The fusion of finance and the metaverse is no longer speculative; it’s unfolding now. From virtual banks issuing loans against digital assets to immersive trading floors in VR, the metaverse is reshaping how capital flows in digital economies. In gaming, players stake tokenized avatars as collateral. In real estate, virtual land mortgages are emerging in parallel with real-world markets. Dive into the data that charts this transformation below.

Editor’s Choice

- As of mid-2025, NFT-backed loans have been estimated to exceed $4–5 billion, though estimates vary by platform and include both active and outstanding loan volume.

- DeFi protocols currently host about 1.8 million NFTs in active lending or yield farming contracts.

- Fractional NFT vaults are up 73% year over year, with TVL (total value locked) of $2.6 billion.

- Global metaverse market revenue is projected to reach $203.7 billion in 2025.

- The sector is forecast to grow over $876.2 billion between 2025‑2029 in metaverse finance alone (CAGR ~ 40.8%).

- Average APR for NFT‑backed loans is 9.4%.

- More than 160 financial dApps now support NFTs as collateral, yield instruments, or premium reward mechanics.

Recent Developments

- In 2024, Meta is on track to cross $100 billion in cumulative investment into AR/VR hardware and related infrastructure.

- Meta’s Reality Labs earned $2.1 billion in revenue in 2024 but sustained large losses, contributing to a cumulative burn of over $60 billion.

- Meta reported a $4.2 billion loss in a single quarter in 2025 in the Reality Labs segment.

- Regulators such as FINRA published guidance in 2024 on metaverse securities, exploring how digital assets in virtual worlds may fall under securities laws.

- Capgemini’s “World Insurance Report 2024” notes that 29% of insurers have adopted metaverse‑based training, and 18% sell products tied to virtual worlds.

- Growth in institutional NFT‑indexed ETFs drew $740 million in new capital to metaverse finance mechanisms.

- Insurance protocols covering NFT asset risk recently issued $460 million in coverage volume.

- DeFi’s integration into immersive platforms has increased cross‑chain interoperability to support lending, swaps, and automated market making in virtual environments.

