Stripe remains a major force in digital payments, powering commerce for millions of businesses worldwide. From serving online retailers to subscription services and marketplaces, its infrastructure delivers both scale and flexibility in real time. For example, online marketplaces can route funds to sellers faster than traditional banking systems, and SaaS companies leverage Stripe’s recurring billing tools to automate thousands of invoices every month. In the sections below, we explore the most current statistics on Stripe’s ecosystem, growth, and financials, essential reading for anyone tracking fintech or payments.

Editor’s Choice

- Stripe processed $1.4 trillion in total payment volume during 2024, up 38% year on year.

- That payment volume represents roughly 1.3% of global GDP.

- Stripe achieved profitability in 2024, after several years of reinvesting heavily in R&D.

- Live websites using Stripe number approximately 1.35 million globally as of May 2025.

- The company’s latest tender offer valuation reached $91.5 billion in early 2025.

- Digital wallet transactions via Stripe, like Apple Pay and Google Pay, are driving checkout conversion increases of 22%+ in some cases.

- Stripe’s merchant platform supports businesses in 50+ countries, highlighting its global footprint.

Recent Developments

- In its 2024 annual letter, Stripe noted its investment in machine learning and AI as key to growth.

- The firm expanded product offerings into stablecoins, crypto payments, and embedded finance tools in 2025.

- At its “Sessions 2025” event, Stripe announced enhancements to its Payments, Connect, Revenue, and Money Management suites.

- Stripe revealed that its fraud prevention system blocked billions in fraudulent attempts, reinforcing its enterprise focus.

- New country launches in 2025 include markets in South Asia, Latin America, and Eastern Europe.

- Stripe reported that instant payouts adoption grew ~27% year on year following expansions in Southeast Asia, MENA, and Latin America.

- The company is committed to renewable computing and infrastructure upgrades, citing 100% carbon-free data center operations in 2025.

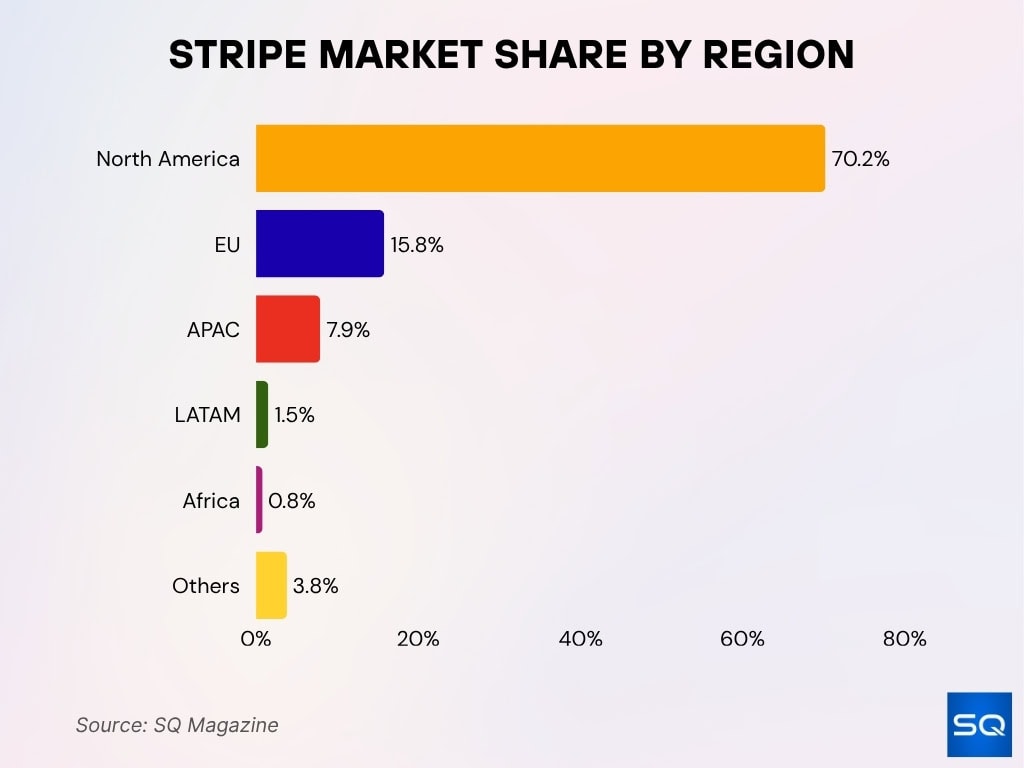

Stripe Market Share by Region

- North America leads with 70.2%, driven by strong adoption in the U.S. and Canada.

