The crypto exchange Coinbase remains one of the most influential platforms shaping how individuals and institutions enter the cryptocurrency market. Coinbase reaches millions of active users and handles hundreds of billions in assets, reflecting how crypto has moved closer to mainstream finance. Its services power everything from casual crypto investing to institutional‑grade custody, highlighting deep real‑world impact across retail, corporate, and institutional investors. Dive in to explore the latest data that defines Coinbase’s user base and growth trajectory.

Editor’s Choice

- Coinbase counted around 120 million total monthly users in 2025.

- As of Q2 2025, Coinbase reports 8.7 million monthly transacting users (users with at least one trade or transaction over a 28‑day period).

- By the end of 2024, Coinbase had ~108 million verified users, based on its last disclosure of that metric.

- The platform’s self‑custody wallet, Coinbase Wallet, reached 3.2 million monthly active users in 2025.

- Coinbase held about $404 billion in assets under custody (AUC) by the end of 2024.

- The latest reported quarterly trading volume on Coinbase stood at ~$237 billion.

- Coinbase now captures a significant portion of crypto holdings, reportedly controlling over 12% of Bitcoin and ~11% of staked Ether.

Recent Developments

- Coinbase’s total monthly users rose from 96 million in 2024 to 120 million in 2025, implying a roughly 25% growth year‑on‑year.

- The company is shifting its business model; in 2025, about 41% of revenue is expected to come from subscriptions and services instead of trading fees.

- Despite market ups and downs, Coinbase’s trading‑fee revenue is still forecast to hit $4.2 billion in 2025, albeit with slower growth.

- Revenues from stable‑coin yield, staking, custody, and services are rising, with stablecoin‑related revenue alone predicted to reach $1.4 billion in 2025.

- Coinbase expanded beyond retail. In 2025, the firm acquired a derivatives exchange, signaling growth in institutional and derivatives trading services.

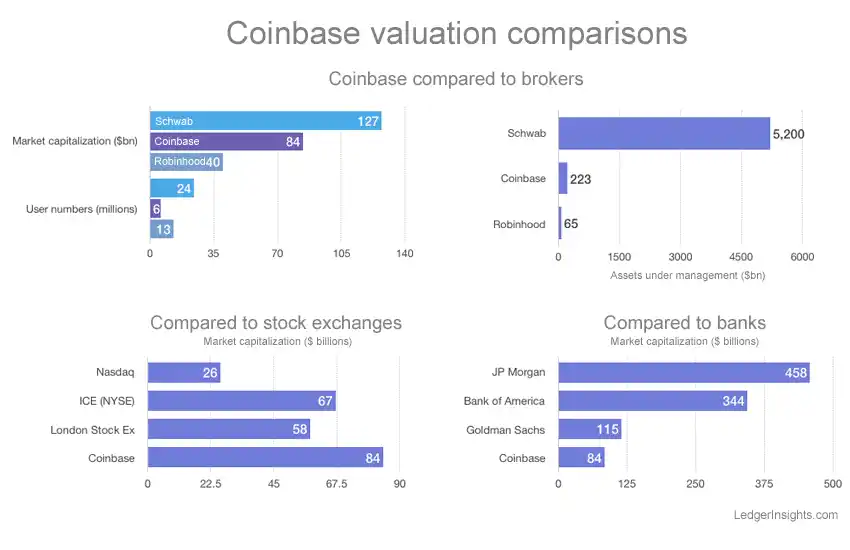

Coinbase Valuation Comparisons

- Schwab market cap: $127 billion vs Coinbase $84 billion and Robinhood $24 billion.

- User count: Coinbase has 13 million, Schwab 6 million, and Robinhood 40 million.

- Assets under management: Schwab $5.2 trillion, Coinbase $223 billion, Robinhood $65 billion.

- Against stock exchanges: Coinbase $84 billion > Nasdaq $26 billion, London Stock Exchange $58 billion, ICE (NYSE) $67 billion.

- Compared with banks: JP Morgan $458 billion, Bank of America $344 billion, Goldman Sachs $115 billion, Coinbase $84 billion.

Verified Users

- At the end of 2024, Coinbase last reported having ~108 million verified users.

- Historically, Coinbase’s verified user count climbed from 23 million in Q1 2018 to 110 million by Q4 2022.

- That jump from 89 million in Q4 2021 to 110 million in Q4 2022 represented a gain of roughly 21 million users in a year.

- Post‑2022, Coinbase stopped publicly updating “verified users,” contributing to uncertainty, but outside sources now estimate the number to be around 120 million in 2025.

