Ethereum’s energy profile has transformed dramatically since The Merge in September 2022. Once criticized for consuming as much electricity as a small country, Ethereum now runs on a proof‑of‑stake (PoS) consensus that has slashed its energy consumption by more than 99.9% compared with its earlier proof‑of‑work (PoW) model.

This shift has real‑world impact: data centers and financial services can now contrast blockchain efficiency with traditional systems, and policymakers can revisit crypto climate impacts with fresh metrics. From decentralized finance (DeFi) platforms measuring operating costs to sustainability teams calculating carbon footprints, these statistics reshape industry discussions. Explore further to see how Ethereum’s energy use evolved and what it means for the future.

Editor’s Choice

- Ethereum’s post‑Merge annual energy consumption is approximately 0.0026–0.01 TWh/year as of 2025.

- The Merge reduced Ethereum’s energy use by ~99.95% vs. PoW.

- Per‑transaction energy usage fell to around 0.03 kWh (30 Wh).

- Annual CO₂ emissions from Ethereum dropped to roughly 870 tonnes CO₂e.

- PoS reduces electricity needs by a factor of ~2,000× compared with PoW.

- Switching to PoS helps position Ethereum among low‑energy blockchains globally.

Recent Developments

- September 15, 2022, Ethereum completed The Merge, fully adopting PoS.

- Energy consumption estimates post‑Merge show a 99.9%+ reduction from PoW levels.

- Annualized energy use of ~0.0026 TWh positions Ethereum alongside small institutions rather than nations.

- PoS validators operate on minimal computing power vs. PoW miners.

- Daily stable block times (~12 seconds) have been maintained under PoS.

- Transaction throughput saw modest upticks as energy costs dropped.

- Migration of former mining hardware affected other PoW chains.

- Continued ecosystem upgrades address scalability alongside energy efficiency.

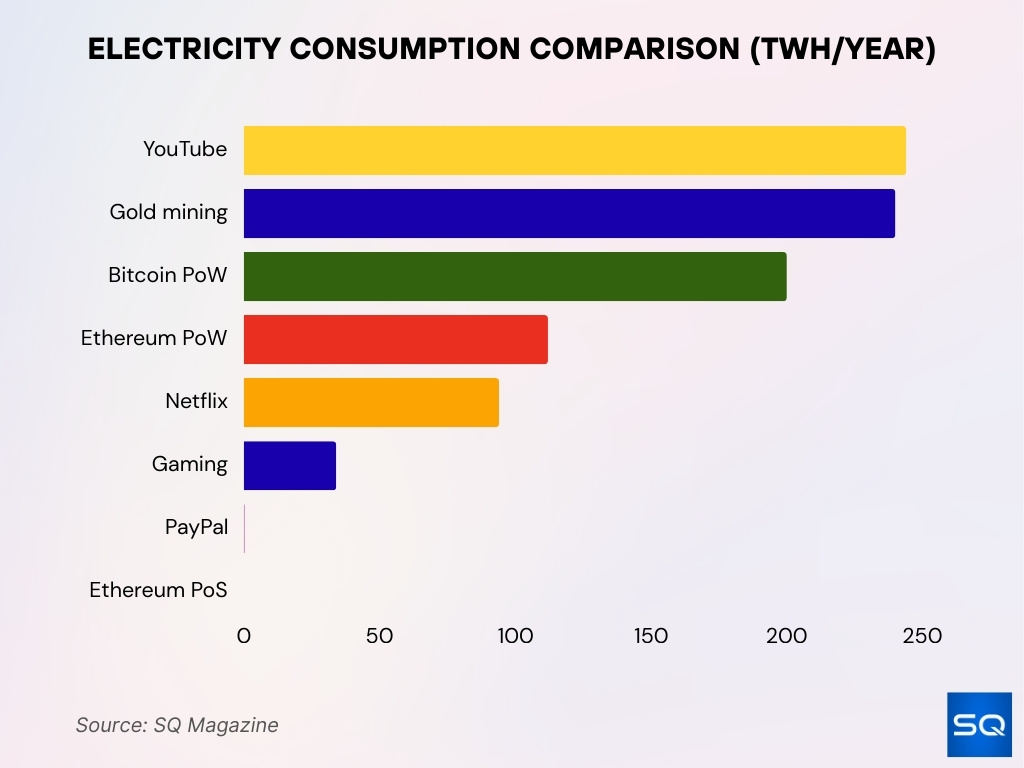

Electricity Consumption Comparison (TWh/year)

- YouTube consumes 244 TWh/year, the highest among all platforms.

