Voice over Internet Protocol (VoIP) has become a cornerstone of modern communications. From enabling seamless remote work calls to powering customer support centers, VoIP’s impact is measurable and growing. In healthcare, clinics use VoIP to coordinate telehealth consultations across regions. In e‑commerce, VoIP integrates with CRM systems to streamline order support. Below are seven editor‑choice statistics that set the stage, then we’ll dive into detailed trends.

Editor’s Choice

- VoIP services are expected to grow at a CAGR between 10–13% through 2034, with market size potentially surpassing $400 billion, depending on growth drivers like AI and 5G.

- In 2025, VoIP is forecast to be valued at $161.79 billion, rising from ~$145.7 billion in 2024.

- AI‑driven VoIP features (real‑time transcription, sentiment routing) are expected to grow by ~35% by 2025.

- Industry surveys indicate a majority of companies (50–60%) are exploring or piloting AI-powered VoIP tools for customer experience enhancement.

- Global VoIP users are expected to number over 1 billion by 2025, driven by mobile VoIP apps and internet penetration in emerging markets.

Recent Developments

- The VoIP market continues to consolidate, with major providers expanding cloud and managed services.

- Integration of AI and machine learning is enabling predictive call routing, sentiment detection, and automated summarization.

- Hybrid work models have fueled rising demand for unified communications that seamlessly blend voice, video, and messaging.

- Carriers and VoIP providers are migrating more infrastructure to the cloud, reducing reliance on legacy PBX systems.

- Security features have grown more sophisticated; encryption, SIP TLS, and fraud detection are now standard in many plans.

- 5G expansion is improving mobile VoIP performance, reducing latency, and expanding use cases.

- VoIP‑CRM integrations are more common, linking call analytics directly with customer journeys.

- Providers are packaging “communications as a service” (CaaS) bundles to appeal to SMBs and scale pricing.

Business and Residential VoIP Usage

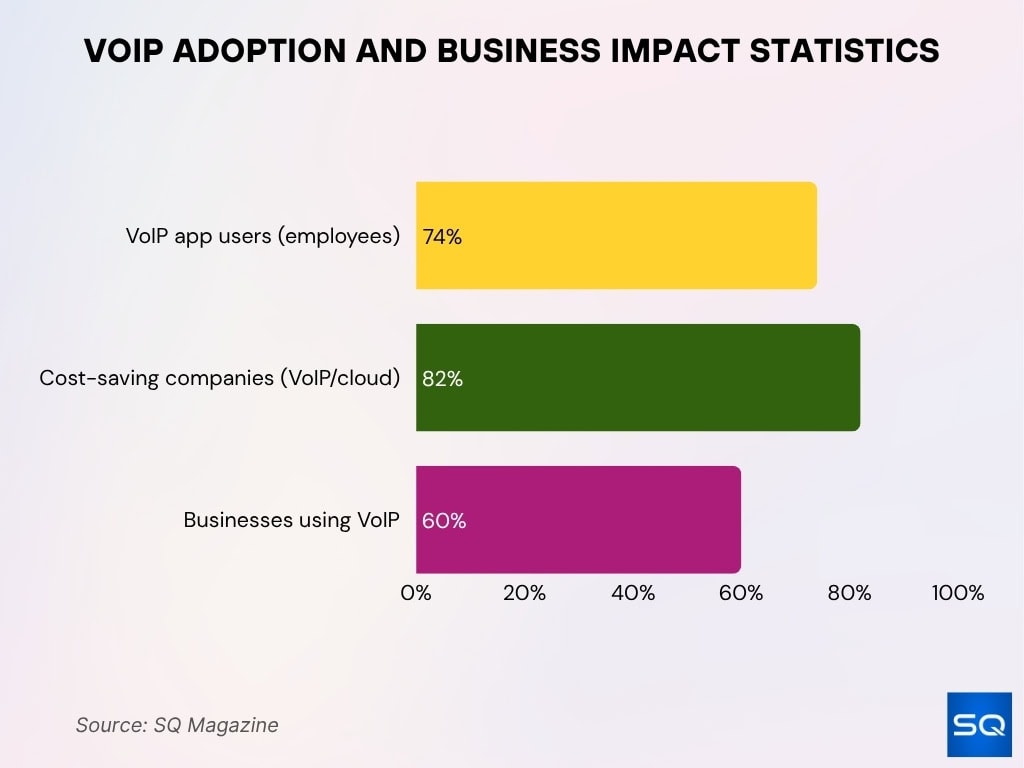

- 74% of employees use VoIP mobile apps for business calls.

