In the early 2000s, Microsoft took a bold leap into the console market, challenging established giants like Sony and Nintendo. It was a risky move. But fast forward to 2025, and Xbox is not just a gaming console; it’s a sprawling digital ecosystem spanning subscriptions, cloud gaming, and global community engagement. Whether you’re an avid Xbox gamer or a curious investor, the numbers behind Xbox’s growth reveal a compelling narrative of innovation and adaptability.

In this article, we break down the most current Xbox statistics for 2025, diving into hardware sales, Game Pass subscriptions, Xbox Live users, and more. Let’s start with a snapshot of the biggest stats you need to know.

Editor’s Choice

- Xbox Series X and Series S have sold a combined total of over 33 million units globally since their launch in late 2020.

- Xbox Game Pass boasts over 37 million active subscribers as of Q1 2025, a 12% increase YoY.

- Xbox Live now has 130 million monthly active users, up from 120 million in 2024.

- In 2024, Microsoft reported that gaming revenue reached $18.1 billion, with Xbox accounting for nearly 40% of that.

- The top-selling Xbox title in 2024 was Call of Duty: Modern Warfare III, with 8.3 million copies sold on Xbox platforms alone.

- Cloud gaming hours streamed via Xbox Cloud Gaming doubled year-over-year to 1.2 billion hours in 2024.

- The United States remains Xbox’s strongest market, with 41% of all Xbox console sales originating from the US.

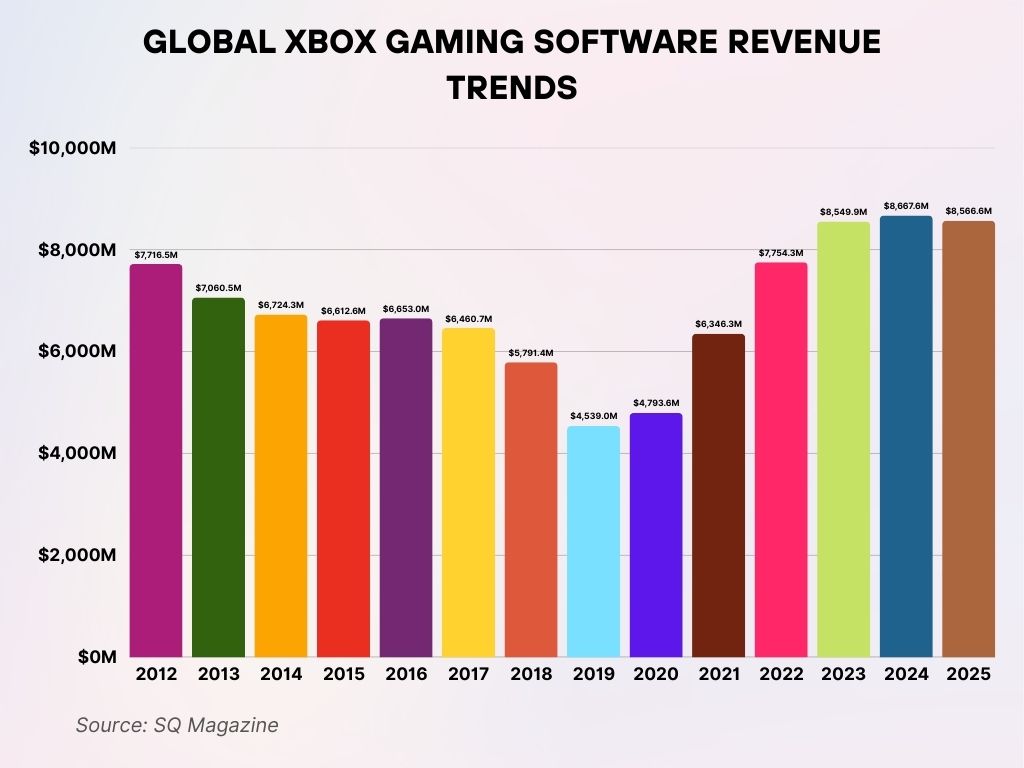

Global Xbox Gaming Software Revenue Trends

- In 2012, Xbox software revenue reached a high of $7.72 billion, marking one of its strongest years early on.

