Cross‑platform gaming bridges device boundaries, letting players move seamlessly between smartphone, console, and PC. Today’s gamers expect flexibility, and the data reflects that demand. In retail and esports alike, developers report stronger retention and spending when titles support cross‑play, while platforms see growing engagement from portable access. Read on for detailed insights into how and why cross‑platform gaming shapes the industry in 2025.

Editor’s Choice

- 79% of gamers use mobile devices, with significant overlap toward PC (42%) and consoles (55%), a clear indicator of cross‑platform habits.

- In the U.S., 70% of players game on smartphones, while ~50% play on consoles and ~40% on PC, demonstrating widespread multi-device use.

- Mobile gaming commands over half of global gaming revenue, estimated at between $120–130 billion in 2025.

- Global gaming revenue is projected to reach $187.7 billion in 2024, although mobile remains the largest segment by revenue. PC may show stronger year-on-year growth in specific markets, but mobile continues to dominate globally.

- In the U.S., gaming consumer spending reached $58.7 billion in 2024, with mobile driving much of that growth.

- PC and console software revenue across both platforms is forecast at $85.2 billion in 2025, with console growth outpacing PC slightly through 2027.

- Steam’s platform share (all PC) shows Windows at 95.45% and Linux rising to 2.69% as of May 2025, hinting at diversification in PC ecosystems.

Recent Developments

- Mobile gaming remains dominant, with more than half of all gaming revenue globally, and projections suggest $120–130 billion by 2025.

- The global gamer population reached 3.42 billion in 2024, growing 4.5% year-on-year, driven in part by cross-platform access.

- U.S. consumer spending hit $58.7 billion in 2024, largely fueled by mobile game purchases.

- In 2023, overall industry revenues grew 7.4%, led by consoles but buoyed by multi-platform availability.

- Microsoft’s Game Pass reached 34 million subscribers by early 2024, highlighting streaming and cross-platform content as growth drivers.

- Global game market forecasts were adjusted to $187.7 billion (2024) due to weaker console sales, but resilience remained thanks to strong PC and mobile results.

- PC and console software revenue is expected to hit $85.2 billion in 2025, reinforcing sturdy middle migration between platforms.

What Is Cross‑Platform Gaming?

- Cross‑platform gaming enables players to switch between devices like mobile, PC, and console while maintaining access to progress and multiplayer.

- It typically includes cross‑play (gaming together across systems) and shared accounts or progression across platforms.

- In the U.S., 70% of players game on smartphones, with significant cross-over to consoles (50%) and PCs (40%), evidence of multi-platform engagement.

- 42% of mobile gamers also play on PC or laptops; 55% also play on consoles, reinforcing the demand for cross-platform experiences.

- As mobile dominates revenue, cross‑platform strategies help keep players within an ecosystem when shifting devices.

- Subscription-based services like Xbox Game Pass, available on both PC and console, facilitate smoother cross-platform access.

- Cross‑platform play retains users longer, which can enhance monetization and engagement, but exact retention metrics vary by title.