- ~82% of companies report cost savings after migrating to cloud communication systems (which include VoIP).

- As of 2025, over 60% of businesses have switched from traditional phone lines to VoIP systems.

- About 40% of the global VoIP market is centered in North America.

- In 2024, the market for VoIP services was estimated at $132.2 billion.

- The mobile VoIP segment is forecast to hit $183.7 billion by 2027.

- Many businesses estimate that VoIP saves ~32 call minutes per day per user via smarter routing and fewer transfers.

- Many residential users now bundle VoIP with broadband and media services, making it a standard feature in home packages.

VoIP Powering the Remote and Hybrid Workforce

- In the U.S., 4.7 million people now work at least half their hours from home, driving demand for reliable voice services.

- Remote workers reportedly average 1.4 more workdays per month (or ~16.8 extra days/year) than in‑office colleagues.

- Remote employees tend to work ~43% more hours weekly than on-site counterparts, averaging over 40 hours weekly.

- Among those who work remotely occasionally (39% of the workforce), 77% report higher productivity, 30% say they do more in less time.

- As of 2023, ~35% of full‑time employees worked remotely at least part of the time (up from 34% in 2022).

- Hybrid work models comprise roughly 28.2% of employees, while ~12.7% are fully remote.

- Approximately 54% of workers say they prefer fully remote roles, 41% want hybrid schedules.

- VoIP enables geographical flexibility; employees can use business lines from anywhere with an internet connection.

Startups and Small Business VoIP Statistics

- Around 31% of businesses currently use VoIP, with adoption rates expected to increase by 15% by 2025 among SMBs.

- More than 60% of organizations plan to roll out AI‑powered VoIP features by 2025, which small firms can adopt to compete.

- In small business settings, VoIP often delivers 25–50% lower costs than traditional telephony systems.

- ~70% of small businesses use VoIP because it scales easily with growth.

- 82% of businesses that moved to cloud communications (including VoIP) reported cost savings.

- 94% of global companies switch to cloud and VoIP to modernize security and operations.

- Many startups bundle VoIP with CRM, help desk, and analytics tools, reducing overhead.

- In emerging markets, VoIP adoption among small firms is growing faster due to lower infrastructure costs.

