Dogecoin (DOGE) stands out as one of the most talked‑about cryptocurrencies, blending meme‑culture origins with mainstream asset dynamics. Originally launched in 2013 as a light‑hearted alternative to Bitcoin, Dogecoin has evolved into a high‑volume digital asset traded across global markets. Its price trends influence retail trading behavior, while its large market cap keeps it relevant among seasoned investors as well.

From tipping content creators online to serving as a hedge in speculative portfolios, Dogecoin’s real‑world applications span both community engagement and financial experimentation. Explore the detailed statistics that map Dogecoin’s journey this year and beyond.

Editor’s Choice

- DOGE currently ranks among the top 10 crypto assets by market capitalization.

- Live price around $0.12–$0.14 in early 2026.

- Market cap near $20‑21 billion, reflecting meme coin demand.

- Bullish scenarios projecting up to $0.45 potential in 2026 under strong market expansion.

- Bearish outlooks suggest potential lows near ~$0.08 if volatility persists.

- Analyst forecasts show mixed medium‑term trends, emphasizing volatility.

Recent Developments

- DOGE has surged in short bursts, with notable price jumps of ~10% in early January 2026.

- Broader meme coin rallies have boosted DOGE’s visibility among retail traders recently.

- Price oscillations show periods of consolidation around key technical levels.

- Analysts remain split on DOGE’s trajectory, balancing bearish pressure with bullish scenarios.

- Community activity on social platforms continues to correlate with price swings.

- Institutional interest remains limited compared to Bitcoin and Ethereum.

- Macroeconomic trends in crypto markets shape DOGE’s investor sentiment.

- Meme coin performance influences risk appetite across crypto portfolios.

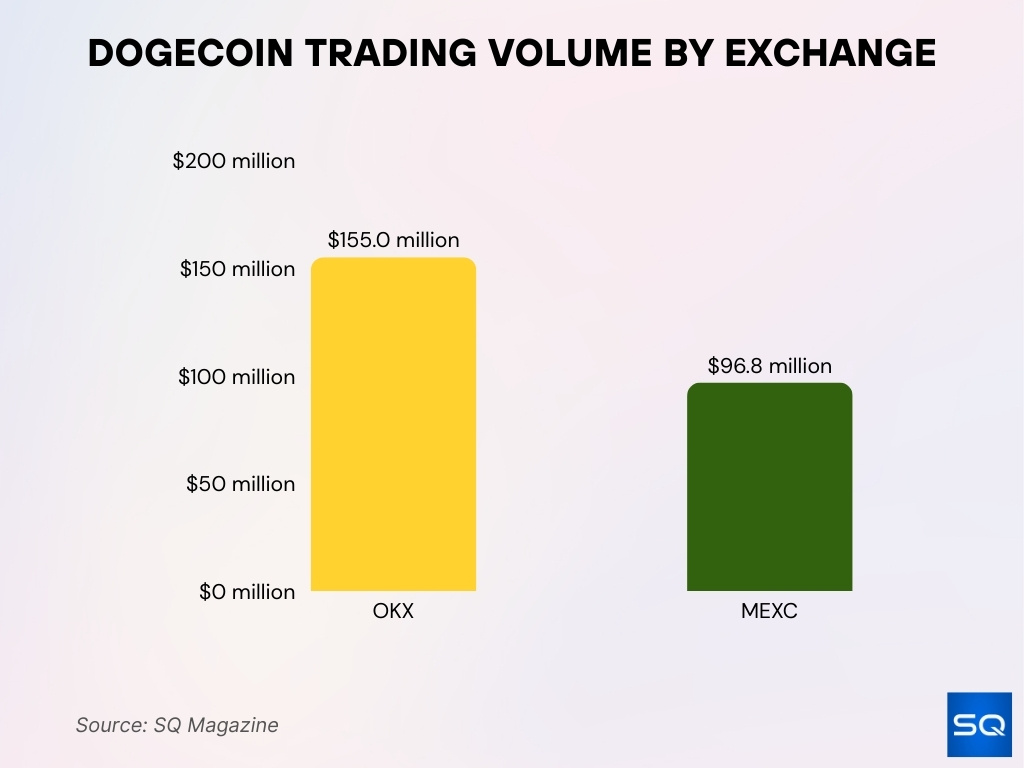

Dogecoin Trading Volume

- Global exchanges like OKX ($155 million) and MEXC ($96.8 million) reflect broad DOGE activity.

- 24-hour DOGE trading volume is currently around $1.0 billion, fluctuating near the $0.9–$1.1 billion range on major exchanges.

