Tokens rarely die from volatility. They die from emptiness.

Every cycle brings a new wave of teams that try to launch a token withouta product, hoping that a good story and early hype will be enough to hold value. It works for a moment. Until it doesn’t. Without something real behind it, a token has nothing to hold on to. The moment the noise fades, the structure cracks.

In Web3, people often mistake motion for progress. They build tokenomics, pitch cryptocurrency narratives, attract early speculation, and assume demand will follow. It never does. Not without a system that needs the token to function.

This is why most crypto projects end up with failed tokenomics, even when the tech looks promising. A token can’t stand alone. It needs a product, a use case, and a reason for anyone to stay after the initial excitement burns off.

The truth here is simple. Value lives where products live, and everything else leaks.

The Token-First Trap

Launching a token before a product feels fast. It looks efficient. On paper, it lets founders raise capital, grow community, and build momentum. But in reality, it creates a problem that will follow the project forever.

A token without a product attracts the wrong crowd. People join for price action, not for utility. They farm airdrops, chase early allocations, and leave as soon as liquidity opens. The token becomes a speculative shell with no demand to stabilize it. This is where tokens start losing ground. Not because the market is cruel. But because the system behind them never existed.

A token can’t create its own gravity. That gravity comes from token value, which comes from product-market fit, not from wishful thinking. Every blockchain system that works in the long term has something real at its center. A reason users return. A reason the token matters.

When a token launches first, the team spends the next eighteen months fighting to justify it. Most never win that fight.

Product-Market Fit Before Tokenomics

Every startup learns one lesson early. If people don’t need what you build, nothing else matters. Web3 isn’t any different. It just hides the problem under more distractions.

Product-market fit isn’t a metric. It is a moment. The moment users prove that the product solves something meaningful. Traditional teams use the PMF framework, test the PMF method, iterate, adjust, and only then scale. In Web3, founders often skip this step. They jump straight to tokenomics models, diagrams, and supply curves. They try to design economics for something that doesn’t work yet.

This flips the process upside down. Economics can’t fix a product that has no pull. It can only amplify what is already there. If the product has traction, the token becomes an accelerant. If the product has nothing, the token becomes a distraction.

This is why every strong tokenomics 101 principle starts with one line: validate the product first. Everything else depends on it.

The Bootstrapping Problem in Web3

Web3 makes the system even harder because, without users, even the best-designed economy stays still. This is the bootstrapping problem. Users join only when there is utility. Utility exists only when users are already around.

Founders try to solve it with incentives: airdrops, points, and early access. None of that creates real utility. It only attracts people who chase rewards, not value. And once the rewards dry up, the room empties fast. A community without a product is not a community. It is a crowd waiting for the next announcement.

Web3 teams forget that customers behave the same way everywhere. They stay when something solves a real problem. They leave when it doesn’t, and a token can’t change that rule.

In most early blockchain ecosystems, the chicken-and-egg dynamic becomes the first crack in the system. Without a working use case, the token never finds demand. Without demand, the economy stalls. Products break this loop. They give people a reason to return, act, contribute, and build. They create the first layer of real behavior that token incentives can strengthen instead of replacing.

What Token-Only Projects Look Like

Tokens without products follow predictable patterns. You see meme coins with nothing behind them. They rise fast, fall faster, and leave nothing except charts. You see token offerings where the story is bigger than the system. You see airdrop hunters who appear early and disappear even faster.

None of this is new. None of this builds value.

Most cryptocurrencies that launch with no utility end up in long lists of pointless tokens. Teams try to rebuild. They try to justify the supply. They try to add features later. But once the market tags a token as empty, it rarely gets a second chance.

Tokens aren’t marketing devices. They are economic instruments. And they behave like any other instrument when the fundamentals are missing.

Why Token Value Collapses

A token collapses for the same reason any economy collapses. Supply outpaces demand, and nothing pulls value back in.

Teams expand their circulating supply because roadmap milestones need funding. They introduce deflationary mechanics, hoping to stabilize prices. They rebuild token allocation tables and adjust token distribution schedules.

None of these moves solves the core issue. Without demand, economics has nothing to work with.

Incentives designed without a product attract mercenary capital. People who move from one reward to the next, leaving no retention behind them. These users create volatility, not stability. They distort growth charts and vanish when rewards dry up. Because the problem isn’t inflation. The problem is emptiness.

Real demand only comes from systems where the token does something meaningful. A token that powers access, transactions, governance, or functionality inside Web3 apps and Web3 platforms has a chance. Anything else fades.

