In recent years, the gender gap in cryptocurrency adoption has become a key topic. Worldwide, men continue to lead in ownership of digital assets, while women’s participation steadily rises. For example, in a U.S. household survey by JPMorgan Chase & Co., men aged 18–49 reported ownership rates far higher than women in the same age group.

In one business scenario, financial services firms are designing crypto-education initiatives targeting women to broaden their customer base. In another, fintech start-ups track gender-based usage patterns to tailor trading-platform features. This article dives into the latest statistics for men vs. women in crypto adoption, exploring demographics, motivations, barriers, and future projections.

Editor’s Choice

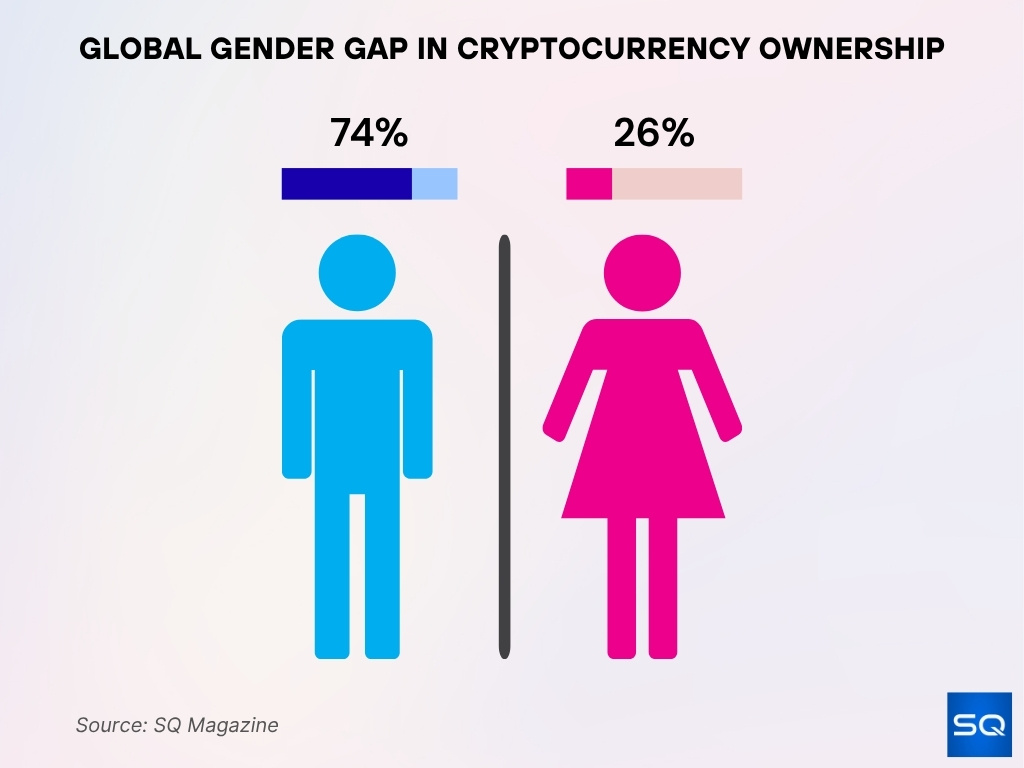

- In 2025, 74% of global crypto investors are men and 26% are women.

- In the age group 25–34, 16.2% of men own crypto, compared to 8.7% of women.

- In the U.S. in 2025, 25% of men aged 18–49 own crypto compared to 8% of women.

- Women are more likely to hold crypto long-term; 52% of women prefer to hold, vs. 36% of men.

- Men dominate Bitcoin-specific ownership, with a reported 86.9% of users being male, 13.1% female.

- Emerging-market regions (Asia-Pacific, Africa) continue to lead growth, potentially narrowing gender gaps over time.

Recent Developments

- Global adoption of crypto rose from roughly 21% of U.S./UK/France/Singapore respondents in 2024 to 24% in 2025.