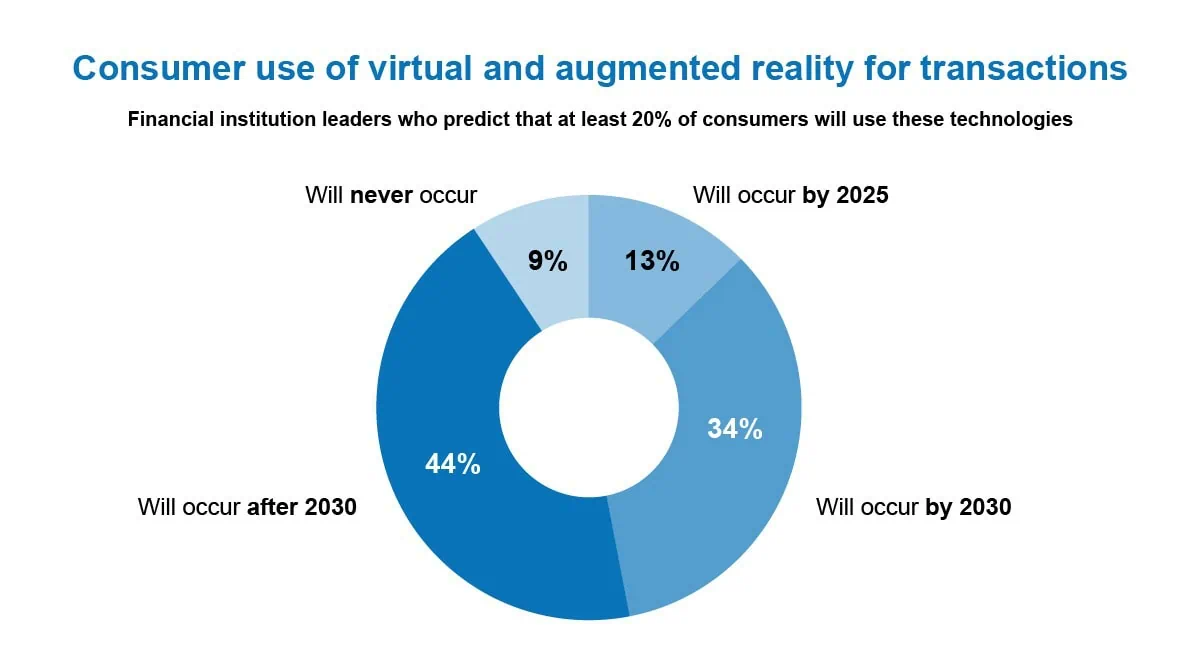

Consumer Use of VR/AR for Financial Transactions

- 44% of financial institution leaders believe VR/AR adoption for transactions will occur after 2030.

- 34% predict it will happen by 2030, showing rising long-term confidence.

- 13% expect adoption as early as 2025, highlighting a small group of early adopters.

- Only 9% believe it will never occur, indicating broad optimism about the future.

- A combined 87% expect at least 20% of consumers to use VR/AR for transactions within a few decades.

Global Metaverse Finance Market Overview

- The global metaverse market size is estimated at $227.05 billion in 2024, rising to $316.34 billion in 2025 (CAGR ~ 38–39%).

- Some forecasts, however, put the 2025 metaverse figure at $1,273.58 billion, with a longer‑term growth to $7,639.7 billion by 2032.

- In the narrower “metaverse in finance” segment, analysts expect $876.2 billion growth between 2025‑2029, expanding at ~40.8% CAGR.

- Prior base sizes for metaverse finance were modest (e.g. $8.01 billion in 2022).

- North America held over 70% share of the broader metaverse sector in 2024.

- The hardware segment dominates in value, thanks to demand for VR/AR devices in immersive platforms.

- In the financial vertical, banks, brokerages, and fintechs are expected to be top adopters within metaverse finance.

- Regions in APAC are forecasted to contribute 56% of growth in metaverse finance from 2025 to 2029.

Market Capitalization of the Metaverse

- The metaverse’s broader valuation (including commerce, social, and media) reached $146.6 billion in 2024, according to certain reports.

- Other sources estimate a lower 2024 base of $105.40 billion, with 2025 projected at $139.07 billion.

- Some data suggest much higher base values, e.g. $737.73 billion in 2024, rising to $1,273.58 billion in 2025.

- Long‑term models aiming to 2034 suggest market sizes in the trillions (e.g. $8,125.3 billion by 2034).

- The range of estimates underscores how definitions differ; “metaverse” may include gaming, social VR, virtual real estate, and finance in overlapping ways.

- In the finance subset, added capitalization stems from tokenized securities, DeFi protocols, and asset-backed virtual instruments.

- Investor confidence and capital flows play a large role in how valuation is computed (e.g., discounted cash flow for virtual economies).

- Volatility in crypto markets adds large swings to these valuations, especially when news, regulation, or major hacks occur.

