Insurance fraud continues to drain money from the U.S. economy and push up costs for consumers, businesses, and government programs. Today, fraud losses are estimated at more than $308.6 billion annually, affecting policyholders through higher premiums and slower claims processing. These losses touch every type of coverage, auto, health, property, life, and workers’ compensation, and show how fraud undermines trust in the insurance system.

Auto accident staging and health care billing scams are among the schemes that illustrate the impact on both insurers and individuals. Read on for detailed, up‑to‑date statistics and trends shaping the insurance fraud landscape.

Editor’s Choice

- $308.6 billion: Estimated annual cost of insurance fraud in the U.S. across all lines in 2025.

- Average policyholders pay about $900 more per year in premiums due to fraud losses.

- 10% of property and casualty claims are estimated to be fraudulent, driving major losses.

- Over 324 defendants were charged in the 2025 National Health Care Fraud Takedown.

- Workers’ compensation fraud losses range between $34 billion and $44 billion.

Recent Developments

- Insurance fraud costs the U.S. economy around $1 trillion annually.

- Total U.S. insurance fraud reaches $308.6 billion per year, raising premiums by $900 for consumers.

- AI-driven fraud detection tools reduce fraudulent claims by up to 60%.

- Automated claims systems cut fraudulent claims by 22%.

- Cyber insurance claims rose nearly 50% globally due to ransomware and breaches.

- Identity theft surged to record levels, enabling fake policies and claims.

- Insurers using AI tools achieve 20-40% fraud reductions.

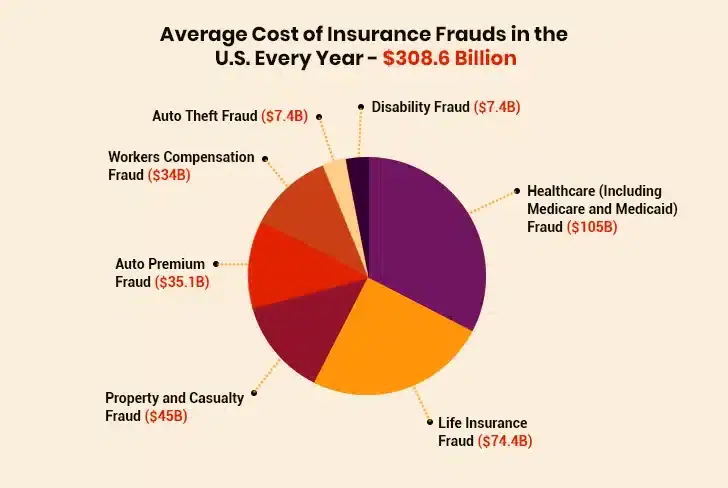

Average Cost of Insurance Frauds in the U.S.

- Healthcare fraud, including Medicare and Medicaid, is the largest category, costing about $105 billion annually.

- Life insurance fraud follows, with losses of around $74.4 billion per year.

- Property and casualty fraud contributes approximately $45 billion annually.

- Auto premium fraud accounts for roughly $35.1 billion each year.

- Workers’ compensation fraud adds about $34 billion annually.

- Auto theft fraud results in losses of nearly $7.4 billion per year.

- Disability fraud also costs close to $7.4 billion annually.

- Total insurance fraud losses drain an estimated $308.6 billion every year from the U.S. economy.

Auto Insurance Fraud Statistics

- Auto fraud surged 19% worldwide, driven by staged accidents.

- 10% of property and casualty claims, including auto, are fraudulent.

- Staged vehicle accidents exceeded 15,000 globally, causing $2.6 billion in losses.

- U.S. auto insurance premiums rose 13.6% partly due to fraud.

- Florida leads in staged-crash incidents from the no-fault PIP structure.

- 15 states and DC enacted laws targeting organized auto fraud networks.

- Fraudulent auto claims inflate consumer premiums by $900 yearly.

Health Insurance Fraud Statistics

- Health care fraud schemes cost insurers and taxpayers tens of billions yearly.

