Fitbit continues to be a central player in the wearable fitness tracker space, bridging health data and user engagement. Its influence persists through device adoption, app usage, and integration into wellness programs. For instance, employers increasingly deploy Fitbit-based programs to monitor workforce health, and researchers leverage aggregated Fitbit data in clinical and epidemiological studies. In the following sections, we’ll explore key statistics about Fitbit’s users, financials, sales, and market share.

Editor’s Choice

- In 2023, Fitbit’s revenue was estimated at around $1.04 billion.

- The global fitness tracker market is projected to reach $187.2 billion by 2032 (from $39.5 billion in 2022) at a CAGR of ~17.3%.

- Fitbit accounted for about 11.3% of global smartwatch shipments in its most recent year.

- As of 2023, Fitbit had been downloaded over 50 million times on Google Play.

- In 2023, Fitbit reportedly sold 6.6 million units, representing a ~28% drop compared to its 2022 sales.

- The Fitbit app maintains a monthly active user base exceeding 8.5 million (U.S.) as of early 2025.

- Google acquired Fitbit in January 2021 for $2.1 billion, folding it into its hardware division.

Recent Developments

- In January 2025, the Fitbit app’s monthly active users in the U.S. surpassed 8.5 million, showing continued stability in app engagement.

- Fitbit has reduced its advertising spend in 2025, signaling a strategic shift toward organic growth and integration within Google’s hardware suite.

- In 2025, Fitbit was fined $12.25 million by the U.S. Consumer Product Safety Commission for failing to promptly report burn risks associated with its devices.

- The Fitbit brand now operates under Google’s hardware umbrella, which allows closer alignment with Google’s health and AI services.

- Critics and long-time users have voiced frustration about data retention and access under Google’s stewardship (e.g., lost historical data).

- Fitbit is increasingly cited in academic and clinical research due to its large user base and data infrastructure.

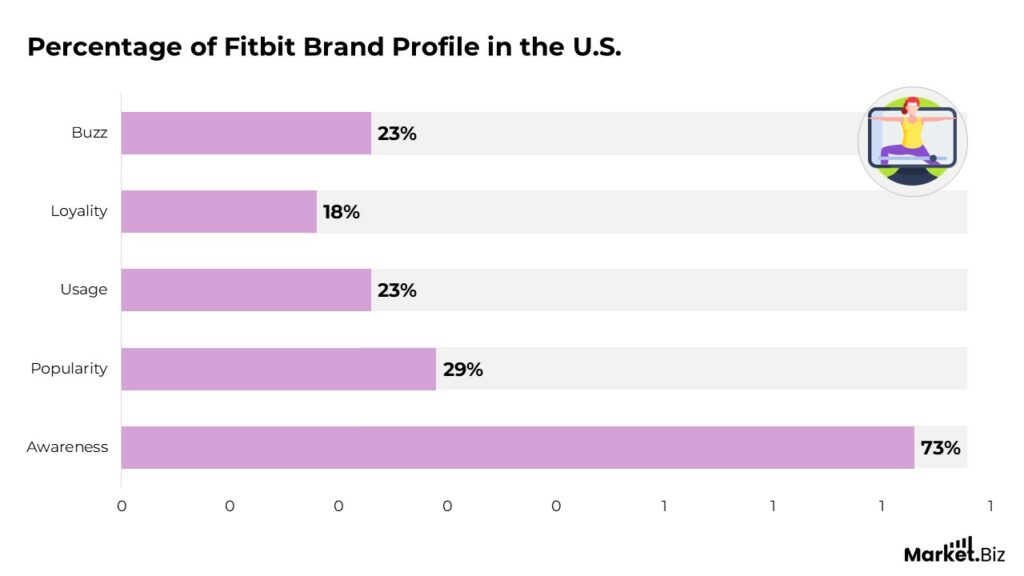

Fitbit Brand Profile in the US

- 73% of U.S. consumers are aware of the Fitbit brand, indicating strong brand recognition.

- 29% rate Fitbit as popular, showing a gap between awareness and perception.

- 23% of respondents actively use Fitbit devices, aligning with the general fitness tracker market penetration.

- 23% mention buzz around Fitbit, reflecting moderate recent media or social attention.

