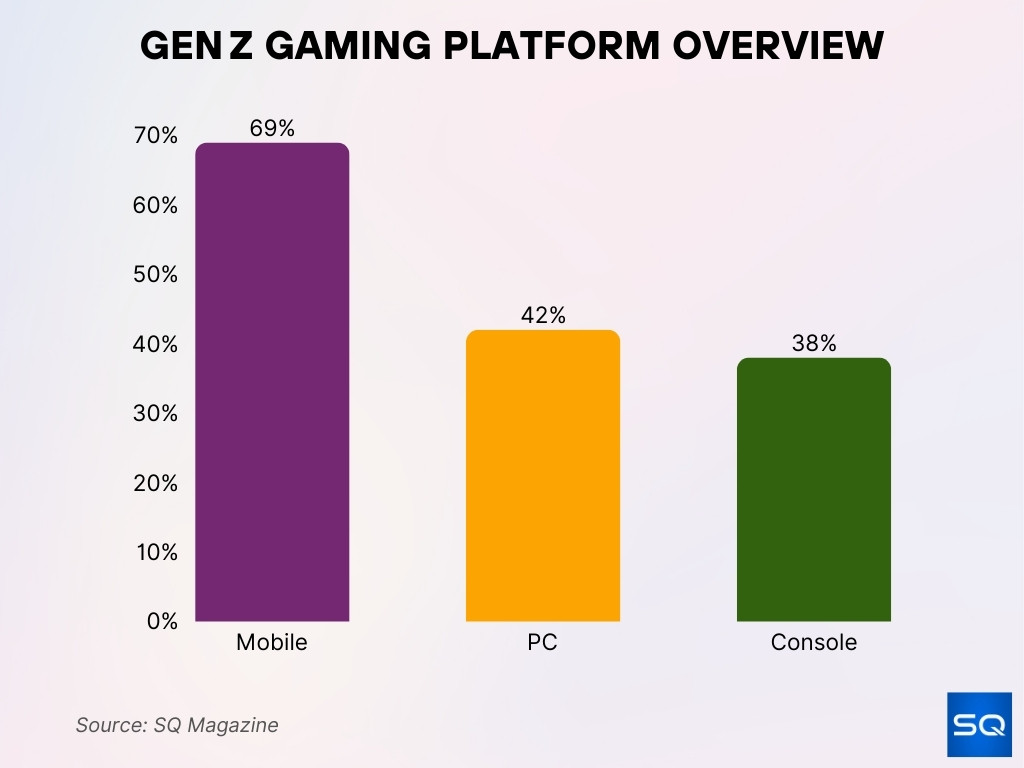

- Gen Z gamers play on mobile at 69%, PCs at 42%, and consoles at 38%.

- Mobile remains dominant: 92% of Gen Z engage through mobile devices.

- Digital gaming engagement among Gen Z in the U.S. is projected to reach approximately 73–75% by 2027.

- Weekly gaming hours for Millennials and Gen Z average 10.3 hours, up from 8.2 overall in 2024.

- Console revenue is projected to grow 7.0% from 2024 to 2027, compared with 2.6% for PC.

- Gen Z gamers identify predominantly as “mobile gamers first” at 86% vs. just 29% for Gen X.

Recent Developments

- Global gaming population will hit 3.5 billion by the end of 2025, up from 3.32 billion in 2024.

- Console revenue growth outpaces PC, +7% vs +2.6% projected through 2027.

- Subscribers: 52% of gamers in the U.S. subscribe to at least one gaming service. Console gamers, 74% likely subscribers, and PC gamers, 66%.

- Cross-platform functionality has been shown to improve player retention, with some studies indicating players return up to 31% more often compared to single-platform users.

- The average gamer now spends 8.6 hours per week gaming in 2025, up from 8.2 hours in 2024.

- Mobile esports viewership has surged 340% since 2022, while console esports viewership fell 10-12%.

- Roblox added Rewarded Video ads and signed a Google partnership, reaching 85.3 million daily active users at the end of 2024. Teen usage jumped from 34% to 46% year-over-year.

Gen Z Gaming Platform Overview

- 69% of Gen Z game on mobile, 42% on PC, and 38% on console.

- 92% access games via mobile.

- Cross-platform users, consoles at 58%, PC at 54% for Gen Z.

- Mobile gaming constitutes 79% of the total gamer base, 42% of mobile gamers also play on PC, 55% on console.

- 52% of Gen Z gamers make at least one in-game purchase, while only 42% of the overall gamer population do.