- Europe (EU) holds 15.8%, expanding across the U.K., France, and Germany.

- APAC captures 7.9%, fueled by e-commerce growth in Japan, Singapore, and Australia.

- LATAM accounts for 1.5%, showing early but steady market penetration.

- Africa represents 0.8%, marking the initial adoption of Stripe technologies.

- Other regions contribute 3.8%, reflecting ongoing global diversification.

Key Stripe Statistics

- Stripe processed $1.4 trillion in payments in 2024, a 38% increase over 2023.

- The company’s footprint is equivalent to about 1.3% of global GDP.

- As of early 2025, approximately 1.35 million live websites use Stripe globally.

- Historically, around 4.9 million websites have used Stripe at some point.

- In 2025, Stripe’s market valuation approached $91.5 billion.

- Digital wallet transactions through Stripe increased conversion by 22.3% on average when Apple Pay was offered early in checkout flows.

- Stripe’s fraud block system reportedly stopped about $2.3 billion in fraudulent activity in 2025.

- In 2025, cross-border payments through Stripe reached $58 billion.

- The average transaction size on Stripe in 2025 rose to $92, driven by enterprise volumes.

Revenue Statistics

- Third-party estimates suggest Stripe’s gross revenue was $14 billion in 2022 from ~$12 billion in 2021.

- For 2023, some sources estimate revenue exceeded $16 billion, representing roughly 14% growth year on year.

- Stripe announced it was profitable in 2024; prior years included heavy reinvestment in R&D.

- Revenue from subscription tools in 2025 was estimated at $3.4 billion, per some industry sources.

- Operating expenses reportedly rose by ~7.5% in 2025 as Stripe expanded its infrastructure.

