In a small town in Oregon, a retired schoolteacher recently lost $24,000 in a sophisticated phishing scam. Despite decades of experience and cautious financial habits, she clicked a link that appeared to be from her bank. This isn’t just a cautionary tale; it’s part of a much bigger picture. In 2025, scams have grown into a global crisis, adapting faster than the systems meant to stop them. With criminals leveraging AI and social engineering like never before, it’s no longer about if you’ll be targeted, but when.

Editor’s Choice

- $15.3 billion: the estimated global financial losses from scams in the first half of 2025.

- 56% of U.S. adults have reported being targeted by at least one scam this year.

- 42% of scams in 2025 involve AI-generated content such as voice cloning or deepfakes, up from just 12% two years ago.

- $1.2 billion: the total romance scam losses reported in the U.S. as of Q2 2025, making it the most lucrative scam type so far this year.

- 33 million: the number of smishing (SMS phishing) attempts blocked by major U.S. telecoms monthly in 2025.

- 71% of social media scams in 2025 originated from platforms with weak moderation on messaging ads.

- 3.8 million: the average monthly fraud complaints filed with the FTC by American consumers this year.

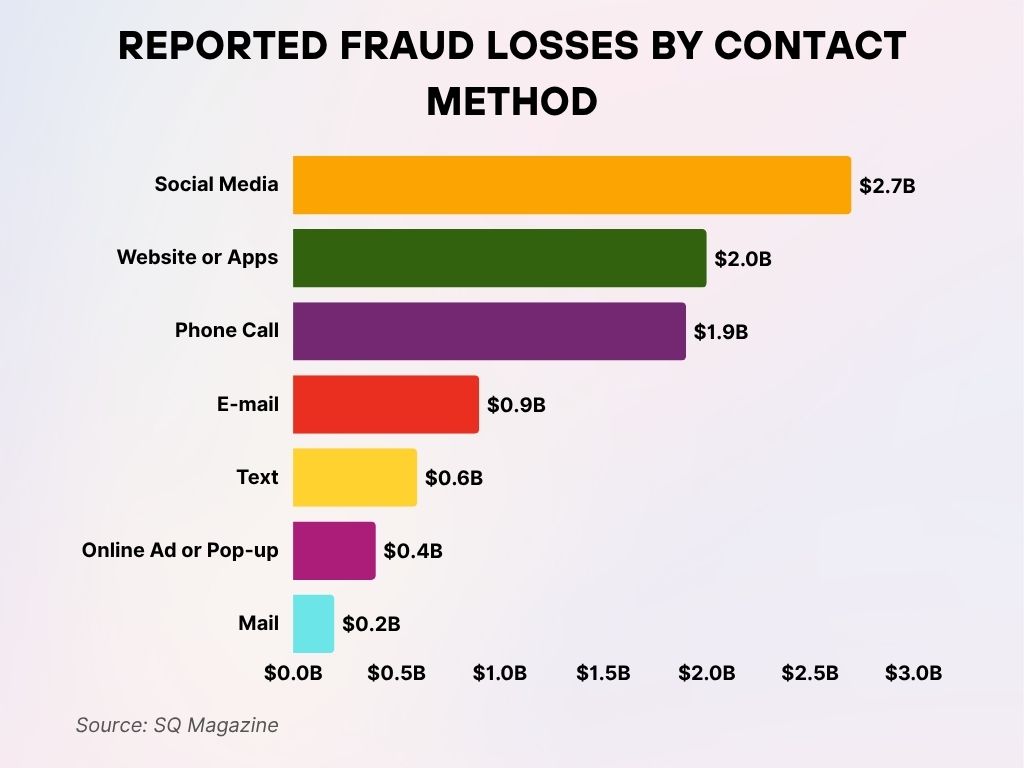

Reported Fraud Losses by Contact Method

- Social media is the leading source of fraud-related losses, accounting for a massive $2.7 billion.