- Average Gen Z gamer plays 6 hours and 10 minutes per day.

- Mobile is “first” for 86% of Gen Z, far above Gen X’s 29%.

Most Popular Gaming Platforms Among Gen Z

- Mobile leads with 69% engagement among Gen Z.

- Cross-platform use is high, consoles (58%) and PCs (54%) appeal to Gen Z.

- Tablet gaming isn’t directly quantified here, but mobile and PC overlap suggests tablet use shares similar trends.

- Mobile is still the hub; 79% of gamers are mobile users, many of whom also game on PC or console.

- Console revenue growing faster, +7% vs PC’s +2.6% through 2027.

- 52% of Gen Z make purchases in mobile games, driven by exclusive content and personalization.

- Mobile esports viewership is booming, 340% growth since 2022.

- Mobile-first identity is strong; 86% of Gen Z prefer mobile gaming.

Gen Z Mobile, Console, and PC Gaming Preferences

- 86% brand themselves “mobile gamers first,” compared with 29% for Gen X.

- Cross-platform engagement, console (58%), PC (54%).

- Gaming subscriptions, console-heavy with 74%, vs PC at 66%.

- Mobile esports viewership rose 340%, console declined 12%.

- Average Gen Z session, about 6 h 10 m of play time daily.

- Cross-play use bolsters retention, a 31% increase in daily return rate.

- In-game spending, 52% of Gen Z gamers spend mostly on in-game currency, gear, and personalization.

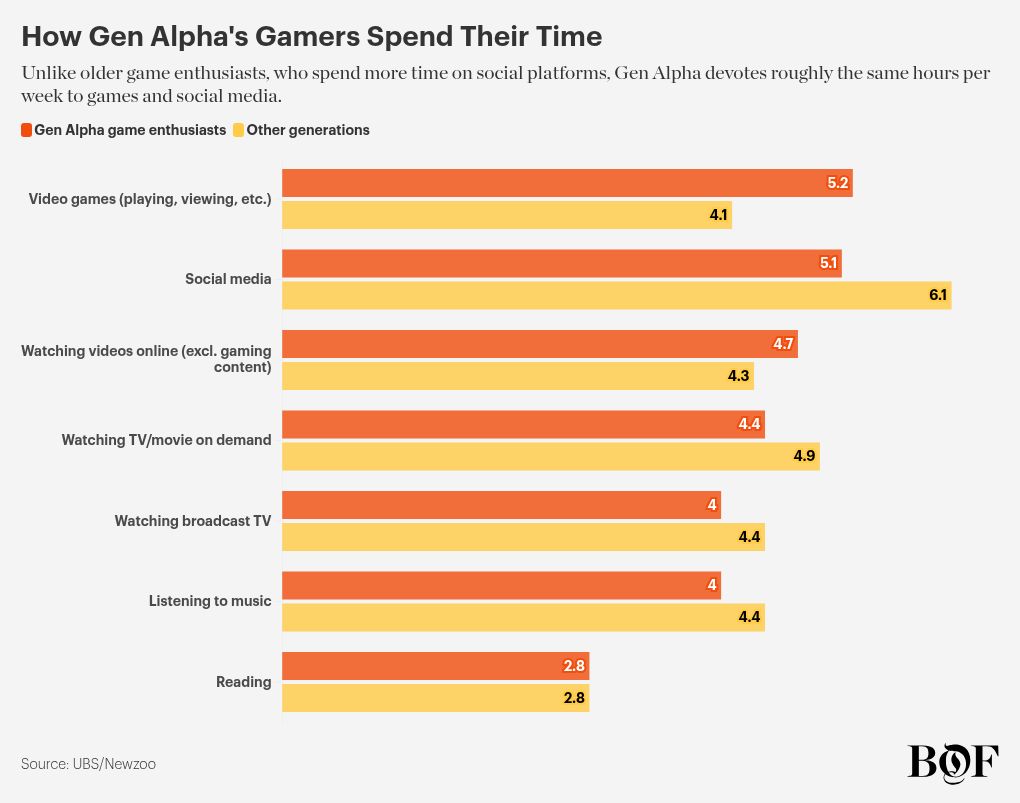

How Gen Alpha’s Gamers Spend Their Time

- Video games (playing, viewing, etc.): 5.2 hours/week for Gen Alpha game enthusiasts vs 4.1 hours/week for other generations.

- Social media: 5.1 hours/week for Gen Alpha vs 6.1 hours/week for other generations.