- Volume spiked 127% to $3.41 billion during the early 2026 price rally to $0.1405.

- Binance led with $315.6 million DOGE/USDT volume, showing activity across top platforms.

- Trading volume hit $1.53 billion on Jan 7 amid 17% price swing from $0.1453–$0.1536.

- Meme coin surge drove 16% weekly volume rise tied to community hype.

- A high ~168.5 billion circulating supply supports liquidity and frequent trading.

- Recent 55.8% volume increase signals high liquidity despite 11.8% 7-day dip.

- Volume fluctuated with sentiment, reaching $1.56 billion on Jan 22 at $0.1269.

Current Price and Market Cap

- DOGE price trades in a range of approximately $0.12 to $0.14 in Jan 2026.

- Live Dogecoin price ~ $0.122 as per recent price feeds.

- 24‑hour price swings show volatility, e.g., +3% to +10% moves at times.

- Market capitalization hovers around $20 billion–$21 billion.

- DOGE ranks around #9–#10 among all cryptocurrencies by market cap.

- Market cap translates to sustained institutional watchfulness.

- Price action reflects both retail speculation and technical barriers.

- Current capitalization remains well below peaks seen during past cycles.

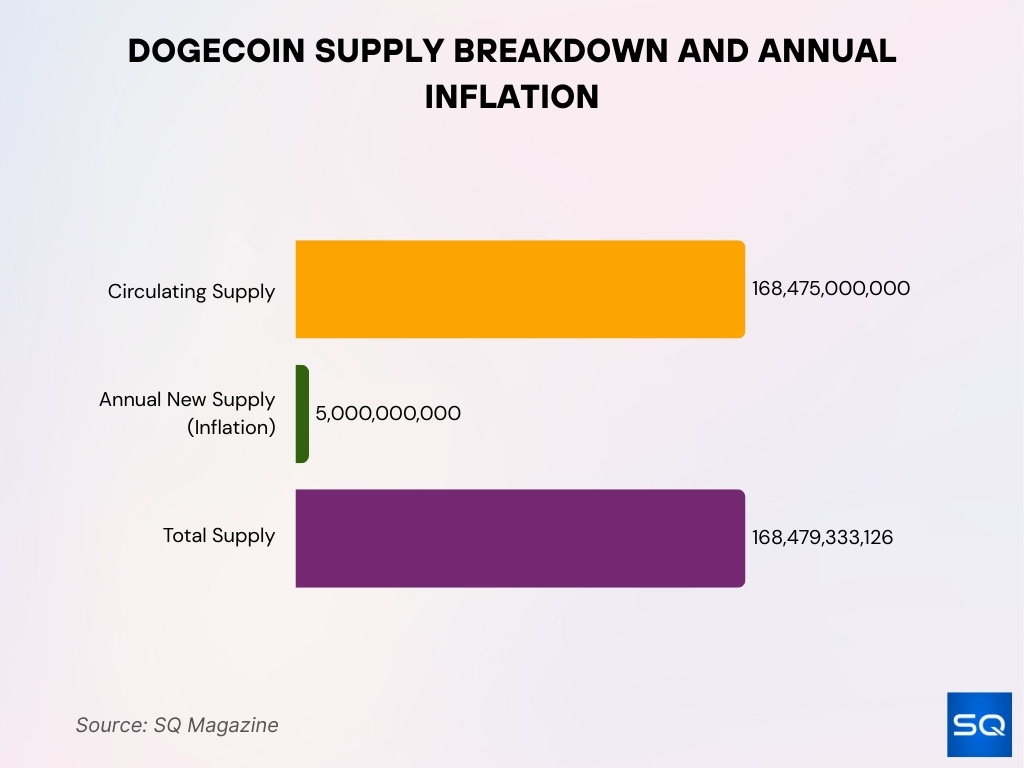

Circulating Supply

- Recent data confirms 168,475,000,000 DOGE precisely in circulation.

- The inflationary model sustains 5,000,000,000 DOGE new coins annually.

- 168,479,333,126 DOGE total drives everyday transaction volumes.

- Circulating supply stands at ~168.4 billion DOGE as of late January 2026.

- Annual inflation adds 5 billion DOGE through consistent block rewards.

- No maximum supply cap ensures perpetual ~3-4% yearly expansion.

- The high 168.37-168.48 billion range reflects the unlimited issuance model.

- ~168.5 billion tradable tokens reduce scarcity versus fixed-supply peers.

- Supply growth influences forecasts with an ongoing ~74 billion increase since 2015.

Total and Max Supply

- No capped maximum supply with continual coin addition through mining rewards.