- Websites or apps come next, with reported fraud losses totaling $2.0 billion.

- Phone calls are close behind, responsible for $1.9 billion in losses.

- Email-based scams resulted in $0.9 billion in reported losses.

- Text message fraud led to $0.6 billion in consumer losses.

- Online ads or pop-ups caused $0.4 billion in fraud-related losses.

- Mail scams, while lower in volume, still contributed $0.2 billion in losses.

Financial Impact of Scams Worldwide

- The U.S. economy alone is projected to lose $10.6 billion to scams in 2025.

- In 2025, the average loss per victim in the U.S. rose to $1,270, a 16% increase from the previous year.

- Corporate account takeover scams have surged, with median thefts reaching $114,000 per incident this year.

- Banking fraud-related losses hit $4.3 billion globally in the first half of 2025.

- The insurance industry reported $2.1 billion in scam-related claim frauds in 2025, a 29% year-over-year rise.

- The elderly (65+) demographic saw a 39% spike in total losses in 2025, reaching $3.4 billion globally.

- Business email compromise (BEC) scams now account for 25% of all reported scam losses worldwide in 2025.

- In the crypto sector, investment scam losses have doubled year-over-year to reach $5.6 billion in 2025.

- Financial institutions reported a 24% rise in fraud alerts triggered by unauthorized transactions in 2025.

- Refund and rebate scams targeting consumers surged by 38%, with average losses of $980 per case in 2025.

Business and Corporate Scam Data

- $7.8 billion: total corporate scam-related losses in 2025, a 22% increase compared to 2024.

- 31% of mid-sized businesses reported at least one scam breach by Q2 2025.

- Impersonation scams targeting company executives have risen 41% this year, costing firms an average of $172,000 per case.

- 74% of supply chain-related scams were initiated through compromised vendor email accounts in 2025.

- In 2025, 1 in 5 reported corporate scams involved fake invoice fraud, leading to $1.6 billion in global losses.

- Tech support scams targeting enterprise IT systems have grown by 35%, with $390 million in estimated damages this year.

- 47% of companies hit by a scam in 2025 suffered reputational damage that led to lost clients or contracts.

- Credential theft scams are up 18% in 2025, with stolen business login data trading for an average of $420 on the dark web.

- Corporate phishing attack frequency increased by 28% in Q1 2025 alone.

- 12% of SMBs in the U.S. permanently shut down after major scam incidents this year.

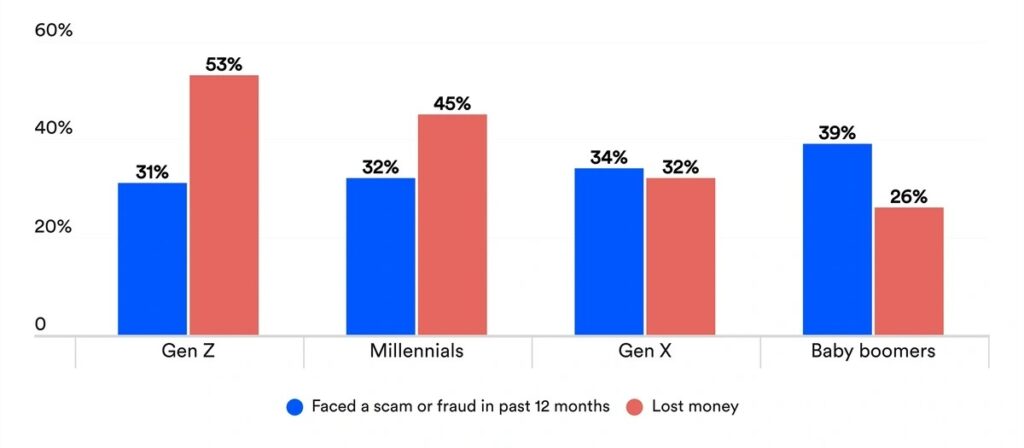

Scam and Fraud Exposure by Generation

- Gen Z reported the highest financial loss rate, with 53% having lost money to scams, even though only 31% faced a scam or fraud.

