XRP, the digital asset created by Ripple Labs, is gaining renewed momentum. Known for its ultra-fast settlement times and low transaction costs, XRP is being adopted across both retail and institutional use cases. From cross-border payments to institutional liquidity corridors, the network’s underlying infrastructure is enabling broader financial inclusion and enterprise-level adoption. This article dives deep into the latest XRP statistics, covering its market behavior, adoption trends, and on-chain activity. Let’s explore the numbers shaping XRP.

Editor’s Choice

- As of Q3 2025, XRP’s market cap peaked near ~$90–$120 billion. It remained a top 5 crypto.

- In Q1 2025, XRP outperformed BTC, ETH, and SOL with a market cap increase of 1.9%, while the others declined by ~22%.

- XRP Ledger processed an average of ~500,000 transactions per day in early 2025, a 12% increase year-over-year.

- Blockchain analytics suggest that wallets likely associated with institutions or custodians hold approximately 40–45% of XRP.

- XRP consumes nearly zero energy per transaction, positioning it as one of the most eco-friendly digital assets.

Recent Developments

- The SEC’s reclassification of XRP as a utility token in early 2025 removed a multi-year regulatory hurdle.

- The XRP Ledger introduced EVM-compatible sidechains, paving the way for DeFi and smart contract applications.

- Open-source contributions to the XRP Ledger GitHub and sidechains have grown, with some estimates suggesting 20–25% YoY growth; actual developer activity can be verified through GitHub analytics or Dev Report tools.

- Whale transactions on the XRP Ledger (over 1 million XRP) surged 14% compared to 2024.

- Daily trading volumes for XRP exceeded $6 billion in several instances during Q2 2025.

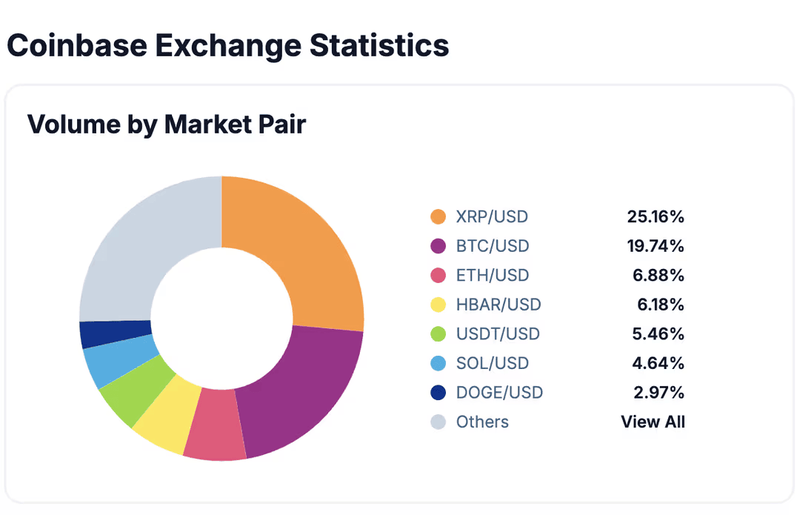

XRP Dominates Coinbase Trading Activity

- XRP/USD leads with 25.16% of total trading volume on Coinbase, signaling growing investor confidence and renewed enthusiasm for XRP.

- BTC/USD follows at 19.74%, making Bitcoin the second-most traded pair despite its broader market dominance.

- ETH/USD captures 6.88% of trading volume, highlighting Ethereum’s continued relevance but lagging performance compared to XRP and BTC.

- HBAR/USD secures 6.18%, reflecting rising trader interest in Hedera across U.S. markets.

- USDT/USD holds 5.46%, maintaining its position as a key liquidity provider within Coinbase.

- SOL/USD represents 4.64% of total trades, showing Solana’s sustained activity amid market volatility.

- DOGE/USD accounts for 2.97%, with Dogecoin’s consistent presence fueled by its community-driven momentum.

- Other pairs collectively make up the remaining share, including a range of altcoins that contribute to Coinbase’s diverse trading ecosystem.

Market Capitalization Trends

- XRP’s market capitalization was approximately $210 billion in mid-2025.

- This figure marked a year-to-date growth of ~19%, despite a broader crypto market correction.

- XRP consistently ranked #3 by total market cap, behind Bitcoin and Ethereum.

- XRP’s price remained relatively stable around $3.50 – $3.80 during Q2 2025.

- Circulating supply as of October 2025 is approximately 59.87 billion XRP.

