Cardano (ADA) continues to evolve as a proof‑of‑stake blockchain and smart contract platform with growing adoption and real‑world utility. Across markets, developers and institutional participants monitor metrics like address growth, staking rates, and transaction throughput to assess Cardano’s maturity. From wallet expansion to staking engagement, these core statistics influence how investors and builders weigh Cardano against rival Layer‑1 networks. Dive into the latest figures shaping ADA’s current landscape.

Editor’s Choice

- ~4.83M unique Cardano wallets exist on the network as of mid‑2025.

- Cardano’s market cap was around $20 billion+ in late 2025.

- Daily active addresses up ~110,000, a major user‑engagement uptick.

- Staking rewards are distributed every epoch (~5 days), creating predictable participation cycles.

- Staking addresses exceeded ~1.3M, signalling sustained participant support.

- Grayscale’s institutional attention and ETF filings boosted on‑chain validation discussions.

Recent Developments

- Cardano expanded wallet count to about 4.8M+ unique addresses in 2025.

- Partnerships like Cardano Card with Wirex opened ADA spending for 6M users globally.

- Daily active addresses surged to ~110,000, up significantly versus last year.

- Q3 2025 analysis showed ~15.7% QoQ transaction growth and a major active address surge.

- Reports indicate a large ADA whale accumulation, increasing network confidence.

- Recent upgrades like Hydra for scalability and governance pushes keep the momentum for future releases.

