Sony Bank is preparing to launch a U.S. dollar-pegged stablecoin aimed at powering payments for video games and anime content as early as 2026.

Quick Summary – TLDR:

- Sony Bank plans to launch a USD-backed stablecoin in the U.S. by fiscal 2026.

- The stablecoin will be used to pay for PlayStation Store and Crunchyroll content.

- Sony has applied for a U.S. banking license and partnered with Bastion for infrastructure.

- The move could reduce card transaction fees and expand Sony’s Web3 presence.

What Happened?

Sony Bank, a unit of Sony Financial Group, plans to launch a USD-denominated stablecoin in the U.S. before the end of fiscal 2026. The stablecoin is designed for use in purchasing games, anime, subscriptions, and other digital content across Sony’s vast entertainment ecosystem, including PlayStation Store and Crunchyroll, the world’s largest anime streaming service.

NEWS: Sony Bank is set to issue a USD-pegged stablecoin for games and anime. pic.twitter.com/wENaNE6zNm

— CoinGecko (@coingecko) December 1, 2025

Sony’s Stablecoin Vision for the U.S.

Sony Bank is setting its sights on the fast-growing U.S. stablecoin market with a token designed to support its media empire. In October, the company applied for a U.S. banking license, laying the groundwork for a trust bank that will issue and manage reserve assets for the upcoming coin.

The stablecoin will be pegged to the U.S. dollar and primarily targeted at American users of Sony’s services. Sony aims to replace or supplement credit card transactions, which currently dominate payment options on platforms like PlayStation and Crunchyroll.

Key benefits Sony is targeting include:

- Lower card processing fees.

- Streamlined cross-border payments.

- Enhanced control of payment flows within Sony’s ecosystem.

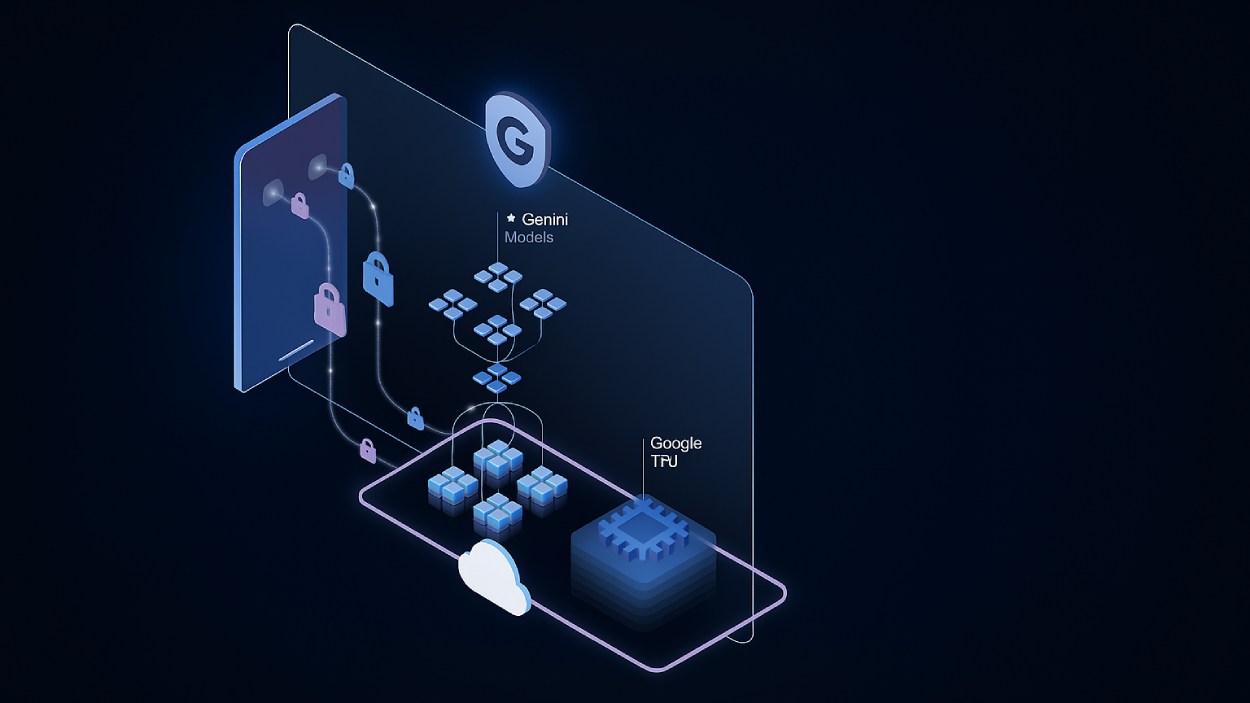

Partnering With Bastion and Building Infrastructure

Sony Bank has formed a strategic partnership with Bastion, a U.S.-based stablecoin infrastructure provider. Bastion offers a white-label stablecoin-as-a-service platform, allowing companies like Sony to issue branded digital tokens.

Sony had previously invested in Bastion through its venture capital arm and will now use the startup’s infrastructure to roll out the stablecoin. This partnership enables Sony to focus on user-facing features while Bastion handles compliance, issuance, and blockchain integration.

Ethereum Layer 2 Could Power Transactions

Though technical details remain limited, Sony has already launched its own Ethereum Layer 2 network called Soneium, which could serve as the settlement layer for the stablecoin. Soneium was created by Sony Block Solutions Labs to support content creators, fans, and communities through a blockchain-powered ecosystem.

The integration of this technology could allow Sony to introduce:

- Fast, low-cost transactions.

- Built-in loyalty rewards or digital incentives.

- Faster payouts for third-party developers on PlayStation Store.

Why This Matters for Sony?

The U.S. is Sony’s largest market, accounting for over 30 percent of the group’s external sales last fiscal year. Launching a stablecoin in this region aligns with both financial opportunity and regulatory readiness, as the U.S. recently passed the GENIUS Act, creating a framework for the legal use and issuance of dollar-backed stablecoins.

Meanwhile, Japan is also building momentum in the stablecoin space, with recent approvals for yen-backed digital assets. But for Sony, the focus now is on leveraging USD-based blockchain solutions to reshape how users pay for and interact with digital content.

SQ Magazine Takeaway

Honestly, I think this is a smart move from Sony. Owning a stablecoin gives them a real edge. It’s not just about cutting out middlemen like Visa or Mastercard, but also about owning the full payment pipeline. Imagine earning loyalty rewards in stablecoins just for watching anime or buying new PlayStation titles. That kind of ecosystem lock-in is powerful. Plus, with their Ethereum Layer 2 already live, Sony isn’t just dabbling in Web3, they’re building the rails. This could be a game changer for content payments.