In recent years, institutional investors have shifted from crypto curiosity to concrete risk frameworks. As digital assets mature, risk management is no longer optional but essential. For example, hedge funds now require on‑chain monitoring systems, and pension funds are mandating counterparty risk limits before allocating capital to crypto. Below, you’ll see how institutions are quantifying and governing crypto risk, and why this matters.

Editor’s Choice

- Nearly 64% of advisors incorporate crypto into portfolios with dedicated risk management layers; adoption is projected to surpass 70% among institutions by 2025.

- 84% of institutions cite regulatory compliance as their top priority in crypto risk management for 2025.

- Institutions are projected to spend $16 billion annually on crypto custodial solutions in 2025.

- 60% of institutions are integrating AI‑driven risk assessment tools into their crypto investment strategies by early 2025.

- 48% have adopted DeFi risk management protocols, up from 21% in 2023.

- 9 out of 10 institutional crypto investors identify counterparty risk as their most significant concern in 2025.

- $6.7 billion worth of insurance policies have been issued to cover institutional crypto assets, a 52% year‑on‑year increase.

Recent Developments

- Year‑to‑date inflows into digital asset funds reached $27 billion, setting a record and pushing total institutional AUM in crypto above $220 billion.

- The 2025 Institutional Investor Digital Assets Survey found that 59% of respondents plan to allocate more than 5% of their AUM to crypto.

- 83% of institutional investors plan to increase allocations to digital assets in 2025.

- In Q1 2025, stablecoin AUM soared to over $218 billion, a 13% increase quarter-over-quarter.

- Tokenized real-world assets increased 37% quarter-over-quarter in Q1 2025.

- The U.S. Office of the Comptroller of the Currency (OCC) cleared national banks to engage in certain crypto activities (custody, stablecoin operations) without prior regulatory permission, conditional on strong risk controls.

- EU watchdogs proposed that insurers holding crypto should face 100% capital requirements, signaling regulatory tightening in Europe.

Risk Managers’ Confidence in Evaluating Emerging Technologies

- 43% of risk managers report full confidence in assessing cloud technology risks.

- 18% feel capable of evaluating Big Data, reflecting moderate confidence levels.

- Only 11% demonstrate strong risk assessment capabilities for Artificial Intelligence (AI).

- Confidence in Robotic Process Automation (RPA) and Machine Learning stands at just 9% each.

- Internet of Things (IoT) ranks even lower, with only 6% expressing readiness to assess its risks.

- Both Blockchain and Quantum Computing scored the lowest, with 5% confidence levels each.

- The data highlights significant capability gaps in risk frameworks for emerging tech, signaling a need for targeted upskilling and stronger assessment models.

Global Adoption of Institutional Crypto Risk Management Frameworks

- In 2025, 78% of global institutional investors report having a formal crypto risk management framework, up significantly from 54% in 2023.

- In North America, 83% of institutional funds now maintain dedicated crypto risk teams, up from ~65% in 2024.

- In Europe, 56% of institutions use ISO/IEC 27001‑certified frameworks for crypto asset management.

- In Asia-Pacific, 72% adoption is reported, fueled by regulatory pushes from Japan’s FSA and Singapore’s MAS.

- Among institutions managing over $10 billion in AUM, 92% have in-house crypto risk assessment departments.

- Institutions in the Middle East report a 46% year-over-year growth in formal crypto risk frameworks, especially among sovereign wealth funds.

- 68% of institutions cite cybersecurity risk as their primary motivator for adopting structured risk frameworks.

- 44% have conducted at least two independent crypto risk audits in the past 12 months.

- 35% integrate blockchain analytics platforms into their risk strategies for on-chain transparency.

- 65% of global insurance underwriters require evidence of a crypto risk management framework before offering coverage.

Key Drivers Behind Institutional Crypto Mitigation Strategies

- Regulatory compliance is cited by 84% of institutions as their top risk priority in 2025.

- Counterparty risk emerges as the top concern among 90%+ of institutions.

- Cybersecurity threats, including smart contract hacks and phishing, drive many to adopt advanced controls.

