Airtable blends a spreadsheet’s simplicity with a database’s power, making app-building accessible to non-technical users. Its impact spans film production planning and vaccine distribution logistics, showcasing real-world reach. Let’s explore how Airtable’s latest traction sets the stage for deeper insights.

Editor’s Choice

- In 2023, Airtable’s ARR hit $375 million, a 50% increase year-over-year, with about 166,000 paying companies.

- Airtable reported 100% YoY revenue growth and a 170% net dollar retention rate among enterprise clients, exceeding rates reported by Asana (130%) and Monday.com (120%) in their earnings disclosures.

- Post-Series F in December 2021, Airtable’s valuation peaked at $11.7 billion, backed by Salesforce and Franklin Resources.

- Total funding amounts to about $1.36–1.4 billion.

- Airtable attributes AI feature adoption to improvements in data analysis (66%), asset utilization (61%), customer loyalty (59%), and content output (56%), though independent verification has not yet been published.

- Over 450,000 organizations use Airtable for diverse needs, ranging from product design to vaccine rollout.

- Companies report a 90% reduction in manual data entry, save around $2.6 million in operations, and launch campaigns 3.4× faster using Airtable.

Recent Developments

- In 2025, Airtable rebranded as an AI-native platform, introducing app-building via natural conversation through features like Omni and AI agents.

- Tools now support massive scalability, compatible with up to 100 million records per table and thousands of AI-powered agents.

- A new AI assistant was launched in April 2025 to streamline app creation and management.

- Cobuilder, launched in July 2024, became the company’s fastest-adopted feature to date.

- A shift toward enterprise focus continues, following a 27% workforce reduction in September 2023.

- As of late 2024, the company reached cash flow positivity while maintaining 30% annual growth.