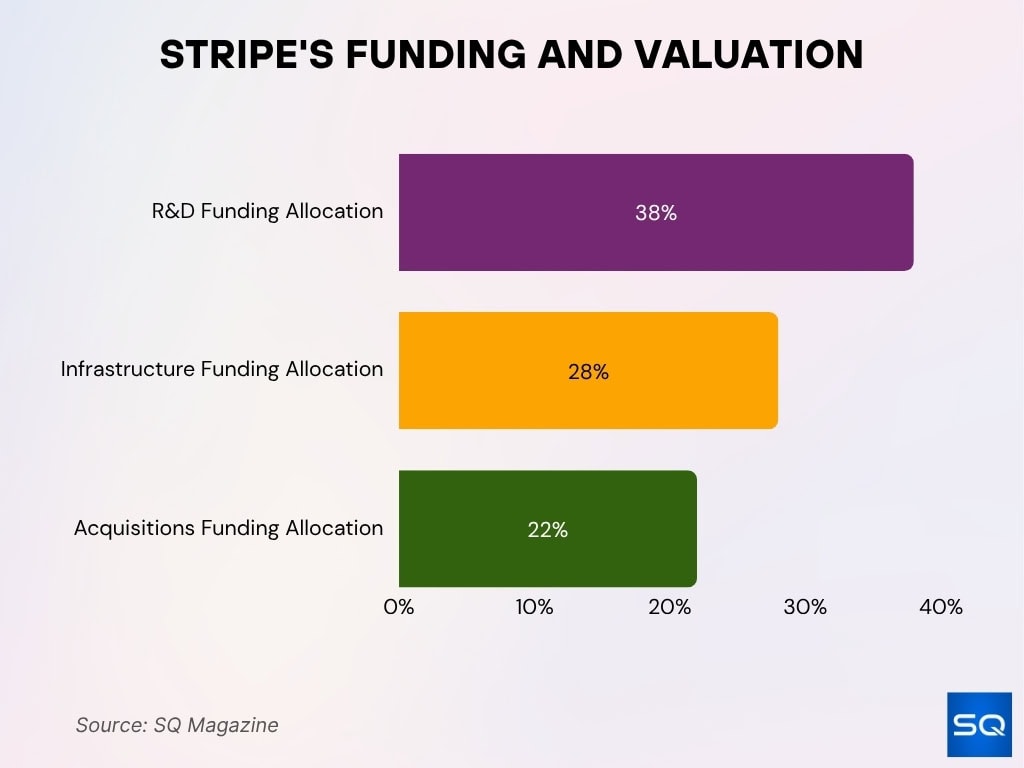

- Stripe’s funding rounds allocation in 2025, ~38% to R&D, 28% to infrastructure, and 22% to acquisitions.

- Stripe’s valuation multiple, ~16.3× net revenue, was cited at the $91.5 billion valuation level.

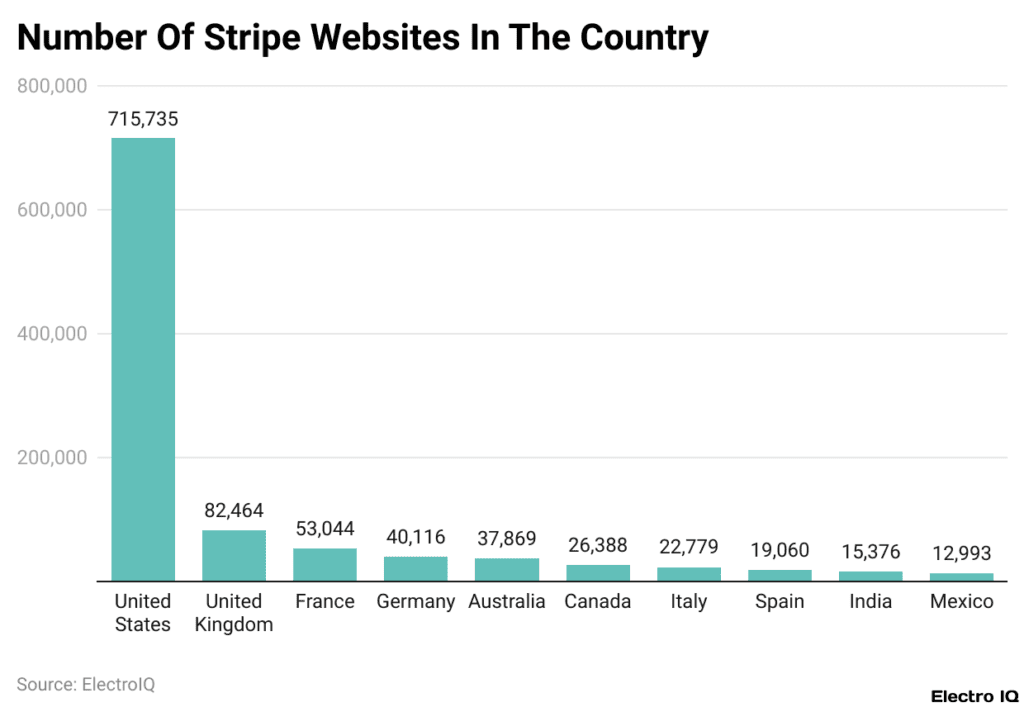

Number of Stripe Websites by Country

- United States leads with 715,735 websites using Stripe, showing a dominant market presence.

- United Kingdom ranks second with 82,464 websites, reflecting strong European adoption.

- France hosts 53,044 Stripe-powered websites, showing steady EU growth.

- Germany records 40,116 websites, highlighting robust fintech integration.

- Australia has 37,869 Stripe-enabled sites, showcasing strong SMB adoption.

- Canada counts 26,388 websites, driven by cross-border e-commerce expansion.

- Italy totals 22,779 websites, signaling rising digital payment acceptance.

- Spain reaches 19,060 websites, marking solid Southern Europe traction.

- India records 15,376 Stripe users, fueled by rapid e-commerce growth.

- Mexico follows with 12,993 websites, showing emerging market momentum.