- Liquidity constraints in volatile market conditions push institutions to stress-test for extreme scenarios.

- Insurance requirements increasingly demand rigorous proofs of risk infrastructure before underwriting crypto assets.

- Reputational risk, institutional failures (e.g., hacks, custodial losses) are amplified by media exposure.

- Tech risk, rapid protocol upgrades, or consensus failures require proactive risk modeling.

- Operational risk, custody operational mistakes, key mismanagement, or system failures can trigger loss.

- Macro events, crypto is highly correlated to broader markets, stress events (e.g., rate shocks) can cascade losses.

- Demand for transparency, institutional LPs demand audit trails, on-chain proofs, and robust reporting in crypto.

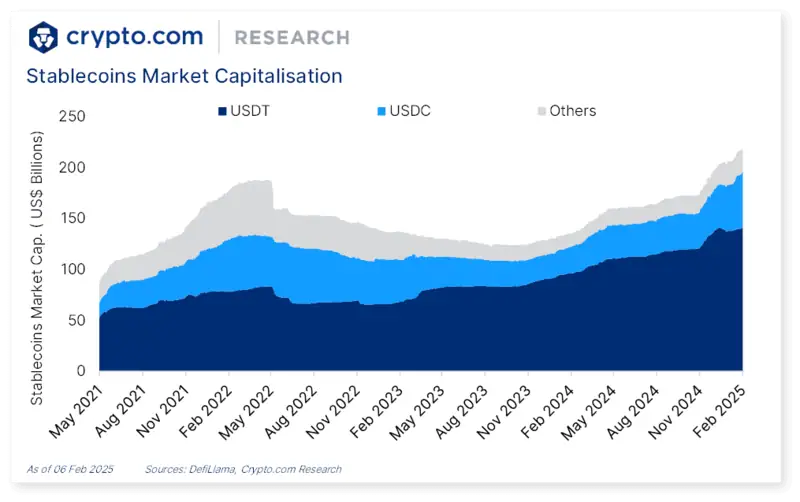

Stablecoin Market Cap Growth and Trends

- The stablecoin market cap surged from $65 billion in May 2021 to nearly $200 billion by February 2025.

- USDT (Tether) led the market, rising from $50 billion in 2021 to around $90 billion by early 2025.

- USDC (USD Coin) grew sharply from $10 billion in 2021 to approximately $60 billion in early 2025, signaling increased trust.

- Other stablecoins expanded from $5 billion in 2021 to almost $50 billion by 2025, reflecting greater market diversification.

- Despite a downturn in late 2022 and early 2023, the market rebounded to record highs by late 2024, showcasing resilience and renewed investor confidence.

Institutional Exposure to Crypto‑Related Risks

- 59% of institutions expect to allocate more than 5% of their AUM to crypto, increasing exposure.

- Many institutions now treat crypto as part of core portfolios, not just speculative allocations, increasing tail risk.

- Inflows to digital asset funds reached $27 billion in 2025, putting more institutional capital at risk.

- Custodial assets under management are rising, exposing institutions to custody failure, insider risk, and governance issues.

- The surge in stablecoin holdings (AUM > $218 billion in Q1 2025) increases exposure to reserve risk and redemption pressure.

- Insurance coverage remains limited, $6.7 billion in crypto insurance backing is still small compared to total institutional exposure.

- Cross‑asset contagion risk increases when institutions hold crypto alongside traditional assets.

- Institutions are now prime targets for cyberattacks, given their size, making them high-value targets.

- Regulation slip-ups, noncompliance can lead to fines, forced unwinds, or reputation damage.

- Liquidity crunches in crypto markets can magnify losses during stress periods.

Common Risk Drivers Across Crypto Assets

- Volatility, many top crypto assets see intraday swings exceeding 5–10%, amplifying portfolio risk.

- Smart contract risk, DeFi exploits cost institutions over $1.2 billion in 2024 alone.

- Governance risk, protocol changes (forks, upgrades) can create losses if institutions mis‑time positions.

