The Markets in Crypto‑Assets (MiCA) regulation has reshaped the landscape for crypto lending and staking across the EU. In fact, within months of application, platforms saw shifts in interest rates, collateral practices, and capital flows. In the U.S., some centralized exchanges have already begun to benchmark their staking yields and lending margins against EU compliance standards. Similarly, institutional treasuries in Asia are monitoring the EU as a regulatory bellwether. Explore below how MiCA’s framework is altering the statistical footprint of crypto lending and staking.

Editor’s Choice

- €1.8 trillion projected size of the European crypto market by end‑2025 under MiCA’s framework.

- Following MiCA enforcement, average EU stablecoin lending rates in Q1 2025 declined to around 5.9%, according to early estimates by European lending platforms.

- 95% share of EU crypto lending that is now collateralized (vs unsecured) after MiCA rules tightened risk requirements.

- 22% growth in assets held by EU crypto lending platforms from 2024 to early 2025.

- Institutional participation in EU crypto lending reportedly increased from ~26% in 2024 to over 50% in Q1 2025, reflecting growing alignment with MiCA requirements.

- 20% contraction in DeFi lending activity in the EU, as non-compliant protocols faced stricter supervision.

- 75% share of staking transaction volume handled by MiCA‑compliant platforms by Q3 2025.

Recent Developments

- MiCA entered into force in June 2023, with full application beginning in December 2024.

- ESMA and EBA published a joint report under Article 142 in early 2025 analyzing lending, borrowing, and staking trends in the EU.

- Some Level 2 and Level 3 technical standards remain under consultation, affecting the finer points of disclosures, audits, and capital rules.

- The European Commission released a MiCA review report in August 2025 as part of its monitoring duties.

- More than 65% of EU-based crypto firms had achieved MiCA compliance by Q1 2025.

- The number of registered Virtual Asset Service Providers (VASPs) in the EU rose by 47% following MiCA clarifications.

- ESMA’s crypto‑assets monitoring now includes stress testing and transparency exercises for crypto lending & staking.

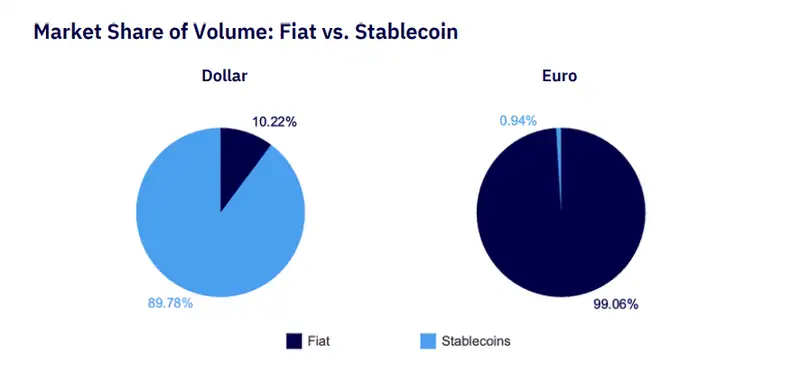

Fiat vs Stablecoin Market Share

- In USD markets, stablecoins control 89.78% of trading volume.

- Just 10.22% of USD volume is settled through traditional fiat.

- In the Euro market, fiat dominates with 99.06% of trading volume.

- Stablecoins hold only 0.94% of euro-denominated activity, showing minimal uptake.

Growth Trends in Crypto Lending and Staking Before MiCA

- In 2022–2023, global DeFi activity accounted for ~4% of total crypto market value.

- Of that DeFi total, ~18% was in lending/borrowing and ~39% in staking in early data sets.

- EU’s share of global DeFi users was estimated at ~13%, implying EU DeFi lending ≈ €1.8B and staking ≈ €3.6B pre‑MiCA.

- Across major Western markets, annual growth in crypto lending platforms ranged from 20–40% year-over-year (before MiCA).

