Cryptocurrency hot wallets are online digital wallets that let users store, send, and receive crypto assets in real time. They power everyday transactions on exchanges, DeFi apps, and peer‑to‑peer platforms, making them central to how millions interact with blockchain networks. In mobile payments, traders rely on hot wallets for instant access, while merchants use them for seamless checkout experiences. With global crypto ownership rising and wallets dominating usage, it’s crucial to understand the trends shaping this space. Explore the latest data on adoption, user patterns, and market movements in hot wallets below.

Editor’s Choice

- 820 million active crypto wallets existed worldwide by 2025, with most being hot (internet‑connected) wallets.

- 78% of all wallets are hot wallets as of late 2025.

- Cold wallets made up only 22% of overall wallet adoption.

- 134 million crypto wallets were in North America in 2025.

- ~520 million downloads of software wallets occurred globally by 2025.

- Active stablecoin wallets increased 53% year‑over‑year in early 2025.

- U.S. crypto ownership among adults reached ~28–30%, indicating rising interest in wallets and associated investment.

Recent Developments

- The global crypto wallet market is projected to jump from $14.84 billion in 2026 to $98.57 billion by 2034 at a strong CAGR.

- Hot wallets retained a major revenue share in 2025, accounting for ~61.5% of crypto wallet industry revenue.

- Market momentum grew due to increasing DeFi integrations and wider retail participation.

- Mobile‑first hot wallets drove much of the growth as smartphone usage expanded in Asia, Africa, and Latin America.

- Biometric and multi‑factor authentication features saw notable upticks in adoption, responding to security concerns.

- The U.S. stood out as a fast‑expanding region, with wallets fueling both retail and institutional flows.

- Stablecoins and yield‑bearing crypto assets expanded use cases, increasing wallet transaction volume.

- Industry bodies continued to emphasize compliance and AML requirements, particularly around custodial wallet operations.

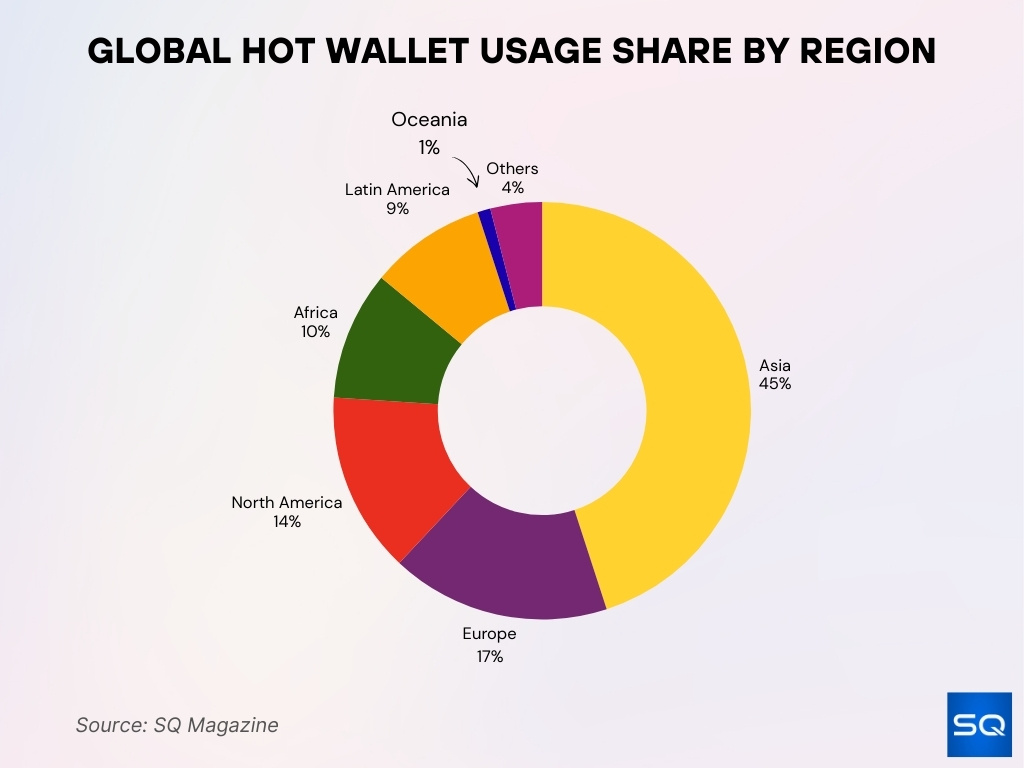

Hot Wallet Usage by Region and Country

- Asia accounts for ~45% of global crypto wallet holders, leading adoption globally.