- Total maximum supply remains capped at 100 billion XRP.

- XRP’s daily trading volume regularly crossed $5 – $6 billion, reflecting high liquidity.

- XRP’s share of the total crypto market cap hovered around 4.3 – 4.6%.

- Ripple’s escrow wallet still holds around 41 billion XRP, released on a monthly schedule.

- The highest weekly inflow into XRP in 2025 came post-ETF announcement, totaling $783 million in a single week.

Wallet Distribution and Holders Data

- There are now over 5.1 million XRP wallets, up from 4.3 million in 2024.

- Non-custodial wallets account for ~57% of all active XRP addresses.

- Top 10 XRP wallets control approximately 15% of the circulating supply.

- Institutional wallets hold around 43.4% of all XRP in circulation.

- Ripple’s own wallets (including escrow) control approximately 42% of the total supply.

- The number of wallets holding between 1,000 – 10,000 XRP rose by 11.2% in 2025.

- Daily active addresses peaked at over 110,000 during XRP ETF approval week.

- Wallets with over 1 million XRP have increased by ~14% YoY.

- XRP ownership distribution has become slightly more decentralized, according to ledger reports.

- Average XRP per wallet is now 11,736 XRP, down from 13,210 XRP in 2024, indicating a broader holder base.

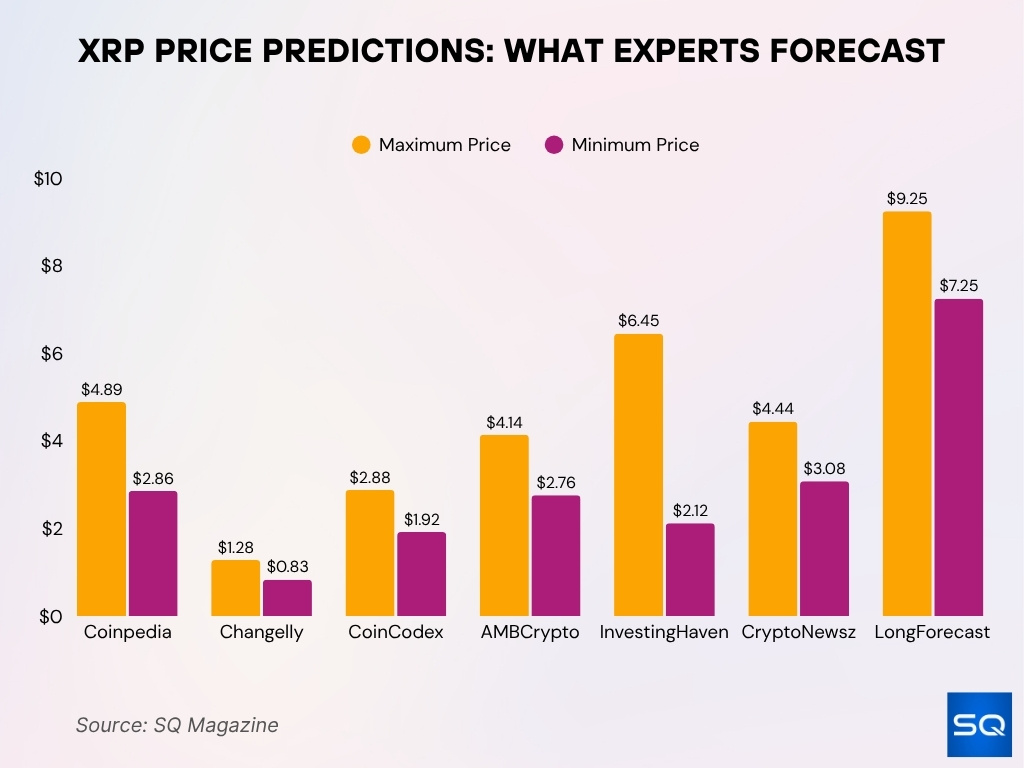

XRP Price Forecasts from Leading Analysts

- LongForecast gives the most bullish outlook, projecting that XRP could hit a high of $9.25 and a low of $7.25.

- Coinpedia estimates XRP will range between $2.86 and $4.89, reflecting a moderately optimistic stance.

- Changelly offers a conservative forecast, with a high of $1.28 and a low of $0.83.

- CoinCodex predicts a narrower band, expecting XRP to trade between $1.92 and $2.88.

- AMBCrypto sees potential growth to $4.14, with downside protection at $2.76.