- Gold mining uses 240 TWh/year, nearly matching YouTube’s usage.

- Bitcoin PoW consumes approximately 200 TWh/year.

- Ethereum PoW required 112 TWh/year before transitioning.

- Netflix streaming uses about 94 TWh/year.

- Gaming platforms consume around 34 TWh/year.

- PayPal operations use only 0.26 TWh/year.

- Ethereum PoS needs just 0.01 TWh/year, cutting >99% from PoW levels.

Post‑Merge Ethereum Energy Consumption

- Post‑Merge, Ethereum’s annual energy draw is ~0.0026 TWh/year.

- Some estimates place total consumption at ~0.01 TWh/year.

- Energy consumption fell by ~99.95% after The Merge.

- PoS nodes require megawatts, not the gigawatts PoW consumed.

- Monthly energy use under PoS equals that of a small town rather than a country.

- PoS validators can run on ordinary servers or laptops, reducing hardware power draw.

- Energy consumption is now more comparable to traditional data services than to extractive mining.

Ethereum Carbon Footprint and Emissions

- Annual carbon emissions are now estimated at ~870 tonnes CO₂e.

- Before PoS, emissions were millions of tonnes CO₂e annually.

- Per transaction, carbon output sits near 0.01 kg CO₂e.

- Carbon reduction aligns with a ~99.9% decrease in energy use.

- Studies show current yearly emissions could be ~2.8 kilotonnes CO₂e in some models.

- Historical emissions debt remains notable due to legacy PoW activity.

- Lower carbon output makes Ethereum more attractive for ESG reporting.

- Carbon footprint now resembles that of small enterprises, not industrial grids.

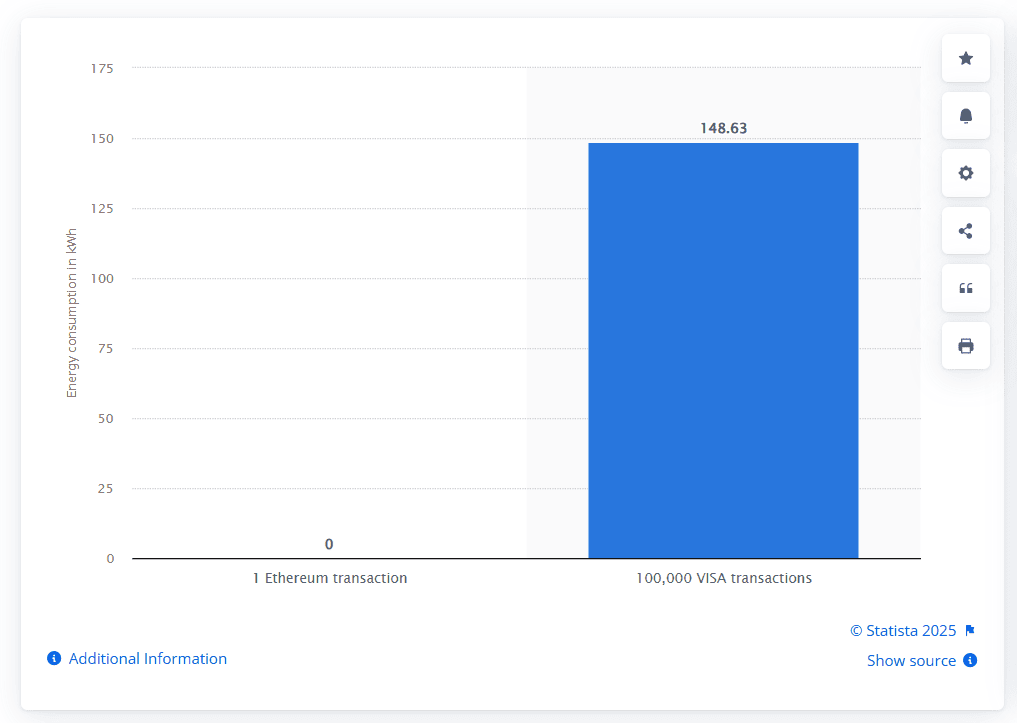

Ethereum vs VISA Energy Consumption

- One Ethereum transaction now consumes about 0 kWh post-Merge.