- Europe represents about 17% of global wallet users.

- North America holds roughly 14% of active wallets.

- Africa contributes ~10% of total global wallet adoption.

- Latin America accounts for ~9% of global users.

- Oceania, including Australia, comprises about 1% of wallet holders.

- In India, there are over 110 million crypto wallet users, the highest in any country.

- The United States has approximately 52 million wallet users.

What Is a Cryptocurrency Hot Wallet?

- A hot wallet connects to the internet for rapid access to funds, unlike offline cold storage.

- Hot wallets account for 72-78% of active crypto wallets globally.

- Crypto wallet market projected to reach $19 billion with 32% YoY growth.

- Hot wallets hold 55-57% of the global wallet revenue share.

- MetaMask leads with 143 million users worldwide.

- Mobile hot wallets are used by 78% of users.

- Non-custodial hot wallets are preferred by 59% of users.

- Hot wallet hacks caused $48 million BTCTurk loss on Jan 1.

- Institutional hot wallet adoption rose 51% YoY.

- Desktop hot wallet usage dropped to 9%.

Global Hot Wallet Adoption and User Base

- 78% of all crypto wallets behind active addresses were hot wallets in 2025.

- 820 million active wallets globally include a strong majority of hot wallets.

- Mobile downloads of wallet software topped 520 million by late 2025.

- U.S. saw ~134 million wallets, with a rising share of hot wallet users.

- Stablecoin wallet growth reflects broader market adoption, up 53% YoY.

- Wallet adoption in emerging markets accelerated due to mobile accessibility.

- Growth continues as institutional firms integrate hot wallets into trading and liquidity operations.

- Survey data show ~30% of U.S. adults own crypto, increasing the potential hot wallet base.