- Millennials experienced similar trends, with 45% reporting monetary losses and 32% encountering scams.

- Gen X had a 34% scam exposure rate and 32% experienced financial losses, showing a more balanced risk and impact.

- Baby Boomers were the most exposed to scams at 39%, yet only 26% reported losing money, the lowest loss rate among all generations.

Government and Tax-Related Scam Reports

- IRS-related scams caused $392 million in consumer losses in 2025, a 19% spike over the prior year.

- 3.2 million: estimated number of fake tax refund schemes filed by fraudsters in 2025.

- Medicare scam calls targeting older adults saw a 44% increase in Q1 2025, with average losses of $1,050.

- Unemployment fraud has resurged in 2025, with fraudulent claims totaling $1.9 billion in the U.S. alone.

- Student loan forgiveness scams hit a record high in 2025, with 1.4 million complaints received by federal agencies.

- 29% of scam victims in 2025 reported being contacted via robocall pretending to be government entities.

- Pandemic relief scam fraud continues with over $780 million in new claims tied to fraudulent grant or aid applications.

- 41 states reported increased fraudulent voter registration activities linked to identity theft in 2025.

- 11% of federal assistance programs faced scam-related anomalies in audit reports this year.

- The average resolution time for government scam claims is 68 days in 2025.

Social Media and Messaging App Scam Metrics

- Instagram tops scam-related reports in 2025, involved in 38% of all social media fraud cases.

- $2.4 billion: total reported scam losses via social platforms in 2025.

- WhatsApp scam activity rose 32% this year, with common tactics involving fake investment groups and lottery alerts.

- Messenger-based phishing links are shared at a rate of 5.6 million per week in 2025.

- 58% of scam victims under age 35 were approached via TikTok or Instagram in 2025.

- Romance scams initiated on Facebook Dating resulted in $730 million in losses this year.

- 15% of influencer profiles analyzed in 2025 were linked to coordinated fraud or scams.

- Telegram fraud networks have grown by 27%, operating increasingly through crypto-themed investment channels.

- Snapchat and Discord scams are targeting U.S. teens, with 9,200+ incidents logged so far in 2025.

- Verified profile impersonations have climbed to 84,000 cases, mostly affecting businesses and public figures on X and Instagram.