- InvestingHaven targets an upper range of $6.45, with a base prediction of $2.12.

- CryptoNewsz anticipates XRP to move between $3.08 and $4.44, leaning slightly bullish.

On‑Chain Activity and Transaction Metrics

- Daily transaction count on the XRP Ledger in 2025 has averaged ~450,000 to 500,000 transactions per day, up ~12% vs. 2024.

- In Q1 2025, XRP saw a 142% increase in daily active addresses versus the prior year.

- Average daily throughput (value of all transactions) exceeded $3 billion in several high-volume days during 2025.

- The median transaction size has remained relatively stable at around $1,200 to $1,500, indicating continued retail usage.

- Whale (large) transactions, transfers above 1 million XRP, have increased ~14% YoY.

- Non‑custodial wallet transactions account for about 57% of total on‑chain activity.

- On a given day in October 2025, a large transfer of 18,744,800 XRP (~$55.8 million) was moved to a Ripple‑associated address.

- XRPL’s EVM compatibility and sidechain activity show rising smart contract–style operations built over XRP.

XRP Adoption by Financial Institutions

- Institutional wallets now hold 43.4% of the circulating XRP supply.

- Top 100 institutional addresses control over $7 billion in XRP via custodian and ETF allocations.

- Ripple itself controls ~42% of XRP through escrow reserves.

- Major exchanges such as Binance, Bithumb, and Uphold each hold over 1.5 billion XRP in custody.

- Several banks, e.g., BBVA, Santander, have integrated or trialed Ripple’s On‑Demand Liquidity (ODL) using XRP corridors.

- Ripple’s acquisition of Hidden Road and the launch of XRPL EVM sidechain are aimed at appealing to institutional liquidity providers.

- The 2025 reclassification of XRP as a utility token in the U.S. by the SEC efforts enabled the first U.S. XRP ETFs, reportedly injecting $2 billion into the market.

- Some forecasts expect inflows of $5 – $8.4 billion of institutional capital from ETFs and regulatory clarity.

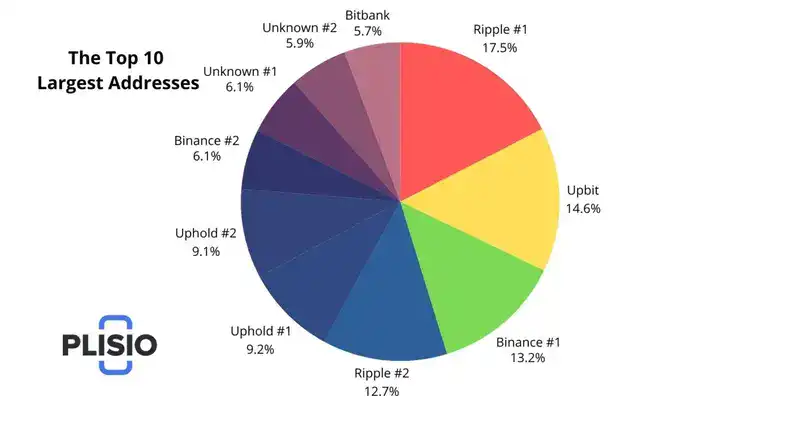

Largest XRP Holders: Breakdown of the Top 10 Wallets

- Ripple #1 leads with 17.5% of total XRP in the top 10, underscoring Ripple’s dominant on-chain control.

- Upbit ranks second with 14.6%, indicating strong custodial holdings for exchange users.

- Binance #1 holds 13.2%, showcasing the exchange’s large XRP exposure across addresses.

- Ripple #2 adds another 12.7%, bringing Ripple’s combined share to over 30%.

- Uphold #1 and Uphold #2 hold 9.2% and 9.1%, reflecting broad user activity on the platform.

- Binance #2 contributes an additional 6.1%, further reinforcing Binance’s multi-wallet XRP strategy.

- Unknown #1 and Unknown #2 control 6.1% and 5.9%, suggesting a significant anonymous whale presence.

- Bitbank holds 5.7%, confirming its role as a key XRP custodian in Japan.

XRP in Cross‑Border Payments

- Ripple claims that XRP could account for 14% of SWIFT’s cross‑border payments volume within five years.

- In 2025, Ripple’s ODL corridors will have processed $1.3 trillion in volume through institutional partners.

- The faster settlement times (3–5 seconds) and low fees (< $0.01 per transfer) help XRP appeal to remittance and payment providers.