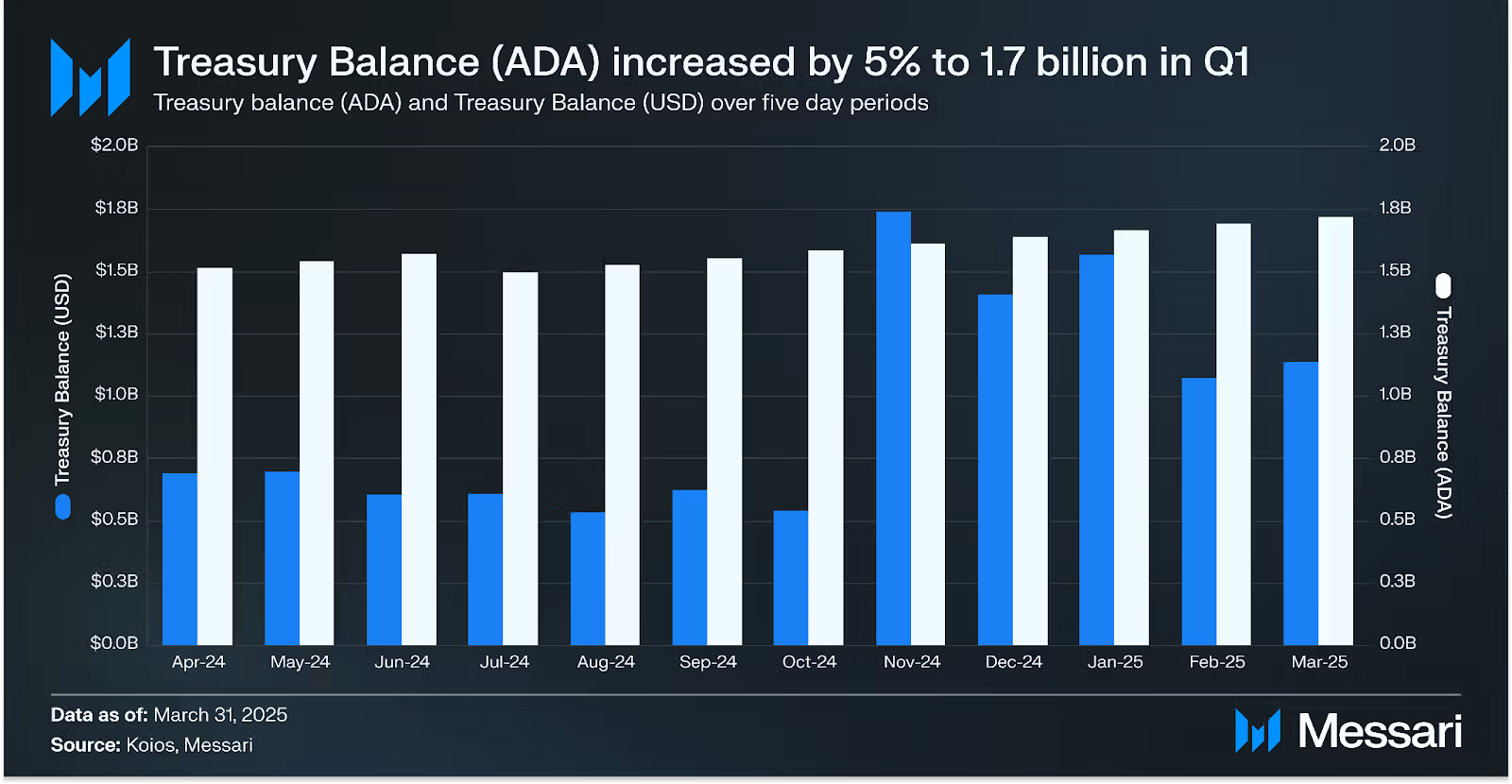

Cardano Treasury Balance Highlights

- Cardano’s treasury reached $1.7 billion, marking a 5% Q1 increase and signaling continued balance growth.

- USD treasury holdings rose steadily from $0.7 billion in April 2024 to nearly $1.3B by March 2025, showing consistent accumulation.

- ADA treasury reserves remained elevated at roughly 1.8 billion ADA at the end of Q1 2025, reflecting stable token holdings.

- November 2024 recorded a peak above $1.8 billion, the highest treasury level over the past 12 months.

ADA Price and Market Performance

- Some price models forecast $0.50–$1.50 range for 2025, reflecting macro and adoption pressures.

- Changelly analysis anticipates ~$0.85 average ADA price in 2025 scenarios.

- Conservative forecasts suggest resistance near $1.00–$1.50 if adoption accelerates.

- Year‑to‑year price movement remains sensitive to broader crypto trends and liquidity.

- Despite volatility, ADA trades actively with notable daily volume increases of around $630 million+ currently.

- Price traction is sometimes tied to whale accumulation and market sentiment shifts.

Market Capitalization and Rankings

- Cardano’s market cap stands near ~$20.6 billion, ranking among the top Layer‑1 tokens.

- Market cap fluctuations reflect both price and network activity.

- Quarterly cap changes sometimes lag behind leading competitors when markets slow.

- Growth toward a broader global adoption index could nudge the ranking upward.

- Despite periodic corrections, Cardano sustains essential liquidity relative to peers.

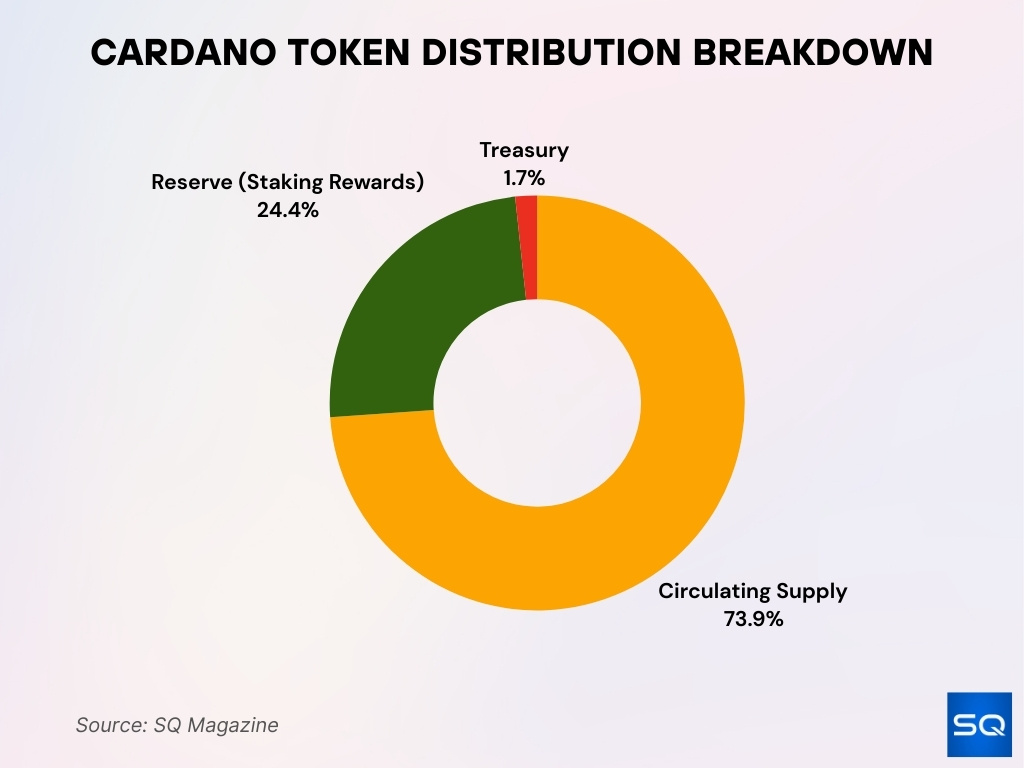

Cardano Token Distribution Overview

- Circulating supply dominates at 73.9%, indicating that most ADA tokens are already in active market use.