- Annual inflation is fixed at 5 billion DOGE added yearly via block rewards.

- Total supply reaches 168.48B DOGE, matching circulating with no burns.

- Unlimited supply contrasts with Bitcoin’s 21 million cap model.

- ~3-4% inflation rate decreases proportionally as supply grows.

- Ongoing issuance of 5,000,000,000 DOGE/year pressures long-term valuations.

- 168.49B DOGE total reflects perpetual expansionary tokenomics.

- High inflation factored into models expecting sustained supply growth.

- Lack of max supply adds risk versus deflationary cryptocurrencies.

All-Time High and Low

- All-time high price reached $0.7316 on May 8, 2021, marking the peak meme coin rally.

- All-time low recorded at $0.0000869 on May 6, 2015, during the early trading phase.

- Current price ~$0.122 remains ~83% below the $0.7316 ATH amid 2026 market fluctuations.

- 989x appreciation from ATL demonstrates an extreme meme-coin volatility profile.

- 2025 surge hit $0.46 three-year high tied to the U.S. DOGE department announcement.

- 75% below the 2021 peak reflects persistent post-rally correction patterns.

- Recent range shows $0.17–$0.46 swings, highlighting speculative risk dynamics.

- Historical extremes shape trader sentiment with 130% annual gains in bull phases.

- 83.21% ATH discount underscores meme-coin risk versus stablecoin benchmarks.

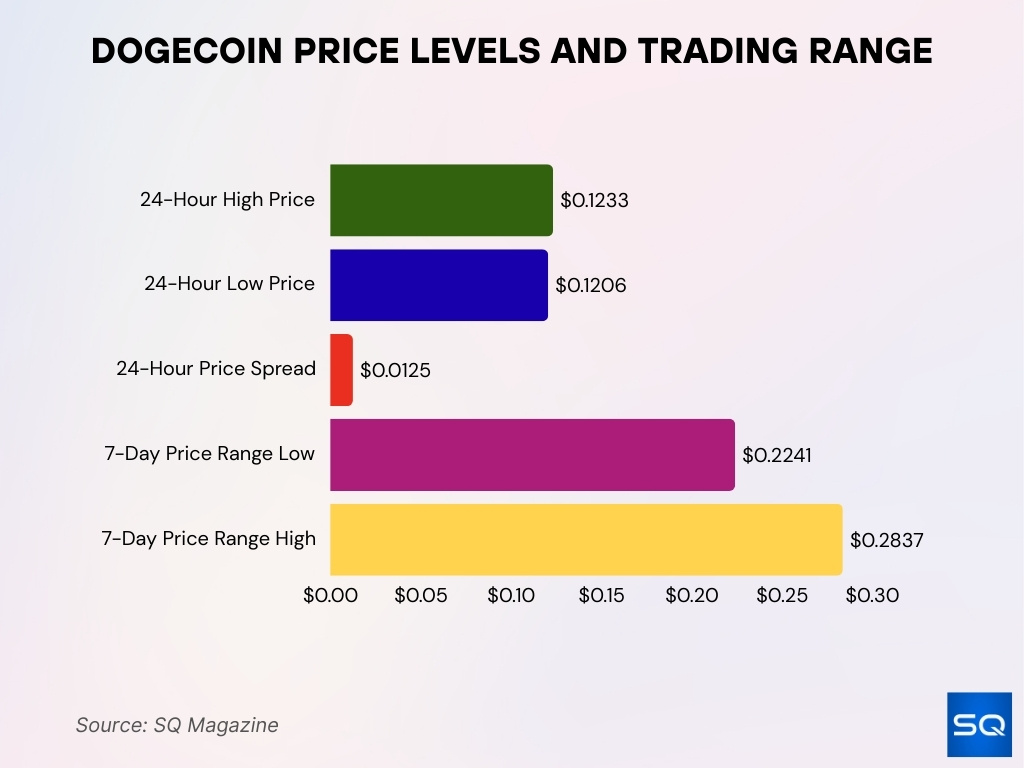

24-Hour Price Range

- 24-hour high reached ~$0.1233 with a low at ~$0.1206 amid a modest daily gain.

- 1.1% price rise within tight bounds signals a consolidation phase.

- 7-day range widened to $0.2241–$0.2837 or 26.6% volatility.

- $0.0125 spread from low to high demonstrates stable short-term movement.

- Day-to-day variation is smaller than 66.9% ATH discount but notable.

- Technicals confirm low fluctuations versus 11.8% weekly decline.

Historical Performance

- 2021 peak hit $0.73 ATH before 85% correction into the 2022 bear market.

- 2025 rallied +130% yearly, reaching $0.42 high amid ETF speculation.

