It started with a pair of headphones and a curiosity: What’s this song playing? In coffee shops, dorm rooms, and crowded subway rides, Spotify quietly transformed how we consume music. Over the years, it’s become more than just a streaming app. It’s a personal DJ, a data mirror of our moods, and a platform that defines our digital soundtracks.

Today, Spotify isn’t just growing, it’s reshaping how the world interacts with music, podcasts, and creators. Let’s explore the platform’s latest data and understand the massive scale behind the sounds in our ears.

Editor’s Choice

- Spotify surpassed 713 million total users globally in Q3 2025, up from 696 million in Q2.

- The platform reached 281 million premium subscribers in Q3 2025, up 11% year-over-year.

- In the U.S., Spotify holds a 37% market share, leading Apple Music and Amazon Music.

- Spotify operates in 184+ countries worldwide, continuing expansion in emerging markets.

- Podcasts on Spotify exceeded 7 million titles as of late 2025.

- Spotify Wrapped 2025 engaged over 200 million participants on the first day alone.

- AI DJ feature usage increased by 48% in 2025 among premium subscribers.

Recent Developments

- Spotify Partner Program expanded to 9 new countries, including France, Germany, and New Zealand.

- Spotify invested over $10 billion in podcasts over the past 5 years.

- New Spotify Ads Manager launched for enhanced self-service advertising.

- Lossless audio and immersive music videos rolled out in beta to Premium users.

- AI Playlist expanded to 40+ new markets for Premium listeners.

- Custom cover art and advanced playlist editing tools added globally.

- In-app Messages and track transition customization were introduced.

- Spotify Sycamore Studios opened for podcasts and creators.

Global Music Streaming Subscriber Market Share

- Spotify leads the global music streaming market with 31.7% of total subscribers, maintaining a clear dominance over competitors.

- Tencent Music ranks second, holding 14.4% market share, driven largely by strong adoption in the Chinese market.

- Apple Music captures 12.6% of subscribers, supported by deep integration within the Apple ecosystem.

- Amazon Music accounts for 11.1% of global subscribers, benefiting from Prime bundle adoption.

- YouTube Music holds a 9.7% share, leveraging YouTube’s massive global user base and video-first discovery model.

- NetEase represents 6.7% of subscribers, with a strong presence in China’s domestic market.

- Yandex Music commands 3.4% market share, primarily concentrated in Russia and Eastern Europe.

- Deezer maintains a niche position with 1.3% of global subscribers.

- Other streaming platforms collectively account for 9.7%, highlighting continued fragmentation beyond the major players.

Spotify Users

- As of Q1 2025, Spotify reported 615 million total users, up from 574 million in Q4 2024.

- Spotify added approximately 41 million users in just the last quarter.

- Premium subscribers now total 239 million, growing steadily from 210 million in Q1 2024.

- Over 100 million users access Spotify via Android devices, while 35% use iOS.

- Desktop users now account for 9% of Spotify’s traffic, with mobile remaining dominant.

- Spotify Family and Duo plans account for 41% of all premium subscriptions.

- Gen Z (aged 18–24) represents 38% of Spotify’s global user base.

- 51% of U.S. Spotify users are female, reflecting a shift toward gender-balanced engagement.

- Spotify recorded over 33 billion listening hours in Q1 of 2025 alone.

- Spotify usage peaks between 4 p.m. and 7 p.m., with Fridays seeing the highest engagement.

Monthly Active Users (MAUs) vs. Premium Subscribers

- MAUs (Monthly Active Users) reached 615 million, a 7.1% quarterly increase.

- Premium subscribers reached 239 million, a 13.8% year-over-year jump.

- 61% of users are free-tier, supported by Spotify’s ad-driven model.

- India now hosts 46 million active users, with a majority still on the free tier.

- The average revenue per premium user (ARPU) is $4.58, slightly down from $4.62 in 2024 due to regional pricing strategies.

- The premium plan churn rate was reduced to 1.3%, the lowest since 2020.