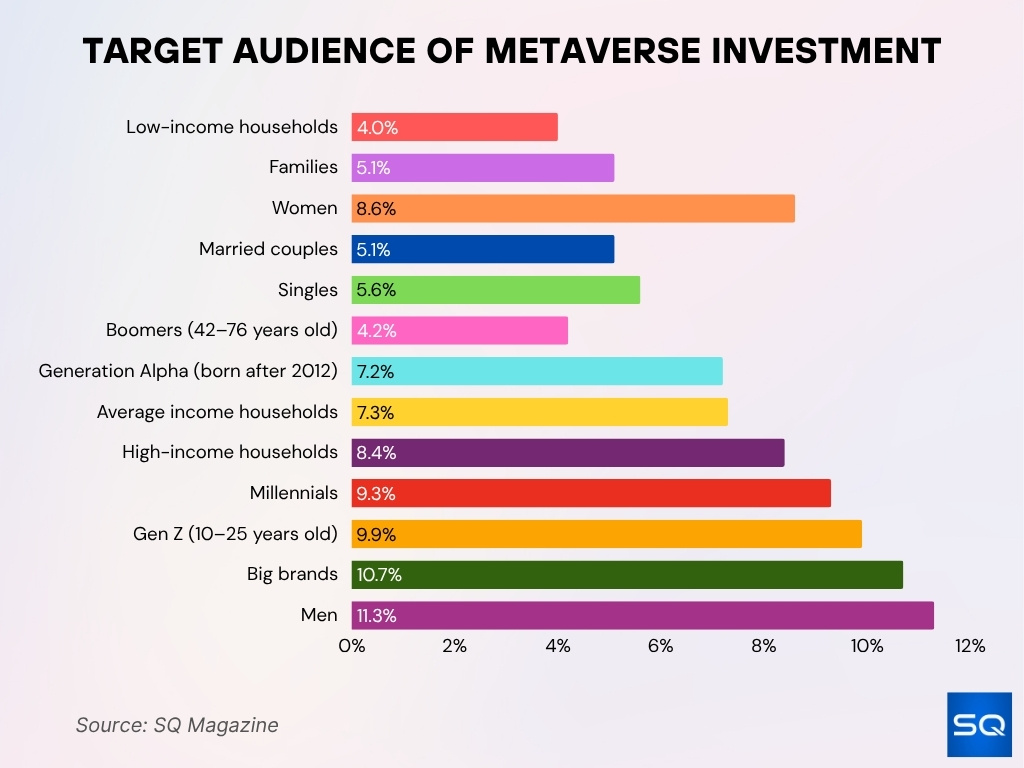

Who’s Investing in the Metaverse? Key Audience Breakdown

- Men lead metaverse investment with 11.3% of the total share.

- Big brands follow at 10.7%, showing strong institutional commitment.

- Gen Z (ages 10–25) makes up 9.9%, reflecting early adoption by youth.

- Millennials account for 9.3%, showing consistent engagement.

- Women contribute 8.6%, nearly matching male participation.

- High-income households represent 8.4%, versus 7.3% from average-income groups.

- Generation Alpha already holds a 7.2% share, signaling future growth.

- Singles invest 5.6%, slightly more than married couples and families at 5.1% each.

- Boomers (ages 42–76) show 4.2%, reflecting lower generational interest.

- Low-income households contribute the smallest share at 4.0%, likely due to affordability limits.

Metaverse Global Market Growth Forecast

- From $227.05 billion in 2024 to $314.71 billion in 2025, the metaverse overall is expected to grow at ~38.6% CAGR.

- Some models expand further, projecting $1,334.18 billion by 2029 in certain scenarios.

- The more aggressive forecast sees the metaverse reach $1,273.58 billion in 2025 and $7,639.70 billion by 2032 (CAGR ~29.2%).

- North America held about 70.78% of the market share in 2024.

- Forecasts place the 2025 size at ~$314.7 billion.

- In parallel, the metaverse‑finance segment is expected to capture $876.2 billion growth over 2025–2029 at ~40.8% CAGR.

- A key growth driver is the influx of capital into virtual infrastructure, digital commerce, and embedded finance layers.

Growth Rate of Metaverse Financial Services

- New user onboarding for DeFi via metaverse apps expanded 52% year-over-year as of mid‑2025.

- Cross‑platform liquidity pools account for 39% of trading volume on multi‑world DEXs.

- DeFi borrowing across all chains rebounded 30% in Q1 2025 from its prior dip.

- Aave held ~45% of the DeFi market share with a TVL of $25.41 billion in May 2025.

- In the broader crypto lending space, the total size reached $48 billion in 2025, up 51% from $23 billion in Q4 2021.

- The DeFi segment now controls ~45.31% of crypto credit markets, compared with 34.57% by centralized players.

- Among metaverse finance platforms, over 160 financial dApps now support NFT collateral, yield instruments, or rewards.