- Only 18% demonstrate brand loyalty, suggesting limited long-term engagement or repeat usage.

Fitbit User Growth and Demographics

- As of the latest figures, 16.08% of Fitbit users are aged 45–54, reflecting growing adoption in middle-aged cohorts.

- Fitbit has reached over 120 million device sales cumulatively since its founding.

- In its earlier years, Fitbit claimed 29 million users across 100+ countries.

- In 2023, the number of registered Fitbit users reached 128 million, up ~8 million from 2022.

- In 2023, the number of monthly active users was around 38.5 million, representing a ~3.75% decline from the prior year.

- Fitbit usage skews toward the 25–54 age bracket, in line with general wearable adoption data.

- Male users tend to slightly outnumber female users in wearable adoption broadly, which may mirror Fitbit user splits.

- In 2025, Fitbit’s position in the U.S. fitness tracker market is around 16% share, behind Apple’s dominance.

Revenue and Financial Performance

- Fitbit’s estimated revenue in 2023 was $1.04 billion, which reflects a ~10% drop year-over-year.

- Google has not separately broken out Fitbit’s financials in recent annual reports, complicating precise 2024–25 figures.

- Fitbit’s revenue decline reflects broader pressure in the mature consumer wearables market.

- The parent category (fitness trackers) is growing, which may help offset declines at the brand level.

- Fitbit’s integration into Google’s hardware may smooth costs and R&D allocations, even if standalone revenue fades.

- The device margin is an important lever, given that many in the industry push premium features over hardware markups.

- Subscription revenue and services may become increasingly important to stabilizing Fitbit’s income.

- In aggregate, Fitbit faces the challenge common to wearables, maintaining high device sales while shifting toward recurring revenue.

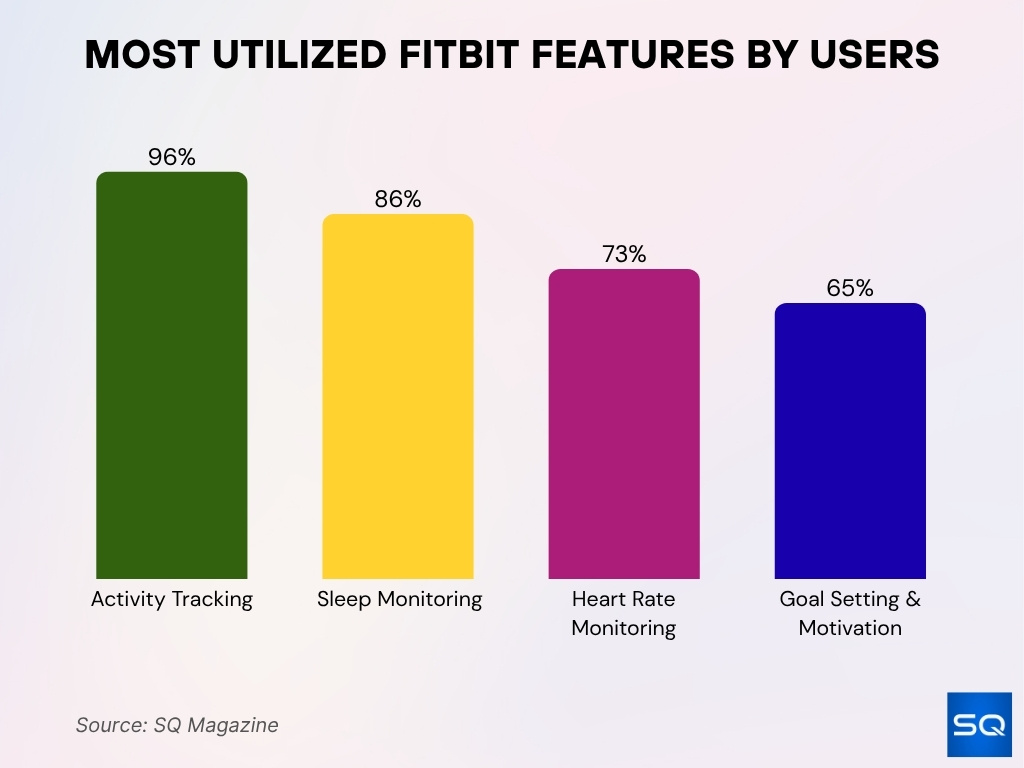

Most Utilized Fitbit Features by Users

- 96% of users actively use Activity Tracking, confirming it as Fitbit’s core feature.

