The tug‑of‑war between blockchain systems and centralized databases has never been more relevant to the financial world than. Blockchain’s distributed ledgers and consensus mechanisms challenge the long‑standing dominance of centralized databases that power most banks, payment systems, and core processing platforms. Today’s finance leaders must weigh trade‑offs between decentralization, speed, cost, and control when designing or modernizing financial infrastructure.

Real‑world applications include cross‑border tokenized payments that settle minutes faster than legacy rails and large banks using hybrid models for trade finance. These trends are reshaping operational choices and competitive positioning across the industry. Continue reading to explore the latest statistics behind both technologies’ performance, adoption, and impact.

Editor’s Choice

- USDC stablecoin circulation rose ≈90% year‑over‑year, surpassing $61.3 billion by mid‑2025.

- Cross‑border blockchain payments are growing ~48% annually, targeting $5trillion by 2025.

- ~560 million people worldwide are blockchain users in 2025 (~3.9% of the global population).

- Nearly 90% of businesses report deploying blockchain in some capacity.

- Enterprise blockchain spending is projected to reach $19 billion globally in 2025.

- Blockchain storage efficiency reaches 91% superiority over traditional databases in motion data tests.

Recent Developments

- Circle’s Arc network launched testing in 2025 to streamline capital markets and foreign exchange.

- The U.S. passed the GENIUS Act, mandating stablecoins to be fully backed by high‑quality assets.

- Major banks like Bank of America and Goldman Sachs integrate blockchain for tokenized money market funds (~$6.75 billion in assets).

- HSBC and Bank of America partner with R3 and Solana for enhanced settlement and shared ledgers.

- Tradeweb’s daily trading volume rose 33% YoY, reaching $2.5 trillion in May 2025, leveraging blockchain initiatives.

- Blockchain adoption shifted from pilots to production in many institutions, with consortium‑based models gaining traction.

- Financial leaders cite interoperability and regulation alignment as key to broader adoption.

- Hybrid consensus innovations (e.g., PoS + BFT) improve validation speed and security in blockchain payment systems.

- Stablecoin issuance and institutional demand show growing integration into legacy finance products.

- Blockchain‑driven DeFi protocols continue evolving, driving new liquidity and lending platforms.

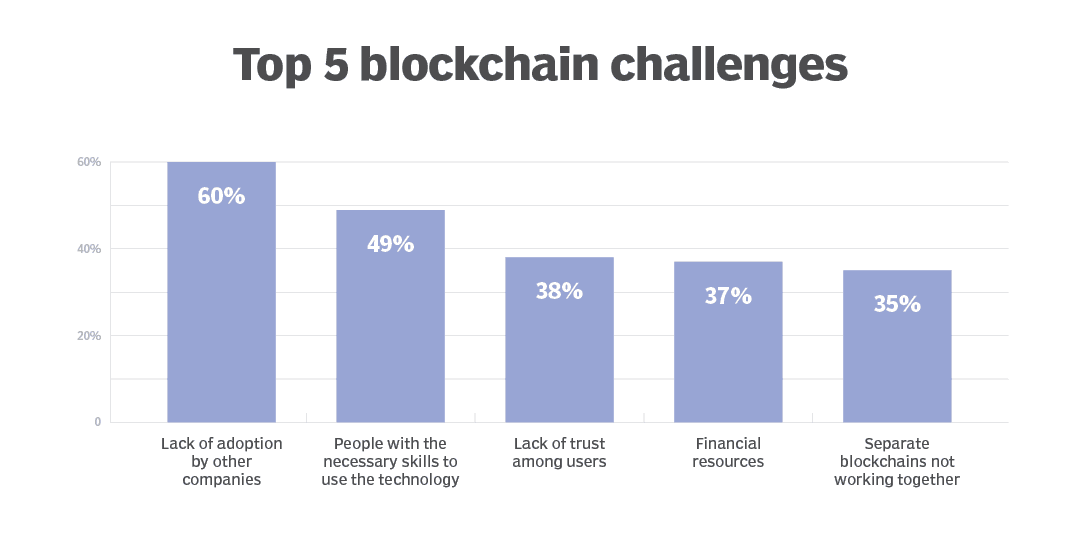

Top Blockchain Challenges

- 60% of companies say the biggest challenge is the lack of adoption by other businesses.

