Ethereum’s gas fees shape the cost of interacting with its blockchain. These fees, denominated in gwei (a small fraction of ETH), spike when demand for block space rises, making some transactions costly. Major upgrades and Layer 2 adoption dramatically altered the fee landscape, affecting users and developers alike. In decentralized finance (DeFi), lower fees mean more efficient trading, while NFT minting has become far more accessible due to reduced costs. Read on to explore up‑to‑date statistics and trends for Ethereum gas fees.

Editor’s Choice

- Average ETH gas fees have dropped significantly compared with recent years, reflecting network improvements.

- Current average transaction fees sit around $0.34 per transaction as of December 2025.

- The Dencun upgrade led to an approximate 95% fee reduction from prior peaks.

- Many Layer 2 solutions, including Arbitrum and zkSync Era, frequently offer transaction fees below $0.10, with occasional periods under $0.03 depending on network load and batch efficiency.

- Approximately 1.2 million transactions per day occur on Ethereum in 2025.

- DeFi activity still consumes a major share of block space, influencing fee dynamics.

Recent Developments

- Average gas prices plummeted from ~72 gwei in early 2024 to ~2.7 gwei by March 2025, a ~95% drop.

- As of late 2025, Layer 2 networks are estimated to handle between 58% and 65% of Ethereum transaction volume.

- Base fees are algorithmically adjusted per block based on congestion.

- Ethereum processes about 1.2 million transactions daily in 2025.

- Gas fee volatility continues despite overall lower averages.

- Average transaction confirmation fees are in the low single digits of gwei on most days.

- Improvements in rollup tech (e.g., EIP‑4844 proto‑danksharding) are expected to further reduce fees.

- The base fee burn mechanism continues to remove ETH from circulation during transactions.

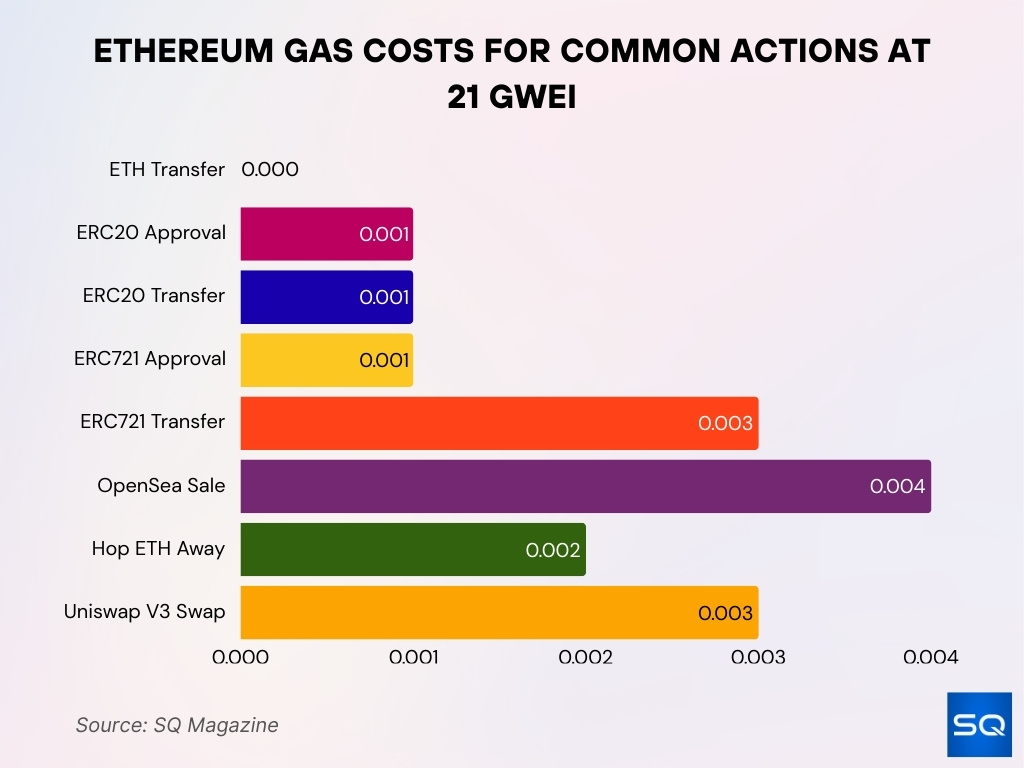

Ethereum Gas Costs for Common Actions at 21 Gwei

- ETH Transfer costs virtually 0 ETH, making it the lowest gas-consuming action among common transactions.