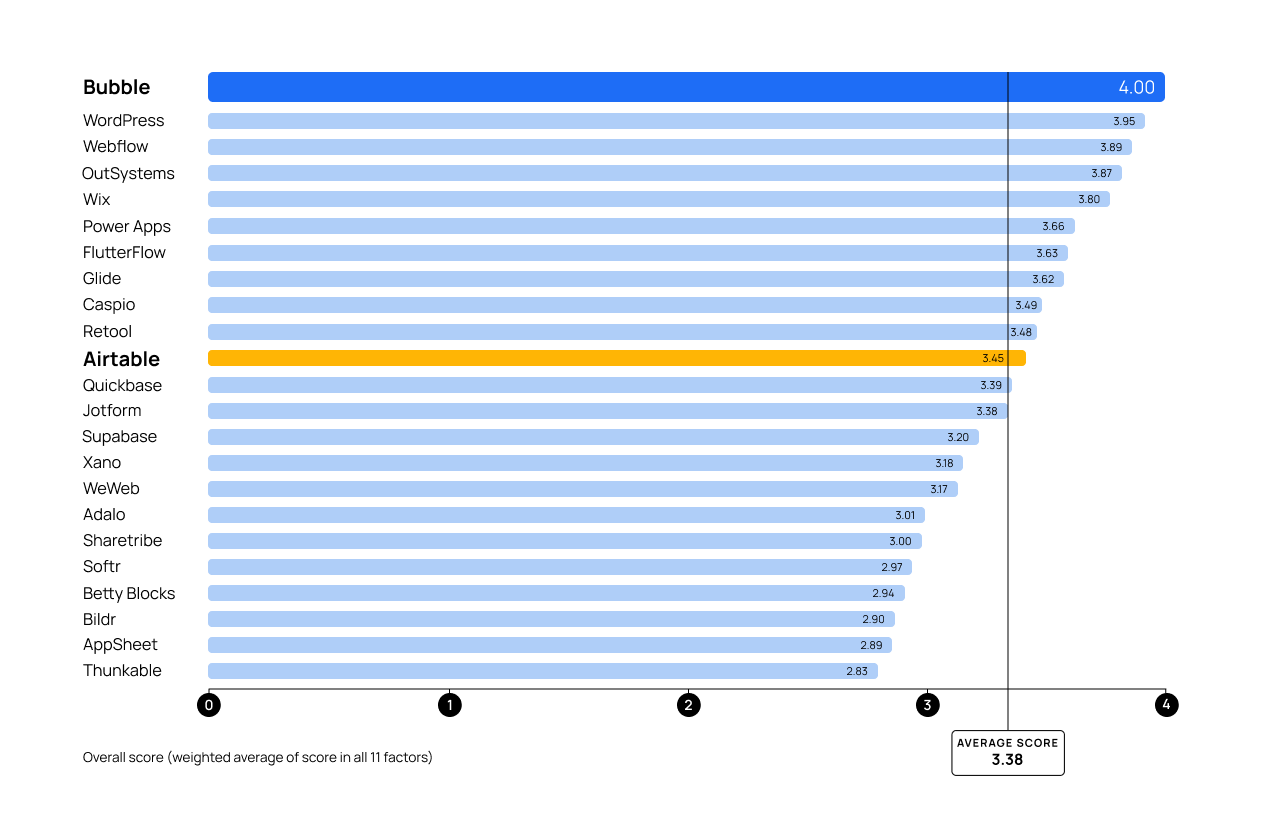

Airtable’s Position in No-Code Platform Rankings

- Airtable scored 3.45, slightly above the overall average score of 3.38.

- It ranked 11th out of 23 platforms, placing it in the upper mid-tier of no-code solutions.

- Bubble led the rankings with a perfect 4.00 score, while Thunkable placed last with 2.83.

- Airtable’s score was ahead of Quickbase (3.39) and Jotform (3.38), but just behind Retool (3.48) and Caspio (3.49).

- The result shows Airtable is a competitive player in the no-code ecosystem, balancing between leading tools and niche platforms.

Global User Base & Adoption

- As of 2025, Airtable serves over 450,000 organizations globally.

- Enterprise usage, evidenced by 100% YoY growth and 170% NDR, outpaces major competitors like Asana and Monday.com.

- Large enterprises often adopt Airtable through a “land and expand” approach, starting with marketing or operations before broadening usage across the organization.

- Trusted by prominent brands like Walmart, Autodesk, and Intuit.

Annual Recurring Revenue (ARR) Growth

- Airtable’s ARR grew from $375 million in 2023 to an estimated $478 million in 2024, a 27% increase.

- Historic growth, scaled from $10 million to $100 million ARR in approximately 3.5 years.

- Competitors’ ARR in late 2023 were significantly higher but with lower growth, Asana at $600M, Monday.com at $757M, and Smartsheet at $987M, growing 23–38% YoY.

- Enterprise demand fueled growth, aided by strong net retention.

- The transition from prosumers to enterprise clients began in 2018.

- Based on earlier company data and employee headcount estimates, Airtable’s ARR per employee was approximately $144,000; current figures may vary as workforce and revenue evolve.

Enterprise Adoption & Net Dollar Retention

- Enterprise clients deliver 100% YoY revenue growth and 170% net dollar retention, outperforming Asana and Monday.com.

- Enterprise focus has driven restructuring, including layoffs and doubling down on governance, security, and scale.

- The “land and expand” model, starting with one team and scaling across the organization, proved effective in expanding the enterprise footprint.

- Airtable offers enterprise-grade capabilities, SSO, audit logs, SCIM provisioning, and activity tracking.

- High NDR indicates strong upsell potential and customer loyalty.

- Reaching cash flow positivity while growing at 30% in late 2024 underscores enterprise momentum.