- The gap between “verified users” and “monthly transacting users” remains wide, 120 M total vs. 8.7 M active transactors in Q2 2025.

Coinbase Wallet Users

- Coinbase Wallet reports 3.2 million monthly active users in 2025.

- This equals 2.7% of Coinbase’s total 120 million monthly users in 2025.

- 8.7 million monthly transacting users across Coinbase platforms in Q2 2025.

- The wallet user base grew alongside 20% total Coinbase user increase from 2024 to 2025.

- Coinbase custodies over 12% of all circulating Bitcoin in 2025.

- Platform assets under custody reached $404 billion by the end of 2024.

- Quarterly trading volume hit $237 billion in the latest 2025 report.

- The total Coinbase verified users is estimated at 120 million in 2025.

- Coinbase supports over 270 cryptocurrencies as of mid-2025.

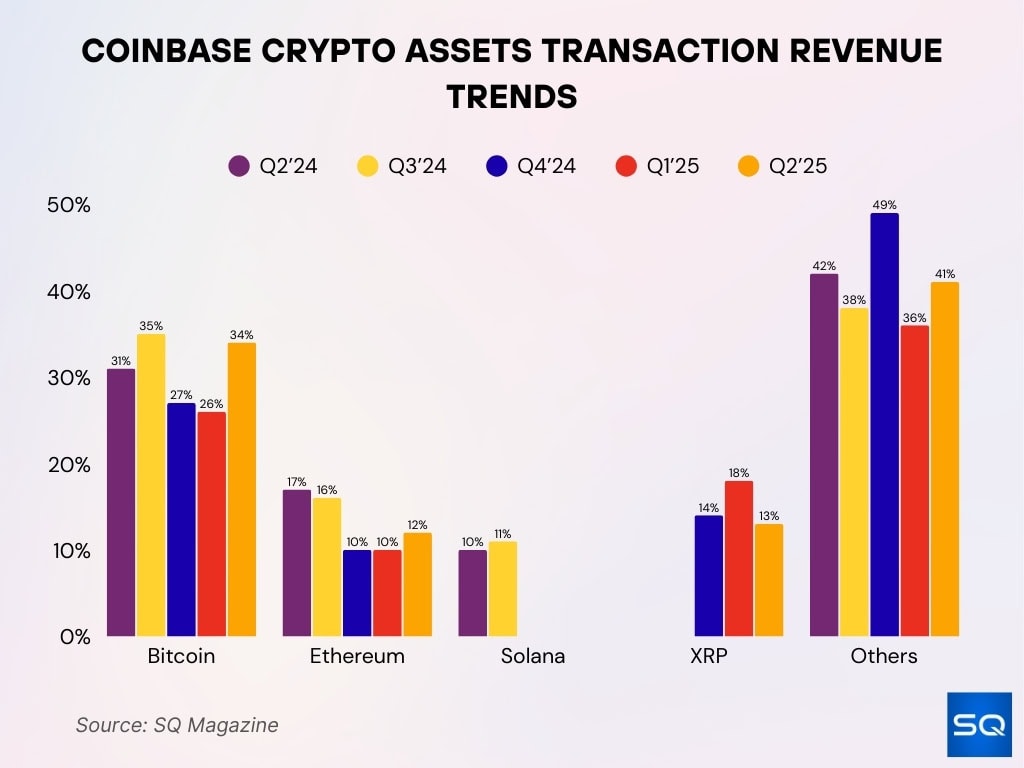

Coinbase Crypto Assets Transaction Revenue Trends

- Bitcoin revenue share was 31% in Q2’24, peaked at 35% in Q3’24, dipped to 27% in Q4’24 and 26% in Q1’25, then rebounded to 34% in Q2’25.

- Ethereum held 17% in Q2’24, 16% in Q3’24, dropped to 10% in Q4’24 and Q1’25, with a slight recovery to 12% in Q2’25.

- Solana contributed 10% in Q2’24 and 11% in Q3’24, but had a negligible share in Q4’24 through Q2’25.

- XRP entered in Q4’24 at 14%, climbed to 18% in Q1’25, then declined to 13% in Q2’25.

- Other assets held a dominant 42% in Q2’24, eased to 38% in Q3’24, surged to 49% in Q4’24, dropped to 36% in Q1’25, and recovered to 41% in Q2’25.

Coinbase One Subscribers

- As of mid‑2025, Coinbase reported about 1 million subscribers under its premium plan, Coinbase One.

- By late 2024, Coinbase One had already surpassed 600,000 members across 42 countries.