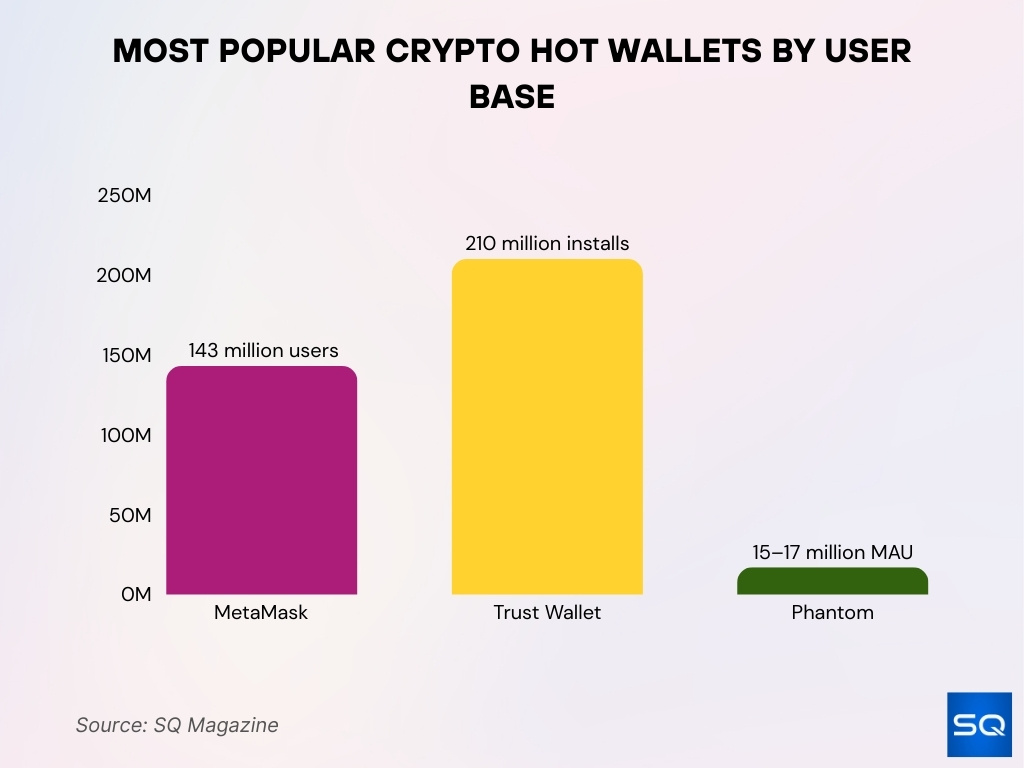

Most Popular Crypto Hot Wallets by Users

- MetaMask boasts 143 million total users worldwide.

- Trust Wallet reaches 210 million installs globally.

- Phantom supports 15-17 million monthly active users.

- Trust Wallet holds a 35% market share in downloads.

- Phantom drives 35% of Solana transaction volume.

- Trust Wallet reports 60 million MAUs in the early years.

- MetaMask Nigeria users comprise 12.7% of the total.

- Trust Wallet shows 4x YoY revenue growth.

- Phantom achieves 5x user growth over the prior year.

Custodial vs Non‑Custodial Hot Wallet Statistics

- In 2025, about 41% of hot wallet users opted for custodial wallets (third-party holds keys).

- Non‑custodial wallets account for ~59% of users who retain control of private keys themselves.

- The non‑custodial wallet market, valued at around $1.5 billion in 2023, is projected to reach $3.5 billion by 2031.

- 71% of crypto users expressed awareness of self‑custody benefits in 2025.

- Institutional wallets show about 43% custodial usage, often for regulatory or operational ease.

- Custodial wallets tend to be chosen by newer or less technical users, prioritizing convenience.

- Non‑custodial wallets dominate among DeFi and NFT participants due to integration flexibility.

- Hybrid strategies, custodial for trading, non‑custodial for long‑term holding, are increasing.

On-Chain Activity from Hot Wallets (Transactions and Volume)

- On‑chain activity surged with total network transactions scaling alongside broader adoption.

- Illicit on‑chain addresses received an estimated $154 billion in 2025, a 162% increase YoY.

- Stablecoins accounted for ~30% of all on‑chain volume, reaching over $4 trillion in value by August 2025.

- Active DeFi transaction volumes continued to rise, mirrored by increasing wallet engagements on DeFi platforms.

- On‑chain NFT trading activity reached 18.1 million assets traded via 2.14 million wallets in Q3 2025.

- Average NFTs per trading wallet climbed to 8.4 by late 2025, indicating deeper on‑chain participation.

- High‑volume wallets often reflect cross‑chain swap usage and multi‑protocol engagement in DeFi.

- The aggregate value of DeFi and NFT transactions driven by hot wallets pushes daily on‑chain activity into the multi‑billion‑dollar range.

