YouTube Shorts and TikTok have become two of the most influential short-form video platforms in the world, shaping how users consume, share, and engage with content. From brand marketing to influencer careers, these platforms have redefined the digital media landscape, fueling trends, viral moments, and new monetization opportunities. Whether it’s TikTok driving cultural trends or YouTube Shorts converting swipes into long-form viewing, each platform brings unique strengths. This article dives deep into their 2025 usage statistics to give you a clear picture of where they stand.

Editor’s Choice

- YouTube Shorts received 90 billion views daily in 2025.

- TikTok has a global adult ad reach of 1.94 billion as of July 2025.

- YouTube holds 12.8% of U.S. TV viewing share, the highest of any platform.

- TikTok users spend an average of 58 minutes and 24 seconds daily on the app.

- YouTube Shorts creators share 45% of revenue after music licensing costs.

- TikTok’s Creator Rewards program emphasizes originality and watch time for payouts.

- Global social media users reached 5.41 billion in July 2025.

Recent Developments

- In July 2025, YouTube retired its Trending page, replacing it with personalized Explore and category-specific charts.

- TikTok expanded its Creator Rewards program to reward originality, watch time, and search-driven value.

- YouTube Shorts’ length was increased to 3 minutes in October 2024.

- TikTok introduced AI creative tools called TikTok Symphony for advertisers.

- Streaming surpassed broadcast and cable combined in May 2025 in the U.S., with YouTube benefiting from CTV growth.

- TikTok continued expanding TikTok Shop with integrated commerce features in 2025.

- YouTube’s TV share reached 12.8% in June 2025, setting new records.

- TikTok’s U.S. adult ad reach hit 49.6% in early 2025.

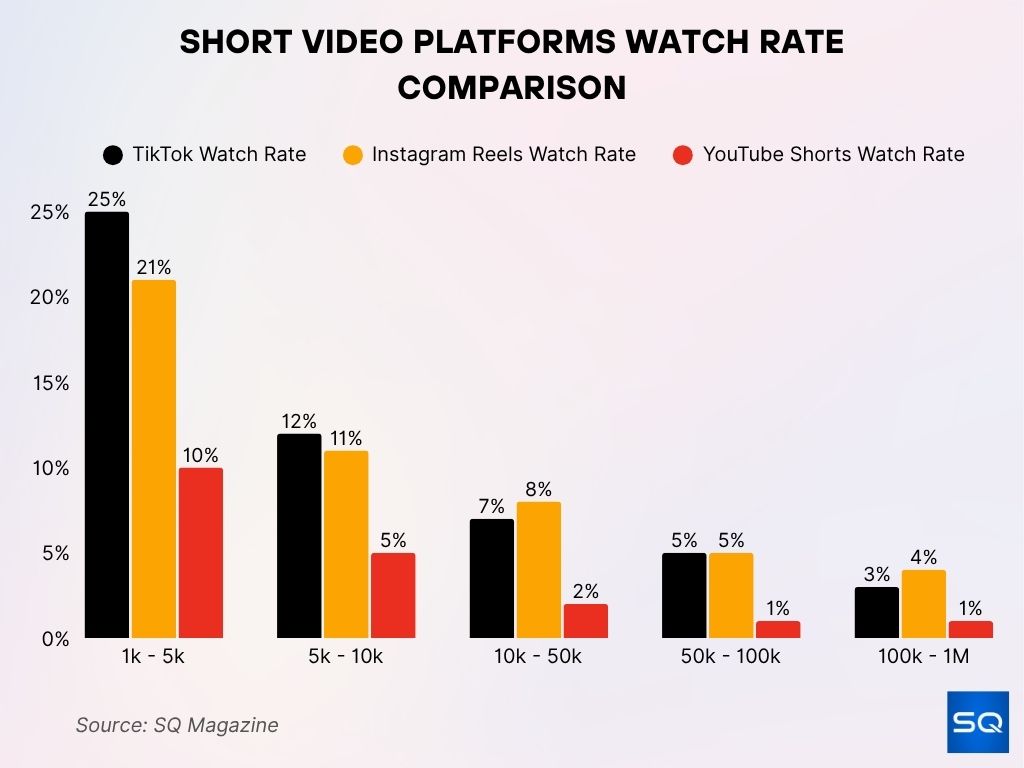

Short Video Platforms Watch Rate Comparison

- TikTok holds the highest watch rate across all follower ranges, peaking at 25% for creators with 1k–5k followers.

- Instagram Reels ranks second, with a 21% watch rate in the 1k–5k followers category, slightly behind TikTok.

- YouTube Shorts lags significantly, achieving only a 10% watch rate for 1k–5k followers.

