NFT lending and borrowing have shifted from a niche DeFi niche to a measurable part of the digital‑asset landscape. Markets reveal sharp contrasts: dramatic declines in loan volumes and total value locked alongside projections of multi‑billion‑dollar industry growth. This trend affects digital art investors seeking liquidity and DeFi platforms optimizing collateral markets. Explore how NFT financialization is reshaping access to capital and liquidity throughout the NFT ecosystem.

Editor’s Choice

- NFT lending volume fell ~97% from nearly $1 billion in early 2024 to just over $50 million by mid‑2025, signaling a contraction in market activity.

- Total NFT lending TVL dropped ~97% to roughly $8.3 million by late 2025, near the lowest levels since 2022.

- Global NFT lending DApps market valued ~$2.46 billion in 2025, with forecasts to expand beyond $37 billion by 2035.

- P2P lending is projected to command ~62.3% of the NFT lending DApps market in 2025.

- Retail investors are expected to represent ~58.7% of NFT lending demand in 2025.

- NFT lending collapse has shifted the ecosystem toward peer‑to‑peer models with more stable collateral.

- DeFi lending TVL overall (including wider credit) reached ~$63 billion in mid‑2025, reflecting broader credit trends.

Recent Developments

- NFT lending volume peaked early but declined sharply, with over $900 million in early 2024 falling to ~$50 million by May 2025.

- Leading protocols saw outstanding debt fall ~45% from ~$150 million in March 2024 to ~$80 million in late 2025.

- The total value locked metric, once a proxy for ecosystem vibrancy, shrank to single‑digit millions by 2025.

- Blend, once dominant, declined from over $115 million TVL to ~$3 million.

- The market is moving toward peer‑to‑peer lending models like Gondi with more diversified collateral.

- Projections highlight renewed growth prospects, with NFT lending markets forecast to expand long‑term.

- Broader DeFi credit markets continue to evolve, with total lending products showing TVL growth outside pure NFT debt.

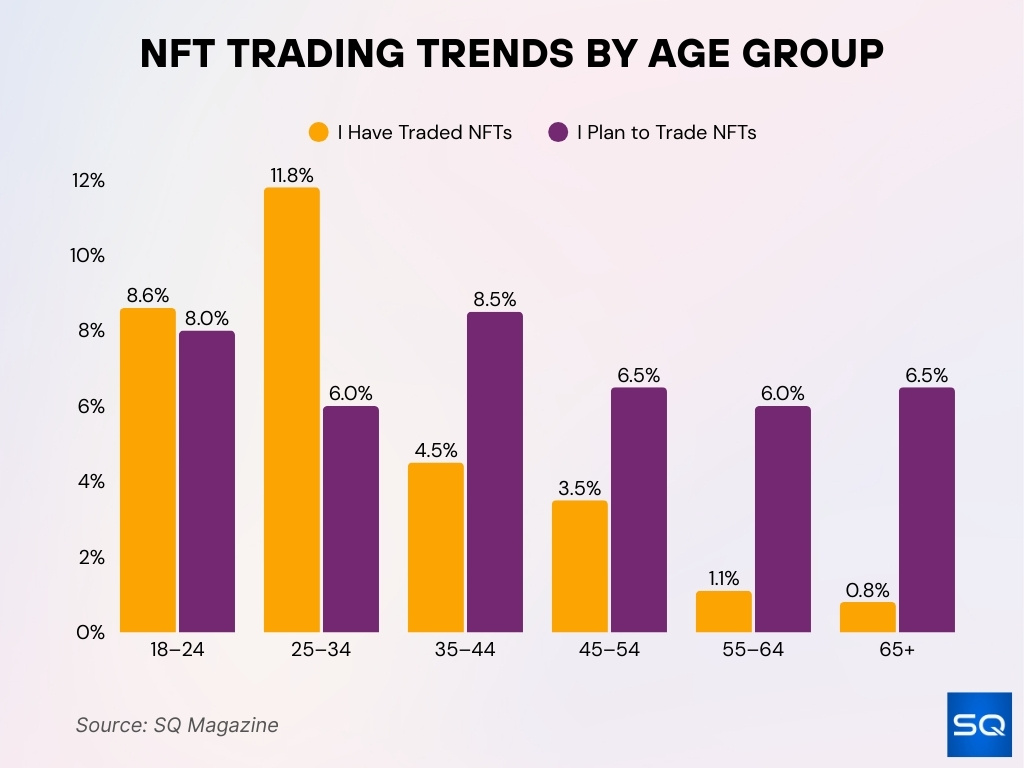

NFT Trading Participation and Intent by Age

- Ages 25–34 lead NFT adoption, with 11.8% already trading NFTs, the highest participation rate among all age groups.

