Ethereum and Cardano are two leading blockchain platforms that shape the modern digital economy. Ethereum powers a vast ecosystem of decentralized finance (DeFi) apps and NFTs, while Cardano focuses on scalable, research‑driven smart contracts with predictable fees. Both networks influence industries from finance to supply‑chain transparency, and developers across sectors choose them based on utility, cost, and community support. The following statistics show how each platform differs in adoption, performance, and network health, inviting you to explore detailed comparisons throughout this article.

Editor’s Choice

- Ethereum’s market cap stands at $381.66 billion, ~27x larger than Cardano’s $13.88 billion.

- Cardano’s fees average around 0.33 ADA (about $0.10–$0.15), lower than typical Ethereum mainnet fees near $0.30–$0.35 per transaction before Layer‑2 solutions.

- Ethereum deploys roughly 170,000–200,000 new smart contracts per month on average, reflecting strong ongoing developer activity.

- Cardano boasts 3,588 active developers contributing across 838 repos.

- Cardano uses 0.004 kWh per transaction vs Ethereum’s 0.03 kWh.

- Ethereum leads development with MetaMask at 893 points, Starknet 265.

Recent Developments

- Ethereum continues to enhance scalability through Layer‑2 solutions like rollups and sidechains to reduce congestion and costs.

- Cardano introduced the Hydra scaling protocol to boost throughput and lower bottlenecks in late 2025.

- Ethereum has seen over 170,000 monthly smart contract deployments on average during 2025, underscoring sustained developer engagement.

- Cardano reports an increase to ~5,800 monthly contracts built on Plutus in the same period.

- Ethereum’s ecosystem includes 1,000+ zkEVM‑based dApps, enhancing privacy and scaling.

- Cardano released the Aiken programming language in early 2025 to attract developers.

- Both ecosystems expanded enterprise pilots, with Ethereum in 60+ and Cardano in 22 projects by mid‑2025.

- Heightened research focus on security and governance models for both chains influenced upgrades in 2025.