- Compared with traditional rails, XRP-based transfers reduce capital lock-up costs because you don’t need pre-funded liquidity in destination currencies.

- Some use cases include cross‑border payroll, micro‑payments, remittance to underbanked regions, and instant settlement for FX trades.

- By mid‑2025, more than 20 new wallet integrations will support XRPL, increasing on‑ramps for cross-border payment providers.

- Non‑crypto companies exploring XRP payments include loyalty platforms and micropayment services, e.g., tipping, rewards.

- Because of regulatory clarity, traditional banks in Asia and Europe are increasingly open to pilot XRP corridors.

Regulatory Impact on XRP

- In 2025, the U.S. SEC moved to reclassify XRP as a utility token, clearing a major legal overhang.

- That shift has unlocked the first U.S. XRP ETF approvals, spawning an estimated $2 billion in new capital.

- Coins on regulated exchanges must comply with KYC/AML, increasing institutional confidence in XRP trading.

- Some jurisdictions still treat XRP as a security class (or regulation uncertain), creating fragmentation in adoption.

- The derivatives exchange CME is launching cash-settled XRP futures in May 2025, pending approval.

- Regulatory clarity in Asia & Europe, e.g., MiCA in the EU, is helping harmonize XRP’s status, reducing jurisdictional risk.

- Some analysts argue that regulatory pressure will push more stablecoin/CBDC alternatives as competition, so XRP’s road is not free.

- The perception of XRP as a “regulated digital asset” strengthens use among banks and institutional adopters.

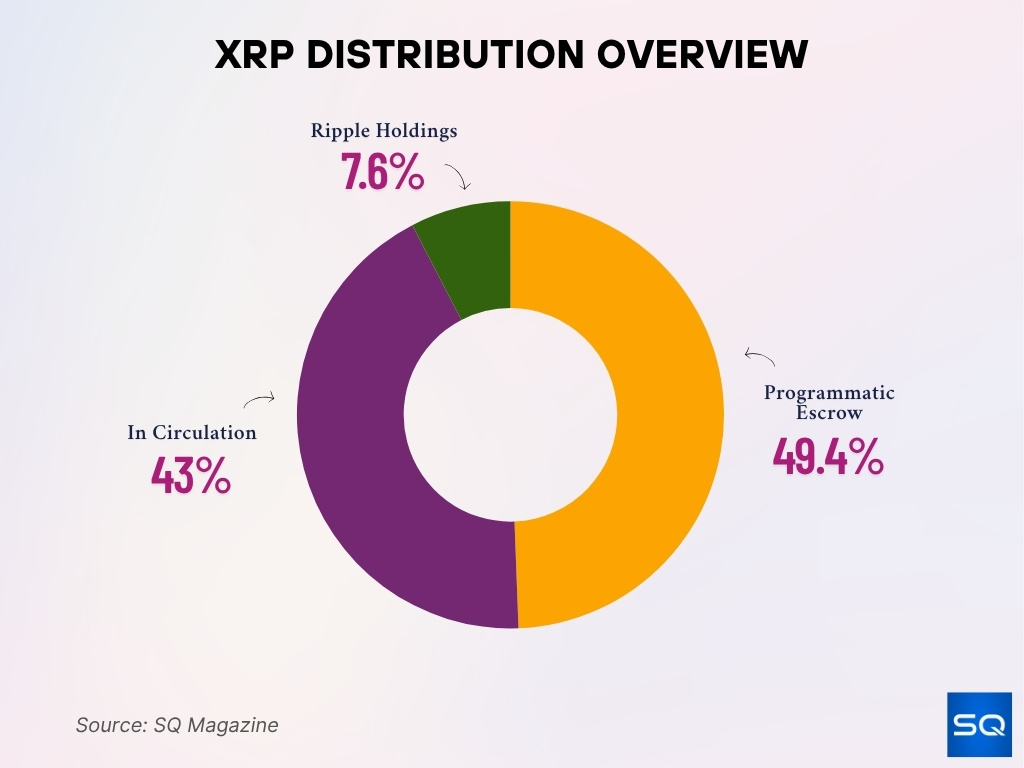

How XRP Is Distributed: Supply Breakdown

- 49.4 billion XRP (49.4% of total supply) is locked in Programmatic Escrow, ensuring predictable and controlled token release.

- 43.0 billion XRP (43.0%) is in active circulation, representing the tradable and accessible market supply.

- 7.6 billion XRP (7.6%) is held under Ripple Holdings, reserved for strategic and operational use by Ripple Labs.