- Layer‑2 integration has enabled gas fee reductions of up to 87% for metaverse finance users.

- Governance tokens tied to metaverse DAOs averaged price gains of 28% in Q2 2025.

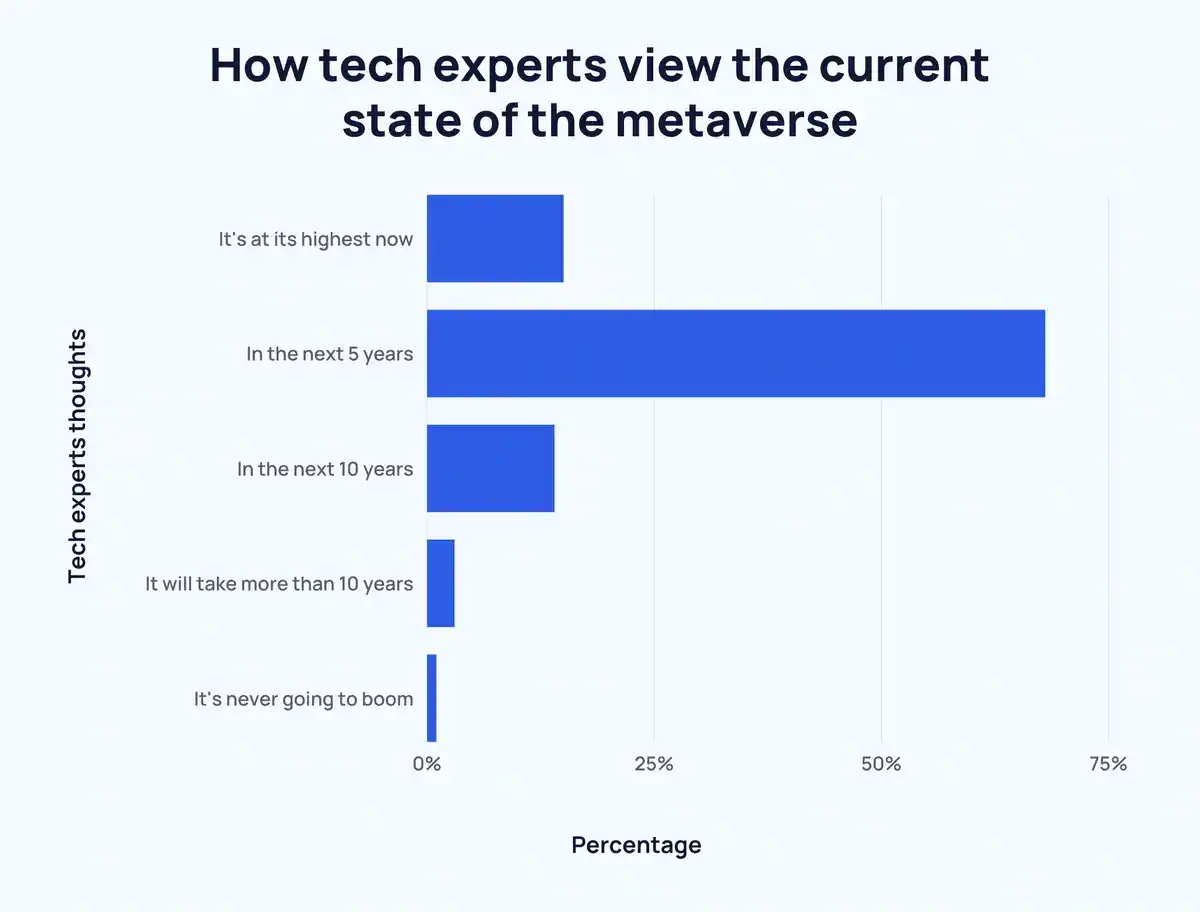

Tech Experts’ Predictions on Metaverse Growth

- 68% of tech experts believe the metaverse will peak within 5 years, showing strong short-term optimism.