- ERC20 Approval costs approximately 0.001 ETH per transaction under standard network conditions.

- ERC20 Transfer averages around 0.001 ETH, reflecting efficient token transfer mechanics.

- ERC721 Approval incurs about 0.001 ETH, closely aligning with ERC20 approval costs.

- ERC721 Transfer is more expensive at roughly 0.003 ETH due to higher NFT contract complexity.

- OpenSea Sale has the highest cost at around 0.004 ETH, driven by contract-heavy marketplace interactions.

- Hop ETH Away transactions average about 0.002 ETH, indicating moderate gas usage for cross-chain transfers.

- Uniswap V3 Swap typically costs around 0.003 ETH, consistent with decentralized exchange trading activity.

Current Ethereum Gas Fee Levels

- As of mid‑December 2025, the average Ethereum transaction fee is about $0.30–$0.33 per transaction, hovering in this band through late November and December.

- The typical average gas price is ~0.037 gwei as of December 2025.

- Simple transfers now often cost well under $1.

- NFT and complex contract transactions frequently remain affordable relative to pre‑upgrade periods.

- During minor congestion events, gwei prices can temporarily rise but stay far below historical peaks.

- Fee levels vary by time of day, with off‑peak periods typically cheaper.

Gas Fees by Transaction Type

- Simple ETH transfers often incur the lowest gas fees, frequently under $0.50 in 2025.

- ERC‑20 token transfers generally cost slightly more than basic ETH transfers due to increased computation.

- Swap transactions on decentralized exchanges saw earlier peaks of ~$86 but now commonly run under $1.

- NFT minting, previously costing $145+ during peaks, can now be as low as $0.65.

- DeFi interactions remain costlier than simple transfers but still far below historical highs.

- Transactions that interact with multiple contracts naturally consume more gas units.

- Priority fees (tips) fluctuate based on how quickly users want their transactions processed.

Ethereum Price and Performance Summary

- Ethereum (ETH) is priced at $1,883.3, down 1.29% (-$24.7) as of 16:37 GMT+2.

- Gas fees have dropped by 95%, indicating lower network congestion or improved efficiency.

- ETH ranks #2 among cryptocurrencies and is tracked on Bitstamp.

- Short-term performance shows -1.23% (24 hours), -15.90% (7 days), and -29.20% (30 days).

- Mid to long-term performance records -22.81% (6 months), -43.42% year to date, and -52.66% (1 year).

- Long-term performance remains positive with +1.62% over 5 years and +66.45% since inception.

Use Case (DeFi, NFT, Transfers)

- DeFi protocols like Uniswap and Aave contribute to 25% of daily Ethereum transaction volume.

- Ethereum NFT sector generated $5.8 billion in trading volume during Q1.

- Uniswap processes over $2.1 billion in daily trading volume.

- Smart contract interactions account for 62% of all daily Ethereum transactions.

- Average gas fees dropped to $3.78 per transaction due to Layer 2 scaling.

- NFT transactions average over 180,000 per day, led by Blur and OpenSea.

- Ethereum DeFi TVL reached $119 billion in Q3, 49% of the total sector.

- Token swaps on DEXs like Uniswap typically require 100,000-200,000 gas at $0.50-$2.

- Lending platforms Aave and Compound hold over $43 billion in locked assets.

Network Activity and Congestion

- Ethereum’s mainnet processes around 1.1–1.2 million transactions per day as of late 2025.

- Daily total transactions, including L2s, can exceed 12.5 million.

- Median gas prices have averaged around 0.45 gwei (~$0.52) over the past year, a dramatic decrease from earlier peak volatility.

- Monthly active addresses grew ~15% year‑over‑year, showing increased network utilization.

- Even with lower average fees, temporary congestion spikes still occur during major NFT drops or DeFi events.

- Mempool dynamics show transaction prioritization remains tied to willingness to pay higher tips, especially during busy periods.

- Successful transaction throughput remains correlated with L2 adoption and blockspace availability.