Comparison with Other Major Cryptocurrencies

- In mid‑2025, XRP’s market cap neared $210 billion, ranking it third among cryptos by capitalization.

- On Slickcharts, XRP’s market share was ~4.35% of the total crypto market cap.

- Ethereum still commands more DeFi activity and smart contract volume than XRP.

- Bitcoin dominates the overall store-of-value narrative, while XRP competes more directly with payment‑oriented tokens, e.g., Stellar.

- XRP’s circulating supply (~59.87 billion) is far larger than BTC’s 21 million or ETH’s ~120 million, which affects price scaling.

- In Q1 2025, XRP outperformed the combined market cap change of BTC, ETH, and SOL, which dropped ~22%, with XRP growing 1.9%.

- Some projections expect XRP to hit $5.50 by the end of 2025, potentially overtaking ETH in market cap.

- XRP’s network growth metrics, active addresses, and transaction volume scale faster than some peers in this period.

Exchange Listings and Liquidity

- XRP is listed on nearly all major centralized exchanges, including Binance, Coinbase, Kraken, Bitstamp, and more.

- Its 24‑hour trading volume often exceeds $6 billion, up ~13.4% in some recent days.

- Volume-to-market-cap ratios suggest healthy liquidity with ~3.5% 24h turnover in some snapshots.

- In Bybit metrics, XRP had 59.83 billion in circulating supply, ranking #3 by market cap.

- Some mid‑tier exchanges and regional platforms added XRP pairs in 2025, improving accessibility in local markets.

- CME’s future contracts will further deepen derivatives liquidity around XRP.

- The presence of high‑frequency trading firms and market makers in XRP pairs supports tight spreads.

- Because of regulatory clarity and ETF introduction, institutional flow into XRP trading desks has increased modestly.

Environmental Impact and Energy Usage

- XRP’s consensus mechanism, Ripple’s consensus algorithm, or XRPL consensus, is energy-efficient and does not rely on proof-of-work.

- Estimates put the energy usage of XRPL per transaction in the millijoules or tens of joules range, far below proof-of-work chains.

- Compared to Bitcoin, which consumes gigajoules per block, XRP’s carbon footprint is negligible in relative terms.

- Because it does not require mining, there is no wasteful hardware arms race or mining farms.

- Its low energy profile has appealed to “green crypto” narratives adopted by ESG-conscious institutions.

- XRP’s architecture enables scaling without a proportionate increase in power usage, a key advantage for mass adoption.

- Some institutions promote XRP for payments, citing sustainability as a differentiator versus legacy systems.

- The minimal environmental cost strengthens arguments for XRP’s use in high-frequency micropayments and IoT contexts.

Community and Developer Engagement

- XRP Ledger has integrated over 20 new wallet solutions in 2025, enhancing the developer ecosystem’s reach.

- Developer contributions to XRPL open‑source repos and sidechains have grown ~25% YoY.

- Community events, hackathons, and grant programs in 2025 have drawn growing participation from fintech startups.

- XRP developers have focused on DeFi bridging, tokenization, and smart contract overlays via XRPL EVM.

- Social media and community forums report rising active participation, especially in Asia and Latin America.

- Developer toolkits, SDKs, and APIs have been expanded and better documented to ease onboarding.

- The community now hosts localized meetups in 50+ cities globally, focused on payments and blockchain use cases.

- Because of legal clarity, more third‑party projects are comfortable building on or around XRP infrastructure.

Frequently Asked Questions (FAQs)

Its market cap is approximately $186–$190 billion, with a circulating supply of about 59.87 billion XRP.

Ripple Labs holds around 42% of the total XRP supply via escrow and operational reserves.

Wallets with over 1 million XRP hold ~6.5% of the supply and have grown ~14% year‑on‑year.

XRP is up ~54% year‑to‑date in 2025, leading major cryptocurrencies in ROI so far.

Conclusion

XRP is no longer just a speculative asset; it is evolving into a payment infrastructure and institutional tool. On‑chain metrics, wallet growth, and high-volume moves suggest broadening use. The reclassification of XRP under U.S. regulatory frameworks and the rollout of ETFs mark structural shifts in adoption dynamics. While XRP still lags in smart contract capability versus ETH, its low‑energy model, robust liquidity, and developer momentum offer a different value proposition. As cross‑border payments and institutional use cases scale, XRP’s next phase may well test whether it transitions from crypto underdog to mainstream financial infrastructure.