- In Q2 2025, Coinbase introduced a lower‑tier plan priced at $4.99/month, making subscription access more affordable for a broader set of users.

- Coinbase One subscribers gain benefits, including zero trading fees, staking‑reward boosts, and account protection.

- The subscription model is now a critical revenue pillar. In 2025, subscriptions and services (including Coinbase One, staking, custody, stablecoin yield) are forecast to account for ~41 % of Coinbase’s total revenue.

- Stablecoin and staking revenue within that segment are projected to grow strongly, with stablecoin‑related revenue reaching $1.4 billion, and staking rewards contributing $723 million in 2025.

Geographic Distribution

- Coinbase operates in over 100 countries worldwide in 2025.

- Strongest user presence in the U.S., Canada, and Western Europe in 2025.

- Received formal requests from entities in over 60 countries per the 2025 reports.

- Expansion is underway in Latin America and the Asia-Pacific regions in 2025.

- 1 million Coinbase One subscribers spread across dozens of nations in 2025.

- Assets under management reached $425 billion on the platform as of Q2 2025.

- U.S. accounts for the largest user share at approximately 68.6% in 2025.

- United Kingdom represents 4.65% of Coinbase traffic in 2025.

- The platform serves 120 million users globally across 100+ countries in 2025.

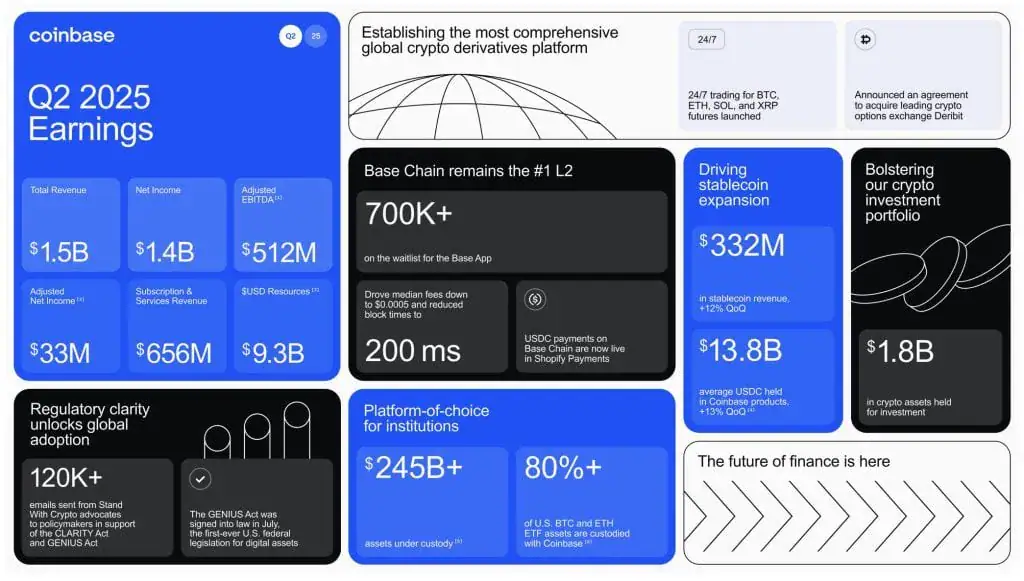

Coinbase Earnings and Key Highlights

- $1.5 billion total revenue reported in Q2 2025.

- $1.4 billion net income recorded for the quarter.

- $512 million adjusted EBITDA delivered.

- $33 million adjusted net income achieved.

- $656 million subscription and services revenue generated.

- $9.3 billion USD resources held.

- 700,000 plus users on the waitlist for the Base App.

- Base Chain median fees dropped to $0.0005 with block times at 200 milliseconds.

- USDC payments on Base Chain are now integrated into Shopify Payments.

- $332 million stablecoin revenue, up 12 percent quarter over quarter.

- $13.8 billion average USDC holdings, a 13 percent quarter-over-quarter increase.

- $1.8 billion of crypto assets held for investment.

- $245 billion plus assets under custody for institutions.

- 80 percent plus of U.S. BTC and ETH ETF assets are custodied with Coinbase.

- 120,000 plus advocacy emails sent to policymakers via Stand With Crypto.

- The GENIUS Act, the first U.S. federal digital assets legislation, was signed into law in July 2025.

- Launched 24/7 trading for BTC, ETH, SOL, and XRP futures.

- Announced the acquisition of crypto options exchange Deribit.

User Demographics

- Global crypto users average of 34.6 years old in 2025.

- 66.69% of Coinbase visitors are male in 2025.

