Solana’s dog-themed memecoin BONK has officially entered Europe’s regulated financial markets through a new exchange traded product (ETP) listed on the SIX Swiss Exchange.

Quick Summary – TLDR:

- BONK ETP is now live on Switzerland’s SIX Exchange, giving both retail and institutional investors access via traditional brokerage platforms

- Bitcoin Capital issued the ETP, offering regulated exposure to the Solana-based memecoin

- This marks a significant expansion into Europe, where crypto ETPs benefit from mature regulatory support

- The launch follows recent memecoin ETF activity in the US, highlighting growing interest in community-driven tokens

What Happened?

BONK, a memecoin born on the Solana blockchain, is now tradable on SIX, Switzerland’s largest and Europe’s third-largest stock exchange. The move was enabled by Bitcoin Capital AG, a Swiss-based issuer of digital asset products. With this listing, BONK is the latest in a growing wave of memecoins gaining regulated investment vehicles in global markets.

The first $BONK ETP is now live on SIX Swiss Exchange❗️❗️❗️

— BONK!!! (@bonk_inu) November 27, 2025

Another step towards getting The Dog’s paws everywhere in the world!

Read more👇 pic.twitter.com/bqB0lBg51w

BONK’s Leap Into Regulated Finance

Originally launched on Christmas Day 2022 through a community airdrop, BONK brands itself as “the first Solana dog coin for the people, by the people.” Now, with the launch of the BONK ETP, it becomes accessible to a much wider audience through traditional financial platforms.

- The ETP allows users to buy and sell BONK like a regular stock, bypassing the need for crypto wallets or blockchain expertise.

- Retail and institutional investors can now participate in the BONK ecosystem with ease, using standard brokerage accounts.

- The product is regulated and backed by Bitcoin Capital AG, which operates under Swiss asset manager FiCAS AG.

Nom, a core contributor at BONK, said:

Why Switzerland?

Switzerland remains one of the most attractive venues for launching crypto financial products, thanks to its regulatory clarity and investor-friendly infrastructure.

Marcel Niederberger, CEO at Bitcoin Capital and FiCAS, said:

He added that the regulated ETP model increases investor confidence and liquidity, with most of the capital inflow coming from institutional desks.

BONK Joins a Growing Trend in Crypto Markets

BONK’s ETP launch comes just days after Grayscale introduced a Dogecoin-focused ETF in the US, with modest early volume. Meanwhile, the US market saw the Rex-Osprey Dogecoin ETF launch in September, marking the first fund to hold DOGE directly.

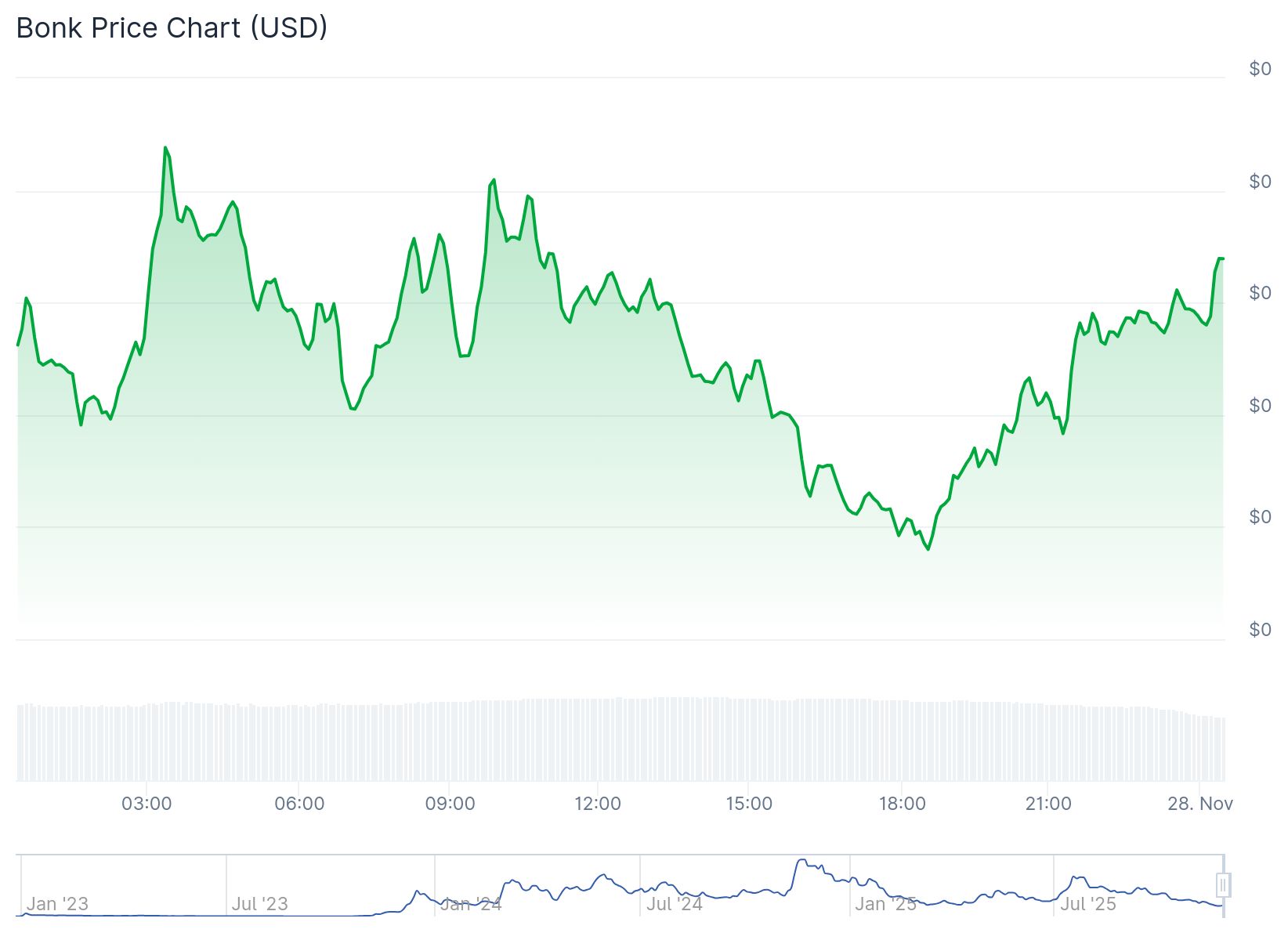

BONK currently sits near $0.0599, up approximately 3.5% on the day of the ETP debut, although it remains down about 83% from its November 2024 all-time high, per CoinGecko data. Despite recent price volatility, the project continues to gain traction in broader financial circles.

Bitcoin Capital, already known for launching the world’s first actively managed Bitcoin ETP in 2020, plans to expand its BONK offerings in 2026. Niederberger expects additional ETPs and structured notes as demand grows for more thematic digital asset investments.

SQ Magazine Takeaway

I love seeing how crypto is slowly becoming part of mainstream finance, and this BONK listing is a great example of that shift. It’s wild to think a memecoin born from airdrops is now sitting next to blue-chip assets on a Swiss stock exchange. This isn’t just a win for Solana or BONK holders, it’s a real sign that regulators and institutions are warming up to the idea of playful yet community-driven tokens being serious financial instruments. I’ll definitely be watching what BONK does next.