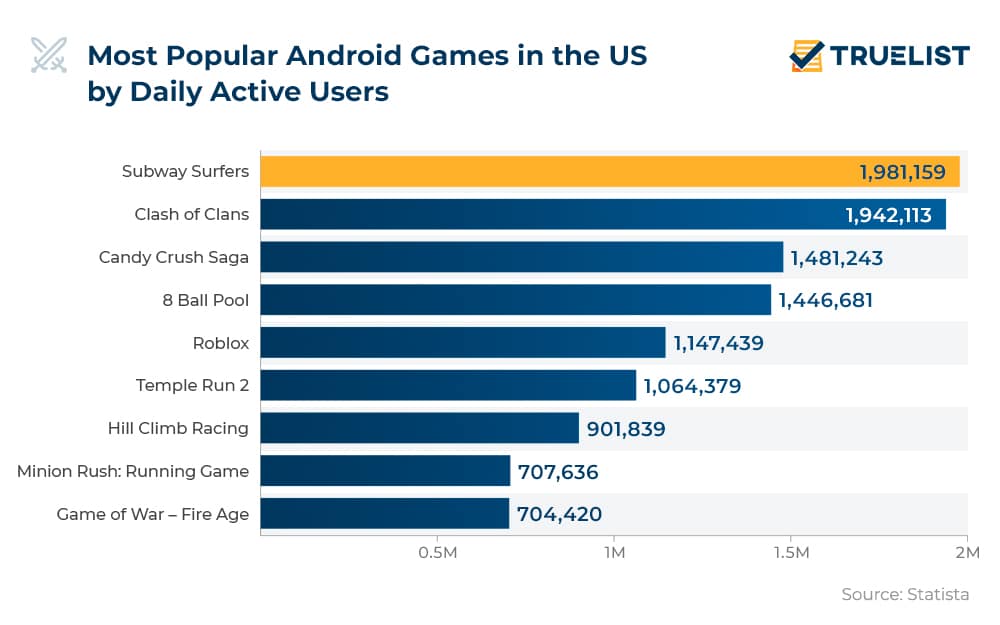

Most Popular Android Games in the US

- Subway Surfers leads with 1,981,159 daily active users.

- Clash of Clans follows closely with 1,942,113 daily active users.

- Candy Crush Saga draws 1,481,243 daily players.

- 8 Ball Pool has a strong user base of 1,446,681.

- Roblox records 1,147,439 daily active users on Android.

- Temple Run 2 sees 1,064,379 daily players.

- Hill Climb Racing maintains 901,839 daily users.

- Minion Rush: Running Game engages 707,636 daily players.

- Game of War – Fire Age rounds out the list with 704,420 daily users.

History of Cross‑Platform Gaming

- Early cross‑platform attempts focused on PC‑to-console ports or LAN-style play, with little true interoperability.

- The rise of Steam Deck and handheld PCs blurred lines, making PC gaming as accessible as consoles by 2025.

- Valve’s original Steam Machine project (mid‑2010s) laid the conceptual groundwork, and today, the Steam Deck exemplifies console‑like PC gaming.

- With PC releases now launched alongside or soon after console versions, development and availability improved, boosting cross‑platform potential.

- Console exclusives migrating to PC widened the player base and established a template for multi‑platform strategy.

- Services like Game Pass and xCloud provide advanced cross‑platform access through cloud streaming.

- By 2025, the expectation of gaming portability, anytime, became mainstream in industry design philosophy.

Growth of Cross‑Platform Gaming

- 79% of gamers use mobile, with 42% also on PC and 55% also on console, showing multi-platform usage is widespread.

- In the U.S., 70% game on smartphones, ~50% on consoles, and ~40% on PC, indicating strong cross-platform participation.

- Global mobile game revenue points to a strong foundation, $120–130 billion expected by 2025.

- Cross‑platform strategies help retain players as they switch devices, a quieter but powerful growth driver.

- Subscriptions like Game Pass foster cross‑platform loyalty, with 34 million subscribers by 2024.

- With the gaming population rising to 3.42 billion in 2024, cross‑platform capability helps meet diverse access points.

- Console and PC software combined are projected to bring in $85.2 billion in 2025, underlining steady foundational spending.

Cross‑Platform Gaming Adoption Rates

- Approximately 72% of global gamers play on two or more platforms, highlighting widespread multi‑device use.

- Among mobile gamers, 55% also play on consoles, and 42% also play on PC, confirming strong cross‑platform overlap.

- In the U.S., 82% of players aged 8+ game on mobile, followed by 47% on consoles and 45% on PCs, showing a broad device spread.

- A striking one in four PC/console gamers play across PC, console, and mobile, indicating tri‑platform engagement.

- Multi‑platform players invest significantly more time and money in gaming than single‑platform users.

- In the U.S., 60% of adults play video games weekly, regardless of device, with an average starting age of 18 years prior.

- Among U.S. gamers, 47% are women and 52% are men, showing near gender balance in cross‑platform adoption.

