Cryptocurrency adoption has accelerated today, reshaping global finance and personal investing. More than half a billion people worldwide now hold or use digital assets, signaling a shift from niche interest to mainstream financial participation. This trend touches real-world domains like peer-to-peer payments and remittance services and institutional portfolio allocations, where family offices are increasingly allocating to digital assets. As we unpack the key figures behind this movement, you’ll see how adoption looks today, and what it means for markets and everyday users alike.

Editor’s Choice

- Global crypto adoption rate reached approximately 9.9% in 2026.

- An estimated 559 million people now hold crypto worldwide.

- ~74% of family offices are now exploring or invested in crypto.

- Over 18,900 different cryptocurrencies exist.

- Bitcoin wallets with at least 1 full Bitcoin number under 1 million globally.

Recent Developments

- Bitcoin (BTC) saw sharp price volatility, hitting highs near $126,000 in late 2025 and then falling significantly early in 2026.

- Regulatory progress in the U.S., such as the GENIUS Act, aims to clarify stablecoin frameworks, encouraging institutional entry.

- Institutional interest surged with crypto ETFs and clearer regulatory signals slated for 2026.

- Family offices reported a +21 percentage point rise in crypto adoption between 2024 and 2026.

- Tokenization of real-world assets is gaining momentum among traditional financial institutions.

- Growth of stablecoins as settlement mediums continues in cross-border payments.

- Enhanced custody solutions and regulated products are driving institutional inflows.

- Crypto assets have seen oscillating total market cap levels, indicative of speculative behavior and macro influence.

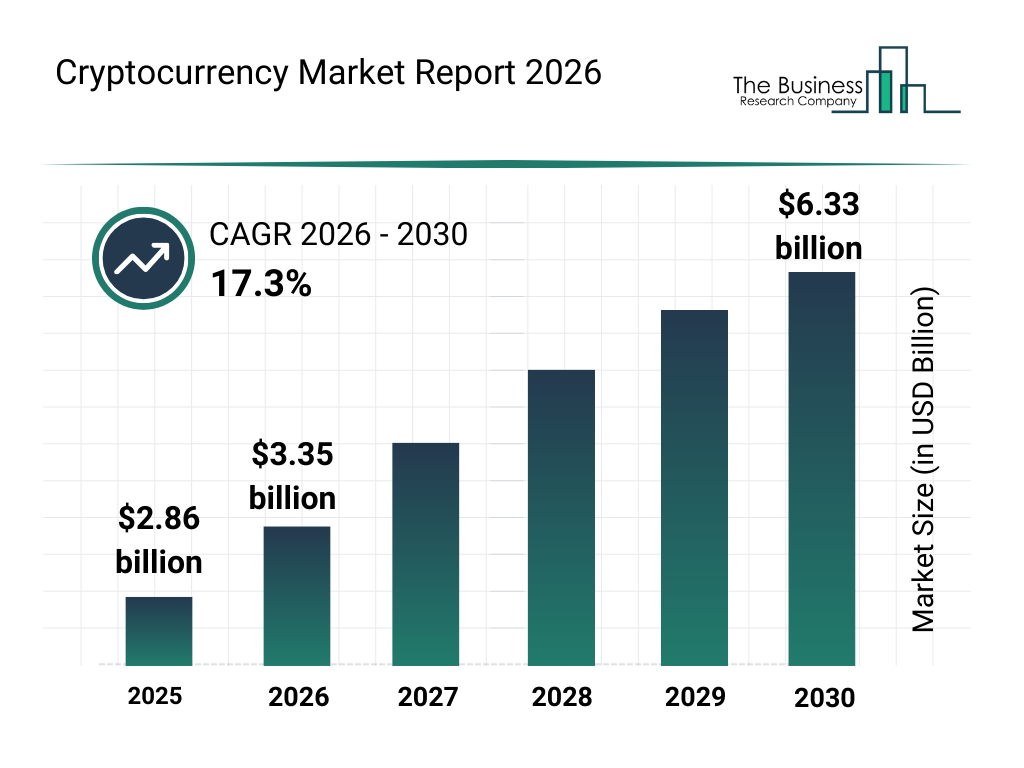

Cryptocurrency Market Growth Forecast

- The global cryptocurrency market is projected to grow from $2.86 billion in 2025 to $6.33 billion by 2030.

