KYC (Know Your Customer) compliance has become a critical anchor for crypto platforms working to build legitimacy and trust. In the banking sector, for example, strong KYC processes have enabled firms to enter new global markets; similarly, in digital‑asset trading, platforms applying rigorous identity checks report fewer scam incidents and higher institutional adoption. As the crypto industry expands, understanding the numbers behind KYC compliance helps both businesses and regulators navigate the evolving landscape. Keep reading to explore detailed statistics and their implications.

Editor’s Choice

- 25% reduction in crypto scams across major exchanges in 2024 due to KYC procedures.

- 61% of users in a 2025 survey say they prefer platforms with robust compliance measures.

- Over 90% of crypto platforms now use AI‑powered identity verification tools.

- Only 40 of 138 jurisdictions were “largely compliant” with the Financial Action Task Force (FATF) crypto standards as of April 2025.

- Illicit crypto sent to identified addresses totaled $40.9 billion in 2024 (including fraud, scams, and money laundering), while direct crypto crime revenue reached $24.2 billion.

- In 2025, more than 70% of onboarding will be automated, using biometric and digital identity verification.

- Fraud attempts rose by 48% globally per Sumsub 2025 data, though APAC saw a regional decline due to regulatory advances.

Recent Developments

- A 2025 article reports one in four users (25%) abandon onboarding due to KYC friction.

- The global share of centralised exchanges in North America that were fully KYC compliant rose from ~85% in 2024 to 90% in 2025.

- The FinCEN reported a 34% increase in suspicious activity reports (SARs) from crypto businesses after the enforcement of new KYC guidelines in 2024.

- Fraud attempts in verification globally rose by 48%, according to the Crypto Industry Report 2025 by Sumsub.

- More than 70% of KYC onboarding processes are expected to be automated in 2025, replacing many manual checks.

- Platforms report verification time improvements of 46%, enabling faster user onboarding and reduced drop‑off.

- The demand for stronger KYC/AML frameworks now spans identity verification, AML/PEP screening, and wallet/transaction monitoring.

- Regulation is tightening, fewer jurisdictions remain outside enforcement zones, but large gaps persist in several regions.

