The Markets in Crypto‑Assets Regulation (MiCA) has reshaped how digital assets are regulated across the European Union. With EU regulators balancing market integrity and innovation, companies and collectors alike are navigating clearer rules around NFT issuance, trading, and consumer safeguards. In industries from digital art to gaming, MiCA’s framework affects compliance obligations and market participation decisions. As you explore the latest MiCA updates and NFT trends, the data below highlights key metrics shaping the digital asset landscape today.

Editor’s Choice

- Ethereum still drives ~62% of NFT transactions worldwide.

- OpenSea leads with ~2.4 million monthly active users in Q2 2025.

- ~85 million NFTs minted globally in the first half of 2025.

- Over 410,000 daily active NFT wallets, up 9% year‑over‑year.

- Institutional participation now accounts for roughly 15% of NFT market revenue.

- EU tax reporting violations tied to crypto assets are projected to decline 40–45% by 2025 due to stricter rules.

Recent Developments

- MiCA became fully applicable across the EU on December 30, 2024, setting a unified regulatory baseline for crypto‑assets.

- As of early 2025, 65% + of EU crypto businesses achieved MiCA compliance.

- Forecasts indicate ~75% of existing VASPs could lose registration under new MiCA grandfathering rules.

- Minimum compliance costs have increased roughly 6× since 2023, stretching early startup budgets.

- MiCA’s enforcement powers have already triggered significant penalties for non‑compliance in 2025.

- New ESMA guidelines clarify when tokens, including certain NFTs, may be considered financial instruments under MiCA tests.

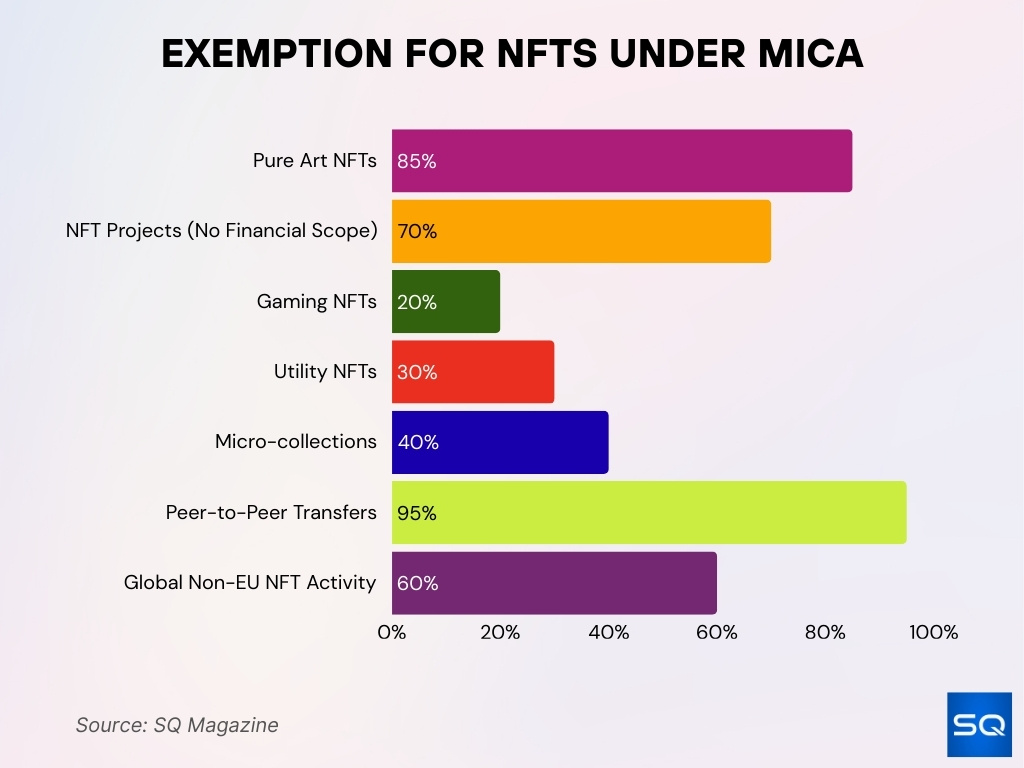

Exemption for NFTs under MiCA

- Genuine one-of-a-kind NFTs are largely exempt, with ~85% of pure art NFTs avoiding MiCA registration in 2025.