- The market is expected to expand at a strong 17.3% CAGR between 2026 and 2030.

- In 2026, the market size is forecast to reach $3.35 billion, reflecting steady year over year growth.

- By 2027, the market is projected to climb to approximately $4.00 billion.

- The industry is expected to surpass $4.70 billion in 2028, driven by broader adoption and institutional participation.

- In 2029, the market is forecast to reach around $5.50 billion, marking continued acceleration.

- Over the five year period from 2025 to 2030, the market is projected to add nearly $3.47 billion in total value.

- By 2030, the cryptocurrency industry is expected to more than double in size compared to 2025 levels.

Global Cryptocurrency Ownership Rates

- Approximately ~9.9% of the global internet population owned cryptocurrency, showing that nearly 1 in 10 internet users have exposure to digital assets.

- Around 559 million people worldwide hold crypto, reflecting rapid expansion from early adopters to mainstream retail participants.

- Crypto wallet installations reached over 1.1 billion, indicating widespread downloads across exchanges, DeFi platforms, and self-custody apps.

- About ~30% of Americans own cryptocurrency, making the U.S. one of the largest national markets for digital asset adoption.

- U.S. ownership remains significant among developed economies, driven by higher financial access, fintech integration, and institutional investment.

- A total of 18,959 distinct cryptocurrencies are tracked globally, spanning major coins, stablecoins, utility tokens, and emerging altcoins.

- Many adopters view crypto primarily as a store of value, similar to digital gold, particularly with assets like Bitcoin.

- Adoption tends to be higher in inflation-affected or underbanked regions, where crypto provides alternative access to savings, remittances, and financial services.

Number of Cryptocurrency Users Worldwide

- Global crypto owners reached approximately 559 million, reflecting steady year-over-year growth as digital assets gain mainstream attention.

- Ownership penetration is at ~9.9% of the world’s population, meaning nearly 1 in 10 people globally now hold some form of cryptocurrency.

- India leads with over 90 million holders, driven by a large tech-savvy population and increasing interest in digital investments.

- The United States has roughly 70 million owners, supported by a strong exchange infrastructure and growing institutional participation.

- Crypto wallet downloads surpassed 1 billion installs, highlighting massive global engagement with blockchain-based applications.

- Southeast Asia exceeds 20% adult adoption, making it one of the fastest-growing crypto regions worldwide.

- Brazil reports more than 15% adult ownership, positioning it as one of Latin America’s most active cryptocurrency markets.

