Trello remains a key tool for visual project management. With a clean interface and flexible board system, teams across industries streamline workflows efficiently. Real‑world examples include marketing teams using Trello to manage campaign timelines and software developers coordinating sprints. Dive into the article to explore rich data showing how Trello performs today.

Editor’s Choice

- Over 50 million registered users as of late 2019, a figure still cited in current coverage.

- Trello supports 21 languages, offering global reach.

- Trello’s web traffic shows a demographic breakdown of approximately 56.4% male and 43.6% female.

- Age group with the highest usage: 25–34 years old, followed by 18–24.

- In early 2025, direct visits made up 83.5% of Trello’s web traffic, indicating brand familiarity and user habit.

- Trello’s customer base is composed of approximately 39.4% small businesses (10–49 employees), 31.3% mid-size and enterprise (50–999+ employees), and 29.2% very small businesses (<10 employees).

- Trello maintains strong adoption in top markets like the U.S., UK, Brazil, and France.

Recent Developments

- Trello traffic data through early 2025 reflects steady engagement growth and seasonal planning usage, especially January spikes.

- Although specific releases or feature updates aren’t detailed in public stats, continued integration through Power‑Ups and market share expansion in ERP categories suggest ongoing product refinements.

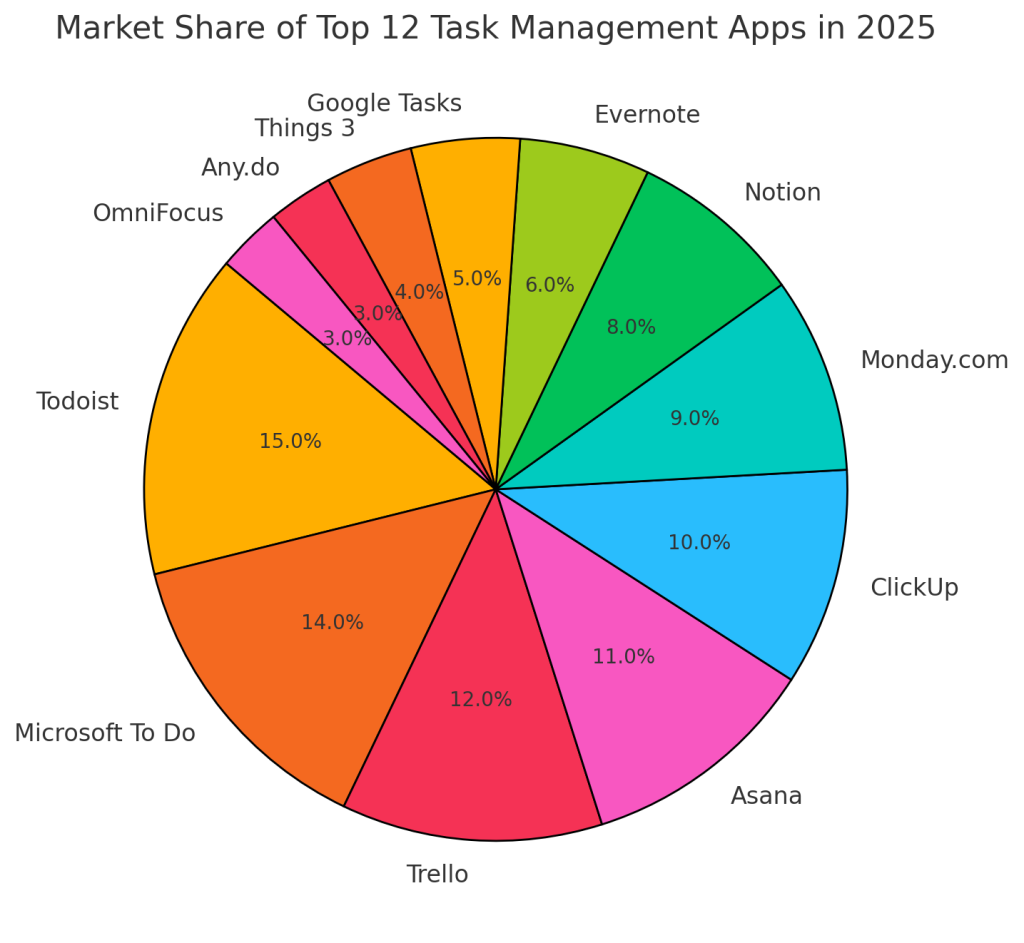

Task Management App Market Share

- Todoist leads the market with a 15.0% share, making it the most widely used task management app.

