The productivity suite Microsoft 365 has become a cornerstone of modern business workflows, enabling collaboration, file sharing, and communication across devices. From a small startup using it for shared cloud storage to a global enterprise relying on it for secure hybrid-work environments, its impact spans industries. For example, a retail chain can streamline store communications via its built-in chat and file-sharing tools, and a healthcare provider can manage secure document access and compliance across multiple clinics. Read on to explore the latest statistics driving Microsoft 365’s current market position and business relevance.

Editor’s Choice

- Microsoft 365 has nearly 345 million paid subscribers and about 321 million active users worldwide.

- Microsoft’s Productivity and Business Processes segment revenue was $77.8 billion in FY 2025.

- Microsoft 365 commercial cloud revenue grew 15% year-over-year in 2025.

- The consumer version of Microsoft 365 saw subscriber growth of 8% and cloud revenue growth of 11% in 2025.

- Microsoft 365 holds approximately 30% global market share among major office-productivity suites.

- Within video-collaboration tools, Microsoft Teams has reached over 320 million monthly active users (MAU) in 2024.

Recent Developments

- By the end of 2025, Microsoft will offer in-country data processing for Microsoft 365 Copilot interactions in 4 countries.

- Microsoft plans to expand in-country data processing to 15 countries, including the US, by 2026.

- OneNote for Windows 10 will retire on October 14, 2025, and become read-only.

- Microsoft introduced “Copilot Tuning” at Build 2025, a low-code tool for organizations with 5,000+ Copilot licenses.

- Microsoft 365 Consumer plans increased prices by 42% for Personal and 31% for Family plans in January 2025.

- The Microsoft 365 roadmap lists over 500 updates planned for 2025 across commercial and education sectors.

- Microsoft enhanced security by integrating the Microsoft Defender Suite into Business Premium subscriptions from March 2025.

- Microsoft 365 hybrid work adoption shows companies require employees to be on-site about 2.3 days per week, up from 42% in 2022.

- By mid-2025, Microsoft introduced over 70 security vulnerability fixes, including zero-day exploits, in Microsoft 365 updates.

- Microsoft’s cloud collaboration focus increased, with over 347 Microsoft 365 roadmap items changed in early 2025, reflecting hybrid work optimizations.

Copilot for Microsoft 365 Is Transforming Work

- 60% of business leaders say a lack of innovation or breakthrough ideas remains a major concern, highlighting the need for AI-driven creativity tools.

- 64% of employees report struggling to find enough time and energy to complete their daily work, underscoring productivity pressure.

- 70% of workers would delegate tasks to AI like Copilot to reduce workloads and improve efficiency.

- 68% of users said Copilot improved the quality of their work through better drafting, organization, and insights.

- 70% of professionals confirmed Copilot made them more productive, enabling faster completion of repetitive tasks.

- 77% of respondents said they don’t want to give up Copilot, showing strong user satisfaction and adoption momentum.

Global Microsoft 365 User Statistics

- Microsoft 365 has nearly 345 million paid subscribers worldwide.

- Over 3.7 million companies use Microsoft 365 globally.

- In the United States alone, about 1 million businesses are active Microsoft 365 users.

- Microsoft 365 has an approximate 30% share of the global productivity software market.

- In 2023, the number of global users stood at around 345 million, a growth from approximately 280 million in 2021.

- Regionally, small and medium-sized businesses are driving much of the growth as large enterprises saturate.

- The consumer version of Microsoft 365 reached about 89.0 million subscribers in 2025, with an 8% growth rate.

Monthly and Daily Active Users

- One article cites an average of 28.75 million monthly users and about 958,000 daily users for Microsoft 365, but these numbers seem low compared with newer estimates.

- For Microsoft Teams, a related service in the ecosystem, MAU reached 320 million by early 2024.

- By June 2025, Microsoft Teams crossed 360 million monthly active users and 220 million daily active users.

- Messages per person on Microsoft Teams averaged 153 per weekday globally in 2025.

- Messages increased 6% YOY globally, with over 20% increases in some regions.