- Watching videos online (excluding gaming content): 4.7 hours/week for Gen Alpha vs 4.3 hours/week for other generations.

- Watching TV/movies on demand: 4.4 hours/week for Gen Alpha vs 4.9 hours/week for other generations.

- Watching broadcast TV: 4.0 hours/week for Gen Alpha vs 4.4 hours/week for other generations.

- Listening to music: 4.0 hours/week for Gen Alpha vs 4.4 hours/week for other generations.

- Reading: 2.8 hours/week for both Gen Alpha and other generations.

Tablet Gaming Usage Among Gen Z

- Mobile and PC are core platforms, tablets likely fall between those footprints.

- Overlap, many mobile gamers also play on PC or console, suggesting tablet inclusion in cross-platform trends.

- No direct stat for tablets, but with mobile at 92% and PC at 42%, tablet likely holds a lower but meaningful share.

- We can infer that as smartphone usage continues to rise, tablets may serve as an alternative for shared home device gaming.

Cross-Platform and Multi-Device Trends

- 58% of Gen Z gamers use consoles and 54% use PCs for cross-platform gaming, showing high platform fluidity.

- Nearly 50% of all gamers play on more than one platform.

- Approximately 13–15% of gamers engage across all three major platforms (mobile, PC, and console), demonstrating high device fluidity.

- Mobile gaming still dominates, with 79% of gamers playing on mobile. Of these, 42% also game on PC and 55% on console.

- In Q2 2024, tablet gaming usage rose from 17% (2020) to 22% among Gen Z.

- Cross-platform players return 31% more often than single-platform users.

- Gen Z picks games first, then device, preferring titles that work across mobile, PC, and console seamlessly.

- Cloud gaming now supports streaming to phones, tablets, PCs, and smart TVs, reducing the need for specific hardware.

Top Game Genres Preferred by Gen Z

- Gen Z gamers favor shooting and action/adventure games, especially those with online multiplayer features.

- Social connection ranks among the top three reasons Gen Z plays games.

- A 2024 ESA report found 63% of Gen Z prefer playing video games to watching films, 71% say gaming is a great way to socialize.

- Gaming leads Gen Z’s leisure time, taking up 25%, more than social media (18%) or streaming video (17%).

- Cozy games, like Stardew Valley or Animal Crossing, have fueled a 7.58% increase in new gamers since 2022.

- A Roblox survey indicated that 84% of Gen Z users who engage in avatar customization report drawing fashion inspiration from their digital looks.

- Title-based content often inspires discovery; 39% of Gen Z say they discovered new songs through the games they played.