- Liquidity providers in staking often offered rewards in the 3–12% APR range before regulatory adjustments.

- Centralized lending platforms took up ~70% of total crypto lending volume globally pre‑MiCA.

- Institutional participation in crypto lending was modest, often under 25% in many jurisdictions.

- Liquid staking derivatives (LSDs) grew rapidly, for example, in the Ethereum ecosystem, ~537,123 ETH (~$877 M) was involved in leverage staking strategies over ~3 years.

Key Statistical Changes in Crypto Lending Post‑MiCA

- EU crypto lending platforms now hold $275 billion, up ~22% from 2024 levels.

- 5.9% average stablecoin lending rate in Q1 2025, down from ~8.9% pre‑MiCA.

- 95% of loans in the EU are now collateralized vs. unsecured lending, dropping ~75%.

- Borrowing demand for BTC and ETH rose ~38% as users shifted from offshore to regulated platforms.

- Liquidation rates on lending platforms fell by ~24% due to improved risk controls and rules.

- Institutional share in lending jumped to 52% in Q1 2025 from ~26% in 2024.

- Non‑compliant crypto lenders lost ~33% of their European user base as migration toward MiCA-approved platforms occurred.

- DeFi lending in Europe contracted ~20% as many protocols struggled to meet compliance demands.

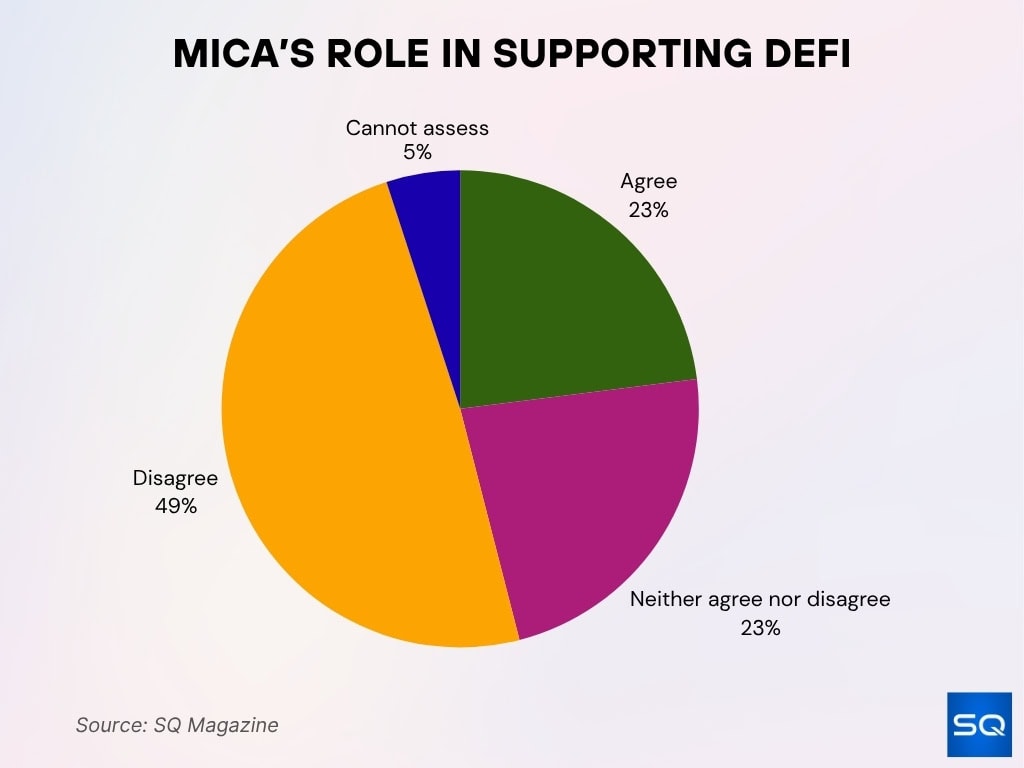

MiCA and the DeFi Debate

- 49% of stakeholders disagree that MiCA adequately supports emerging sub-industries like DeFi.