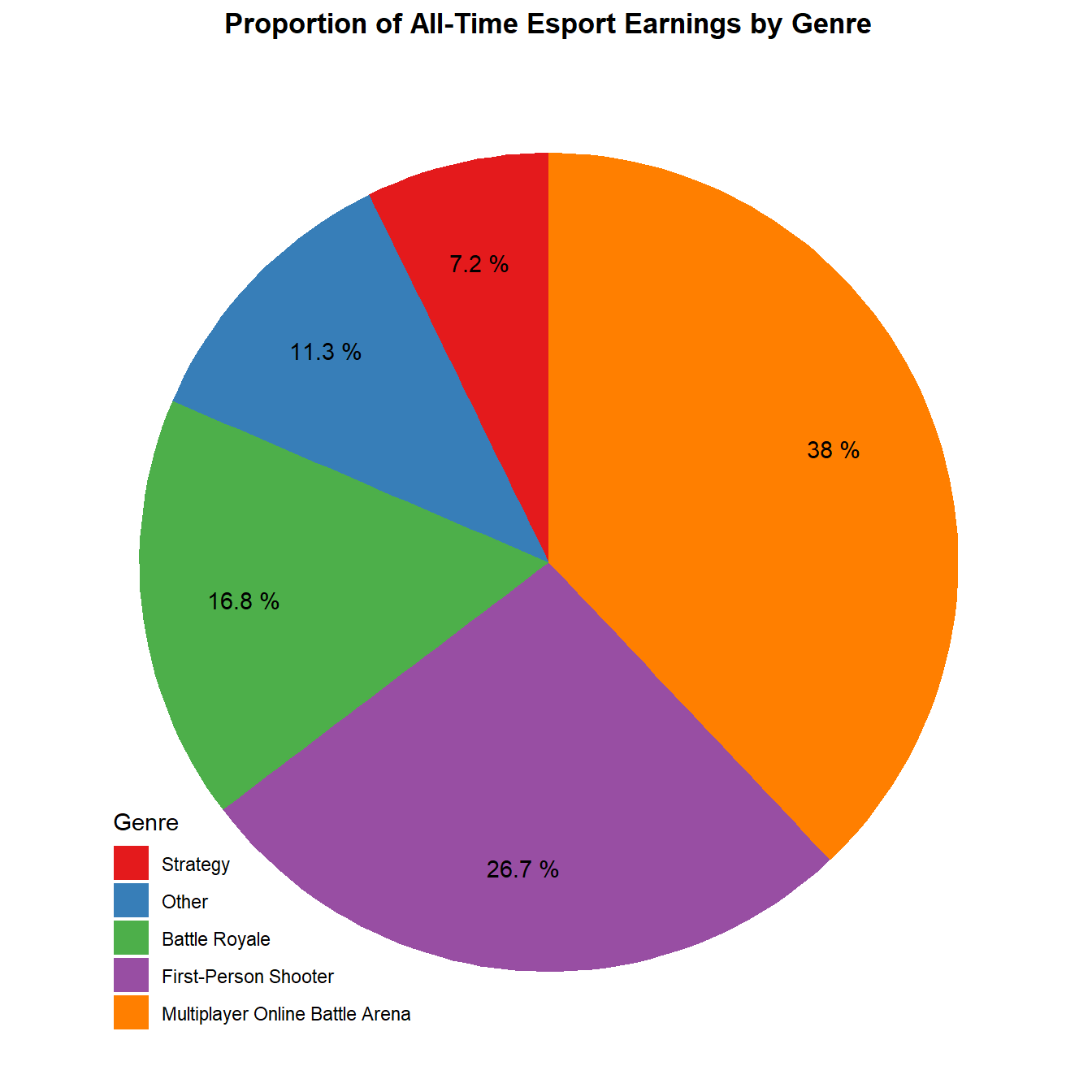

All-Time Esport Earnings by Game Genre

- Multiplayer Online Battle Arena (MOBA) dominates with 38% of all-time esports earnings.

- First-person shooter (FPS) games account for 26.7% of total earnings.

- Battle Royale titles contribute 16.8% to cumulative esports prize pools.

- Other genres collectively represent 11.3% of earnings.

- Strategy games make up the remaining 7.2% of esports earnings.

