The Markets in Crypto‑Assets (MiCA) regulation has reshaped the European and global blockchain landscape by providing legal clarity and oversight for digital assets, particularly Initial Coin Offerings (ICOs). ICOs once operated in largely unregulated markets, exposing investors to fraud and uncertainty. MiCA now sets standards for transparency, disclosures, and compliance across the EU.

As a result, startups can raise capital with clearer legal expectations, and institutional investors gain confidence to participate more actively. This regulatory shift affects real‑world scenarios such as blockchain fundraising platforms adapting to compliance frameworks and EU‑based exchanges requiring MiCA‑compliant listings. Read on to explore current statistics that illustrate MiCA’s impact on the ICO ecosystem.

Editor’s Choice

- The global ICO market is projected to reach $38.1 billion by 2025, signaling renewed fundraising growth.

- 65% of European ICOs in 2025 are expected to be fully MiCA‑compliant, a sharp rise from 38% in 2024.

- Average ICO funding size in the EU has improved by 45% compared to pre‑MiCA years.

- Institutional investor participation in EU ICOs has climbed to 42% in 2025, up from 18% in 2023.

- 90% of blockchain startups launching ICOs in Europe now undergo regulatory assessments under MiCA.

- The average approval process for MiCA‑compliant ICOs now takes about 3.5 months, reducing regulatory uncertainty.

Recent Developments

- The European Commission proposed reforms to shorten ICO approval timelines by up to 30% for eligible startups.

- Drafts for MiCA 2.0 now include wider oversight of DeFi and NFT‑based ICOs, affecting about 22% of new digital asset issues.

- France and Germany have driven a 33% rise in stablecoin regulatory initiatives to align with central bank digital currency policy goals.

- Major exchanges like Binance, Kraken, and Coinbase Europe prioritize 100% MiCA‑compliant token listings.

- MiCA‑compliant security token exchanges increased by about 41% in 2025.

- 11 EU governments introduced funding grants for MiCA‑aligned crypto startups this year.

- The European Investment Fund (EIF) is actively vetting 37 ICO projects for potential strategic investment.

- The U.S. SEC’s proposed MiCA‑style framework could influence 29% of U.S. crypto fundraising if adopted.

- Singapore and Japan have adopted 85% of MiCA’s investor protection protocols into domestic ICO oversight.

- DeFi policy consultations referencing MiCA have climbed by about 48% across EU states.

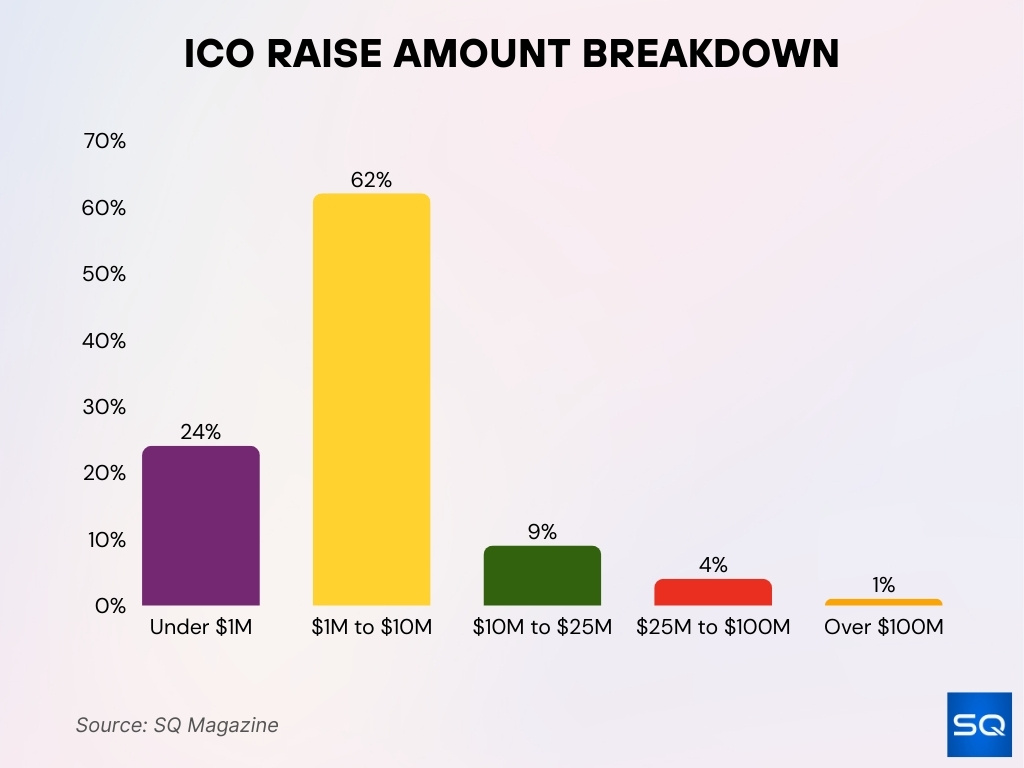

ICO Raise Amount Breakdown

- Under $1 million accounts for 24% of ICOs, indicating many projects still rely on smaller early-stage funding.