Stripe Payment Volume

- In 2024, businesses using Stripe processed $1.4 trillion in total payment volume, representing a 38% year-over-year increase.

- That volume equates to about 1.3% of global GDP, showing Stripe’s reach within the global economy.

- Cross-border payments processed by Stripe reached approximately $58 billion in 2025, as platforms and marketplaces expanded globally.

- The number of mobile wallet transactions (e.g., Apple Pay and Google Pay) increased by about 31% in 2025, now making up 38% of Stripe’s mobile volume.

- Stripe’s product for issuing virtual and physical cards, Stripe Issuing, grew by 58%, processing over $13.4 billion in transactions in 2025.

- The platform economy arm, Stripe Connect, generated around $340 million in new revenue in 2025, driven by marketplaces and embedded finance growth.

- Instant payout adoption grew by 27% year on year in 2025 as Stripe expanded payout services in Southeast Asia, MENA, and Latin America.

- Fraud prevention systems blocked approximately $2.3 billion in fraudulent activity in 2025, illustrating risk management.

- Average transaction size on Stripe was reported to be around $92 in 2025, reflecting increased enterprise and high-value usage.

Funding Rounds

- In 2025, Stripe raised approximately $7.8 billion in a funding round, bringing its total raised capital to about $16.2 billion.

- Funding allocation in 2025, ~38% directed toward R&D, ~28% toward infrastructure, ~22% for acquisitions.

- The company’s valuation reached around $91.5 billion in early 2025.

- Among large investors, Sequoia Capital and Andreessen Horowitz each contributed about $3.2 billion collectively in this funding round.

- Stripe launched a global expansion fund of roughly $1.3 billion in 2025, targeting new markets.

- Analysts estimate the company’s valuation multiple at roughly 16.3× net revenue at the given funding levels.

- Funding in the embedded finance sector rose sharply; Stripe allocated more than $1.1 billion into BNPL integrations in 2025.

- Operating expenses increased by around 7.5% in 2025, aligning with funding allocations toward growth initiatives.

- Stripe’s internal tender offer enabled early employees and shareholders to cash out at the $91.5 billion valuation without a public listing.