- 49% report a shortage of skilled blockchain professionals as a key barrier.

- 38% of users cite lack of trust as a major obstacle to blockchain acceptance.

- 37% identify financial constraints as a top hurdle to blockchain implementation.

- 35% say interoperability issues between separate blockchains slow adoption.

Data Structure, Storage, and Access Model Comparison

- Bitcoin blockchain reached 709.88 GB in total size by late December.

- Blockchain nodes require 13.35% higher storage growth year-over-year versus centralized systems.

- Decentralized storage market is valued at $9.1 billion, supporting distributed ledger replication.

- The financial blockchain market hit $10.65 billion, driven by hybrid permissioned models.

- Permissioned platforms like Hyperledger Fabric power 45% membership growth in trade finance consortia.

- ICP blockchain achieves an average of 8,000 TPS, rivaling centralized high-frequency systems.

- Centralized financial TPS systems enforce ACID compliance across $1.7 trillion trade volumes.

- The hybrid blockchain finance market is sized at $20 billion, blending on/off-chain storage.

Consensus, Control, and Governance Models in Finance

- PoS reduces energy use by over 99% compared to PoW in financial blockchains.

- Ethereum PoS achieves a 99.9% validator participation rate, securing network consensus.

- The consortium blockchain market is valued at $6.57 billion, powering financial governance models.

- PBFT protocols tolerate up to 33% faulty nodes in permissioned finance networks.

- Financial blockchains using PoS command $400 billion Ethereum market cap dominance.

- Trade finance consortia membership grew 45% via consortium governance structures.

- 29% of the Ethereum supply staked aligns with holdings-based validation.

- Blockchain governance tokens secure $25 billion TVL in liquid staking platforms.

- PoS staking yields an average of 3.15% APY for financial validators in Q2.

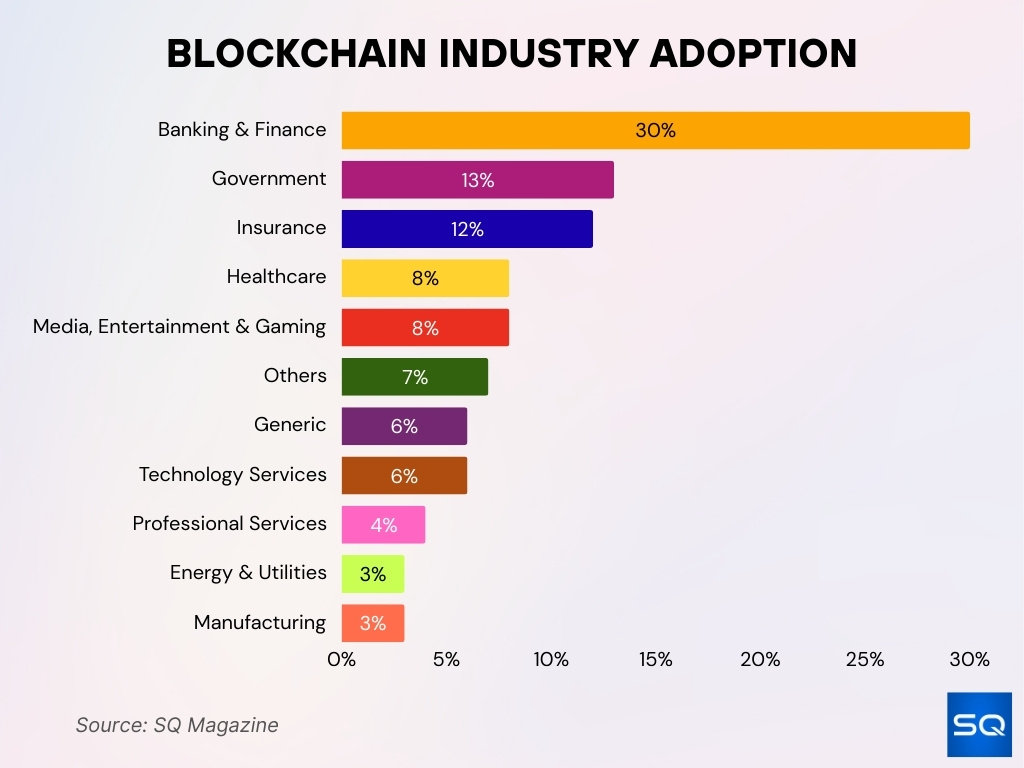

Blockchain Industry Adoption

- Banking & Finance leads with a 30% share, dominating blockchain use in digital transactions.