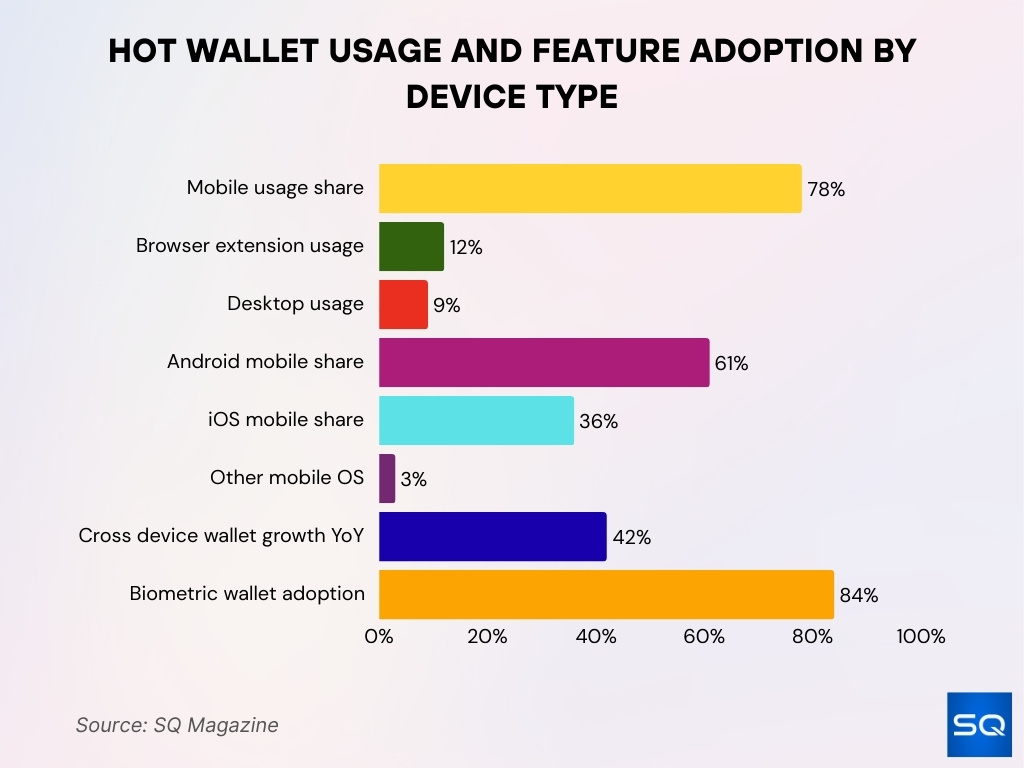

Hot Wallet Usage by Device Type (Mobile, Desktop, Web)

- Mobile wallets are used by over 78% of hot wallet users worldwide in 2025, making phones the dominant access point.

- Desktop hot wallet usage remains comparatively low, at around 9% of all hot wallet activity.

- Browser extension wallets account for about 12% of active usage, popular among DeFi and NFT traders.

- Android devices represent roughly 61% of mobile wallet installs and usage, with iOS on ~36%.

- Wallets that sync across devices grew usage by about 42% year‑over‑year as cross‑platform continuity improves.

- Biometric authentication (fingerprint, face ID) appears in ~84% of mobile wallets, enhancing convenience and perceived security.

- Real‑time notifications and QR payment features helped increase retention among mobile wallet users in 2025.

- Web‑based wallets saw increased use for wallet‑connect features, particularly in NFT marketplaces and DeFi dashboards.

Average Transaction Size and Frequency in Hot Wallets

- OKX Wallet users average 3.2 transactions per active user daily.

- Bitcoin network processes 362,913 transactions per day.

- Power users execute over 25 swaps weekly in OKX Wallet.

- Swap activity rose 41% YoY across hot wallets.

- Cross-chain bridging usage increased 57% in recent quarters.

- The average DeFi user conducts 11.6 transactions monthly.

- Transaction success rates exceed 99.8% in major wallets.

- DeFi weekly transaction volume surpasses $48 billion.

- Blockchain gaming wallets average 4.66 million daily active.

Hot Wallet Adoption Across Blockchains and Networks

- Ethereum holds 56.8% of DeFi TVL in hot wallets.

- Solana captures 7.03% TVL share with rapid wallet growth.

- Tron ranks third at 6.54% TVL in wallet activity.

- BNB Chain accounts for 8% cross-chain swap volume.

- Polygon supports 5% of interoperability transfers.

- Sui emerges with 1.14% TVL in new wallets.

- Hyperliquid holds a 1.1% share in hot wallet usage.

- Aptos attracts 0.9% TVL among niche chains.

- Cross-chain bridges process $1.3 trillion annually.