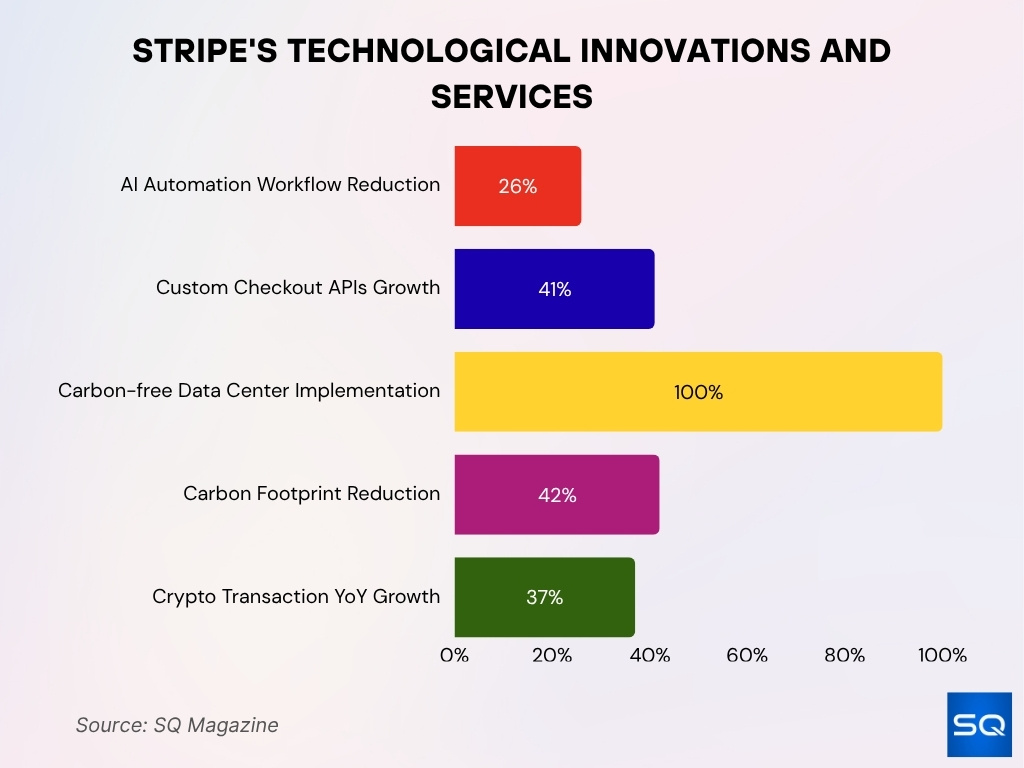

Technological Innovations and Services

- AI automation tools cut manual workflows by 26% in 2025, improving business efficiency.

- Custom checkout APIs grew 41% in enterprise adoption, enabling personalized user experiences.

- Carbon-free computing achieved 100% implementation, reducing Stripe’s carbon footprint by 42% in 2025.

- Crypto tools now support 150+ digital currencies, with crypto transactions up 37% year-over-year in 2025.

User Statistics

- As of June 2025, approximately 1.315 million active websites globally were using Stripe.

- Historically, over 4.9 million websites have integrated Stripe at some point.

- In the U.S., about 695,356 active websites use Stripe, representing roughly 52.9% of its global active website count.

- On average, Stripe onboarded around 35,000 new businesses per month in 2025.

- Stripe served 92% of the Fortune 100 companies as of 2025.

- Among the top 500 DTC e-commerce brands in Q2 2025, approximately 93% used Stripe.

- Usage by subscription-based SaaS companies: About 78% of such firms used Stripe in 2025.

- For the first time, digital merchants globally, Stripe reported an average 21% ROI improvement when migrating from legacy gateways.

- Stripe’s live website count using its services grew by more than 20% year on year from 2024 to 2025.

Adoption by Industry

- Among SaaS companies and subscription-based businesses, Stripe achieved around 78% adoption in 2025.

- Within the platform and marketplace segment, usage of Stripe Connect increased by 58%+ in 2025.

- E-commerce merchants adding Stripe’s prebuilt payment UI saw roughly a 10.5% increase in revenue on average.

- Stripe reported that the revenue that businesses process on Stripe is growing 7× faster than that of all companies in the S&P 500.

- In emerging markets, adoption of instant payouts and new payment methods grew by ~27% year on year as platforms expanded globally.

- Stripe’s embedded finance offering (issuing cards, managing funds) grew by over 50% in industries like marketplaces and fintech platforms.

- The fraud prevention tool Stripe Radar is now used by more than 300,000 businesses and filters billions of transactions annually.

- In the subscription economy, Stripe Billing manages nearly 200 million active subscriptions as of 2024.

Funding and Valuation

- 2025 funding allocation: 38% R&D, 28% infrastructure, and 22% acquisitions.

- Stripe raised $7.8 billion in 2025, reaching a $91.5 billion valuation.

- Sequoia Capital and Andreessen Horowitz remain top investors, contributing $3.2 billion collectively.

Companies Using Stripe

- Stripe lists major enterprise customers such as Apple, Microsoft, Uber, and Zara among thousands of live clients.

- As of 2025, Stripe served half of the Fortune 100 companies globally.

- More than 300,000 businesses use Stripe Billing.

- Over 50,000 companies founded using Stripe Atlas are projected to generate $5 billion in annual revenue combined.

- Stripe integrates with platforms like Shopify, Adobe Commerce, and Salesforce, boosting merchant reach and volume significantly.

- Large SaaS and subscription firms list Stripe as the primary payments partner in ~80% of cases.

- Enterprise usage of Stripe’s APIs in 2025 grew by >40% year on year as firms adopted cloud native payment stacks.

Enterprise Customers

- The platform is used by 50% of the Fortune 100 companies as of 2025.

- Roughly 62% of the Fortune 500 now use the platform, according to recent industry tracking.

- According to user case examples, more than 300,000 companies use the Billing product for subscriptions and revenue operations.

- Over 100 companies reportedly process more than $1 billion annually using the platform.