- Spotify HiFi, introduced in late 2024, has a 6% adoption rate among premium subscribers.

- Over 40 million users upgraded to premium in the past year, driven by features like offline listening and ad-free access.

- Spotify Student Premium saw a 19% rise in subscription rate in university towns across the U.S.

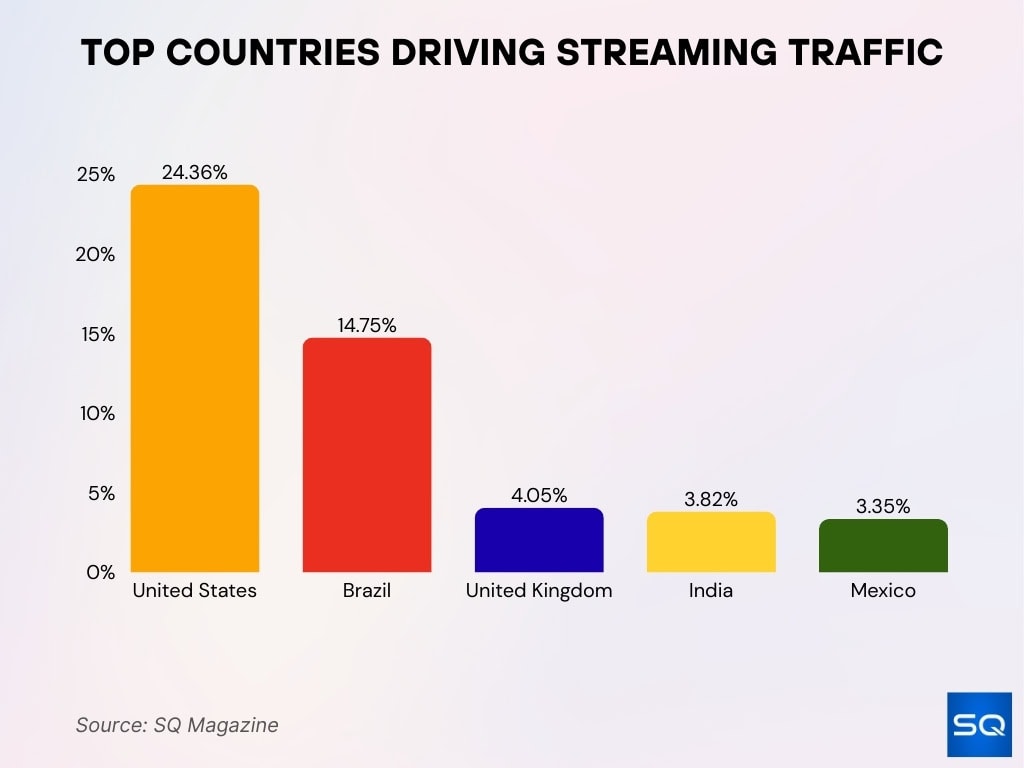

Top Countries Driving Streaming Traffic

- The United States leads global streaming traffic, accounting for 24.36% of total visits, making it the single largest source of platform engagement.

- Brazil ranks second with 14.75% traffic share, highlighting its rapidly growing digital music and streaming audience.

- The United Kingdom contributes 4.05% of total traffic, reflecting strong but more mature market penetration.

- India generates 3.82% of streaming traffic, supported by a fast-expanding user base and increasing mobile adoption.

- Mexico rounds out the top five with 3.35% traffic share, driven by rising smartphone usage and streaming popularity.

Age Breakdown of Spotify Podcast Listeners

- 18-34 age group comprises 66% of U.S. monthly podcast listeners.

- 35-54 segment accounts for 61% monthly listenership rate.

- 55+ users represent 38% of monthly podcast consumers.

- 18-44 group makes up 59% of the total U.S. podcast audience.

- 12-34 listeners show a 66% monthly engagement rate.

- 45-54 age range holds 61% monthly listenership.

- Gen Z (18-24) dedicates 14% consumption to video podcasts.

