MakerDAO remains one of the most influential decentralized finance (DeFi) protocols. Its dual‑token structure, the DAI stablecoin and MKR governance token, underpins a decentralized lending and stablecoin ecosystem that bridges traditional finance use cases and web3 innovation. Today, MakerDAO powers stablecoin liquidity on major exchanges and serves as collateral in institutional lending strategies. These statistics unpack the most critical metrics shaping MakerDAO’s performance this year and last. Read on for a deep dive into the protocol’s key figures and trends.

Editor’s Choice

- MakerDAO Total Value Locked (TVL): approx. $6.07 billion in 2026.

- DAI Circulating Supply: over 5.36 billion tokens.

- DAI Market Cap: roughly $5.36 billion.

- MKR Trading Volume (24h): about $380,000.

- DeFi Total TVL (2025): $123.6 billion across protocols.

- Stablecoin Wallet Growth (2025): over 53% YoY.

Recent Developments

- MakerDAO’s TVL jumped ~20% in the past year, signaling renewed capital inflows.

- The protocol expanded collateral vault integrations, improving DAI issuance flexibility.

- Maker’s MKR token has shown positive momentum over multiple weeks despite broader market pressures.

- DeFi ecosystem growth (total TVL up 41% in 2025) supports MakerDAO’s network effects.

- Stablecoin adoption stabilizes DAI usage on major lending platforms.

- Protocol governance updates continue refining risk parameters in CDPs.

- MakerDAO governance has adjusted stability fees across collateral types to maintain peg stability.

- Adoption of multicollateral vaults has enhanced DAI minting flexibility.

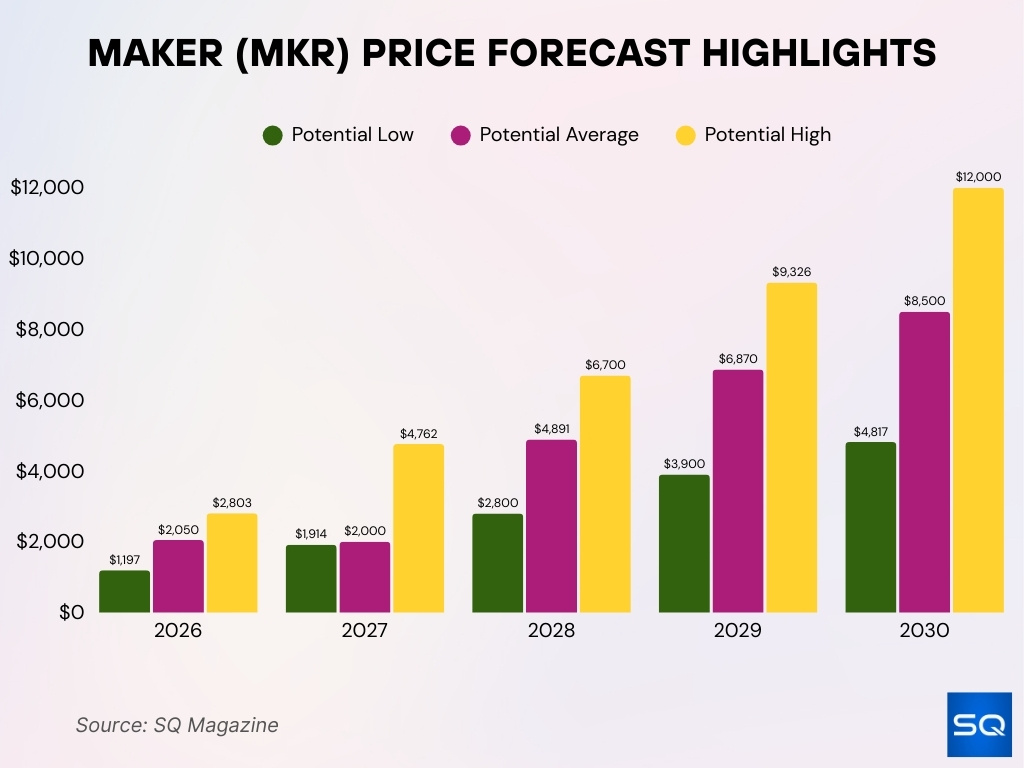

Maker (MKR) Price Forecast Highlights

- MKR’s projected low price rises from $1,197 in 2026 to $4,817 by 2030, showing a strong long-term support trend.