- 86% rely on Sleep Monitoring to improve rest quality and understand sleep patterns.

- 73% use Heart Rate Monitoring for fitness insights and cardiovascular health tracking.

- 65% engage with Goal Setting and Motivation features to maintain consistency and reach targets

Device Sales and Market Share

- Fitbit’s share of global smartwatch shipments is estimated at 11.3% in recent data.

- In comparison, Apple remains dominant with a larger shipment share (often > 20–30%).

- In the U.S. market, Fitbit holds ~16% share of the fitness tracker segment.

- The global wearable market continues to expand; in 2025, smartwatch users globally may exceed 450 million users.

- Fitbit sold 6.6 million units in 2023, a ~28% drop from 2022 levels.

- Declines in unit sales may reflect saturation in key markets and strong competition.

- Fitbit faces pressure from multifunction devices (e.g., Apple Watch, Samsung) that bundle more features.

- Market share gains will likely depend on innovation in health features, battery life, and app ecosystem compatibility.

Usage Patterns and Behavior

- On average, Fitbit users engage with the app 4–6 days per week, according to internal usage analytics (industry reports).

- Wear-time retention is high, many users wear their devices ≥18 hours/day, especially those tracking sleep.

- Challenges drive usage; participants in social step challenges log ~2,200 extra steps per day compared to non‑participants.

- Competitive participation increases retention; users in peer challenges show ~30% higher month‑to‑month retention vs non‑challenge users.

- On average, each user is connected to ~21.7 friends in the Fitbit app network.

- Fitbit Groups exceed 5 million active groups globally, often centered around fitness goals or corporate programs.

- Community engagement adds scale globally; community‑driven users together log ~850 billion extra steps/year compared to solo users.

- In peer comparisons, community participants maintain ~42 active minutes/day vs 38 for non‑participants.

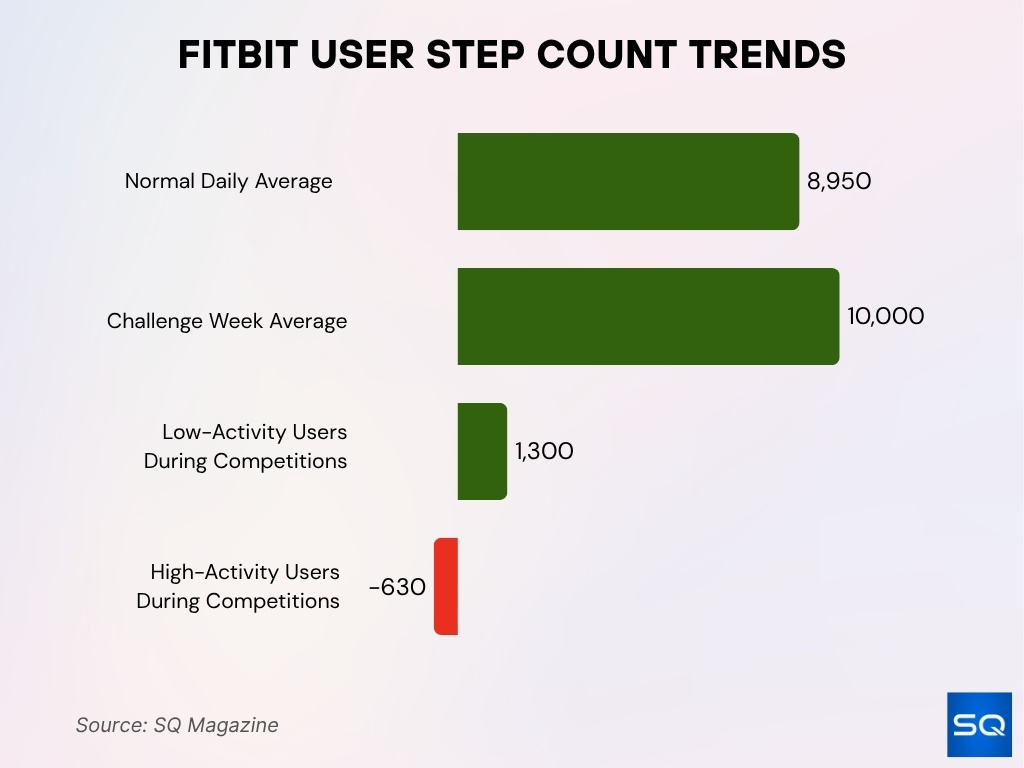

- Leaderboards show mixed effects; sedentary users increase steps by ~1,300/day, while highly active users may decline by ~630 steps/day.