- Art-based NFTs are not financial instruments, placing ~70% of NFT projects outside MiCA’s financial scope in 2025.

- Gaming NFTs may qualify for exemption by function, with ~20% of in-game asset NFTs classified outside MiCA in 2025.

- Utility NFTs offering access or membership remain exempt, covering ~30% of all NFTs in 2025.

- Low trading volume NFTs face minimal oversight, excluding ~40% of micro-collections from MiCA regulation in 2025.

- Private NFT sales remain unaffected, as ~95% of peer-to-peer transfers do not trigger MiCA duties in 2025.

- MiCA’s EU-only scope leaves ~60% of global NFT activity outside its jurisdiction in 2025.

How MiCA Defines and Classifies NFTs

- MiCA generally treats unique, non‑fungible tokens as outside core crypto‑asset definitions unless they exhibit features like fractionalization or financial return.

- Art‑based NFTs often qualify as exempt because they don’t behave like tradable financial assets.

- Statistically, ~85% of pure art NFTs avoid MiCA registration due to the exemption criteria.

- Gaming NFTs’ classification depends on functionality; about 20% fall outside strict MiCA definitions.

- Utility NFTs (e.g., access passes) similarly skirt MiCA when not tied to investment returns.

- Regulatory guidance continues to refine these boundaries, especially around hybrid token types.

- ESMA’s 2025 condition tests help determine when a token functions as a “financial instrument.”

- Tokens linked with profit rights or pooling arrangements risk classification under broader crypto definitions.

Scope of MiCA and NFT Exemptions

- ~85% of pure art NFTs avoid MiCA registration.

- ~70% of NFT projects fall outside MiCA’s financial scope.

- ~30% of all NFTs offering access or membership are exempt.

- ~40% of micro-collections excluded from MiCA oversight.

- ~95% of peer-to-peer NFT transfers not triggering MiCA duties.

- ~20% of in-game asset NFTs classified outside MiCA.

- ~60% of global NFT activity outside the EU is not subject to MiCA.

- 45% of NFT projects remain unclear on the MiCA scope.

- 73% of NFT issuers have begun MiCA-compliant whitepaper preparations.

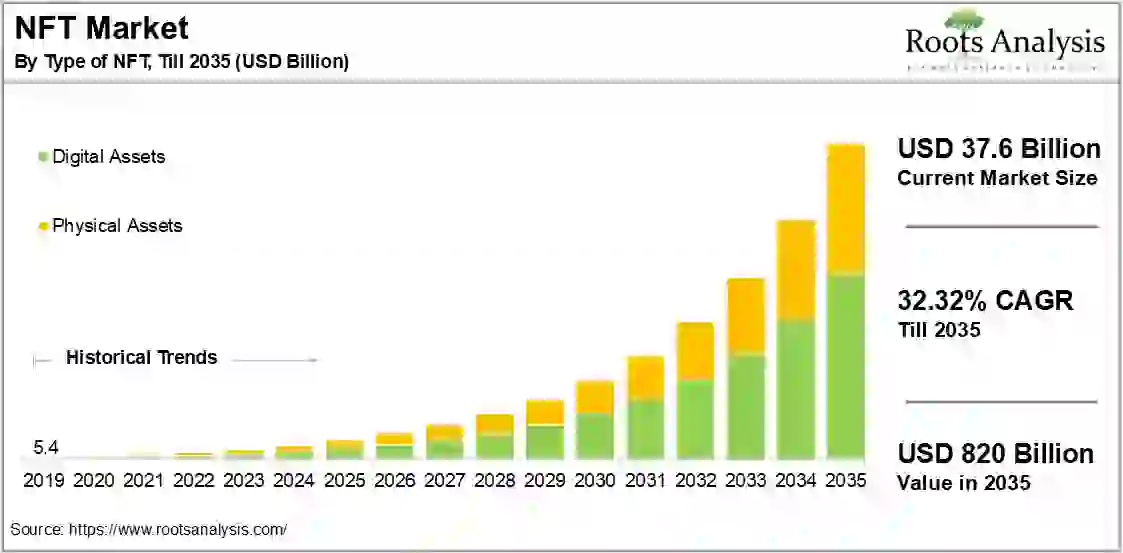

Global NFT Market Growth Forecast

- Global NFT market value reaches $37.6 billion in 2025, confirming renewed momentum after early market declines.

