Invesco Galaxy’s QSOL Solana ETF is on the verge of trading after clearing a major regulatory milestone, signaling rising institutional confidence in the crypto.

Quick Summary – TLDR:

- Invesco Galaxy has filed a Form 8-A with the SEC, marking a crucial step before launching its Solana ETF, QSOL.

- The ETF could begin trading on the Cboe BZX Exchange as early as next week.

- Invesco has seeded the fund with a 4,000-share, $100,000 investment and completed an independent audit.

- Institutional interest in Solana is rising, with CME preparing to launch Solana futures and over $16 million in recent investment inflows.

What Happened?

Invesco Galaxy has filed a Form 8-A with the U.S. Securities and Exchange Commission, signaling that its Solana ETF (QSOL) is structurally ready and could launch soon. The ETF will trade on the Cboe BZX Exchange, pending final SEC approval. This move follows recent updates to the fund’s operational structure, sponsor fee plans, and a confirmed $100,000 capital injection.

🚨UPDATE: @InvescoUS, with over $10 billion AUM, has filed a Form 8-A with the SEC for its Invesco Galaxy @solana ETF, a step that typically comes right before launch. These filings are usually followed by trading beginning the next day. pic.twitter.com/MxXcV4coeK

— SolanaFloor (@SolanaFloor) December 9, 2025

Invesco Galaxy Prepares for Market Entry

The filing of Form 8-A is often the last step before an ETF goes live, and Invesco Galaxy has checked off every box. The company recently revised its ETF registration, detailing its operational terms and fee structure. While it does not plan to waive the sponsor fee at launch, it has left room for adjustments in the future.

To back the fund, Invesco Ltd. purchased 4,000 Solana shares, creating a $100,000 seed investment that serves as the trust’s initial capital. An independent audit has been completed, confirming the ETF’s readiness to start trading under the ticker QSOL.

If final approval from the SEC comes through quickly, trading could begin as early as next week.

Growing Institutional Momentum Behind Solana

The upcoming launch of QSOL is not happening in isolation. It follows the debut of Franklin Templeton’s Solana ETF, which recently entered the U.S. market, highlighting a growing competitive landscape for Solana-focused institutional products. If QSOL launches successfully, it could become the eighth Solana ETF available to American investors.

Further strengthening Solana’s case among institutions, CME Group is preparing to launch spot-quoted Solana futures on December 15, pending regulatory approval. This would provide another tool for investors to gain Solana exposure in a regulated environment.

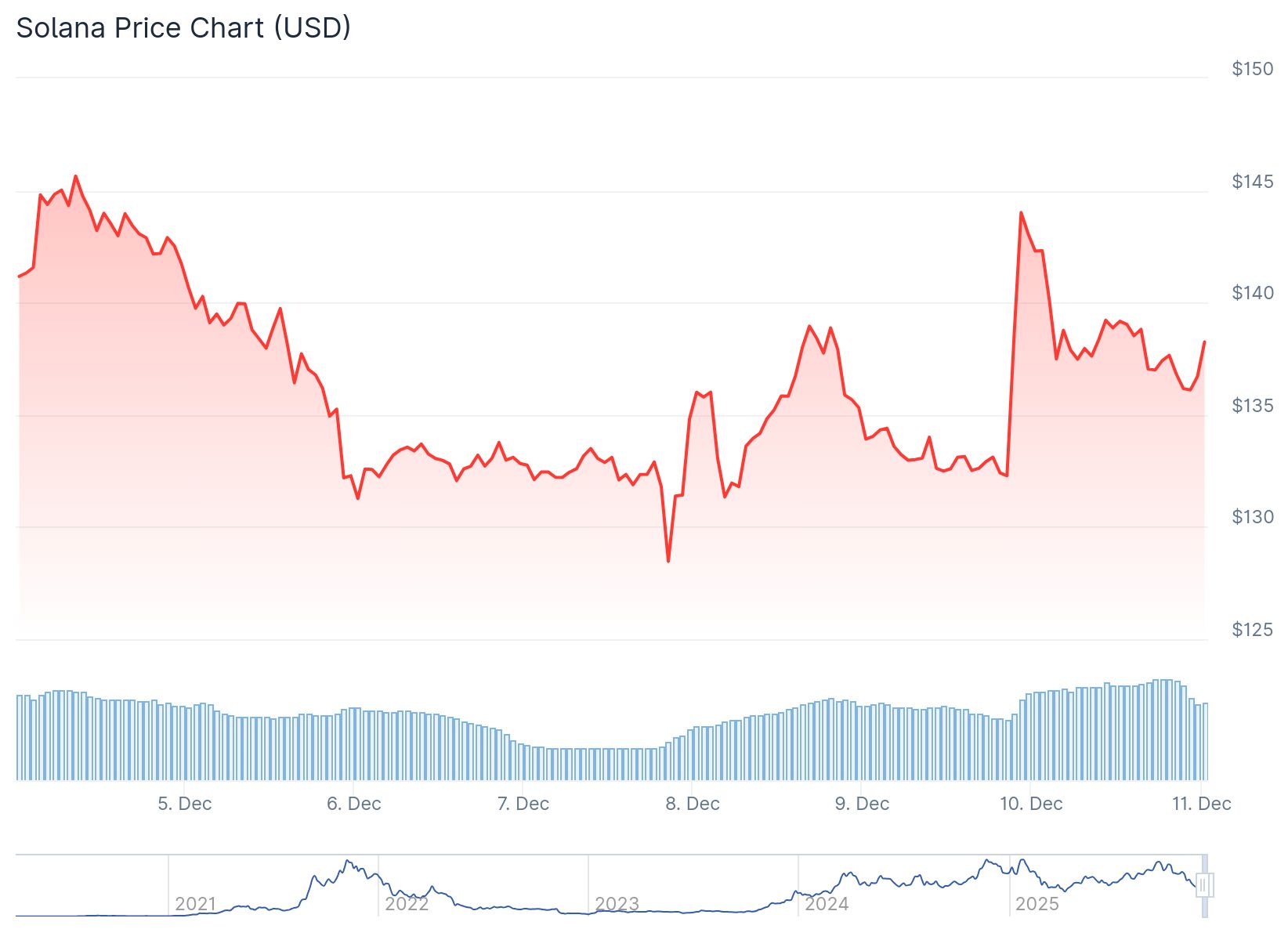

Solana Price Reacts to ETF Buzz

The announcement of QSOL’s readiness initially gave Solana’s price a 4 percent boost, as investors welcomed the possibility of greater institutional adoption. Over the last week, Solana investment products saw over $16 million in inflows, marking four straight days of positive momentum after a period of outflows.

However, price action has been volatile. Solana recently dropped over 4 percent, now trading near $136. According to analyst Ali Martinez, the token is stuck in a multi-week range between $124 and $145, with repeated rejections near the upper level. Traders are watching the $134 level closely, as a break below could signal further downside toward $128 or even $124.

Additionally, on-chain data from Glassnode shows Solana’s Realized Profit-to-Loss Ratio has stayed below 1 since mid-November. This indicates more losses than profits are being locked in, suggesting that while institutional confidence is rising, retail traders remain cautious.

SQ Magazine Takeaway

I see this as a turning point for Solana. The fact that big names like Invesco and CME are lining up institutional-grade products shows that Solana is finally shaking off its earlier reputation for outages and instability. Sure, on-chain metrics still show some hesitation, but let’s be real: retail traders often lag behind when big institutional moves happen. If QSOL goes live smoothly, this could trigger a whole new wave of interest and credibility for Solana. I’d say keep an eye on this one.