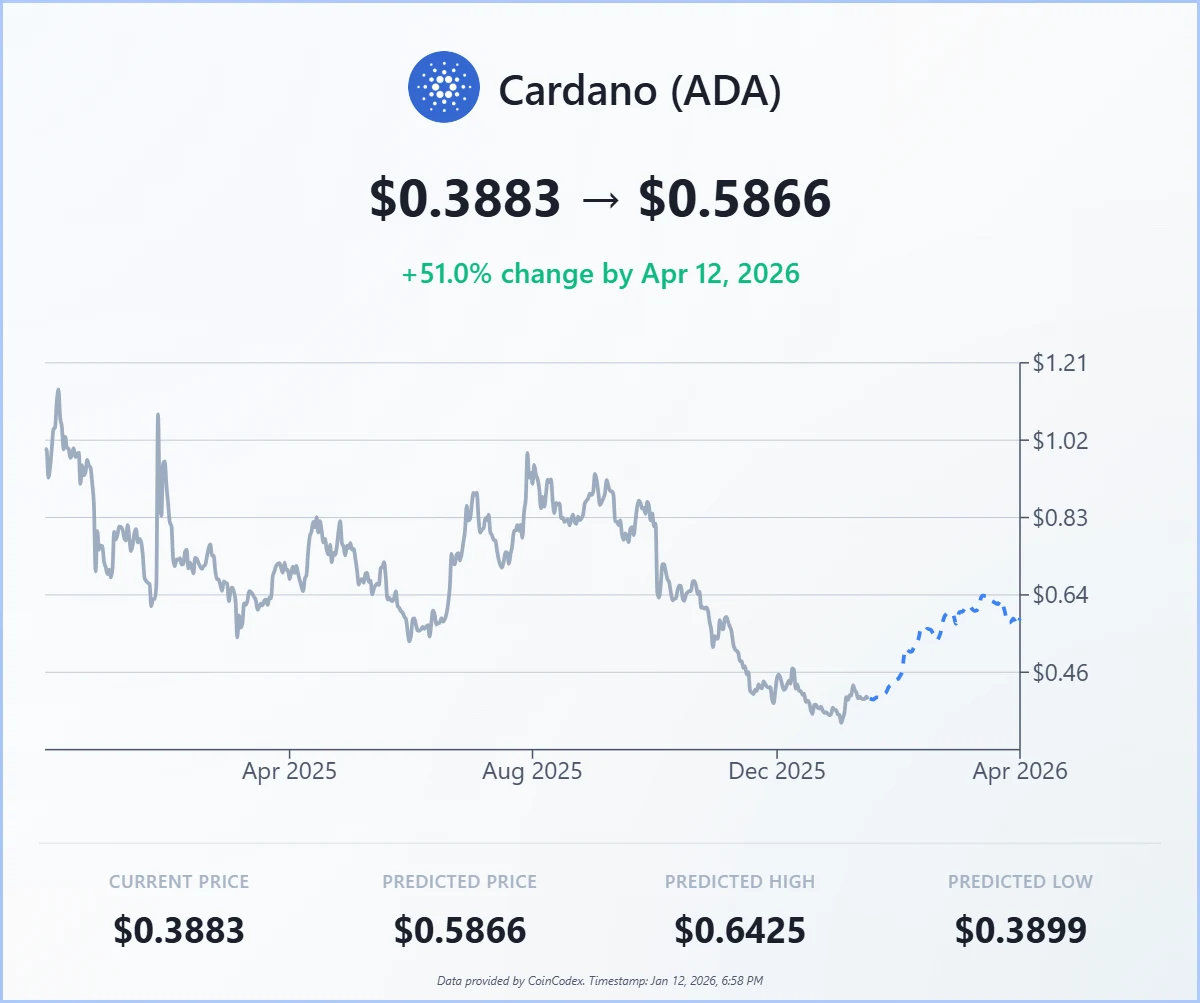

Cardano (ADA) Price Forecast Highlights

- Cardano (ADA) is currently priced at $0.3883, reflecting subdued market conditions entering 2026.

- The projected ADA price rises to $0.5866 by April 12, 2026, implying a +51.0% upside from current levels.

- Forecast models estimate a potential high of $0.6425, suggesting stronger bullish momentum if market sentiment improves.

- The downside scenario remains limited, with a predicted low of $0.3899, closely aligned with the current price.

- Price history from early 2025 to late 2025 shows extended consolidation following mid-year volatility.

- The blue dotted forecast line indicates a gradual recovery trend through early 2026 rather than a sharp spike.

- Key resistance zones appear near $0.64, while support is clustered around the $0.46 to $0.39 range.

- Overall, the forecast suggests moderate growth with controlled downside risk, positioning ADA as a medium-risk recovery play for 2026.

Ethereum vs. Cardano Overview

- Ethereum’s market capitalization substantially exceeds Cardano’s as of 2025, 2026, underscoring broader adoption.

- Ethereum’s total deployed smart contracts are>7 million historically.

- Cardano’s cumulative contract deployments exceed ~220,000, a modest figure comparatively.

- Cardano chooses a methodical, academic review process for upgrades.

- Ethereum’s broad DeFi and NFT ecosystem drives higher activity despite higher fees.

- Ethereum and Cardano both use proof‑of‑stake consensus, but with different validator and governance models.

- Cardano emphasizes on‑chain governance, while Ethereum’s is largely off‑chain.

Price Performance and Volatility Statistics

- Ethereum price hovers at $3,106, down 39% from its ATH $4,953.

- Ethereum’s 30-day volatility at 3.2%, lower than Cardano’s 5.51%.

- Cardano ADA shows 33% green days in the last 30, range-bound amid adoption.

- Ethereum trading volume surges to $19 billion during price swings.

- Ethereum 2026 forecasts eye $5,440 amid institutional inflows.

- Cardano price predicted to reach $0.53 by February with a 37% rise.

- Ethereum’s ATH $4,878 towers over Cardano’s $3.09 peak.

