Bitget continues to emerge as a major global cryptocurrency exchange, blending spot, derivatives, and Web3 wallet services under a unified ecosystem. Its growth reflects both rising retail and institutional engagement, transforming how millions access crypto trading and on‑chain services. Through vast user adoption, deep liquidity, and expanding global reach, Bitget is shaping how exchanges evolve. Read on to explore its latest performance numbers, developments, and what they mean for the industry.

Editor’s Choice

- Bitget’s total user base surpassed 120 million in 2025.

- In Q1 2025, Bitget and Bitget Wallet added 19.89 million new users, a growth of 20% in that quarter alone.

- Bitget’s global derivatives market share rose to 7.2% in April 2025, ranking it third globally.

- Futures trading volume in April 2025 reached $757.6 billion, with spot volume at $68.6 billion.

- For H1 2025, Bitget averaged $750 billion monthly trading volume.

- As of August 2025, its wallet service reported over 12 million monthly active users (MAU).

- Bitget’s liquidity depth for ETH and SOL spot markets ranks #1 globally; for BTC spot liquidity, it ranks #2 globally.

Recent Developments

- In April 2025, Bitget secured regulatory licenses (DASP and BSP) in El Salvador, enabling full crypto services, spot, derivatives, staking, and yield, under local law.

- In 2025, Bitget expanded its global workforce to about 1,800 employees from 60+ nationalities, reflecting a widening geographic and operational scope.

- The company broadened its token offering: as of early 2025, Bitget lists 800+ tokens and more than 400 futures trading pairs, plus 800+ spot pairs.

- During 2025, Bitget launched new ecosystem features, including its “Universal Exchange (UEX)” model, integrating spot, futures, staking, payments, and on‑chain access.

- The On‑chain side of Bitget expanded to major chains like Ethereum, Solana, BSC, and Base, with daily on‑chain trading volume surpassing $113 million by Q3 2025.

- Bitget introduced support for tokenized traditional assets: in 2025, it launched USDT‑margined perpetual futures tied to U.S. stocks, enabling leveraged access to equities without a brokerage account.

- The platform strengthened its wallet offering via integrations (e.g., MPC‑based wallet login via Telegram, Google, Apple ID), making Web3 more accessible to Web2 users.

- Bitget reported net inflows of $461.3 million in July 2025, ranking among the top five centralized exchanges globally for net inflows that month.

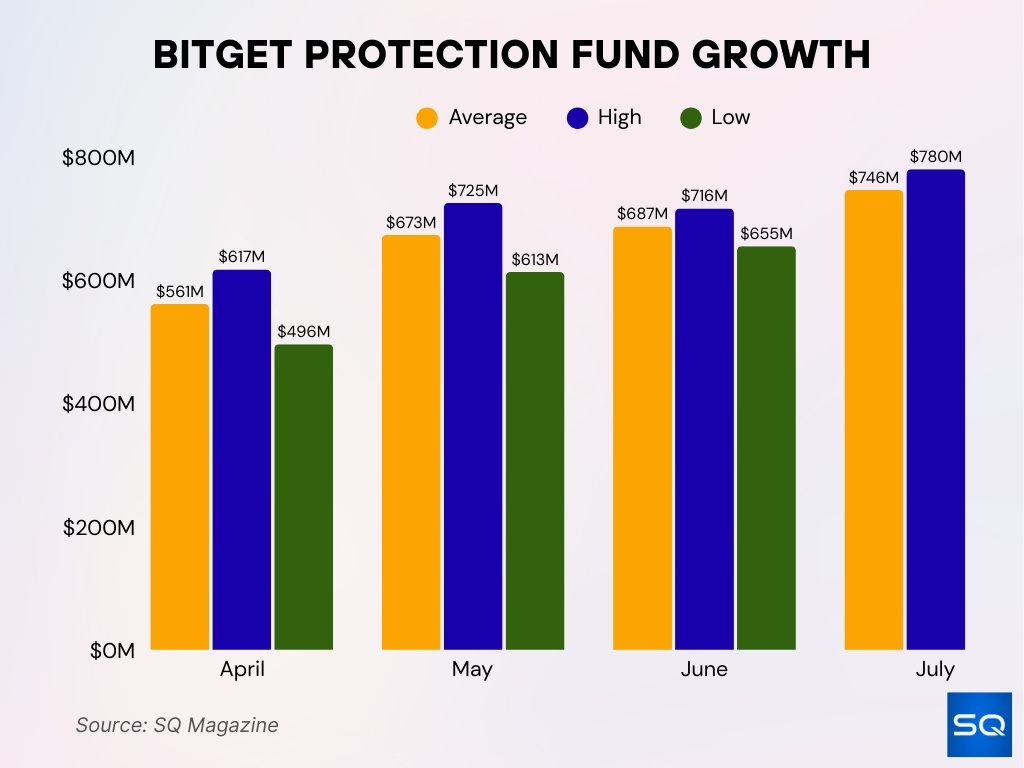

Security and Protection Fund Statistics

- April 2025: Average fund at $561 million, with lows at $496 million and highs at $617 million.