- $1 million to $10 million dominates with 62%, making it the most common fundraising range for ICO launches.

- $10 million to $25 million represents 9% of ICOs, reflecting mid-tier projects with stronger investor backing.

- $25 million to $100 million makes up 4%, showing that large-scale ICO raises have become less frequent.

- Over $100 million accounts for just 1%, highlighting the rarity of mega raises in today’s regulated environment.

Overview of MiCA Regulations

- 87% of CASPs initiated licensing under MiCA by mid-2025.

- 65% of EU crypto firms achieved full MiCA compliance by early 2025.

- 78% of exchanges reinforced security and risk management protocols.

- €486 million in total fines issued for MiCA violations across the EU.

- 85% of crypto service providers are registered with EU financial authorities.

- 70% of licensed firms operate cross-border on a single EU license.

- €5.6 million average fine for non-compliance cases.

What is an ICO Under MiCA

- 65% of European ICOs are fully MiCA-compliant, up from 38% prior year.

- 90% of blockchain startups launching ICOs underwent MiCA assessments.

- Average MiCA approval time for ICOs reduced to 3.5 months, down 27%.

- Regulatory enforcement against non-compliant ICOs rose by 32%.

- Average successful ICO raises $8.2 million, up 30% from pre-MiCA.

- ICO failure rates dropped to 35% from 55% due to vetting.

- Median participants in MiCA-compliant ICOs reached 2,950.

- 80% of new tokens listed on European exchanges are MiCA-compliant.

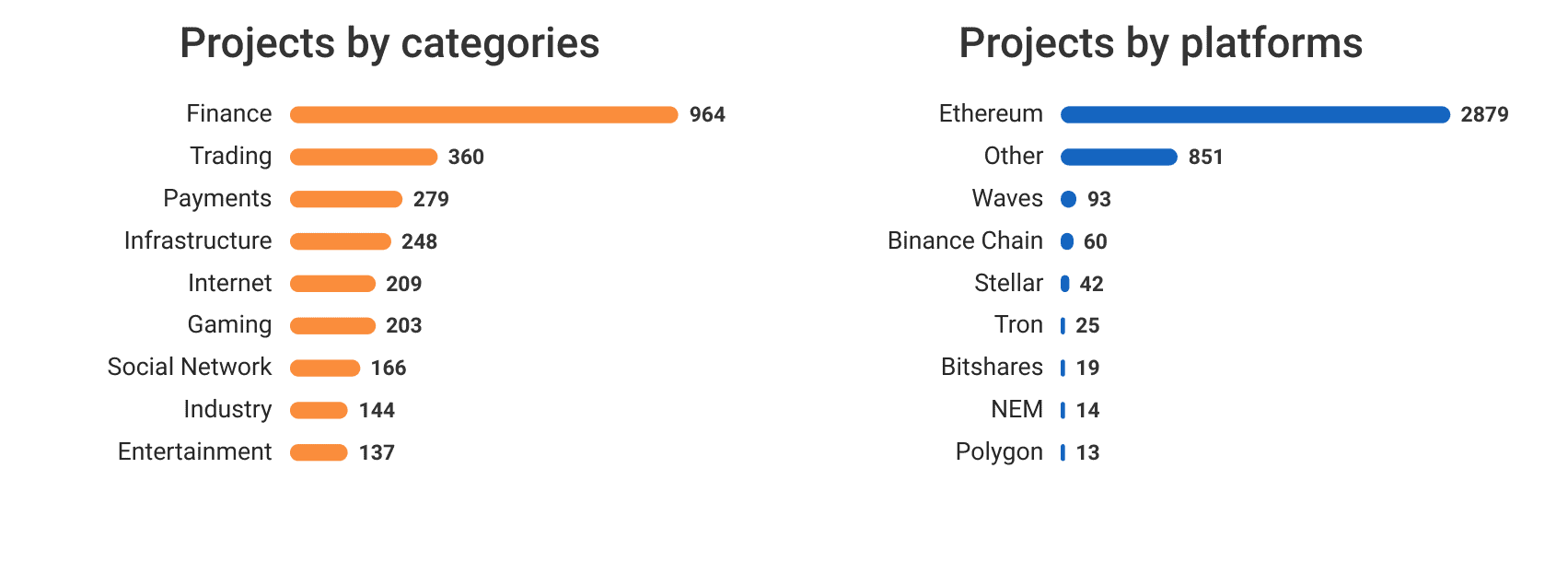

Key Insights from Blockchain Project Distribution

- Finance leads with 964 projects, confirming it as the largest blockchain use case today.