- 15% say it’s already at its peak, suggesting belief in a current plateau.

- 14% expect a major boom within 10 years, indicating gradual development.

- Only 3% think it will take more than 10 years to gain traction.

- Just 1% believe it will never boom, showing minimal long-term skepticism.

Tokenized Assets and Virtual Currency Usage

- The total volume of virtual currencies in metaverse finance exceeded $212 billion in 2025.

- Stablecoins contribute ~65% of transactional value in metaverse commerce.

- Over 45% of NFT holders have used their tokens as collateral in financial transactions.

- The three tokens MANA, SAND, and AXS have a combined market cap of $31.4 billion.

- Smart contract rentals in virtual real estate grew 93% year-over-year.

- More than 1.3 million fractionalized NFTs exist for pooling and resale markets.

- Tokenized treasury or debt instruments in sandboxed virtual worlds have reached $730 million in issuance.

- The universe of tokenized real‑world assets (RWAs) has surpassed $33 billion in value as of late 2025.

- Some sources place tokenized RWAs at over $25 billion, up ~380% in three years.

- In metaverse finance, NFT‑backed lending contributed ~$6.5 billion to total capitalization.

NFT‑Backed Financial Products and Services

- NFT-collateralized loans reached $5.3 billion in outstanding volume by mid‑2025.

- The average APR for NFT-backed lending is ~9.4%.

- Fractional NFT vaults grew 73% year over year, with TVL across vaults at $2.6 billion.

- Protocols such as BendDAO, NFTfi, and others have expanded collateral options beyond art, into gaming items, royalties, and virtual land.

- NFT loan use cases now integrate royalty payments, automatic liquidation triggers, and dynamic rate oracles.

- Some NFT projects allow perpetual rentals, where token holders lend usage rights in exchange for yield.

- NFT loans backed by tokenized real estate stabilize valuations.

- Coverage and insurance protocols for NFT-backed products reached $460 million in volume in 2024–25.

- Projects issuing collateralized NFT-based derivatives numbered over 160 dApps in 2025.