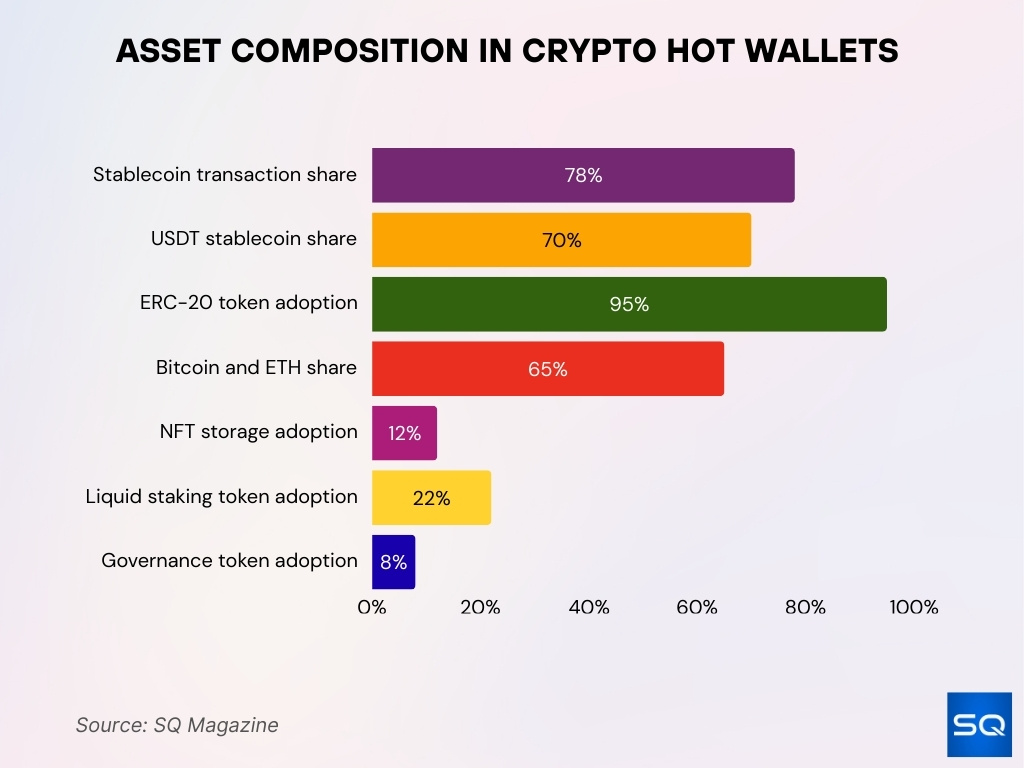

Types of Assets Stored in Hot Wallets

- Stablecoins comprise 78% of hot wallet transaction volume.

- USDT dominates with a 70% stablecoin market share in wallets.

- ERC-20 tokens are held in 95% of DeFi hot wallets.

- Bitcoin and ETH represent 65% of major crypto holdings.

- NFTs are stored in 12% of active hot wallets.

- Liquid staking derivatives are in 22% of multi-chain wallets.

- Governance tokens are present in 8% of user portfolios.

- Stablecoin transfers exceed $18.4 trillion annually.

- Multi-chain assets are supported across 65 blockchains.

DeFi, NFT, and Web3 Usage Through Hot Wallets

- 198 million wallets were active in DeFi activities in 2025, about 24% of all crypto wallets.

- NFT‑linked wallets surpassed 290 million globally, up ~30% from the prior year.

- Gen Z NFT ownership jumped ~42% in 2025, showing younger demographic adoption.

- ~61% of NFT interactions originated from gaming‑related assets.

- Metaverse wallet usage reached ~79 million users in 2025.

- Staking and yield wallets in DeFi climbed to ~92 million users.

- DeFi wallets tended to support 5+ tokens on average and interact across multiple chains.

- Web3 usage through wallets expanded as protocols added NFT marketplaces, token swaps, and social features.

Security Risks and Breach Statistics for Hot Wallets

- In the first half of 2025, an estimated $1.93 billion in crypto assets was stolen through various cyberattacks and wallet breaches.

- By mid‑2025, total funds stolen from crypto services exceeded $2.17 billion, surpassing 2024’s figures.

- Hot wallet compromises were responsible for about $1.7 billion of total stolen assets across 34+ distinct incidents in 2025.

- Phishing attacks alone accounted for roughly $410 million in losses during 2025.

- Centralized exchange hot wallet breaches contributed to ~82% of all exchange‑related losses over recent years.

- API vulnerabilities were implicated in ~17% of exchange hacks, highlighting systemic tech risks.

- Unauthorized account access played a role in ~29% of exchange security incidents in 2025.

- High‑value nation‑state actors, especially North Korean hackers, have driven record‑setting thefts, with individual breaches exceeding $1 billion.