- In the 5k–10k range, TikTok maintains an edge at 12%, followed by Instagram Reels at 11%, and YouTube Shorts at 5%.

- For 10k–50k followers, Instagram Reels (8%) slightly surpasses TikTok (7%), while YouTube Shorts remains low at 2%.

- In larger accounts (50k–100k), TikTok and Instagram Reels tie at 5%, with YouTube Shorts at 1%.

- Among top-tier creators (100k–1M), Instagram Reels leads slightly at 4%, TikTok follows at 3%, and YouTube Shorts holds 1%.

Global User Base Statistics

- YouTube Shorts is available in over 100 countries and more than 70 languages.

- TikTok is accessible in more than 150 countries.

- TikTok reached 1.59 billion monthly active users globally in 2025.

- YouTube has over 2.7 billion monthly active users, including Shorts and long-form content.

- TikTok penetration exceeds 80% of adults in specific markets such as Saudi Arabia (94.2%) and the United Arab Emirates (90.1%) as of July 2025.

- YouTube Shorts integration into the main YouTube app gives it cross-format visibility.

- TikTok’s audience is heavily skewed toward Gen Z and Millennials.

- YouTube’s global reach extends across mobile, desktop, and connected TV.

Monthly Active Users

- TikTok’s monthly active users reached 1.59 billion globally in 2025.

- YouTube has 2.7 billion monthly active users across formats.

- TikTok’s MAU growth slowed slightly compared to its early pandemic surge.

- YouTube continues steady year-over-year MAU growth.

- TikTok maintains dominance in Southeast Asia and emerging markets.

- YouTube leads in North America and Europe for total audience size.

- MAUs on both platforms show high daily usage rates.

- TikTok’s MAUs support its position as a leading ad platform.

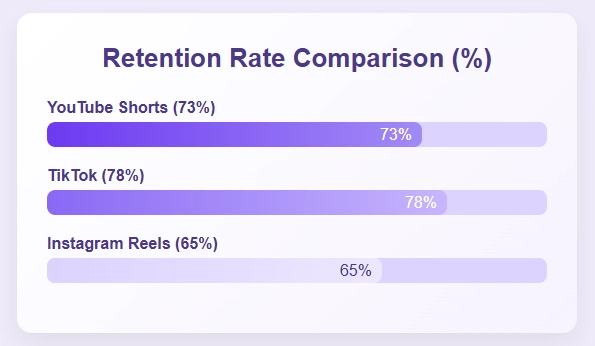

Retention Rate Comparison for Short-Form Video Platforms

- TikTok leads with the highest retention rate at 78%, showing strong audience engagement.

- YouTube Shorts follows closely with a 73% retention rate, indicating competitive viewer hold.

- Instagram Reels ranks third with a 65% retention rate, trailing behind both TikTok and YouTube Shorts.

Daily Active Users

- TikTok has between 875 million and 954 million daily active users.

- TikTok’s DAUs are approximately 55–60% of its MAUs.

- YouTube Shorts sessions average 14 minutes per user per day.

- Many YouTube users consume both Shorts and long-form videos daily.

- TikTok DAUs watch dozens of videos in each session.

- YouTube DAU engagement is supported by its recommendation system.

- TikTok DAUs are highly responsive to trends and viral challenges.

- YouTube DAUs often engage across multiple content formats.

Geographic Distribution of Users

- TikTok is most popular in Southeast Asia, the Middle East, and parts of Eastern Europe.

- YouTube dominates in North America, Western Europe, and parts of Latin America.

- TikTok penetration exceeds 80% of adults in certain markets, such as Saudi Arabia (94.2%) and the United Arab Emirates (90.1%).

- YouTube maintains a near-universal reach in developed countries.

- TikTok’s growth in Africa is accelerating due to increased mobile adoption.

- YouTube benefits from broad device compatibility across regions.

- TikTok’s regional restrictions affect its user base in some countries.

- YouTube Shorts is accessible wherever YouTube is available.