- Microsoft To Do holds the second spot with a strong 14.0% market share.

- Trello captures 12.0% of the market, maintaining a solid presence among users.

- Asana is close behind with 11.0%, favored by teams for project coordination.

- ClickUp accounts for 10.0%, reflecting its rise in popularity among productivity tools.

- Monday.com registers a 9.0% share, known for visual planning and collaboration.

- Notion holds 8.0%, appealing to users who want integrated note-taking and task tracking.

- Evernote has a 6.0% share, used for its note-focused task capabilities.

- Google Tasks maintains a 5.0% share, integrated within Google Workspace tools.

- Things 3 owns 4.0% of the market, popular especially among Apple users.

- Any.do and OmniFocus each claim 3.0%, rounding out the top twelve.

Key Trello Statistics

- Founded in 2011, Trello’s foundation dates back more than a decade.

- As of October 2019, 50 million registered users.

- Available in 21 languages, reaching diverse global users.

- 1.1 million daily active users recorded in 2016.

- Visited heavily by 25–34 (largest group), then 18–24, 35–44.

- Website traffic is 83% direct, showing brand strength.

- Users: 54.5% male, 45.5% female.

- Business user distribution: 39.4% SMB, 31.3% mid/enterprise, 29.2% very small.

User Demographics

- Trello visitors: roughly 56.4% male, 43.6% female.

- Dominant age bracket: 25–34, followed by 18–24 and 35–44.

- Among purchasers or business usage: balanced across small, medium, and enterprise organizations (29–39% each category).

- Suggests Trello serves both young professionals and seasoned teams equally.