- The government sector follows at 13%, applying blockchain to transparency and digital IDs.

- Insurance holds 12%, using blockchain for fraud prevention and claims automation.

- Healthcare and Media/Gaming each have 8%, focusing on secure data and content rights.

- Other industries contribute 7%, showing varied, smaller-scale applications.

- Generic Services and Technology Services each account for 6% of adoption.

- Professional Services make up 4%, applying blockchain in consulting and auditing.

- Energy & Utilities and Manufacturing each capture 3%, signaling early-stage adoption.

Security, Cryptography, and Data Integrity Statistics

- 84% of financial institutions report greater transparency and trust via blockchain audit trails.

- Blockchain provides immutable ledgers, preventing post-recording alterations in financial records.

- 90% of blockchain-adopting banks cite improved data protection as the primary benefit.

- Centralized systems face single points of failure, absent in distributed blockchain nodes.

- $2.17 billion lost to crypto service breaches underscores smart contract vulnerabilities.

- Deloitte COINIA verifies 100% of blockchain transactions, boosting audit accuracy.

- Blockchain reduces fraud via tamper-proof logs compared to centralized perimeter defenses.

Immutability, Audit Trails, and Financial Reporting

- Blockchain pilots reduced reconciliation time by 85-90% from hours to minutes.

- 72% of auditors rate blockchain as enhancing transparency via immutable records.

- Compliance fraud dropped 51% using blockchain’s tamper-evident ledgers.

- Audit cycle shortened from 3 months to 6 weeks, cutting labor costs by 40%.

- 88% of institutions report improved regulatory accuracy with distributed ledgers.

- Fraud detection rated effective by 65% of auditors leveraging tamper-proof trails.

- Month-end close accelerated from 7-10 days to 1-2 days via auto-reconciliation.

- Audit prep time reduced 70% from 85 hours to 25 hours annually.

- 90% temporal reduction in reconciliation protocols per PwC blockchain cases.