- Ages 35–44 show rising future demand, as only 4.5% have traded NFTs so far, but 8.5% plan to enter the market.

- Ages 18–24 display steady engagement, with 8.6% having traded NFTs and 8.0% planning to trade, signaling consistent interest.

- Ages 45–54 reveal growing curiosity, where 3.5% have traded NFTs while 6.5% express future intent.

- Ages 55–64 show low past but higher future interest, with just 1.1% having traded NFTs and 6.0% planning to explore them.

- Ages 65+ remain the least active historically, as only 0.8% have traded NFTs, yet 6.5% still indicate future interest.

Monthly and Quarterly NFT Lending Volume Trends

- NFT lending volume dropped ~97% from early 2024 to mid‑2025.

- Most of the contraction occurred throughout 2024 into 2025, tying into broader NFT market downturns.

- Weekly NFT borrowing once reached ~$197 million in Q2 2023 on some platforms.

- Cumulative NFT lending data showed year‑over‑year increases before the 2024 decline.

- Lending spikes are often aligned with farming incentives and yield programs.

- Declines correlate with reduced incentives and broader crypto market headwinds.

- Cross‑platform differences show some protocols experienced steadier volumes.

- Current quarterly volumes remain far below peaks, underscoring market contraction.

Number of Active NFT Borrowers and Lenders

- Active lender and borrower counts rose initially during the NFT market expansion.

- On some platforms, the top 10 lenders accounted for nearly 48% of volume, showing concentration.

- The borrowing side was less concentrated, with the largest borrower under 5%.

- Protocol data shows user engagement diminished alongside lending activity declines.

- User participation surges are often tied to incentive programs.

- Smaller retail borrowers form the bulk of active participants.

- Institutional involvement remains limited in core NFT lending but is growing in broader DeFi credit.

- Platform diversification across chains influences where active users cluster.