Phishing, Malware, and Social Engineering Attacks on Hot Wallet Users

- Phishing attacks rose 31% year-over-year, targeting hot wallets.

- Wallet drainers stole $1.93 billion in the first half of the year.

- Phishing emails caused $594.1 million in losses in H1.

- Address poisoning has hit 17 million victims globally.

- AI-generated phishing emails increased 70%.

- Vishing scams surged 449% for wallet compromises.

- Trust Wallet extension breach led to $7 million theft.

- Fake wallet sites caused $150 million in confirmed losses.

- 42% of crypto losses from drainer phishing scripts.

- Average drainer attack loss $2,000-$35,000 per victim.

Losses from Hacks and Exploits Involving Hot Wallets

- Total crypto hacks reached $3.4 billion last year.

- North Korean hackers stole $2.02 billion, up 51% YoY.

- Bybit‘s hot wallet breach lost $1.4 billion in ETH.

- Exchange hacks accounted for 76% of losses at $1.6 billion.

- Hot wallet breaches comprised 62% of stolen funds.

- 303 separate hack incidents recorded.

- DeFi exploits caused $320 million in losses.

- Individual wallet compromises totaled $180 million.

- The three largest hacks represented 69% of service losses.

- Trust Wallet extension hack resulted in $7 million being stolen.

Security Features Adoption in Hot Wallets (MFA, Biometrics, MPC)

- Biometric authentication adoption surged 46%.

- MFA blocks 99.9% of automated crypto attacks.

- 95% of top hot wallets integrate AI fraud detection.

- MPC wallets eliminate single points of failure in 80% institutional use.

- Passkey adoption projected to surge 60%.

- Multi-biometric methods are standard in 70% digital wallets.

- 85% exchanges require MFA for withdrawals.

- Seedless recovery is used in 65% MPC solutions.

- Behavioral biometrics is deployed in 25% advanced wallets.

- Real-time AI monitoring flags 92% suspicious transactions.

Institutional and Enterprise Use of Hot Wallets

- 31 million wallets linked to institutions and organizations.

- 76% of global investors are expanding digital asset exposure.

- 43% of institutional wallets operate as custodial.

- Spot Bitcoin ETFs manage $115 billion AUM.

- Crypto custody market valued at $447.9 billion.

- 60% institutions allocate over 5% AUM to crypto.

- Tokenized MMFs reached $7.4 billion AUM.

- Hedge funds hold 41% of Bitcoin ETF shares.

- The custodial market is projected to hit $6.03 billion by 2030.

- 90% qualified custodians use multi-wallet structures.

Regulatory and Compliance Trends Affecting Hot Wallet Usage

- 85 of 117 jurisdictions advanced Travel Rule implementation.

- MiCA covers 85% of traded crypto-assets in Europe.

- 65% EU crypto startups applied for MiCA licenses.

- Regulatory compliance costs rose 30% for wallet providers.

- €250 million fines issued to non-compliant firms.

- 70% users prefer KYC-compliant platforms.

- KYC platforms show 28% higher lending volumes.

- AML-compliant wallets boosted tx volumes 35%.

- €350,000 capital required for custodial providers.

- Fraud cases dropped 15-22% among compliant wallets.

Frequently Asked Questions (FAQs)

Approximately 43% of all active crypto wallets were in the Asia‑Pacific region in 2025.

An estimated 87% of crypto investors used more than one wallet to diversify asset security by 2025.

The global crypto wallet market is projected to grow at a 26.7% CAGR from 2026 to 2034.

Conclusion

The hot wallet ecosystem offers unparalleled convenience and access to global crypto markets, yet carries persistent security challenges. From growing hot wallet adoption and enterprise integration to sophisticated phishing and high‑value breaches, users and institutions alike must balance accessibility with robust safeguards.

The data make it clear, security feature adoption, from MFA and biometrics to MPC, paired with emerging regulatory frameworks, is reshaping wallet usage and trust. Hot wallets will remain central to crypto activity, but their future success depends on strengthened defenses, compliance readiness, and informed risk management. As the landscape evolves, staying updated on threats and protections will be essential for every participant in the digital asset economy.