- Microsoft indicates seat growth for Microsoft 365 Commercial was 6% in 2025.

- The consumer subscriber growth (8%) also contributes to active-user increases, particularly cross-device.

- Admin usage analytics indicate that organisations can drill into the last 12-month user activity trends across Microsoft 365.

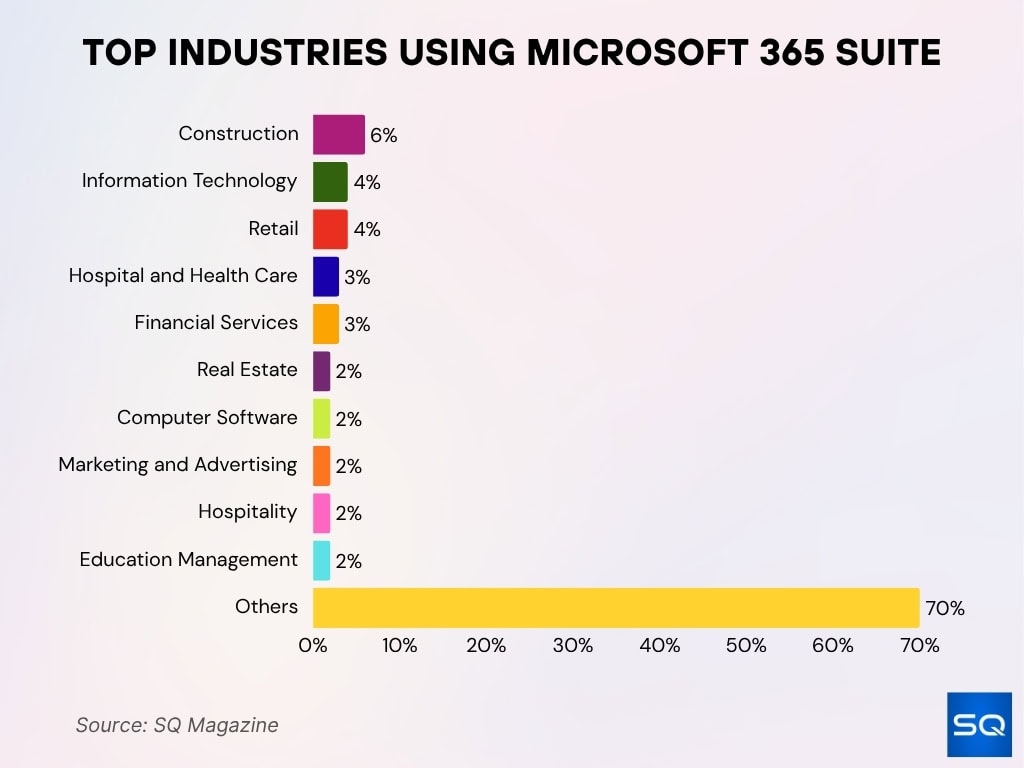

Top Industries Using Microsoft 365 Suite

- Construction leads with 6% of total Microsoft 365 users, reflecting strong adoption for managing projects, schedules, and documentation.

- Information Technology accounts for 4%, showing widespread use of Microsoft 365 for collaboration, coding documentation, and workflow integration.

- Retail represents 4%, using the suite for inventory tracking, team communication, and point-of-sale coordination.

- Hospital and Health Care make up 3%, leveraging Microsoft 365 for secure record management and compliance.

- Financial Services also holds 3%, relying on it for secure data handling, client reporting, and productivity tools.

- Real Estate contributes 2%, using it for document sharing and remote property management.

- Computer Software and Marketing & Advertising sectors each represent 2%, integrating Microsoft 365 with design and development workflows.

- Hospitality and Education Management both stand at 2%, enhancing operational efficiency and academic collaboration.

- The remaining 70% falls under Other industries, indicating Microsoft 365’s broad, cross-sector reach across global organizations.

Market Share

- Microsoft 365 holds about 30% of the global productivity suite market among major office solutions.

- In the worldwide office suite rivalry, Google Workspace controls over 44% of the market as of February 2024.