- Revenue slightly declined to $7.06 billion in 2013, continuing a downward trend over the next few years.

- By 2014 to 2016, revenue stabilized around $6.6 billion, showing consistent yet modest declines.

- In 2017, revenue fell further to $6.46 billion, and then to $5.79 billion in 2018, indicating a weakening market.

- A major drop occurred in 2019, when revenue hit $4.54 billion, the lowest point in the chart.

- A slight recovery followed in 2020 with $4.79 billion, and then a stronger rebound in 2021 with $6.35 billion.

- Xbox software revenue surged in 2022 to $7.75 billion, followed by an all-time peak of $8.67 billion projected for 2024.

- Forecasts for 2023 and 2025 estimate revenues of $8.55 billion and $8.57 billion, respectively, suggesting steady growth post-2021 recovery.

Xbox Console Sales Figures (All-Time and Recent)

- As of early 2025, total lifetime Xbox console sales have surpassed 175 million units globally across all generations.

- The Xbox Series X|S family sold 11.4 million units in 2024, compared to 9.8 million in 2023.

- Xbox 360, launched in 2005, remains the best-selling Xbox console to date with over 85 million units sold.

- Series X accounts for 62% of current-gen Xbox sales, while the more affordable Series S makes up 38%.

- In Japan, Xbox Series X|S sales crossed 500,000 units, marking a notable milestone in a traditionally PlayStation-dominated market.

- In 2024, Xbox captured 32% of the console market share in North America, up from 28% in 2023.

- Microsoft confirmed that Xbox console hardware sales revenue hit $5.2 billion in 2024, a 15% increase YoY.

- Despite a strong year, supply chain improvements in 2024 were credited with reducing out-of-stock instances by 65% compared to 2023.

- Xbox consoles sold in Latin America increased by 22% in 2024, led by strong performance in Brazil and Mexico.

- Refurbished and certified pre-owned Xbox Series consoles accounted for 8% of total Xbox sales in 2024.

Xbox Game Pass Subscriber Statistics

- Xbox Game Pass reached 37 million subscribers by Q1 2025, growing from 33 million in Q2 2024.

- Game Pass Ultimate subscribers represent 68% of the total user base, highlighting a shift toward premium plans.

- In 2024, subscribers played an average of 18 different titles per year, up from 15 in 2023.

- Game Pass users generate 34% higher engagement measured in hours played than non-subscribers.

- Microsoft added 78 new titles to Game Pass in 2024, including 23 day-one releases from Xbox Game Studios.

- Indie games on Game Pass saw a 74% increase in playtime, driven by spotlight campaigns and curated playlists.

- The most downloaded Game Pass title in 2024 was Starfield, with over 7 million downloads in the first six months.

- Mobile gaming through Game Pass (via xCloud) increased by 89% YoY, especially in India, South Korea, and Brazil.

- Family Game Pass plans, tested in select markets in 2024, had a 70% satisfaction rate among participating households.

- 71% of surveyed Game Pass users said the service influenced their decision to remain within the Xbox ecosystem.

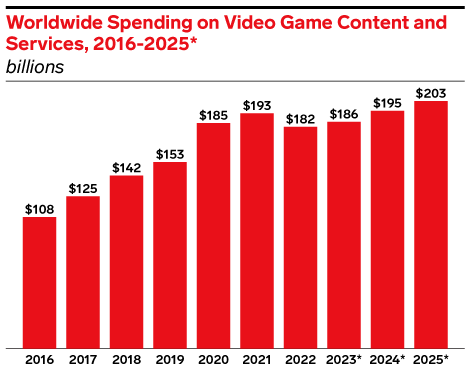

Global Video Game Content & Services Spending Trends (2016–2025)

- In 2016, global spending on video game content and services was $108 billion.

- Spending rose to $125 billion in 2017, reflecting a growing market.

- By 2018, it increased further to $142 billion, and hit $153 billion in 2019.