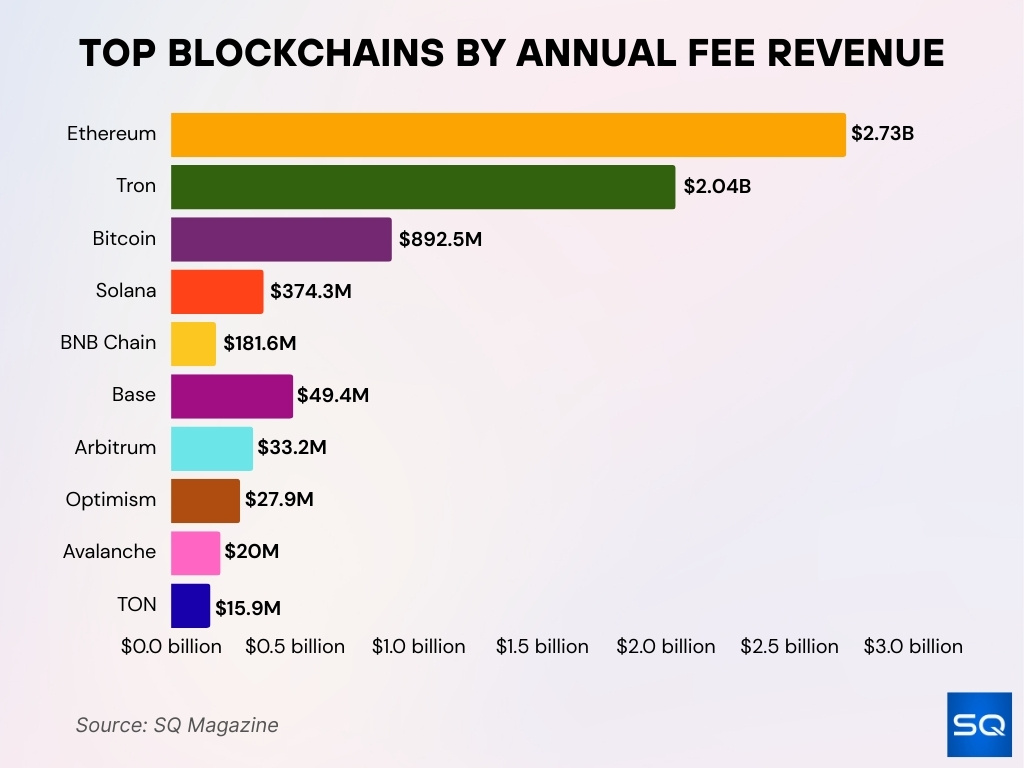

Top Blockchains by Annual Fee Revenue

- Ethereum dominates with $2.73 billion in annual transaction fees, the highest across all blockchains.

- Tron follows with $2.04 billion, highlighting its consistently high network usage.

- Bitcoin ranks third, generating $892.5 million in transaction fee revenue.

- Solana and BNB Chain recorded $374.3 million and $181.6 million in annual fees, respectively.

- Base leads emerging networks with $49.4 million in yearly fee revenue.

- Arbitrum and Optimism earned $33.2 million and $27.9 million, reflecting strong Layer 2 adoption.

- Avalanche and TON complete the top ten with $20.0 million and $15.9 million in annual fees.

Gas Fees Before and After Major Upgrades

- Before the Dencun upgrade, average gas prices soared to ~72 gwei; after, they dropped to ~2.7 gwei, about a 95% reduction year‑over‑year.

- Swap transaction costs fell from ~$86 to roughly ~$0.39 post‑Dencun, while NFT sale costs dropped from ~$145 to about ~$0.65.

- Prior to EIP‑1559, fees were determined by auction bids, often leading to unpredictable spikes. After the upgrade, fees became more stable with base fee burning.

- Post‑Merge fee volatility persists despite other benefits, underscoring that The Merge did not directly lower fees.

- Pre‑London hard fork gas price mechanisms were entirely auction‑based, while post‑EIP‑1559 introduced tip plus base fee structures, smoothing spikes.

- L2 upgrades following major hard forks increasingly absorb excess mainnet demand.

- Across major upgrades, total transactions across the ecosystem have grown, diluting per‑transaction cost pressure.

- Protocol changes continually balance throughput and fee levels as network demand evolves.

Impact of EIP‑1559 on Gas Fees

- EIP‑1559 replaced the traditional auction model with a base fee plus an optional priority tip, providing predictable pricing signals.

- A portion of the base fee is burned, effectively reducing the circulating ETH supply and creating deflationary pressure.

- Since EIP‑1559’s introduction, over 4 million ETH have been burned through base fee burns.

- This burn has removed over $10 billion worth of ETH from circulation based on historical values.