- 100,000 VISA transactions consume approximately 148.63 kWh.

- Ethereum’s PoS upgrade delivers massive energy efficiency gains.

- VISA’s optimized network still uses substantially more total energy than Ethereum per transaction.

Impact of the Merge on Energy and Emissions

- The Merge’s proof‑of‑stake model cut Ethereum’s energy use by roughly 99.95% compared with proof of work.

- Annual electricity consumption post‑Merge is about 0.0026 TWh/yr (~2,601 MWh).

- This is equivalent to the annual energy use of a small neighborhood rather than a national grid.

- Carbon emissions reduced from millions of tonnes CO₂e under PoW to ~870 tonnes CO₂e/year under PoS.

- Some research suggests older legacy emissions total up to 27.5 million tonnes CO₂e.

- Per‑transaction emissions dropped from over 100 kg CO₂ under PoW to near 0.01 kg CO₂ under PoS.

- A study estimated PoS’s carbon footprint decrease at ~99.992% versus PoW.

- After the Merge, network performance stabilized with fast block times (~12 seconds), supporting lower emissions per unit of activity.

Ethereum Validator and Node Energy Usage

- Ethereum network consumes 0.0026 TWh/year under PoS.

- Annual energy use equals 2,601 MWh for all validators.

- Network emits 870 tonnes CO₂e/year from validator operations.

- Single transaction uses 0.02-0.03 kWh in PoS mode.

- Post-Merge energy dropped by 99.95% versus the PoW era.

- Over 1.2 million active validators span 80+ countries.

- Average validator uptime reaches 99.2% network-wide.

- Top validators achieve 99.92% uptime consistently.

- PoS validators run on commodity hardware, drawing watts to low kilowatts.

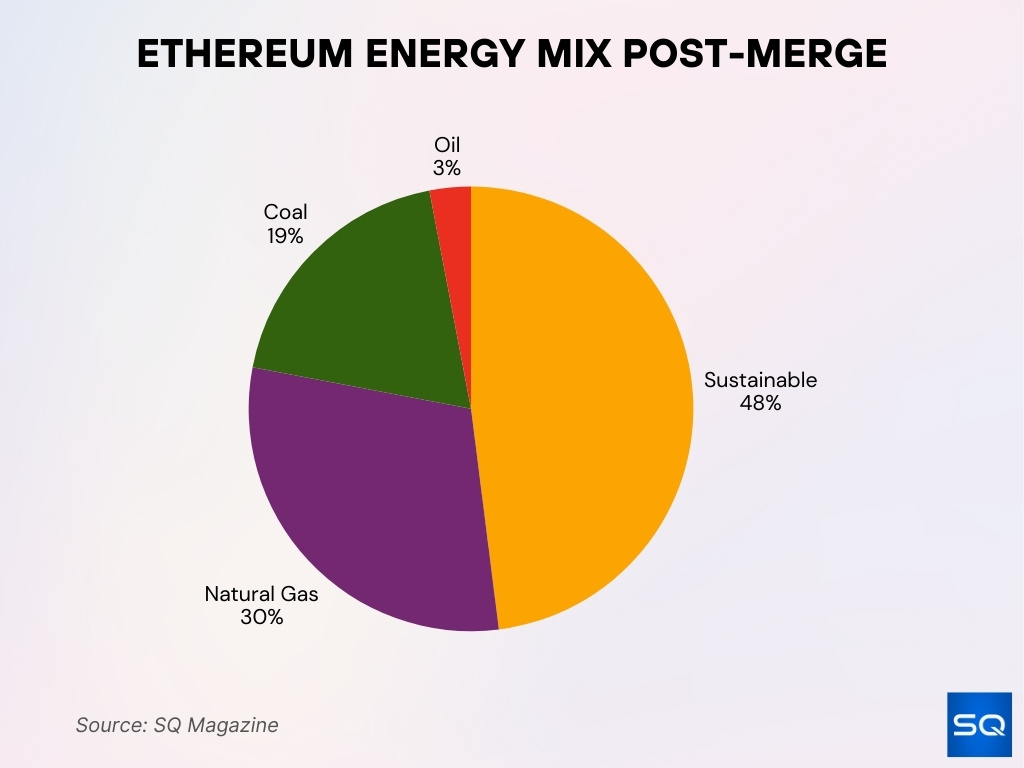

Sustainability and Environmental Impact of Ethereum

- 48% of Ethereum’s energy now comes from sustainable sources like wind, nuclear, and renewables.