- Among video-conferencing and collaboration platforms, Microsoft Teams captured around 32.29% market share in 2025.

- In fiscal 2025, Microsoft’s “Productivity and Business Processes” revenue segment grew by 13%, reinforcing market strength.

- The Microsoft Cloud business, which includes Microsoft 365, had overall revenue growth of 23% in 2025.

- Microsoft 365 commercial cloud revenue increased 15% in 2025.

- Microsoft 365 Consumer cloud revenue grew 11% in 2025.

- The seat growth for Microsoft 365 Commercial was about 6% in 2025, showing market penetration still increasing.

Usage by Region

- In Microsoft 365 deployments, the Americas region continues to command the largest share of usage, with roughly 50% of enterprise seats as of 2025.

- Europe, the Middle East, and Africa (EMEA) accounts for around 30% of seats globally, indicating a strong footprint beyond the U.S. market.

- Asia-Pacific and Latin America regions are collectively responsible for about 20% of seats, reflecting high growth potential.

- In the construction industry globally, 6% of organisations are using Microsoft 365, higher than 4% in IT and retail, and 3% in healthcare and finance.

- Among small- and mid-sized businesses, adoption in the Asia-Pacific grew by approximately 12% year-over-year in 2024-25, whereas in North America it grew closer to 8%.

- The rollout of data-sovereignty capabilities (Multi-Geo support) in regions such as India, Brazil, and the U.S. is expanding regional uptake in regulated industries.

- In North America, hybrid–work deployments using Microsoft 365 increased by 15% in the past year, compared to 10% in EMEA.

- Adoption in Latin America accelerated by 9% in 2025 for frontline workers using Microsoft 365 Business plans.

- Organizations in the Middle East reported a 13% increase in OneDrive and SharePoint usage within Microsoft 365 over the preceding 12 months.

- In the Asia-Pacific region, average usage of Microsoft 365 apps per user rose by 7%, reflecting more consistent cloud collaboration.

Revenue Statistics

- Microsoft invested an estimated $80 billion in AI and cloud infrastructure during 2025, underpinning Microsoft 365’s expanding feature set.

- Microsoft 365 mobile apps have been downloaded over 500 million times on Android and over 376,000 times on iOS in 2025.

- For the fiscal year ended June 30, 2025, Microsoft reported total revenue of $281.7 billion, up 15% year-over-year.

- In the “Productivity and Business Processes” segment (which includes Microsoft 365), revenue reached approximately $77.8 billion in 2025.