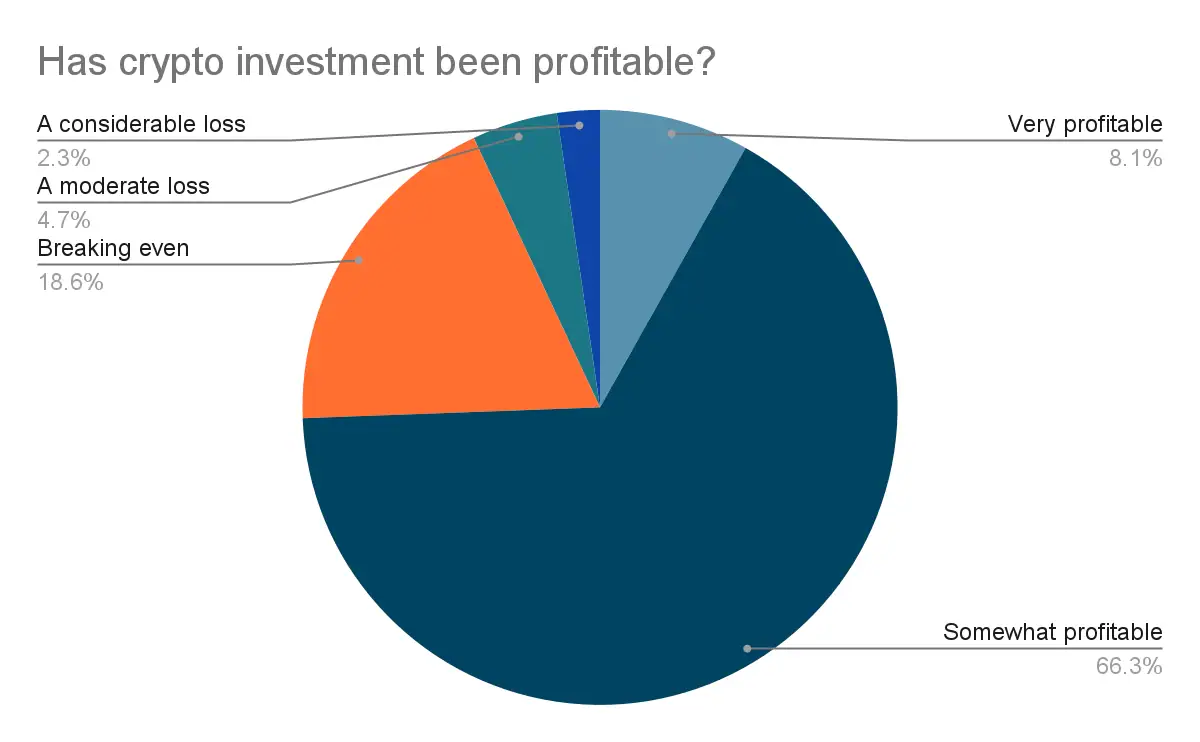

Profitability of Crypto Investments

- 66.3% of investors found crypto somewhat profitable, earning moderate but positive returns.

- 8.1% were very profitable, marking the top-performing investor group.

- 18.6% were breaking even, showing no major gains or losses.

- 4.7% reported moderate losses in their crypto holdings.

- 2.3% faced considerable losses, reflecting market volatility.

The History of KYC in Crypto and Liberty Reserve

- Liberty Reserve processed over $8 billion in digital transactions before its shutdown in 2013, with authorities citing the lack of KYC as central to its use for money laundering.

- In 2014, only about 26% of major crypto exchanges publicly listed KYC policies, most requiring just email and password verification.

- By 2016, less than 15% of global crypto platforms performed document-based identity checks on new users.

- FATF’s “travel rule” recommendations directly influenced over 60 countries to introduce crypto KYC regulations between 2019–2024.

- A survey in 2023 showed 84% of regulated VASPs used advanced biometric, device, and AI-based verification tools instead of legacy document uploads.

- The number of exchanges requiring full KYC for withdrawals rose from 42% in 2021 to more than 87% in 2025.

- A 2025 fintech report states, “KYC is now the bedrock of trust for all leading crypto firms,” reflecting its cultural shift from compliance to business necessity.

- Modern onboarding uses AI-driven identity checks for 80% of new crypto accounts in top 20 platforms, versus less than 10% in 2018.

- Regulators worldwide now classify VASPs as “financial institutions” for AML/KYC, resulting in $2.5 billion in crypto firm fines issued since 2020.

Impact of KYC on Crypto Transaction Volumes

- Total crypto transaction volume in 2024 exceeded $10.6 trillion, up approximately 56% from 2023.

- Illicit volume in 2024 was about $45 billion, down roughly 24% from 2023.

- Illicit activity therefore shrank to around 0.4% of total crypto volume in 2024, from ~0.9% in 2023.

- Platforms with strong KYC report a 25% reduction in scams across major exchanges in 2024.

- A survey found that 48% of users believe comprehensive KYC policies increase their confidence to invest.

- Onboarding abandonment due to KYC friction stands at 25%, potentially reducing volume growth for less‑compliant platforms.

- As KYC becomes stricter, fiat‑to‑crypto gateways increasingly require identity verification, reducing anonymity‑driven volume.

- In North America, with 90% of exchanges KYC‑compliant in 2025, the remaining 10% may attract higher risk flows or illicit volume.