- A sharp surge occurred in 2020, reaching $185 billion, driven by pandemic-era gaming demand.

- The peak so far was in 2021, with spending at $193 billion globally.

- A slight dip occurred in 2022, down to $182 billion, possibly due to post-pandemic normalization.

- Spending recovered to $186 billion in 2023, with continued growth projected.

- Projections show $195 billion in 2024 and $203 billion in 2025, setting new industry records.

Revenue from Xbox Hardware and Services

- Xbox generated an estimated $18.1 billion in total gaming revenue for Microsoft in 2024, up from $16.2 billion in 2023.

- Hardware sales alone brought in $5.2 billion, while software and services revenue accounted for $12.9 billion.

- Xbox Game Pass contributed $4.7 billion in revenue in 2024, making it the largest recurring income source in the Xbox portfolio.

- In-game purchases and microtransactions across Xbox titles generated $3.2 billion, a 19% YoY increase.

- Revenue from first-party titles, such as Forza Motorsport and Starfield, totaled $1.9 billion in 2024.

- Subscription services, including Xbox Live Gold and Game Pass, now represent over 65% of Xbox’s total services revenue.

- Xbox’s accessory segment (controllers, headsets, etc.) earned $620 million, a 12% increase over 2023.

- Xbox reported a gross margin of 49.8% on digital services, compared to 21.5% on hardware.

- PC gaming revenue under Xbox (from titles like Age of Empires and Halo Infinite) rose to $1.6 billion, showing Microsoft’s push beyond consoles.

- Revenue from Xbox in emerging markets like Southeast Asia and Latin America grew by 27% year-over-year.

Most Played and Best-Selling Xbox Games

- Call of Duty: Modern Warfare III was the top-selling Xbox game in 2024, moving 8.3 million copies.

- Starfield became the most played Xbox Game Studios title, with over 13 million active players across console and PC.

- Minecraft remains Xbox’s most played game of all time, with over 166 million cumulative players on Xbox platforms.

- Fortnite continues to dominate free-to-play engagement, logging over 2 billion hours played on Xbox in 2024 alone.

- EA Sports FC 24 was the top-selling sports game, selling 5.4 million units on Xbox in its first six months.

- Forza Horizon 5 surpassed 25 million total players globally since its release, making it the most successful racing game in Xbox history.

- Xbox’s top 5 genres by engagement are shooter, action-adventure, racing, RPG, and sports.

- Hi-Fi Rush, a surprise release in 2024, crossed 4 million downloads, largely driven by Game Pass exposure.

- Indie game Cocoon was named the most critically acclaimed Xbox indie title, scoring a Metacritic average of 90+.

- Retro compatibility titles contributed to 12% of total play hours, showing consistent interest in Xbox’s legacy catalog.