Global VoIP Services Market Growth

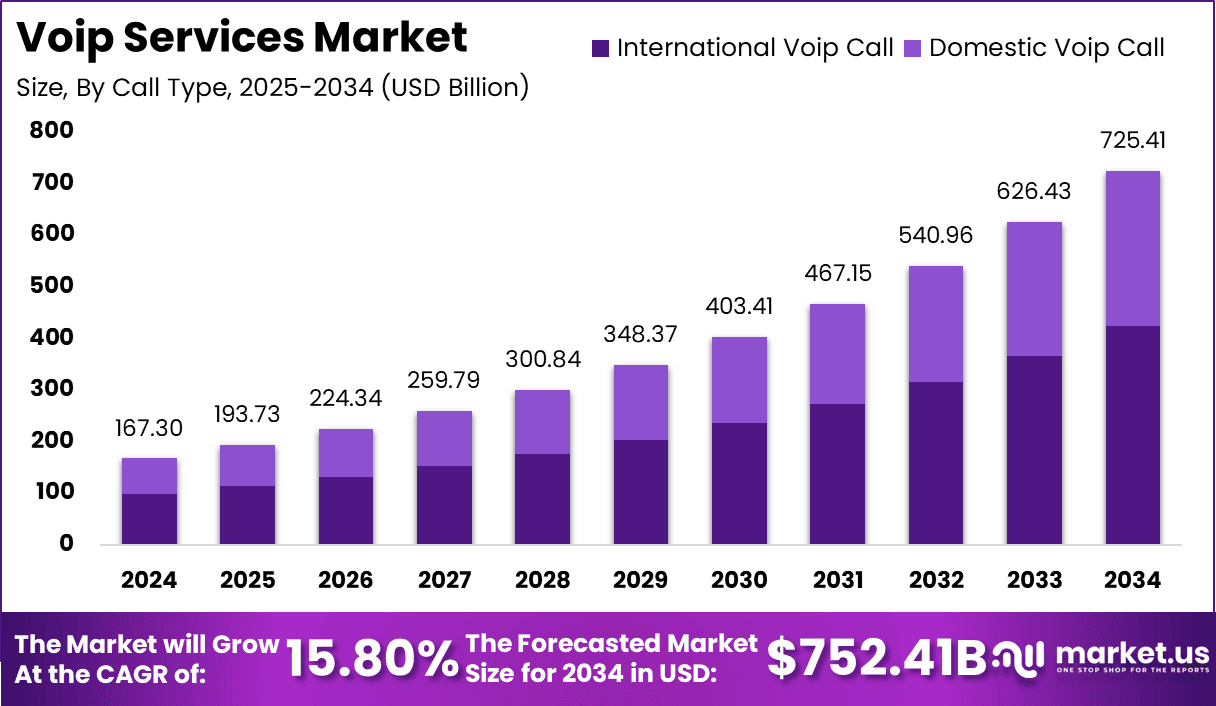

- The VoIP services market is projected to reach $725.41 billion by 2034, reflecting strong global expansion.

- The industry is expected to grow at a CAGR of 15.8% between 2025 and 2034, driven by cloud adoption and mobile VoIP use.

- Market size will rise from $193.73 billion in 2025 to $540.96 billion by 2032, more than doubling within seven years.

- International VoIP calls and domestic VoIP calls both show consistent year-over-year growth, with international traffic contributing a larger share.

- By 2029, the market is forecast to surpass $348 billion, fueled by enterprise-grade cloud PBX systems and global connectivity demand.

- Continued transition from traditional telephony to internet-based communication will push the market beyond $700 billion by 2034.

VoIP Usage Statistics

- Globally, the VoIP market is valued at $161.79 billion in 2025, projected to reach $415.20 billion by 2034 (CAGR ~11.04%).

- In 2024, the VoIP market was estimated at $131.89 billion, rising to ~$146.82 billion in 2025 (CAGR ≈ 11.3%).

- Approximately 31% of businesses currently use VoIP systems. As of 2025, this share is rising.

- VoIP adoption among enterprises is accelerating; more than 60% of U.S. companies have migrated from traditional telephony to VoIP or cloud communications.

- Integration into unified communications is growing; the UCaaS market (which includes VoIP) is forecast to reach $69.93 billion by 2028.

- Mobile VoIP is expected to expand; the mobile VoIP market could reach $183.7 billion by 2027.

- VoIP is expected to displace legacy systems, with over 64% shift from traditional telephony systems, driving expansion in hosted VoIP.

- Some market analyses estimate the VoIP services market in 2025 at $178.89 billion, growing toward $413.36 billion by 2032 (CAGR ~12.7%).

Growing Use of AI in Voice Communications

- AI‑powered VoIP features are projected to grow by 35% by 2025, including real-time transcription, sentiment routing, and intelligent call summarization.

- More than 60% of organizations are expected to adopt AI‑driven VoIP tools by 2025.

- AI helps in predictive routing, routing calls based on predicted customer intent or agent skills.

- Machine learning models analyze call patterns over time to flag fraud, anomalies, or potential churn.

- Language models power automatic summarization of voice calls, converting them to text and extracting action items.

- Voice biometric authentication (via AI) is becoming more common in VoIP setups to reduce fraud risk.

- Intelligent voice assistants (bot integrations) handle routine queries before transferring to human agents.

- AI analytics layer helps management spot trends, average call sentiment, dwell time, and agent performance.