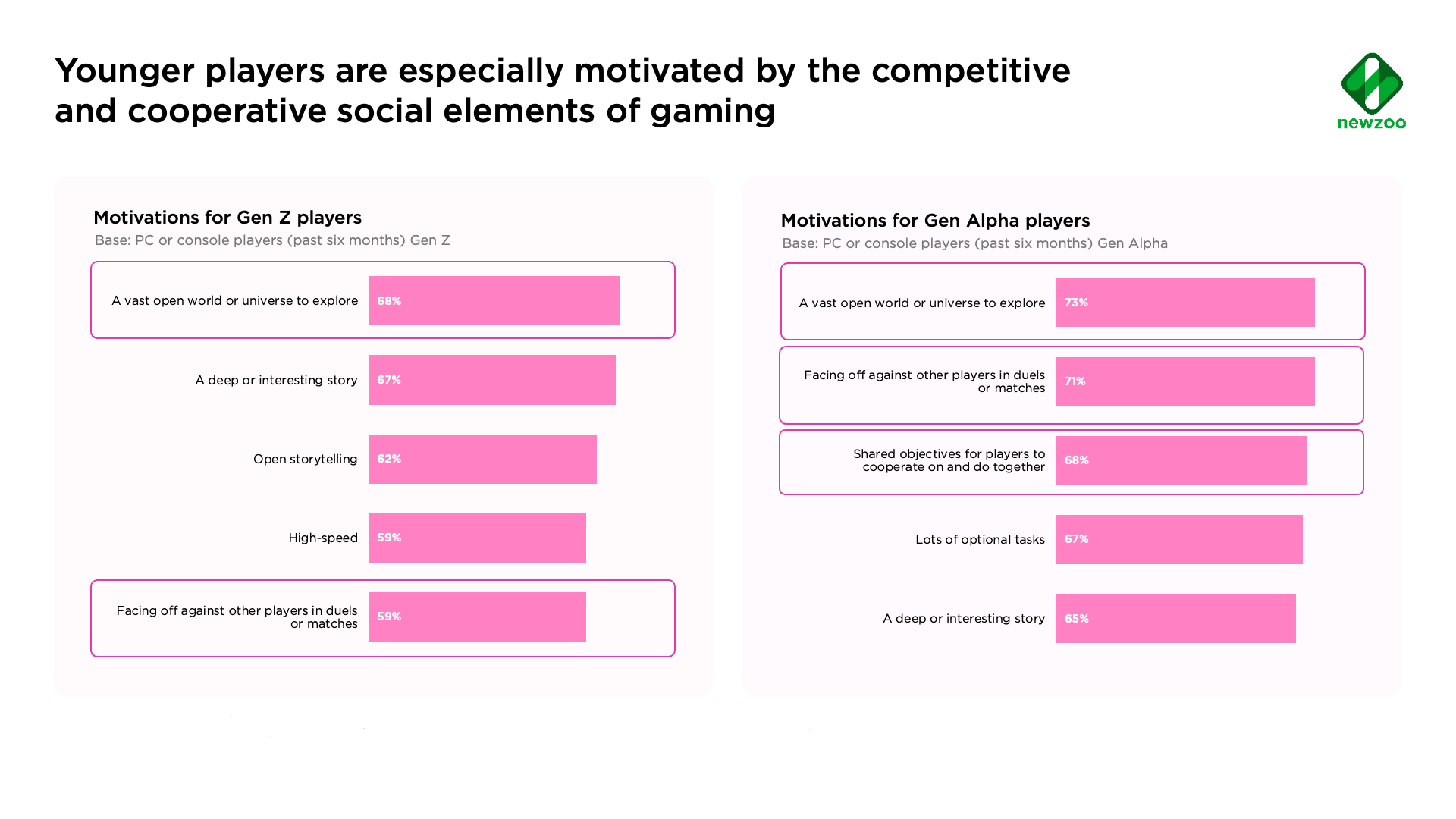

Motivations Driving Gen Z and Gen Alpha Gamers

- Gen Z players are most motivated by a vast open world or universe to explore (68%), followed by a deep or interesting story (67%).

- Open storytelling is appealing to 62% of Gen Z gamers, while high-speed gameplay attracts 59%.

- Facing off against other players in duels or matches is important for 59% of Gen Z gamers.

- Gen Alpha players rank a vast open world or universe to explore the highest at 73%.

- Facing off against other players in duels or matches motivates 71% of Gen Alpha gamers.

- Shared objectives that allow players to cooperate appeal to 68% of Gen Alpha.

- Lots of optional tasks engage 67% of Gen Alpha gamers.

- A deep or interesting story is a motivator for 65% of Gen Alpha players.

Favorite Multiplayer and Social Gaming Experiences

- 58% of Gen Z consider gaming their main social space, outranking messaging apps and social media.

- 67% of multiplayer gamers use voice chat regularly to coordinate or socialize.

- 45% have made at least one real‑life friend through gaming.

- Guilds and clans now include approximately 1.8 billion users globally, many active daily.

- Social features like co‑op missions boost engagement time by 35%.

- Gen Z enjoys low‑pressure “cozy” spaces for social connection.

- Gen Z and millennials both report 70% met new people through gaming, and 63% of Gen Z say they met a good friend or partner this way.

- They often discover music or shows via games; 28% say gaming led them to new TV shows or movies.

User-Generated Content (UGC) Platforms Popular With Gen Z

- User-generated content has transformed gaming into a collaborative ecosystem, shifting culture toward creativity and participation.

- Platforms like Roblox drive UGC, with daily active users hitting 85.3 million at the end of 2024. Teen usage rose from 34% to 46% over the year.

- Games like Dress to Impress emphasize community‑driven fashion, with 84% of Gen Z deriving inspiration from their avatars.

- UGC fosters self‑expression, and Gen Z values personalized environments, sharing their creative identities.

- UGC strengthens brand interest, and immersive ad experiences tied to creative platforms help marketers tap Gen Z directly.

- Analysis notes growing complexity in UGC types and tools, reflecting how players contribute to and reshape game worlds.

Social Features in Gaming

- Gen Z uses games for social connection; 58% see gaming as their main social space.

- Voice chat is crucial; 67% of multiplayer gamers use it to coordinate or socialize.

- Social gameplay styles boost engagement by 35%.

- 70% of Gen Z met people through gaming, 63% formed close bonds.

- UGC and creative spaces enhance social identity.