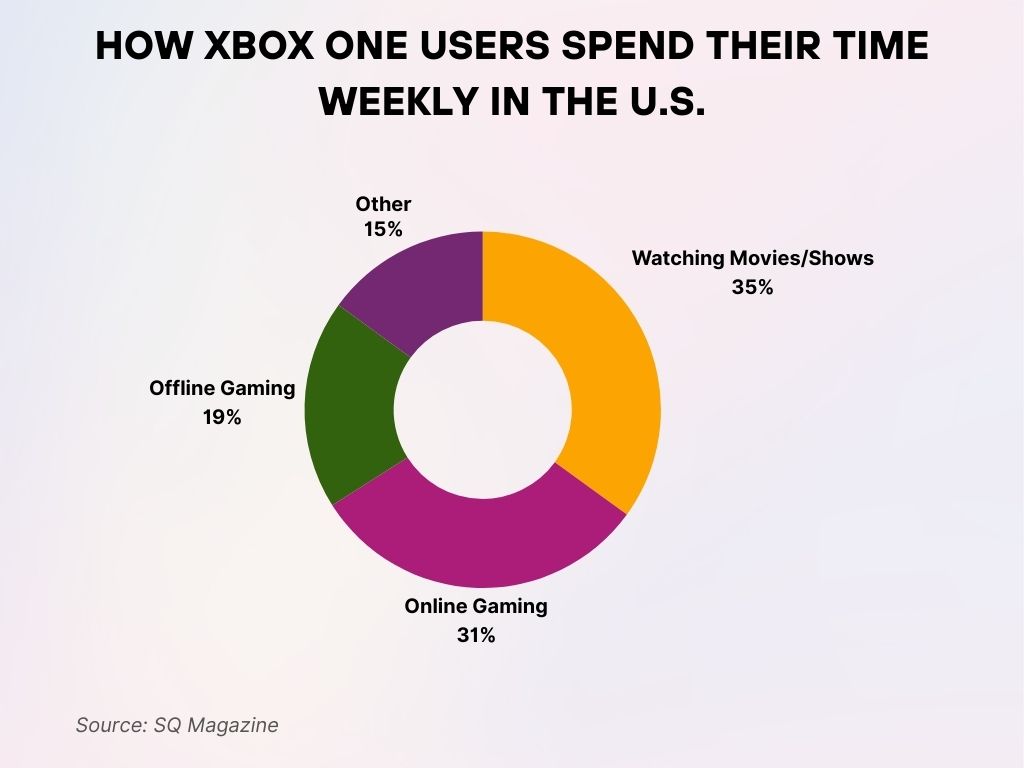

How Xbox One Users Spend Their Time Weekly in the U.S.

- Watching Movies/Shows takes the top spot with 35% of weekly console usage, highlighting Xbox One’s role as an entertainment hub.

- Online Gaming accounts for 31%, showing strong engagement in multiplayer and internet-connected gameplay.

- Offline Gaming makes up 19%, indicating a solid portion of users still enjoy single-player or non-connected experiences.

- Other activities, such as apps or browsing, represent 15% of usage, underscoring Xbox One’s broader functionality beyond gaming.

Xbox Cloud Gaming Usage Data

- Xbox Cloud Gaming (xCloud) users streamed over 1.2 billion hours in 2024, a 100% increase from 2023.

- The average cloud gamer plays for 63 minutes per session, most often via smartphones or tablets.

- Xbox Cloud Gaming is now available in over 40 countries, including recent expansions into South Africa, Colombia, and the Philippines.

- Over 85% of cloud gaming traffic comes from mobile devices, followed by web browsers and smart TVs.

- In 2024, 27% of all Game Pass titles were accessed via the cloud at least once per user.

- The top-streamed game via cloud was Halo Infinite, followed by FIFA 24, Starfield, and Fortnite.

- Xbox introduced cloud touch controls for over 120 titles, enhancing accessibility on touchscreen devices.

- In India, cloud gaming user growth spiked by 143%, driven by increased smartphone penetration and 5G access.

- Average download times for streamed titles improved by 38%, thanks to Microsoft’s Azure network enhancements.

- Xbox’s partnership with Samsung and LG brought native cloud gaming apps to 15 million smart TVs globally.

Xbox Player Demographics and Regional Breakdown

- In 2024, 71% of Xbox users were male, while 29% were female, with growing interest among female-identifying gamers YoY.

- The largest age group of Xbox players is 18–34 years old, representing 64% of the user base.

- The US accounts for 41% of Xbox console sales, followed by the UK (14%), Germany (9%), and Canada (7%).

- Xbox’s fastest-growing region is Southeast Asia, with a 31% YoY player increase, especially in Vietnam and the Philippines.

- Xbox users in the US spent an average of $492 annually on games, DLCs, and services in 2024.

- Spanish is the second most common language used on Xbox globally, after English.

- Xbox players in Latin America are 20% more likely to play free-to-play titles and invest in microtransactions.

- Xbox reports over 16 million users with accessibility preferences enabled, including text-to-speech and high-contrast modes.

- Game Pass Family Plan testing in Europe showed a 23% growth in household gaming sessions.

- Mobile-first Xbox players (cloud gamers who never log into a console) now represent 8% of the global Xbox user base.