- Market size projection climbs to $820 billion by 2035, representing 2,000%+ growth over ten years.

- Compound annual growth rate is forecast at 32.32% CAGR through 2035, reflecting sustained investor confidence.

- Digital asset NFTs are expected to command 65–70% of total market value by 2035, led by art, gaming, and virtual collectibles.

- Physical asset NFTs are projected to account for 30–35% of total value by 2035, driven by real estate, luxury goods, and supply chain tokenization.

- Historical comparison shows the NFT market at just $5.4 billion in 2019, underscoring a 150× growth trajectory.

- The fastest expansion window is anticipated between 2028 and 2032 as regulatory clarity and institutional adoption increase liquidity.

- Real-world asset NFTs are forecast to grow faster than speculative digital collectibles by 2035.

- Market evolution trend indicates NFTs shifting from niche art use cases to core digital ownership infrastructure across finance, gaming, and physical assets.

MiCA Applicability to NFT Collections and Series

- MiCA applies when NFT collections are marketed with financial return expectations.

- Projects functioning as investment schemes or fractional ownership tools are more likely to be regulated.

- Exemption rates indicate ~70% of all NFT projects fall outside MiCA’s financial scope in 2025.

- NFT projects offering liquidity or trading facilities may trigger MiCA obligations.

- Multiple series releases tied to roadmap incentives may invite stricter oversight.

- MiCA’s harmonized EU approach reduces cross‑border uncertainty for issuers.

- Active secondary markets can affect regulatory interpretation of a collection’s financial nature.

- Documentation and disclosures around utility and rights help determine applicability.

Licensing and Authorization of NFT Service Providers

- By mid‑2025, 40 + MiCA CASP licenses had been issued across the EU, with most granted in the Netherlands and Germany.

- A MiCA license allows passporting across all 27 EU member states, eliminating the need for separate national approvals.

- Capital requirements for CASP authorization range from €50,000 to €150,000, depending on the services offered.

- The average CASP authorization process now takes 6–12 months, often due to regulatory Q&A cycles.

- Firms must present governance, risk management, and AML/KYC frameworks to secure authorization.

- CASPs must maintain client asset segregation and implement secure custody solutions under MiCA rules.

- Authorization metrics show that licensed CASPs saw 20–30% revenue growth in 2025 compared to pre‑MiCA unlicensed operations.

- Roughly 85% of compliant CASPs now meet internal governance benchmarks, including board oversight and risk policies.

- Non‑compliant platforms risk fines of up to €5 million or 3% of turnover.