- The average MKR price estimate increases from $2,050 in 2026 to approximately $8,500 in 2030, reflecting growing protocol adoption.

- Upside potential expands significantly, with the high price target climbing from $2,803 in 2026 to $12,000 by 2030.

- In 2027, MKR’s high projection nearly doubles year over year, reaching $4,762, signaling heightened volatility and growth expectations.

- 2028 marks a breakout phase, as the average price jumps to $4,891 and the high target reaches $6,700.

- By 2029, MKR’s average valuation is projected at $6,870, while the upper range extends beyond $9,326.

- Over the full forecast period, MKR’s potential average price grows by more than 314% from 2026 to 2030.

- The widening gap between low and high estimates highlights increasing market maturity, risk, and upside opportunity for long-term holders.

MakerDAO Overview

- DAI total supply reached $8.4 billion.

- MakerDAO TVL stands at $6.07 billion.

- MKR price trades around $1,390 with roughly $380,000 24h volume in early 2026.

- MKR market cap is approximately $1.15 billion, in line with recent circulating‑supply data.

- RWA-backed collateral totals $948 million or 14% of reserves.

- Protocol score at 30.6/100, up +3.3 points.

- Over-collateralization ratio averages 155%.

- RWA revenue share is 10.9% of the total over 14 months.

- DSR-linked yield delivered 5.48% APY.

- DeFi lending TVL share 28%.

Protocol TVL and Market Share

- MakerDAO TVL stands at $6.07 billion.

- Total DeFi TVL reaches $89.35 billion.

- MakerDAO holds ~6.8% share of total DeFi TVL.

- Ethereum DeFi TVL is at $72.77 billion.

- MakerDAO represents 8.3% of Ethereum DeFi TVL.

- MakerDAO TVL is 53,584K BTC equivalent.

- TVL equivalent to 1.657M ETH.

- Year-over-year TVL growth is approximately 20%.

- DSR TVL contributes $265.77 million.

- Lending TVL share at 28% of DeFi lending.