- Trading ranks second with 360 projects, reflecting strong demand for market-focused blockchain tools.

- Payments follow with 279 projects, highlighting continued adoption in digital transaction systems.

- Infrastructure counts 248 projects, supporting the core backbone of blockchain ecosystems.

- Internet-related projects reach 209, showing steady growth in web-based blockchain utilities.

- Gaming accounts for 203 projects, driven by Web3 gaming and digital asset ownership models.

- Social networks total 166 projects, indicating rising interest in decentralized social platforms.

- Industry-specific projects reach 144, covering logistics, manufacturing, and enterprise solutions.

- Entertainment records 137 projects, fueled by NFTs and creative media platforms.

- Ethereum dominates with 2,879 projects, remaining the leading blockchain for development.

- Other blockchains collectively host 851 projects, showing growing ecosystem diversification.

- Waves supports 93 projects, maintaining a moderate and stable developer base.

- Binance Chain powers 60 projects, driven largely by exchange-centered demand.

- Stellar hosts 42 projects, primarily focused on payments and cross-border solutions.

- Tron includes 25 projects, widely used in entertainment and DeFi applications.

- BitShares counts 19 projects, remaining a niche blockchain ecosystem.

- NEM supports 14 projects, reflecting limited recent ecosystem activity.

- Polygon records 13 projects, as projects are often counted separately despite their scaling role.

MiCA Implementation Timeline and Phases

- 87% of CASPs initiated licensing processes post-December 2024 phase.

- 65% of EU crypto firms achieved compliance by early implementation deadlines.

- Germany led with 20 CASP approvals, representing 30% of the EU total.

- 75% of Europe’s 3,165 VASPs faced registration loss by June deadlines.

- 12 CASPs and 10 EMTs licensed during the initial MiCA slowdown phase.

- 22% of license applicants reported significant delays in 2025 approvals.

- 18 member states extended the transition to July 2026 for full enforcement.

- ESMA published JSON schemas for data standards effective December 2025.

Key Provisions Impacting ICOs

- 100% of EU ICOs required to publish regulator-approved whitepapers.

- 95% of ICO issuers registered as legal entities in the EEA.

- 100% of ICOs implement mandatory KYC/AML checks at onboarding.

- 42% of ICO participation from institutional investors.

- 80% of ICOs conduct mandatory smart contract audits.

- 95% of EU exchanges list only MiCA-compliant ICO tokens.

- 87% of ICO projects submit quarterly financial disclosures.