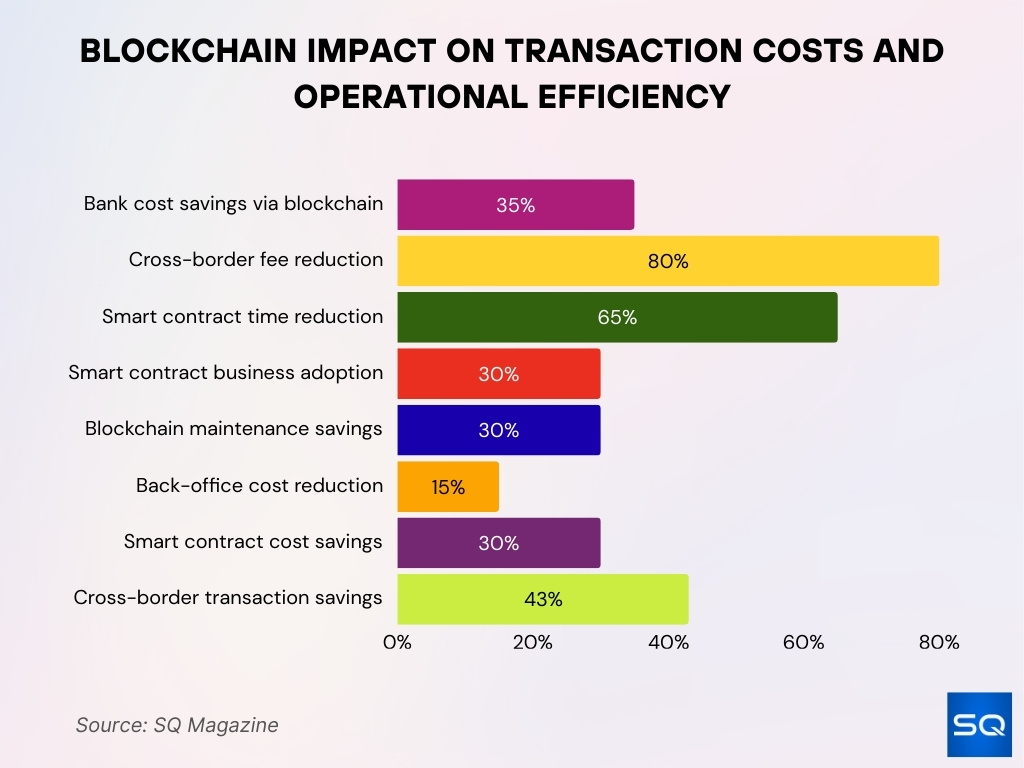

Transaction Costs, Fees, and Operational Efficiency

- Banks save 35% on operational costs by adopting blockchain payments, removing intermediaries.

- Blockchain cross-border payments cut transaction fees by 70-80% versus traditional channels.

- Smart contracts reduce processing times by 65% used by 30% global businesses.

- Blockchain migration yields ~30% lower maintenance costs than centralized systems.

- Syndicated loan volume growth drives 15% structural back-office cost reduction.

- Smart contract adoption cuts financial services operational costs by ~30% average.

- Cross-border blockchain payments achieve 42.6% transaction cost reduction.

- Immutable audit trails reduce reconciliation expenses by eliminating manual verification.

- Hybrid blockchain models compress fees via high-performance consensus layers.

Regulatory Compliance, Privacy, and Data Residency

- GENIUS Act drove stablecoin market cap to $306 billion with 49% growth.

- 80% of jurisdictions saw financial institutions launch digital asset initiatives post-regulation.

- 15% of AML/KYC procedures now use blockchain-based immutable ledgers.

- RegTech market exceeded $22 billion, boosting blockchain AML automation.

- mBridge settled $22 million cross-border CBDC payments with jurisdiction compliance.

- 84% multinational firms prepare for GDPR-blockchain data residency rules.

- Zero-knowledge proofs secure $28 billion TVL in privacy-preserving rollups.

- 61% financial institutions increase spending on privacy-enhancing technologies.

- 71% organizations cite cross-border data compliance as the top regulatory challenge.

Centralized Database Usage in Core Banking and Capital Markets

- The core banking software market is valued at $17.94 billion, powering centralized ledgers.

- 77% financial institutions maintain centralized databases for high-speed core operations.

- SaaS core banking platforms reached $13.48 billion, supporting real-time ACID compliance.

- Core systems process millions of TPS with 99.999% uptime for mission-critical banking.

- 50% central banks operate centralized data collection for regulatory reporting.

- Banks invest heavily in centralized modernization for API-driven digital channels.

- Centralized CIF systems unify customer data, reducing KYC/AML compliance risks.

- Legacy centralized systems outperform distributed ledgers in low-latency trading.

- 80% adoption projected for centralized FedNow/TCH RTP real-time payments.