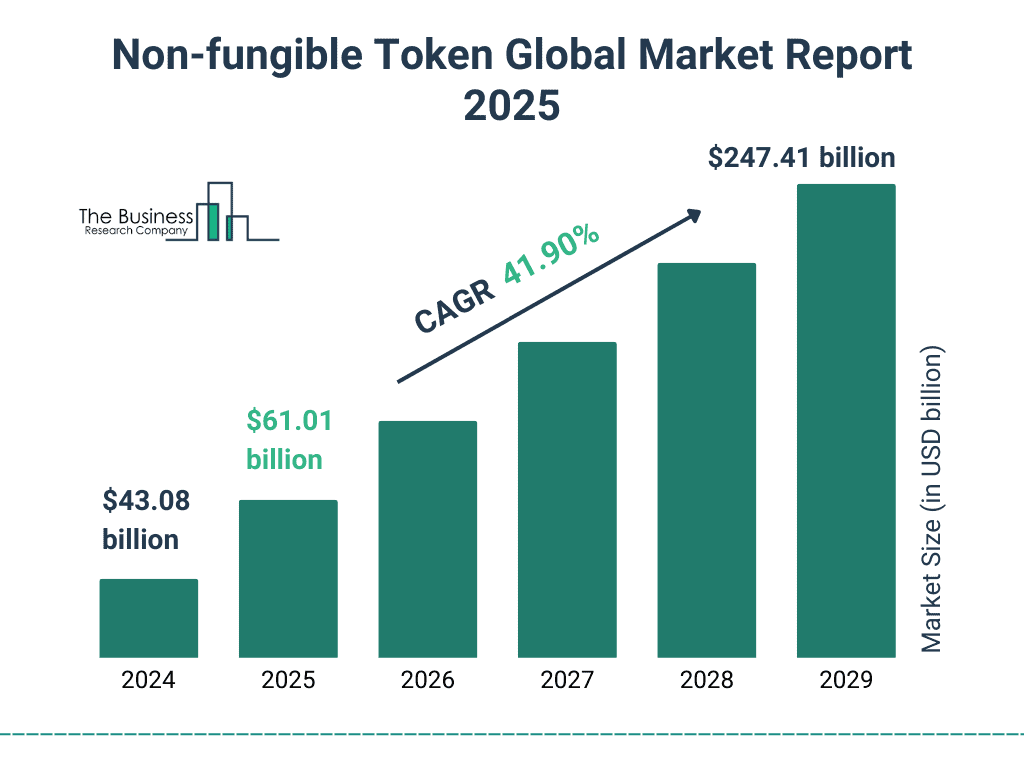

Global NFT Market Growth Outlook

- The global NFT market is expected to hit a key milestone of $61.01 billion in 2025, signaling accelerating adoption and investment.

- The forecast implies a powerful 41.90% CAGR, highlighting one of the fastest growth rates across digital asset markets.

- Year-over-year market expansion remains consistent, reflecting sustained interest from both institutional and retail participants.

- NFT adoption is accelerating across art, gaming, music, and collectibles, driving long-term demand and valuation growth.

Average NFT Loan Size and Duration

- Average NFT loan size reached $4,000 in May.

- Loan sizes dropped 71% year-over-year from $14,000.

- Average loan duration shortened to 31 days.

- High-profile collections like Autoglyphs averaged $166,823 per loan.

- Doodles collection loans averaged $12,819.

- Moonbirds averaged $14,856 loan size.

- CloneX loans averaged $12,536.

- GONDI held 54% of the NFT lending market share.

Loan-to-Value Ratios and Interest Rates in NFT Lending

- P2P NFT loans maintain average LTV ratios of 50-60%.

- Interest rates on NFT lending range from 10-25% APR.

- P2P platforms charge higher rates, averaging 15-25%.

- Arcade supports LTVs up to 70% for high-value NFTs.

- Blue-chip NFTs allow higher LTVs due to asset quality.

- Risk premiums elevate rates during market volatility.

- Default rates for NFT loans average 8-12%.

- Blend protocols show LTVs between 60-80%.

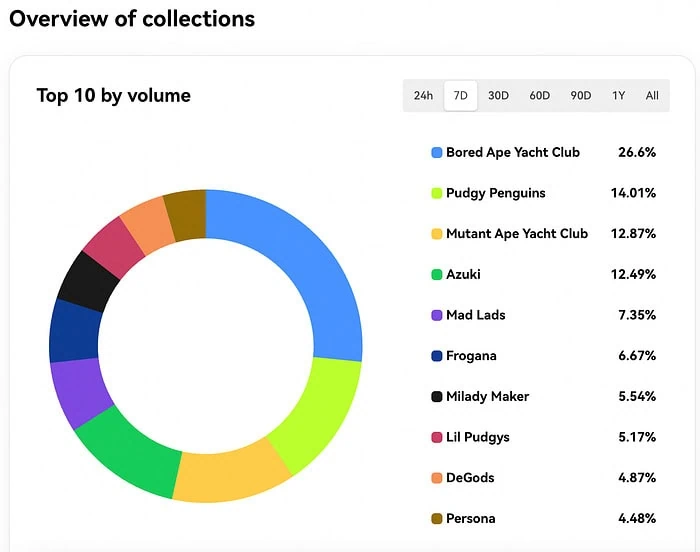

Top NFT Collections by Trading Volume Share

- Bored Ape Yacht Club leads the market, commanding 26.6% of total NFT trading volume and retaining category dominance.

- Pudgy Penguins ranks second, capturing 14.01% of trading volume driven by strong community engagement.

- Mutant Ape Yacht Club follows closely, accounting for 12.87% and reinforcing the broader Yuga ecosystem.

- Azuki holds fourth place, securing 12.49% of volume with continued strength in anime-inspired NFTs.

- Mad Lads shows rising momentum, representing 7.35% of total NFT trading activity.

- Frogana gains traction, holding 6.67% as interest grows in gamified NFT projects.

- Milady Maker maintains niche appeal, contributing 5.54% of overall trading volume.