- May 2025: Fund peaked at $725 million, averaged $673 million, with lows around $613 million.

- June 2025: High of $716 million, low of $655 million, with a monthly average of $687 million.

- July 2025: Hit a record high of $779.7 million, averaged $746 million, and ended July at $752 million.

Bitget User Base Statistics

- As of Q1 2025, Bitget’s ecosystem (exchange + wallet) exceeded 120 million users globally.

- The addition of 19.89 million users in Q1 implies the user base rose about 20% in just three months.

- According to earlier 2024 data, the platform saw 400% user growth, signaling rapid adoption that year.

- The number of professional traders on Bitget reportedly exceeds 200,000 as of early 2025.

- For 2025, Bitget claims roughly 50% of derivatives volume, and 80% of spot volume comes from institutional or professional traders.

- Wallet-side growth also accelerated: Bitget Wallet had crossed 60 million users by early 2025, rising toward 80 million users mid‑year.

- In August 2025, Wallet’s monthly active users (MAU) surpassed 12 million, with new downloads reaching 2 million in a month, making it the top-downloaded Web3 wallet globally at that time.

- The combined rapid growth suggests that many users adopt Bitget not just for trading but also for wallet and on‑chain services, underscoring the appeal of its integrated model.

Geographic Distribution Statistics

- By early 2025, Bitget reported operations in 150+ countries and regions, reflecting a wide global reach.

- Its workforce spans 60+ nationalities, supporting localized operations across multiple jurisdictions.

- The 2024 annual report highlighted exceptional regional growth: user growth reached 1,614% in Africa, 729% in South Asia, and 216% in Southeast Asia.

- Bitget’s recent expansion into regions like Latin America, Asia, and Africa indicates that high growth is driven by emerging markets rather than traditional crypto hubs.

- Regulatory localization, such as licensing in El Salvador, supports this geographic diversification and helps the platform operate legally in different jurisdictions.

- Tokenized stock futures (e.g., U.S. equities access) appeal especially to regions with limited traditional brokerage options, increasing Bitget’s relevance globally.

- The global distribution of wallet users suggests users in non‑traditional markets are leveraging Bitget Wallet to access crypto and Web3, not just trading.

Bitget Token (BGB) Price Analysis

- Daily range fluctuated between $4.93 and $5.05, showing moderate volatility.

- Key EMAs signal support with EMA 20 at $4.70, EMA 50 at $4.63, EMA 100 at $4.62, and EMA 200 at $4.47.

- Support zone lies between $4.10 and $4.65, offering downside protection.

- Descending resistance holds near the $5.5–$6 range, forming a wedge pattern.

- RSI stands at 60.28, above the 53.93 average, indicating neutral-to-bullish momentum.

Website Traffic Statistics

- Bitget’s main domain saw 2.28 million organic visits in the latest period, up about 6.3% month-over-month.

- Paid‑search traffic fell by about 11.4%, indicating a strategic shift toward organic and referral traffic over paid acquisition.

- Total visits rose by about 9.5%, with an average session duration of 7 minutes 34 seconds and 14.35 pages per visit.

- The bounce rate is relatively low at 23.8%, suggesting that visitors tend to interact meaningfully rather than leaving immediately.

- About 84.1% of visitors are male, and 15.9% female. The largest age cohort visiting the site is 25–34 years old.

- The United States remains the top source of desktop traffic, contributing roughly 10.6%, followed by Hong Kong, Germany, Singapore, and South Korea.

- The site’s backlink profile remains strong, with approximately 38.4K referring domains and around 21.4 million backlinks, with monthly growth.

Copy Trading Statistics

- Bitget recorded a total trading volume of $2.08 trillion in Q1 2025.

- Copy‑trading volume rose to $9.2 billion, a 36% increase QoQ.

- By July 2025, the number of copy‑trading followers reached 1.1 million.

- Cumulatively, copy‑trading executed over 110 million trades by mid‑2025.

- Profits distributed to “elite” or leading traders grew from $27 million to $29 million.