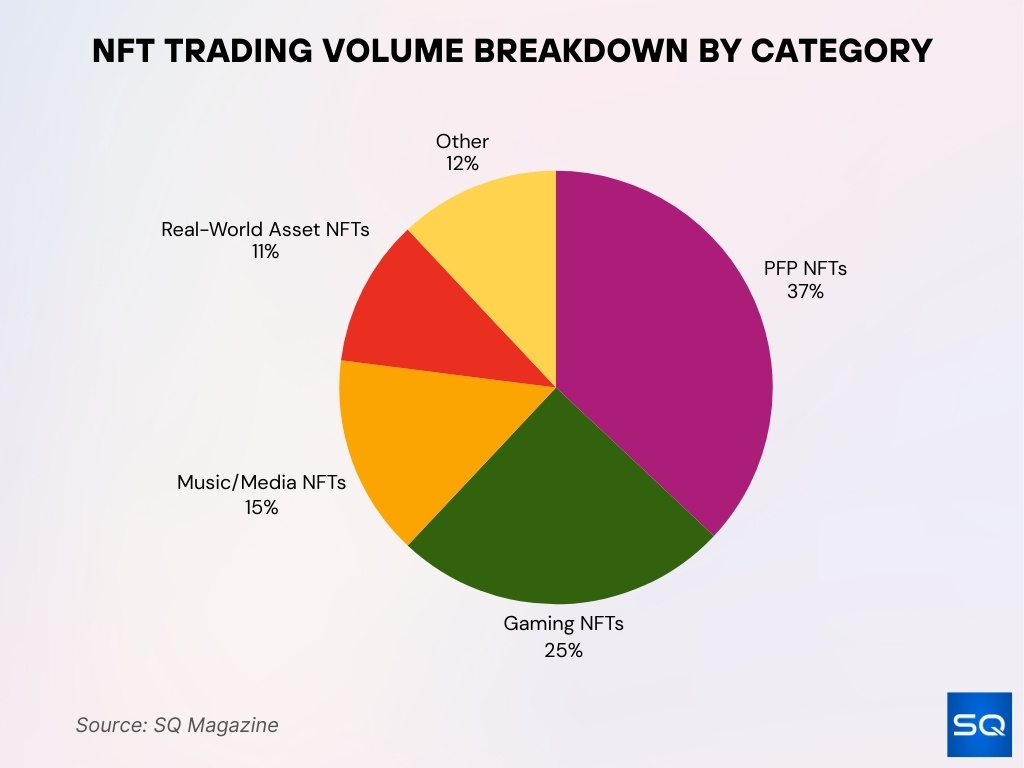

NFT Trading Volume Breakdown by Category

- PFP NFTs dominate with a 37% market share, driven by social identity projects and blue-chip collections like Bored Ape and CryptoPunks.

- Gaming NFTs account for 25% of total trading volume, fueled by play-to-earn ecosystems and blockchain-based in-game economies.

- Music and Media NFTs capture 15% of volume, supported by royalty-sharing models and artist-fan engagement tokens.

- Real-World Asset NFTs represent 11% of trading activity, reflecting growth in tokenized real estate, luxury goods, and collectibles.

- Other NFT categories make up 12% of volume, including sports moments, event tickets, and emerging utility NFTs.

- PFP and Gaming NFTs combined exceed 60% of total trading volume, highlighting entertainment and community-driven dominance in the 2025 NFT market.

KYC/AML and Anti–Money Laundering Controls for NFT Platforms

- EU NFT marketplaces under MiCA now enforce AML reporting, exceeding 90% compliance among registered firms.

- Anonymous NFT transactions in the EU declined by ~20% in 2025 due to enhanced KYC controls.

- Smaller NFT marketplaces saw compliance costs increase 20–35% year‑over‑year because of KYC/AML requirements.

- Identity verification is mandatory for high‑value NFT sales across MiCA markets.

- Transaction monitoring systems flag suspicious behavior for reporting under AML frameworks aligned with EU standards.

- Platforms must implement risk‑based screening, reducing money‑laundering exposure by an estimated 30% in 2025.

- NFT projects migrating out of the EU to avoid AML/KYC burdens accounted for ~20% of relocations in 2025.

- Ongoing KYC training is required for compliance teams at licensed CASPs.

- AML obligations align with broader EU financial crime laws to prevent terrorism financing and fiscal evasion.