How Product-First Fixes Everything

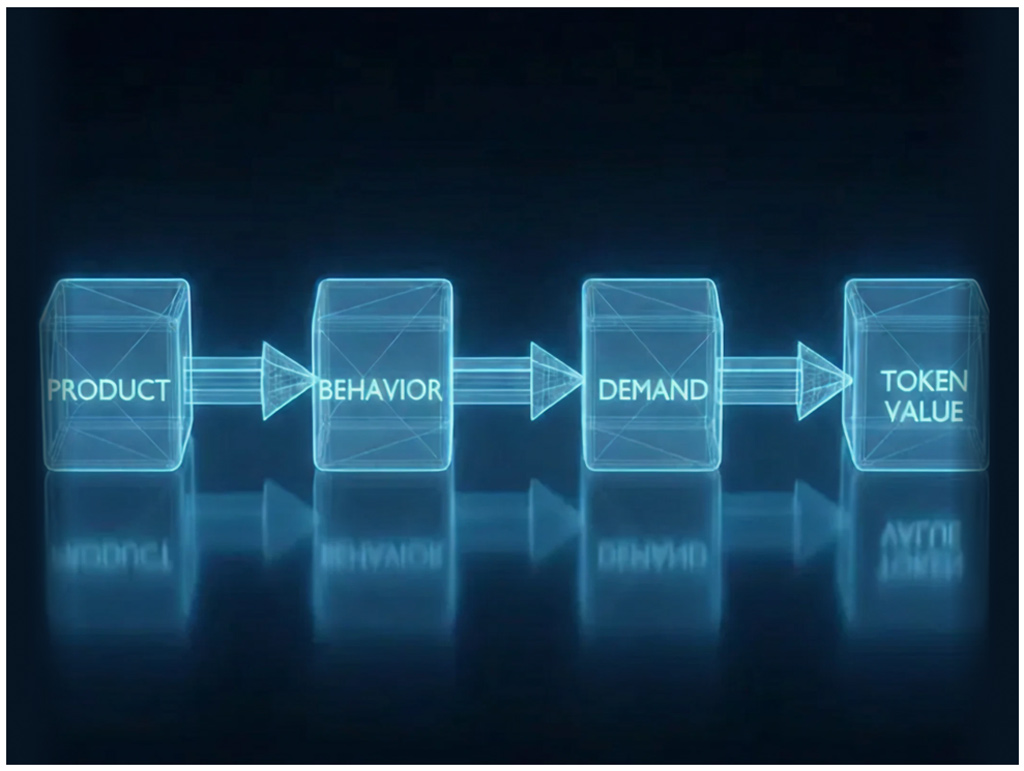

A strong product solves what tokenomics alone can’t. It creates behavior, and behavior creates demand. When demand grows, value follows. This is the pattern every working token relies on.

Before writing the economic model, strong teams map use cases. They define where the token lives inside the system. They design mechanics with product engineers, product managers, and real constraints, not assumptions.

When the product works, the token becomes a natural extension of the experience. It unlocks access, powers actions, and fuels the ecosystem.

Here, the smart contracts behind the system become real infrastructure, not decoration. The token becomes part of the product, not a badge for the marketing deck. And this is where value stabilizes. Not because the supply is perfect, but because the product gives users a reason to stay.

When Tokens Make Sense

A token works only when the product proves it needs one. This means product-market fit comes first. Only then does the team introduce a tokenomics model that supports what already works. Tokens become growth accelerators, not replacements for product value. They reinforce what users already do instead of trying to convince them to care.

Some tokens serve decentralized infrastructure. Some power security tokens are backed by real assets. Some enable coordination inside decentralized networks. These systems function because the token has a job, not a promise.

Good models are built on real mechanics, not narrative. This is what separates durable economies from speculative cycles.

A Founder’s Framework

Here is a simple framework that teams use when they want to avoid failed tokenomics.

Start by validating the product. Find the early traction, run your PMF tests, and make sure the idea solves something real.

Once that’s clear, map where the token fits into what users already do. Don’t design incentives for actions that don’t exist in the product yet.

Then build the economics around real behavior, not projections. Teams often work with independent experts like 8Blocks when they want their tokenomics model to survive real market conditions. Use principles from crypto tokenomics design, and keep the system lean until the data shows it can grow.

When the model is ready, time the launch with intent. A token released after PMF strengthens the ecosystem. A token released before PMF weakens it from day one. Look at the blockchain ecosystems funded by a16z, Andreessen Horowitz, First Round Capital, or FasterCapital. The tokens they back grow out of the product, not the narrative.

Product First, Token Second

A token isn’t a shortcut. It comes after the system proves it works. When the product creates real demand, the token grows with it. When the foundation is weak, no supply models or utility charts can hold the value in place. The market doesn’t reward noise. It follows proof.

When the product is real, the token becomes a part of the blockchain technology it lives in. It gains stability, traction, and relevance. It grows because people use it, not because someone promotes it.

The rule never bends: product first, token second. Every time.