- The number of women participating in crypto in India grew nearly 10-fold between 2023 and 2024, driven by rising smartphone access, fintech education, and community-led Web3 initiatives.

- In the U.S., survey awareness among men aged 18–49 is about 59%, while women aged 18–49 stand at 24%.

- Gender gap research indicates that men are more likely to intend future crypto ownership. In Nordic countries, men are 26% vs women 14%.

- The launch of spot crypto ETFs in early 2024 corresponded with increased investor interest, still largely male-dominated.

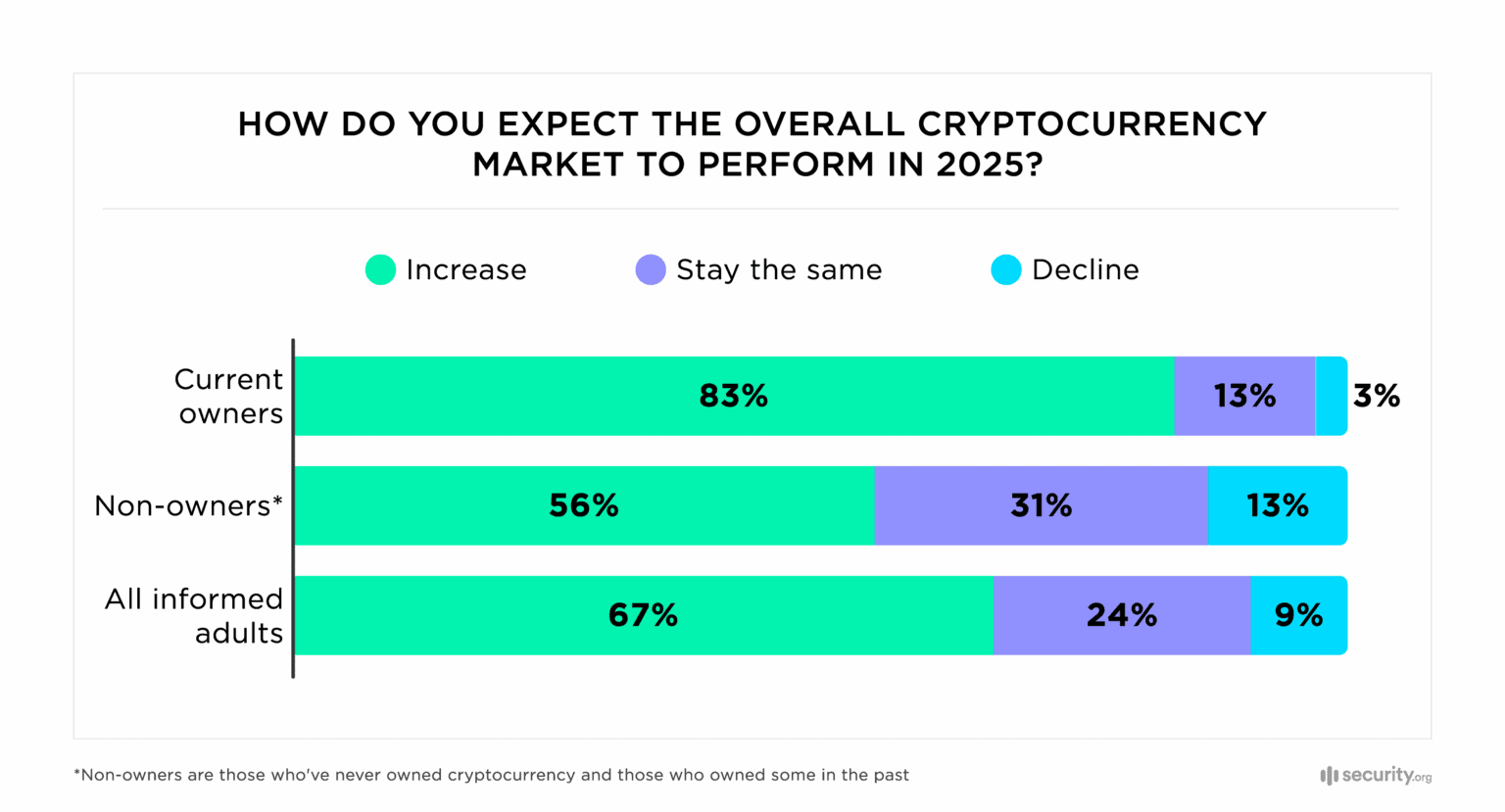

Crypto Market Sentiment Expectations

- 83% of crypto owners expect the market to rise in 2025, showing strong optimism among investors.

- 13% of owners think it will stay flat, while 3% expect a decline.

- Among non-owners, 56% foresee growth, 31% stability, and 13% a drop.

- Across all informed adults, 67% expect an increase, 24% no change, and 9% a decline.

- The data highlights a clear optimism gap between crypto owners and non-owners.

Regional Differences in Gender Adoption

- In Vietnam, the gender ratio is roughly 4:1 male to female crypto users.

- In North America, crypto ownership is ~16% of adults in 2025, gender-specific split not always published, but male dominance remains.

- Europe’s adult crypto-ownership rate rose to ~8.9% in 2025; women’s share remains significantly lower.

- U.S. survey, men 18–49 at 25% ownership, women 18–49 at 8%.

- In India, female crypto investors grew 10× in one year, with surges led by women aged 25–30.

- Among the Scandinavian retail-investor sample, men are 28% current crypto participants, women 11%.

- Across every age bracket in a global sample, men were nearly twice as likely to own crypto as women.

Age and Gender Demographics in Crypto

- For the age group 25–34, men 16.2% own crypto, women 8.7%.

- Age 35-44, men 14.1%, women 7.8%.

- Older age 65+, men 3.2%, women 1.8%.

- U.S. numbers, men 18–49 ownership ~25%, women 18–49 ~8%.