- Staking rewards account for 24.4% of the total supply, reinforcing long-term participation in Cardano’s proof-of-stake network.

- Treasury holdings remain limited at just 1.7%, supporting decentralization with minimal central reserves.

Cardano Wallet and Address Statistics

- ~4.83 million unique ADA wallets active on the network mid‑2025.

- Approx. 1.3 million addresses used for staking, showing ecosystem depth.

- Daily active addresses jumped to about 110,000, signaling reengagement.

- Compared to previous years, wallet growth rose ~10–15% year‑over‑year.

- Address clustering studies show that address complexity affects network analysis.

- Wallet growth spans retail users, dApp participants, and institutional accounts alike.

- Continued wallet expansion reflects Cardano’s retention and onboarding trends.

Staking Participation and Delegation Stats

- Over 1.5M ADA wallets have withdrawn staking rewards, indicating active, long‑term participation by users.

- A large share of ADA holders delegate without running nodes, choosing to support the network via delegation.

- Delegation flexibility on Cardano allows users to re‑delegate ADA at any time without lock‑up periods.

- Average annual nominal staking rewards typically fall in a ~3–4% range, depending on epoch performance and stake pool conditions.

- Stake pool saturation mechanisms help maintain decentralization by balancing reward distribution.

- Both wallets and decentralized exchanges support easy staking delegation, broadening accessibility.

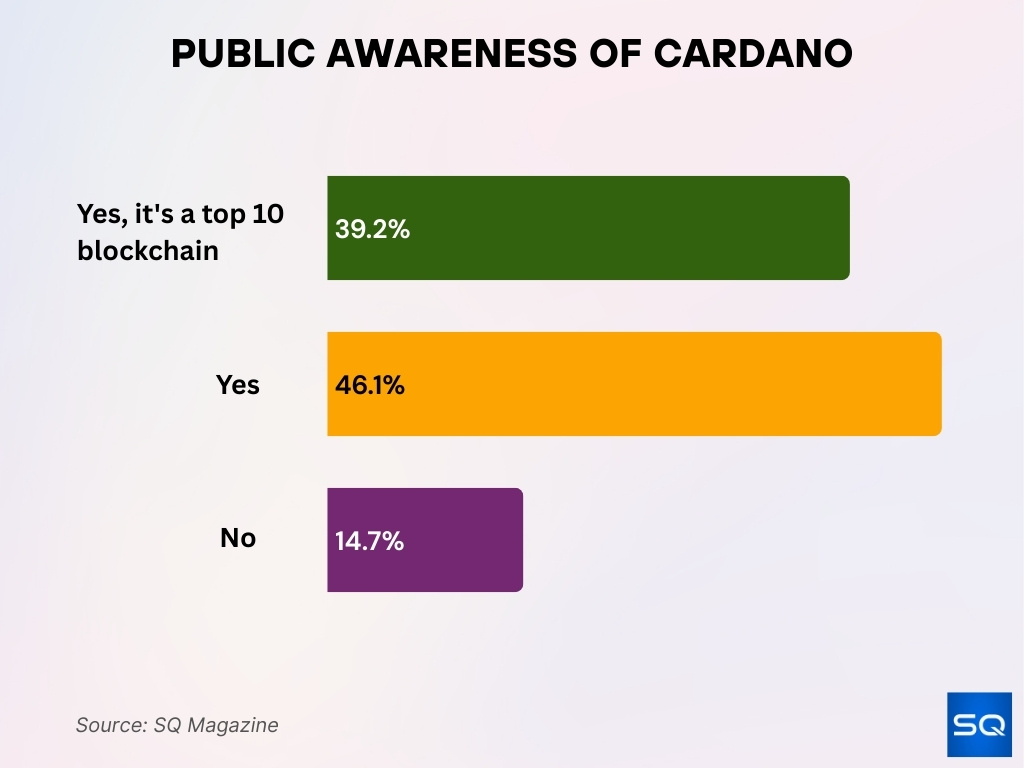

Public Awareness of Cardano Survey Results

- 46.1% answered “Yes”, showing general awareness of Cardano without detailed familiarity.