- Total copy-trading token listings rose from 271 to 305 in July 2025.

- 100,000 new copy‑trading users joined in July alone.

- Copy trading remains a major pillar for user acquisition and retention, helping Bitget engage both novice and experienced users.

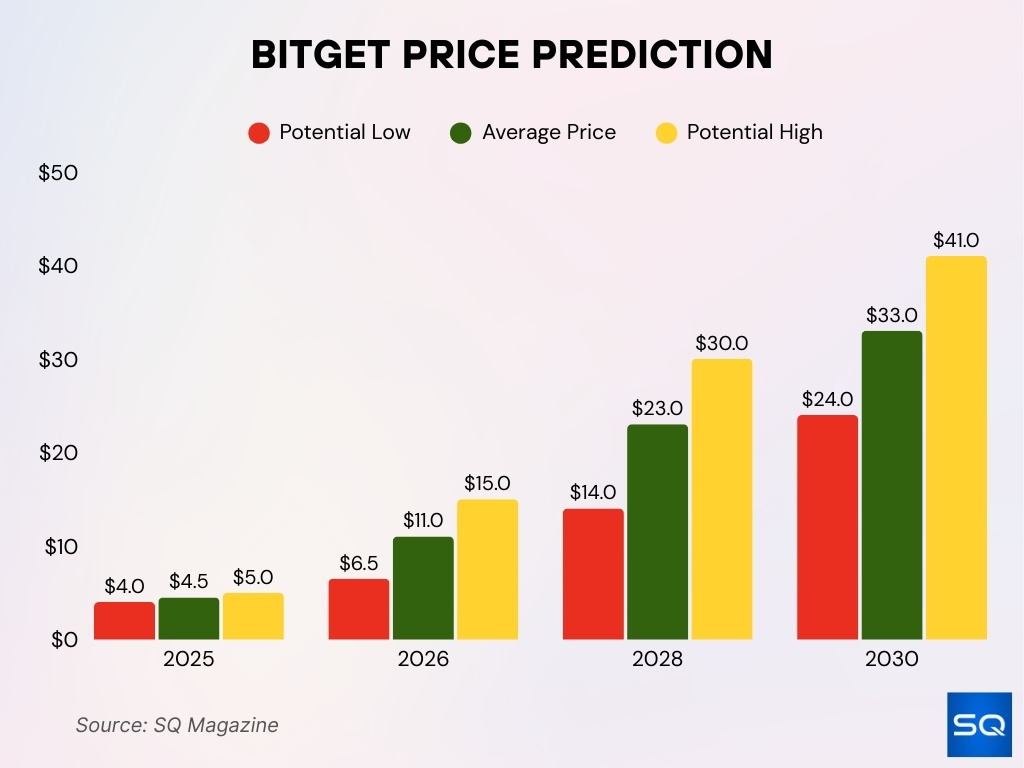

Bitget Price Prediction

- The current price range is projected between $4 and $5, forming a base level.

- By 2026, the expected average is $11, with a high of $15 and a low of $6.5.

- In 2028, the forecast shows an average of $23, a high of $30, and a low of $14.

- By 2030, Bitget may average $33, with a high of $41 and a low of $24.

Institutional Trading Statistics

- Bitget averaged $750 billion in total monthly trading volume in H1 2025.

- Institutions accounted for roughly 80% of spot trading volume.

- Market‑maker participation rose from 3% to 56.6% in futures markets.

- In October 2025, Bitget recorded $23.1 billion in new institutional inflows, a record monthly figure.

- Bitcoin holdings rose 6% month-over-month, from 28.6K BTC to 30.3K BTC by October.

- Total reserves reached $7.83 billion.

- Bitget ranks among the top two exchanges globally for institutional trading volume in BTC, ETH, SOL, and XRP.

Protection Fund and Reserves Statistics

- Bitget’s Protection Fund exceeded $800 million as of Q3 2025.

- The platform maintains a 1.8× Proof‑of‑Reserves (PoR) ratio.

- Net inflows reached $461.3 million in July 2025.

- Ethereum reserves reached approximately 211,200 ETH as of July 31, 2025.

- Clean assets totaled $5.62 billion out of $5.66 billion in July 2025.

- Protection Fund grew from $495 million in January to about $514 million by March.

- Rising reserves and a large safety buffer prepare Bitget for volatility and institutional withdrawals.

- Strong reserve policies enhance user trust and long-term platform stability.