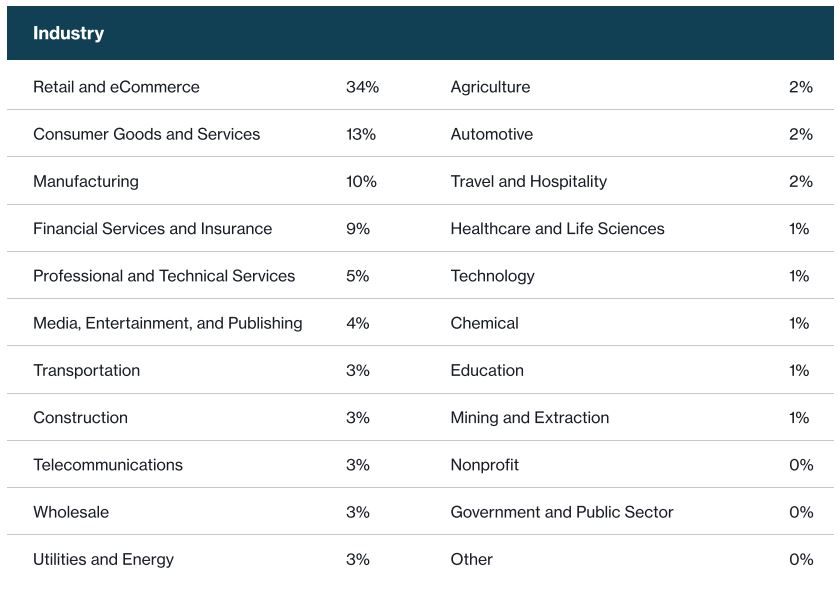

Airtable Adoption by Industry

- Retail and e-commerce lead with 34%, making it the largest sector using Airtable.

- Consumer Goods and Services follow at 13%, showing strong adoption in consumer-focused markets.

- Manufacturing holds 10%, while Financial Services and Insurance account for 9%.

- Professional and Technical Services (5%) and Media, Entertainment, and Publishing (4%) also contribute notable usage.

- Smaller adoption is seen in Transportation, Construction, Telecommunications, Wholesale, and Utilities — each at 3%.

- Agriculture, Automotive, and Travel & Hospitality sectors each represent 2% of Airtable’s user base.

- Niche industries like Healthcare, Technology, Chemical, Education, and Mining each hold only 1% share.

- Nonprofit, Government, and Other sectors show 0% adoption, highlighting untapped growth potential.

Funding & Valuation History

- Airtable has raised approximately $1.4 billion through multiple funding rounds to date.

- In December 2021, Airtable secured $735 million in its Series F round, valuing the company at $11.7 billion.

- Earlier rounds include:

- Series E: $270 million (March 2021).

- Series D: $185 million (September 2020).

- Series C: $100 million (November 2018).

- Series B: $52 million (March 2018).

- Series A: $3 million (February 2015).

- Total number of funding rounds: 7, including seed, Early‑Stage, and Late‑Stage, with 58 investors participating.

- Though valued at over $11 billion in 2021, secondary market estimates in 2024 peg its valuation closer to $3.8 billion, suggesting a post-boom correction.

- Airtable reduced its workforce by 27% (237 employees) in September 2023 as part of a strategic shift toward enterprise focus.

- As of late 2024, the company reached cash flow positivity while sustaining approximately 30% annual growth.

Pricing Tiers & Plan Capacities

- Airtable offers four main tiers: Free, Team, Business, and Enterprise Scale.

- Free Plan:

- Up to 5 editors per workspace.

- 1,000 records per base.

- 1 GB attachments, 100 automation runs/month, 1,000 API calls.

- Includes 500 AI credits/user/month.

- Team Plan ($20–24/user/month):

- 50,000 records, 20 GB attachments, 25,000 automation runs, 100,000 API calls.

- Adds Gantt/Timeline views, sync integrations, Interface Designer, and 15,000 AI credits/user/month.

- Business Plan ($45–54/user/month):

- 125,000 records, 100 GB attachments, 100,000 automation runs.

- Includes two-way sync, verified data, admin controls like SSO/SAML, and extended features.

- Enterprise Scale Plan (custom pricing):

- Designed for large organizations with 500,000+ records, 1 TB attachments, and 500,000 automation runs.

- Offers advanced governance, audit logs, enterprise API, HyperDB, enterprise hub, and DLP.

- Education & Nonprofit Discounts:

- Students can access free Team accounts for 6–24 months, subject to approval.

- Nonprofits receive a 50% discount, e.g., the Plus plan becomes $10/user/month (from $20) and the Pro plan $20 (from $40).