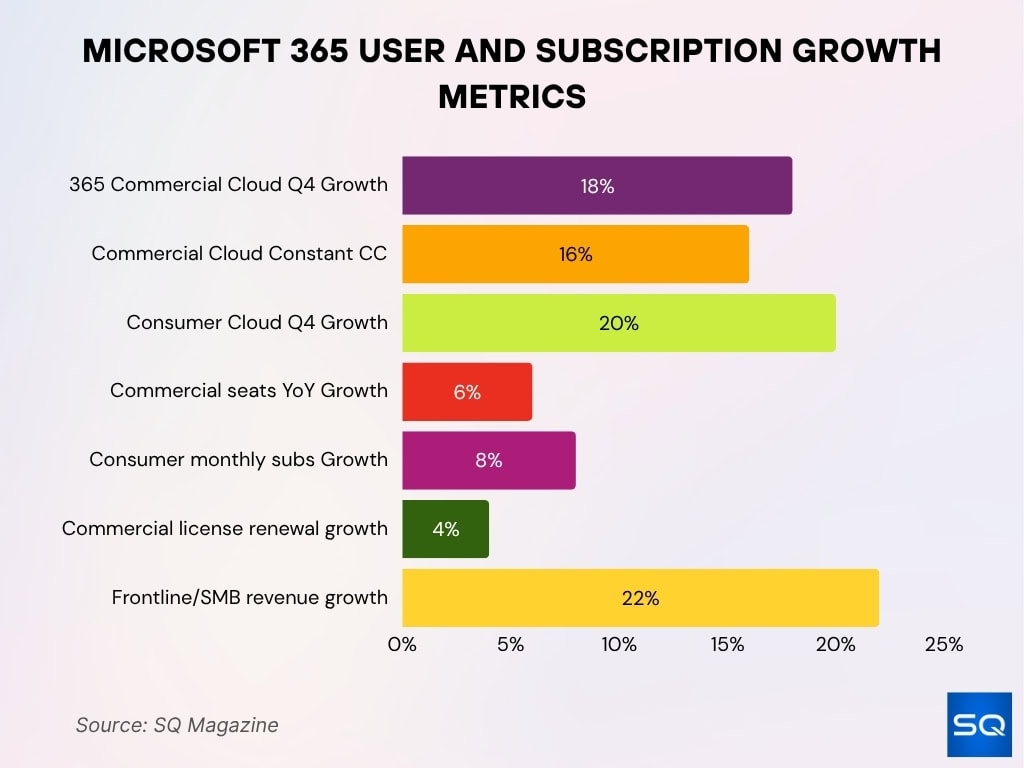

- Within that segment, Microsoft 365 Commercial cloud revenue grew 18% in Q4 FY 2025, with constant-currency growth of 16%.

- Microsoft 365 Consumer cloud revenue increased by 20% in the same quarter, driven by higher average revenue per user (ARPU) after the January price increase.

- Paid Microsoft 365 Commercial seats expanded by 6% year-over-year in 2025.

- Monthly subscription growth for Microsoft 365 Consumer was about 8% in 2025.

- Commercial license renewals for Microsoft 365 increased by approximately 4% in fiscal 2025, reflecting a stronger enterprise commitment.

- Revenue from frontline workers and SMB segments within Microsoft 365 grew by about 22%, outpacing enterprise seat growth.

Apps Usage Breakdown

- Microsoft 365 Apps for enterprise (desktop versions of Word, Excel, and PowerPoint) remain in use by more than 200 million licensed users globally.

- Usage of the mobile apps (Word, Excel, PowerPoint) has seen a 10% annual increase in time spent per user across business segments.

- Within Microsoft 365, Teams, SharePoint, OneDrive, and Outlook account for over 60% of active collaboration sessions in a given month.

- The “read-only” versus “edit” ratio in Office files inside OneDrive and SharePoint shifted; in 2025, approximately 65% of interactions were edits (up from 58% in 2024).

- The adoption of Microsoft 365 Copilot features across apps increased by 12% in the number of users using AI-assisted document creation versus the prior year.

- Among business users, 45% reported using at least three Microsoft 365 apps weekly beyond email and documents.

- In mobile usage scenarios, the time spent editing Office files via mobile apps rose by 8% compared with the previous year.

- Organizations leveraging Microsoft 365’s collaboration apps (Teams + SharePoint + OneDrive) reported that around 72% of their workforce used at least two of these apps per week.

- In enterprises with over 10,000 users, the average number of apps deployed per user in Microsoft 365 reached 6.5, up from 5.9 the year prior.

Microsoft Teams User Statistics

- The daily average active users of Microsoft Teams reached approximately 220 million in 2025.

- Monthly active user count for Teams exceeded 360 million by mid-2025.

- The number of messages sent per user per weekday in Teams averaged about 153 globally in 2025.

- Teams usage among frontline-worker licenses grew by 14%, faster than the overall seat growth rate.

- Organizations using Teams for meetings reported a 35% rise in meeting length (minutes) year-over-year as collaboration patterns evolved.

- In hybrid-work firms, more than 80% of Teams meetings now include at least one attendee on a mobile device.

- Teams’ adoption of external collaboration (guests) increased by around 18%, showing elevated cross-organization usage.

- The share of Teams chats converted to video or voice calls climbed to 38%, up from 31% the previous year.

- Approximately 41% of enterprises using Teams also enabled integrated features like Viva Engage and Whiteboard, representing an integrated workloads trend.