- Only 23% believe MiCA provides sufficient backing for DeFi’s growth.

- Another 23% remain neutral, highlighting mixed perceptions in the sector.

- Just 5% say they cannot assess, showing most have formed clear views.

- Overall, skepticism outweighs confidence in MiCA’s effectiveness for DeFi.

Key Statistical Changes in Crypto Staking Post‑MiCA

- Staking participation on MiCA‑compliant platforms rose 45% in 2025 as investors migrated toward regulated protocols.

- Average staking yields across proof-of-stake networks stabilized at 4.8%, down from ~7.4% in 2024.

- EU-based staking providers now handle 80% of all staking transactions (versus ~75% earlier).

- Non-EU staking providers experienced significant EU user attrition, estimated between 20–30%, as users favored MiCA-compliant alternatives.

- Institutional portion of staking increased to 50% in 2025, up from ~31% in 2024.

- Retail staking deposits declined 9.5% as some smaller actors moved offshore.

- Validator node counts in the EU rose 22% driven by MiCA’s security and decentralization requirements.

- Compliant staking providers now command 85% of staking pools, cutting dominance of unregulated actors.

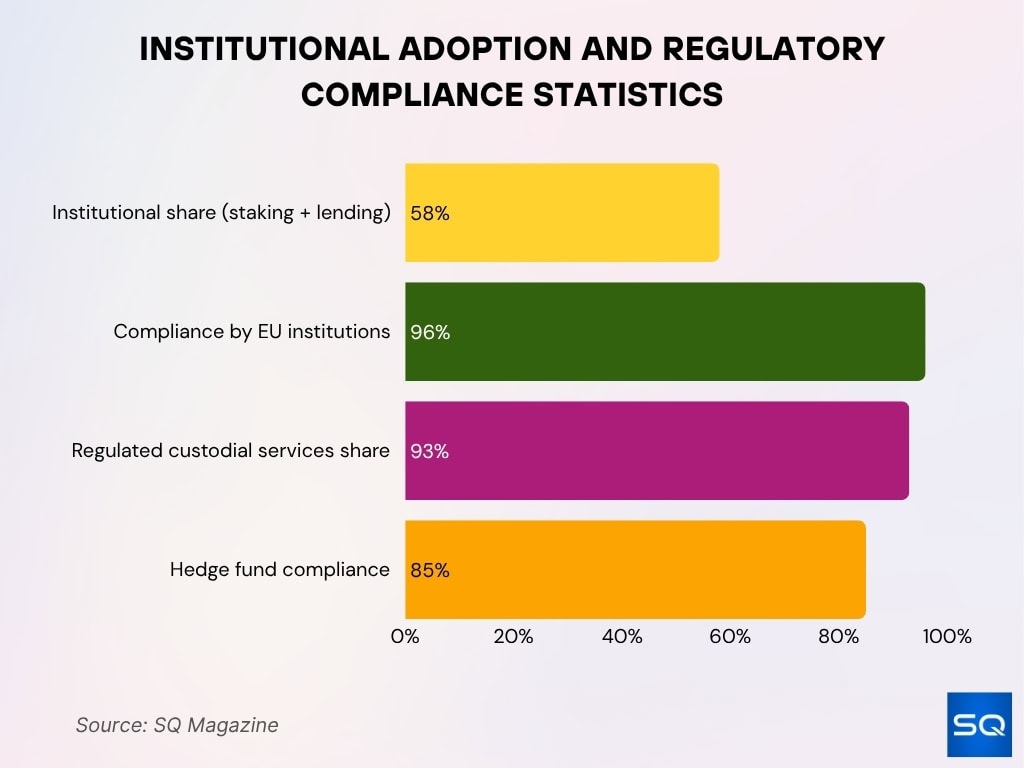

Institutional Adoption and Regulatory Compliance Statistics

- Institutional investors now account for 58% of combined lending and staking activity in the EU.