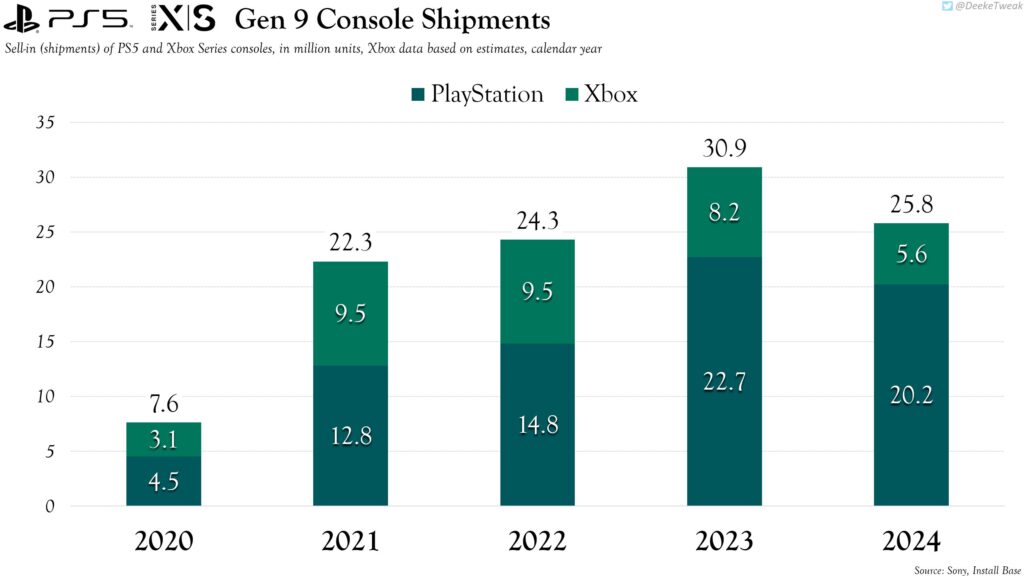

Gen 9 Console Shipments: PS5 vs Xbox Series (2020–2024)

- In 2020, PlayStation shipped 4.5 million units, while Xbox shipped 3.1 million, totaling 7.6 million units.

- In 2021, shipments surged to 22.3 million units, led by PlayStation with 12.8 million and Xbox with 9.5 million.

- 2022 saw modest growth with 24.3 million units shipped: 14.8 million PlayStation and 9.5 million Xbox units.

- 2023 marked a peak year, hitting 30.9 million total shipments, with 22.7 million from PlayStation and 8.2 million from Xbox.

- In 2024, shipments declined to 25.8 million units, driven by 20.2 million PlayStation consoles and only 5.6 million Xbox consoles.

Xbox Game Studios Development and Release Trends

- Xbox Game Studios released 11 first-party titles in 2024, including Avowed, Senua’s Saga: Hellblade II, and Towerborne.

- 85% of Xbox Game Studios titles in 2024 launched day one on Game Pass.

- Microsoft invested $3.5 billion in first-party game development in 2024, a 14% increase over the prior year.

- Obsidian Entertainment, part of Xbox Game Studios, reported that Avowed reached 3.8 million players within its first 60 days.

- 343 Industries confirmed a new Halo spin-off title is in development, with a release window in late 2025.

- Ninja Theory’s Hellblade II received Game of the Year nominations across 6 major gaming outlets.

- Double Fine Productions began development on two unannounced IPs, marking its most active development cycle since 2018.

- Xbox Game Studios currently has 23 titles in development, with 9 confirmed for release by mid-2025.

- Internal surveys show that 76% of players feel Xbox first-party titles improved in quality over the past 2 years.

- Cross-platform development grew, with 44% of new titles supporting Xbox, PC, and Steam Deck compatibility.

Xbox Market Share vs. PlayStation and Nintendo

- As of Q1 2025, Xbox holds a 31% share of the global console market, compared to 44% for PlayStation and 25% for Nintendo.

- In North America, Xbox’s market share increased to 35%, narrowing the gap with PlayStation’s 39%.

- Xbox leads in subscription services, with Game Pass’s 37 million subscribers compared to PlayStation Plus’s estimated 29 million.