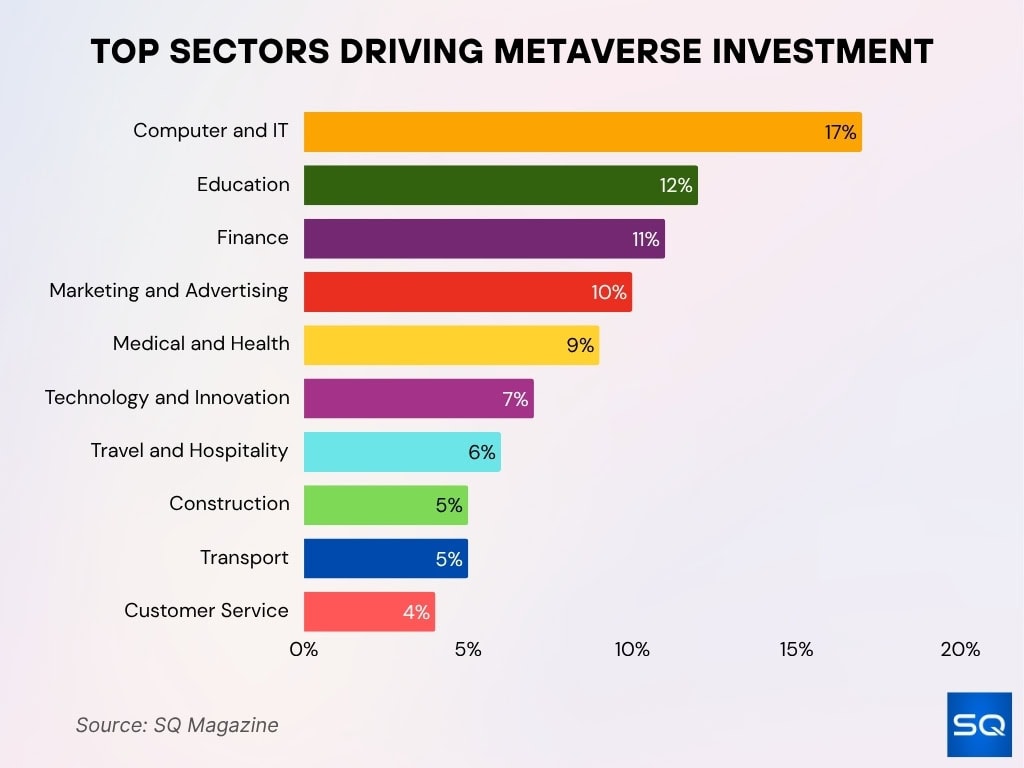

Leading Industries Powering Metaverse Investment

- Computer and IT lead with 17% of total metaverse investments, emphasizing tech’s central role in virtual world development.

- Education follows at 12%, driven by the growth of immersive learning platforms.

- Finance contributes 11%, fueled by interest in virtual banking, crypto, and blockchain integration.

- Marketing and advertising account for 10%, reflecting demand for branded virtual experiences.

- Medical and health make up 9%, supported by advances in telehealth and virtual therapy.

- Technology and innovation represent 7%, backing experimental platforms and emerging solutions.

- Travel and hospitality invest 6%, promoting virtual tourism and interactive experiences.

- Construction and transport each hold 5%, using the metaverse for modeling and logistics simulations.

- Customer service ranks lowest at 4%, yet shows early adoption of AI-driven support tools.

DeFi Integration Within the Metaverse

- The share of transactions on cross-world liquidity pools is 39% of DEX volume.

- Many classic DeFi protocols (Aave, Curve, Uniswap) now maintain metaverse‑optimized frontends.

- Multi‑chain interoperability now supports lending, swapping, and AMM within virtual environments.

- DeFi’s total TVL in 2025 was around $135.55 billion (as a snapshot) with expectations of further growth.

- More than 160 financial dApps integrate DeFi + metaverse features (loans, yield farming, collateral).

- Layer‑2 rollups host over 71% of financial dApps in metaverse environments.

- Metaverse dApps slashed gas costs by up to 87% through L2 integration.

- Cross-domain liquidity bridges now connect virtual world economies with mainnet DeFi.

- Governance and DAO models govern financial rules within metaverse protocols, using token votes, staking, and treasury control.

User Adoption of Metaverse Banking and Payments

- As of early 2025, estimates suggest 40–50 million active wallets, which may represent users engaging with financial tools in metaverse environments, though the wallet count ≠ unique users.

- DeFi transactions in metaverse ecosystems totaled $96 billion during H1 2025 alone.

- Among all virtual real estate trades, 57% settle via DeFi‑based escrows or smart contracts.

- Over 160 metaverse finance dApps support wallet payments, lending, and in‑world settlement.

- KYC is now mandatory in ~70% of regulated metaverse finance platforms.

- Gas and transaction fees dropped by up to 87% via Layer‑2 optimizations, boosting payment feasibility.

- Governance tokens in metaverse DAOs saw average price gains of 28% in Q2 2025, increasing incentives for adoption.

- Cross‑platform liquidity pools now contribute 39% of trading volume across metaverse DEXs, facilitating payments across worlds.

- Among U.S. adults, ~26% reported using some metaverse platform over the past 12 months.

Leading Platforms in Metaverse Finance

- Decentraland, The Sandbox, and Somnium Space remain among the top in transaction volume and user activity.

- Decentraland alone processes over $9.1 billion in annual finance‑linked transactions.

- Somnium Space has introduced regulated financial instruments via partnerships with EU firms.

- Binance’s “MiniVerse” sees over 600,000 daily active wallets participating in DeFi.

- The Ronin Network (Axie Infinity) handles $1.3 billion monthly in gaming‑linked DeFi flows.

- Over 160 new metaverse finance platforms launched globally in 2025.

- ~71% of these platforms deploy on Layer‑2 rollups (Arbitrum, Optimism, etc.).