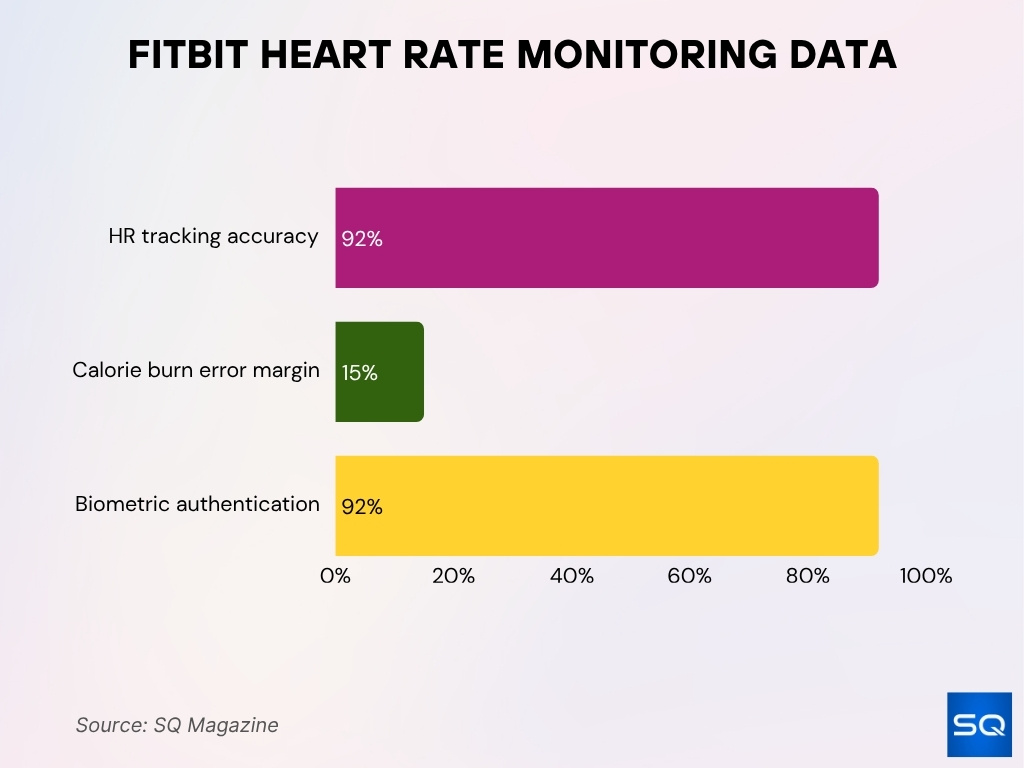

Heart Rate Monitoring Data

- Fitbit’s heart rate tracking is estimated to have ~92% accuracy under many conditions.

- Calorie burn estimations by Fitbit are often cited with ~10–15% error margins.

- In behavioral analytics research, combining heart rate + step + calorie data achieved ~92% biometric authentication accuracy in sedentary periods.

- In the All of Us research program, Fitbit users provided ~1,310 ± 170 minutes/day of heart rate data (i.e., ~21h 50m) on average.

- In studies, heart rate data helps refine sleep algorithms and wearable-derived activity metrics.

- Newer algorithms (e.g,. post‑calibration) aim to reduce motion artifact errors in heart rate readings.

- Heart rate data collected continuously enables metrics like resting HR trend, HR variability proxies, and training load estimations.

Health and Fitness Impact

- Fitbit has powered over 1,700 published research studies spanning topics like activity, sleep, cardiovascular health, and behavioral change.

- Lack of physical activity costs U.S. healthcare an estimated $117 billion annually. Fitbit positions itself as part of the intervention solution.