- In the U.S. sample, men aged 50+ ~12%, women aged 50+ ~9%.

- Older generations show smaller gender gaps than younger ones in some studies (e.g., Gen X vs Millennials) per JPMorgan data.

- Globally, ~60% of crypto investors are aged 25–34 in 2025.

- In certain regions, women aged 25–30 made up 53% of new female investors in India in 2024-25.

Global Gender Gap in Cryptocurrency Ownership

- 74% of global cryptocurrency investors are men, showing a strong male dominance in digital asset ownership.

- Only 26% are women, highlighting the persistent gender imbalance in crypto participation worldwide.

Awareness vs. Ownership, Gender Analysis

- Among U.S. adults, men aged 18–49, 59% report some knowledge of crypto, women in the same age group, 24%.

- Globally, men were ~13 percentage points more likely than women to be crypto participants (Nordic survey).

- Survey shows women’s awareness remains lower, but the gap is narrowing as adoption increases.

- In the age 25-34, men own 16.2% vs women 8.7%, indicating awareness/interest leads for men.

- In the U.S., women aged 50+ show 9% ownership but lower awareness (22%) compared to men, 12% ownership (37% awareness).

- Regions with higher female awareness initiatives show faster female adoption (e.g., India).

- Barriers in education, comfort with technology, and finance contribute to the awareness gap between genders.

Investment Amounts, Men vs. Women

- Of respondents who invested $5,000 or more in crypto in the past year, 78% were male.

- In a subset of bitcoin users, 86.9% were male and only 13.1% were female.

- Among American households, men aged 18-49 had a ~25% crypto ownership rate vs. ~8% for women of the same age.

- A 2025 global adoption summary shows the average crypto investor allocates about 12% of their portfolio to digital assets.

- Female investors are increasing in number, but the average investment size among men remains significantly higher in most surveys.