Global Market Size & Revenue

- The global games market will reach $211.2 billion by 2025, while other sources like Statista project as high as $345.34 billion, depending on the scope and market inclusions.

- Another estimate pegs the industry at $345.34 billion in 2025, with a 13% CAGR through 2029.

- The global game publishing market is expected to rise from $117.4 billion in 2025 to $150.5 billion by 2030.

- In early 2025, some analysts noted a short-term market contraction, with console and PC segments declining due to saturation and hardware cycles, while mobile continued modest growth.

- In that quarter, PC revenue declined 10%, from $41.5B to $37.3B, while console revenue fell 15%, to $42.8B.

- By contrast, mobile revenue rose 6%, from $92.5B to $97.6B, reinforcing mobile’s resilience.

- Mobile gaming overall generates over $111 billion globally, accounting for more than half of total gaming revenue.

Player Demographics

- 3.32 billion active gamers worldwide as of mid‑2025, projected to grow to 3.5 billion by year-end.

- Nearly 205 million Americans aged 5–90 play video games regularly, about two‑thirds of the population.

- The average U.S. gamer is 36 years old, having played for roughly 18 years.

- Weekly gaming penetrates all generations, 83% of Generation Alpha, 60% of adults, over 50% of Gen X, and significant percentages among Boomers (49%) and the Silent Generation (36%).

- Gender split in the U.S. industry is nearly equal, 47% women, 52% men.

- Globally, about 45% of gamers are female, and 55% male, showing a growing gender balance.

- Gen Z gaming participation is forecasted to approach 75% by 2027, according to industry trends, particularly driven by mobile-first and cross-platform titles.

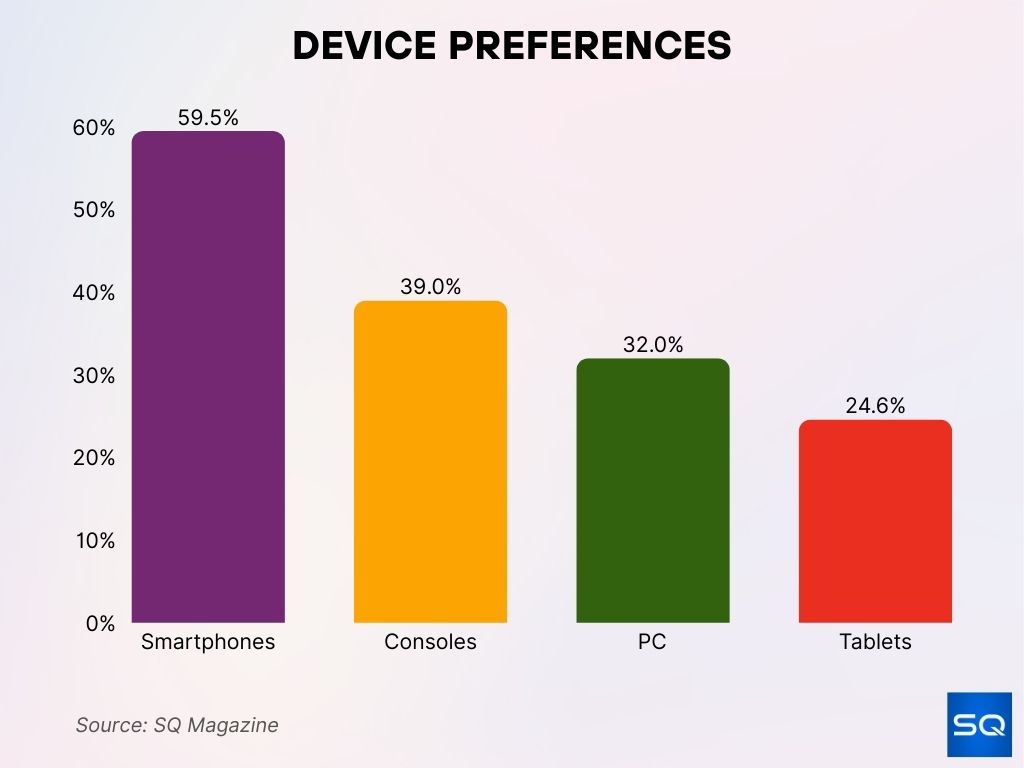

Device Preferences: PC vs Console vs Mobile

- Globally, 79% of gamers use mobile, 42% use PC, and 55% use consoles, with overlapping usage common.