Device and Platform Usage (Windows, Mac, Web, Mobile)

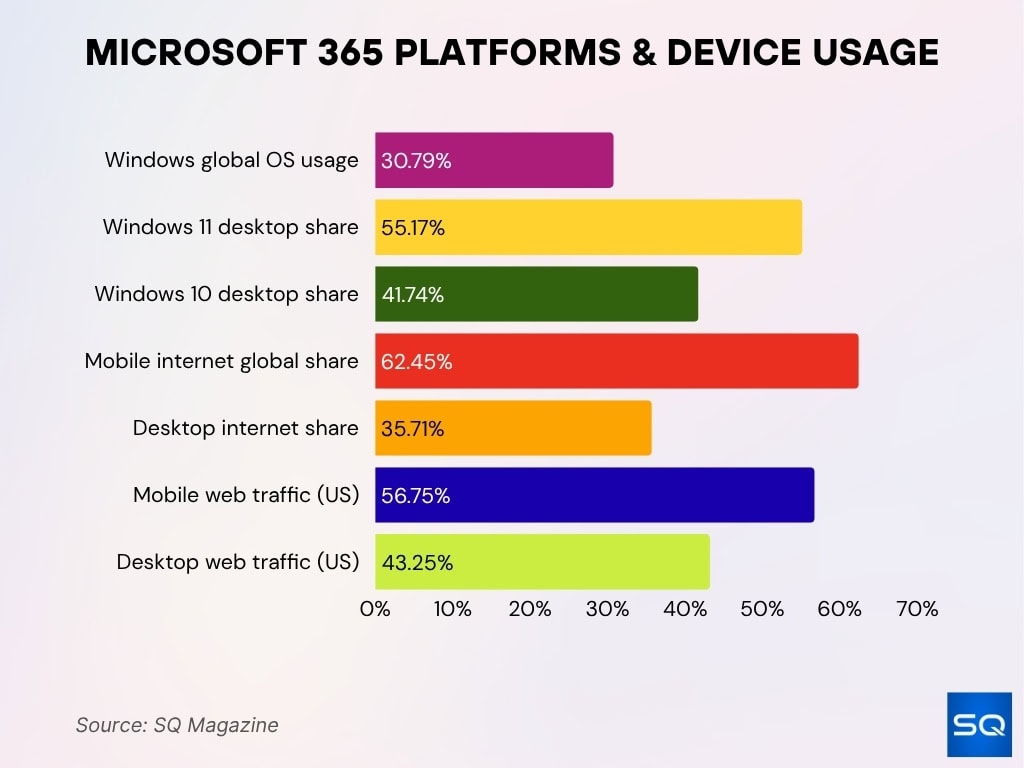

- As of October 2025, Windows held about 30.79% of all operating-system usage worldwide.

- Windows 11 accounted for about 55.17% of desktop Windows versions worldwide, and Windows 10 held about 41.74%.

- Mobile internet traffic globally reached approximately 62.45%, compared to 35.71% for desktop.

- For the U.S., mobile device share of web traffic stood at about 56.75%, with desktop at about 43.25%.

- Many users connect via Outlook mobile or Outlook on the web rather than desktop Outlook, especially in SMB and frontline-worker scenarios.

- Organizations report deploying Microsoft 365 apps across Windows, macOS, iOS, and Android.

- MacOS-based device usage is also rising in enterprise environments as Microsoft ensures its apps remain platform-agnostic.

- Outlook on the web and other web-based Microsoft 365 apps are seeing increased usage in hybrid-work models, reducing dependency on local installations.

Microsoft Exchange and Outlook Usage Statistics

- Outlook has over 400 million active users globally as of early 2025.

- Outlook’s share of the global email-client market is approximately 4.38% in 2025.

- Within the business and enterprise segment, Outlook holds a stronger foothold owing to its integration with Exchange Online and Microsoft 365 workflows.

- The Outlook mobile app is used by roughly 60% of Outlook users for email access.

- A new usage report released in May 2025 allows admins to track usage of the “New Outlook” and Outlook Classic versions, offering endpoint-level insight.

