Polkadot stands among the most influential blockchain ecosystems shaping Web3 today. Built for interoperability, it empowers multiple chains to operate in parallel and share security, enabling tailored blockchains (parachains) to serve real‑world needs. Across decentralized finance, cross‑chain data transfers, and scalable Web3 applications, Polkadot’s architecture influences how developers and enterprises build next‑generation decentralized systems. As the network evolves, these metrics show how Polkadot measures up in adoption, market performance, and ecosystem maturity.

Editor’s Choice

- Polkadot’s market cap has hovered in the multi‑billion‑dollar range, typically between $3.4 billion and $5 billion, in early 2026.

- Circulating supply stands near 1.6–1.7 billion DOT.

- 24‑hour trading volume often exceeds $100 million to $400 million.

- The yearly inflation rate is around 7.6–7.8%.

- Polkadot has a bearish sentiment on price indicators in early 2026.

- Transaction levels show ecosystem activity spikes, reflecting network usage growth.

Recent Developments

- Ecosystem transactions surged 200% to 39.6 million.

- Unique accounts grew 150% from 5.2 million to 13.2 million.

- DOT price reached $2.14 amid DIGI crypto index ETF inclusion.

- Annual inflation set to decline to 3.11% starting March 14.

- JAM upgrade enables pay-as-you-go computing for scalability.

- Bifrost SLPx 2.0 boosts cross-chain liquid staking liquidity.

- DOT supply capped at 2.1 billion via 81% DAO approval.

- 216 parachain projects registered across Polkadot and Kusama.

- DOT traded at $260-280 million in 24-hour volume.

- Staked DOT increased 7.9% QoQ to 843.9 million.

DOT Price Prediction Highlights

- DOT is projected at $1.96 in 2025, reflecting a -4.12% potential ROI, indicating short-term price pressure.

- 2026 shows the weakest outlook, with an expected price of $1.38 and a sharp -32.55% ROI, suggesting elevated downside risk.

- 2027 marks a stabilization phase, as DOT is forecast at $2.05, delivering a marginal 0.49% return.

- Volatility persists in 2028, with the price dipping to $1.43 and a -30.05% ROI.

- A strong recovery is expected in 2029, with DOT climbing to $3.12, generating a 52.94% potential return.

- 2030 delivers the most bullish outlook, with DOT reaching $3.56 and a robust 74.51% ROI, signaling long-term upside potential.

- Overall trend highlights high volatility, with near-term weakness followed by long-term growth, favoring patient, long-horizon investors.

Polkadot Market Capitalization and Rankings

- Market capitalization stands at $3.51 billion.

- Circulating supply totals 1.65 billion DOT.

- Fully diluted valuation mirrors at $3.54 billion.

- Ranks #46 among cryptocurrencies by market cap.

- 24-hour trading volume reaches $103.22 million.

- Volume-to-market cap ratio hits 2.93%.

- Total supply fixed near 1.65 billion DOT.

- Unlocked market cap valued at $3.53 billion.

- Ranks in the top 50 by overall capitalization.