- 39.2% identified Cardano as a top 10 blockchain, reflecting stronger recognition of its market standing.

- 14.7% responded “No”, indicating a smaller segment remains unfamiliar with Cardano.

Validator and Stake Pool Statistics

- Cardano supports a wide network of stake pools globally, helping maintain decentralization and performance.

- Thousands of active stake pools contribute to block production and transaction validation across epochs.

- The top 10 staking pools control less than ~11% of total staked ADA, a sign of relatively balanced stake distribution.

- Pools operate under the Ouroboros PoS protocol, attracting delegators based on performance, fees, and rewards.

- Stake pool performance metrics (block production vs expected) influence effective returns to delegators.

- Both operator margin fees and fixed ADA costs per epoch affect pool desirability and reward yields.

- Cardano’s governance model (including SPOs and DReps) links stake pools to network decision‑making.

- Some academic analyses note moderate consensus power concentration, though decentralization remains a core design goal.

On‑Chain Transaction Volume and Throughput

- The Cardano chain processes ~2.6M transactions per day on average, reflecting active usage.

- Total transactions handled since early 2025 exceed 450M with high reliability.

- Cardano’s base layer processes ~0.41 real‑time TPS, with a max observed ~11.62 TPS and a theoretical cap ~18.02 TPS, while higher throughput relies on Hydra layer‑2 scaling.

- Layer‑2 solutions such as Hydra contribute to scaled microtransaction processing.

- Smart contract calls comprise over 35% of daily on‑chain transactions, showing growing dApp utilization.

- Thousands of native tokens trade on-chain, amplifying volume beyond ADA transfers.

- Daily token transfers often exceed 300,000 individual transactions across all assets.

- Interoperability protocols drive a noted percentage of cross‑chain tagged transactions in 2025.

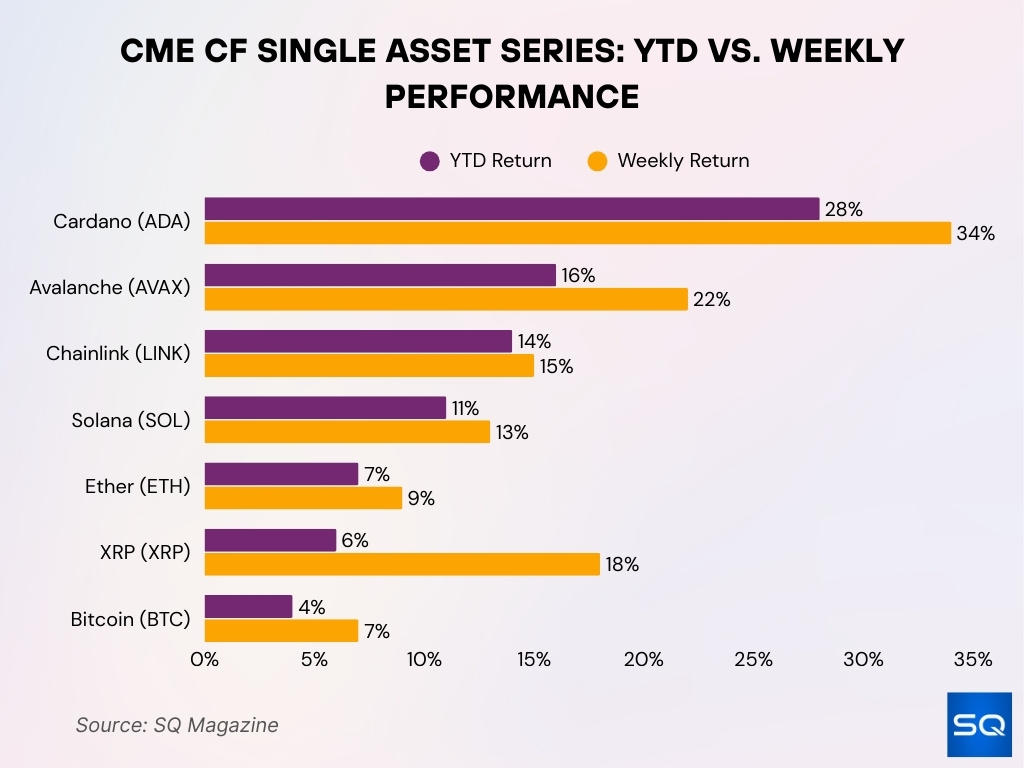

CME CF Single Asset Series Performance Snapshot

- Cardano (ADA) leads with 34% weekly and 28% YTD returns, highlighting strong short- and long-term momentum.