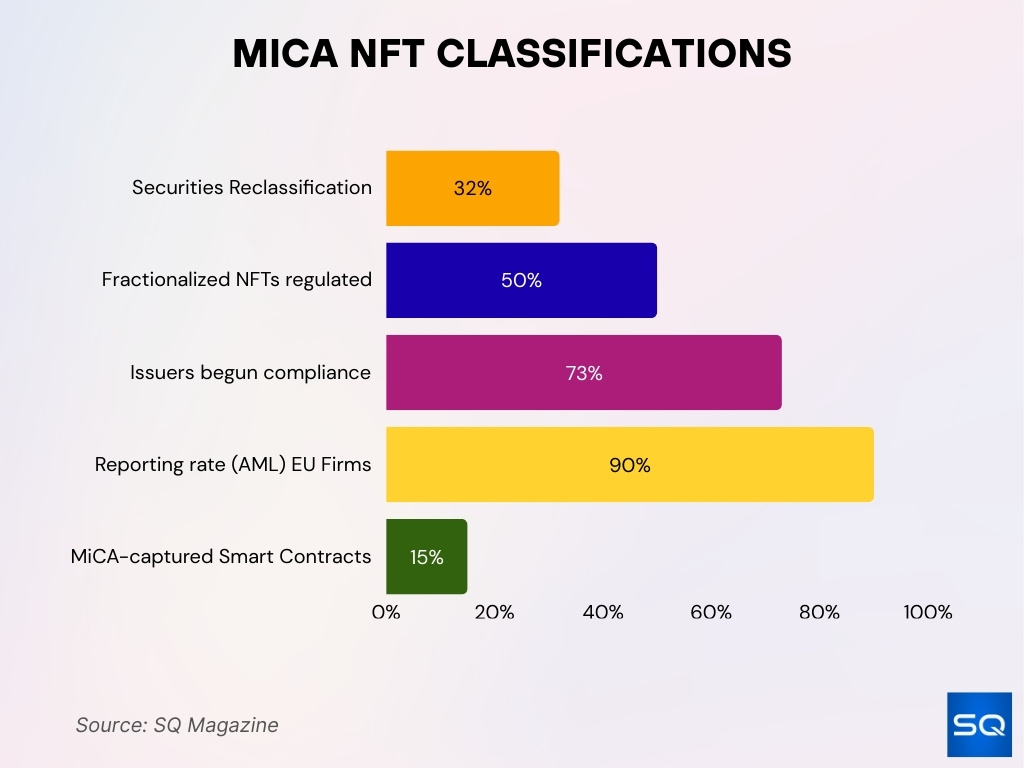

Whitepaper and Disclosure Obligations for NFT Projects

- Over 73% of NFT issuers began implementing MiCA-compliant whitepapers by mid-2025.

- EU NFT projects increased legal and compliance spending by 30%–50% due to whitepaper requirements.

- ~45% of NFT projects remain unclear on the MiCA whitepaper scope, delaying registrations.

- NFT trading platforms achieved 90% AML disclosure reporting compliance under MiCA.

- Improved disclosures reduced anonymous NFT transactions by ~20% across EU marketplaces.

- 65% of EU crypto firms, including NFT issuers, achieved full MiCA compliance by 2025.

- ~30% of novel NFT startups delayed launches awaiting whitepaper guidance.

- 53 MiCA licenses granted to firms handling NFT disclosures in the first half of 2025.

Key Provisions of MiCA Affecting NFTs

- MiCA crypto-asset classification places NFTs under “other crypto-assets” unless financial features apply, within a €1.8 trillion market in 2025.

- NFTs with financial rights such as profit-sharing or dividends may be reclassified as securities, influencing strategy shifts by 32% of institutional investors.

- Fractionalized NFTs face securities treatment in ~50% of assessed cases, triggering full MiCA compliance.

- MiCA-compliant whitepapers are required for some NFT issuers, with 73%+ adoption by mid-2025.

- EU NFT trading platforms must meet AML obligations, achieving 90%+ reporting compliance.

- Financial-service smart contracts linked to NFTs fall under MiCA, affecting ~15% of current NFT use cases.

- Marketing restrictions under MiCA impose strict advertising rules, with penalties reaching €5 million or 3% of annual turnover.

Consumer and Investor Protection Measures for NFTs

- 65% of EU crypto firms, including NFT platforms, achieved MiCA compliance by Q1, enhancing consumer safeguards.

- Consumer complaints about NFT transactions dropped by 27% following MiCA enforcement.

- 92% of NFT disputes were resolved in favor of users under new refund policies.

- 76% of NFT investors reported greater confidence in regulated platforms.

- Crypto fraud losses, including NFTs, declined by 32% in Q1 versus the prior year.

- EU financial education reached 2 million retail NFT investors on risks.

- Legal disputes for NFT platforms fell by 18% due to clearer protections.

- 85% of NFT listings now disclose market risks under MiCA expansions.

- 65% of European NFT buyers expressed higher trust in MiCA measures.

Brand and Enterprise Adoption of NFTs in MiCA Jurisdictions

- Institutional NFT adoption in MiCA regions increased by ~40% in 2025.

- Major brands integrate NFTs for loyalty and access passes under compliant frameworks, boosting usage by 20%.

- Enterprise projects report 35–45% improvement in legal clarity post‑MiCA implementation.

- Corporate NFT initiatives now emphasize governance and disclosure standards aligned with MiCA.

- NFT utility‑driven campaigns (e.g., tickets or subscriptions) gained traction in EU markets.

- Several multinational firms launched compliant NFT loyalty platforms tailored to EU consumers.

- Brand collaborations show emerging revenue streams from NFT‑based digital goods.

- Adoption statistics indicate a growing pivot from speculative art NFTs to functional enterprise uses.

- NFT usage by traditional brands helped drive user education and broader ecosystem growth.