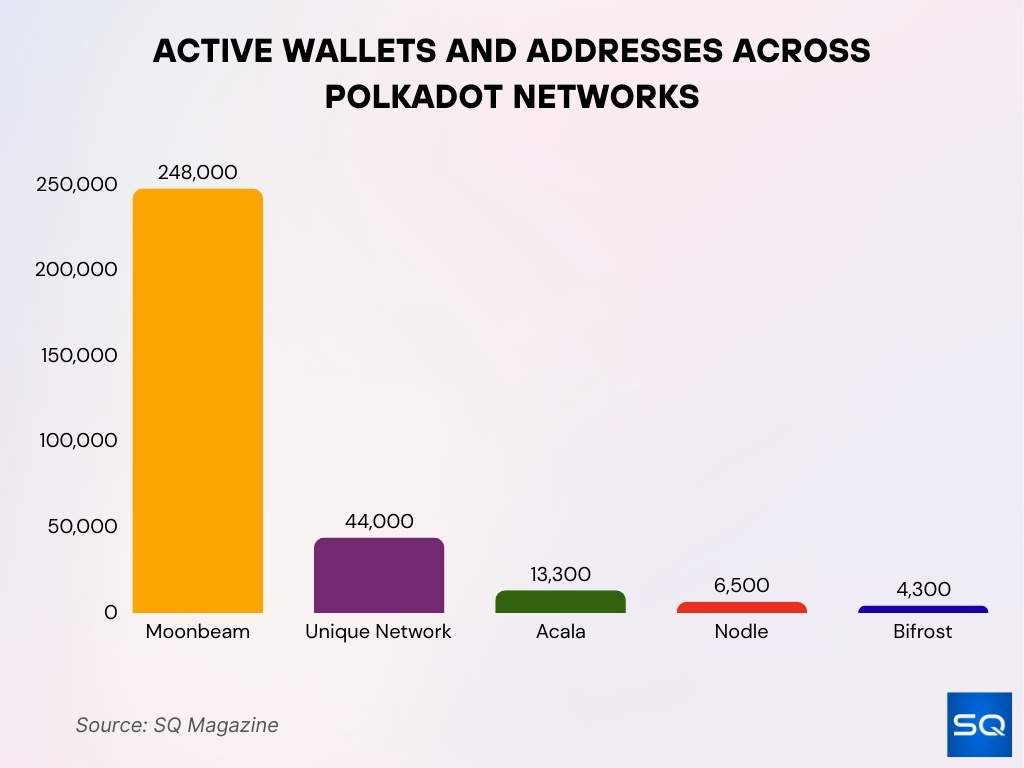

Network Usage and Activity Metrics

- Total monthly active addresses (MAA) across Polkadot networks in early 2025 hovered around 529,900.

- MAAs previously peaked at 610,000, showing a 13.1% quarterly decline.

- The main Polkadot Chain contributed nearly 48.8% of total MAAs, signaling core usage.

- Moonbeam accounted for 21.4% of active addresses, linked to its Ethereum compatibility.

- peaq represented about 11.3% of total active addresses, a notable share for IoT‑linked activity.

- Unique Network (NFT‑focused) reported ~44,000 MAAs, solidifying its niche.

- Hydration (multi‑functional appchain) had ~13,700 MAAs, indicating early community traction.

- Acala Network captured ~13,300 MAAs, reflecting DeFi engagement on Polkadot.