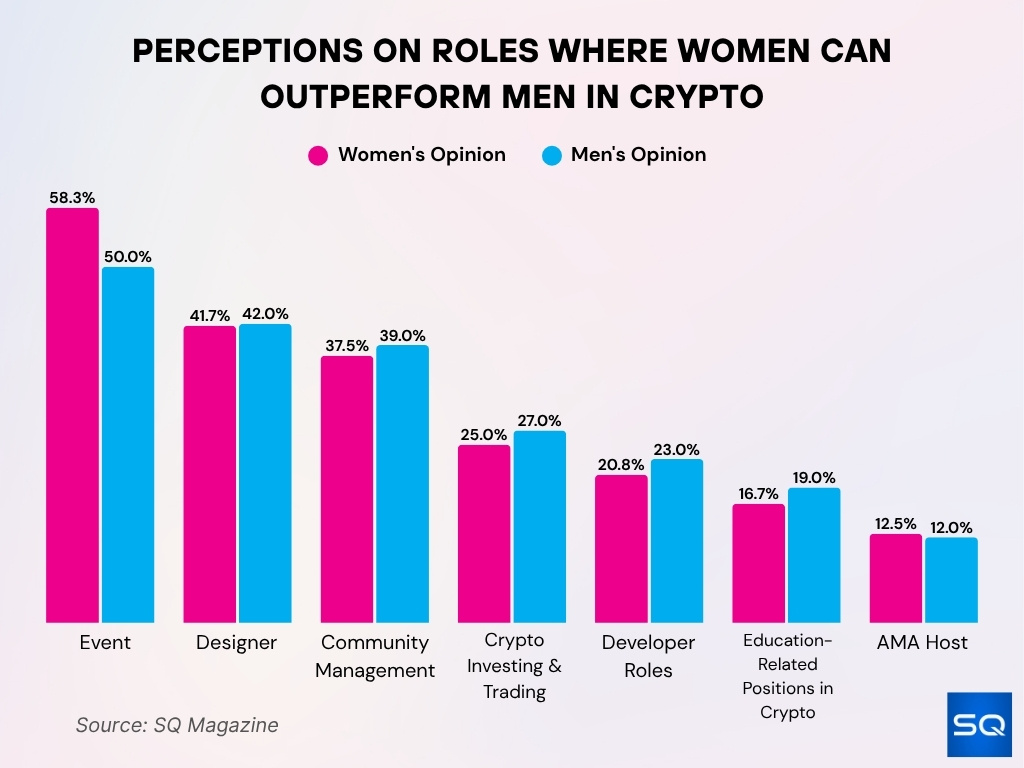

Perceptions on Roles Where Women Can Outperform Men in Crypto

- 58.3% of women and 50% of men believe women excel in event roles within crypto.

- 41.7% of women and 42% of men see women outperforming as designers.

- 37.5% of women and 39% of men think women lead better in community management.

- 25% of women and 27% of men view women as strong investors and traders.

- 20.8% of women and 23% of men believe women can lead in developer roles.

- 16.7% of women and 19% of men think women excel in education-related positions.

- 12.5% of women and 12% of men say women make better AMA hosts.

- 4.2% of women identified other roles where women may outperform men.

Motivations for Crypto Adoption by Gender

- Among men, 43% believed Bitcoin would reach $200,000 by 2025, compared to 37% of women.

- Female crypto investors often cite motivations including financial empowerment, alternative assets, and diversification rather than just speculative returns.

- Men show higher interest in new crypto products, DeFi protocols, and trading platforms, while women focus more on platforms that offer education or long-term utility.

- In regions with rising female participation (e.g., India), women reported motivations like ownership of digital assets as financial freedom, especially in younger age brackets.

- Gender research indicates women are somewhat less driven by peer-influence and more by community, education, and trust in crypto ecosystems.

Financial Literacy and Knowledge Gap by Gender

- In the U.S., awareness of crypto among men aged 18-49 was about 59%, while for women in the same age range, it was 24%.