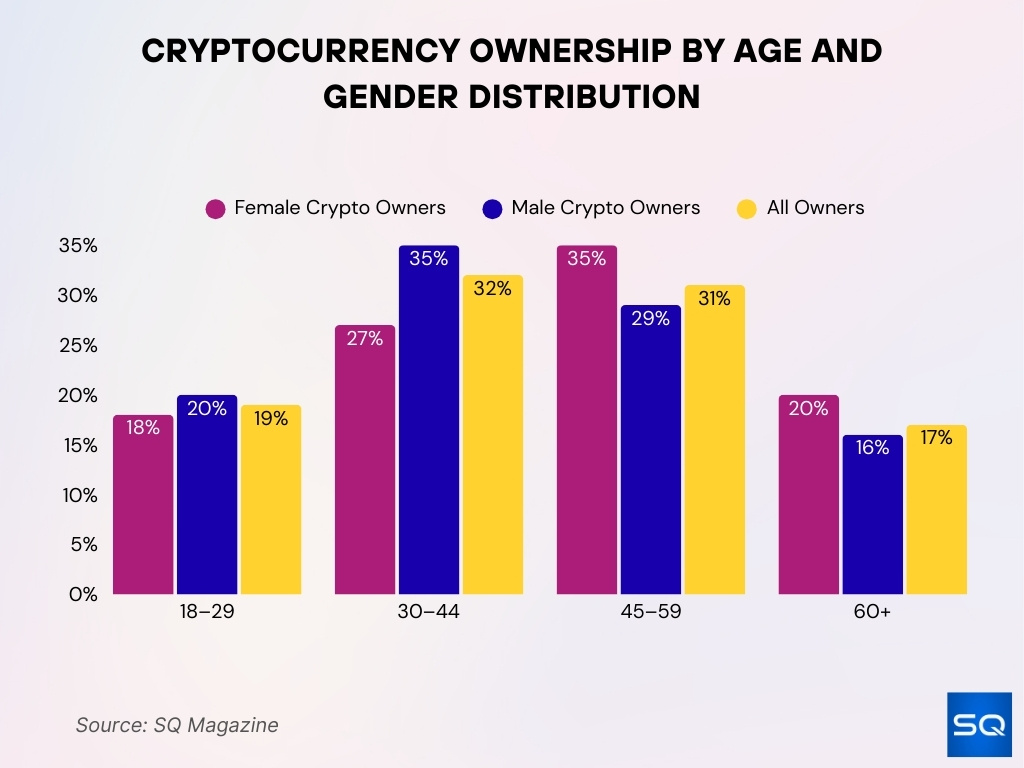

Cryptocurrency Ownership by Age and Gender Distribution

- The 30–44 age group represents the largest share of crypto owners overall at 32%.

- Among male crypto owners, the highest concentration is in the 30–44 segment at 35%.

- For female crypto owners, the largest group is 45–59 years old at 35%, indicating stronger midlife participation.

- The 18–29 age group accounts for 19% of all owners, with 20% male and 18% female participation.

- The 45–59 age group makes up 31% of total crypto ownership, with women leading men by 6 percentage points in this segment.

- Older people aged 60+ represent 17% of all crypto owners, with 20% female and 16% male ownership shares.

- Gender differences are most pronounced in the 30–44 group, where male ownership exceeds female participation by 8 percentage points.

- Overall, crypto ownership shows strong representation among middle-aged adults (30–59), who collectively account for more than 60% of total owners.

Cryptocurrency Adoption by Education Level

- In the U.S., individuals with a bachelor’s degree or higher are 2 times more likely to own cryptocurrency compared to those with only a high school diploma.

- About 45% of U.S. crypto holders have at least a bachelor’s degree, showing strong adoption among college-educated investors.

- Globally, roughly 52% of crypto users hold a bachelor’s degree, indicating that higher education levels correlate with digital asset participation.

- Around 17% of global users have postgraduate degrees, including master’s and doctoral qualifications, suggesting advanced academic backgrounds among a segment of investors.

- In emerging markets, college-educated individuals account for over 25% ownership rates, often driven by digital literacy and exposure to fintech innovation.

- Approximately 21% of global crypto users have only a high school diploma, highlighting that adoption is not limited exclusively to higher education groups.

- In the U.S., about 62% of crypto investors are college-educated, reinforcing the link between education level and investment activity.

- Roughly 41% of Gen Z crypto holders in the U.S. are college students or recent graduates, reflecting early exposure to blockchain and digital finance trends.

- STEM graduates are 1.5 times more likely to invest in cryptocurrency, likely due to stronger familiarity with technology, data, and emerging innovations.

Consumer Attitudes Toward Cryptocurrency

- About 30% of American adults own cryptocurrency, reflecting a significant level of mainstream awareness and participation.

- Roughly 61% of current owners plan to increase their investments, showing continued confidence among existing holders despite market fluctuations.