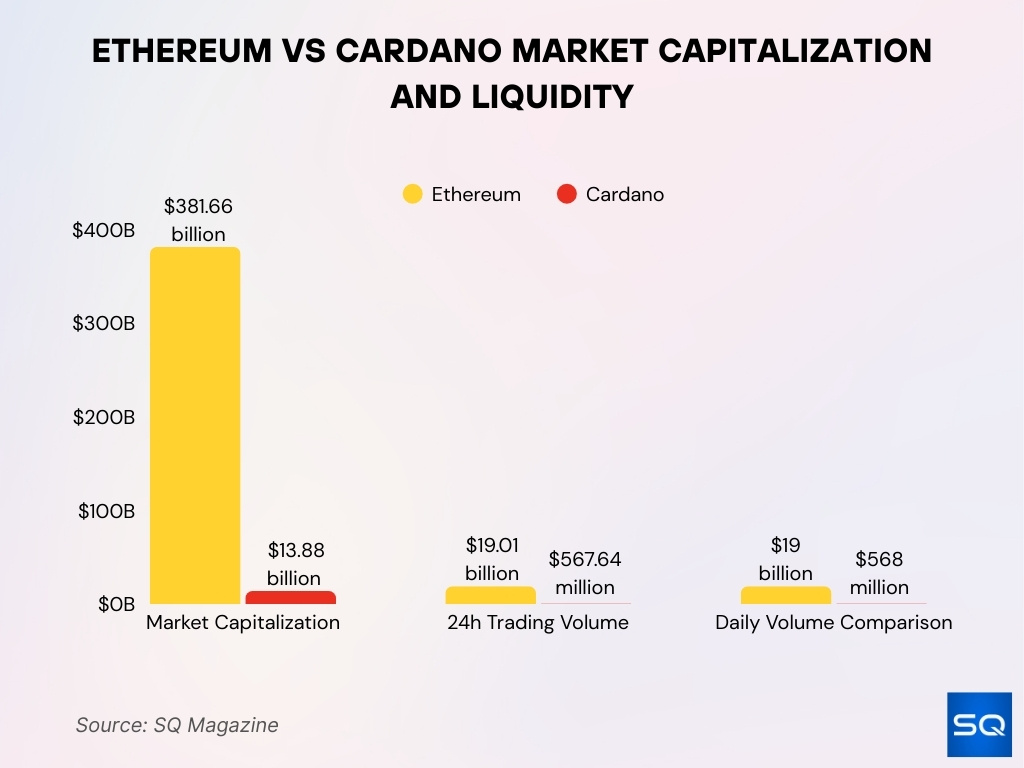

Market Capitalization and Liquidity

- Ethereum’s market cap reaches $381.66 billion, dwarfing Cardano’s $13.88 billion by ~27:1.

- Cardano’s market cap hovers at $13.88 billion, securing a top 10 spot among cryptos.

- Ethereum’s 24h volume hits $19.01 billion, enabling deep order books and tight spreads.

- Cardano’s 24h volume stands at $567.64 million, up YoY with ecosystem growth.

- Ethereum dominates daily volume at $19 billion vs Cardano’s $568 million.

- Cardano’s ADA ranks top 10 in trading volume on major exchanges.

- Institutions hold nearly 5% of the ETH supply via firms like BitMine and Bit Digital.

- Ethereum claims over 10% share of total crypto market cap.

Token Supply, Inflation, and Staking Rewards

- Ethereum has no hard supply cap, but annual issuance has been controlled by fee burns and staking economics since the Merge.

- Approximately 34M+ ETH is staked to secure the network, representing over $100 billion in value locked in PoS consensus.

- Ethereum’s validator count exceeds 1 million active validators, enhancing decentralization and distributed consensus.

- ETH staking yields vary but are often in the ~4 – 6% range annually, depending on network conditions and participation.

- Cardano has a maximum supply of 45 billion ADA, with roughly ~36–37 billion in circulation (2025 data).

- ADA holders can delegate tokens to stake pools with no strict minimum lock‑up, offering flexibility for participants.

- Cardano’s inflation is tied to block issuance and rewards distribution; real yields often run ~3–4% annually.

- ETH issuance has become partially deflationary due to EIP‑1559 fee burning combined with staking lock‑ups.

Consensus Mechanism and Security Metrics

- Both Ethereum and Cardano use proof‑of‑stake (PoS), improving energy sustainability vs. proof‑of‑work chains.

- Ethereum’s PoS requires a minimum of 32 ETH to operate a solo validator node.

- Ethereum’s security can be measured by the total staked ETH value (~$100 billion+) defending against attacks.

- Cardano secures its network via the Ouroboros PoS protocol, emphasizing formal academic proofs of security.

- Cardano has around 3,700 active stake pools globally, reflecting broad stake distribution across the network.

- PoS reduces energy consumption for both blockchains by orders of magnitude vs. PoW designs.

- Validators on Ethereum risk slashing (losing stake) for certain protocol violations, reinforcing honest participation.

- Cardano’s staking design does not use slashing penalties, lowering risk for delegators but altering incentive dynamics.