- A 2023 gender-gap study found interest levels, 65% of men vs. 53% of women expressed interest in crypto assets.

- Women in crypto reported significantly higher rates of experiencing discrimination or feeling unsafe in crypto spaces; 60% of women reported feeling discriminated against.

- Globally, women hold less representation in fintech and crypto leadership; women make up less than 13% of fintech leadership positions.

- The gap in financial literacy and understanding of crypto mechanics remains a barrier; women are more likely to rate themselves as “not confident” in investing.

- Platforms and communities targeting female investors show early benefits in narrowing the knowledge divide.

- Regions with targeted female-education initiatives show faster female adoption progression, suggesting literacy plays a key part in gender uptake.

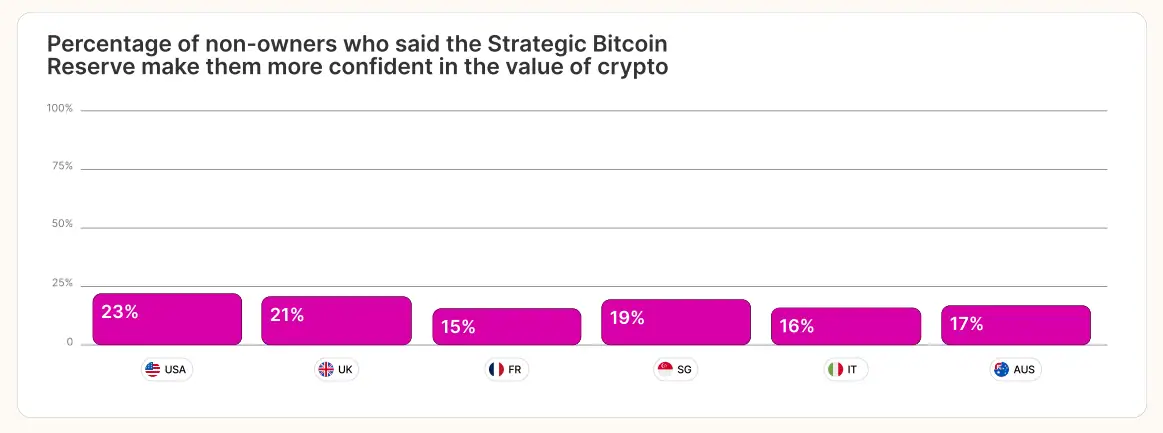

Non-Owners Gaining Crypto Confidence from Strategic Bitcoin Reserve

- 23% of U.S. non-owners say the Strategic Bitcoin Reserve boosts their confidence in crypto’s value.

- 21% of UK non-owners report greater trust in cryptocurrency due to the Reserve.

- 15% of French non-owners feel more confident, marking the lowest rate among surveyed countries.

- 19% of Singaporean non-owners say the Reserve strengthens their trust in crypto.

- 16% of Italian non-owners report increased confidence from the Reserve’s influence.

- 17% of Australian non-owners feel more assured in crypto because of the Reserve.

- Overall, the Reserve modestly improves crypto sentiment among non-investors, especially in the US and UK.

Gender and Risk Appetite in Crypto Investment

- Women appear more patient with asset holding; 52% of female investors preferred to hold through volatility, whereas 64% of men preferred to sell during high market fluctuation.

- Men are more likely to engage in speculative trading and higher-risk strategies in crypto markets.

- Female investors show a lower likelihood of investing in unfamiliar or highly volatile tokens; they prefer trusted assets and longer horizons.

- Research indicates generational gender risk differences; among millennials, men’s uptake of crypto is higher and risk tolerance greater compared to women.

- The gender risk-appetite gap contributes to women holding smaller crypto positions in many cases.

- Some industry voices suggest that if female risk-appetite levels matched male levels, the “gender gap” in crypto investing could shrink more rapidly.