- Burn mechanisms help align user fee expenditure with long‑term tokenomics, influencing scarcity models.

- EIP‑1559’s structure has made fee estimation more reliable for users and wallets.

- The predictability introduced by EIP‑1559 has encouraged developers to optimize contract gas usage.

- Network fee revenues post‑EIP‑1559 remain meaningful, even with a lower average fee per transaction in 2025.

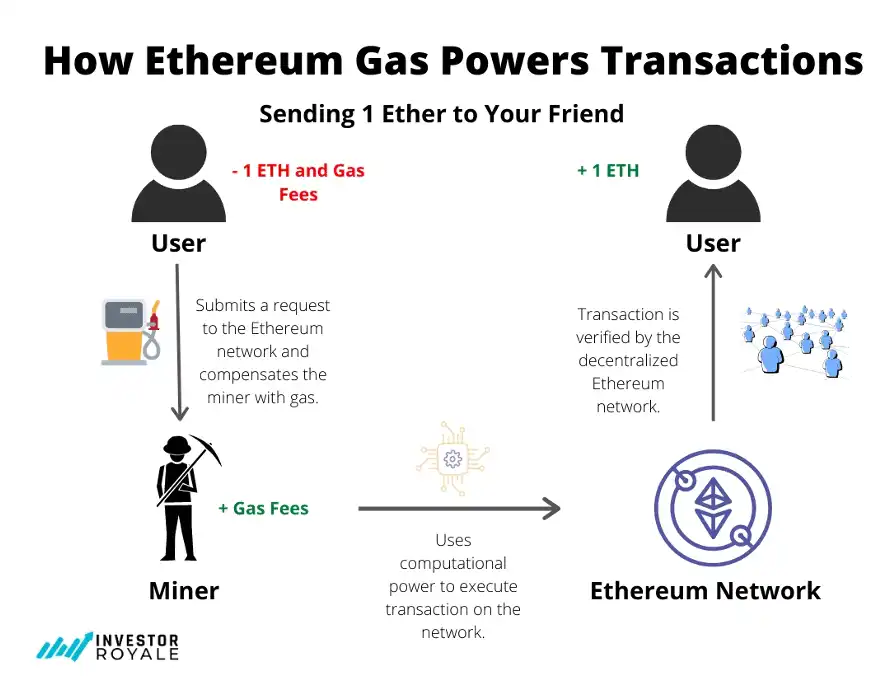

How Ethereum Gas Enables Transactions

- Sending ETH requires paying gas fees in addition to the 1 ETH transferred to process the transaction.

- The sender pays 1 ETH plus gas fees, while the receiver receives exactly 1 ETH.

- The transaction request is broadcast to the Ethereum network for processing and validation.

- Miners verify and execute the transaction using computational power and earn gas fees as rewards.

- Ethereum’s decentralized design ensures transactions remain secure, trustless, and verifiable.

- Gas fees incentivize miners, powering network operations and sustaining the Ethereum ecosystem.

Impact of The Merge on Gas Fees

- The Merge did not directly lower gas fees; its main effect was shifting Ethereum to proof‑of‑stake, not altering the fee market mechanism.

- It reduced Ethereum’s energy consumption by >99.9%, indirectly supporting broader scalability goals.

- By enabling future sharding and scaling upgrades, The Merge set the stage for systemic throughput improvements.

- Post‑Merge, transaction throughput became steadier, but congestion‑linked fee spikes still occur.

- The Merge improved network security and validator participation but did not introduce fee compression mechanisms.

- Subsequent upgrades built on Merge’s PoS foundation to tackle gas fee challenges more directly.

- The effectiveness of fee stabilization relies primarily on later proposals like EIP‑1559 and Dencun.

- Merge’s primary legacy remains sustainability and preparation for Ethereum’s scaling roadmap.

Ethereum Gas Fees vs Layer 2 Networks

- Layer 2 networks such as Arbitrum, Optimism, and Base process transactions off‑chain, then batch‑settle on Ethereum, reducing costs by 10×–100× compared with mainnet.

- On many Layer 2 solutions in 2025, average transaction fees range from ~$0.05 to $0.30, far below typical mainnet costs.

- Arbitrum One often shows fees near $0.05–$0.30 per transaction.

- zkSync Era has some of the lowest Layer 2 gas fees, frequently under $0.10.

- Optimism generally runs slightly higher than zkRollups but still in the tens of cents range per tx.