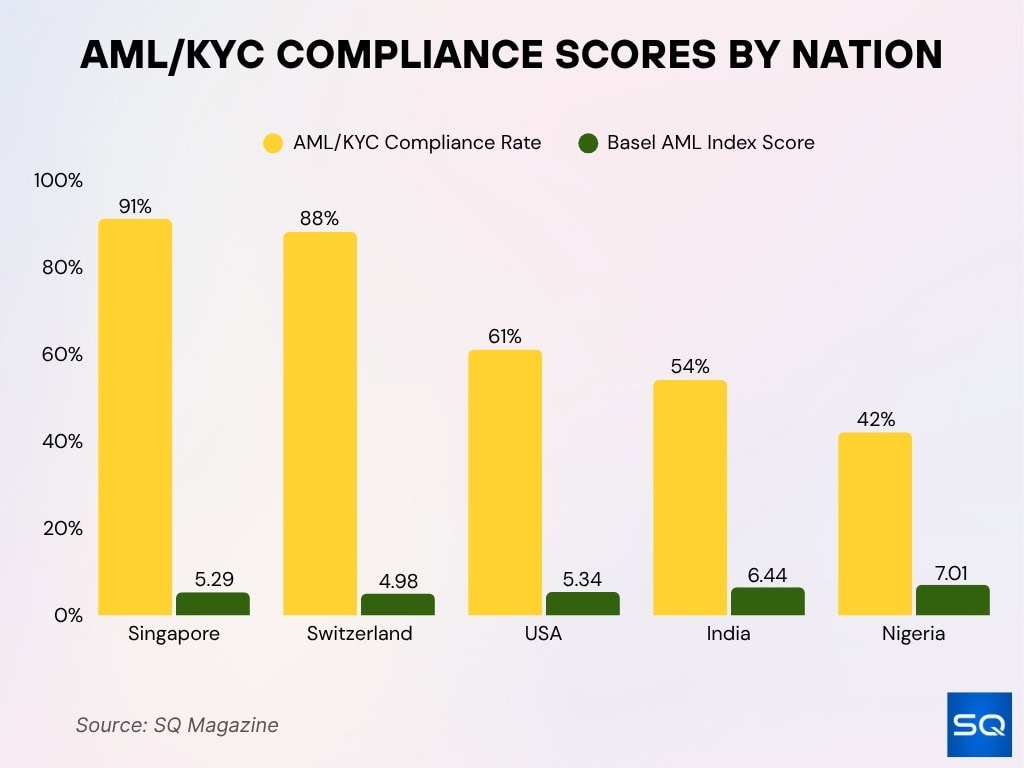

AML/KYC Compliance Scores by Nation

- Singapore leads with 91% compliance and a Basel AML Index score of 5.29, reflecting strong regulations.

- Switzerland follows at 88% compliance with a score of 4.98, showing high transparency standards.

- United States posts 61% compliance and a score of 5.34, indicating moderate enforcement among VASPs.

- India records 54% compliance with a score of 6.44, highlighting the need for stronger AML controls.

- Nigeria ranks lowest at 42% compliance and a score of 7.01, signaling major enforcement gaps.

KYC Compliance and User Privacy Concerns

- 57% of crypto users express concern about how exchanges handle personal data collected in KYC processes.

- 68% worry about potential data breaches involving sensitive information like passports or biometrics.

- 45% of users in a 2025 survey say that stringent KYC undermines the decentralised ethos of cryptocurrency platforms.

- Only 14% of KYC‑compliant exchanges currently offer data anonymisation features to reduce identity theft risks.

- 21% of crypto platforms have adopted privacy‑enhancing technologies (PETs) in their KYC workflows as of 2025.

- 80% of regulated exchanges now comply with major data‑protection laws (e.g., GDPR, CCPA).

- 31% of users say they prefer platforms offering zero‑knowledge proof (ZKP) or privacy‑preserving KYC alternatives.

- 23% of crypto users avoid platforms that mandate full KYC, opting for decentralised exchanges with minimal verification.

- 42% of exchanges cite securing user KYC data as a “major issue” in 2025.

Effects of KYC Compliance on Crypto Fraud and Scams

- Platforms with robust KYC and AML policies saw 44% fewer phishing attacks compared to non‑compliant peers.

- On KYC‑compliant platforms, 75% detected and prevented account takeover attempts more effectively.

- 50% of global crypto‑scam losses in 2024 occurred on platforms without KYC protocols.

- 68% of rug pulls in recent analyses were linked to decentralised exchanges that lacked KYC requirements.

- According to a 2024‑25 report, crypto fraud losses are down by around $3.2 billion compared to 2023, largely due to stronger KYC enforcement.