- Xbox overtook PlayStation in PC gaming revenue, earning $1.6 billion versus PlayStation’s $1.2 billion in 2024.

- Xbox consoles outsold Nintendo Switch in the UK for the first time in over five years during Q4 2024.

- Xbox captured 60% of the cloud gaming market, with its competitors still in early rollout stages.

- Mobile-first engagement is higher on Xbox than rivals, accounting for 8% of its global user base.

- In Latin America, Xbox now holds a 38% market share, driven by tailored pricing models and regional content.

- Xbox outperforms Nintendo in total revenue per user, at $141 per user annually vs. Nintendo’s $106.

- Xbox’s average lifetime value per customer is estimated at $1,320, significantly higher than both Sony and Nintendo users.

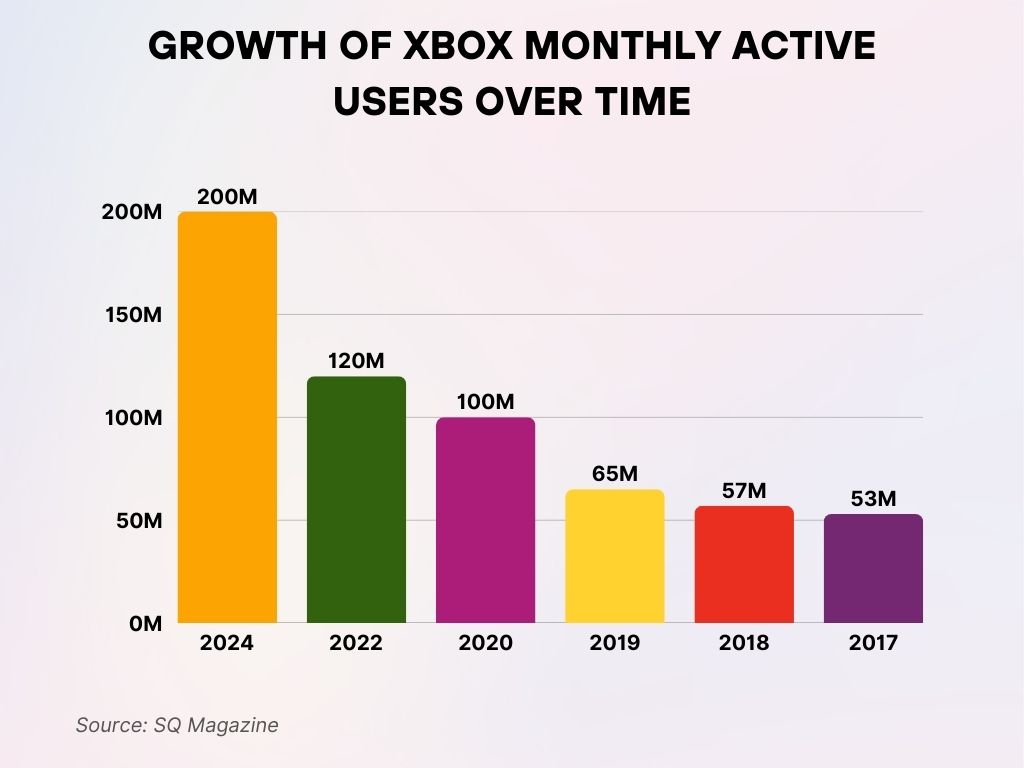

Growth of Xbox Monthly Active Users Over Time

- In 2024, Xbox reached a record high of 200 million monthly active users, showing massive platform growth.

- 2022 saw a significant increase with 120 million users, up sharply from previous years.

- Back in 2020, the platform crossed the 100 million mark for the first time.

- In 2019, Xbox reported 65 million active users, a substantial leap from earlier figures.

- The growth continued from 57 million in 2018 and 53 million in 2017, marking a steady upward trend.

Xbox Engagement on Streaming Platforms (Twitch, YouTube)

- In 2024, Xbox-related streams on Twitch accumulated over 1.9 billion watch hours, a 22% YoY increase.