- Multiplatform social sync encourages play across devices.

- Multiplayer modes in cozy, low-pressure games nurture social bonds without competitive stress.

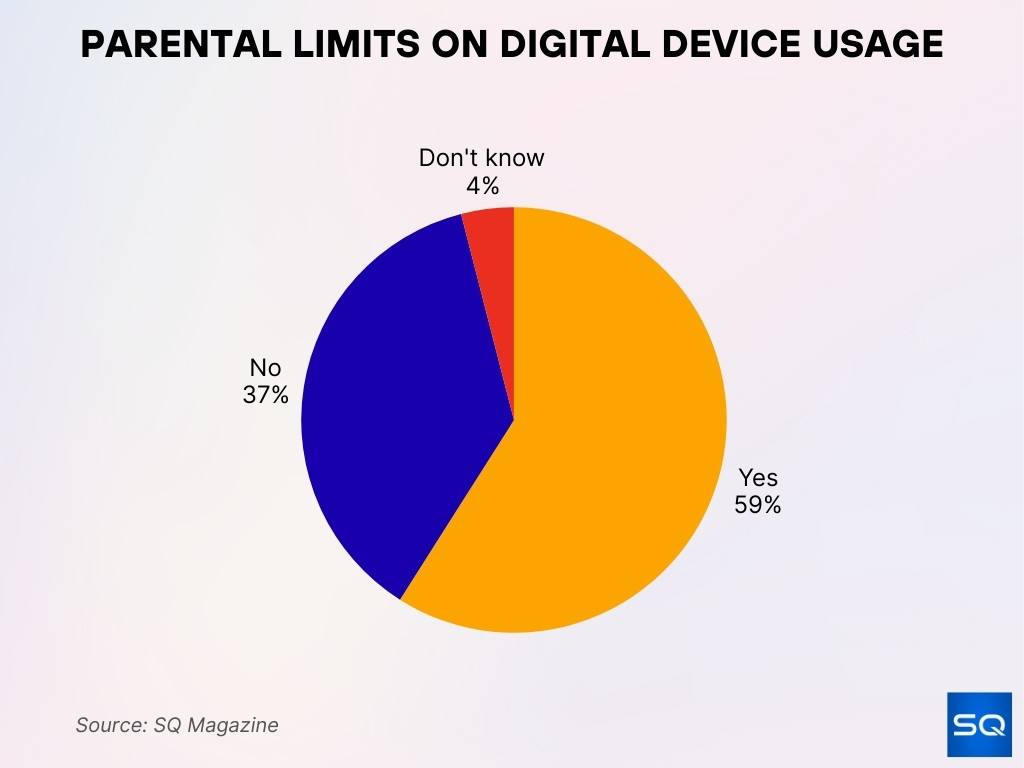

Parental Limits on Digital Device Usage

- 59% of respondents say their parents or guardians limit the number of hours they can use digital devices.

- 37% report having no restrictions on their device usage.

- 4% are unsure whether any limits are in place.

Time Spent on Gaming Platforms by Gen Z

- Gen Z spends an average of 6 hours and 10 minutes gaming per day.

- That totals roughly 43 hours and 10 minutes per week.

- Newzoo reports 81% of Gen Z respondents play games, averaging 7 hours and 20 minutes per week.

- Mobile players average 2.5 sessions per day, each around 22 minutes.

- U.S. gamers overall play 12.8 hours per week across platforms, 75% of them play at least 4 hours weekly.

- Gen Z leisure behavior: 25% of their free time goes to gaming.

- Among Millennials and Gen Z, weekly engagement hits 10.3 hours, versus 8.2 for prior years.

- Cloud streaming growth allows play on mobile, tablet, PC, or TV. More access means more total play time.

Gen Z Gaming and Online Communities

- 58% of Gen Z gamers now view gaming as their primary social space, surpassing messaging apps or social media.

- Guilds, clans, and online groups include approximately 1.8 billion users, with many participating daily.

- 67% of multiplayer gamers use voice chat regularly.

- 45% have made at least one real-life friend through gaming.

- The global online gaming population is around 3.43 billion in 2025.

- Esports engagement grows fast, and Gen Z makes up 43% of the global esports audience in 2025.

- Esports fans tend to be highly active, 58% tune in weekly, 30% watch documentaries, 29% engage with fan-created content, and 21% listen to podcasts.

Gen Z Spending Patterns and Monetization Preferences

- Gen Z spending on video games dropped ~25% in 2025 relative to 2024.

- Between January and April 2025, both online and retail game purchases fell 13% year-over-year.