- 23% of new KYC‑compliant platforms introduced behavioural analytics tools to detect fraud before it escalated.

- 70% of crypto hacks in 2023 targeted exchanges with weak or no KYC frameworks.

- According to Chainalysis, stolen funds in 2024 reached about $2.2 billion, up ~21% YoY, underscoring the need for strong KYC among platforms.

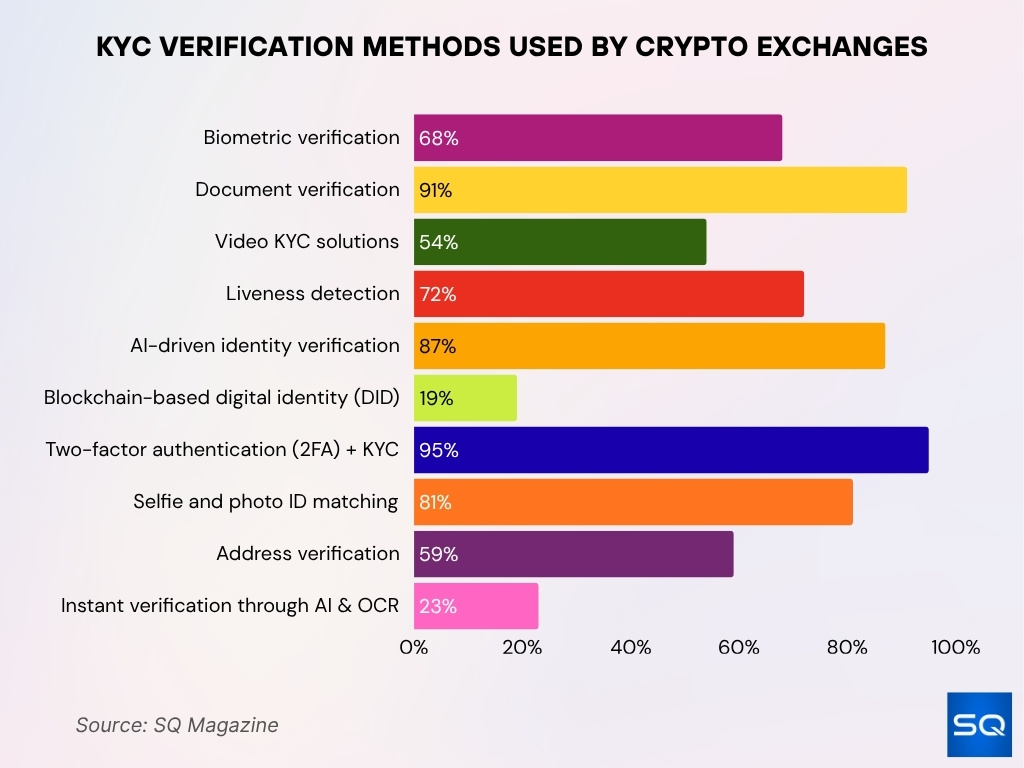

KYC Verification Methods Used by Crypto Exchanges

- 68% of exchanges in 2025 use biometric verification like facial and fingerprint scans.

- 91% of centralized exchanges adopt document verification for identity checks.

- 54% implement video KYC with live user verification processes.

- 72% use liveness detection to prevent spoofing and deepfake attacks.

- 87% rely on AI-driven verification to automate checks and speed up approval.

- 19% are testing blockchain-based digital identity (DID) programs.

- 95% of the top 100 platforms enforce 2FA integrated with KYC for stronger security.

- 81% use selfie and photo ID matching as the first onboarding step.

- 59% require address verification through utility bills or official documents.

- The average KYC time is 3.5 minutes, with 23% achieving instant AI-based verification.

Trends in Automated KYC Technologies for Crypto

- Over 90% of crypto platforms now use some form of AI or machine-learning-based identity verification.

- By 2025, more than 70% of onboarding processes are expected to be fully automated, reducing manual review times.

- Verification time improvements of ≈ 46% have been reported by platforms using automation vs manual checks.