- Interoperability risk, bridges, and cross-chain layers are common failure points; historical losses exceed $2 billion.

- Oracle/price feed risk, manipulated oracles have triggered large margin calls in institutional DeFi trades.

- Concentration risk, heavy exposure to a few large tokens, raises idiosyncratic tail risk.

- Liquidity drying, 42% of institutions reported excessive slippage in exit trades.

- Correlation with the crypto market, institutional portfolios with crypto are more exposed to systemic crypto drawdowns.

- Regime risk, policy shifts, or legal rulings can retroactively change the risk calculus of assets.

- Valuation ambiguity, many assets lack stable pricing or audited fundamentals, complicating risk estimation.

Enterprise Risk Management Market Outlook

- The global ERM market is projected to grow from $5 billion in 2024 to about $7.28 billion by 2029.

- The market is set to expand at a CAGR of 8.9%, reflecting steady and robust growth.

- Rising adoption is driven by increased business complexity and tighter regulatory environments.

- The largest annual jump is expected between 2025 ($5.17 billion) and 2026 ($5.8 billion), signaling a surge in enterprise adoption.

- Sustained growth through 2029 underscores the strategic importance of ERM in global business planning.

Data Breaches and Cybersecurity Threats Impacting Institutional Crypto Portfolios

- From 2025 to date, crypto‑related cyber thefts amount to $1.93 billion.

- Institutions in 2025 have already recorded $2.9 billion in losses attributable to breaches of crypto portfolios.

- 43% of institutional investors report at least one cyberattack attempt in the past year.

- Phishing is the top vector, responsible for 32% of successful breaches.

- 72% of firms now use multi‑factor authentication and hardware security modules (HSMs) to protect access.

- 58% of institutions partner with specialized blockchain cybersecurity firms.

- 45% conduct regular penetration testing and red‑teaming of their custody or exchange systems.

- Smart contract exploits cost $1.2 billion in institutional losses in 2024.

- 29% of security incidents trace to insider threats.

- Zero-trust architectures are now used by 39% of institutional custodians.

Counterparty and Liquidity Risks in Institutional Crypto Trading

- 79% of institutional traders flag counterparty risk as their top concern.

- 48% of institutions report settlement delays tied to counterparty credit issues in 2025.

- In 2024, $3.4 billion in losses were linked to counterparty defaults in crypto lending markets.

- Liquidity risk: 42% of institutions reported significant slippage when exiting thinly traded tokens.

- Many institutions stress test for extreme liquidity dry-up scenarios.

- Institutions now demand pre‑funded collateral with counterparties to reduce credit risk.

- Cross‑margining across crypto and traditional assets introduces contagion risk in stressed markets.

- Use of algorithmic market makers in illiquid pools sometimes compounds adverse moves.

- Some institutions face rehypothecation risk in overleveraged counterparties.

- Clearinghouse risk, reliance on centralized clearing could introduce a systemic node of failure.