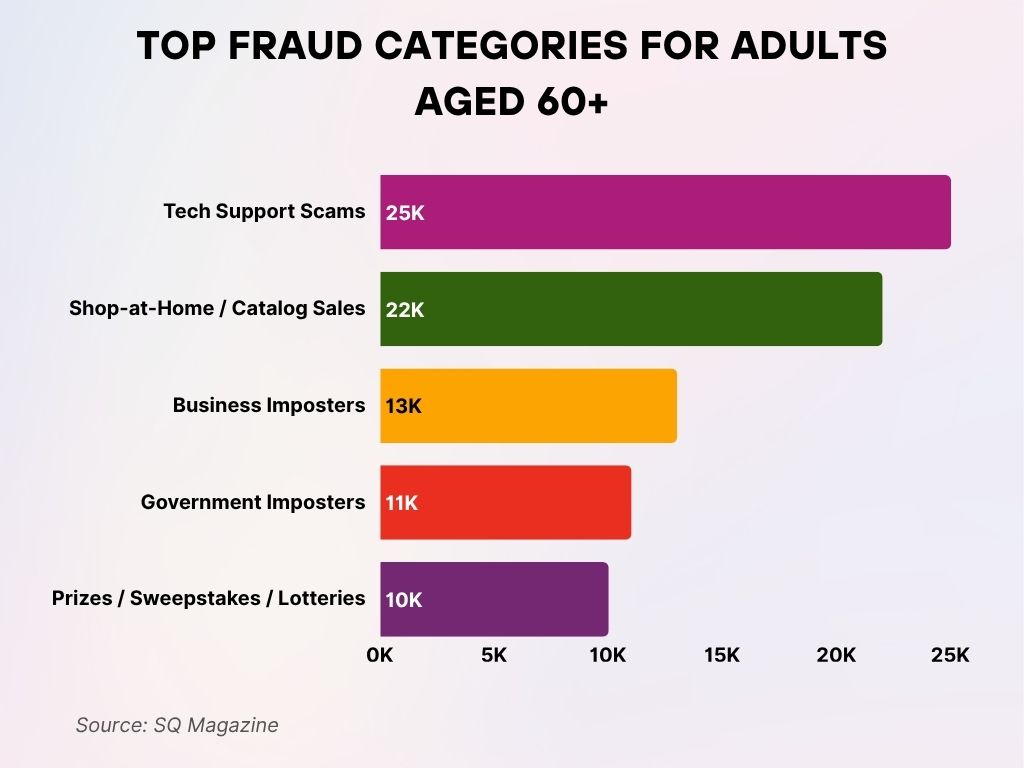

Top Fraud Categories for Adults Aged 60+

- Tech support scams topped the list with 25,000 reports indicating a financial loss, the most common fraud targeting older adults.

- Shop-at-home and catalog sales scams followed closely, generating 22,000 loss reports.

- Business imposters accounted for 13,000 reports of monetary losses among seniors.

- Government imposters triggered 11,000 reports from victims aged 60 and above.

- Prize, sweepstakes, and lottery scams led to 10,000 loss reports, making them the fifth most reported scam type.

Geographic Hotspots for Scam Activity

- California, Texas, and Florida lead U.S. states in reported scam losses in 2025, collectively surpassing $2.3 billion.

- India and Nigeria were identified as primary origination points for international scam rings in 2025.

- Hong Kong saw a 47% rise in financial scam reports in 2025, particularly linked to fintech and forex fraud.

- Scam complaints per capita are highest in the U.S. at 1 in every 94 residents in 2025.

- Germany leads Europe in scam-related digital crime reporting, tallying 890,000+ cases in 2025.

- Latin America witnessed a 34% rise in WhatsApp-based scams, especially in Brazil and Colombia.

- Canadian fraud centers recorded $683 million in consumer scam losses as of Q2 2025.

- Russia and Ukraine are under scrutiny for hosting dark web platforms enabling global scam campaigns.

- Australia saw a 21% jump in reported scam texts, hitting 170 million+ spam messages this year.

- South Africa leads sub-Saharan Africa in scam volumes, with over 124,000 incidents tied to mobile money fraud.

Law Enforcement and Regulatory Response

- In 2025, the FBI’s Internet Crime Complaint Center (IC3) received over 5.4 million scam-related complaints.

- Interpol coordinated 38 global sting operations in 2025, leading to 7,800 arrests tied to cross-border scam syndicates.

- $1.6 billion in scam-related assets were seized or frozen globally by authorities this year.

- The FTC levied $920 million in fines against fraudulent companies and platforms in 2025.

- Europol shut down 23 dark web marketplaces involved in scam toolkits and stolen credentials.

- The DOJ prosecuted 121 major scam cases in the U.S. federal courts during the first five months of 2025.

- 46% of scam victims in 2025 reported being satisfied with the law enforcement response.

- Cybercrime task forces in Asia expanded by 26%, primarily to counter rising financial scams and phishing rings.

- New global anti-fraud data sharing frameworks were ratified by 78 countries in early 2025.

- Real-time payment fraud prevention laws were passed in 12 U.S. states this year.