- 16% of advanced KYC systems now implement zero‑knowledge proof (ZKP) technology to enhance privacy while verifying identity.

- 19% of platforms are piloting decentralised identity (DID) systems so users can control their own data.

- The global market for blockchain‑based KYC solutions is projected to grow at a compound annual growth rate (CAGR) of 24.6% from 2025 to 2030.

- RegTech providers are helping crypto firms reduce regulatory risk by 28% through real‑time monitoring and automation.

- Firms still cite “onboarding friction”, especially when switching to new automated systems, as a barrier in 73% of cases.

Costs of KYC Implementation for Crypto Businesses

- A 2025 report found average compliance costs for small‑to‑mid‑sized crypto firms have risen 28%, now around $620,000 annually.

- In 2024‑25, KYC/AML protocols consumed 34% of total compliance budgets for many crypto‑firms.

- In a study covering the U.S. & Canada, financial crime compliance costs reached $61 billion, with 79% of firms citing rising KYC‑software costs.

- Manual KYC reviews cost between $1,500 and $3,500 per client for many institutions.

- Companies report that labour and technology are the top cost drivers. 78% of small financial firms said labour costs rose; among large firms, 82% noted increased tech costs.

- Onboarding delays are costly; some corporate KYC reviews in banking took 31‑60 days for 40% of firms.

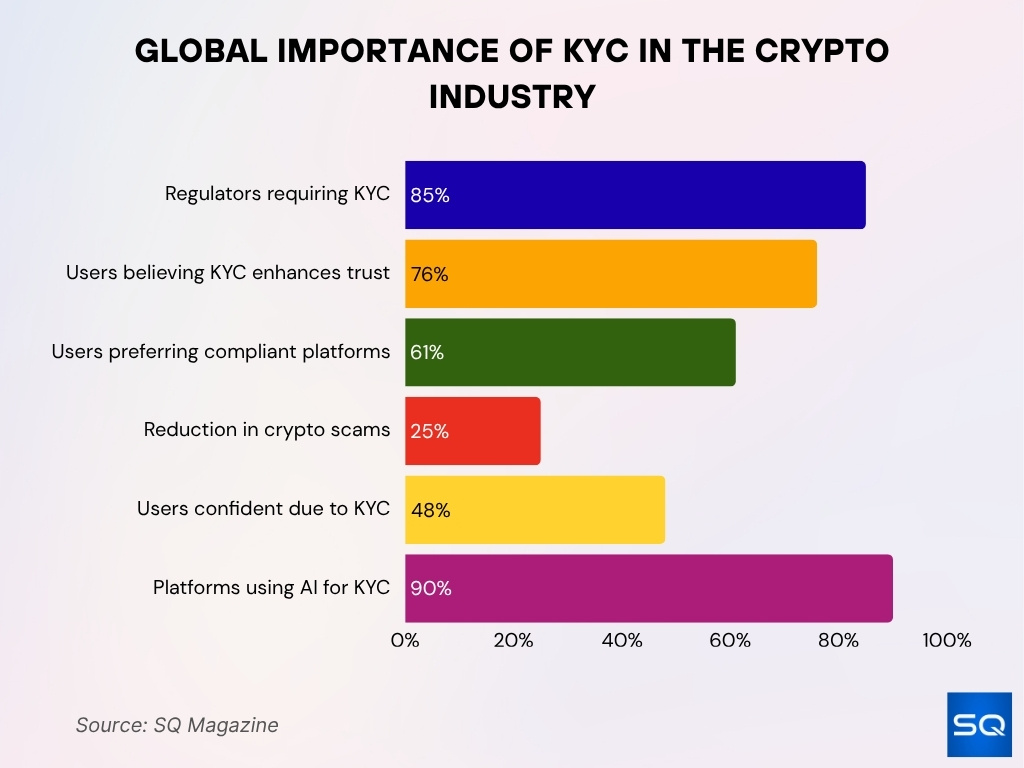

Importance of KYC in the Crypto Industry

- KYC ensures verified identities, reducing fraud, money laundering, and terror-financing risks.