- The largest Coinbase age group was 25-34 years old in 2025.

- 68% of crypto owners are Gen Z or Millennials in 2025.

- 70% of wallet users aged 18–34 globally in 2025.

- 33.31% of the Coinbase audience is female in 2025.

- 67% of wallet holders have a college degree or higher in 2025.

- Many users earn over $50,000–$100,000 annually in 2025.

- 26.5% of U.S. Gen Z adults own cryptocurrency in 2025.

Gender Breakdown

- Coinbase users show a ~70% male and ~30% female split in 2025.

- Global crypto ownership reaches 61% male and 39% female in 2025.

- Women represent 26% of global crypto investors in 2025.

- Coinbase Wallet’s gender breakdown mirrors 70% male dominance in 2025.

- Crypto ownership among women rose 20% in Africa during 2025.

- Female crypto holders increased 16% year-over-year globally in 2025.

- 78% male vs 22% female persists in some regions during 2025.

- Women comprise less than 30% of the crypto workforce in 2025.

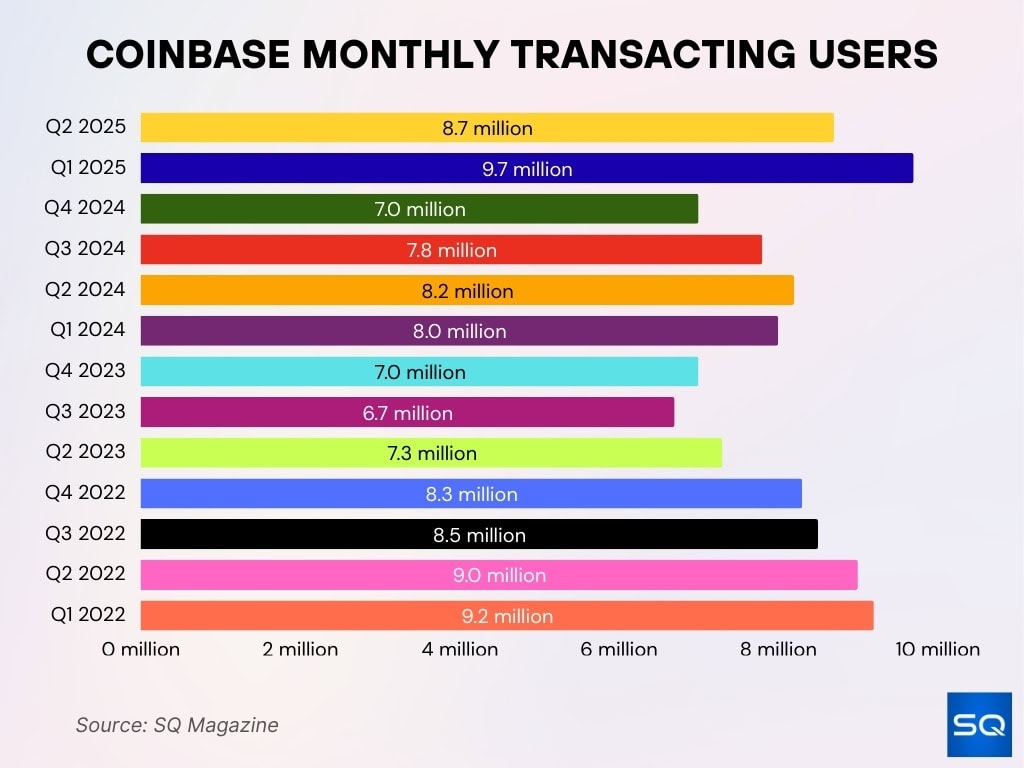

Monthly Transacting Users (MTUs)

- Q2 2025 recorded 8.7 million MTUs.

- Q1 2025 saw a higher 9.7 million MTUs.

- Q4 2024 dropped to 7.0 million MTUs.

- Q3 2024 had 7.8 million, Q2 2024 had 8.2 million, and Q1 2024 had 8.0 million MTUs.

- Historical: Q4 2023 had 7.0 million, Q3 2023 had 6.7 million, and Q2 2023 had 7.3 million MTUs.

- Earlier: Q4 2022 saw 8.3 million, Q3 2022 had 8.5 million, Q2 2022 hit 9.0 million, and Q1 2022 peaked at 9.2 million MTUs.

- MTUs declined from 9.2 million in early 2022 to 6.7 million in 2023, before recovering to mid-8 million levels by mid-2025.

- Shift from general active users to MTUs reflects a stronger emphasis on real platform engagement.