- The remaining energy mix includes 30% natural gas, 19% coal, and 3% oil.

Energy Efficiency of Proof of Stake for Ethereum

- PoS reduces energy needs by approximately 2,000× compared with PoW.

- Under PoW, Ethereum consumed on the order of tens of TWh per year; under PoS, it’s ~0.0026 TWh.

- PoS’s energy use resembles that of typical information systems, not energy‑intensive mining.

- Energy efficiency improves security per watt because validators stake ETH, not compute cycles.

- PoS allows easier integration of renewable energy resources for network operations.

- Compared with traditional finance networks, Ethereum PoS uses far less cumulative energy.

- PoS enables broader participation without large hardware investment, lowering barriers to entry.

- Reduced energy demand may encourage enterprises to adopt PoS systems for sustainability goals.

Ethereum Energy Intensity per Dollar Transacted

- Post‑Merge estimates show per‑transaction energy near ~0.03 kWh (30 Wh).

- Some academic figures place per‑transaction energy as low as ~7.2 Wh using adjusted throughput estimates.

- Under PoW, earlier per‑transaction figures could exceed 80 kWh or more.

- Using energy per value transferred, Ethereum’s PoS energy intensity is orders of magnitude lower than PoW.

- Compared to legacy financial rails, Ethereum PoS shows competitive energy efficiency.

- Intensity per transaction varies with throughput, but longer block times do not increase energy use proportionally.

- Layer‑2 rollups may further lower effective energy per economic unit of work.

- Energy intensity remains a core metric for comparing blockchain sustainability across networks.

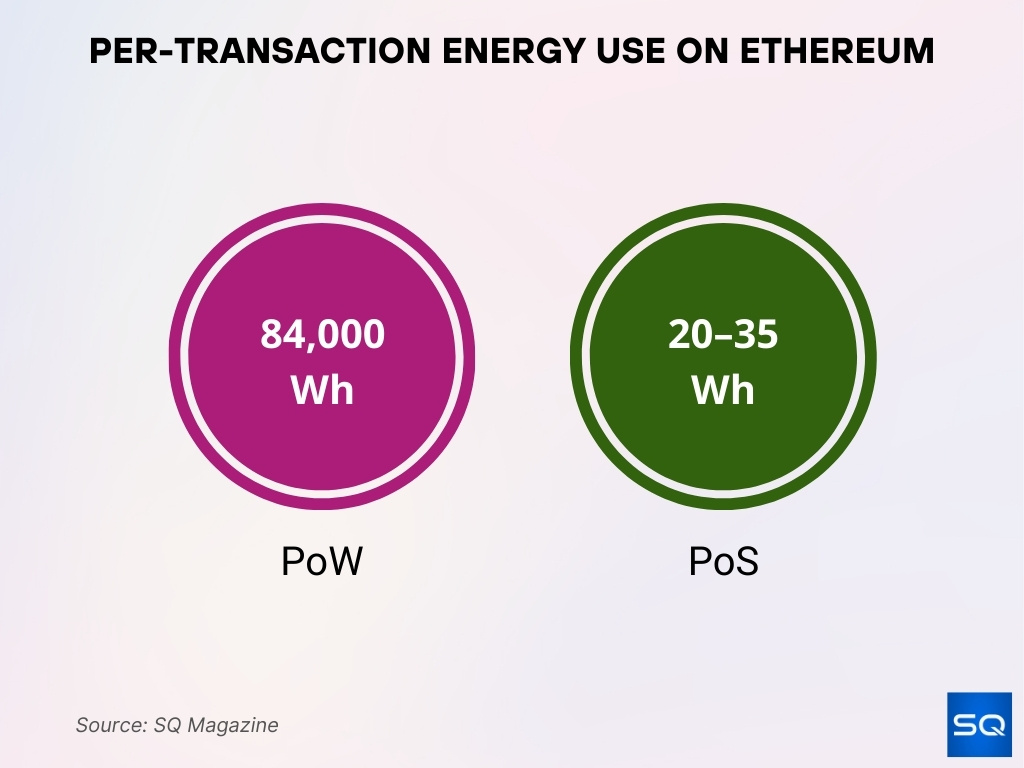

Per-Transaction Energy Use on Ethereum

- Ethereum PoS transactions consume about 0.02 kWh (20 Wh) per transaction based on Digiconomist estimates.