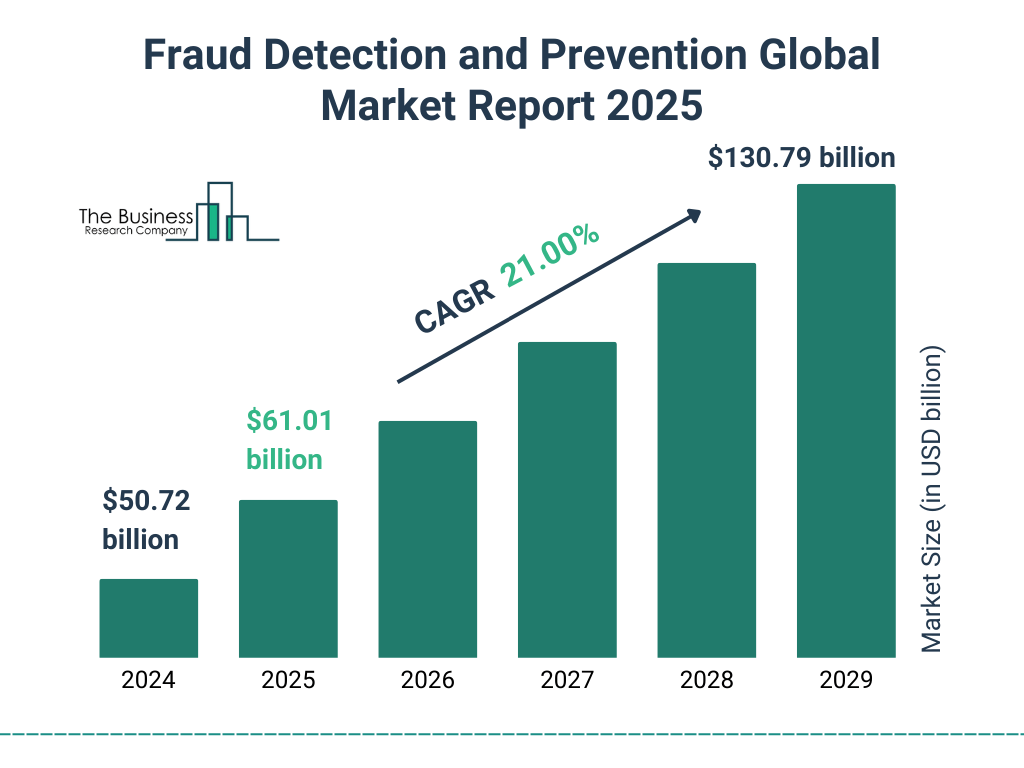

Global Fraud Detection and Prevention Market Growth

- The fraud detection and prevention market is expected to grow from $50.72 billion in 2024 to $130.79 billion by 2029.

- In 2025, the market will reach $61.01 billion, reflecting strong early momentum.

- The industry is projected to expand at a CAGR of 21.00% over the 5-year period.

- The market size shows consistent yearly growth, nearly tripling by 2029.