- Poor sleep contributes ~$94.9 billion in annual U.S. healthcare expenditure; sleep tracking is a core Fitbit offering.

- Many studies show that adding a Fitbit tracker + app to wellness programs improves adherence and outcomes over control arms.

- In one wearable authentication study with 421 Fitbit users, combined metrics (steps, heart rate, calories) achieved ~92% accuracy in user recognition during sedentary periods.

- Comparative validation studies have confirmed that Fitbit’s step counts, active minutes, and resting heart rates correlate well with gold‑standard monitors, though some bias is present.

- Fitbit’s hardware + app interventions have been incorporated into population health deployments to reduce chronic conditions via behavior change.

- The promise of adaptive metrics like “Cardio Load”, introduced by Google in 2024, may deepen Fitbit’s relevance in fitness and training use cases.

App Downloads and Engagement

- The Fitbit app has surpassed 50 million downloads on Google Play (as of 2023).

- In the U.K. from Oct 2024 to Mar 2025, monthly active users of the Fitbit app held steady around 1 million.

- Across fitness apps broadly, 345 million people used fitness apps in 2024.

- Fitness apps were downloaded 850 million times in 2024 (across platforms), showing demand.

- In 2024, fitness app revenues grew to $3.98 billion, up ~11.1% year‑over‑year.

- The global fitness app market was estimated at $10.59 billion in 2024, with projected growth to $23.21 billion by 2030 (CAGR ~13.9%).

- North America accounted for ~46.6% of global fitness app revenue in 2024.

- About 73% of health & fitness tracker users in the U.S. use Fitbit.

Daily Activity Metrics

- Fitbit users log an average of ~8,950 steps/day.

- During challenge weeks, daily steps often rise above 10,000 steps/day on average.

- Leaderboard effects: Users with low baseline activity add ~1,300 steps/day during competitions, high-activity users sometimes drop ~630 steps/day in certain small leaderboards.

- Some users see ~2,200 extra steps during social challenge participation.

- In research cohorts, “fairly active” and “very active” minutes are right-skewed (many users record low values) versus sedentary minutes.

- Wear-time adherence in active cohorts is high; many participants wear their devices ≥20 hours/day.

- Fitbit community engagement correlates with ~42 active minutes per day (vs ~38 for non‑participants).

- Daily activity metrics feed into features like Active Zone Minutes, Cardio Load, and readiness scores.

Geographic Distribution

- Fitbit is used globally across 100+ countries, with strong adoption in North America, Western Europe, and parts of Asia.

- North America dominates the fitness app market, holding ~46.6% of revenue in 2024.

- In markets like the U.K., Fitbit maintains a stable user base (app usage ~1M MAU).

- Asia Pacific is expected to be the fastest-growing region for fitness apps, driven by rising smartphone penetration and health awareness.

- Latin America and MEA (Middle East & Africa) present growth potential for Fitbit through fitness & chronic disease management markets.

- In Europe, Fitbit ranks among the top wearable brands in core markets (UK, Germany, Netherlands).

- Fitbit’s community features show global reach, with groups active in diverse regions.

- Some local language support and region‑specific features (e.g., local activity recognition) help adoption in varied markets.

Community and Social Engagement

- Over 45% of Fitbit users engage in community challenges (step goals, weekend competitions).

- There are 5 million+ active Fitbit Groups globally.

- Peer challenge users log ~2,200 extra steps/day compared to non-challenge users.

- The average user has 21.7 friends connected in the Fitbit social network.

- 30% higher retention is observed month-to-month for users who join peer challenges.

- Community-driven users globally deliver ~850 billion extra steps/year over solo users.

- During challenge weeks, average daily steps rise to ~12,400 vs ~7,100 for baseline users.

- Many Fitbit Groups are integrated into workplace wellness and corporate programs (shared goals, social accountability).

Corporate Wellness Programs

- Fitbit’s enterprise solutions cite over 1,200 corporate clients for health and activity programs.

- These programs enroll ~3 million employees globally in Fitbit-based wellness initiatives.

- Several published cases show Fitbit-driven programs reduce absenteeism, improve biometric outcomes, and lower healthcare costs.

- In corporate settings, community challenges and incentives often drive ~10–20% increases in step counts.