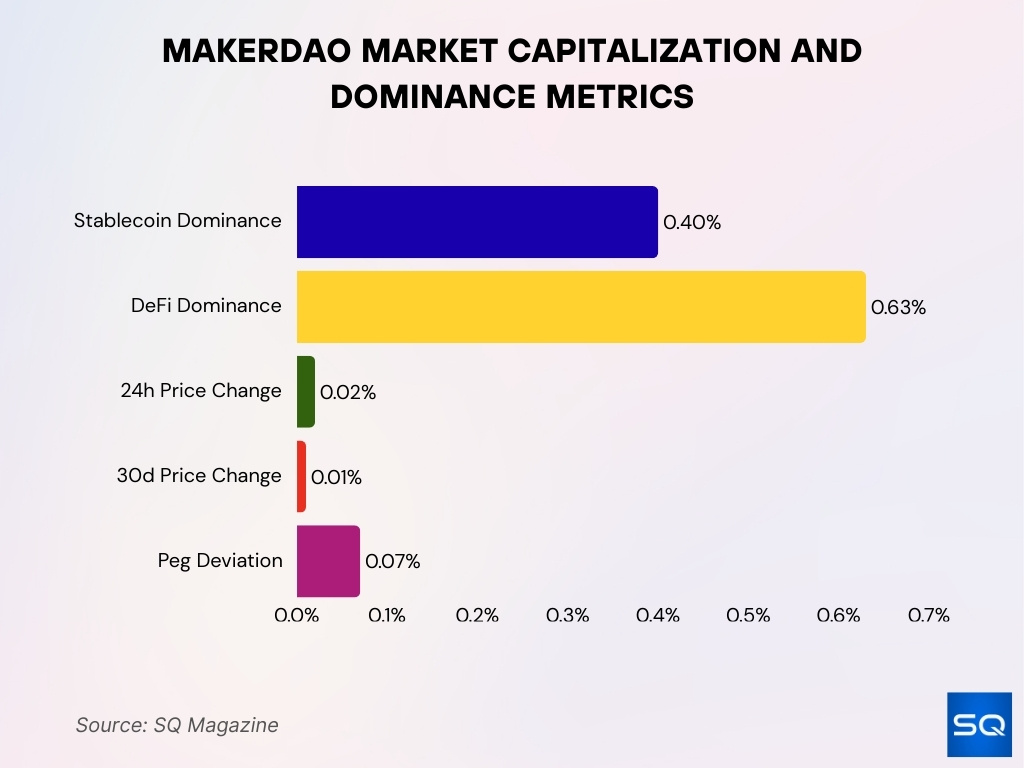

Market Capitalization and Dominance

- DAI market cap stands at $5.36 billion.

- Ranks #18 overall by market capitalization.

- Top #3 stablecoin by market cap.

- Stablecoin market dominance is at 0.40%.

- DeFi dominance share is 0.63%.

- 24-hour price change +0.02%.

- 30-day price change +0.01%.

- Peg stability deviation is minimal at 0.07%.

Peg Stability and Volatility Metrics

- Price deviation from the USD peg is under 0.003% weekly.

- Current price is precisely at $1.00.

- 30-day volatility measures 0.18%.

- 24-hour price change limited to +0.02%.

- Projected max deviation in 2026: 0.20% from peg.

- Historical all-time low deviation -12% at $0.88.

- PSM spread maintains 10 bps for arbitrage.

- Weekly volatility is among the lowest at <0.1%.

- 63% green days in the last 30days with minimal fluctuations.

DAI Supply and Circulation Statistics

- Total DAI supply stands at 5.36 billion tokens.

- Circulating supply matches at 5.36 billion DAI.

- DAI price holds steady at $1.00.

- 24-hour trading volume reaches $92.63 million.

- Market cap valued at $5.36 billion.

- 24h volume-to-market cap ratio 1.72%.

- Recent price range $0.9996–$1.00.

- All-time high recorded at $1.22.

- All-time low at $0.88.

- Volume change +25.07% over 24 hours.

Collateral Types and Allocation Breakdown

- PSM-related assets comprise 32.9% of collateral.

- ETH/BTC derivatives and stablecoins at 20%.

- RWA exposure reaches 23.5% of total collateral.

- Over-collateralization ratio averages 155%.

- Minimum collateralization ratio set at 150%.

- Supports over 30 different asset types.

- RWA revenue contributes 10.9% of the total.

Real‑World Asset (RWA) Exposure Statistics

- RWA collateral valued at $948 million.

- Represents 14% of total reserves.

- RWA exposure totals 23.5% of collateral.

- RWA revenue share is 10.9% of the total over 14 months.

- USDS RWA loan balances exceed $2.68 billion.

- Projected RWA collateral percentage 38%.

- RWA vaults contribute $35.7 million in revenue.

- Institutional RWA borrowers include New Silver and HV Bank.

- RWA diversification reduces crypto volatility exposure.

Maker (MKR) Token Price and Market Cap

- MKR current price at $1,390.

- Market cap totals $1.15 billion.

- 24-hour trading volume $380,000.

- Circulating supply 847,220 MKR.

- Total supply capped at 1,005,577 MKR.

- Fully diluted valuation $1.36 billion.

- 24-hour price range $1,508–$1,595.

- 24h volume change up 5.32%.