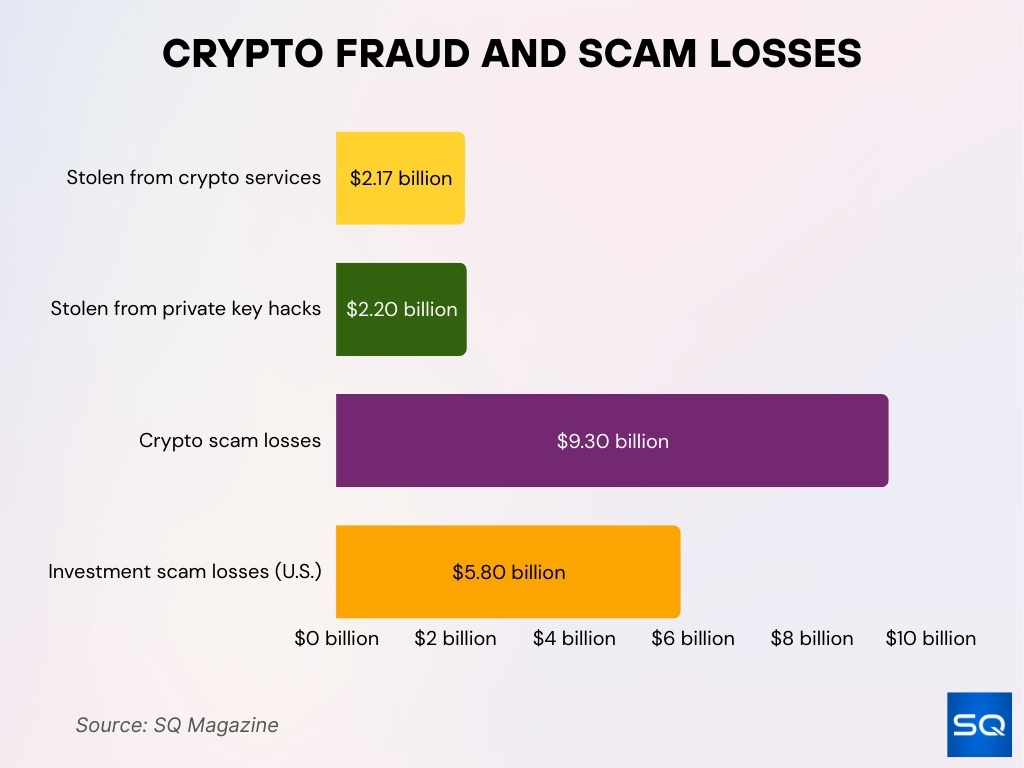

Impact on Fraud Prevention

- $2.17 billion has been stolen from crypto services in 2025 alone.

- $2.2 billion was lost due to private key compromises, highlighting security flaws.

- Crypto scams led to $9.3 billion in total losses across the ecosystem.

- Investment scams caused $5.8 billion in U.S. losses, underscoring consumer risk.

Hybrid Architectures Combining Blockchain and Centralized Databases

- Canton Network processes $350 billion daily on-chain assets via a hybrid design.

- 600 nodes upgraded seamlessly, supporting hybrid institutional workflows.

- 77% financial institutions adopt hybrid models for selective decentralization.

- Consortium/hybrid blockchain grows, balancing public/private ledger features.

- 15 million monthly transactions via Canton Coin in hybrid finance flows.

- Blockchain banking market hits $10 billion, driven by hybrid integration.

- Hybrid smart contracts enable 40% faster settlement in trade workflows.

- 95% hybrid chain users cite compliance as the primary adoption driver.

Cross‑Border Payments and Remittances Performance Metrics

- Global cross‑border payments market size now exceeds $194 trillion annually, with forecasts to rise to $320 trillion by 2032, driving the need for more efficient rails.

- Blockchain‑based remittances often settle in minutes instead of days, dramatically faster than traditional systems.

- Traditional international transfers can take 3–5 business days and cost ~1–7% of the amount sent.

- Blockchain solutions report 60–80% lower fees in many corridors compared with legacy banking wires.

- Cross‑border blockchain payment volumes are increasing rapidly as institutions test stablecoins and CBDCs for settlement.

- Studies show that increasing blockchain adoption in remittance corridors improves financial inclusion by lowering barriers to entry.

- Projects like mBridge aim to enable peer‑to‑peer CBDC transactions in real time, enhancing FX settlement efficiency.

- Blockchain protocols used in cross‑border contexts integrate AML/KYC compliance, reducing regulatory friction.

- Emerging markets and SMEs especially benefit from lower costs and faster settlement via blockchain rails than traditional correspondent banking.

Frequently Asked Questions (FAQs)

Global blockchain technology spending is expected to reach $19 billion in 2025.

An estimated 560 million people globally are blockchain users in 2025.

The blockchain market for banking and financial services is projected to $10.85 billion in 2025.

Cross‑border blockchain payments are growing at approximately 48% per year.

Conclusion

The financial ecosystem is balancing legacy strengths with emerging technologies. Centralized databases remain essential for core banking, compliance, and high‑performance processing, while blockchain technologies are proving their worth in cross‑border payments, auditability, and hybrid integration models. Regulatory and privacy frameworks are maturing, and hybrid architectures help institutions adopt distributed ledgers without sacrificing control or compliance. As real‑world deployments expand and performance metrics improve, finance leaders must evaluate both approaches to build resilient, compliant, and efficient systems for the future of global finance.