- Only 6% of non-owners say they plan to buy crypto, indicating that adoption growth may rely heavily on converting skeptics.

- Around 57% of respondents expect the cryptocurrency market to increase in value, highlighting generally optimistic market sentiment.

- Approximately 52% believe crypto values will rise under current policies, suggesting that regulatory and economic environments influence investor outlook.

- Key concerns among non-owners include volatility, lack of consumer protection, and cybersecurity risks, which remain major barriers to broader adoption.

- Among owners specifically, 67% expect the market to increase, reflecting stronger optimism within the invested community.

- Meanwhile, 19% overall expect the market to decline, showing that a notable minority remains cautious or bearish.

- For many participants, speculation continues to drive adoption more than everyday utility, as investors focus on potential price appreciation rather than transactional use.

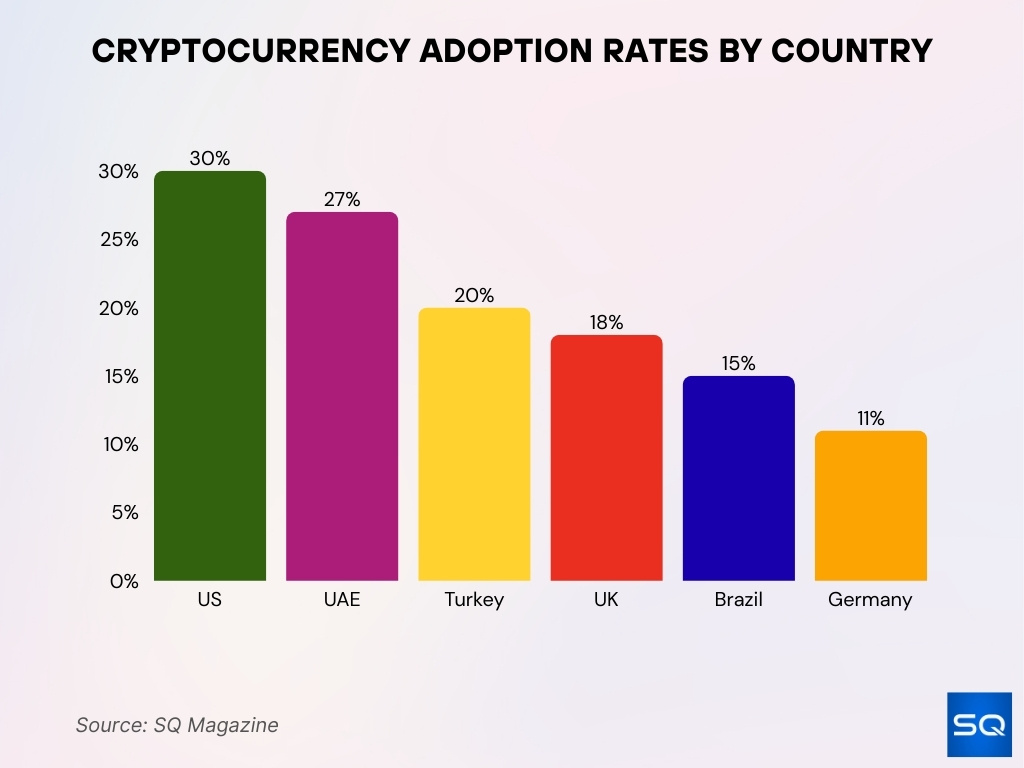

Cryptocurrency Adoption by Country

- United States, approximately 30% adult ownership.

- United Kingdom, around 18% adult ownership.

- The United Arab Emirates exceeds 27% ownership.

- Turkey has above 20% ownership due to volatility.

- Brazil near 15% adoption rate.

- Germany has approximately 11% ownership.

- Nigeria consistently top 10 with high retail activity.

- Vietnam strong grassroots adoption ranking in the top 5.

Cryptocurrency Adoption by Income Level

- Households earning over $100,000 annually are nearly 2 times more likely to own cryptocurrency compared to lower-income households, showing a strong correlation between income and adoption.