- Fitbit Enterprise claims that integrating the device + app into health plans can improve lifestyle behaviors at scale.

- Many employers bundle Fitbit data with health coaching, rewards, and behavioral nudges to increase engagement.

- Some organizations allow subsidy or reimbursement for Fitbit devices based on meeting health metrics targets.

- Fitbit’s published “Proof It Works” resource aggregates numerous studies that validate enterprise use of Fitbit in population health initiatives.

Brand Awareness and Recognition

- In the U.S., 73% of wearable users recognize the Fitbit brand.

- In 2023, Fitbit led awareness among fitness tracker brands in the U.S. with 53.52%, slightly ahead of Apple Watch at 51.71%.

- In the U.K., Fitbit’s brand awareness was about 87% in 2022, though only ~34% of wearable users actively used it.

- Fitbit ranks among the top wearable brands in Western markets, often cited in consumer tech reviews and retail surveys.

- In consumer behavior studies, brand familiarity correlates with lower churn in earlier years of ownership.

- Fitbit’s marketing includes influencer partnerships, expo participation, and alignment with health campaigns to maintain visibility.

- While brand awareness is high, active usage lags; many who recognize Fitbit don’t currently own or use one.

Hardware Evolution and Models

- As of 2025, Fitbit’s active models include Charge 6, Inspire 3, Versa 4, and Sense 2 under the Google Fitbit umbrella.

- The Charge 6 integrates Google Maps navigation and Google Wallet (tap-to-pay) features.

- The Sense 2 continues to emphasize health metrics like ECG, stress, and skin temperature.

- Older models (e.g. Charge 5, Versa 3) remain in use and supported, though feature updates may taper.

- Fitbit’s product history spans from clips (One, Zip) to wristbands (Flex, Charge) to smartwatches (Ionic, Versa).

- Fitbit devices support features such as water resistance, multi‑day battery life, and multiple sensors (HR, SpO₂, temperature).

- The acquisition by Google has accelerated integration with Google services, affecting firmware rollout and feature alignment.

Sleep Tracking Statistics

- In 2025, the global sleep tracking & optimization products market is valued at about $3,655.8 million, with wearables holding ~72% share.

- The sleep monitoring apps segment alone is projected to grow from $3.87 billion in 2024 to 4.69 billion in 2025 (CAGR ~21.3%).

- Around 72.87% of Fitbit users report using the device to monitor heart rate during exercise (often linked to sleep metrics).

- About 65% of Fitbit users use the device to set personal goals, track progress, or get motivational alerts (which include sleep goals).

- Approximately 72% of Fitbit users regularly use the sleep tracking feature, and 60% check their sleep score weekly.

- A recent algorithm update has increased detection of brief awakenings, making “awake time” appear higher in nightly charts.

- Published research shows many participants provide multi‑day sleep data, about 40% wear their Fitbit all 7 nights/week, and 70% at least 5 nights/week.

- Fitbit’s sleep scoring uses a combination of movement + heart rate + PPG-derived signals.

Premium Subscription Statistics

- Fitbit Premium launched with early adoption reaching 500,000+ subscribers within its first year.

- Premium unlocks deeper/intraday insights, advanced sleep analysis, guided programs, and wellness reports.

- Premium drives behavior; in early trials, new subscribers added ~700 extra steps/day in the first two weeks.

- Critics debate “worth it” vs free versions; some say $9–10/month is steep for what is offered.

Frequently Asked Questions (FAQs)

Fitbit sold 6.6 million units in 2023.

Fitbit holds about 11.3% of global smartwatch shipments.

Fitbit’s share of smartwatch sales increased by 2 percentage points year‑on‑year (rising from ~10% to ~12%).

The global fitness tracker market is projected to grow at a ~17.3% CAGR through 2032.

Conclusion

Fitbit remains a notable force in wearable health technology, fuelled by deep brand recognition, a mature device line, and an ecosystem tied to metrics like sleep, heart rate, and activity. Though user growth is more incremental than explosive, innovation around Cardio Load, AI coaching, and integrated health services positions Fitbit for continued relevance. As competition intensifies, success will hinge not just on hardware, but on the value of insights that users unlock. Dive into earlier sections to see how Fitbit’s user demographics, financials, usage behavior, and wellness programs all weave into the full picture.