- Initiatives aimed at reducing intimidation and improving confidence may impact women’s willingness to take risks in crypto environments.

Barriers to Entry for Women in Crypto

- Entry barriers include a lack of representation, lower financial literacy, and a male-dominant community culture in crypto. For example, only 6% of crypto company CEOs are women.

- Female investors cite lack of accessible education and perceived complexity of crypto platforms as deterrents.

- Social-cultural norms and a lack of role models further discourage women from entering crypto investment spaces.

- Reports note that women often feel unwelcome or underestimated in crypto panels and forums, with less visibility and voice.

- Women may also face systemic funding challenges when involved in crypto start-ups; female-founded Web3 firms receive only about 7% of VC deals.

- The gender pay gap and lower disposable income affect women’s ability to allocate funds to higher-risk assets like crypto.

- Platform design and marketing often target male-dominant trading behavior, which can alienate potential female participants.

Gender Representation in Crypto Professions

- Women hold an estimated less than 13% of leadership roles in fintech industries globally.

- In 2025, just 6% of crypto CEOs are women and women-led startups secure 7% of Web3 VC funding.

- Start-ups with female founders account for only about 7% of Web3 venture-capital deals.

- Lack of female representation in major crypto firms affects the talent pipeline and decision-making diversity.

- Industry commentary highlights that the perception of crypto as a male domain discourages female professionals from entering technical roles.

- Women in crypto are increasingly visible in roles tied to education, community building, regulation and compliance rather than core trading or protocol design.

- Organizations that focus on increasing female representation in Web3 are gaining traction, signaling future changes in professional gender mix.

Women’s Role in Crypto Startups and Leadership

- Female-led crypto/start-up firms currently secure only about 7% of venture capital deals in Web3.

- Although women make up ~40% of the workforce at one major exchange (as cited by the company’s CMO), women still hold fewer executive seats.

- Female founders often attribute success to networks, mentorship program access, and targeted funding initiatives.

- The growth of women-focused accelerator programs in crypto is helping expand leadership pipelines and startup involvement.

- Women in leadership roles are increasingly shaping strategy around tokenization, DeFi regulation, and community governance.

- Yet a significant leadership gap persists; senior-executive roles (CTO, CEO) in crypto firms remain majority male, limiting mid-level role models for women.

- Industry commentary cautions that unless funding and visibility improve for women-led crypto startups, the gender leadership gap could hinder broader female adoption.

Gender Distribution in NFT and DeFi Sectors

- In 2025, 15% of men and only 4% of women reported collecting NFTs.

- Research shows men are approximately three times more likely than women to collect NFTs.

- Women’s participation in DeFi remains notably lower than men’s, though precise figures are less published.

- Female creators in NFT art still face pay disparities; some reports indicate they earn up to 46% less than their male counterparts.

- Among female NFT investors, fewer engage in high-volume trading; they tend to prefer stable, known projects rather than highly speculative ones.

- Several studies suggest gender-based bias in NFT pricing; female-creator artworks often receive lower valuations.

- Emerging platforms focused on women in Web3 are starting to increase female participation in NFTs and DeFi.

Cultural Attitudes and Gender Imbalance in Crypto

- Approximately 60% of women report experiencing discrimination or discomfort in crypto-related spaces.

- Cultural norms continue to treat crypto as a male-dominated domain, reinforcing barriers for women.

- Women in Web3 finance reportedly earn 46% less than men on average.

- Media analysis from Spain highlights that less than 25% of speakers at major crypto conferences were women.

- Studies of cross-country culture and crypto trust find that ethical and cultural traits reduce women’s confidence in crypto.

- Female investors are more likely to cite financial independence and community support as motivations than men.

- Visibility of female role models in crypto remains low, reducing the effect of social proof for women entering the space.

Influence of Education and Income on Adoption by Gender

- Crypto ownership is higher among college graduates (19%) and upper-income earners (19%), compared to under 10% among lower-education groups.