- Some analyses place Ethereum PoS energy use slightly higher at 0.03 kWh (30 Wh) per transaction.

- Other post-Merge benchmarks cite around 35 Wh per transaction.

- Under Ethereum PoW, per-transaction energy use reached up to 84,000 Wh (84 kWh) in some studies.

Geographic Distribution of Ethereum Energy Use

- Ethereum validators operate across 80+ countries globally.

- United States hosts 52.92% of tracked Ethereum nodes.

- Germany accounts for 12.00% of the total node distribution.

- United Kingdom runs 2.98% of Ethereum nodes.

- South Korea operates 2.67% of the validator network.

- Canada contributes 2.64% to node geography.

- France supports 2.46% of Ethereum’s node presence.

- Validators cluster heavily along the Atlantic regions in the EU and the US East Coast.

- Emerging growth in West Africa, Southeast Asia, South America, and Eastern Europe.

Projected Future Energy Use of Ethereum

- Annual PoS consumption projected at 0.0026–0.01 TWh/year through the next decade.

- Validator growth may raise usage to 37.756 GWh annually in the likely scenario.

- Energy demand stays flat despite transaction volume scaling in PoS models.

- Layer-2 adoption dilutes per-transaction costs to under 0.02 kWh.

- Rising node counts could increase consumption by 300% from early post-Merge baselines.

- Sharding upgrades forecast to curb energy per unit work by an additional 20–30%.

- Ethereum PoS remains 8,000× below legacy PoW networks long-term.

- 48% renewable mix projected to cut effective CO₂ even with slight growth.

- Forecasts show a footprint below 0.0014% global data centers indefinitely.

Environmental Benefits of Ethereum’s Energy Reduction

- Merge slashed annual CO₂e emissions to 870 tonnes from 11 million tonnes.

- Single Ethereum transaction now emits 0.01 kg CO₂ versus 109.71 kg pre-Merge.

- Overall energy reduction achieved a 99.95% drop post-Merge transition.

- Network footprint equals 2.8 KtCO₂e/year despite node growth.

- PoS shift cut emissions by 99.97% per Cambridge analysis.

- 48% of validator energy is drawn from renewable sources.

- Annual consumption matches 2,000 English households’ electricity use.

- Historical emissions debt totals 27.5 MtCO₂e versus the current minimal output.

- E-waste reduced via commodity hardware replacing high-end mining rigs

Policy, Regulatory, and ESG Perspectives on Ethereum’s Energy Use

- Ethereum achieved an AA grade in the first institutional ESG benchmark.

- MiCA mandates kWh energy consumption disclosure for all crypto assets.

- 500,000 kWh threshold triggers enhanced sustainability reporting under MiCA.

- ESG assets are projected to reach $50 trillion in AUM globally.

- PoS transition positions Ethereum as a regulatory benchmark for low-energy consensus.

- MiCA requires 5 supplementary indicators for high-energy assets above the threshold.

- 90% reduction in mandatory indicators for low-consumption crypto under MiCA.

- Ethereum leads crypto ESG rankings ahead of Solana and Cardano.

- EU MiCA promotes sustainable finance taxonomy compliance for mining.

Frequently Asked Questions (FAQs)

Approximately 0.0026 TWh/year of electricity.

Ethereum reduced energy consumption by ~99.95%.

Around 870 tonnes CO₂e per year.

About 20–35 Wh (0.02–0.03 kWh) per transaction.

Conclusion

Ethereum’s transition to proof of stake has dramatically reshaped its energy and environmental profile. What once required energy comparable to a nation is now measured in fractions of a terawatt‑hour, with energy and carbon footprints reduced by more than 99%. Its low consumption positions the network as a key case in sustainable blockchain design, admired by environmental analysts and ESG investors alike.

Yet uncertainties remain, especially in geographic carbon intensity and long‑term forecast models. As policy and market forces continue to evolve, Ethereum’s energy journey offers critical lessons for decentralized technologies aiming to balance performance with environmental stewardship.