- Halo Infinite and Sea of Thieves were the top two Xbox games streamed on Twitch in terms of hours watched.

- YouTube content featuring Xbox titles generated over 4.3 billion views, with Starfield alone driving 640 million views.

- Xbox-sponsored eSports tournaments streamed in 2024 reached an audience of 92 million viewers worldwide.

- Microsoft’s official Xbox YouTube channel grew to 8.2 million subscribers, adding 1.4 million in 2024 alone.

- Game Pass trailers were the most watched Xbox content format, with a 35% share of total video impressions.

- Xbox’s creator partner program saw a 47% increase in signups, with payouts exceeding $28 million to influencers.

- Over 32% of the top 100 Twitch streamers featured at least one Xbox-exclusive game in their 2024 broadcasts.

- Xbox’s new integration with Discord helped stream-sharing increase by 54% among Xbox Live users.

- Live community events such as ID@Xbox showcases drew record engagement, with over 1 million concurrent viewers in March 2024.

Xbox’s Role in Microsoft’s Gaming Strategy

- Xbox accounted for 13.6% of Microsoft’s total revenue in fiscal year 2024.

- Gaming is now Microsoft’s fourth-largest business segment, surpassing advertising and LinkedIn.

- Satya Nadella, Microsoft CEO, stated in Q4 2024 earnings that “Xbox is central to Microsoft’s consumer strategy moving forward.”

- Xbox’s success with Game Pass and Cloud Gaming aligns with Microsoft’s cloud-first, subscription-based model.

- Microsoft now holds two of the top 10 gaming IPs globally, Minecraft and Call of Duty (post-Activision acquisition).

- Xbox Game Studios employs over 9,800 developers, a 17% increase over the previous year.

- With the Bethesda and Activision acquisitions finalized, Xbox now controls 28 internal game development studios.

- Xbox’s integration with Microsoft Azure provides the backbone for global multiplayer and cloud services across the ecosystem.

- Xbox and Microsoft AI teams partnered in 2024 to develop adaptive difficulty systems, expected to launch across select titles in 2025.

- Phil Spencer confirmed that Xbox will remain multiplatform-friendly, with several titles now launching simultaneously on PC and rival platforms.