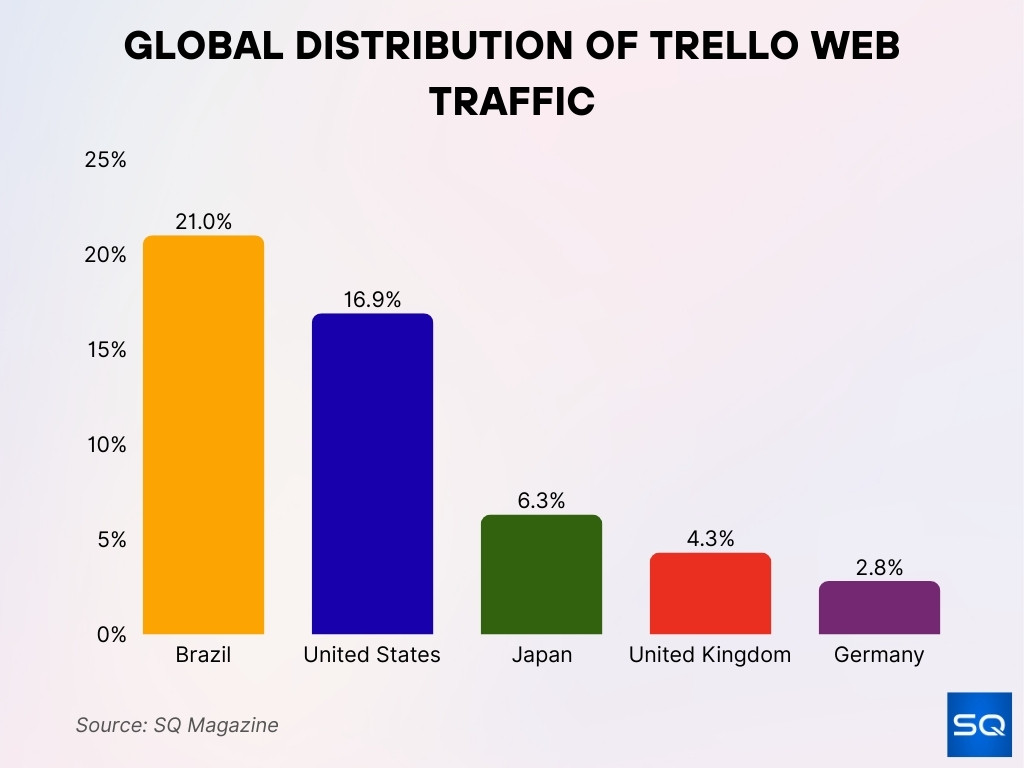

Global Usage & Adoption

- On website visits: Brazil currently leads at 21%, followed by the U.S. (16.9%), Japan (6.3%), the UK (4.3%), and Germany (2.8%).

- The United States leads Trello usage with over 20,000 users.

- The UK is the second-largest with nearly 3,900 users.

- Brazil (~3,214) and France (~2,403) follow.

Website Traffic & Engagement

- 83.5% of Trello site traffic comes from direct visits, signaling strong brand recognition.

- 10.8% originates from organic search, with 1.4% from paid marketing, 3.65% from referrals, and smaller shares from social and email.

- The high direct numbers reflect strong repeat visits from loyal users.

Usage by Industry or Department

- Trello is used by 7,251 companies in Information Technology Services, making it the strongest sector.

- 5,129 companies in the Computer Software industry use Trello.

- 3,207 marketing and advertising firms actively use Trello.

- Across all industries, over 47,794 companies globally use Trello for productivity or collaboration.

- Trello powers workflows for small teams, creative departments, and agile software groups, favored for its visual simplicity.

- Real‑world creative teams organize ideation and design using Trello’s boards and cards.

- Departments like software engineering, marketing, and project management rely on it for oversight and coordination.

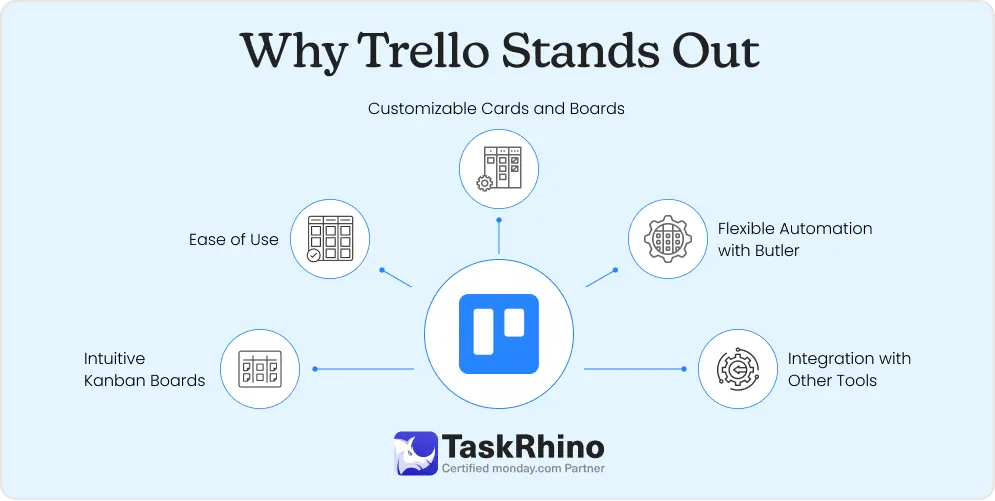

Why Trello Stands Out in the Market

- Customizable Cards and Boards allow teams to tailor workflows to their specific needs.

- Flexible Automation with Butler simplifies repetitive tasks through built-in rule-based automation.

- Integration with Other Tools enhances productivity by connecting Trello with popular apps and services.

- Intuitive Kanban Boards provide a clear, visual way to manage tasks and project flow.

- Ease of Use makes Trello accessible to teams of all sizes, regardless of technical experience.