- In 2025, the National Health Care Fraud Takedown charged 324 individuals, including medical professionals.

- Major operations like Operation Gold Rush uncovered over $10.6 billion in false Medicare claims.

- CMS prevented over $4 billion in fraudulent Medicare and Medicaid payments.

- False billing and unnecessary medical supply claims remain the leading scam types.

- Health fraud comprises a significant share of federal investigations and settlements.

- Healthcare fraud may represent 3%–10% of total healthcare expenditures.

- Every $1 spent on fraud prevention can yield multiple dollars in recoveries.

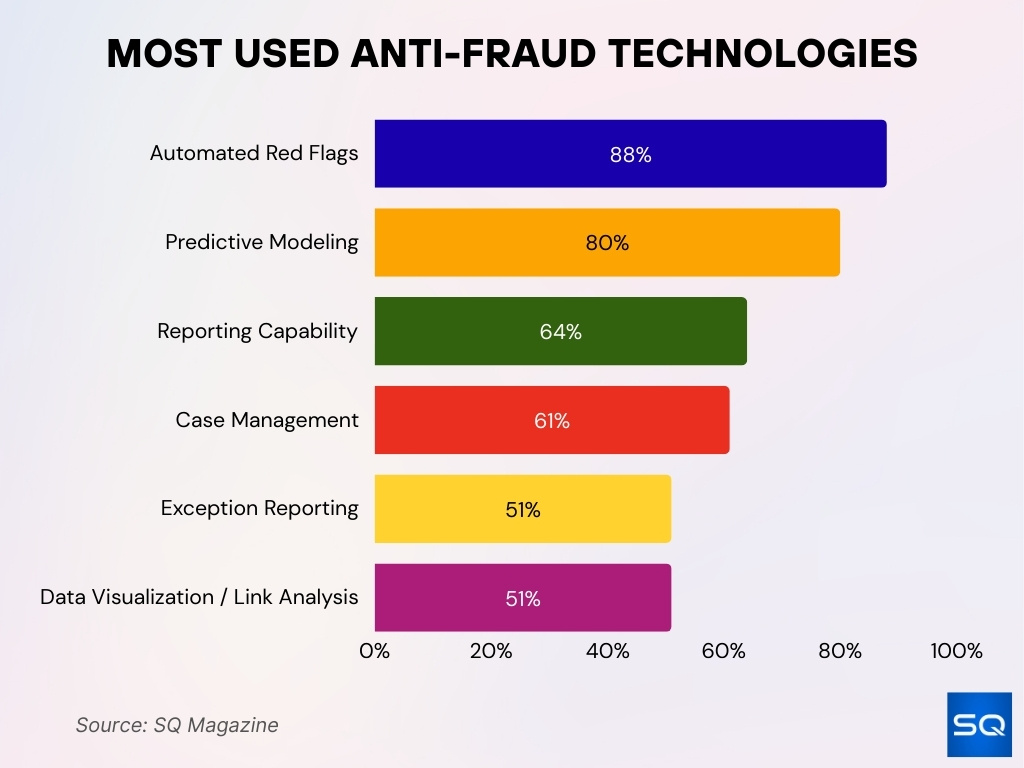

Most Used Anti-Fraud Technologies

- Automated red flags lead adoption, used by 88% of insurers to quickly identify suspicious activity.

- Predictive modeling is widely implemented, with 80% of insurers using it to forecast and detect fraud risks.

- Reporting capabilities support fraud detection for 64% of organizations, improving transparency and tracking.

- Case management systems are applied by 61% of insurers to streamline fraud investigations.

- Exception reporting is leveraged by 51% of insurers to flag irregular or abnormal claims.

- Data visualization and link analysis are also used by 51% of insurers to uncover deeper fraud patterns.

Property and Casualty Fraud

- P&C fraud losses include inflated dwelling damage claims, staged property incidents, and organized arson schemes.

- Soft fraud, such as exaggerated claims after minor events, remains a leading contributor to P&C abuse.