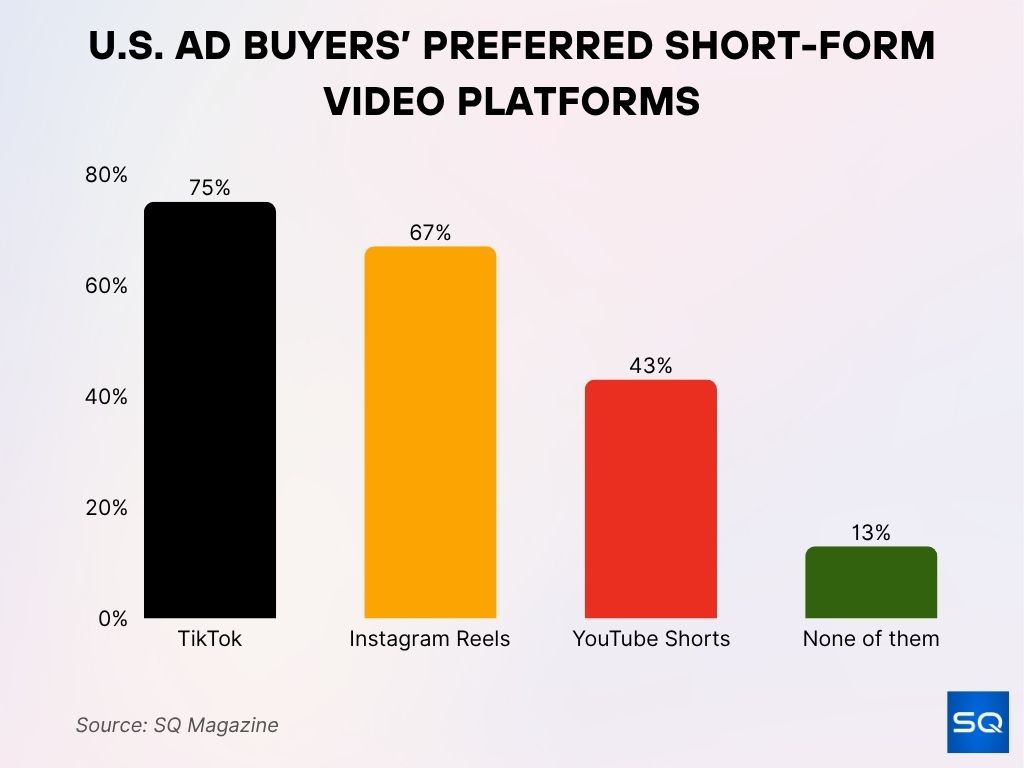

U.S. Ad Buyers’ Preferred Short-Form Video Platforms

- TikTok leads as the top choice for advertisers, with 75% of U.S. ad buyers placing client campaigns on the platform.

- Instagram Reels follows closely, used by 67% of ad buyers for their largest clients.

- YouTube Shorts is gaining traction, with 43% of ad buyers leveraging it for advertising campaigns.

- 13% of ad buyers report that their largest clients are not advertising on any of these short-form video platforms.

Gender Demographics

- YouTube Shorts viewers are approximately 54–58% male and 42–46% female in 2025.

- On TikTok, global users include 41% aged 16–24, with 90% of them using the app daily.

- In the U.S., TikTok boasts 117.9 million MAUs, roughly 32.9% of the population, showing wide demographic penetration.

- Overall, TikTok MAUs indicate a global mix of genders, with 70% of users falling between 18 and 34 years old.

- Shorts maintain a strong male engagement advantage, while TikTok’s younger skew suggests more balanced gender engagement across Gen Z and Millennials.

Average Watch Time per User

- Users spend, on average, about 58 minutes and 24 seconds per day on TikTok in 2025.

- YouTube overall sees an average daily watch time of 1 billion hours.

- Shorts sessions average about 14 minutes, during which viewers watch 12–18 Shorts.

- TikTok’s high session time links to its 875 million to 954 million estimated DAUs.

- Short-form videos retain 41–80% of watch length across platforms, with 30% exceeding 81% completion.

Content Upload Volume

- YouTube Shorts sees over 12 million uploads per day in 2025.

- The total number of Shorts videos on YouTube is estimated at 910 million.

- TikTok’s upload volume is significant but not publicly quantified.