- 85% of regulators in 2025 require KYC compliance for crypto exchanges.

- 76% of users say KYC boosts trust and security on crypto platforms.

- Platforms without KYC are 10x more likely to enable illicit transactions.

- 61% of users prefer robustly compliant platforms for peace of mind and fund safety.

- KYC cut crypto scams by 25% across major exchanges in 2024.

- 48% of users say comprehensive KYC improves their investment confidence.

- 90% of platforms use AI-powered verification to accelerate KYC checks.

- 120+ countries enforced KYC regulations for crypto firms as of Q1 2025.

Global KYC Regulatory Requirements

- As of 2025, 85% of materially important jurisdictions have FATF “Travel Rule” regulations enacted or in progress, covering 57 of 67 key markets.

- The EU’s MiCA regulation, effective December 30, 2024, made KYC and AML checks compulsory for all licensed crypto‑asset service providers.

- Singapore leads global AML/KYC compliance with a 91% adherence rate, followed by Switzerland at 88%, reflecting strict regulator enforcement by MAS and FINMA.

- The United States shows a 61% compliance rate among virtual‑asset service providers, paired with a Basel AML Index score of 5.34, ranking mid‑tier for KYC performance.

- Nearly 94% of reporting jurisdictions performed risk assessments for VASPs, while 80% enacted legislation mandating registration and AML/KYC compliance.

- South Korea’s FSC began real‑time KYC verification for crypto exchanges in Q2 2025, while Japan’s FSA now requires audits every 6 months.

- 417% surge in global financial institution penalties in H1 2025, totaling $1.23 billion, much from KYC and AML breaches in digital asset firms.

- MAS guidance in 2025 redefined KYC as a core operational control, extending compliance to DeFi and tokenized‑asset sectors.

- Over 80 countries now implement full‑scope crypto‑KYC laws, with the Asia‑Pacific region reporting the fastest regulatory growth.

- Blockchain‑based KYC solutions are projected to grow at a 24.6% CAGR (2025–2030) as global compliance digitalizes.

Core Elements of Crypto KYC Requirements

- 92% of centralized crypto exchanges globally are fully KYC compliant in 2025, making identity verification via photo ID and biometrics nearly universal.

- Ongoing customer due diligence (CDD) checks are standard, with 85% of exchanges conducting regular risk profile updates for existing users.

- 71% of crypto platforms adopt a risk-based approach, adjusting KYC intensity by transaction size, user geography, and activity type.

- Over 1,245 crypto wallets have been sanctioned and flagged for compliance monitoring globally in 2025, up 32% year-over-year.

- 90% of crypto platforms now deploy continuous wallet and transaction monitoring powered by AI to detect suspicious behavior.

- 80% of regulated exchanges offer GDPR- or CCPA-compliant data storage, ensuring privacy and encryption for sensitive KYC artefacts.

- 76% of users believe explicit privacy disclosures and informed consent for data handling are vital KYC elements on crypto platforms.

- Audit and SAR reporting is robust, with 86% of enforcement actions from 2019-2024 triggered by KYC non-compliance.

- In 2025, 62% of regulated exchanges enforce strict cross-border KYC data controls to comply with local and international regulations.

- The introduction of instant, AI-driven KYC reduces onboarding time to 3.5 minutes on major platforms, streamlining compliance.

Compliance Challenges for Crypto Businesses

- 79% of global crypto firms cite regulatory complexity as a top‑three challenge in 2025.

- Only 40 of 138 jurisdictions were “largely compliant” with Financial Action Task Force crypto standards as of April 2025.

- 46% of platforms report high costs due to duplicate KYC systems across jurisdictions.

- 73% of firms said onboarding friction when implementing new automated KYC systems remains a barrier.

- Manual reviews still dominate some segments, one study found onboarding delays of 31–60 days in 40% of small finance/crypto firms.

- Labour and technology cost increases, 78% of small firms say labour is the top cost driver, 82% of large firms say technology is.