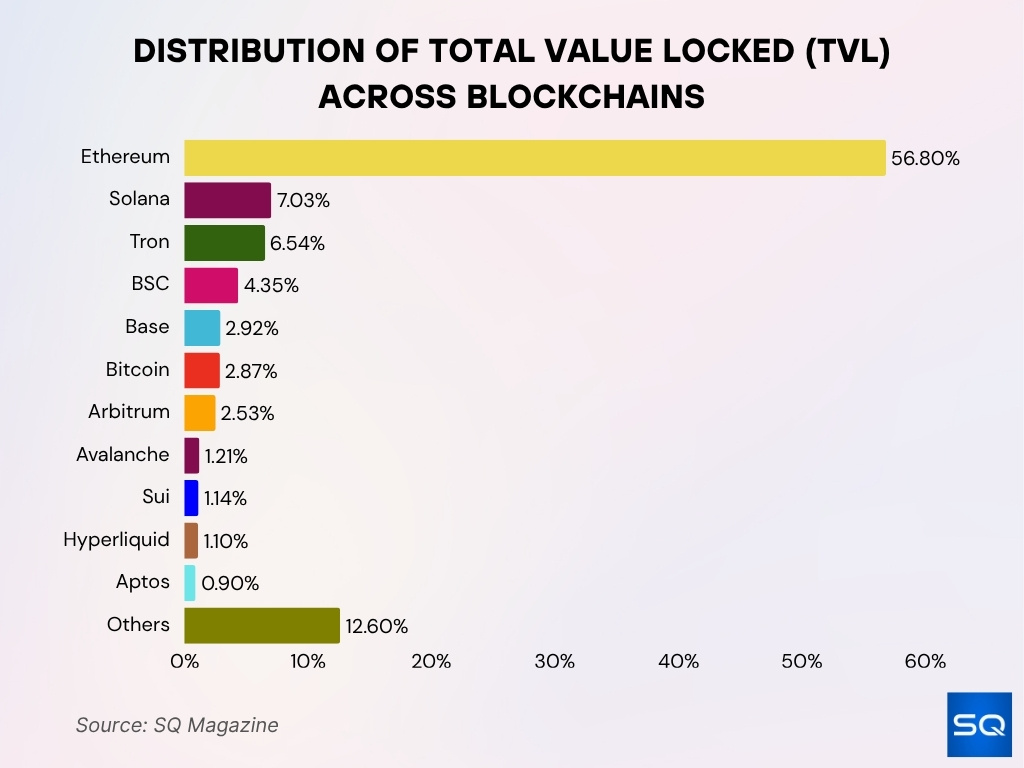

TVL Breakdown by Blockchain

- Ethereum leads with 56.8% of total value locked (TVL), maintaining its dominance in the DeFi ecosystem.

- Solana (7.03%) and Tron (6.54%) hold strong as leading alternatives in decentralized finance.

- Binance Smart Chain (BSC) captures 4.35%, reflecting ongoing adoption and investor confidence.

- Base (2.92%), Bitcoin (2.87%), and Arbitrum (2.53%) show growing traction in TVL distribution.

- Smaller but rising chains like Avalanche (1.21%), Sui (1.14%), Hyperliquid (1.1%), and Aptos (0.9%) reveal niche but expanding communities.

- Other blockchains collectively make up 12.6% of TVL, illustrating a diverse and fragmented DeFi landscape.

Impact of Stablecoins and DeFi Protocols on Institutional Risk Management

- 74% of institutions say they plan to engage with DeFi within the next two years.

- 48% have already adopted DeFi risk protocols.

- DeFi exploits such as reentrancy and flash loans caused $1.2 billion in institutional losses in 2024.

- Stablecoin deposits and holdings cross $218 billion in Q1 2025.

- The GENIUS Act in 2025 forces stricter reserve audits and dual oversight for stablecoin issuers.

- Institutions increasingly demand proof-of-reserves audits for stablecoin backing.

- DeFi lending protocols now include liquidation triggers and over-collateralization thresholds.

- Tokenized real‑world assets in DeFi rose 37% quarter-over-quarter in early 2025.

- Some institutions limit exposure to unverified algorithmic stablecoins and prefer fiat‑backed ones.

- DeFi composability risk: a failure in one module can cascade across layered strategies.

Insurance and Hedging Solutions Adoption in Institutional Crypto Portfolios

- The crypto insurance market grew to $4.2 billion in 2025 amid rising demand.

- Institutions insured $6.7 billion of crypto assets, a 52% YoY increase.

- 65% of underwriters require proof of a formal crypto risk framework before issuing policies.

- Hedging via futures and options is now standard; more than 50% of institutions use derivatives to limit tail exposure.

- Use of variance swaps on crypto volatility has grown 25% year-over-year.

- Some institutions adopt delta-neutral hedging strategies combining long crypto and short derivatives.

- Structured credit products tied to digital asset pools are in development, offering downside buffers.

- Reinsurance, major insurers are now pooling risk across diverse crypto exposures to manage tail events.

- Parametric insurance is emerging, triggering when adverse crypto indices cross predetermined thresholds.

- Catastrophic loss caps are common; many policies cap payouts to 30–50% of asset value.