- Fewer than one-third of women reach high financial literacy, while about half of men do among non-owners.

- Women with higher income and education are 1.8x more likely to own crypto than lower-income peers.

- Among Bitcoin owners, women report 25% lower understanding of crypto mechanics than men.

- Younger, educated women (Millennials and Gen Z) show the fastest growth, rising 16% year-over-year in adoption rates.

- Surveys show 60% of women cite lack of crypto knowledge as a major barrier to entry, versus 35% of men.

- Financial literacy training raises female crypto participation by up to 30% across demographics.

- 70% of female crypto holders in the U.S. are under 40, often with higher education credentials.

- Education initiatives such as SheFi and Crypto Chicks report 100–150% growth in women’s participation since 2023.

- In markets with strong fintech and mobile finance ecosystems, the gender adoption gap narrows by about 20% due to improved access and education.

Initiatives Promoting Female Participation in Crypto

- The initiative Unstoppable WoW3 (Women of Web3) launched with a $10 million grant and aims to educate six million African women in Web3.

- Significant annual growth (100–150%) in membership, driven by targeted education, mentorship, and Web3 access programs designed for women.

- Universities and NGOs are incorporating crypto-finance modules targeting women to reduce literacy and entry gaps.

- Accelerator programmes for women-led Web3 startups are increasing, though female-led deals still account for a small share (~10%).

- Some crypto exchanges are partnering with female-entrepreneurship networks to sponsor women-in-crypto events and hackathons.

- Mentorship networks and community groups report increases in women joining crypto training and trading groups, raising female confidence levels.

- These initiatives indicate that with targeted support, female participation is growing and gender gaps may shrink over time.

Trends in Gender Parity Over Time

- Female crypto investor growth year-over-year globally is reported at about 16% in 2025, the fastest in Asia and Africa.

- In older age brackets (55+), the gender split remains more lopsided (male ~65%, female ~35%).

- Although women’s participation is rising, leadership and professional representation remain stagnant below ~30% in many regions.

- Regions such as Africa and Southeast Asia show narrowing gender gaps faster than developed markets.

- Market research suggests that as financial literacy rises among women, adoption rates accelerate.

- Still, the overall industry remains male-dominated, signifying that parity will take years rather than months.

Future Projections for Gender Balance in Crypto

- Women make up 26% of active global crypto investors in 2025, projected to reach ~45% by 2030.

- Market projections suggest that if current growth trends and inclusion efforts persist, female participation in crypto could reach 40–45% by 2030, narrowing the existing gender gap significantly.

- Programs like Unstoppable WoW3 target onboarding 6 million African women into Web3 by 2030, accelerating parity in emerging markets.

- Survey projections suggest global female crypto adoption could approach 40–45% within 5 years, supported by education initiatives like SheFi.

- In South and Southeast Asia, female crypto growth rose 17% YoY, aided by mobile-first fintech ecosystems.

- The CrossFi 2025 survey reported that in specific Web3 platforms or programs within India, Finland, and Russia, women constituted up to 80% of active users, largely in education and DeFi ecosystems, though this is not representative of the broader market.

- Despite progress, only 6% of crypto CEOs and 7% of Web3 funding go to women-led startups, showing an uneven leadership balance.

Frequently Asked Questions (FAQs)

48% of male investors prefer medium-term trading.

Median gross transfers are about $1,000 for men and $400 for women.

60% of women report they have faced discrimination or discomfort in crypto spaces.

Conclusion

The gender gap in crypto adoption remains real but is showing meaningful signs of narrowing. Cultural norms, education and income disparities, and platform design bias all contribute to the imbalance. At the same time, targeted initiatives and rising female interest are reshaping the landscape. For the U.S. audience especially, this means that women are increasingly part of the crypto narrative, not just as investors, but as creators, strategists, and influencers. With sustained effort and structural support, we have the opportunity to make crypto a truly inclusive space.