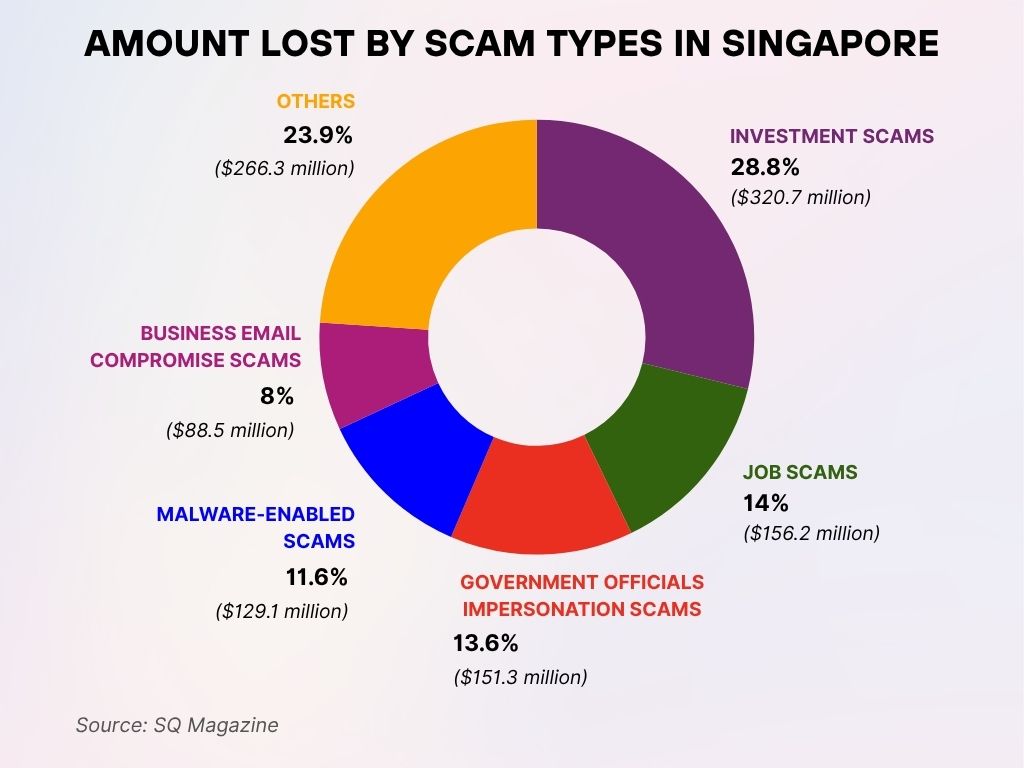

Amount Lost by Scam Types in Singapore

- Investment scams caused the highest losses, accounting for 28.8% or S$320.7 million of the total amount lost.

- Job scams ranked second, with victims losing S$156.2 million, representing 14.0% of the total.

- Government official impersonation scams led to S$151.3 million in losses, or 13.6% of the overall figure.

- Malware-enabled scams resulted in S$129.1 million in financial losses, contributing 11.6% to the total.

- Business email compromise scams made up 8.0% of losses, totaling S$88.5 million.

- Scams categorized as “Others” still represented a large portion, with S$266.3 million lost, 23.9% of the total.

- In total, at least S$1.1 billion was lost to scams across all categories.

Consumer Awareness and Reporting Trends

- 68% of scam victims in 2025 did not realize they were scammed until money was lost or accounts were compromised.

- The average consumer delay in reporting scams is 9.4 days.

- Online scam awareness programs reached 102 million people globally in the first half of 2025.

- 21% of U.S. adults participated in fraud education workshops or webinars this year.

- 38% of Americans can correctly identify all major scam types in 2025.

- Scam detection software downloads surged 51% in 2025, driven by growing concern around mobile fraud.

- 12.3 million scam reports were filed with the FTC as of mid-2025.

- 29% of victims used bank alerts or app warnings to catch scam attempts in real time this year.

- Word of mouth remains the top way consumers share scam experiences, reported by 47% of survey respondents in 2025.

- 58% of young adults (ages 18–29) report sharing scam awareness posts on social media in 2025.