Phones as a Primary Communication Tool in Companies

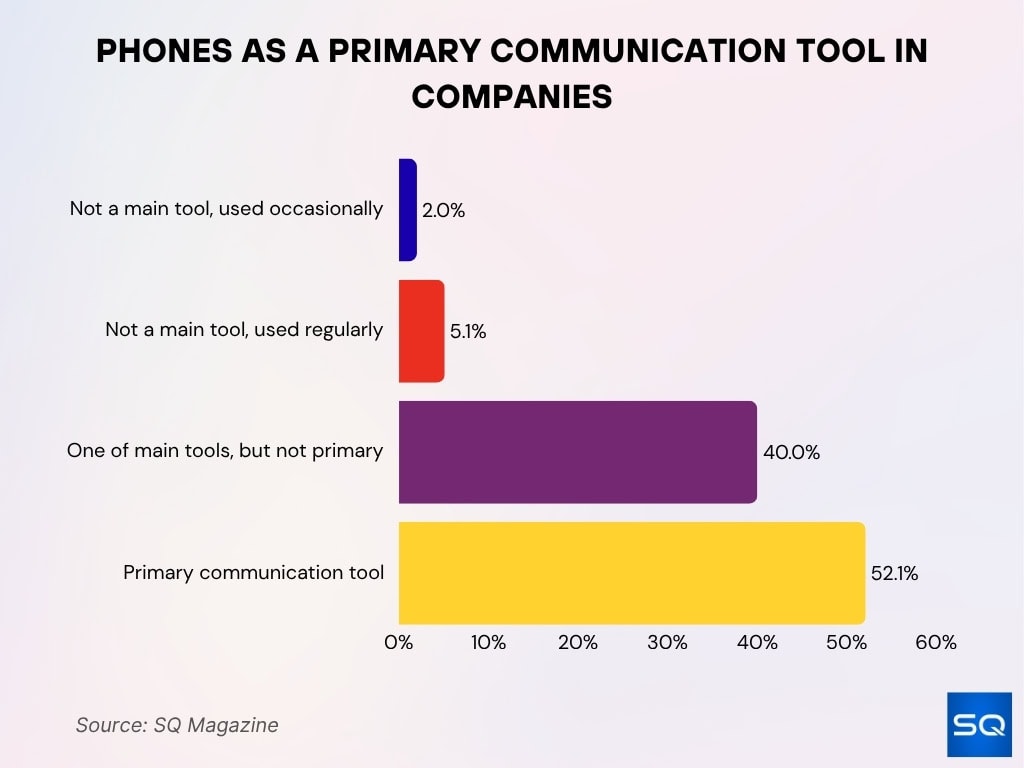

- 52.1% of companies say phones are their primary communication tool, underscoring their continued importance in daily operations.

- 40% of organizations use phones as one of their main tools, though not the primary channel.

- Only 5.1% of businesses use phones regularly but not as a main tool, showing a shift toward more integrated communication platforms.

- Just 2% report using phones occasionally, indicating that nearly all companies rely on phone communication in some capacity.

- Overall, over 90% of businesses include phones as part of their core communication strategy, despite the rise of VoIP and digital messaging systems.

Financial Impact and Cost Savings of VoIP

- Switching to VoIP can reduce communication costs by 30% to 50% for many organizations.

- VoIP setups eliminate many hardware and infrastructure expenses, which contribute to “up to 50%” cost savings claims.

- A VoIP phone system typically costs $15 to $40 per user per month, with variations for enterprise customization.

- Many companies report significant ROI within 6–12 months after migration, driven by lower call rates, simpler maintenance, and scalability.

- Revenue increased from $131.89 billion in 2024 to $146.82 billion in 2025, reflecting growing demand and rising investment in VoIP solutions.

- The underlying drivers of cost savings include reduced long-distance charges, elimination of PSTN lines, and lower administrative overhead.

- Many SMBs view the shift as a capital‑light upgrade, since VoIP moves expense into operating costs rather than heavy upfront CAPEX.

- Some operators also bundle analytics, support, and software upgrades into VoIP plans, improving cost transparency and reducing surprises.