- Avalanche (AVAX) follows with 22% weekly and 16% YTD gains, pointing to a recent upswing in investor demand.

- Chainlink (LINK) posts 15% weekly and 14% YTD returns, reflecting balanced and steady growth.

- Solana (SOL) records 13% weekly and 11% YTD gains, maintaining consistent performance across periods.

- Ether (ETH) shows 9% weekly and 7% YTD returns, indicating moderate growth trends.

- XRP delivers an 18% weekly jump despite a 6% YTD return, signaling a short-term breakout.

- Bitcoin (BTC) trails with 7% weekly and 4% YTD returns, reflecting comparatively subdued price movement.

Transaction Fees and Cost Metrics

- Cardano’s average transaction fee is ~0.17 ADA (~$0.12).

- Network processes average 2.6 million transactions per day with low fees.

- On-chain fees show a 30% year-over-year increase.

- Smart contract calls comprise over 35% of daily transactions.

- Chain fees reached $4,131 in a 24-hour period.

- App fees generated $64,878 over 24 hours.

- Transaction fees follow the formula a × size(tx) + b.

- Fees are pooled and shared among all stake pool participants.

- Basic transfer fee set at $0.10.

Network Performance and Scalability Metrics

- The base layer currently sustains around 0.4–1.0 TPS in live conditions, with max recorded ~11.62 TPS and theoretical ~18.02 TPS, while Hydra is designed to scale throughput far beyond these limits.

- Real-time TPS averages 0.41 tx/s over 1-hour periods.

- Max TPS reaches 11.62 tx/s across 100 blocks.

- Theoretical maximum TPS stands at 18.02 tx/s.

- Average block time measures 17.75-20.1 seconds.

- Transaction finality achieves 20 seconds on average.

- Network uptime maintains 99.998% reliability.

- Hydra processes over 100,000 microtransactions per second.

- Daily transactions average 2.6 million.

- Input endorsers reduce latency by up to 30%.

Smart Contracts and Plutus Activity Statistics

- Cardano hosts over 17,000+ Plutus smart contracts deployed by mid‑2025, showing ecosystem growth.

- Monthly deployment of new contracts often averages 680+, reflecting developer momentum.

- Smart contract interactions now represent a significant portion of daily transactions, over 35%.

- Over 1.6M wallet addresses interacted with smart contracts in 2025.

- Financial protocols, identity systems, and NFT marketplaces dominate contract categories.

- Marlowe financial contracts saw a ~58% year‑over‑year rise in deployments.

- Key dApps like Minswap and Liqwid drive much of the usage retention.

- Ecosystem upgrades have reduced execution costs, benefiting contract developers.

Cardano DeFi Ecosystem Statistics

- Cardano’s total value locked (TVL) in DeFi reached around $423.5 million in Q3 2025, a ~28.7% increase quarter‑on‑quarter.

- Minswap retained the largest share of TVL (~26%) across Cardano DeFi protocols in mid‑2025.

- Cardano’s stablecoin market cap grew 6% QoQ to about $32 million, led by USDM and USDA growth.

- DeFi TVL on Cardano, while increasing YOY, can still fluctuate with market conditions relative to competitor chains.

- Lending protocol Liqwid Finance saw notable TVL increases, surpassing $100 million+ in some periods.

- DEX volume on Cardano averaged $3.6 million daily in Q2 2025, though down QoQ amid broader market shifts.

- Cardano’s DeFi ecosystem includes swaps, lending, derivatives, and cross‑asset mechanisms under continuous development.

- Swing in TVL and liquidity reflects evolving user preferences between active yield strategies and stable positions.

Cardano DEX and Liquidity Metrics

- DEX’s volume reaches $2.2 million in 24 hours.

- Total DeFi TVL grows 28.7% to $423.5 million.

- Minswap holds 74.7% of the DEX volume share.

- Daily DEX volume averages $3.8 million.

- DEX’s volume totals $35.71 million over 7 days.

- Minswap TVL stands at $47.61 million.

- App fees generate $8,091 in 24 hours.

- The stablecoins market cap measures $32.91 million.

- Perps volume hits $652,491 in 24 hours.

- DEX’s dominance versus CEX at 0.01%.