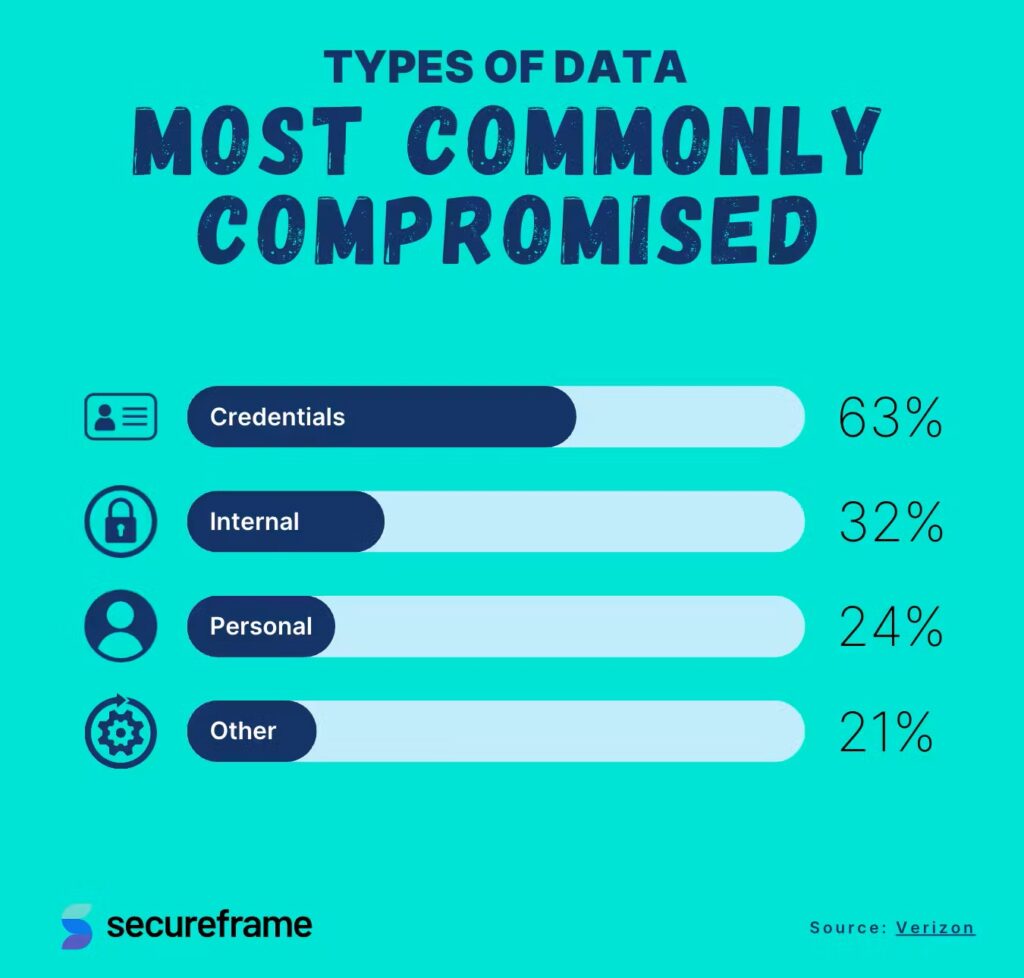

Most Commonly Compromised Data Types

- Credentials are the most frequently breached, involved in 63% of data compromises.

- Internal data (such as company-sensitive info) was exposed in 32% of incidents.

- Personal data (names, addresses, etc.) was compromised in 24% of breaches.

- Other data types made up 21% of all compromised cases.

Recent Developments

- The World Economic Forum classified scam proliferation as a “top 10 cyber risk” in its 2025 global risk report.

- Visa and Mastercard launched AI-driven fraud engines capable of intercepting $4.1 billion in potential scam attempts annually.

- TikTok and Instagram announced mandatory scam-content detection APIs in partnership with regulators.

- Apple’s iOS 18 features built-in scam call detection with 92% accuracy across major U.S. carriers.

- Google Search began de-ranking known scam URLs algorithmically, removing 16 million pages in Q1 2025.

- Amazon now flags potentially fraudulent sellers via pattern recognition, leading to the removal of 120,000+ accounts.

- PayPal introduced real-time scam reimbursement for verified victims in 15 countries, including the U.S., in 2025.

- Open banking platforms in Europe adopted biometric authentication in 2025 to counter digital payment fraud.

- The U.N. announced a global anti-scam registry prototype set for pilot testing in early 2026.

- AI whistleblower platforms are being piloted to auto-detect scam scripts and report malicious campaigns across the dark web.

Conclusion

Scams in 2025 are more complex, more personal, and more technologically advanced than ever before. What was once limited to emails from supposed Nigerian princes has now evolved into a multi-billion-dollar shadow economy driven by artificial intelligence, deepfakes, and hyper-targeted social engineering. While law enforcement and tech giants are finally catching up, consumer education and vigilance remain critical. The threat is not slowing down, but neither is the effort to fight back.