- The Radicati Group estimated tens of millions of mailboxes under Microsoft’s hosted email services between 2021 and 2025.

- In the U.S., the strong tie-in between Outlook and Microsoft 365 means many organizations use it not just for email but also for calendar, contacts, and integrated workflows.

- Organizations report that upgrading to “New Outlook” versions has become a priority, as older clients lack full integration with newer Microsoft 365 features.

Security Statistics

- Microsoft analyzes 38 million identity risk detections daily to track cyber threats.

- Microsoft blocks around 4.5 million new malware threats daily across its security ecosystem.

- Over 85% of Microsoft 365 users experienced security breaches involving compromised credentials.

- Enabling MFA on Microsoft 365 accounts reduces the risk of compromise by over 90%.

- Organizations with Microsoft 365 native security tools respond to incidents up to 75% faster than those using disparate solutions.

- Microsoft 365 Business Premium added new security add-ons in September 2025 for SMBs with up to 300 users.

- Zero-trust security adoption in Microsoft 365 increased by 87% for destructive campaigns in 2025.

- Email threat protection and endpoint security upgrades rank among the top 3 IT budget priorities for Microsoft 365 adopters in 2025.

- Microsoft’s global security team comprises 34,000 cybersecurity professionals protecting M365 environments.

- Microsoft scans 5 billion emails daily for malware and phishing threats to protect Microsoft 365 users.

Licensing Statistics

- In April 2025, Microsoft announced a 5% price increase for certain Microsoft 365, Office 365, Dynamics 365, and Windows 365 annual commitments paid monthly.

- A Forrester-commissioned study of Microsoft 365 for Business found the ROI for SMBs deploying the suite averaged 223%, with a net present value (NPV) of about $631,000 over three years.

- Licensing renewals and seat expansions continue; many enterprises report annual seat-growth rates of 4% to 6% for Microsoft 365 Commercial licenses.

- Microsoft’s shifting licensing models, “with Teams” vs “without Teams,” coming into effect in late 2025, reflect evolving modular demands.

- The SMB segment continues to benefit from bundled licensing, productivity + security, in Microsoft 365 Business Premium. Adoption of this SKU is rising in 2025.

- Some organizations delayed license renewals ahead of pricing changes announced for October 2025 and later.

- Licensing complexity remains a challenge; choosing the right Microsoft 365 plan (Business Basic, Business Standard, Business Premium, Enterprise E3/E5) remains a frequent strategic decision point.

Enterprise vs SMB Adoption

- Over 3.7 million companies globally use Microsoft 365, which is about 1% of all businesses worldwide out of an estimated 358 million total businesses.

- In the U.S., approximately 3% of companies are active Microsoft 365 users.

- SMB-segment adoption of Microsoft 365 continues to grow faster than large-enterprise in certain regions, thanks to bundled plans combining productivity and security.

- In enterprises with over 10,000 users, average Microsoft 365 app-usage (number of apps per user) is reported at around 6.5 in 2025, up from 5.9 the prior year.

- Licensing seat growth for Microsoft 365 Commercial in 2025 is around 4% to 6% annually.

- For SMBs, transitioning to Microsoft 365 reduced legacy-software costs and improved operational efficiency.

- Adoption of advanced features like AI capabilities (e.g., Copilot) in Microsoft 365 by enterprises is higher than by SMBs, but SMBs are catching up.

- Some SMBs cite licensing complexity and change management as key barriers to adoption, while enterprises weigh security and compliance readiness before full deployment.

Frequently Asked Questions (FAQs)

Approximately 345 million paid subscribers globally.

Over 3.7 million organisations worldwide.

It holds about 30% of the global office-suite market.

Conclusion

The numbers around Microsoft 365 reinforce that it remains a major player in digital productivity and collaboration across organisations, large and small. The data show clear patterns of growth and maturity. At the same time, security threats, device-platform shifts, and licensing complexity mean that simply subscribing isn’t enough; successful adoption requires strategy, management, and readiness. Whether you are a U.S.-based enterprise or a global SMB, these statistics provide meaningful benchmarks.