- P&C insurers report increased fraud detection costs as they invest in analytic tools to identify anomalous claims patterns.

- States with higher property and auto claim rates often report elevated levels of fraud activity.

- P&C fraud contributes to slower claims processing times, affecting consumer satisfaction.

Life Insurance Fraud

- Synthetic identity fraud accounts for $30 billion in life insurance losses, up to 85% of identity-related cases.

- Children’s SSNs are 51 times more likely to be used in synthetic identity theft for life policies.

- Identity-theft-linked insurance fraud, including life, is projected to rise 49% by year-end.

- Fraud rings use complicit agents and false identities for multiple policies worth millions.

- 85% of synthetic fraud cases evade initial underwriting but activate at the claims stage.

- Deepfakes and AI-driven impersonation fuel 82% of emerging life insurance fraud attempts.

- Independent verifications detect 20-40% more suspicious life policy applications.

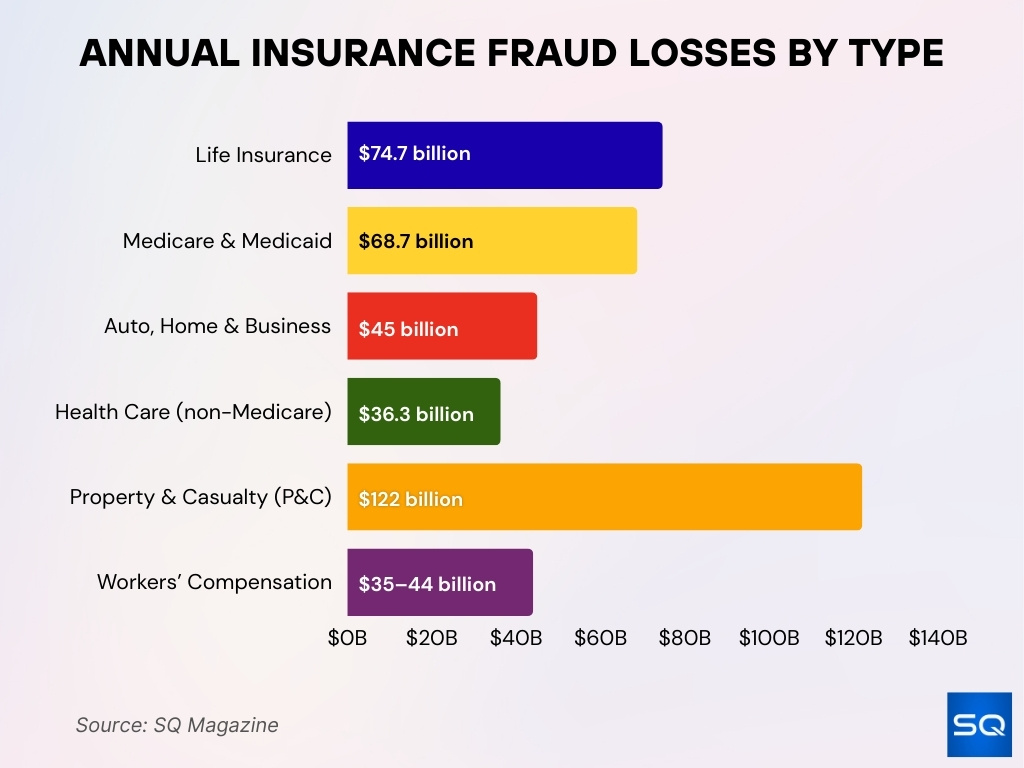

Insurance Fraud by Type

- Life insurance fraud leads all categories, generating about $74.7 billion in annual losses.

- Medicare and Medicaid fraud costs roughly $68.7 billion each year.

- Auto, home, and business insurance fraud combined result in around $45 billion annually.

- Health care fraud, excluding Medicare, accounts for approximately $36.3 billion per year.

- Property and casualty fraud represents about 10% of industry losses, totaling nearly $122 billion annually.

- Workers’ compensation fraud causes losses estimated between $35 billion and $44 billion per year.