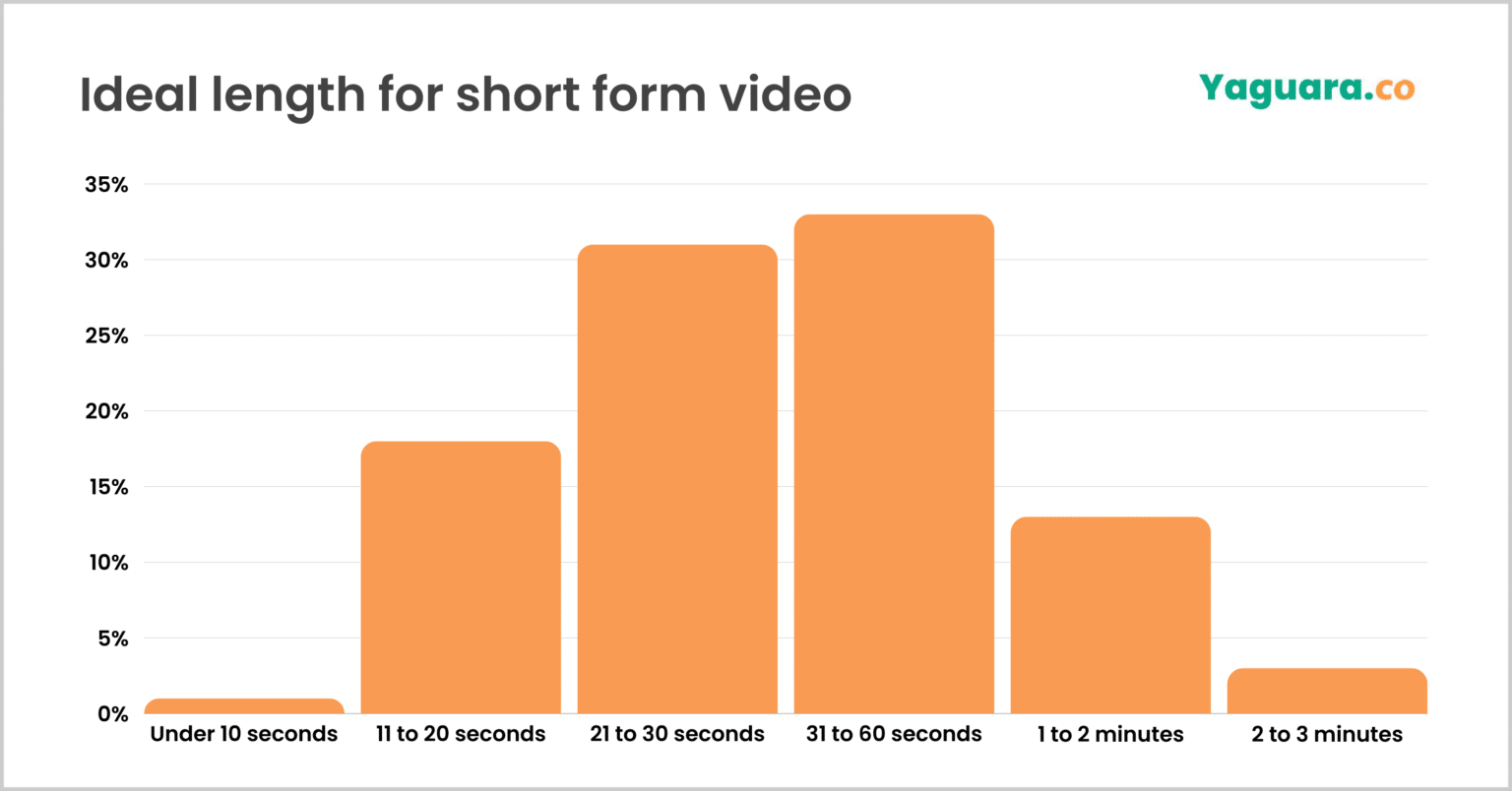

Ideal Length for Short-Form Videos

- 31 to 60 seconds is the most preferred, chosen by 33% of marketers.

- 21 to 30 seconds follows closely with 31%, making these two ranges dominant for short-form content.

- 11 to 20 seconds is favored by 18% of marketers, ideal for quick, impactful messaging.

- Longer formats like 1 to 2 minutes attract 13% preference, while 2 to 3 minutes drop sharply to 3%.

- Extremely short videos under 10 seconds have the lowest adoption at just 1%.

Most Popular Content Categories

- Entertainment accounts for 17% of Shorts views, leading all categories in popularity.

- YouTube Shorts content length ranges from 20 to 40 seconds, with top performers in the 50–60 second range hitting over 4.1 million views.

- Across short-form video broadly: 48.2% in South Korea favor humor/gag content, 39.1% lean to entertainment, 27% choose pet videos, 23.5% watch food content, and 22.1% prefer celebrity themes.

Revenue and Monetization Statistics

- YouTube ad revenue reached ~$9.8 billion in Q2 2025, up ~13% year over year.

- Alphabet said all of YouTube’s ad business grew double-digits in Q1 2025.

- Independent read-outs peg YouTube Ads at ~$9.8 billion for Q2 2025.

- Shorts revenue share: creators receive a share from a pool (45% after music licensing).

- YouTube’s broader services revenue hit $82.5 billion in Q2 2025.

- TikTok’s Creator Rewards pays based on originality, watch time, search value, and audience engagement.

- Reports indicate ByteDance revenue surpassed $110 billion in 2024.

- Nielsen confirms YouTube as the No. 1 streaming “media distributor” on U.S. TVs by share of viewing through mid-2025.