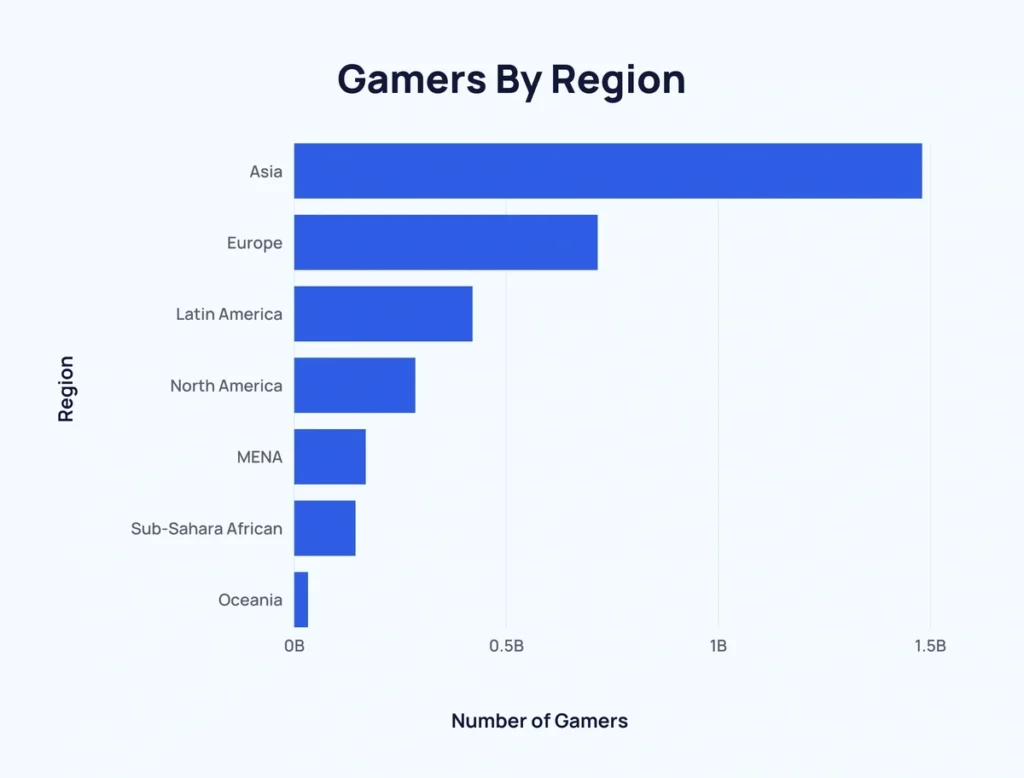

Global Gaming Population by Region

- Asia dominates the global gaming market with nearly 1.5 billion gamers, the highest by far among all regions.

- Europe follows with over 700 million gamers, making it the second-largest gaming population.

- Latin America has a strong base with approximately 400 million gamers.

- North America accounts for around 300 million gamers, led by the U.S. and Canada.

- The MENA region (Middle East and North Africa) contributes about 200 million gamers to the global count.

- Sub-Saharan Africa has close to 150 million gamers, showing steady growth potential.

- Oceania has the smallest gaming population, estimated at under 50 million.

Xbox Accessibility and Inclusion Metrics

- As of 2025, over 16 million Xbox users have accessibility features enabled on their devices.

- The Xbox Adaptive Controller remains one of the most lauded accessibility innovations, now shipped to 52 countries.

- Xbox added over 250 accessibility tags in the Microsoft Store to help gamers identify features like voice navigation, subtitle support, and colorblind modes.

- Game Accessibility Guidelines adopted by Xbox Game Studios have become mandatory for all first-party games since 2023.

- In 2024, 92% of Xbox-published titles included at least three core accessibility features.

- Microsoft reported a 94% satisfaction rate among players using Xbox’s system-wide accessibility options.

- Forza Motorsport received an award for Best Accessibility Innovation for its Blind Driving Assist, enabling visually impaired players to race using audio cues.

- Sign language overlays were introduced in Minecraft and Sea of Thieves, piloted in partnership with accessibility nonprofits.

- Xbox committed $25 million in grants through the Gaming for Everyone fund, supporting developers prioritizing inclusive design.

- Xbox launched Inclusive Play Labs in 2024, where gamers with disabilities co-create and test prototypes alongside Xbox engineers.

Recent Developments in the Xbox Ecosystem

- In early 2025, Xbox launched the “Brooklyn” Series X refresh, featuring a redesigned controller and 2TB storage.

- Game Pass Core replaced Xbox Live Gold in late 2024, streamlining online services and bundling key titles.

- Xbox opened a new studio in Tokyo, signaling a deeper commitment to Asian markets and local development.

- Microsoft introduced AI-driven game testing tools, reducing quality assurance time by 30% across studios.

- In 2024, Xbox launched cloud-native development tools, enabling faster game prototyping for indie and AA developers.

- Family Sharing improvements let Game Pass be accessed by up to 6 users in a household, now rolling out globally.

- Xbox added Dolby Vision support to 200+ titles, enhancing HDR gaming for supported displays.

- Microsoft expanded Play Anywhere support to include third-party titles, increasing flexibility for cross-platform play.

- Project Moorcroft, a Game Pass preview program, launched in beta, giving subscribers early access to unreleased indie games.

- Xbox partnered with LEGO for limited-edition hardware bundles, including themed controllers and console wraps.

Conclusion

From its early days of competing for relevance to becoming a pillar of Microsoft’s digital strategy, Xbox in 2025 stands as a powerhouse in gaming. With Game Pass leading subscription adoption, cloud gaming pushing mobile-first experiences, and a renewed focus on accessibility and inclusion, Xbox is no longer just about consoles; it’s about ecosystems, platforms, and players worldwide. Whether you’re measuring user growth, hardware sales, or streaming presence, the numbers reveal one clear truth: Xbox isn’t slowing down, it’s evolving.