- Lil Pudgys expands its ecosystem reach, accounting for 5.17% of market activity.

- DeGods remains a steady contender, capturing 4.87% of total trading volume.

- Persona completes the top ten, holding 4.48% as its identity-focused concept gains attention.

NFT Lending Total Value Locked (TVL) Trends

- NFT lending TVL plunged to ~$8.3 million in 2025, a ~97% drop from 2024 highs.

- Outstanding debt also declined significantly, reflecting reduced market engagement.

- High points in early 2024 saw TVL over $300 million.

- Individual protocol TVL dropped drastically (e.g., from $21.5 million to ~$300k for some).

- The shift toward decentralized, peer‑to‑peer lending models influences TVL distribution.

- Broader DeFi lending still shows substantial TVL (~$63 billion in 2025), though NFT lending is a small slice.

- Cross‑chain TVL patterns reflect expansion beyond single networks.

- TVL fluctuations signal market sentiment and collateral demand.

Leading NFT Lending and Borrowing Platforms

- GONDI holds 54% of the NFT lending market share.

- NFTfi facilitated over $300 million in total loans.

- GONDI reported $100 million TVL on June 30.

- Arcade and NFTfi combined claim 60% P2P market share.

- NFT lending dapps total 33 across ecosystems.

- GONDI processes over 3,300 NFT loans annually.

- NFTfi remains the top peer-to-peer marketplace.

- BendDAO uses a peer-to-pool lending model.

- Frakt operates on Solana for NFT liquidity.

- Solvent converts NFTs into fungible tokens.

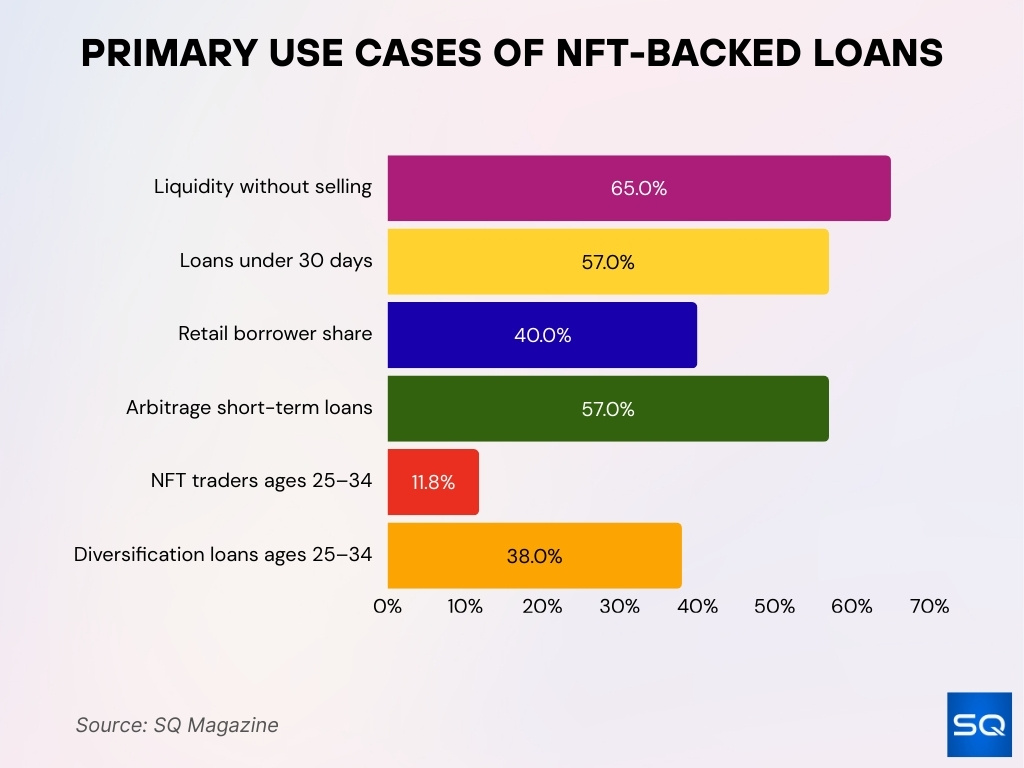

Use Cases for NFT‑Backed Loans

- 65% of borrowers cite liquidity access without selling NFTs as their primary use.