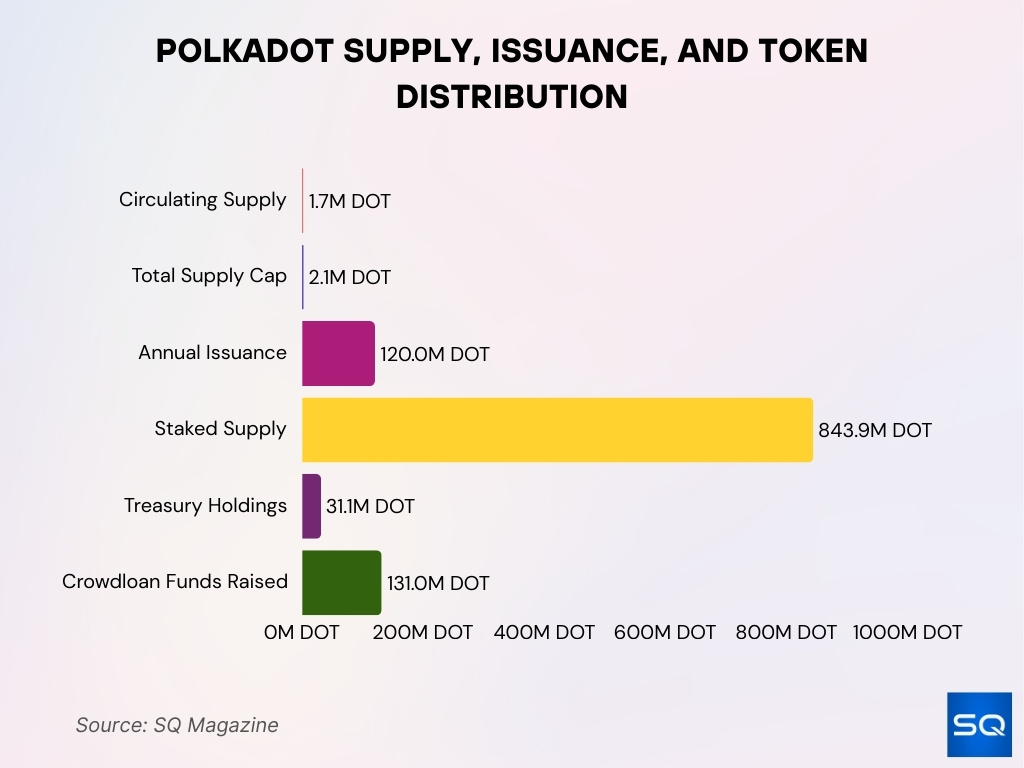

Supply, Issuance, and Tokenomics

- Circulating supply recorded at 1.65 billion DOT.

- Annual inflation is scheduled to drop to 3.11% starting March 14.

- Total supply capped at 2.1 billion DOT via governance approval.

- The previous annual issuance totaled 120 million DOT.

- Staked supply reached 843.9 million DOT.

- Treasury holds 31.1 million DOT.

- Crowdloans raised 131 million DOT.

- The initial inflation rate hovered around 10% annually.

- Issuance reduction set at 13.14% every two years.

Trading Volume and Liquidity Statistics

- 24-hour trading volume totals $274.54 million.

- Volume-to-market cap ratio stands at 2.78%.

- Binance reports $23.52 million DOT/USDT volume.

- HTX exchange volume hits $31.03 million.

- DEX volume reaches $7.27 million.

- Coinbase volume logged at $6.07 million.

- 24-hour volume up 41.80% day-over-day.

- Bybit contributes $5.29 million in volume.

- MEXC records $13.47 million in DOT trading.

Volatility and Risk Metrics

- All-time high reached $55 on November 4, 2021.

- Current price 96.21% below ATH.

- 30-day volatility measures 7.92%.

- 14-day RSI stands at 38.85.

- Fear & Greed Index at 27 (Fear).

- Green days in the last 30: 10/30 (33%).

- Weekly volatility exceeds broad market indices.

- 50-day SMA at $2.12.