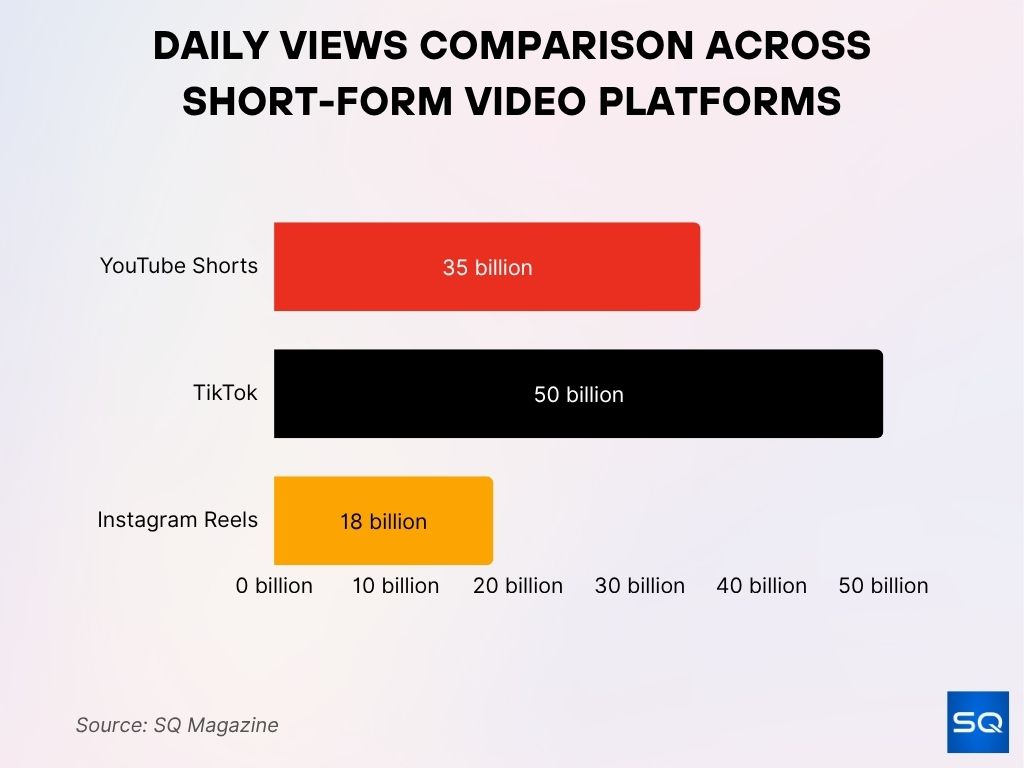

Daily Views Comparison Across Short-Form Video Platforms

- TikTok leads the pack with 50 billion daily views, showing its dominance in short-form content consumption.

- YouTube Shorts follows with an impressive 35 billion daily views, cementing its position as a strong competitor.

- Instagram Reels records 18 billion daily views, significantly lower than TikTok and YouTube Shorts.

Growth Trends Over Time

- YouTube Shorts scaled from tens of billions of daily views in 2022 and 2023 to continued growth into 2025, alongside YouTube’s overall viewing share on TV.

- YouTube ad growth stayed double-digit in Q1 and Q2 2025, signaling durable demand compared to 2023 and 2024.

- TikTok’s global ad reach rose to ~1.94 billion (18+ only) by July 2025, up from earlier 2025 snapshots.

- Quarter-to-quarter fluctuations in TikTok’s ad-planning reach, for example, 5.7% from Oct 2024 to Jan 2025, reflect measurement and eligibility shifts.

- YouTube’s TV share set platform highs through spring and summer 2025, such as 12.4% in April and 12.8% in June of total TV usage.

- Streaming overall hit a record 44.8% of U.S. TV usage in May 2025, surpassing broadcast and cable combined.

- Business of Apps estimates show YouTube 2024 revenue at ~$36.1 billion (+14.6% YoY), underscoring multi-year growth entering 2025.

- Creators’ income mix is shifting back toward YouTube for payouts in 2024, with surveys showing YouTube as the top income driver vs. TikTok for many creators.

Platform Algorithm and Discovery Features

- TikTok’s For You ranks videos using user interactions, content info such as sounds and hashtags, and user or device signals, with watch time weighted heavily.

- TikTok surfaces content across For You, Following, Friends, LIVE, Shop, and Search, each tuned to different weighted signals.

- YouTube recommendations rely on watch history for Home and current-video context for “Up Next,” with user controls to pause or reset history.

- YouTube explains Recommendation quality and user controls through Home, Watch Next, and Top or Breaking News shelves.

- Shorts ranking looks at view choice rate, average view duration, percentage viewed, and satisfaction signals such as likes, dislikes, and surveys.