- In the U.S., 72% of players use mobile, 54% use PCs, 42% use consoles, and 12% use VR devices.

- Among U.S. players aged 8+, 82% use mobile, 47% use consoles, 45% use PCs, and 10% use VR.

- Smartphones are the most popular device globally at 59.5%, followed by consoles at 39%, laptops/desktops at 32%, and tablets at 24.6%.

- Console revenue is growing faster (+7% CAGR 2024–2027) than PC (+2.6%).

- Among Gen Alpha and Gen Z gamers, 58% use consoles, and 54% use PCs, highlighting dual platform engagement among younger players.

- Console players generate higher revenue per paying user, $81.68 vs. $55.47 on PC.

Gender‑Based Platform Preferences

- U.S. gender share in gaming is nearly equal, 47% women, 52% men.

- Globally, 45% of gamers are women, a figure gradually rising toward parity.

- Among older Boomers, 52% of women play, compared to 46% of men, showing a generational shift.

- Female gamers often prefer puzzle, social, and casual genres, while male players lean toward competitive or action experiences.

- Board game insights note that designers remain male-dominated (22% women), and 73% of characters are male, a gap likely mirrored in video games.

- Cross‑platform play is especially important to young male gamers; 69% of U.S. males aged 18–24 value it.

- In the U.K., 62% of 18–24-year-old men say cross‑platform play matters, reinforcing its appeal in younger male audiences.

Age‑Based Platform Preferences

- Generation Alpha (5–12), 83% play weekly, often leaning toward mobile and casual.

- Adults (18+), 60% play weekly, average age remains 36 years.

- Gen X, over half play weekly, Boomers at 49%, Silent Generation at 36%; gaming spans ages.

- Mobile use is consistent across ages, but younger players favor console and PC more than older groups.

- In the U.S., 45% of players aged 8+ use PC, 47% use consoles, and 82% use mobile.

- Younger gamers (Gen Z) are increasingly cross‑platform, with consoles (58%) and PC (54%) both attracting this group.

- Mobile remains dominant across age bands, while PCs and consoles gain traction with older youth and adults.

- Anticipated growth shows 75% of Gen Z engaging in digital gaming by 2027.

Engagement & Usage Statistics

- The average gamer spends 8.6 hours per week playing games in 2025, up from 8.2 hours in 2024.

- Millennials and Gen Z gamers are the most engaged, averaging 10.3 hours per week, particularly in multiplayer and cross-platform titles.

- Mobile gamers show shorter but more frequent sessions, averaging 2.5 sessions per day and 22 minutes per session.

- Players on cross-platform games are 31% more likely to return daily compared to single-platform users.

- In the U.S., 60% of gamers play at least once per day, with 33% gaming multiple times daily.

- Games that offer cross-progression and cloud saves see 45% higher engagement retention within the first 30 days post-install.

- Titles like Fortnite and Roblox maintain session durations above 40 minutes, indicating deep engagement among cross-device players.