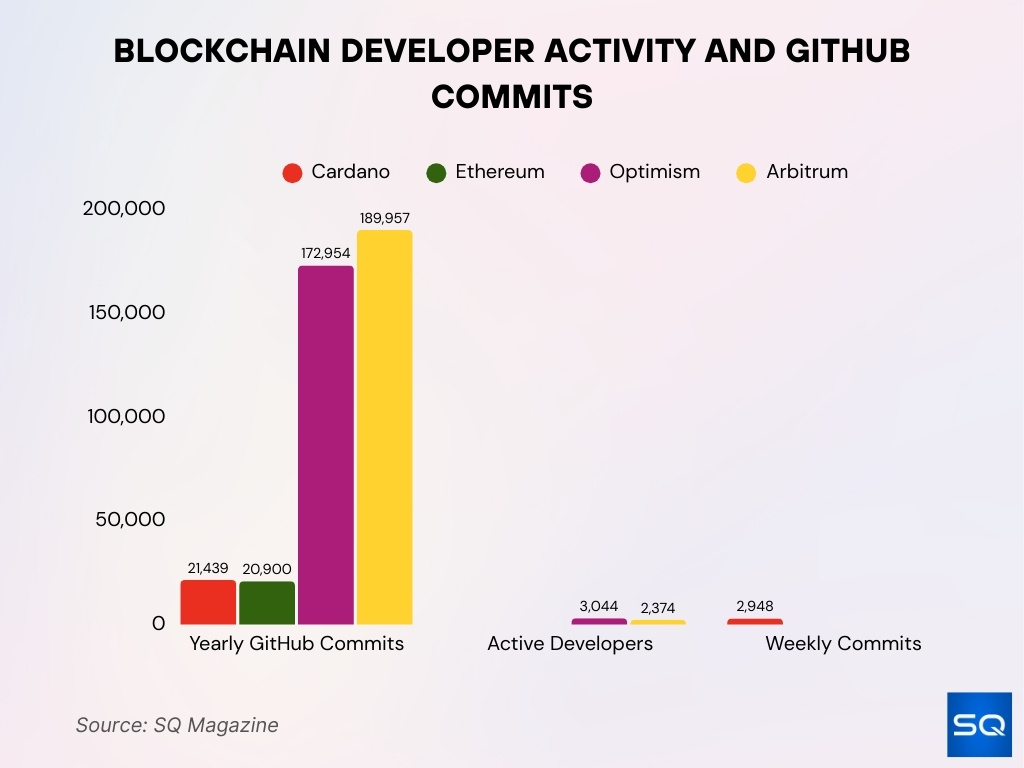

Developer Activity and GitHub Commits

- Cardano leads core dev with 21,439 commits vs Ethereum 20,900 yearly.

- Optimism L2: 3,044 devs, 172,954 commits; Arbitrum 2,374 devs, 189,957 commits.

- Cardano weekly commits hit 2,948 (Jan 5-12).

- Cardano tallies 30,716 commits past year across 838 repos.

- Cardano has hosted 3,588 active developers in the past year.

- Ethereum deploys record 8.7 million smart contracts in Q4.

- Ethereum developer activity reaches an all-time high in Q4.

Network Fees and Cost per Transaction

- Ethereum’s average mainnet fee was near $0.01 on January 11, 2026, but still spikes toward $0.30–$0.35 during periods of heavy demand.

- EIP-1559 has burned ~$9 billion of ETH since its implementation.

- Layer-2 fees drop to $0.000116 on Base vs mainnet $0.31.

- Cardano fees fixed at a × size + b, ~$0.10 average.

- Cardano predictability uses 0.34 ADA/byte base fee parameter.

- Ethereum fee revenue supports validators amid 1.82 million daily transactions.

- Cardano base fee per epoch plus variable operations margin.

- Ethereum gas complexity persists despite L2 at $0.0001 effective costs.

Active Addresses and User Activity

- Ethereum daily active addresses hit 700,407 on Jan 11.

- Ethereum processes about 1.82 million daily transactions with a steady influx of new addresses around early 2026.

- Cardano’s daily active addresses average around 30,000–40,000 in 2025–2026, significantly below Ethereum’s levels.

- Ethereum supports 292,000 new addresses daily post-Fusaka upgrade.

- Ethereum’s unique addresses have exceeded 257.6 million historically.

- Cardano address base grows, but at a fraction of Ethereum’s 300+ million scale.

- Ethereum active addresses up 51% YoY to 700K average.

- Weekly new Ethereum addresses reach 1 million amid DeFi/NFT spikes.