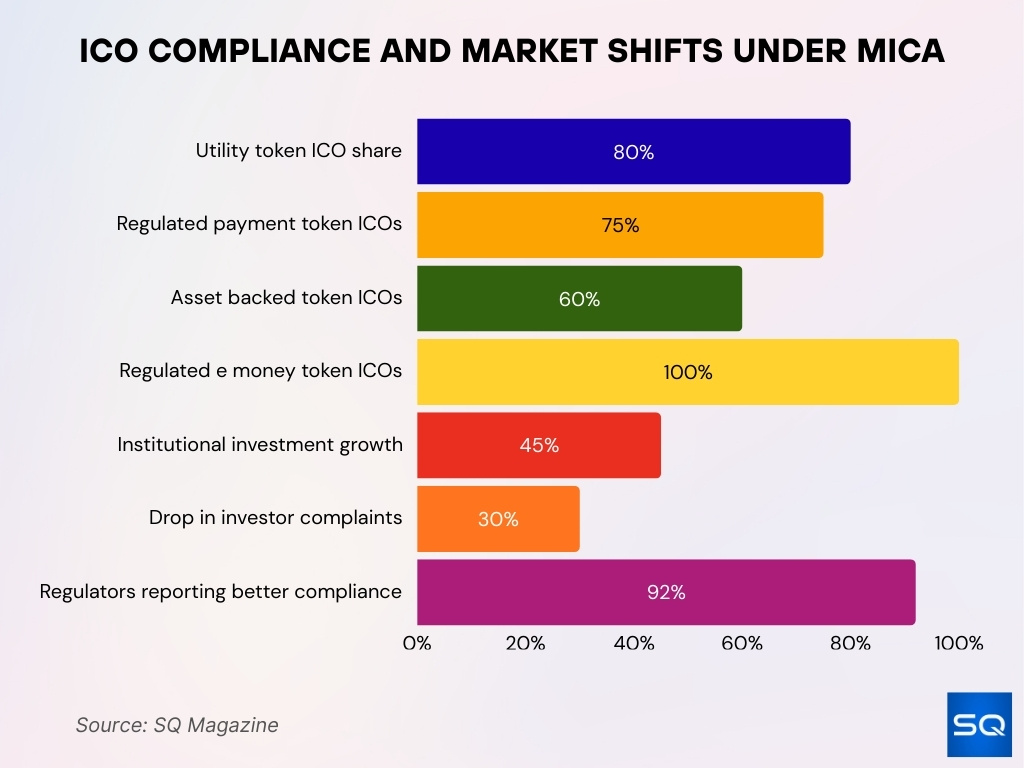

What Is an ICO According to MiCA

- 80% of European ICOs in 2025 launch utility tokens for platform access while meeting MiCA compliance standards.

- 75% of payment token ICOs in Europe are fully regulated under MiCA, covering major cryptocurrencies and stablecoins.

- 60% of new asset-referenced token ICOs are backed by tangible assets like fiat and commodities to meet MiCA reserve rules.

- 100% of e-money token ICOs in the EU fall under MiCA regulation, ensuring full digital currency compliance.

- 45% growth in institutional investment is recorded for European crypto startups in 2025 due to MiCA-driven market legitimacy.

- 30% reduction in investor complaints is linked to MiCA oversight and stricter controls on fraudulent or mismanaged ICOs.

- 92% of EU regulators report better compliance outcomes and lower market volatility after MiCA consumer protections took effect.

MiCA Requirements for ICO Issuance

- 95% of ICO issuers registered as legal entities in the EEA to meet MiCA compliance.

- 100% of EU ICOs must publish regulator-approved whitepapers detailing project use, risks, and economics.

- 100% of ICOs now implement KYC/AML checks at participant onboarding, curbing illicit financing risks.

- 89% of EU ICOs use automated suspicious transaction monitoring, enhancing regulatory oversight.

- 80% of ICOs conduct mandatory smart contract audits, slashing security vulnerabilities.

- 87% of new ICO projects submit quarterly financials and disclose material changes to regulators.

- 74% of investors receive clear exit and refund terms in whitepapers, as enforced by MiCA.

- 90% of new ICOs undergo direct supervision by national financial authorities.

ICO Listing Requirements

- 95% of EU crypto exchanges list only MiCA-compliant tokens, enforcing stricter entry standards.

- 100% of EU exchanges verify whitepapers and financial disclosures before new listings.

- Average listing time for compliant tokens fell from 4 months to 6 weeks, a 62.5% reduction since MiCA rollout.

- 35% more high-risk tokens were delisted by exchanges, reducing fraudulent offerings.

- 80% of new tokens listed on European exchanges are fully MiCA-compliant.

- 90% of trading platforms integrate pre-trade risk disclosures for investor protection.

- 70% of exchanges deploy enhanced security and reporting systems for market integrity.

- 100% of stablecoin listings require audited reserve compliance under MiCA rules.

Global ICO Market Statistics and Comparisons

- Europe under MiCA regulation records $4.8 billion, accounting for 45.7% of global ICO volume in 2025.

- North America reaches $2.9 billion, representing 27.6% of the worldwide ICO market.

- Asia Pacific generates $2.3 billion, capturing 21.9% of the global ICO share.

- Other regions contribute $0.5 billion, making up just 4.8% of total global ICO activity.

Trends in MiCA‑Compliant ICOs

- Utility and real-world asset tokens represent 80% of compliant ICO offerings.

- Security token and hybrid models comprise 34% of overall fundraising rounds.

- 41% of ICOs focus on real-world asset tokenization.

- ICO launch cycles shortened by 21% year-over-year under MiCA standards.

- 45% of ICO investors are institutions due to regulatory clarity.

- 67% of regulated ICO tokens see increased secondary-market liquidity.

- 68% of new ICOs launched in MiCA-compliant EU jurisdictions.

- Smart contract audits are standard for 80% of compliant ICOs.

- ICO failure rates dropped to 35% from stricter project vetting.