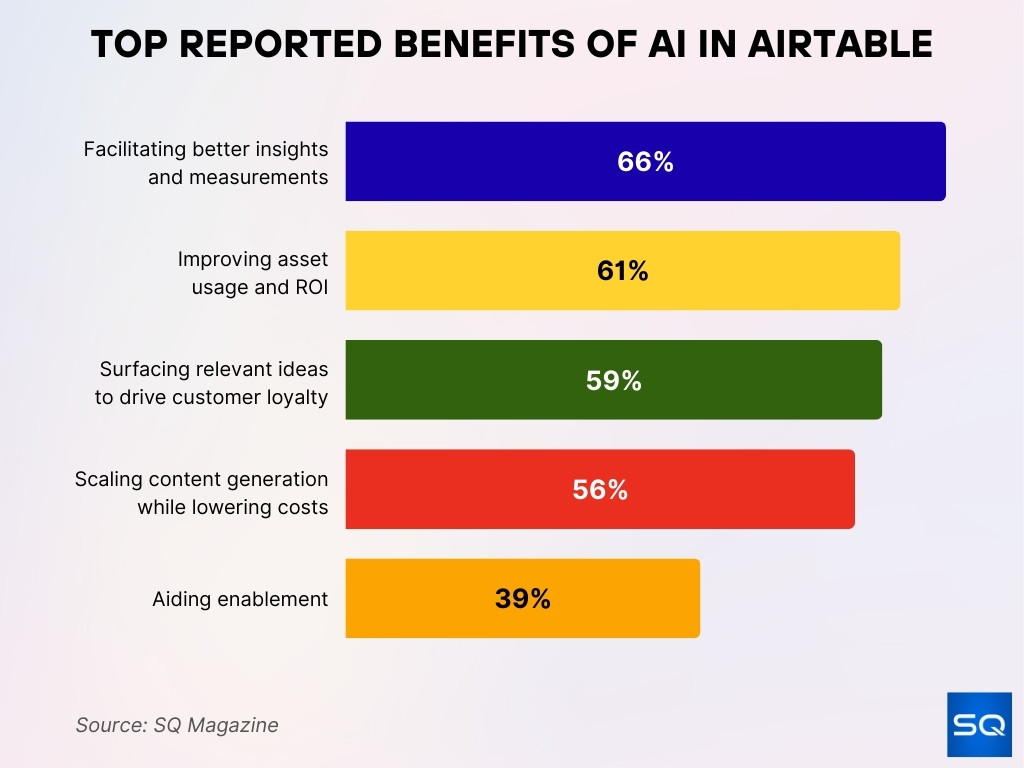

Top Reported Benefits of AI in Airtable

- 66% of users highlight AI for better insights and measurements.

- 61% report improvements in asset usage and ROI.

- 59% see AI helping in driving customer loyalty through relevant ideas.

- 56% credit AI with scaling content generation while reducing costs.

- 39% point to AI’s role in aiding enablement.

Storage, Automation & API Usage Limits

- Free Plan caps:

- 1 GB storage, 100 automation runs/month, 1,000 API calls/month.

- Team Plan offers:

- 20 GB storage, 25,000 automation runs, 100,000 API calls/month.

- Business Plan ups the ante to:

- 100 GB storage, 100,000 automation runs/month, unspecified API call enhancements.

- Enterprise Scale unlocks:

- 1 TB storage, 500,000 automation runs/month, likely unlimited API access using enterprise API.

- Revision history retention increases with each plan,

- Free: 2 weeks, Team: 1 year, Business/Enterprise: up to 3 years.

- AI capabilities: Each plan includes AI credits, ranging from 500 to 25,000 credits per user per month, with no separate AI fee within credit limits.

AI Integration & Enterprise‑Grade Features

- In 2025, Airtable relaunched as an AI-native app, embedding AI deeply into workflows.

- Each plan includes a predefined amount of AI credits, enabling generative and automation tasks within usage tiers.

- The Team Plan provides 15,000 AI credits/user/month.

- Enterprise features include,

- SSO/SAML, audit logs, enterprise API, enhanced admin controls, DLP, HyperDB, enterprise hub.

- Enterprise-ready AI agents and integration tools complement governance and scale demands. While pricing is custom, these features meet the regulated environment.

User Demographics and Industry Segments

- Airtable serves over 450,000 organizations globally, spanning industries like marketing, operations, film production, and vaccine logistics.

- Large enterprises, Walmart, Autodesk, Intuit, Netflix, Shopify, Time, use Airtable to replace spreadsheets with structured, agile apps.