- In July 2025, YouTube retired the Trending page in favor of Explore and category-specific charts, emphasizing personalized discovery.

- Algorithm transparency pages from both platforms highlight user controls to influence recommendations, such as Not Interested and history tools.

- Feature evolution: Shorts length expanded up to 3 minutes in Oct 2024, bringing formats closer to TikTok while keeping YouTube’s multi-format feed.

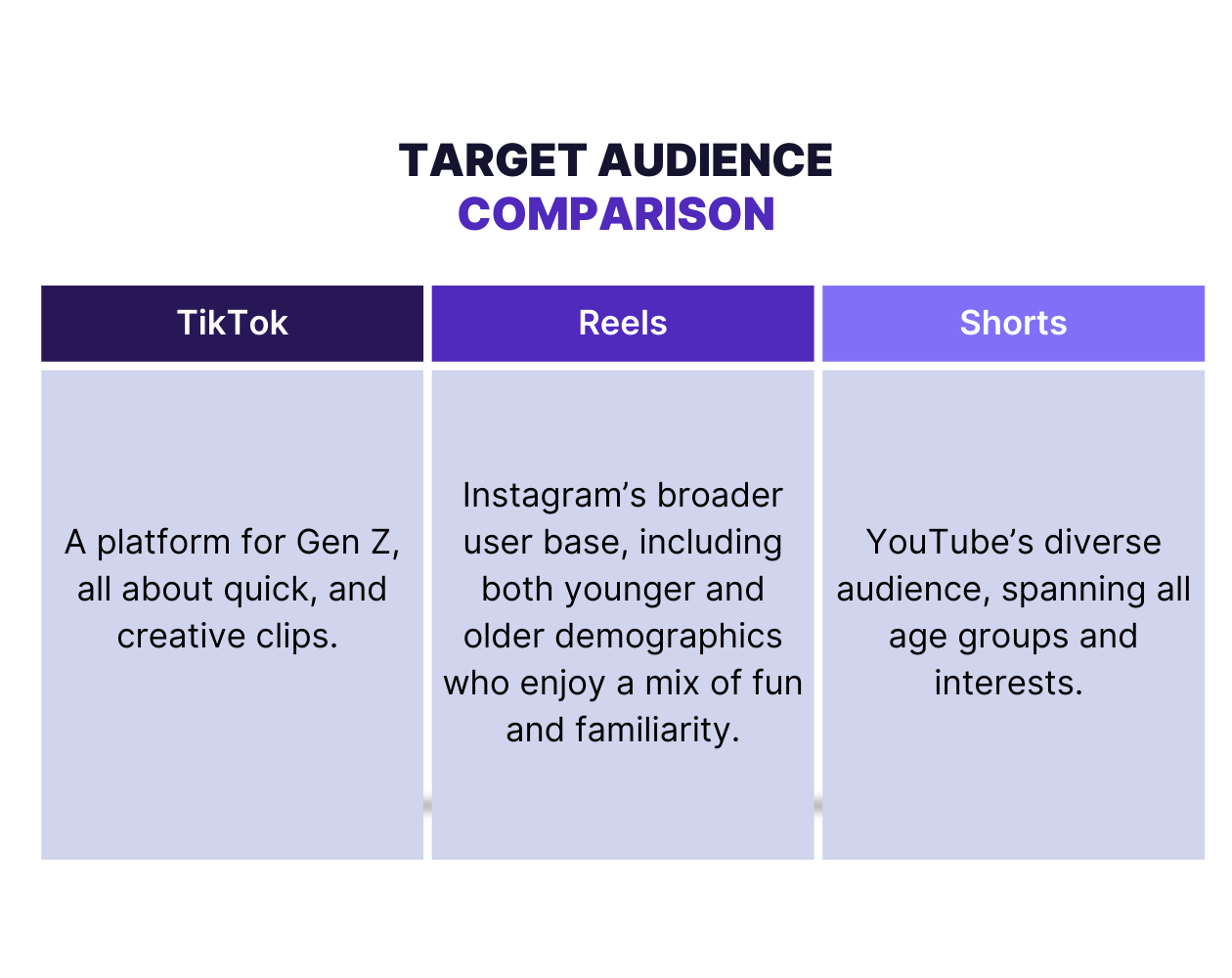

Target Audience Comparison for Short-Form Video Platforms

- TikTok primarily attracts Gen Z, focusing on quick and creative clips.

- Instagram Reels appeals to a broader audience, including both younger and older demographics who enjoy fun and familiarity.

- YouTube Shorts engages a diverse audience that spans all age groups and varied interests.