Top Countries Using Trello

- The U.S. leads with 20,195 companies using Trello.

- The UK follows with 3,876 companies.

- Brazil accounts for 3,214 companies using Trello.

- France has 2,403 companies leveraging Trello.

- In December 2024, Trello saw 72.56 million website visits, rising to 76.75 million in January 2025.

- February 2025 recorded a slight dip to 74.49 million visits.

- Brazil contributed 20.02% of global website traffic, though this number has declined by 2.76%.

- In contrast, the U.S. traffic share grew by 3.20%, reaching 16.95%.

- Japan saw the sharpest drop at 5.12%, landing at 5.98% share.

Growth Trends Over the Years

- Trello’s website traffic was 72.56 million in December 2024, grew to 76.75 million in January 2025, then eased to 74.49 million in February 2025, reflecting seasonal usage peaks.

- The broader productivity software market is expanding fast, from $64.93 billion in 2024 to $74.94 billion in 2025 at ~15.4% CAGR.

- Cloud-based productivity tools are especially booming, with projections hitting $75.52 billion in 2025.

- A longer-range forecast expects the productivity software market to swell to $130.99 billion by 2029, sustaining a 15% CAGR.

- Another benchmark pegs the segment at $62.06 billion in 2024, projected to hit $70.44 billion in 2025, and climb to $193.99 billion by 2033 (13.5% CAGR).

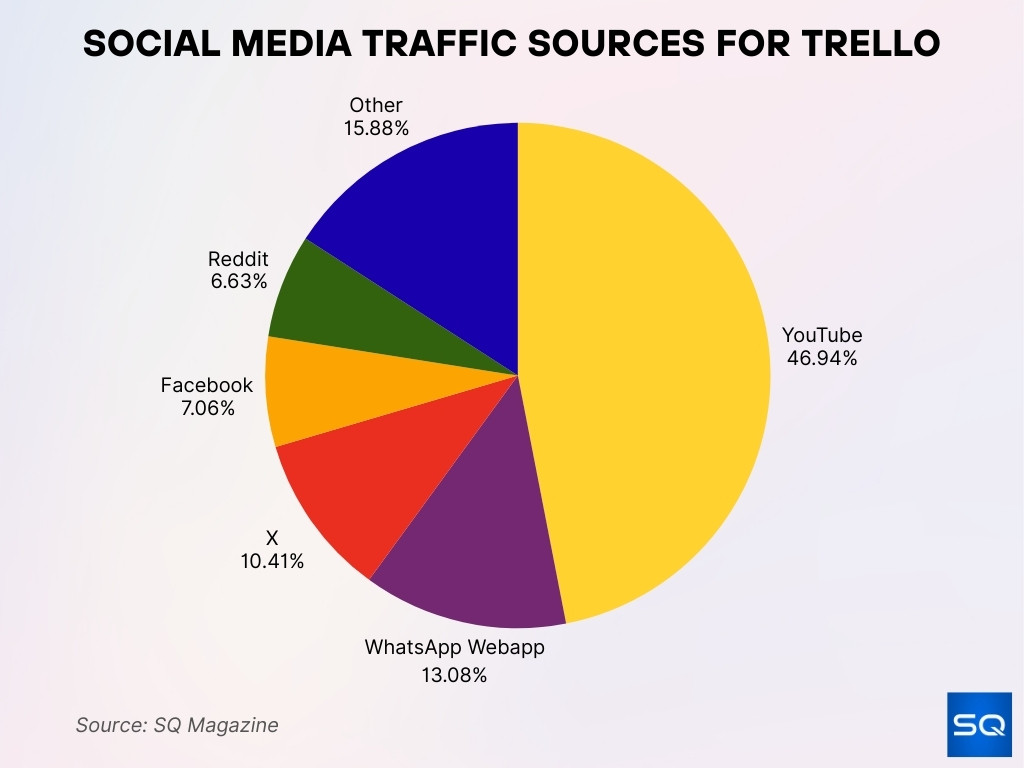

Social Media Traffic Sources for Trello

- YouTube is the top traffic driver, accounting for 46.94% of Trello’s social media visits.