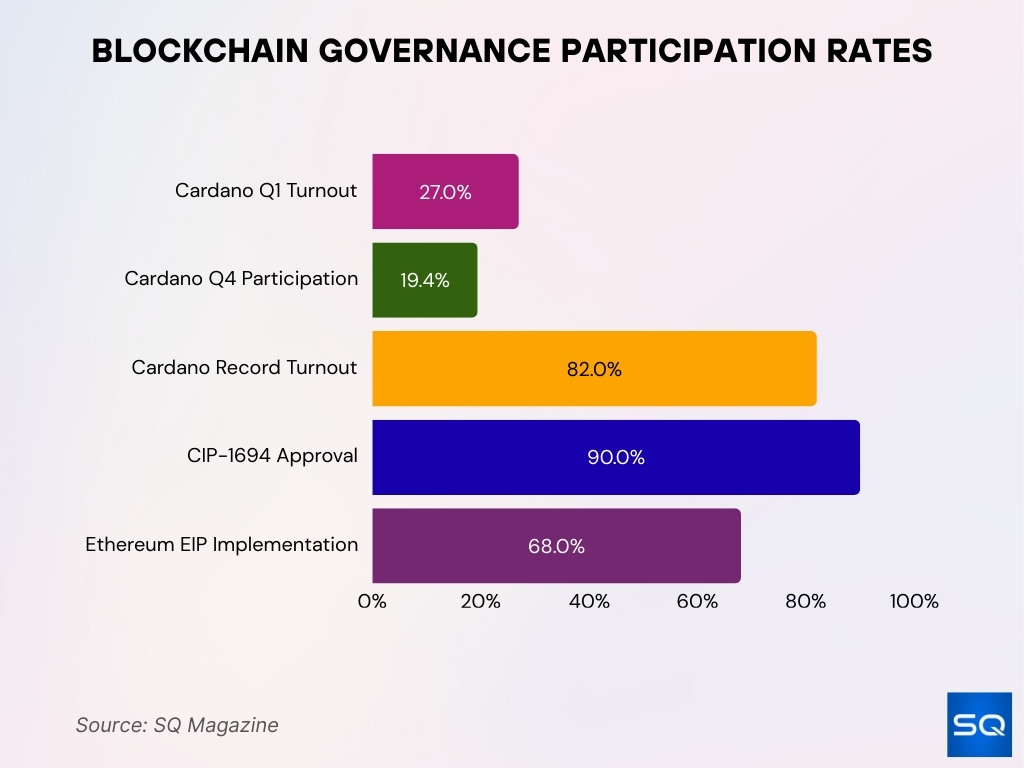

Governance Structure and Voting Participation

- Cardano achieves fully decentralized Voltaire governance post-Chang upgrade.

- Cardano Q1 2025 election sees 27% turnout, 522 voters.

- Cardano Q4 2025 election records 19.4% participation, 5,182 ballots.

- Cardano governance vote hits record 82% eligible ADA holder turnout.

- Cardano CIP-1694 empowers ADA holders for direct protocol voting.

- Ethereum coordinates 300+ EIPs via off-chain core dev consensus.

- Cardano DReps and SPOs drive 90%+ approval on key CIP-1694 poll.

- Ethereum governance emerged from 10 key authors proposing 68% implemented EIPs.

DeFi Ecosystem Size and TVL

- Ethereum DeFi TVL at $72.77 billion, 9x next L1.

- Uniswap contributes $4.5 billion TVL across L1/L2.

- Cardano DeFi TVL reaches $183 million, led by Minswap $50.5 million.

- Ethereum holds a 62% global DeFi TVL share.

- Ethereum TVL peaks $99 billion in 2025 amid stablecoin surge.

- Minswap dominates Cardano DEX with $50.5 million TVL.

- Liqwid Finance adds $43.5 million to Cardano lending TVL.

- Ethereum TVL eyed for 10x growth to $680 billion by year-end.

NFT Activity and Tokenization Metrics

- Ethereum continues to lead the NFT sector, powering around 62% of all NFT contracts and transactions in 2025.

- Total NFT sales volume across blockchains reached $2.8 billion in H1 2025, indicating sustained collector interest.

- Ethereum’s marketplace activity remains strong, with OpenSea reporting over 2.4 million monthly active users in Q2 2025.

- The global NFT market size is estimated to reach $60.8 billion in 2025, up from $43.1 billion in 2024.

- Gaming‑focused NFTs represent about 38% of total NFT transaction volume in 2025, highlighting sector diversification.