Users & Audience

- In 2025, 47% of Spotify’s audience is under the age of 35.

- Millennials (25–34) make up 29% of the global user base.

- Over 62% of Gen Z users listen to music daily through Spotify.

- In the U.S., 68% of Spotify users identify music as their top use case, while 22% prefer podcasts.

- The average time spent on Spotify per day is 102 minutes globally.

- The most engaged audience is in Mexico, where the average daily listening time exceeds 120 minutes.

- Spotify Kids, a sub-platform for children, grew by 12% year-over-year in active users.

- U.S. Latino listeners on Spotify grew by 15%, driven by regional content and curated playlists.

- Spotify’s wellness and ambient categories are up 34% in listener engagement.

- 72% of Spotify users report that algorithmic recommendations influence their playlist choices.

Global Market Share by Music Streaming Services

- Spotify dominates with 31.7% global subscriber share.

- Tencent Music holds 14.4% of the market.

- Apple Music accounts for a 12.6% share.

- Amazon Music captures 11.1% market share.

- YouTube Music represents 9.7% of subscribers.

- Netease secures 6.7% of the streaming market.

- Other platforms collectively hold a 9.7% share.

- Deezer maintains a 1.3% niche market share.

- Yandex accounts for 2.8% of global subscribers.

Most Streamed Songs and Artists

- Bad Bunny topped Spotify’s most-streamed artist globally in 2025 with 19.8 billion streams.

- Taylor Swift ranked second with 26.6 billion streams from prior years, strong in 2025.

- The Weeknd leads monthly listeners at 122.86 million as of January 2026.

- Drake secured fourth place among top top-streamed artists in 2025.

- Billie Eilish placed fifth globally for 2025 streams.

- “Golden” by HUNTR/X et al. dominated as the top song on the 2025 Wrapped soundtrack.

- Taylor Swift’s “Father Figure” led 2025-released songs at 247 million streams.

- Ariana Grande’s “Twilight Zone” hit 244.6 million streams in 2025.

- Bad Bunny’s “KETU TeCRÉ” reached 244.4 million streams released in 2025.

Spotify Financials

- Spotify’s Q3 2025 revenue reached €4.3 billion ($5 billion), up 12% year-over-year.

- Premium subscriptions generated €3.8 billion ($4.47 billion), while ads contributed €446 million.

- Total revenue projected to exceed €17 billion for full-year 2025.

- Operating profit hit €582 million in Q3 2025, up 33% year-over-year.

- Gross margin improved to 31.6% in Q3 2025 from 31.1% prior year.

- Premium ARPU stood at €4.53 ($5.29) in Q3 2025, flat year-over-year.

- Ad-supported revenue grew 13% year-over-year to a record in recent quarters.

Spotify Top Genres For You

- Hip-Hop/Rap leads with 32% of global streams on Spotify.

- Pop accounts for 28% of total platform streams.

- Latin music represents a 15% share, surpassing 15 billion monthly streams.

- R&B holds 30.7% of all streams worldwide.

- Rock secures 14.7% market share alongside Pop.

- R&B/Soul captures 12% of global streaming volume.

- EDM/Dance comprises 8% of Spotify streams.

Artist Earnings and Royalty Distribution

- Spotify paid out over $10 billion in royalties to artists and rights holders in 2024.

- More than 100,000 artists generated over $10,000 each on Spotify in 2024.

- Nearly 1,500 artists earned more than $1 million in royalties from Spotify in 2024.

- Spotify pays $0.003–$0.005 per stream, depending on market and subscription type.

- 70 artists earned over $10 million in royalties, up 600% since 2017.

- Independent artists generated over $5 billion, half of the total Spotify royalties in 2024.

- Taylor Swift topped earnings with $426 million from 106 billion lead streams.

- Bad Bunny earned $370 million from 92 billion streams on Spotify.

Spotify’s Role in the Podcasting Industry

- Spotify hosts over 7 million podcast titles and 300,000 video podcasts.