Influencer and Creator Adoption Rates

- YouTube’s monetization model through ads, memberships, Super Chat or Thanks, and Shopping remains a top income source, with a 2024 survey finding YouTube leading TikTok as the platform where creators “earn the most.”

- Linktree’s 2025 Creator Commerce update shows that many creators still struggle to monetize consistently, pushing them toward multi-platform strategies.

- Shorts revenue sharing at 45% after music licensing opened monetization to more creators beyond long-form thresholds, widening adoption among mid-tier channels.

- TikTok Creator Rewards prioritizes original, high-retention content, incentivizing adoption of longer, searchable videos.

- U.S. TikTok adult reach ~49.6% (18+) in early 2025 indicates sizable addressable creator audiences for partnerships.

- YouTube’s CTV leadership as No. 1 in share of TV viewing is drawing podcasters and long-form creators onto the platform.

- Brand and affiliate monetization remain critical, with a large share of creator income still coming from sponsorships, and YouTube and TikTok acting as lead-gen funnels.

- TikTok’s U.S. monthly active users at approximately 118 million in 2025, while TikTok itself reported 170 million U.S. users in 2024.

Ad Reach and Advertising Performance

- TikTok global adult ad reach: ~1.94 billion in July 2025, representing 18+ users only.

- YouTube’s reach and time on CTV keep rising, with YouTube holding ~12.5–12.8% share of total U.S. TV viewing in May–June 2025, the highest of any platform.

- YouTube has been the most-watched streaming platform in the U.S. since Feb 2023, a point regularly highlighted at brand upfronts.

- YouTube ranks among the top adult-reach platforms globally, supporting cross-format buys that include Shorts.

- TikTok’s U.S. adult ad reach is ~136 million in early 2025, equal to ~49.6% of U.S. adults 18+.

- Streaming’s overall share hit 44.8% in May 2025, improving ad-supported reach opportunities on both platforms.

- Alphabet noted strong direct-response and brand demand on YouTube for Q2 2025, often correlating with higher fill on Shorts inventory.

- CTV ad view share with ads reached 73.6% of overall TV usage in Q2 2025, strengthening the case for YouTube on TV buys.

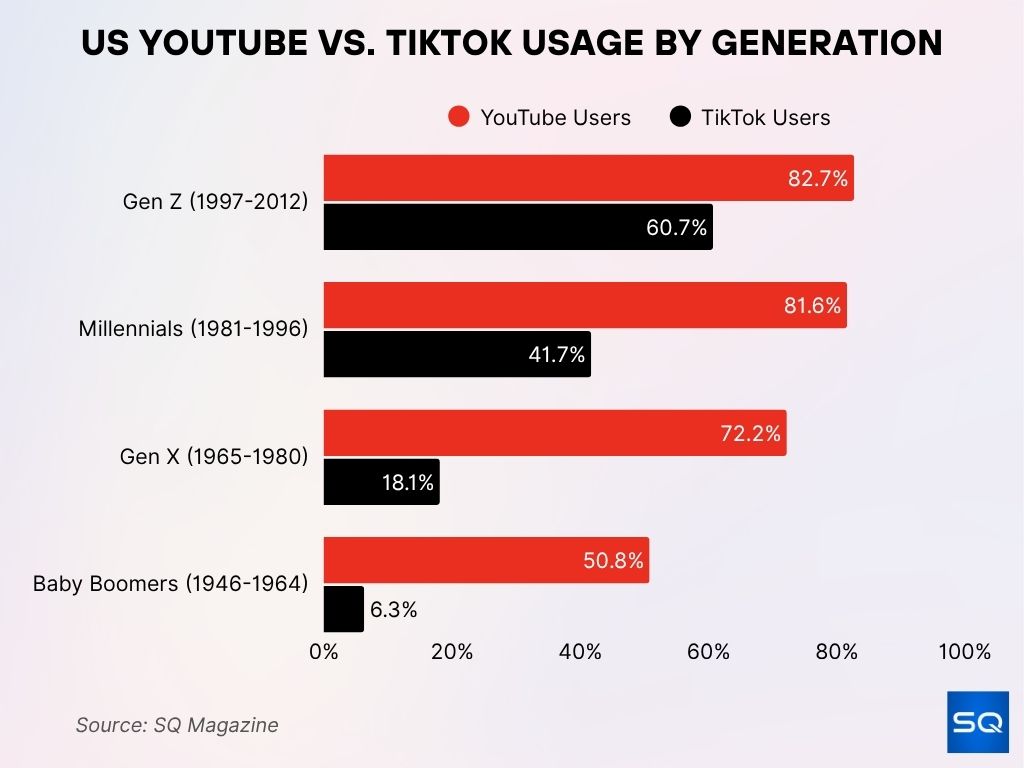

US YouTube vs. TikTok Usage by Generation

- Gen Z shows the highest engagement, with 82.7% using YouTube and 60.7% using TikTok.