Platform Engagement

- In 2024, Coinbase recorded 10.8 million monthly active users (MAUs).

- That surge in activity suggests renewed user interest and re‑engagement.

- Coinbase supports over 270 cryptocurrencies on its exchange platform.

- The platform offers around 315 coins and 460 trading pairs.

- Usage extends to custody, staking, and asset management.

- Diversified offerings help attract users with different needs.

- Coinbase pushes toward an “all-in-one” platform where users trade, store, stake, and manage assets.

App Usage Statistics

- Coinbase supports over 315 coins and 460 trading pairs.

- Coinbase is accessible via both iOS and Android, with the mobile app contributing to high MAU numbers.

- In 2024, Coinbase saw more than 100 million mobile app downloads globally.

- Coinbase ranks in the top 50 finance apps on the App Store in the U.S. in 2025.

- Its app rating averages 4.7 out of 5 stars on Apple’s App Store and 4.3 stars on Google Play.

- With rising crypto adoption, mobile usage has become a key component of Coinbase’s user engagement.

- Mobile-first design and features like price alerts and biometric login continue to boost retention.

- The wallet app also contributes to total app ecosystem engagement.

Daily Active Users

- In Q2 2025, Coinbase records 8.7 million monthly transacting users (MTUs).

- That number follows a Q1 2025 peak of 9.7 million MTUs.

- Monthly active users represent a broader group, with 10.8 million MAUs in 2024.

- Many users engage with Coinbase beyond trading.

- Despite volatility, MTU figures show stable core user engagement.

- Institutional trading volume of $236 billion suggests significant engagement.

- Coinbase’s services beyond trading contribute to deepening platform usage.

Supported Countries

- Coinbase operates in over 100 countries worldwide in 2025.

- Received 12,716 government requests from over 60 countries in 2025.

- U.S., Germany, the UK, France, Spain, and Australia account for 80% of requests in 2025.

- 53% of legal requests originated internationally in 2025.

- 115+ countries supported with services in five languages in 2025.

- Staking and USDC will be available in over 110 countries in 2025.

- 245,000 ecosystem partners utilize Coinbase services globally in 2025.

- Expansion includes Latin America and Asia-Pacific markets in 2025.

- Coinbase Earn will be accessible in 100+ countries throughout 2025.

Market Share

- Coinbase holds 60–65% of U.S. crypto exchange trading volume.

- Globally, Coinbase accounts for 6.9% of exchange volume.

- Q2 2025 trading volume reached $312 billion.

- Institutional trading volume made up $236 billion of that.

- Coinbase’s regulatory focus supports a higher market share in developed regions.

- Subscription and custody revenue diversify its model beyond trading.

- Coinbase remains among the top five global exchanges by trading volume.

Retail vs Institutional Users

- Institutional trading volume was $194 billion in Q2 2025.

- Retail transaction revenue was $650 million in the same quarter.

- Institutional revenue from transactions was $61 million.

- Retail activity remains strong despite quarter-over-quarter variation.

- Institutional custody continues to grow as a trusted service.

- Retail users benefit from Coinbase’s user-friendly tools and mobile apps.

- The balance between both groups helps Coinbase remain versatile.

Trading Volume Statistics

- Coinbase’s annual transaction volume in 2024 was $1,162 billion.

- Q2 2025 trading volume was $312 billion.

- Institutional trading volume was $194 billion in that quarter.

- Retail transaction revenue stood at $650 million.

- Bitcoin accounted for 34% of Q2 2025 trading volume.

- Ethereum held a 12% share of volume.

- 315 coins and 460 pairs are supported for trading.

- Coinbase continues to dominate among regulated platforms.

Frequently Asked Questions (FAQs)

Coinbase reports about 120 million total monthly users in 2025.

As of Q2 2025, Coinbase has 8.7 million monthly transacting users (MTUs).

In 2025, approximately 41% of Coinbase’s total revenue is forecast to come from subscriptions and services.

The latest reported quarterly trading volume for Coinbase is about $237 billion.

Conclusion

Coinbase remains a leading force in the cryptocurrency world, with millions of active users, hundreds of billions in trading volume, and a global reach spanning over 100 countries. Its platform continues to serve a diverse mix of retail traders, institutional clients, and custody or asset-holding users. Despite market fluctuations, Coinbase’s broad asset support, strong market share, and evolving service mix give it resilience and versatility. As the crypto landscape evolves, Coinbase’s data‑backed footing suggests it will remain a cornerstone exchange, likely continuing to shape how users everywhere access digital assets.