A $110 million investment round is positioning Greenlane Holdings as a major player in the crypto treasury world, centered around Berachain’s BERA token.

Quick Summary – TLDR:

- Polychain Capital led a $110 million private investment round to help Greenlane build a BERA token-based treasury.

- The deal includes $50 million in cash and $60 million worth of BERA tokens acquired via shares and warrants.

- Other key backers include Blockchain.com, Kraken, dao5, and CitizenX, signaling strong institutional interest in Layer 1 crypto protocols.

- Greenlane will make BERA its primary reserve asset, creating a hybrid model that merges public equity and tokenized finance.

What Happened?

Greenlane Holdings has announced a major private investment in public equity (PIPE) valued at $110 million to fund a crypto treasury built around Berachain’s BERA token. The financing, led by Polychain Capital, includes contributions from major industry players such as Kraken and Blockchain.com. The goal is to reshape Greenlane’s treasury structure by positioning BERA as its core digital asset.

The Berachain Foundation is excited to support Greenlane Holdings (NASDAQ: GNLN) as they build the first and only BERA Digital Asset Treasury. https://t.co/tRtLKQLby5

— Berachain Foundation 🐻⛓ (@berachain) October 20, 2025

Greenlane’s $110M Crypto Treasury Strategy

Greenlane Holdings, a Nasdaq-listed company, is stepping into the digital asset world by building a treasury that will be heavily weighted in BERA tokens. This marks a significant shift for a public company toward crypto-backed balance sheet strategies.

- The $110 million PIPE deal includes $50 million in cash and $60 million in BERA tokens.

- Shares and pre-funded warrants are being offered at fixed prices: $3.84 per share and $3.83 per warrant.

- The strategy will be directed by Ben Isenberg as Chief Investment Officer.

- Bruce Linton, former Canopy Growth executive, will serve as Chairman, and Billy Levy, co-founder of Virgin Gaming, joins as Director.

According to disclosures, the BERA tokens will be acquired via open market purchases and over-the-counter deals, expanding Greenlane’s presence in the blockchain space.

What is BERA and Why Does It Matter?

BERA is the native token of Berachain, a Cosmos-based, EVM-compatible Layer 1 blockchain that launched in February 2025. What sets it apart is its Proof of Liquidity consensus model, which rewards liquidity providers rather than traditional stakers. This encourages real value creation within the network.