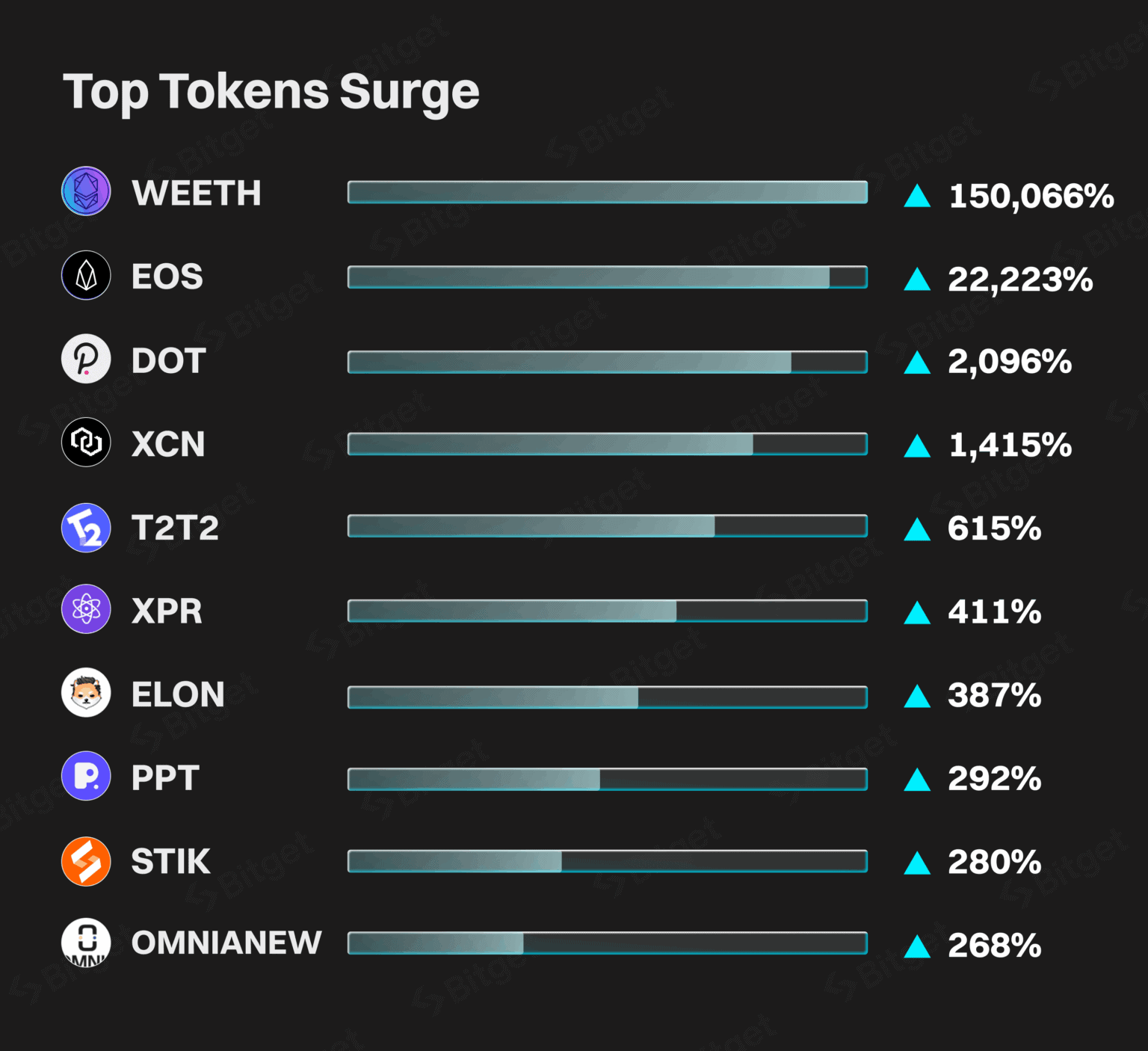

Top Token Surges on Bitget

- WEETH surged by 150,066%, leading all tokens in gains.

- EOS jumped 22,223%, showing explosive momentum.

- DOT gained 2,096%, driven by high investor interest.

- XCN rose 1,415%, continuing a strong rally.

- T2T2 increased 615%, reflecting sharp growth.

- XPR advanced 411%, attracting market attention.

- ELON climbed 387%, maintaining bullish momentum.

- PPT added 292%, extending its upward trend.

- STIK grew 280%, sustaining strong performance.

- OMNIANEW gained 268%, rounding out the top movers.

On-chain and DeFi Activity Statistics

- Bitget’s on-chain platform hit a daily trading volume of $113 million in Q3 2025.