- The platform appeals across sectors, education, nonprofits, creative agencies, tech, media, and finance, due to its mix of no‑code flexibility and relational power.

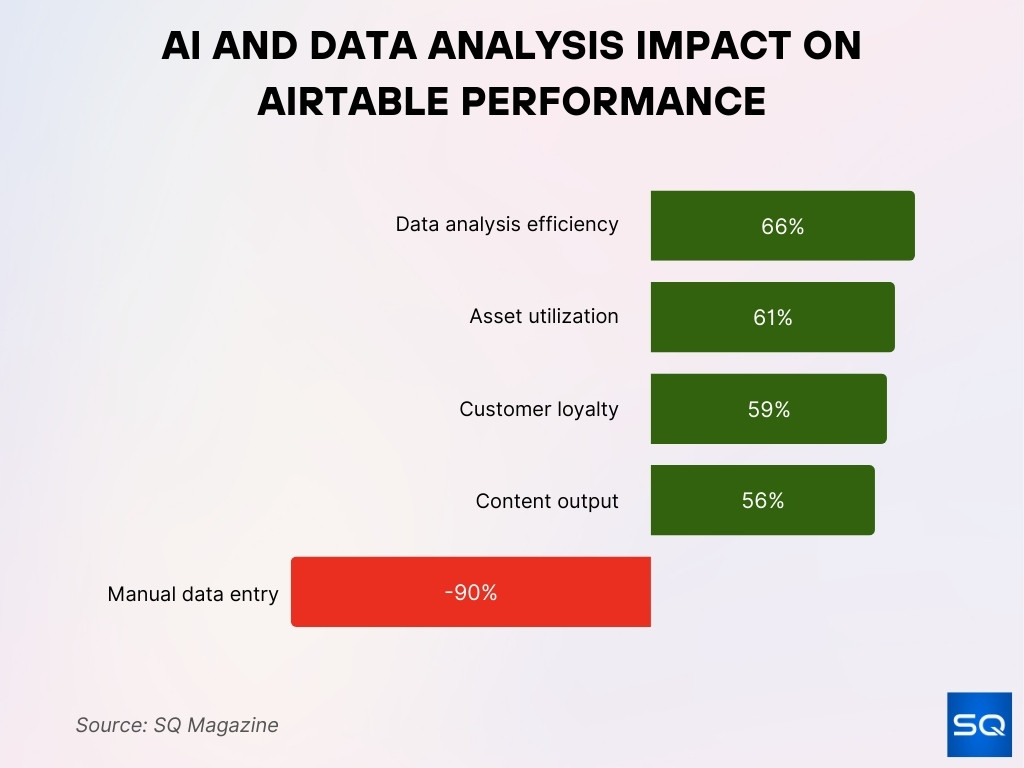

AI and Data Analysis Impact

- Embedding AI has reportedly improved productivity metrics by,

- 66% in data analysis efficiency.

- 61% in asset utilization.

- 59% in customer loyalty.

- 56% increase in content output.

- Users also report,

- 90% drop in manual data entry.

- Savings of around $2.6 million in operations.

- Campaign launch speeds accelerated by 3.4×.

- Adoption of AI tools like Omni, Cobuilder, and AI agents has reshaped how users build and manage apps.

Airtable vs. Competing Platforms

- 65% of all application development activity will be driven by low-code platforms, including tools like Airtable, Webflow, and Bubble.

- By 2025, 75% of large enterprises will be using at least four low-code development tools to accelerate innovation and scale automation.

- By 2025, 70% of new enterprise apps will be developed using low-code or no-code technologies due to increasing demand for rapid development and citizen programming.

- By 2026, 80% of low-code platform users will come from business units outside of formal IT departments, underscoring the rise of citizen developers.

- Low-code/no-code market reached $26.9 billion in 2023, with projections to surpass $65 billion by 2027.

- Airtable differentiates itself as a spreadsheet-database hybrid, while competitors like Monday.com and Bubble focus on visual workflows or full-stack app building.

- Its AI-native features, like Omni and AI agents, set it ahead in conversational app building compared to platforms relying more on manual design.

Adoption Patterns & Use Cases

- Airtable’s flexibility allows teams in marketing, operations, education, and healthcare to build tailored workflows, bridging data and automation needs.