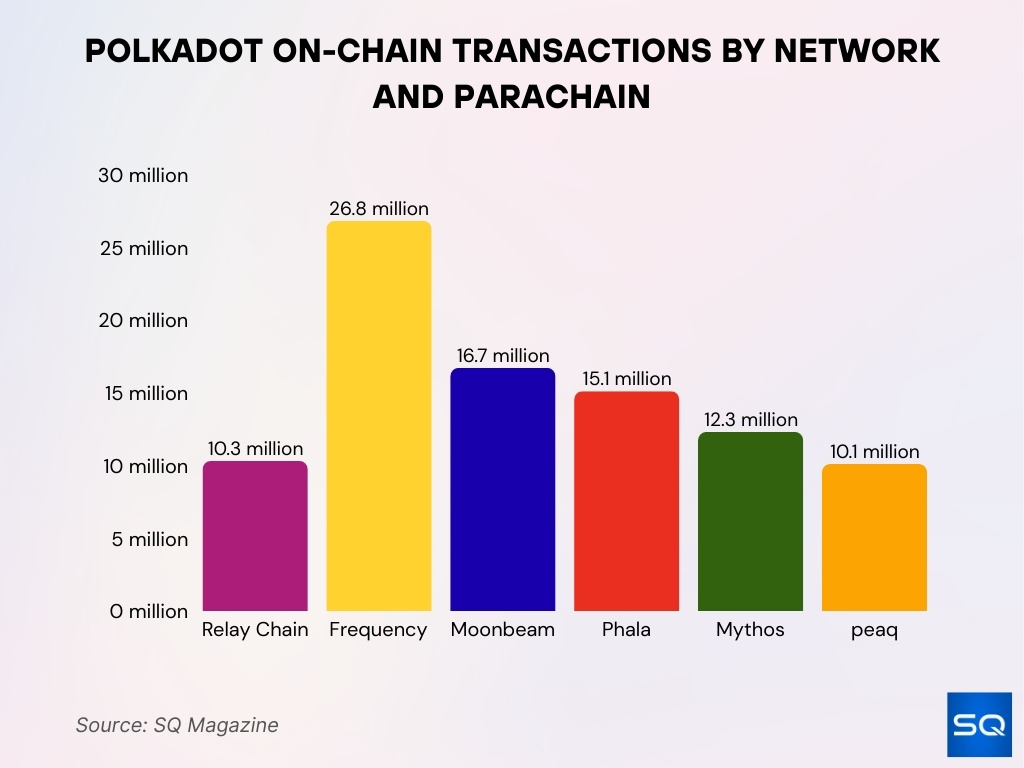

On‑Chain Transaction Statistics

- Although this marked a 36.9% quarterly decline, it represented a 76.3% increase year‑over‑year.

- The Relay Chain itself handled roughly 10.3 million transactions during the same period.

- Moonbeam led parachain activity with 16.7 million transactions (≈12.2% of ecosystem throughput).

- Frequency parachain logged 26.8 million transactions, the highest single parachain contribution.

- Mythos recorded about 12.3 million transactions, reflecting growth in gaming‑focused use cases.

- peaq showed rapid expansion with 10.1 million transactions (≈7.4% share).

- Phala registered 15.1 million transactions, underscoring privacy‑oriented compute demand.

- Unique accounts grew 150% to 13.2 million.

- Total accounts reach 3.84 million.

- Holders total 1.46 million.

- Daily active addresses average 123.8K monthly.

- Exchange addresses represent over 40% of unique addresses.

Staking Participation and Rewards Statistics

- Active validators increased from about 500 to 600 in early 2025.

- Total DOT staked grew 7.9% QoQ, exceeding 843.9 million DOT staked.

- Nominators must meet a 250 DOT minimum stake; pools can start with just 1 DOT.

- The unstaking period remains 28 days, aligning with protocol rules.

- Stakes must be claimed within 84 days to collect rewards.

- Liquid staking options allow users to retain usable tokens while earning yield.

- Only the top 256 delegators per validator earn direct rewards.

- Aggregate staking participation continued strongly in 2025, supporting network security.

Validators, Nominators, and Security Metrics

- Active validators number 297.

- Maximum validators increased to 500.

- Staked DOT totals 843.9 million.

- Staking rate achieves 51.2%.

- Treasury value stands at $106 million.

- Nominators select up to 16 validators.

- Crowdloans raised 131 million DOT.

- NPoS ideal staking rate targets 50%.

- Validator slash for major offense up to 36%.

- 216 registered parachains supported.

Wallets, Accounts, and Address Growth

- Unique Network active addresses hit 44,000.

- Moonbeam active addresses are at 248,000.

- Acala active addresses reached 13,300.

- Nodle recorded 6,500 active accounts.

- Bifrost had 4,300 active addresses.

Parachains and Coretime Allocation Statistics

- 50+ live parachains operational.

- 216 parachain projects registered.

- Moonbeam transactions hit 16.7 million.

- Mythos recorded 12.3 million transactions.

- peaq surged 84% to 10.1 million transactions.

- Frequency topped with 26.8 million transactions.

- Phala logged 15.1 million transactions.

- Agile Coretime enables 1,000+ potential parachains.

- Kusama stress test reached 143,000 TPS.