- 96% of European financial institutions are compliant (or in process) with MiCA rules.

- Custodial services manage 93% of institutional crypto assets via regulated providers.

- Over 85% of crypto hedge funds in the EU now meet MiCA compliance standards.

- EU banks hold $110 billion+ in digital asset reserves under MiCA’s clearer legal framework.

- Private wealth funds have expanded crypto exposure by 71%, favoring regulated lending and staking.

- Corporate treasuries boosted allocations to crypto lending more than 2×, reaching ≈ $42 billion.

- Non‑compliant institutions incurred over €230 million in penalties in 2025 under MiCA enforcement.

- EU crypto litigation volume reportedly dropped by about 30% in 2025, suggesting increased regulatory clarity under MiCA, though causality remains debated.

- Centralized exchanges saw a 27% boost in institutional users after adopting MiCA‑aligned services.

Institutional Adoption and Compliance Under MiCA

- 58% of EU crypto staking and lending activity now comes from institutional investors.

- 96% of European financial institutions meet MiCA standards, allowing them to legally provide digital asset services.

- 93% of institutional crypto assets are held with regulated custodians, cutting dependence on offshore providers.

- Over 85% of EU-based crypto hedge funds are already MiCA compliant.

Impact on DeFi Lending and Staking Platforms

- DeFi lending volume in the EU declined 23% in 2025 as stricter Know Your Customer (KYC) rules discouraged anonymous participation.

- 78% of prior DeFi users migrated to centralized, regulated platforms for clearer compliance protections.

- Leading DeFi protocols like Uniswap, Aave, and Compound lost an average 18% of their European user base.

- MiCA‑compliant DeFi or hybrid platforms saw 26% growth in transaction volume in the EU.

- Total staking rewards paid by MiCA‑compliant platforms reached $5.0 billion in Q1 2025, up ~15% year over year.

- HNWIs’ lending participation rose 42% following a clearer regulatory footing.

- Some purely decentralized lending pools lost up to 30% of liquidity overnight when they were deemed non‑compliant.

- DeFi protocols had to integrate on‑chain KYC or partner with CASPs to remain active in the EU.

- Migration patterns show that stablecoin-based DeFi yield farming in the EU fell ~20% in volume as composite regulation tightened.

MiCA’s Influence on User Participation and Market Dynamics

- EU crypto trading volume jumped 24% since MiCA enforcement, with growth concentrated on regulated exchanges.

- Non‑compliant exchanges lost 40% of their EU user base as trust shifted to regulated platforms.

- 22% increase in new users to crypto lending platforms after transparency rules reduced counterparty risk.

- 65% of crypto firms in the EU had achieved MiCA compliance by Q1 2025.

- Applications for MiCA licensing rose 150% in 2024 compared to 2023.

- “A minority of crypto exchanges, estimated at under 20%, had fully implemented MiCA-aligned AML and reporting standards by early 2025.

- 91% of crypto firms reported being unprepared for MiCA compliance ahead of enforcement.

- 45% of applied licensing requests were rejected due to non‑compliance.

- 42% of European crypto startups expected significantly higher operational costs because of MiCA compliance.