- Base, Coinbase’s Layer 2, combines cheap fees with deep exchange integrations, often < $0.50 per tx.

- Layer 2s carry much of DeFi transaction volume, lowering mainnet congestion and indirectly reducing average fees.

- Despite lower costs, some L2s see persistent demand for blockspace, especially where speculative or MEV activity concentrates.

- Many wallets now default to L2 postings if gas prices are low there, further migration from L1.

Ethereum Gas Fees vs Other Blockchains

- Compared with chains like Nano and IOTA, which often offer zero or near‑zero fees, Ethereum’s gas remains higher even after reductions.

- Stellar and Ripple (XRP) boast micro‑fees often below $0.00001–$0.00003, trivial compared with Ethereum.

- Solana keeps fees around ~$0.00025, enabled by its high-throughput architecture.

- Algorand typically clocks fees near $0.0002, supporting transaction throughput with minimal cost.

- Polygon’s PoS sidechain (EVM‑compatible) often averages ~$0.002 per tx, making it far cheaper than Ethereum L1 yet still compatible with many dApps.

- Avalanche (AVAX) transactions are commonly ~$0.02, again far below Ethereum’s mainnet levels.

- On pure value chains (e.g., Tron), fees are near‑zero while still supporting stablecoin and token transfers.

- Even with periodic spikes, Ethereum’s fees remain higher due to smart contract demand and blockspace competition.

- Some specialized chains (e.g., Nano) intentionally subsidize or eliminate fees to support micropayments and IoT use cases.

Gas Fee Volatility and Spikes

- Average gas fees dropped 95% from 72 gwei to 2.7 gwei post-Dencun upgrade.

- Peak fees hit $112,745 for a single transaction during extreme congestion.

- Daily gas fees declined 70% from $23 million to $7.5 million.

- Gas prices spiked 10-20x during MEV bot gas wars.

- Record low gas reached 0.067 gwei in November.

- Complex DeFi transactions peaked above $95 during congestion.

- Fees surged to 200+ gwei during NFT drops and token launches.

- Average swap costs fell to $0.39 from $86 yearly prior.

- Network revenue from fees hit $1.42 billion in Q1.

Highest and Lowest Gas Fee Records

- Ethereum’s highest recorded gas fees were during NFT/DeFi peaks, exceeding 500 gwei, costing some users over $100+ per tx.

- Early historical highs like the 2017–2018 bull run saw average fees persistently high relative to expectations.

- In contrast, off‑peak fees in 2025 often dip to low single‑digit gwei, making simple transfers inexpensive.

- Extremely low fee periods correlate with minimal network demand and off‑peak hours.

- Layer 2 transactions have set informal low benchmarks below $0.01 due to batching efficiencies.

- Some specialized blockchains (e.g., Nano) report near‑zero fees as their practical low bound.

- Peak volatility snapshots remain useful for benchmarking network stress events.

- Gas pricing history informs user expectations and strategic timing decisions.

Fee Revenue and Burned ETH Statistics

- 4.6 million ETH burned since EIP-1559 including 870,000 ETH in Q1-Q3.

- Ethereum network revenue reached $1.42 billion in Q1.

- Average daily ETH burned totals 10,200 ETH, rising during high activity.

- $13.5 billion worth of ETH has been burned since 2021 via EIP-1559.

- 9,463 ETH burned in one month, valued at $32.2 million.

- Annual fee revenue leads all chains at $2.73 billion.

- Daily gas fees average $6.3-$7.5 million post-peak declines.

- Q3 fees declined 11% in ETH but rose 6% in dollar value.

- Mainnet fees dropped to $500K/month as L2s capture 94% margins.

Frequently Asked Questions (FAQs)

The average Ethereum gas fee in 2025 ranges between $0.30 and $0.50 per transaction.

The average gas price on Ethereum fluctuates between 0.5 and 2.5 gwei during normal network conditions in 2025.

A standard ETH transfer costs between $0.20 and $0.60, depending on network congestion.

Conclusion

Ethereum’s gas fee landscape reflects a dramatic transformation. Mainnet fees are far lower than before, thanks to upgrades and scaling adoption, yet volatility remains a constant factor tied to network demand. Layer 2 networks consistently offer cheaper alternatives, while comparisons with other blockchains show Ethereum’s cost remains higher but increasingly optimized for real‑world use cases. Gas fee records, both high and low, underscore network stress and efficiency findings, and fee revenue plus burn metrics contribute to evolving tokenomics.