Workers’ Compensation Fraud

- Of these losses, about $9 billion stems from premium fraud and $25 billion from false claims.

- Soft fraud, such as exaggerating injury severity, drives a large share of total claim abuse.

- Organized rings that stage workplace injury events contribute to inflated claims volumes.

- Small business employers often see disproportionate claim severity due to insufficient fraud controls.

- Enhanced analytics are helping carriers flag inconsistent medical reporting in injury claims.

- Some states report that aggressive benefit expansion during economic downturns correlates with upticks in fraud.

- Workers’ comp fraud increases administrative costs, ultimately raising premiums for employers.

Demographic Trends in Insurance Fraud

- Consumers in their 20s and 30s are 25% more likely to report losing money to fraud than those 40+.

- Two out of five respondents aged 25-34 consider committing insurance fraud to save money.

- Millennials are 77% more likely than other groups to lose money to email scams.

- Adults aged 25-34 are most likely to lie on application forms (8%) and claims (7%).

- Younger adults under 34 show a higher propensity for misleading insurers on claims.

- Londoners admit the highest rates of lying on applications (7%) and claims (6%).

- 32% of alleged fraud victims never report suspicions, underreporting demographics.

- Older Americans exploited by fraud suffer average losses of $34,200 per victim.

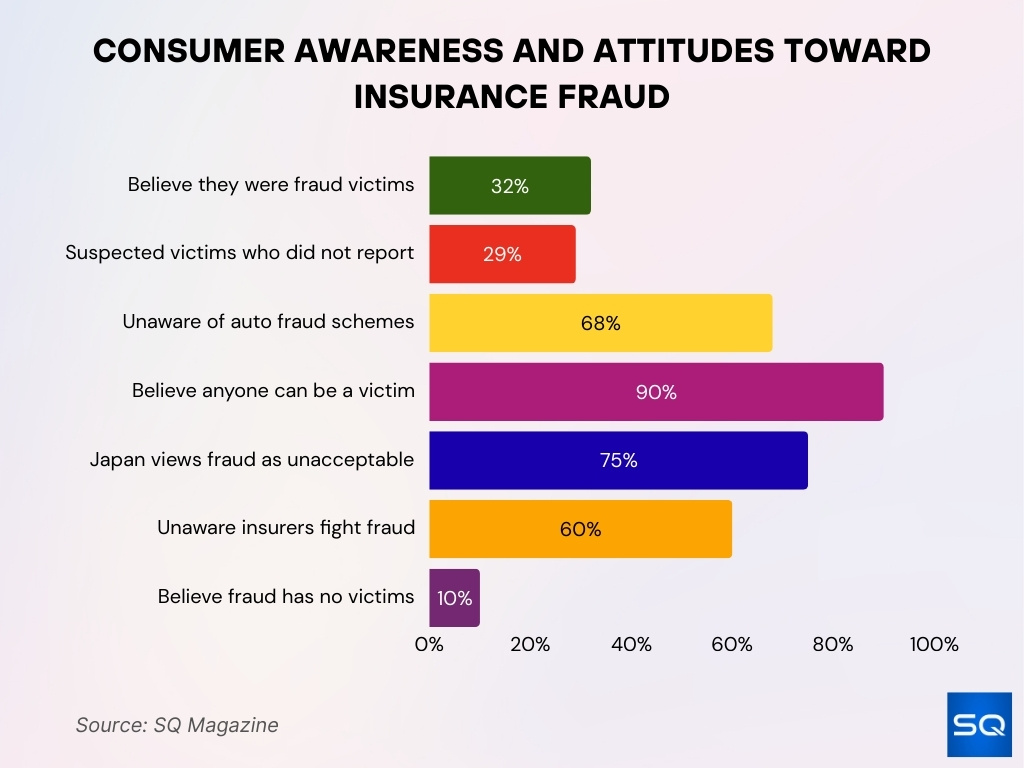

Consumer Awareness and Reporting

- Insurance fraud adds $900 to average policyholder annual premiums.