- It supports 4 major blockchains: Ethereum, Solana, BSC, and Base.

- Bitget migrated 440 million BGB tokens to the Morph Foundation, burning half and locking the rest.

- USDT-margined stock futures launched with up to 25x leverage covering 25 U.S. stocks.

- Gas abstraction allows fee payments in stablecoins or BGB on multiple chains, including Ethereum and Solana.

- Institutional capital utilization boosted by a financing program offering up to 2 million USDT interest-free.

- DeFi liquidity deepened with Bitget maintaining an Amihud liquidity score of 0.0014, on par with peers.

- Bitget evolves as a hybrid model combining CEX liquidity with DEX flexibility for seamless trading.

- Over 120 million users globally engage with Bitget’s ecosystem, enhancing on-chain activity.

- Monthly derivatives volume surpassed $500 billion, highlighting strong institutional trading interest.

Wallet Usage Statistics

- Bitget Wallet reported over 12 million monthly active users (MAU) in August 2025.

- That month saw ~2 million app downloads, the highest globally among Web3 wallets.

- By early 2025, the user base had crossed 60 million, approaching 80 million by mid-year.

- Supports 130+ blockchains for swaps, DApps, and asset management.

- Offers MPC keyless login using Google, Apple ID, Telegram, or email.

- Launched a zero-fee crypto card in LATAM markets.

- Includes stablecoin yield aggregation via “Earn” tools.

- Adoption is strongest in Southeast Asia, Latin America, and Africa.

Mobile App Performance Statistics

- Bitget mobile apps hold average ratings of 4.6/5 across Google Play (263K reviews) and App Store (4.7K ratings).

- Bitget Wallet Lite surpassed 3 million users within days of launch in 2025.

- App downloads ranked 3rd globally among CEXs with 1.92 million in October 2024.

- Wallet MAU exceeded 12 million in August 2025, leading global Web3 wallet downloads.

- Fiat gateways via Mercuryo and MoonPay support 25+ currencies, including USD, EUR, and GBP.

- Mobile tokenized stocks trading hit $5 billion cumulative volume, led by Tesla and MicroStrategy.

- Over 120 million total users in the Bitget ecosystem by Q1 2025, with 19.89 million new users added.

- Cross-chain gas abstraction enables stablecoin fee payments on 100+ networks via mobile.

Security and Compliance Statistics

- Bitget enforces 2FA, device management, phishing codes, and withdrawal allowlists.

- Protection Fund was $749 million in July, and remained above $735 million through Q3 2025.

- PoR ratio ranged from 186% to 200%, consistently above liabilities.

- Operates in 150+ countries and regions.

- Publishes quarterly transparency reports.

- Recognized for frequent PoR updates and robust security measures.

- Promotes trust via cold/hot wallet separation and risk control.

Partnerships and Ecosystem Statistics

- Fiat partners Mercuryo and MoonPay enable on/off-ramps in 25+ currencies like USD, EUR, GBP.

- USDT-margined stock futures surpassed $1 billion cumulative volume, led by Tesla ($380M).

- Bitget Wallet supports 130+ blockchains, including BTC, ETH, and Solana for cross-chain access.

- GetAgent AI assistant drew 20,000 early access users with 15 daily interactions per user.

- Stablecoin Earn Plus TVL topped $80 million with 10% annualized yields via Aave.

- Africa’s user base grew over 300% from 2021-2024 via targeted partnerships.

- Visa-powered crypto cards hit $365 million monthly volume, accepted at 150M merchants.

- 19.89 million new users added in Q1 2025 across Southeast Asia, LATAM, and Eastern Europe.

Frequently Asked Questions (FAQs)

Bitget reported over 120 million total users (exchange + wallet) in Q1 2025.

Bitget’s On‑chain platform surpassed $113 million in daily trading volume by Q3 2025.

Bitget averaged $750 billion in total monthly trading volume as of Q3 2025.

Conclusion

Bitget has matured from a derivatives-focused exchange into a full-fledged crypto ecosystem, combining exchange, wallet, on‑chain tools, real‑world asset access, and strong security practices. Its wallet user base expansion, robust app performance, and deep ecosystem integrations showcase a platform evolving to meet demands from retail users, institutions, and emerging‑market audiences alike. Notably, the high Proof of Reserves, substantial Protection Fund, and transparent reporting strengthen trust, a critical factor in crypto adoption. As Bitget continues to scale globally and innovate across CeFi and DeFi boundaries, its trajectory signals both ambition and a commitment to long-term stability.