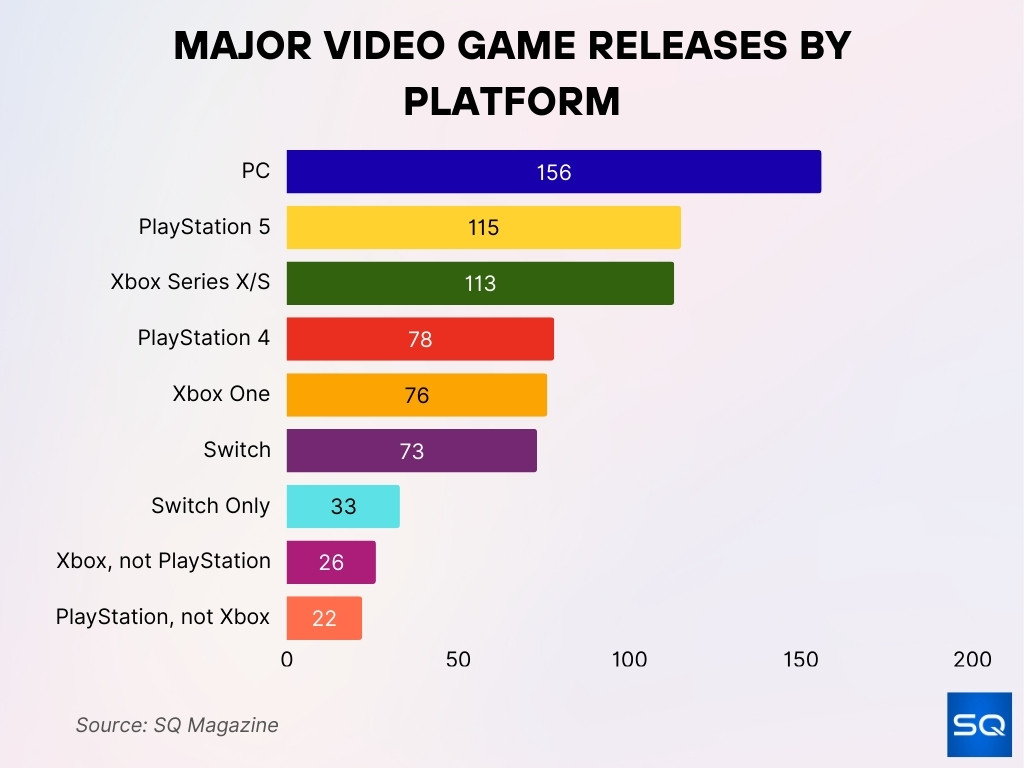

Major Video Game Releases by Platform

- PC leads all platforms with 156 major video game releases, showcasing its dominance in cross-platform and indie game development.

- PlayStation 5 follows with 115 titles, reflecting strong support from both AAA and exclusive developers.

- Xbox Series X/S has seen 113 major releases, nearly matching PS5 in next-gen game availability.

- PlayStation 4 continues to receive attention with 78 releases, highlighting ongoing support for previous-gen hardware.

- Xbox One holds steady with 76 releases, just slightly behind its PlayStation 4 counterpart.

- Nintendo Switch accounts for 73 major releases, balancing portability with mainstream appeal.

- Switch Only titles total 33, underscoring the platform’s unique library of exclusives.

- Xbox-exclusive (not PlayStation) games number 26, showing a smaller but focused set of titles.

- PlayStation-exclusive (not Xbox) games reach 22, emphasizing Sony’s continued strategy around platform-specific content.

Popular Cross‑Platform Games

- As of mid‑2025, major titles like Marvel Rivals, Fortnite, and Call of Duty: Black Ops 7 support cross‑platform play, enhancing shared gameplay across devices.

- Fan favorites such as Split Fiction, Rocket League, Diablo 4, Destiny 2, and Minecraft Bedrock Edition now offer extensive crossplay across PC, consoles, and Switch.

- Helldivers 2 expanded to Xbox on August 26, 2025, introducing crossplay with PlayStation and PC for a unified player experience.

- Among Us maintains over 17 million active players even during slower months, proving long-term cross-platform appeal.

- MMOs like Final Fantasy XIV, World of Warcraft, and Lost Ark continue thriving in 2025, with player bases ranging from ~1.2 million daily users to ~20 million accounts globally.

- Roblox boasts 129.7 million monthly active users and 76 million daily users, with average session lengths of over 28 minutes across platforms.

- Candy Crush Saga, with 87.9 million monthly and 53.8 million daily users, remains a top puzzle cross‑platform hit.

Monetization in Cross‑Platform Gaming

- In‑game purchases make up 76% of all online gaming revenue globally in 2025.

- Free-to-play models contribute $92 billion, accounting for over 40% of total gaming revenue.

- Digital in‑game spending is projected at $171.6 billion in 2025, dominating the monetization landscape.