- Although overall spending declined, in‑game purchases still drive 76% of online gaming revenue globally in 2025.

- 52% of gamers make monthly in-game purchases, and mobile gamers contribute 57% of all microtransaction revenue.

- The average gamer spends $147 annually on microtransactions, up from $132 last year.

- Mobile gaming revenue in the U.S. reached $34.7 billion, up 7.6% year-over-year.

- Free-to-play models generate $92 billion, more than 40% of total online gaming revenue.

Impact of Ads and In‑Game Purchases on Gen Z Gamers

- In-game purchases now represent 76% of global online gaming revenue.

- Cosmetics (non-functional items) account for 41% of microtransactions.

- Gacha-style games, especially popular in Asia, contribute $12.4 billion to annual in-game revenue.

- An estimated 60–65% of players in leading games like Fortnite and Call of Duty regularly engage with battle pass systems, reflecting a preference for structured progression and rewards.

- In the U.S., mobile microtransactions led overall gaming spending with $34.7 billion, reflecting strong engagement with ad-driven and freemium models.

- Despite lower spending, Gen Z continues gaming by shifting to free or affordable “friendslop” titles, priced under $10.

- Among Japanese players aged 20–29, ~19% admitted that in-game purchases impacted their ability to pay for essentials, and microtransaction uptake rose ~6% year-over-year.

Gen Z Participation in Esports and Streaming

- Gen Z makes up 43% of the global esports audience in 2025.

- Esports viewership continues to grow, projected to reach over 640 million globally, including 318 million dedicated fans and 322 million casual viewers.

- Mobile devices are now used for 56% of live tournament streams.

- The 2025 Esports World Cup in Riyadh features a $71.5 million prize pool, the largest combined esports payout ever.

- The 2025 League of Legends Mid-Season Invitational, held in Vancouver, featured the most “game-fives” in history, nine of nineteen series reaching the fifth match.

- Roughly 52% of U.S. esports fans are aged 18–34, with an average viewer age of 26.

- Esports betting trends show $2.5 billion in revenue with over 74 million participants, and Gen Z making up nearly half of all bettors.

Brand and Social Media Integrations in Gaming

- Fashion and luxury brands increasingly use gaming to reach Gen Z. Roblox and Fortnite have become key marketing channels.

- Digital fashion and in-game customization, particularly from brands like Louis Vuitton, Dior, and Gucci, accounted for three‑quarters of gaming revenue in 2021.

- AI-powered virtual stores on platforms like Roblox and Google’s Gemini help brands sell merchandise in immersive, gamified spaces.

- Gen Z responds when brands blend interactivity, authenticity, and identity, using gaming spaces to shape and express personas.

Reasons Gen Z Chooses Specific Gaming Platforms

- Social connection ranks among the top three reasons Gen Z plays games; platforms that enable interaction win out.

- Titles must work across mobile, PC, and console to attract Gen Z, who expect seamless cross-platform play.

- Value and affordability matter; Gen Z gravitates toward free-to-play or inexpensive games, especially amid financial pressures.

- Convenience of mobile access continues to be key; 82% of Gen Z play on phones.

- Personalization and creative control, like avatar customization and UGC, strongly influence platform preference.

- Brand integration, like fashion drops or digital goods, makes some platforms feel more relevant and engaging.

Changes in Gen Z Gaming Trends Over Time

- Gen Z has become the most digitally penetrated gaming generation and is projected to reach 75% engagement by 2027.

- Mobile gaming among Gen Z has grown 9% since 2020, cementing mobile-first habits.

- In-game spending rose from $132 to $147 annually per gamer.

- Esports viewership continues to skyrocket, from 435 million in 2020 to a projected 640+ million by 2025.

- Despite economic pressure, platforms offering free or low-cost social gameplay, like “friendslop” titles, helped Gen Z maintain engagement.

- The balance between gaming and offline connection grows, and some Gen Zers seek more IRL interaction and screen-time breaks.

Conclusion

Gen Z gaming is defined by social immersion, platform fluidity, and creative expression. They lead cross-platform play, dominate esports audiences, and value personalization, yet face real economic constraints that shape smarter spending. Microtransactions and virtual goods drive much of the industry’s revenue, but lower-cost, social-first games keep Gen Z engaged. As they intersect with fashion, AI, and virtual commerce, gaming becomes far more than play; it’s a lifestyle. Ultimately, understanding Gen Z’s evolving landscape is key for any brand, developer, or strategist aiming to stay relevant.