ICO Success Rates by Region

- MiCA‑regulated jurisdictions in Europe show about a 65% ICO success rate in 2025, surpassing other regions.

- North America’s success rate is approximately 53%, reflecting stronger oversight but less unified regulation than MiCA.

- Asia‑Pacific ICOs trail at roughly 48% success, indicating regulatory variation and market fragmentation.

- Regions outside major markets average near 31% success, often due to unclear rules and enforcement gaps.

- The global average ICO success rate (across all regions) climbed in 2025 compared with previous years as regulations tightened worldwide.

- MiCA‑aligned ICOs tend to complete funding goals more often than those in unregulated markets.

- ICOs backed by robust compliance, including white paper disclosures and KYC/AML checks, show higher rates of reaching milestones.

- Projects with clearer governance and reporting under MiCA frameworks outperform peers in success metrics.

- European ICOs targeting real‑world assets often see stronger investor uptake, further enhancing their success profiles.

ICO Fraud Reduction Statistics

- Fraudulent ICOs in MiCA‑regulated Europe dropped to around 4% of offerings in 2025, significantly below global averages.

- The global ICO fraud rate remains near 18%, reflecting lingering risks in markets without unified regulation.

- Increased disclosure requirements and compliance checks under MiCA have materially reduced fraudulent campaigns.

- Mandatory white papers and investor protection rules have helped flag deceptive ICOs before public marketing begins.

- Regions enforcing robust KYC/AML regimes have seen fraud reduction of over 50% in recent years.

- Blockchain analytics tools used by regulators and exchanges now detect fraud patterns more rapidly than in prior years.

- Public‑private partnerships in anti‑fraud enforcement have increased, enhancing asset recovery and scam deterrence.

- Growing adoption of automated monitoring of token flows has flagged suspicious behavior earlier in the fundraising cycle.

- Exchanges delist tokens tied to criminal indicators more quickly than before, shrinking scam lifespans.

Regulatory Challenges for ICOs

- The average MiCA approval process takes 3.5 months, delaying 46% of new EU ICO startups.

- Compliance costs range from $150,000 to $500,000, hindering 38% of small issuers.

- 22% of hybrid token projects require additional licenses due to regulatory ambiguity.

- 41% of EU ICOs targeting non-EU investors face extra U.S. SEC and Asian compliance.

- 40% of firms report diverging national interpretations, causing operational confusion.

- 22% of MiCA license applicants experience significant approval delays.

- 33% of blockchain startups fear slowed project launches from regulatory burdens.

- >50% of DeFi platforms remain uncertain on MiCA applicability.

MiCA Impact on ICO Funding

- The global ICO market is projected to $38.1 billion in 2025, signaling renewed capital raising momentum.

- European markets under MiCA now lead with about 45.7% of total ICO volume, surpassing other regions.

- The average successful ICO raises around $8.2 million, higher than in pre‑MiCA periods due to investor confidence.

- Institutional participation in EU ICOs reached about 42% in 2025, more than double earlier years.

- Regions with stronger compliance frameworks tend to attract larger investments and longer‑term holders.

- ICOs focused on tokenizing real‑world assets account for a growing share of funding, around 41% of total 2025 volume.

- Funding rounds in regulated markets are typically longer, allowing broader investor access and due diligence.

- Projects that meet MiCA disclosure standards often close funding faster than those operating outside regulated regimes.

- Enhanced transparency reduces capital flight risks and improves post‑issue investor engagement.

Frequently Asked Questions (FAQs)

The global ICO market is projected to reach $38.1 billion by 2025 under the influence of regulatory clarity from frameworks like MiCA.

About 65% of European ICOs in 2025 are expected to be fully compliant with MiCA regulations.

Approximately 41% of ICOs in 2025 focus on real‑world asset tokenization, indicating evolving project trends.

The average successful ICO in 2025 raises about $8.2 million, up around 30% from pre‑MiCA years.

Conclusion

MiCA’s regulatory framework is proving pivotal in transforming the ICO landscape from a high‑risk, fragmented market into a more structured and transparent investment channel. Across Europe, ICO success rates and fundraising volumes have climbed significantly compared with regions without unified regulation, while fraud levels have fallen sharply thanks to compliance requirements and enhanced oversight.

Regulatory challenges still affect global harmonization, but clear rules under MiCA have attracted institutional capital and elevated investor confidence. As the ICO ecosystem continues to mature, regulation‑driven improvements in transparency, funding efficiency, and risk mitigation will likely shape the next stage of digital asset fundraising growth.