Regulatory Compliance and Risk Management in Institutional Crypto Investments

- 84% of institutions place regulatory compliance as their top risk priority.

- 86% of institutional investors report they already have, or will soon have, exposure to digital assets.

- The GENIUS Act (2025) mandates stricter reserve backing and audit standards for stablecoins.

- Only 40 out of 138 jurisdictions are “largely compliant” with FATF crypto standards as of April 2025.

- Illicit crypto wallet addresses received $51 billion in 2024, a key enforcement target.

- FATF warns that regulatory gaps in one region pose a global spillover risk.

- Many jurisdictions now require license regimes for custodians, exchanges, and DeFi protocols.

- Institutions are adopting compliance-as-a-service tooling, such as transaction monitoring and sanctions screening.

- Some funds set regulatory buffers, excluding tokens not yet cleared for sale.

- Auditability mandates, regulators increasingly demand on-chain proof or third‑party attestation of reserves.

Market Data on Crypto Custodial Risk Management Solutions

- In 2025, projected industry spend on crypto custody solutions is $16 billion annually.

- Total assets under custody in institutional custody platforms exceed $220 billion.

- 70% of institutional custodians now offer multi‑party computation (MPC) key management.

- 58% of institutions partner with custodians that provide real‑time monitoring and alerts.

- 50% of custodians now integrate on-chain analytics to flag suspicious flows.

- Custodian downtime risk, some report < 0.5% annual availability SLAs.

- 40% of custodians conduct quarterly external audits of key management.

- 33% maintain geographically distributed cold storage across several jurisdictions.

- 45% of custodians have adopted zero-trust internal architectures to limit internal breaches.

Operational and Reputational Risks in Institutional Crypto

- A single custody mismanagement or unapproved transfer could erode client trust irreversibly.

- In 2025, the Bybit hack of $1.5 billion inflicted reputational damage across the crypto world.

- Major brand names have suffered public breaches, underscoring third‑party vendor risk.

- Some incidents lead to class‑action lawsuits or regulatory scrutiny.

- Operational glitches, like failure of automated keysigning, have caused temporary withdrawal halts.

- Reputational risk, negative media coverage can reduce institutional inflows or attract regulatory investigations.

- Internal process errors, such as KYC mistakes or AML misses, may expose institutions to fines or loss of license.

- Misaligned incentives between crypto desks and legacy operations can fragment governance.

- Institutional partners might avoid institutions perceived as high-risk, reducing deal flow.

Vendor and Partner Due Diligence for Institutional Crypto Services

- 45% of institutions request third‑party audit reports before onboarding crypto vendors.

- Many demand SOC 2 / ISAE 3402 compliance in custody, KYC, and analytics partners.

- Institutions often require proof-of-reserves audits from counterparties.

- Some vendors are excluded if they lack smart contract security audits or bug‑bounty programs.

- Institutions run penetration tests on vendor APIs before integration.

- Geopolitical risk screening: vendors from high‑risk jurisdictions undergo extra scrutiny.

- Contracts now embed SLAs, breach indemnities, and clawback clauses for vendor failure.

- Institutions cross-check vendor funds flows on-chain to detect front-running or adversarial behavior.

- Some firms maintain a vendor risk rating system, weighting crypto vendors more heavily.

Frequently Asked Questions (FAQs)

Nearly 34% of institutional investors now use enhanced risk management systems tailored for crypto assets.

Institutions are projected to spend $16 billion annually on crypto custodial solutions in 2025.

84 % of institutions rank regulatory compliance as their top concern in crypto risk management.

$6.7 billion of crypto assets have been insured under institutional policies in 2025, reflecting a 52% year‑on‑year increase.

Conclusion

Institutional crypto risk management has matured from speculative experiment to mission-critical practice. Institutions are building robust frameworks to address cyber threats, counterparty defaults, liquidity constraints, DeFi complexities, and regulatory uncertainties. As capital flows deepen and the ecosystem evolves, institutions that invest early in capable teams, analytics, and governance will be best positioned to navigate volatility and seize opportunity.