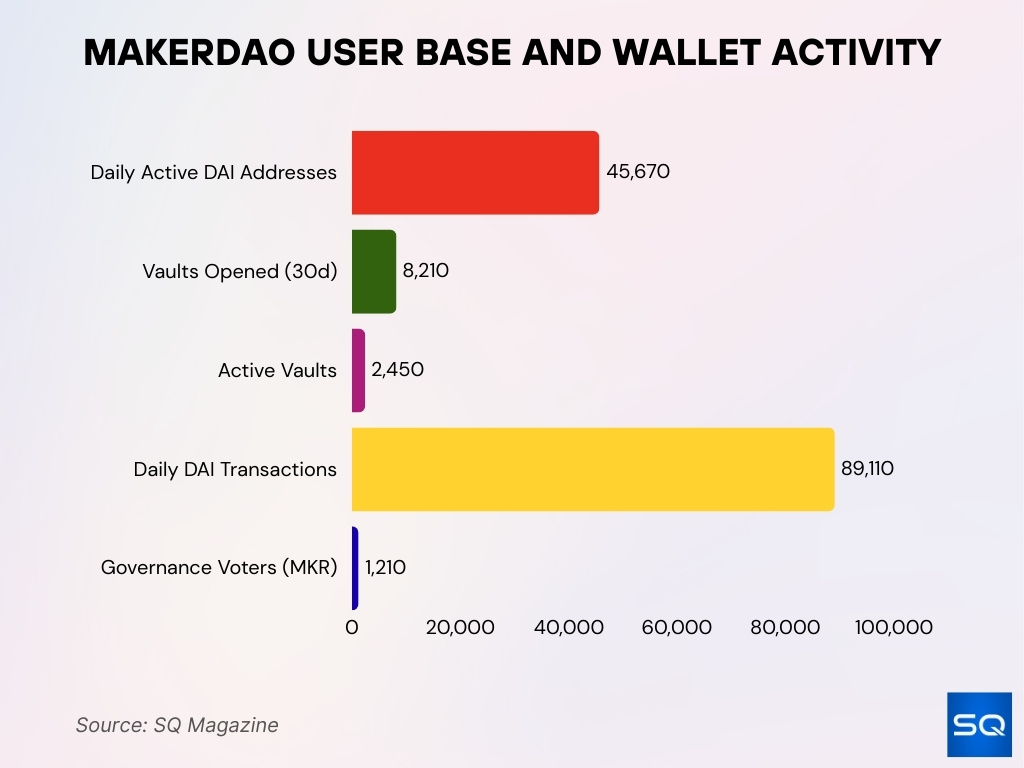

User Base and Wallet Activity

- Daily active DAI addresses average 45,670.

- Vaults opened in the last 30 days: 8,210.

- Active vaults currently 2,450.

- Daily DAI transactions exceed 89,110.

- Governance voters number 1,210 MKR delegates.

- DAI unique holders total 1.2 million wallets.

- DEX transaction volume share 28%.

- Lending integration deposits $265 million.

MKR Trading Volume and Liquidity Metrics

- Volume-to-market cap ratio stands at 0.30%.

- Top exchange volume on Coinbase $1.2 million.

- DEX liquidity pools contribute 15% of volume.

- Bid-ask spread averages 0.45%.

- 7-day average volume $2.8 million.

- Order book depth $500K within 2% price.

- Volume spike during governance votes up 150%.

- Liquidity score rated 72/100.

MKR Token Supply and Distribution

- Total supply stands at 870,820 MKR.

- Circulating supply recorded at 847,220 MKR.

- Max supply capped at 1,005,577 MKR.

- Active holders total 89,110 wallets.

- The top 10 holders control 32.4% of the circulating supply.

- Governance delegation covers 65% of voting power.

- Cold storage balances represent 28% of the total.

- MKR burn rate averages 1,200 tokens monthly.

- Institutional wallets hold 12.7% of the supply.

Protocol Revenue and Fee Generation

- Stability Fees generate $35.7 million annually.

- RWA vaults contribute $35.7 million in revenue.