- Data‑sharing and cross‑border identity verification remain problematic; 21% of platforms currently deploy PETs (privacy‑enhancing technologies) in KYC workflows.

- Firms operating globally must align with multiple frameworks (e.g., EU AMLR, MiCA, U.S. FinCEN CIP); regulatory divergence remains a challenge.

Best Practices for Staying Compliant

- Platforms using automated onboarding report verifications are 46% faster than manual checks, with an average KYC completion time of 3.5 minutes in 2025.

- 68% of exchanges now use biometric, liveness, and ID-document checks, dramatically reducing fraud compared to simple data-match systems.

- Data encryption for KYC artefacts is standard, serving as a regulatory requirement at 92% of centralized exchanges globally.

- 87% of exchanges automate audit trails for onboarding, supporting compliance with sanctions, PEP, and Travel Rule obligations.

- Adopting global compliance frameworks, including cross-border screening, is now practiced at 62% of regulated platforms.

- 80% of major exchanges disclose privacy policies and GDPR/CCPA compliance up front to users during onboarding.

- Real-time transaction and wallet monitoring post-KYC is implemented by 90% of centralized platforms to detect suspicious behavior.

- 73% of crypto platforms conduct regular staff training and compliance control rotation to limit insider and human-error risk.

- AI-driven KYC systems now flag 38% more high-risk users automatically for enhanced checks, freeing manual teams for EDD cases.

- Behavioral analytics are used by 23% of new regulated exchanges to further improve KYC and fraud detection coverage.

KYC Market Growth and Statistics

- The broader KYC market (all industries) is projected at $6.73 billion in 2025, growing at a CAGR of ~16.4% toward $14.39 billion by 2030.

- The global e‑KYC market was valued at $805.8 million in 2024 and is forecast to reach $3.56 billion by 2033 (CAGR ≈ 17.7%).

- According to one crypto‑specific review, the global crypto market KYC compliance rate stands at 79% in 2025.

- In 2025, 92% of centralized crypto exchanges globally are reported to be fully KYC compliant.

- Spending on AML/KYC tech is expected to hit $2.9 billion in 2025, up ~12.3% from the previous year.

- Among crypto platforms, 67% of institutional investors say robust KYC protocols drive their choice of platform.

- Platforms lacking KYC procedures are reportedly 10 times more likely to be used for illicit activities.

Blockchain Technology in KYC

- The global blockchain technology market is estimated at $41.15 billion in 2025, growing at a projected 52.9% CAGR through 2034.

- Blockchain-based KYC solutions are forecast to reach $39.7 billion in global market size by 2025.

- 19% of crypto exchanges in 2025 are piloting blockchain-based digital identity (DID) verification programs.

- Over 45% of total KYC revenue in 2024 was driven by biometric verification technologies increasingly deployed via blockchain identity modules.

- Two-thirds of top blockchain KYC adopters cite onboarding cost reductions of 20–30% versus traditional KYC solutions.

- Self-sovereign, blockchain-backed digital identity supports user-controlled credentials and selective information sharing, with project launches in over 27 countries as of 2025.

- 68% of crypto exchanges in 2025 will integrate biometric verification with blockchain modules for KYC, dramatically reducing manual intervention.

- Blockchain KYC adoption results in a reported 81% decrease in duplicate verification requests across partner exchanges.

- Decentralized KYC solutions help mitigate the 23% increase in reported data breaches that impacted centralized identity stores from 2022 to 2024.

Frequently Asked Questions (FAQs)

92%.

58%.

More than 70%.

$1.25 billion, a 35% increase from the previous year.

Conclusion

The world of cryptocurrency is rapidly maturing, and KYC compliance has moved from optional to essential. We’ve seen how KYC impacts fraud reduction, transaction volumes, and user trust. The cost and complexity for crypto businesses are real, yet so is the growth in compliance markets and blockchain‑enabled identity technology. As platforms, regulators, and users converge on higher standards, the winners will be those that implement smart, tech‑driven KYC frameworks. The full article outlines the full landscape, from historical origins to global regulation, user‑privacy trade‑offs, and the future of identity in crypto.