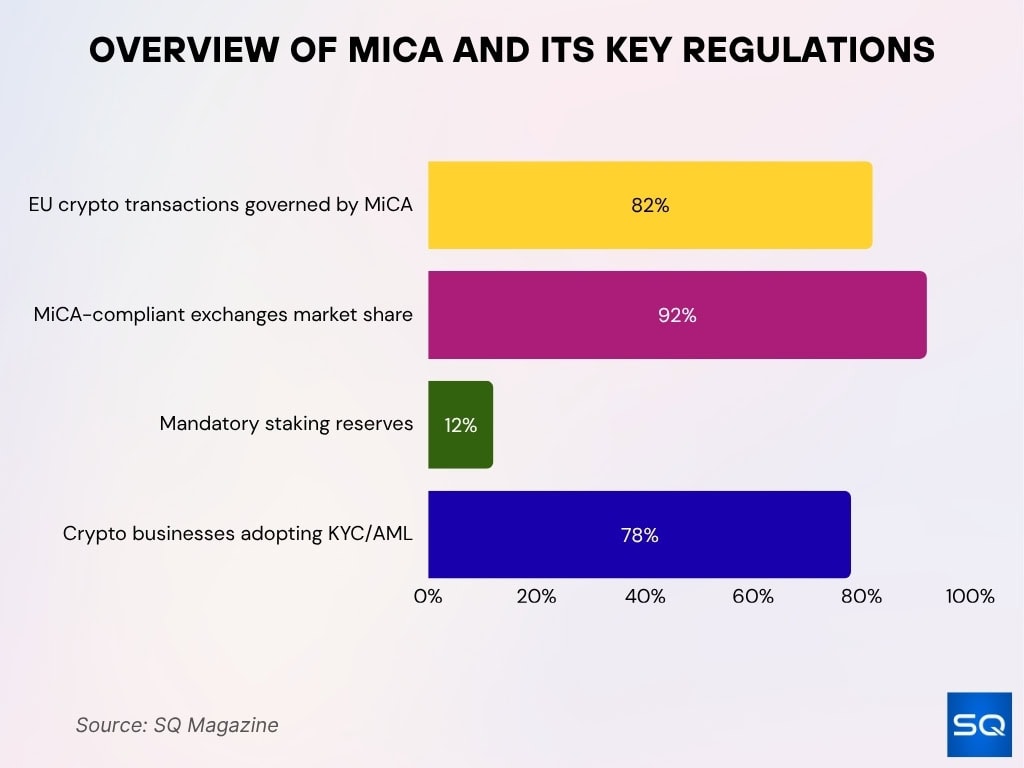

MiCA Overview and Core Regulatory Impact

- 82% of EU crypto transactions, spanning lending, staking, stablecoins, and exchanges, now fall under MiCA.

- 92% of crypto trading volume in the EU is processed through MiCA-compliant exchanges.

- Staking providers are required to keep 12% of staked assets in reserves to curb liquidity risks.

- Over 78% of EU crypto firms have implemented updated KYC/AML protocols to meet MiCA requirements.

Market Share of Fiat vs Stablecoins

- As of mid‑2025, total stablecoin market capitalization is estimated at $246 billion, with fiat‑backed stablecoins dominating the space.

- Tether (USDT) alone represents roughly $150 billion of that total, making it the clear leader.

- USDC ranks second with about $60+ billion in market cap as of 2025.

- Fiat‑backed stablecoins constitute ~91% of the overall stablecoin market, with decentralized alternatives holding the remainder.

- Decentralized stablecoins now represent about 20% of the stablecoin market cap in 2025.

- Ethereum hosts ~70% of the total stablecoin supply across blockchains, and Binance Smart Chain accounts for ~15%.

- Stablecoin supply grew ~59% in 2024 over 2023.

- Fiat-backed stablecoin market cap increased by ~$97 billion (+76%) between 2024 and 2025.

- Most stablecoin demand (≈ 88%) is driven by crypto-native activity (trading, DeFi), not payments (≈ 6%).

Comparative Analysis: EU vs. Non‑EU Crypto Markets

- The global crypto exchange market in 2024 was ~$24.75 billion, and centralized exchanges made up ~90.8% of that.

- In non-EU regions, crypto trading volumes have surged, e.g., North America saw monthly transfer volumes exceed $2 trillion, peaking near $3 trillion in 2025.

- In the U.S., total adjusted transaction value from Jan–Jul 2025 neared $16 trillion, almost triple the same period a year earlier.

