Solana has blindsided crypto traders with a massive year-end rebound, triggering a record-breaking liquidation imbalance that wiped out short sellers in just one hour.

Quick Summary – TLDR:

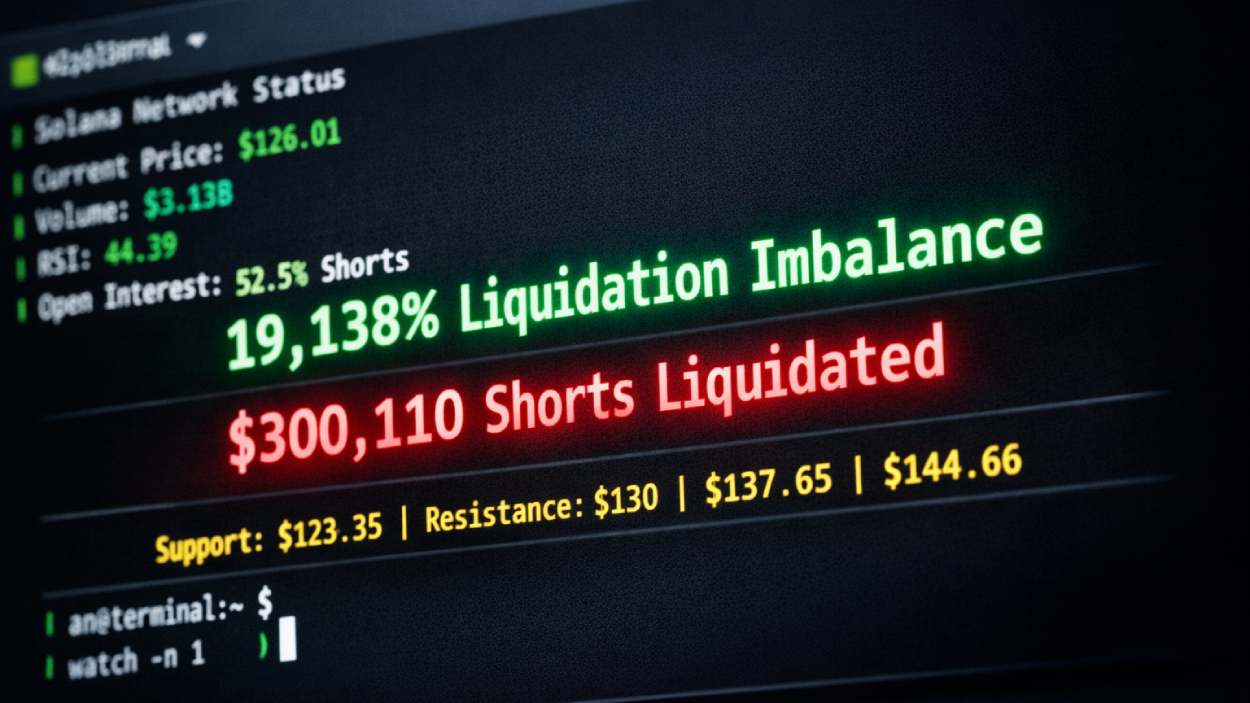

- Solana surged over 1.6% in one hour, sparking a $300,110 short-side liquidation.

- A record 19,138% liquidation imbalance crushed bearish traders.

- Trading volume jumped 12.47% to $3.13 billion, signaling strong market participation.

- Despite a 35% annual drop, Solana is showing signs of resilience heading into 2026.

What Happened?

Solana (SOL) surprised the crypto market by staging a rapid price reversal that liquidated more than $300,000 in short positions in a single hour. This sharp move led to an extraordinary 19,138% liquidation imbalance, putting short sellers in a tight spot and reigniting optimism after a challenging year.

A Sudden Shock for Short Sellers

In what can only be described as a short squeeze event, Solana surged from $123.50 to $126.57 before settling around $126.01, a 1.63% intraday gain. During this hour-long price spike, CoinGlass data showed that short traders lost $300,110, while long traders incurred minimal losses of just $1,560. This dramatic imbalance indicates that bearish traders were caught off guard by Solana’s unexpected strength.

- Liquidation Imbalance: 19,138% favoring long traders

- Shorts Liquidated: $300,110 in one hour

- Long Liquidations: $1,560

Market watchers noted that Solana remains above key moving averages and still has room to rise, with the Relative Strength Index (RSI) hovering near 44.39 to 45.40, well below the overbought threshold.

Price Levels and Market Context

Solana’s latest bounce comes in the final stretch of what has been a volatile year. After hitting a high of $294.33 in January 2025, SOL plummeted to $96.59 in April, reflecting a 35% yearly decline. However, this year-end move is giving bulls some hope.

Current price action shows SOL trading near $125.58, with a 24-hour trading range between $123.60 and $126.86, and market capitalization at $70.7 billion.

- Key Support: $123.35

- Major Resistance Levels: $130, $137.65, $144.66, $152.20

- Bearish Risk Levels: $115 wedge support, $107 pivot, $95 April low

Futures market data indicates that 52.5% of open interest remains in short positions, suggesting lingering bearish sentiment despite the bullish bounce. Yet, institutional support persists, with daily spot ETF inflows of $2.93 million, pointing to steady underlying demand.

Momentum, Volume, and Trading Sentiment

A 12.47% spike in volume to $3.13 billion reveals that investor interest is surging along with price. If Solana can break above the $130 resistance, analysts believe a broader bullish phase could begin, especially if short-term traders avoid early profit-taking.

Still, caution remains. Solana’s descending wedge near $120 reflects ongoing market pressure, and traders are watching RSI, volume shifts, and resistance zones closely to gauge sustainability.

SQ Magazine Takeaway

I find this Solana move incredibly revealing. It’s a textbook example of how quickly sentiment can flip in crypto. Bears were dominating the narrative all year, and then boom, one hour, and they’re out $300,000. This tells me that liquidity depth and trading psychology still rule the day in crypto. If Solana holds this ground and punches past $130, we could be looking at a comeback story in the making. But let’s be real, the next few days will tell us if this was just a flash or the start of something bigger. Keep your eyes open.