- Millennials follow closely, with 81.6% on YouTube and 41.7% on TikTok.

- Gen X prefers YouTube (72.2%) far more than TikTok (18.1%).

- Baby Boomers have the lowest usage, with 50.8% on YouTube and just 6.3% on TikTok.

Regional Market Performance

- UK: Ofcom’s 2025 report shows YouTube is the second most-watched service overall behind the BBC and averages 39 minutes/day at home, with 20% of children 4–15 going to YouTube first on the TV set.

- UK children (8–14): YouTube reached 96% monthly, and YouTube plus Snapchat accounted for 52% of kids’ daily online time on monitored devices.

- Southeast Asia: TikTok Shop’s regulatory journey in markets such as Indonesia has shaped commerce-led viewing and creator incentives.

- United States: TikTok’s ~49.6% adult ad reach in early 2025 and YouTube’s No. 1 TV share define a duopoly in short-form reach.

- Eastern Europe and Caucasus: TikTok penetration can exceed 80% of adults in some markets.

- Global snapshot: 5.41 billion social users in July 2025 keep pushing short-video consumption higher.

- CTV context: Streaming surpassed linear in May 2025, solidifying YouTube’s regional CTV ad scale across the U.S.

- Platform access variations due to policy or legal issues can shift local reach, making it important for advertisers to check country-level ad eligibility.

Virality and Performance Benchmarks

- Shorts ranking signals emphasize view choice rate and average percentage watched, making hooks and retention critical.

- TikTok’s For You weighs watch time and interactions most heavily, with completion rate and replays correlating with scale.

- Short-form videos earn 2.5× more engagement than long-form on average.

- Creators gain ~16.9 subscribers per 10k Shorts views on average, underscoring Shorts as a subscriber funnel.

- Watch-time concentration on CTV helps longer Shorts, such as 60–90 seconds or 3 minutes, sustain attention on TV screens.

- Streaming with ads accounted for 73.6% of overall TV viewing in Q2 2025, expanding reach for short-form ad units on big screens.

- Global social growth of 241 million new users year over year to July 2025 raises baseline virality potential.

- YouTube’s share highs in April–June 2025 indicate more opportunities for Shorts discovery on TV.

Integration with Long-Form Content (YouTube Shorts Advantage)

- Shorts to long-form synergy: YouTube encourages using Shorts to reach new viewers, then converting to long-form watch time via channel shelves and end-screen CTAs.

- CTV growth benefits long-form follow-ups after Shorts exposure, with YouTube’s 12.4–12.8% TV share in Apr–Jun 2025 placing long videos one click away on TV.

- Search plus Shorts: creators can stack keyworded long-form with trend-aligned Shorts to occupy more shelf space.

- Shorts length expansion to 3 minutes allows for teasers, chapterized summaries, and “watch next” nudges to long-form.

- Subscriber funnel benchmarks at ~16.9 subs per 10k Shorts views show Shorts as a reliable seeding tool.

- Recommendation controls let creators reset audience training after a format pivot.

- News and Top-News shelves can showcase long-form credibility alongside Shorts.

- Streaming’s milestone in May 2025 suggests brands should pair Shorts with long-form in CTV-heavy campaigns.

Unique Features Impacting Usage

- TikTok Shop blends content and commerce, with Shop recommendations appearing in feeds and search.

- TikTok Symphony AI creative tools for ads lower production friction and lift throughput of testable ads.

- YouTube’s multi-format ecosystem across Shorts, long-form, Live, Podcasts, and TV drives compounding time-spent and ad diversity.

- Shorts editing tools such as remix, green screen, and cut, plus music licensing, enable easy trend participation.

- YouTube discontinued Trending in July 2025 to push personalized Explore and category charts.

- Creator Rewards on TikTok encourage searchable, original content, nudging behavior toward evergreen topics.

- CTV-first user growth on YouTube shifts discovery from mobile swipes to lean-back sessions.

- Shorts length up to 3 minutes enables deeper storytelling and shoppable sequences.

Conclusion

YouTube Shorts and TikTok now anchor two complementary, high-reach ecosystems. TikTok offers massive 18+ ad reach of about 1.94 billion and commerce-native features, while YouTube combines Shorts with long-form content and CTV dominance at 12% or more of U.S. TV viewing, creating a funnel from swipe to deep engagement that appeals to both brands and creators. For 2025 planning in the U.S., the practical playbook is clear: use TikTok for cultural velocity and in-feed shopping, then convert with YouTube’s multi-format and TV footprint.