- Low-code platforms like Airtable can enable app prototyping significantly faster than traditional methods, though ‘10× faster’ is an anecdotal estimate and not formally verified.

- Over 85% of enterprise developers anticipate incorporating low-code tools into their workflow by 2025.

- 88% of organizations report running at least one low-code or no-code project, reflecting broad adoption across industries.

- Adoption thrives in industries like e-commerce, CRM, HR, supply chain, and customer service, all areas suited to Airtable’s relational approach.

- 41% of companies currently support citizen development initiatives, with another 21% planning to launch such programs within the next 12–18 months.

- Use cases vary widely, from creative project tracking to vaccine logistics and film production planning, demonstrating Airtable’s real-world versatility.

Integration and Customization Statistics

- Airtable integrates with over 9 popular tools in 2025, including Slack, Jira, Salesforce, Mailchimp, Snowflake, BigQuery, Zendesk, and Google Drive, among them.

- These integrations allow real-time messaging, data sync, ticket automation, and marketing workflows, all without code.

- The platform supports building apps using natural language via Omni, plus deploying thousands of AI Field Agents for scalable task automation.

- Airtable can handle massive data scales, up to 100 million records per table, enabling enterprise-grade deployment.

- Custom Interfaces and Portals let teams build external collaboration points for guest users, enhancing flexibility and access.

- Automation capabilities help users replace manual workflows with AI-infused processes, streamlining operations significantly.

- Governance features (audit logs, security, and interface control) enable customization that meets enterprise needs.

Enterprise Trends and Expansion

- By 2025, 75% of large enterprises will deploy four or more low-code tools, demonstrating deep integration of platforms like Airtable.

- Low-code platforms are increasingly playing roles in digital transformation across sectors like healthcare, finance, energy, and manufacturing.

- Airtable builds on this with features such as SSO/SAML, enterprise API, HyperDB, governance tools, and AI-driven agents to support complex deployment.

- The rise of citizen development and hybrid deployment models positions Airtable as a flexible solution in enterprise ecosystems.

- With growing enterprise adoption and embedded AI features, Airtable is emerging as a strong contender in the enterprise automation space, particularly among no-code platforms.

Competitive Position in No‑Code/Low‑Code Market

- The low-code/no-code market is rapidly expanding, from $14 billion with ~20% growth to an expected $65 billion by 2027.

- Airtable positions itself strongly by combining AI, relational data, and scalability in one platform, appealing to both technical and non-technical users.

- It offers conversational app building, deep integrations, and enterprise governance, surpassing many rivals in balance and adoption.

- By 2026, 80% of low-code users will be beyond IT, aligning with Airtable’s democratizing mission.

- Analyst views post-IPO see Airtable accelerating innovation in AI, analytics, and consolidation while establishing its market leadership.

- As brand recognition grows, Airtable benefits from a virtuous cycle of adoption, partner ecosystem expansion, and feature development, reinforcing its competitive edge.

Future Outlook & Market Potential

- By 2025, 50% of all new applications will be built with low-code or no-code tools.

- The global low-code market is forecast to grow from $45.5 billion in 2025 to $187 billion by 2030, with a ~30% CAGR for SMEs.

- AI-enhanced low-code tools could contribute tens of billions in enterprise productivity gains by 2030, although specific estimates like $50B vary by model.

- By 2029, a significant majority of business applications, potentially up to 80%, will be built using low-code platforms augmented by AI capabilities.”

- By 2026, low-code tools will be used to develop about 70% of all new business applications.

- Continued growth in cloud deployment, AI integration, and citizen development positions platforms like Airtable at the heart of next-gen enterprise tooling.

- With momentum in automation, scalability, and industry-specific use cases, Airtable is well-positioned to capture a leading share of the evolving market.

Conclusion

Airtable’s snapshot shows a platform that marries scalability, AI integration, and intuitive design to dominate enterprise workflow automation. With adoption surging across industries and the low-code/no-code market expected to balloon in the coming years, Airtable stands out, not just for its features, but for enabling transformation where speed, collaboration, and efficiency matter most. Explore the full article to unlock deeper insights and chart how Airtable might reshape your team’s future.