- In the U.S., mobile game revenues hit $34.7 billion, up 7.6% YoY.

- Studies suggest that adding cross-platform support can increase game revenue by 20–40%, particularly for titles with strong multiplayer or social features.

- Roblox’s “Rewarded Video Ads” rollout could add between $150 million and $1.2 billion to its ad revenue by 2026, according to projections from analysts based on monetization tests and user base growth.

- Globally, mobile gaming revenue is forecasted at $206 billion in 2025, with Asia‑Pacific driving over 50% of that total.

Technical Challenges and Solutions

- Latency remains a major cross‑platform hurdle, especially in cloud gaming. Solutions like edge computing and infrastructure upgrades are key to improvement.

- Cross-play heightens security risks, from data breaches to cheating, widening the attack surface across devices.

- Balancing gameplay fairness across different input methods (mouse, controller, touch) demands careful design and continuous testing.

- Not all games adapt well to cross-platform; titles heavy on platform-specific controls or demanding graphics may suffer performance setbacks.

- Developers report 87% of multiplayer gamers want more cross‑platform titles, while 43% actively seek them, a sign of growing player expectations.

- Market data shows 67% of developers are shifting toward cross‑platform development.

- Use of AI (61%) and cloud tools (72%) in game design and development is rising, supporting smoother multi-platform workflows.

Cross‑Platform Game Development Tools

- The global game development tools market is estimated at $0.45 billion in 2024, growing to $1.21 billion by 2033, CAGR ~11.6%.

- Platform’s market value is projected at $362.2 million in 2025, continuing to grow at 11.6% annually through 2033.

- Unity leads cross‑platform development, especially among mobile and indie developers.

- Unreal Engine 5, with Nanite and Lumen, remains dominant for AAA cross‑platform titles.

- No-code engines like GameMaker and BuildBox are empowering rapid cross-platform prototyping.

- Cross‑platform game creation simplifies development by enabling a single codebase to run across Windows, PS, Xbox, macOS, Android, and iOS.

- This approach balances performance, accessibility, and cost, especially relevant with rising mobile demand.

Esports and Cross‑Platform Play

- The global esports market is valued at $649.4 million in 2025, expected to grow to $2.07 billion by 2032, CAGR of 18%.

- Esports marketing revenue is projected to surpass $1 billion in 2025.

- Cross-play titles are increasingly featured in competitive esports, boosting tournament inclusivity and audience engagement.

- Industry trends show more cross-platform tools and cloud casting elevating esports reach.

- The U.S. alone has over 3,000 esports players active in various competitions.

- Cross-platform titles like Fortnite and Call of Duty enhance audience reach and team matchups across regions and devices.

- Esports brands and sponsors benefit from unified cross-platform viewership, driving deeper ad integration and fan loyalty.

Streaming & Viewer Statistics

- Twitch hit 1.71 billion visits per month by September 2024, with 2.5 million concurrent viewers, and more than 1.3 trillion minutes watched annually.

- Daily, Twitch users stream over 71 million hours, with 31 million daily active users.

- YouTube dominates globally with 52% of live-streaming users, followed by Facebook at 42.6%.

- Twitch amassed 3.3 billion hours watched in Q1 2024 alone.

- Game streaming service markets are worth $9.8 billion in 2023 and projected to reach $21.2 billion by 2030, CAGR 11.8%.

- Live streaming service market growth is even more aggressive, forecast to expand from $13.5 billion in 2024 to $86.5 billion by 2034, CAGR ~20.4%.

- Viewership of game content, through platforms like Twitch and YouTube, drives cross-platform fandom and monetization opportunities.

Conclusion

In 2025, cross‑platform gaming is far more than a feature; it’s the industry standard. From powerful title lineups and smarter monetization to innovative development tools and expanding esports and streaming ecosystems, the shift is unmistakable. Gamers expect flexibility. Developers seize broader audiences. Markets command stronger revenues. As cross‑platform continues to unfold, the future promises smoother experiences, wider reach, and deeper player engagement. Explore the data, feel the momentum, and see how gaming’s platform walls continue to fall.