- Short-term loans under 30 days comprise 57% of NFT-backed lending.

- Retail investors account for 40% of NFT-backed loan demand.

- Digital asset traders utilize 57% short-term loans for arbitrage.

- 11.8% of 25-34 year olds trade NFTs for portfolio needs.

- 38% NFT holders aged 25-34 seek diversification loans.

Market Share of Top NFT Lending Protocols

- The global NFT lending DApps market is valued at about $2.4–$2.6 billion in 2025, reflecting usage across peer‑to‑peer and pooled models.

- Peer‑to‑peer lending protocols account for roughly 60%+ of NFT loan activity by volume, driven by flexible pricing and bespoke collateral terms.

- In 2024, the top three protocols controlled more than 70% of active loan volume, showing high concentration during market downturns.

- By early 2025, market share became more distributed as newer platforms captured 5–10% shares each across niche segments.

- Protocols focused on blue‑chip NFT collections consistently command higher average loan sizes and fee revenue.

- Lending platforms offering fixed‑rate loans represent a smaller share but show higher borrower retention.

- Multichain protocols now represent over one‑third of active NFT lending apps, reducing single‑chain dependency.

NFT Lending Activity by Blockchain Network

- Ethereum supports roughly 60–65% of NFT lending volume in 2025 due to its deep liquidity and established NFT markets.

- Solana accounts for about 20% of NFT loan transactions, benefiting from lower fees and faster settlement.

- Polygon‑based NFT lending activity grew over 30% year over year, largely tied to gaming and metaverse assets.

- Layer‑2 networks such as Arbitrum and Base now host 10%+ of NFT lending transactions, improving capital efficiency.

- Cross‑chain NFT lending remains limited but is expanding as bridges mature and risk controls improve.

- NFT lending tied to gaming blockchains shows higher transaction counts but lower average loan sizes.

- Chains with strong developer ecosystems attract more lending protocol deployments and integrations.

- Network choice increasingly depends on fee predictability and NFT liquidity depth, not just user count.

Risks and Vulnerabilities in NFT Lending Markets

- NFT price volatility reaches 20-30% daily fluctuations.

- Default rates average 8-12% for NFT-backed loans.

- NFT lending volumes crashed 97% to $50 million monthly.

- Liquidation losses average 46.1% of NFT collateral value.

- Smart contract exploits caused $4.6 million in damages.

- Borrower numbers dropped 90% since the market peak.

- Lender participation declined 78% amid downturns.

- Illiquid collateral sales extend recovery to weeks.

- $340K lost in Idols NFT contract exploit.

Regulatory Landscape for NFT Lending and Borrowing

- 70% of major jurisdictions proposed digital-asset regulations affecting DeFi lending.

- 28% of DeFi platforms adopted KYC procedures amid regulatory pressure.

- SEC considers classifying certain NFT-backed loans as securities.

- MiCA regulation covers NFT lending under the EU digital asset framework.

- AML/KYC compliance boosted lending volumes by 28% on platforms.

- 32% rise in AML compliance with real-time transaction monitoring.

- Cross-border compliance costs surged 35% for multi-jurisdictional protocols.

- 70% of users prefer KYC-compliant platforms for high-volume transactions.

- Tax reporting rules affected 6.3 million US DeFi users.

Frequently Asked Questions (FAQs)

NFT lending TVL plunged to about $8.3 million in 2025, down roughly 97% from a peak above $300 million.

NFTfi has facilitated over $600 million+ in total loan volume, with 65,000+ total loans and an average loan size of $16,000.

There are 33+ NFT lending dApps deployed across popular blockchain ecosystems in 2025.

Peer‑to‑peer lending is expected to dominate with around 62.3% market share in 2025.

Conclusion

NFT lending and borrowing reflect a market in transition. While volumes and TVL remain well below previous peaks, the data shows growing structural maturity, wider blockchain participation, and clearer use cases tied to liquidity management. As regulation evolves and platforms refine risk controls, NFT‑backed loans are likely to persist as a specialized but meaningful segment of digital finance. Readers who want a data‑driven view of where NFT lending is headed can explore the full statistics above to understand both the opportunities and the limits of this market.