- EU-based crypto activity is more tightly regulated under MiCA, limiting the number of non‑compliant platforms.

- Many startups and VASPs in the EU face high licensing, compliance, and operational burdens. ~42% of European crypto startups expect higher operational costs due to MiCA.

- Up to 80% of European crypto exchanges will need significant process changes to comply with MiCA.

- In non-EU markets, regulatory regimes are often more permissive or nascent, enabling faster product launches and experimentation.

- The U.S. stablecoin space is strong; USD stablecoins have surpassed $220 billion in market cap, representing ~99.8% of fiat-denominated stablecoins.

- Innovation, venture capital influx, and talent concentration tend to favor non-EU markets with fewer regulatory constraints.

Effect on Innovation and Startups in the Crypto Sector

- 42% of European crypto startups expect significantly higher operational costs due to MiCA compliance burdens.

- Startup capital flow into EU crypto firms has slowed due to regulatory risk and uncertainty.

- Some firms are relocating outside the EU to more welcoming jurisdictions (e.g. U.S., the UAE, and Asia).

- Startups often cite licensing complexity and long delays as major deterrents.

- Hybrid and regulated fintech‑blockchain models are emerging as the path of least resistance under MiCA.

- The increased centralization pressure favors incumbents, making it harder for new entrants to gain market share.

Challenges and Criticisms of MiCA

- Some critics argue MiCA’s strict rules may stifle innovation by imposing burdensome compliance on smaller players.

- National-level divergences still exist despite harmonization, creating fragmentation in implementation across EU states.

- High operational and compliance costs disproportionately impact startups and small firms.

- The delayed or uncertain adoption of technical standards (Level 2 / Level 3) poses ambiguity for firms preparing to comply.

- Some protocols and DeFi projects struggle with on-chain KYC, identity, and permissioning under MiCA’s requirements.

- MiCA predominantly addresses institutional and regulated models, leaving open questions for innovation frameworks such as algorithmic stablecoins.

- Critics warn that overly cautious regulation may drive talent and capital out of Europe.

- Compliance deadlines, enforcement readiness, and regulatory resource constraints may lead to uneven enforcement across states.

Future Developments and Expectations

- MiCA may evolve to better accommodate permissionless innovation, possibly through pilot regimes or regulatory sandboxes.

- Review cycles from the European Commission may yield amendments to reduce burdens for small actors.

- Cross‑border coordination (e.g., EU with U.S. and, UK) in crypto regulation could influence how MiCA adapts.

- The stablecoin market is projected by JPMorgan to reach $500 billion by 2028.

- Innovations in interoperable staking, cross‑chain DeFi, and Layer‑2 solutions may drive areas less encumbered by regulation.

- Growth of algorithmic, hybrid, or overcollateralized stablecoins may spur regulatory revisit.

- Some EU member states may build more favorable local policies to attract crypto firms within MiCA’s framework.

- Increased institutional demand could push regulated platforms to expand offerings, borrowing from fintech models.

Frequently Asked Questions (FAQs)

It is 5.9 %.

They grew by 22 %.

95 % of loans are collateralized.

75% of staking volume.

Around €1.8 trillion.

Conclusion

MiCA marks a turning point in how the EU regulates crypto lending, staking, and stablecoins. It has already shifted capital flows, borrower/lender behavior, and the competitive landscape in favor of regulated, institutional services. Yet, the regulation is not without friction; startups and decentralized protocols are navigating steep compliance costs, uncertain technical standards, and regional differences in implementation. Non‑EU markets continue to offer faster innovation cycles and lighter regulatory overhead, tempting talent and capital away.

Looking ahead, MiCA’s evolution will determine whether the EU becomes a model of balanced crypto governance or whether it will lag behind dynamic crypto hubs. The statistics we’ve reviewed serve as a foundation; the final verdict lies ahead in how regulation, market forces, and innovation converge under this new era.