- Podcasts account for 21% of U.S. weekly listeners’ primary platform usage.

- 40% of the U.S. population listens to podcasts monthly, with Spotify key platform.

- Spotify paid over $100 million to podcasters in Q1 2025 alone.

- Spotify holds 38% global share of podcast listens vs. Apple’s 31%.

- 270 million Spotify users have watched video podcasts to date.

- Apple Podcasts hosts 2.7 million podcasts as of 2025.

- Video podcasts on Spotify grew 28% in Q1 2025 in active monthly titles.

- 584 million people worldwide listened to podcasts in 2025.

Advertising Revenue and Spotify Ad Platform Performance

- Spotify’s ad revenue is projected at $2.08 billion for 2025, up 6.8% year-over-year.

- U.S. ad business forecasted at $1.35 billion in 2025, up from $1.21 billion in 2024.

- Ad-supported revenue reached €1.85 billion in 2024, 11.8% of total revenue.

- Q1 2025 ad-supported revenue grew 8% year-over-year to €419 million.

- Spotify Ad Exchange improved conversion rates by nearly 70% for partners.

- Audio ads CPM ranges $15–$25, video $20–$30, podcasts $18–$50.

- Ad-supported users comprise 58% of Spotify’s total audience in early 2025.

- Programmatic audio ads projected to hit $2.26 billion U.S. market in 2025.

Spotify App Engagement and User Behavior

- Average Spotify user streams 114 minutes of audio daily, premium 142 minutes.

- North America users average 140 minutes daily listening time.

- Discover Weekly leads to 56 million new artist discoveries weekly.

- 77% of Discover Weekly discoveries feature emerging artists.

- Spotify Wrapped 2025 hit 250 million engagements in under 3 days.

- Wrapped 2025 shares exceeded 500 million, up 41% year-over-year.

- 200 million users engaged with Wrapped 2025 in the first 24 hours.

- AI DJ is available in over 60 markets, used by 1 in 5 active users.

Trends in Playlist Popularity and Curation

- Spotify users create over 4 billion total playlists worldwide.

- Today’s Top Hits boasts 35 million followers as the top editorial playlist.

- Editorial playlists drove 30% of all Spotify streams in recent years.

- Over 3,000 official Spotify editorial playlists exist globally.

- Collaborative playlists surged 41% in creation among under-30 users.

- Custom cover art and edit tools boosted playlist engagement.

- New Music Friday averages a 3:12 track duration across 100 tracks.

- Personalized playlists like Daylist update daily based on habits.

- Playlist tools added sorting and filtering for better curation.

Impact of AI and Personalization on Spotify Recommendations

- Spotify’s personalization uses over 5,000 musical attributes and 600 billion monthly user events.

- AI DJ boosts user retention by 15% and engagement to 80% among users.

- AI users spend 140 minutes daily vs. 99 minutes for non-AI users.

- AI-recommended users show 40% higher retention rates.

- Personalized playlists contribute to 46% of premium conversions.

- 72% of users feel Spotify understands their music taste.

- AI DJ handles voice commands in 60+ markets for Premium users.

- Discover Weekly and Release Radar drive 56 million new artist discoveries weekly.

Frequently Asked Questions (FAQs)

Out of 713 million total users, 446 million are free users and 281 million are paying subscribers.

Spotify is available in more than 180 global markets.

Spotify holds approximately 31.7% of the global music streaming market share.

Spotify reached 281 million Premium subscribers by Q3 2025.

Conclusion

Spotify’s landscape is both familiar and futuristic, a platform where human touch and AI coexist to shape how we discover, connect, and groove. With rising revenue, growing global influence, and hyper-personalized tools, Spotify isn’t just keeping pace; it’s setting the beat.

For artists, marketers, and listeners alike, the numbers tell a powerful story: Spotify is more than a streaming service; it’s a digital culture engine. As the platform evolves, it continues to set new standards for how we experience sound in the streaming era.