- NFT trading on Ethereum often accounts for a meaningful portion of daily transaction volume, especially during high‑minting periods.

- Cardano’s NFT activity remains emerging with smaller total volumes, but niches like JPG Store are showing market traction through millions in lifetime sales.

- NFT users globally climbed to ~11.6 million by 2025, illustrating broader adoption beyond early collectors.

- Average NFT sale prices have stabilized to reflect more mature market behavior vs. peak speculative phases.

Number of dApps and Protocols Built

- Ethereum hosts thousands of dApps led by Uniswap ($8B TVL), Aave ($7B).

- Ethereum averages about 170,000 new smart contracts per month, consistent with recent 2025–2026 deployment trends.

- Cardano deploys 680 new smart contracts monthly, totaling 17,400 Plutus.

- Ethereum finance dApps capture bulk volume with 90K+ daily users, Uniswap.

- Cardano ecosystem builds 1,300+ active projects, including 42 DEXs.

- Ethereum zkEVM dApps grow with Arbitrum (189K commits), Optimism (173K).

- Cardano dApps feature Minswap, SundaeSwap for 70% smart contract interactions.

- Global dApps hit 24.6 million daily unique wallets in early 2025.

Decentralization and Validator Distribution

- Ethereum secures with 973,100 validators globally.

- Cardano runs ~3,700 active stake pools.

- Cardano top pools hold under 12% total stake for broad distribution.

- Ethereum Nakamoto Coefficient at 2 due to Lido/Coinbase concentration.

- Cardano Ouroboros enables liquid delegation across thousands of pools.

- Ethereum validator queue tops 2.17 million ETH ($6.74 billion).

- Cardano 60% circulating ADA ($15.5 billion) actively staked.

- Ethereum validators span 11,400 nodes in 80 countries.

Ecosystem Partnerships and Enterprise Adoption

- Enterprise Ethereum Alliance unites 200+ members, including JPMorgan, BlackRock.

- Cardano Foundation partners with UTN Buenos Aires, PUC Rio for blockchain research.

- Ethereum boasts 89 enterprise customers via Alchemy, including Splunk, Enjin.

- Cardano joins MiCA Crypto Alliance, boosting EU regulatory compliance.

- Ethereum hosts 31,869 active developers plus enterprise ties to JPMorgan, BlackRock.

- Cardano launches $10 million RWA initiative for institutional tokenization.

- Ethereum powers tokenized assets for 50+ non-crypto firms like Deutsche Bank.

- Cardano pursues Digital Product Passport pilots with government partners.

Energy Efficiency and Sustainability Metrics

- Ethereum’s post‑Merge energy use dropped over 99.95%, consuming just 0.0026 TWh/year in 2025.

- Cardano’s annual energy usage remains low (~0.0031 TWh/year), aligning with sustainability goals.

- The average energy per Ethereum transaction is around 0.03 kWh, drastically reduced from pre‑PoS.

- Cardano’s transactions use approximately 0.004 kWh per operation, emphasizing minimal resource needs.

- Both blockchains outperform older proof‑of‑work chains by large margins in environmental impact.

- Validator networks increasingly incorporate renewable energy sources as part of sustainability commitments.

- Industry coalitions aim for broader net‑zero goals across blockchain ecosystems.

Frequently Asked Questions (FAQs)

Ethereum’s market cap is around $380 billion in early 2026, while Cardano’s is about $14 billion over the same period.

Ethereum processes roughly 1.8–2.0 million transactions per 24 hours in early 2026, depending on network activity.

Ethereum’s TVL is approximately $72 billion, while Cardano’s DeFi TVL is less than $200 million.

Ethereum’s active daily addresses average around 700,000 in early 2026, with peaks that can approach 800,000 users.

Conclusion

The contrast between Ethereum and Cardano reveals two distinct but influential blockchain ecosystems. Ethereum continues its dominance in NFTs, decentralized applications, and commercial adoption, supported by a vast number of dApps and strong developer engagement. Cardano, while smaller in volume, emphasizes research‑based design, decentralized governance, and low environmental impact, positioning it for long‑term structural growth.

Both networks showcase valuable metrics in decentralization, sustainability, and community participation, highlighting varied paths for future innovation in decentralized finance, digital assets, and governance frameworks. As the blockchain landscape broadens, developers, users, and enterprises will weigh these quantitative strengths when choosing platforms for new digital ventures.