- 32% of people believe they’ve been victims of insurance fraud.

- 29% of suspected fraud victims never report incidents.

- 68% of consumers are unaware of common auto fraud schemes.

- 90% of Americans accept that anyone can fall victim to fraud.

- 75% in Japan view fraudulent claims as unacceptable.

- Nearly 60% unaware insurers actively combat fraud.

- Over 10% believe fraudulent claims have no victims.

- NICB receives over 300 tips monthly via hotline.

Geographic Trends in Insurance Fraud

- Florida leads U.S. states in staged auto crash fraud due to no-fault PIP laws.

- Nevada ranks highest for auto-related fraud at 346 cases per million residents.

- New York staged crashes and inflated claims comprise 75% of all insurance fraud cases.

- Ohio tops states for healthcare, Medicare, and Medicaid scams.

- Connecticut reports the highest per-capita claims fraud rate nationwide.

- Arizona handles 10% of U.S. auto glass claims despite a smaller population.

- Urban areas like Birmingham dominate crash-for-cash insurance scams.

- Memphis led cities with 56 reported COVID-19-related scams.

- Identity theft-linked insurance fraud projected to rise 49% nationally.

Law Enforcement and Legal Actions

- Enforcement actions seized over $245 million in cash, vehicles, and cryptocurrency assets.

- CMS prevented $4 billion in fraudulent Medicare and Medicaid payments pre-takedown.

- Federal False Claims Act settlements recovered $1.257 billion from January to May.

- Fewer than 2% of identified insurance fraud incidents result in prosecution.

- Operation Gold Rush exposed $10.6 billion Medicare scam with unnecessary equipment billing.

- California charged 5 defendants in $1.4 million life insurance commission fraud scheme.

- NYC’s Operation Bright Eyes targets $1 billion staged accident fraud network with taxi cameras.

- Inland Empire task force charged 16 individuals with $217,000 in vehicle-hostage scams.

Economic Impact of Insurance Fraud

- Insurance fraud costs the U.S. economy $308.6 billion annually, raising premiums $900 per family.

- Total fraud losses reach $1 trillion, stressing growth and trust.

- Medicare and Medicaid fraud losses hit $68.7 billion annually.

- Healthcare fraud consumes 3-10% of total expenditures.

- Fraud detection market projected at $6.46 billion.

- Every $1 in fraud prevention yields $3.35 in recoveries.

- Fraud inflates family premiums $400-$900 yearly.

Impact on Policyholders

- Fraud adds $900 annually to average U.S. policyholder premiums.

- 20% of insurance claims are fraudulent, inflating costs for honest customers.

- High-fraud states see premiums 13.6% above national averages.

- Fraud investigations delay legitimate claims by 25-30% on average.

- Honest claimants face 16% higher denial rates from heightened scrutiny.

- Small businesses pay $5,000-$10,000 extra yearly in commercial premiums.

- 68% of policyholders report longer processing times due to fraud checks.

- High-fraud areas like Florida impose $1,200 average premium hikes.

- Consumer trust drops 22% after exposure to fraud-related claim disputes.

Frequently Asked Questions (FAQs)

Americans lose about $308.6 billion each year due to insurance fraud.

About 10% of property and casualty insurance claims are estimated to be fraudulent.

Identity theft‑linked insurance fraud is projected to rise by 49% by the end of 2025.

Insurance fraud adds roughly $900 per year in premium costs per policyholder.

Conclusion

Insurance fraud today remains a major burden on the U.S. insurance ecosystem, draining hundreds of billions of dollars in economic value and disrupting the claims process for legitimate policyholders. While enforcement efforts are expanding, the gap between fraud identification and prosecution underscores the need for stronger legal tools and public awareness.

Consumers are learning to spot and report scams, but ongoing education and robust industry collaboration will be essential to slow the growing tide of fraud. As fraud detection technologies and legislative frameworks evolve, policyholders and insurers alike must stay informed and engaged to protect themselves and the broader insurance marketplace.