- Enterprises using the platform report onboarding reductions of “weeks to minutes” when deploying checkout and payouts.

- The platform’s fraud prevention, billing automation, and payout tools are cited as key enablers for large-scale businesses.

- Among the top global software firms (the Forbes Cloud 100), about 75% are customers of the platform.

Employee Count

- In January 2025, the company laid off about 300 employees, representing roughly 3.5% of the workforce.

- Despite layoffs, the company targets a headcount of ~10,000 employees by the end of 2025.

- A more detailed breakdown, about 8,017 employees mid-2025, reflecting growth of ~7% from the prior year.

- Engineering is the largest function, with approximately 3,378 people reported in that role in recent tracking.

- New hires in the period reached 1,117, with about 558 departures documented.

- The target growth from ~8,000 to ~10,000 implies ~17% expansion in headcount within the calendar year.

- Workforce reductions in prior years, ~14% of roles cut in late 2022 (~1,000 employees).

Payment Methods Supported

- The platform lists support for eight major categories of payment methods: cards, bank debits, bank redirects, bank transfers, buy now, pay later, real-time payments, vouchers, and wallets.

- It supports 135+ currencies across its buyer network.

- The company enables business accounts to accept payments from customers in 195+ countries, even when the merchant is in one of ~46 fully supported countries.

- Instant Payouts are available in the United States, Canada, the United Kingdom, the EU, Singapore, Australia, Norway, New Zealand, and Malaysia.

- Support for “wallets”, including mobile wallet payments, is included as part of core payment families.

- The platform added 50+ new payment methods globally, as noted in recent product update commentary.

- Local currency payout support was extended to 165+ currencies in some coverage announcements.

- The platform supports bank debits and transfers in addition to card-based and wallet payment options, widening its method scope.

Global Coverage & Countries Available

- As of December 2025, the platform is fully supported in 46 countries for merchant accounts.

- Through extended networks, it enables purchasers in 195+ countries to buy from merchants using the platform.

- It supports trades in 135+ currencies across its global footprint.

- The SEPA zone for Euro payments currently covers 41 countries, and the platform builds into this network for cross-border Europe payments.

- Global acquiring guide notes that the fortress, operating in 46 countries, allows merchants to process payments from many markets without needing local banking relationships.

- While merchant support is limited to ~46 countries, customers everywhere in buyer markets can be located in 100+ countries using its checkout flows.

- The platform continues to add new markets; recent country launches include Chile, Pakistan, and Serbia, among others, in 2025.

- Some features tax, payouts, and issuing, may have regional limitations depending on local banking and regulatory access.

API Statistics

- The company reports that the enterprise adoption of its custom checkout APIs grew by 41% in 2025.

- Machine learning fraud systems reached over 1.4 billion training data points per month in 2025 to enhance real-time accuracy.

- The platform supports 54 programming languages and frameworks in the developer ecosystem.

- At developer events (Sessions 2025), the company announced new APIs for stablecoins and global payouts to 58 countries via one email address.

- The network of apps for integrations more than doubled within a year; for example, the App Marketplace listing grew from 70 to 150 items in 2025.

- API enhancements allowed businesses to reduce manual workflows by 26% in 2025 by automating reconciliation and billing processes.

- The platform’s single-component checkout API supports multiple one-click payment buttons, e.g., Apple Pay, Google Pay, and Link, across 100+ countries.

Frequently Asked Questions (FAQs)

Around 1.3% of global GDP.

Approximately $91.5 billion.

About 1.35 million live websites.

Estimated revenue of $19.4 billion, with about 17% growth year-over-year.

Conclusion

The data shows that the platform has matured beyond startup status into one of the leading global payment infrastructures. With enterprise adoption climbing, broad global reach, rich API functionality, and a workforce oriented toward growth, the platform is now a core choice for businesses ranging from fast-growing SaaS firms to large e-commerce enterprises.

The strong support for diverse payment methods, multi-currency operations, and developer-friendly APIs positions it well for continued expansion. For U.S.-based companies and global players alike, these statistics highlight the practical scale and enterprise readiness of the platform, inviting further review of the full article for deeper insight.