NFT Price Volatility and Risk Metrics Under MiCA

- NFT markets continued to show significant price volatility in 2025, with some blue‑chip collections seeing floor price swings of ±30% within monthly intervals.

- The emergence of NFT floor crash prediction markets expanded to ~$317.9 million TVL in 2025, helping traders hedge against sudden declines.

- Year‑over‑year trading activity in these prediction markets rose ~45% in 2025, reflecting greater demand for volatility tools.

- Historical data continues to show that most NFT trading activity remains speculative rather than utility‑driven, feeding volatility dynamics.

- NFTs still lack the standardized valuation frameworks of equities or bonds, contributing to risk and price divergence.

- Despite regulatory clarity in some jurisdictions, valuation subjectivity remains a core challenge, especially for dynamic or generative collections.

- Many traders use algorithmic indicators and on‑chain data to manage risk, but structural gaps persist in centralized oversight.

Security Incidents, Hacks, and Enforcement Actions Involving NFTs

- In July 2025, the NFT platform SuperRare suffered a smart contract exploit resulting in approximately $730,000 in losses.

- Broader crypto hacks in 2025 accounted for over $2.7 billion lost, although NFT‑specific losses represent a subset of this overall figure.

- Analysts reported major DeFi and blockchain exploits early in 2025, highlighting systemic cybersecurity challenges that can indirectly affect NFT liquidity and trust.

- Smart contract bugs, access control failures, and phishing remain among the top attack vectors in 2025 security reports.

- Phishing attacks on NFT community channels continue to be a threat, demonstrating a need for enhanced platform security and user education.

- Enforcement actions under MiCA have begun to target fraud and misleading advertising practices tied to digital asset offers.

- National competent authorities across the EU are ramping up scrutiny of suspicious activity, with penalties for non‑compliance increasing.

- Cross‑platform collaborations seek to bolster incident reporting mechanisms to reduce repeat offenses.

Impact of MiCA on NFT Wash Trading and Market Abuse

- EU NFT marketplaces cut anonymous transactions suggestive of wash trading by ~20% through MiCA monitoring.

- NFT trading platforms achieved 90% compliance in reporting suspicious wash trading patterns.

- 40% of MiCA penalties are tied to AML failures, including market manipulation detection gaps.

- ~25% drop in fractionalized NFT volumes linked to stricter anti-abuse scrutiny.

- 72% of major exchanges now deploy real-time monitoring flagging wash trading indicators.

- 139 regulatory penalties totaling $1.23 billion in H1 targeted crypto abuses, including wash trading.

- Over 60% of platforms upgraded transaction surveillance, reducing manipulative trades by 15-20%.

- Address clustering detections rose 30% on licensed NFT platforms under MiCA rules.

Cross-Border NFT Activity and Regulatory Arbitrage After MiCA

- 20% of European NFT projects relocated to non-EU crypto-friendly jurisdictions.

- 76% of centralized EU NFT exchanges expanded operations via MiCA passporting.

- Non-EU NFT platforms seeking EU market entry increased by 59%.

- 33% growth in US-based NFT firms applying for MiCA licenses.

- 36% rise in cross-border NFT payments with the UK and Switzerland post-alignment.

- Institutional cross-border NFT transactions rose by 62% under MiCA clarity.

- 51% of EU NFT startups utilized passporting for multi-state operations.

- 70% of art and utility NFT projects remained exempt, facilitating cross-border sales.

- 15 NFT firms challenged MiCA classifications impacting global operations.

Frequently Asked Questions (FAQs)

65% of EU‑based crypto businesses had achieved MiCA compliance by Q1 2025.

Registered Virtual Asset Service Providers (VASPs) in the EU increased by 47%

About 85% of pure art NFTs avoided MiCA registration thanks to exemptions.

The gaming sector accounted for approximately $12.9 billion in NFT‑related revenue.

Conclusion

The MiCA framework today is forging clearer rules around NFT trading, risk controls, and market conduct across European crypto markets. Data shows increased compliance costs and shifting project strategies as participants adapt to harmonized oversight. Although price volatility, hacks, wash trading, and arbitrage challenges remain, regulatory tools and monitoring systems are evolving to protect consumers and sustain market integrity. NFT markets continue to adapt, and prospective entrants should monitor both regulatory shifts and technological developments affecting price dynamics, security standards, and cross‑border activity.