- WhatsApp Webapp contributes 13.08%, indicating strong traffic from direct sharing.

- X (formerly Twitter) generates 10.41%, reflecting active engagement from professional and tech users.

- Facebook brings in 7.06% of traffic, supporting collaboration-focused user groups.

- Reddit drives 6.63%, likely from discussions in productivity and software forums.

- Other platforms collectively make up 15.88%, showing that Trello benefits from a wide range of social channels.

Trello Integrations & Power‑Ups

- Trello rolled out the Power‑Up platform in 2016, enabling third-party tool integrations.

- By January 2022, Trello offered 247 Power‑Ups in its directory.

- Butler, an automation Power‑Up, was acquired in December 2018, bolstering Trello’s internal automation.

- Trello offers a robust API plus a Zapier connector, rated B+, to link with other tools.

- Teams using the Atlassian stack can access native integrations with Trello, enhancing interoperability.

Trello Board Types & Use Cases

- Trello’s founders built visual boards, lists, and cards, ideal for Kanban-style task flow.

- Common use cases range from everyday household to-do lists to corporate project planning.

- It suits creative teams, event planners, and remote agile teams using visual task tracking.

- Trello is also widely recommended for personal task management, offering flexibility for goals and daily to-dos.

Team Collaboration Statistics

- Trello supports over 50 million users globally, many collaborating in teams across departments and projects, with data highlighting its wide organizational adoption.

- While not a full ERP solution, Trello accounted for 4.8% of the task/project management software segment within ERP-related tools, as reported by 6sense market intelligence.

- The U.S. leads with 20,195 companies using Trello, suggesting deep penetration in North American team environments.

- The platform registers between 72.56 million (Dec 2024) and 76.75 million (Jan 2025) site visits monthly, indicative of consistent team collaboration dynamics.

- Organic search accounts for 10.78% of visits, pointing to discovery and onboarding via search, key for team growth.

- Trello’s user base spans industries, IT services, software, and marketing, supporting diverse team types from creative to technical.

- The seasonality in traffic (peak in January) suggests teams rely on Trello for planning and executing new-year projects.

Kanban & Workflow Analytics

- Though specific data on workflow analytics use isn’t directly available, Trello’s Kanban-style boards remain central to its identity and usage.

- Teams across IT, marketing, and software sectors often adopt the Kanban methodology via Trello for visibility and flexibility.

- The upward trend in platform traffic affirms that Trello supports ongoing workflow management at scale.

- Trello’s integration with automation (Butler) and Power‑Ups enhances workflow efficiency and custom dashboards.

Productivity Impact

- Trello’s integration into the ERP space (4.8% share) positions it as a productivity accelerator for enterprises.

- Its visual, intuitive boards reduce setup friction, teams see faster onboarding, and improved task flow. Though precise figures aren’t published, the high traffic underlines its practical impact.

- The automation via Butler and Power‑Ups strengthens productivity, cutting manual effort for recurring tasks.

- Consistent site visits and widespread industry use reflect tool-driven gains in team productivity.

Security & Compliance Statistics

- No current publicly available statistics detail Trello’s security metrics or compliance certifications. For future versions, platform documentation or security audits could fill this gap.

Customer Satisfaction & Reviews

- At present, there’s limited quantitative data on satisfaction scores or Net Promoter Scores (NPS) for Trello. Future insights might come from customer review platforms or industry surveys.

Conclusion

Trello remains a pivotal visual collaboration platform. It supports millions of users and consistently generates monthly traffic, dominant in IT, software, and marketing teams. With 4.8% of the ERP software market and supportive Power‑Ups like Butler, it demonstrates real productivity gains and workflow efficiency. While some data, such as mobile vs. desktop use or security metrics, is sparse, the numbers we have show steady adoption, especially during the year’s planning phases. Trello continues to power team collaboration with simplicity and scale.