- Protocols like Aave, Curve, and Uniswap launched metaverse‑optimized frontends to interface with virtual worlds.

- Cross‑world DEXs are now common, allowing users to swap assets between virtual worlds seamlessly.

Geographic Distribution of Metaverse Finance Adoption

- The U.S. leads with approx. 21.4 million active metaverse finance users.

- Asia‑Pacific region reports ~19.6 million users, with heavy activity in Japan, South Korea, and India.

- Europe accounts for ~15.2 million users, benefitting from regulatory clarity in the EU zone.

- Latin America shows the fastest YoY growth, with user numbers increasing by ~48%.

- In Africa, Nigeria and Kenya are rising as hubs for mobile-based metaverse banking.

- The Middle East (especially the UAE & Saudi Arabia) backs state‑driven metaverse pilots.

- Over 60% of metaverse-based remittances originate from developing countries.

- Singapore and Hong Kong host over 20% of registered metaverse finance startups in Asia.

- Brazil leads South America with 5.3 million metaverse finance users in 2025.

Investment & Funding in Metaverse Finance

- From 2025–2029, the metaverse finance market is forecast to expand by $876.2 billion, at a CAGR of 40.8%.

- Asia‑Pacific is set to contribute 56% of that growth.

- European metaverse funds surpassed $1.1 billion in AUM by March 2024, doubling from $403 million a year earlier.

- Amundi’s Digital Economy & Metaverse ESG ETF grew assets by 85%.

- Invesco’s Metaverse & AI fund saw > 260% growth to $180.2 million.

- Institutional capital is turning to the metaverse as fund flows accelerate.

- Many new DAOs and investment vehicles are forming within virtual economies in 2025.

- Regional venture capital investment into metaverse finance startups is intensifying, especially in APAC.

- Infrastructure plays (blockchain tools, cross-chain bridges, security) attract a disproportionate share of funding.

Risks and Security Challenges in Metaverse Finance

- Over the past 12 months, smart contract exploits led to $1.17 billion in losses across metaverse DeFi.

- Phishing scams targeting metaverse wallets surged by 41% from 2024 to 2025.

- Only 32% of platforms comply with ISO/IEC 27001 cybersecurity benchmarks.

- Audited protocols experienced 93% fewer losses, but just 45% of metaverse finance projects undergo full audits.

- Rug pulls and exit scams in crypto markets caused over $300–500 million in losses in recent years, but virtual land–specific scams are harder to quantify and typically much smaller.

- Credential‑stuffing attacks on metaverse banking apps rose 36% YoY.

- Regulatory gaps are cited as a primary impediment to institutional participation.

- Bug bounties across 50+ metaverse projects paid out $72 million in 2025 to remediate security flaws.

- Blockchain forensics now covers 70%+ of major metaverse transaction flows for fraud detection and analysis.

- High‑profile past breaches, such as the Ronin Network hack (≈ $620 million), underscore structural risk in validator governance.

- Many real‑world attacks trace not just to code bugs but to protocol logic and governance vulnerabilities.

Frequently Asked Questions (FAQs)

The metaverse market was valued at $146.6 billion in 2024 and is projected to reach $1.1 trillion by 2030.

That segment is projected to grow at a CAGR of 40.8%, with a total growth of $876.2 billion over 2025‑2029.

The metaverse is estimated to have about 700 million monthly active users in 2025.

In 2025, metaverse revenues are projected to hit $203.7 billion, reflecting a growth trajectory in recent years.

Conclusion

Metaverse finance is rapidly shifting from concept to reality. Tens of millions transact using virtual wallets. Major platforms now integrate financial layers. Capital is pouring in. Regulators are racing to keep pace. But as adoption deepens, security, governance, and regulatory cohesion remain the toughest hurdles.

For fintech leaders, crypto innovators, and financial institutions alike, the message is clear: engage now, but with rigorous safeguards. The metaverse frontier rewards early action, but only for those who build responsibly.