- Relay Chain processed 10.3 million transactions.

Governance and Voting Participation Data

- Referenda totaled 221 proposals.

- Referendum #747 passed with 1.89 million DOT backing.

- Supply cap referendum approved by 81% votes.

- Direct voters peaked at 1,700 unique addresses.

- Delegated voters dropped 7.1% QoQ.

- Direct voters declined 28.8%.

- Stakeholders supported with 65.5% Aye votes.

- ChaosDAO delegate participation is at 99%.

- Saxemberg delegate rate reached 92%.

- 451 valid votes in the Turkish business referendum.

Developer Activity and Ecosystem Growth Statistics

- 8,898 active developers in the ecosystem.

- 421 weekly active ecosystem developers.

- 122 weekly active core developers.

- 3,593 developers contributed past year.

- 3,000 weekly GitHub commits.

- 17,123 total GitHub commits last year.

- 750 monthly active developers average.

- 2,750+ hackathon participants.

- 230 hackathon project submissions.

- 1.5% QoQ developer growth.

DeFi, NFTs, and dApp Ecosystem Metrics

- Total Value Locked reaches $500 million.

- 38+ DeFi teams active.

- 137.1 million ecosystem transactions Q1.

- Moonbeam DeFi transactions are 16.7 million.

- Mythos GameFi has 12.3 million transactions.

- peaq 10.1 million transactions.

- Phala 15.1 million transactions.

- LST market exceeds $70 billion.

- Treasury generates $2.8 million monthly.

- 4-6% APY target for stablecoin yield.

Institutional Interest and Investment Statistics

- Treasury expenditures hit $87 million in H1 2024.

- Treasury balance totals $245 million.

- Hyperbridge secured $2.5 million in seed funding.

- Hyperbridge crowdloan raised $2.7 million.

- Polkadot Capital Group partners with Zodia Custody.

- $106 million treasury value.

- 131 million DOT raised in Crowdloans.

- DOT holdings increased among institutions.

- $23 million in development expenditures.

- $15 million in economic expenditures.

Community, Social Media, and Sentiment Statistics

- Twitter followers total 1.6 million.

- Sentiment score measures 87/100 (positive).

- 2,750+ hackathon participants.

- 230 hackathon project submissions.

- 50+ local events organized.

- 2,000 in-person event attendees.

- ~30% rise in interactive contributions.

- Fear & Greed Index at 25 (Extreme Fear).

- Discord messages exceed a few hundred weekly.

- Developer forum engagement is robust.

Comparisons with Other Layer-1 Blockchains

- Polkadot ranks 2nd in developer activity behind Solana.

- 17,123 GitHub commits vs Ethereum’s 20,752.

- TVL trails Solana’s $9-12 billion.

- Supports 100 parachains vs Solana’s monolithic chain.

- 297 active validators vs Cardano’s lower count.

- TPS potential exceeds Ethereum’s 15 TPS.

- Market cap $3.51 billion vs Ethereum’s trillions.

- 8,898 developers vs Ethereum’s lead.

- Shared security differs from Cosmos’ sovereign chains.

- Niche in interoperability over EVM-centric L1s.

Frequently Asked Questions (FAQs)

Polkadot’s market cap is about $3.5 billion.

There are approximately 1.65 billion DOT in circulation.

DOT’s 24‑hour trading volume is around $104 million.

DOT’s price is about 96% below its all‑time high of $54.98.

Conclusion

Polkadot’s statistical landscape highlights a deeply technical, governance‑oriented ecosystem with strong developer involvement and meaningful community participation. Network metrics show growth in on‑chain engagement, developer activity, and diversified use cases, even as TVL and adoption trail some peers.

Institutional momentum and cross‑chain initiatives signal forward progress, while comparisons with other Layer‑1 blockchains underscore Polkadot’s unique modular architecture. As the network evolves with upgrades and community‑led governance, understanding these metrics helps gauge Polkadot’s role in the broader blockchain ecosystem.