- About 44% of U.S. crypto owners report annual incomes of $100,000+, highlighting that higher earners are leading investors in digital assets.

- Approximately 43% of U.S. holders have household incomes above $75,000, further emphasizing that crypto adoption skews toward wealthier demographics.

- Around 26% of U.S. adults earning under $50,000 have owned cryptocurrency, reflecting growing interest among mid- and lower-income earners despite financial constraints.

- The average crypto investor earns about $7,467/month, compared with $6,648 for non-investors, indicating slightly higher earning power among those participating in the market.

- The top 10% of wallets control over 80% of the Bitcoin supply, showing a significant concentration of ownership among wealthy or early investors.

- Roughly 32% of gig economy workers holding crypto earn under $40,000, demonstrating that lower-income groups are increasingly exploring digital assets.

- Households earning under $40,000 have seen a 12% YoY rise in crypto usage, suggesting adoption is steadily growing even among lower-income segments.

- In Brazil, middle-class adoption of cryptocurrency exceeds 15%, indicating meaningful penetration beyond high-income groups in emerging markets.

Reasons for Adopting Cryptocurrency

- Around 52% of global owners cite investment growth as their primary reason for buying crypto, viewing it as an opportunity for capital appreciation.

- Approximately 60% of U.S. holders are motivated by long-term wealth building, treating cryptocurrency as part of a diversified investment portfolio.

- In emerging markets, about 38% of users adopt crypto as a hedge against inflation, using digital assets to preserve purchasing power amid currency instability.

- Roughly 40% express interest in crypto mainly for its investment potential, rather than for everyday transactions or payments.

- An overwhelming 88% of crypto holders plan to continue investing, indicating sustained confidence despite market volatility.

- Around 33% of U.S. holders are drawn to decentralization, valuing the independence from traditional financial institutions.

- About 74% of family offices have either invested in cryptocurrency or are actively exploring exposure, signaling growing institutional interest in the asset class.

Reasons for Avoiding Cryptocurrency

- Around 39% of non-owners cite price volatility as the primary barrier, pointing to sharp market swings as a major deterrent.

- Approximately 59% of Americans report lacking confidence in crypto security, reflecting concerns about hacking, exchange failures, and digital theft.

- Security concerns remain the leading barrier among non-owners, especially regarding wallet safety and platform reliability.

- About 48% of users fear losing money due to volatility, highlighting the emotional and financial risks tied to unpredictable price movements.

- Roughly 37% cite unclear regulation as the main reason for staying out of crypto, signaling uncertainty around legal frameworks and future policy changes.

- Around 27% say cryptocurrency is simply too risky compared to traditional investments like stocks or bonds.

- In North America, 34% express concern about potential government interference, including tighter regulations or restrictions on crypto activity.

- Scams and fraud remain major contributors to investor losses, reinforcing skepticism among cautious consumers.

- The lack of consistent regulation and formal investor protection mechanisms continues to limit broader trust and mainstream adoption.

Frequently Asked Questions (FAQs)

About 9.9% of the global internet population now owns cryptocurrency as of 2026.

An estimated 559 million people worldwide own or used cryptocurrency in 2026.

Mobile crypto wallet installations have reached roughly 1.1 billion globally by 2026.

Conclusion

Cryptocurrency adoption today reflects both momentum and caution. More than half a billion people now hold digital assets, yet ownership patterns vary sharply by income, education, geography, and risk tolerance. While many adopters pursue long-term investment growth, inflation protection, or financial independence, skeptics remain concerned about volatility, fraud, and regulation.

For U.S. investors, policymakers, and institutions, these statistics highlight a maturing but uneven market. Adoption continues to expand in emerging economies and among higher-income households, while education and regulatory clarity will likely shape the next wave of participation. As digital assets integrate further into mainstream finance, understanding these trends becomes essential for making informed decisions.