NFT and Digital Collectibles on Cardano

- Cardano’s NFT trading activity saw average NFT sale volumes rise approximately 561% QoQ in Q3 2025, reaching an average of about $262,450.

- The ecosystem supports thousands of NFT projects and collections, with more than 8,000+ NFT projects recorded by late 2025.

- Daily NFT volume contributes materially to on‑chain usage statistics relative to ADA transfers.

- Popular marketplaces like jpg.store remain central hubs for Cardano NFT trading activity.

- NFT categories range from art to utility‑linked collectibles, integrating DeFi and gaming elements.

- NFT trading increases correlate with broader ecosystem engagement metrics, including wallet activity.

- Expansion of minting tools and community collections continues driving creative and commercial interest.

- NFT liquidity remains a nascent but growing pillar of Cardano’s multi‑asset landscape.

dApp and Ecosystem Growth Metrics

- Hosts over 70 active dApps across multiple categories.

- Features over 1,300 active ecosystem projects.

- Records 672 active developers with 276 full-time.

- dApp usage peaks at 150,000 daily active users.

- Deploys 17,400 Plutus smart contracts with 39% growth.

- Averages 680 new smart contracts monthly.

- 1.6 million wallet addresses interact with smart contracts.

- Supports over 8,000 NFT projects.

- DeFi TVL reaches $680 million with 42% increase.

Developer Activity and GitHub Statistics

- Cardano developer surveys show 672 active developers engaged with ecosystem projects.

- Of those developers, ~276 work full‑time on Cardano‑related technical development.

- The top programming languages used by developers include TypeScript (15%), JavaScript (13%), and Python (10%).

- Over 75% of surveyed developers use Aiken to build smart contracts, reflecting tooling preferences.

- Libraries like Mesh, Cardano‑js‑sdk, and Blockfrost are widely used for decentralized application development.

- Projects emphasize improving documentation and throughput via solutions like Ouroboros Leios.

- Developer focus areas include identity, DeFi, and stablecoin applications.

- GitHub and open‑source contributions remain essential metrics of ecosystem health and growth.

Cardano Governance and Voting Participation

- Cardano’s governance framework enables ADA holders to participate directly in protocol decisions.

- A key governance milestone saw 99.5% of delegated ADA stakeholders participate in a major governance vote in 2025.

- On‑chain governance involves Delegated Representatives (DReps), SPOs, and elected committees guiding protocol actions.

- Governance participation allows votes on treasury withdrawals, parameter changes, and network upgrades.

- Proposals can be sourced, discussed, and voted on transparently via governance dashboards.

- Community‑led governance workshops, events, and discussions enhance ecosystem engagement.

- The fastest governance vote in Cardano history crossed major thresholds in less than 2 days.

- Broader participation is encouraged through wallets like Yoroi and governance tooling platforms.

Cardano vs. Other Layer‑1 Blockchains

- Cardano’s daily smart contract executions (~52,000) are lower than Ethereum’s (~1.4 million), highlighting throughput differences.

- Cardano’s PoS model emphasizes energy efficiency and decentralization relative to proof‑of‑work chains.

- Developer activity and GDP‑scaled engagement metrics place Cardano amid competitive Layer‑1 ecosystems.

- Consensus inequality studies show moderate stake concentration compared with chains like Bitcoin and Hedera.

- Cardano’s NFT and DeFi metrics progress steadily but often trail comparable Ethereum figures in usage volume.

- Governance participation models differ from other Layer‑1s by emphasizing Delegated Representatives.

- Unique Plutus and extended UTXO architecture shape Cardano’s smart contract scalability relative to rivals.

- Community and ecosystem growth patterns vary widely across Layer‑1 landscapes, with Cardano focusing on gradual adoption and resilience.

Frequently Asked Questions (FAQs)

Cardano has over 1.3 million users staking ADA and participating in governance.

Active Cardano wallet and on‑chain participation data consistently show ~110,000 active addresses per day.

Long‑range models estimate ADA possibly trading between $0.348 and $2.46 in 2025, depending on scenario and model chosen.

Conclusion

Cardano’s ecosystem shows meaningful growth across DeFi, NFTs, dApps, governance, and developer activity. TVL highs and rising NFT engagement confirm expanding use cases, while governance participation and developer surveys underscore community involvement. Compared to some Layer‑1 peers, Cardano trades raw scale for energy‑efficient design and decentralized participation models. As the network matures, these metrics help chart its trajectory toward broader adoption and technical evolution in the blockchain space.