- Liquidation penalties add 2.1% of total fees.

- Maker Buffer surplus reaches $1.2 billion.

- MKR buyback and burn totals 12,450 tokens.

- DSR accrual yields 5.48% APY.

- Revenue per MKR holder averages $42.

- 14-month RWA revenue share 10.9%.

- Projected annual revenue exceeds $165 million.

Net Income and Profitability Trends

- Protocol surplus buffer totals $1.2 billion.

- Quarterly net revenue averages $41.25 million.

- MKR burns from surplus auctions reach 12,450 tokens.

- RWA yield boosts profitability by 10.9% share.

- Maker Buffer growth up 18% year-over-year.

- Fee income per $1B DAI debt $4.2 million.

- Retained earnings cover 155% liquidation risk.

- Treasury yield allocation 5.1% APY.

- Profit margin from Stability Fees is 92%.

DAI Savings Rate (DSR) and Yield Metrics

- DSR TVL totals $265.77 million.

- Current DSR rate set at 5.48% APY.

- sDAI circulating supply $266 million.

- Daily DSR inflows average $1.2 million.

- DSR deposits represent 5% of the total DAI supply.

- Yield payout over 30 days is 1.37%.

- Active DSR lockers number 12,450 wallets.

- sDAI TVL growth up 22% year-over-year.

sDAI Adoption and TVL Statistics

- sDAI TVL reaches $266 million.

- Represents 4.4% of the total DAI supply.

- Active holders total 12,450 wallets.

- 30-day TVL growth up 8.2%.

- Yield linked to DSR at 5.48% APY.

- Institutional allocation: 22% of sDAI TVL.

- Integration with Spark Lend boosts 15% liquidity.

- Monthly inflows average $5.1 million.

- Adoption rate up 32% year-over-year.

Geographic and Institutional Adoption

- U.S. stablecoin volume share is 42% of the global.

- Institutional DAI allocation is 22% of TVL.

- South Asia’s growth rate is 28% year-over-year.

- North Africa adoption up 35%.

- RWA partners include 12 institutions.

- DeFi funds hold 15% of the MKR supply.

- Cross-border settlements via DAI $1.2 billion monthly.

- U.S. DAI wallet addresses 320K.

Liquidations and Risk Management Metrics

- Liquidation penalties contribute 2.1% of fees.

- Active vaults total 2,450.

- Average liquidation ratio 150%.

- 30-day liquidations number 210.

- Recovery rate post-liquidation: 98.5%.

- Keeper incentives paid $45,670.

- The credit loss trend is minimal at 0.12%.

- Risk-adjusted collateral coverage 155%.

Governance Participation and Voting Statistics

- Active MKR voters total 1,210 delegates.

- Delegated voting power covers 65% of MKR.

- Executive votes passed 45 in the last year.

- Voter turnout averages 32% per poll.

- Governance proposals are submitted 89 annually.

- The top delegate controls 12.4% voting weight.

- Participation up 18% year-over-year.

- Polls were conducted 210 over 12 months.

Frequently Asked Questions (FAQs)

MakerDAO’s Total Value Locked (TVL) is about $6.47 billion in 2025–2026, reflecting assets locked across its protocol.

The circulating supply of DAI is approximately 5.37 billion tokens as of early 2026.

DAI’s market cap is roughly $5.36 billion based on recent live statistics.

DAI’s 24‑hour trading volume is around $66.7 million according to recent exchange data.

Conclusion

MakerDAO continues to evolve as a foundational protocol in decentralized finance, blending stablecoin utility, governance participation, and risk‑managed borrowing. Across savings rate adoption, liquidation safeguards, and expanding global usage, the system demonstrates resilience and adaptability. With ongoing governance reforms and institutional engagement, DAI and the broader ecosystem remain pivotal in shaping decentralized money markets. As real‑world adoption intensifies and modular governance frameworks develop, MakerDAO’s trajectory affirms its role as a cornerstone of the DeFi landscape.