VoIP Technology and Software Statistics

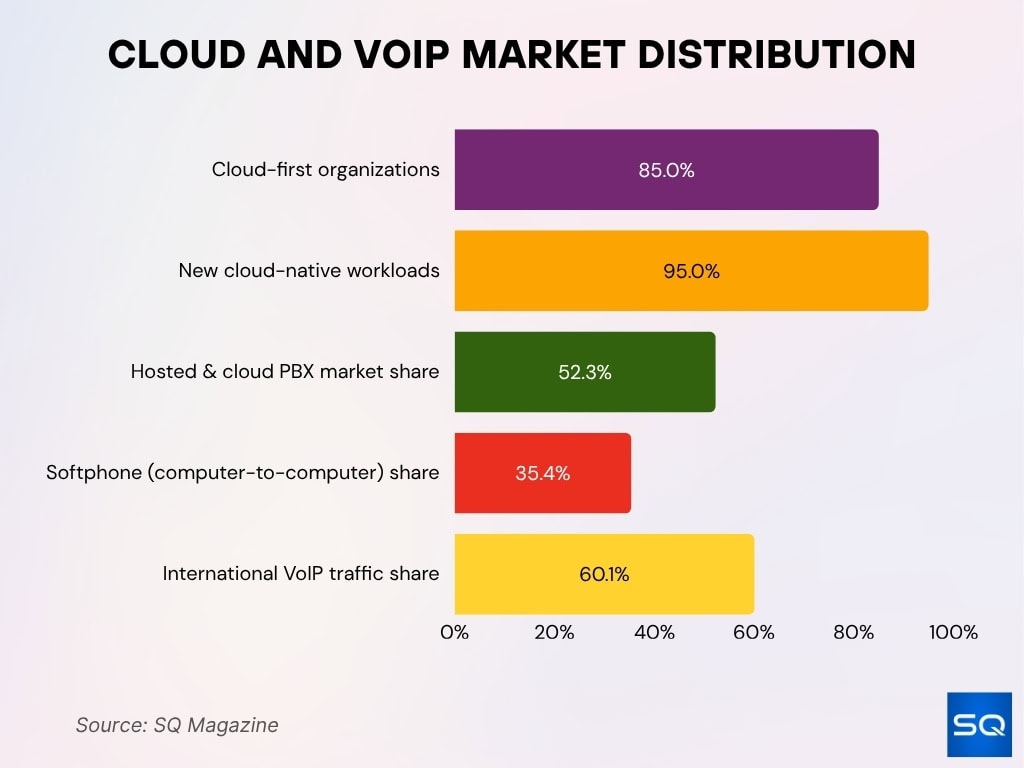

- 85% of organizations are expected to adopt a cloud‑first principle by 2025.

- 95% of new workloads will be cloud‑native by 2025.

- Hosted and cloud PBX deployments captured ~52.3% of the market share.

- Computer‑to‑computer (softphone) configurations held ~35.4% share.

- International long-distance VoIP traffic made up ~60.1% of the market.

- The SIP trunking market was valued at $70.40 billion in 2024 and is projected to reach $255.36 billion by 2034 (CAGR ~13.75%).

- The mobile VoIP market was valued at $44.99 billion in 2023.

- In North America, mobile VoIP revenue was ~$9,458.2 million in 2023.

VoIP Trends and Future Predictions

- Some sources project growth from $167.3 billion in 2024 to $752.41 billion by 2034.

- Voice assistants and virtual agents will handle a rising share of routine calls.

- Edge computing and 5G will reduce latency and improve voice quality.

- AR/VR voice interfaces may blend communication into immersive environments.

- Increased security demands will emerge.

- Voice over WebRTC / browser‑native VoIP will gain adoption.

- Consolidation among providers is likely.

- Regulation and call authentication mandates will tighten access.

Frequently Asked Questions (FAQs)

The global VoIP market is projected to $161.79 billion in 2025.

The expected CAGR is 11.04% from 2025 to 2034.

About 31% of all businesses use VoIP systems.

The U.S. mobile VoIP market is expected to reach $47.41 billion by 2032.

Conclusion

VoIP is not just an alternative to traditional telephony; it is central to business communication strategies. While challenges like network quality, fraud risk, and integration complexity persist, technology advances in cloud, AI, and bandwidth improve reliability and feature depth. Organizations across geographies are shifting toward unified, smart voice systems that blend voice, video, analytics, and security. The coming years will likely see further convergence, smarter routing, and deeper automation. Explore the full article to see how VoIP continues evolving and what your organization must watch.