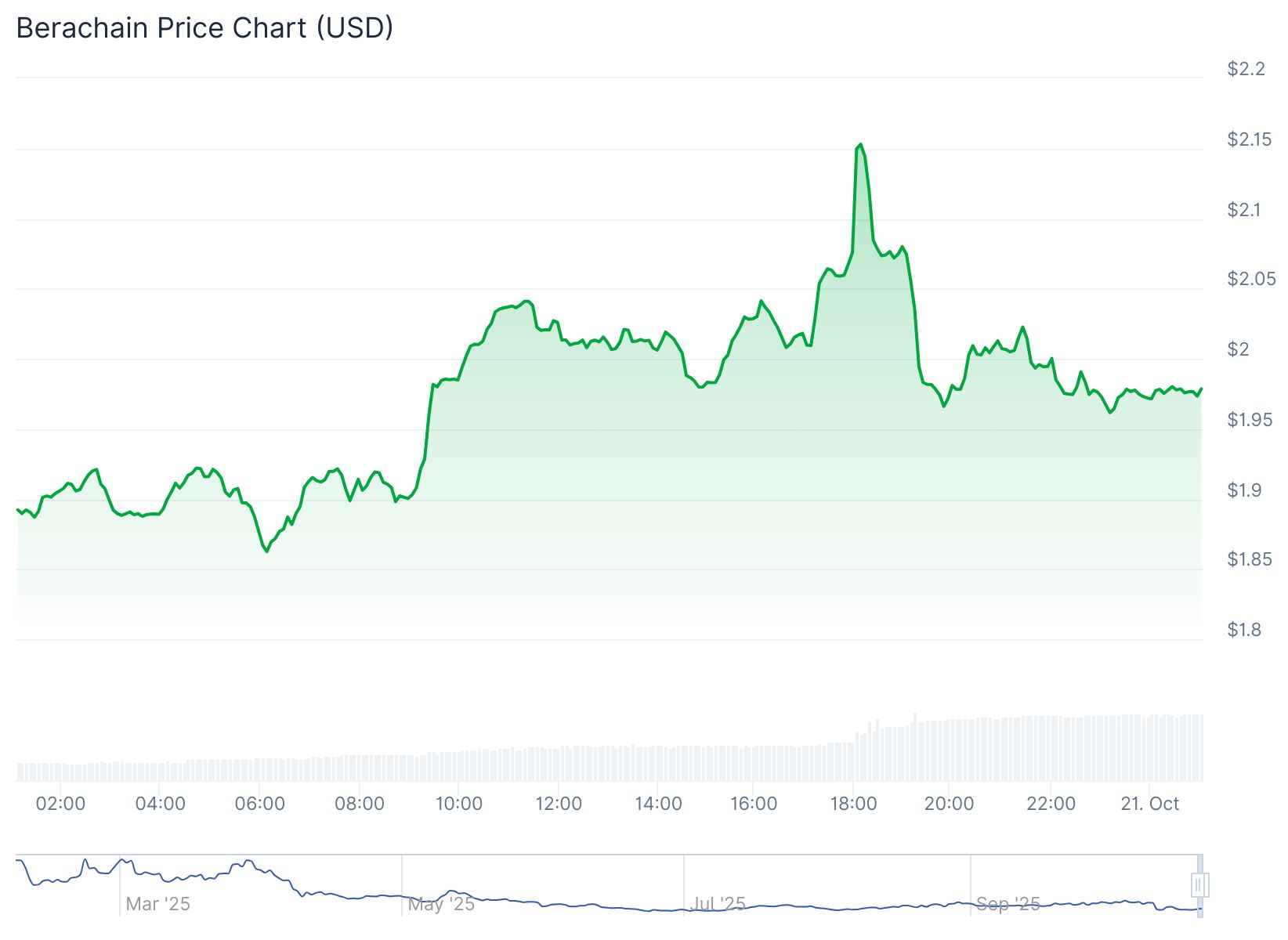

Currently, BERA trades around $1.98, down from its all-time high of $14.83, but up more than 10 percent on the day of the announcement. Market watchers are paying close attention to how this move might impact token volatility and institutional confidence in on-chain assets.

Institutional Capital Meets Decentralized Tech

The involvement of Polychain, Kraken, and Blockchain.com brings considerable institutional weight to Berachain’s ecosystem. Their investment signals a broader trend: Layer 1 blockchain protocols are increasingly attracting structured capital from both crypto-native and traditional finance players.

Greenlane’s “BeraStrategy” is part of this evolving model, merging equity investment tools with digital asset holdings, and giving shareholders exposure to tokenized value alongside traditional operations.

According to Bruce Linton, “We believe a token-weighted treasury aligns incentives and unlocks long-term value.” However, the long-term success of this approach will depend on how well Greenlane can manage its token reserves and maintain transparency.

Market Reaction and Regulatory Considerations

Following the announcement, Greenlane’s stock price jumped over 65 percent, briefly reaching $6.35, before settling to a gain of more than 14 percent. The market clearly responded positively to the news, but execution remains key.

- The deal is expected to close on or around October 23, 2025.

- Custody and compliance protocols are still pending final approval.

- Market analysts point to the rising trend of public companies diversifying into digital asset treasuries.

SQ Magazine Takeaway

I love seeing these kinds of bold moves that bridge crypto and traditional finance. Greenlane is not just dabbling in digital assets, it’s doubling down on a token-centric strategy in a big way. With powerhouses like Polychain and Kraken on board, this feels like a serious attempt to normalize token reserves in the corporate world. That said, it also raises the bar. If Greenlane fumbles treasury transparency or token performance, it could spook future institutional interest. But if they get it right, this could set the gold standard for how public companies interact with crypto. It’s a big risk, but an even bigger signal.