- The recent $0.120–$0.140 range shows high‑single‑digit monthly volatility persistence.

- Trading volumes expanded to $6 billion during $0.218–$0.253 recovery swings.

- 989x gain from $0.000087 2015 low underscores meme-coin resilience.

- 2025 settled -11.8% weekly after $0.52 billion market cap peak near $0.24.

- Cycles mirror Bitcoin with 216% single-day spikes tied to social catalysts.

- $0.002–$0.73 decade range defines an extreme speculative performance profile.

- Recent $3.56 billion volume accompanied -1.76% daily amid broader crypto trends.

7-Day Performance

- DOGE declined -11.8% over the past 7 days amid market consolidation.

- 7-day low hit $0.2241 while high reached $0.2837 for 26.6% range.

- Weekly trading volume averaged $2.8 billion during the price dip phase.

- -7.6% alternative 7-day drop reflects meme-coin sentiment cycles.

- Muted swings versus -1.8% 30-day and +45% yearly trends.

- Bearish pressure coincided with the $1.9 billion lowest daily volume.

- Technicals signal consolidation after 17% intraday volatility peaks.

Token Utility

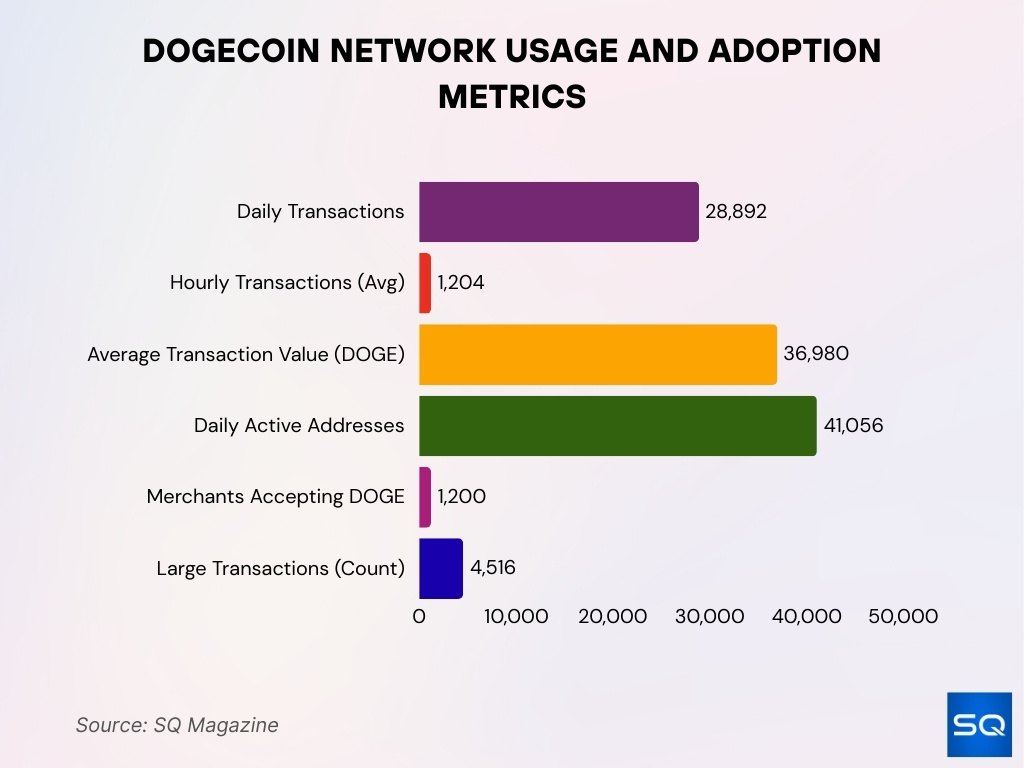

- Network processes 28,892 daily transactions, averaging 1,204 hourly, with $130.2 million value transferred.

- Average transaction value reaches 36,980 DOGE ($4,506) while median stays low at 14.39 DOGE ($1.75).

- 41,056 active addresses daily reflect growing adoption for everyday currency use.

- 1,200+ online merchants accept DOGE via BitPay and CoinGate payment gateways.

- 4,516 large transactions totaling 4.52 billion DOGE ($550 million) show institutional utility.

30-Day and Yearly Changes

- 30-day performance down -1.8% with range $0.2241–$0.2873 or 28.1% volatility.

- Yearly gain stands at +45.2% amid meme-coin market recovery trends.

- 30-day volume averaged $2.9 billion during a slight downtrend phase.

- -7.6% alternative monthly decline versus stablecoin benchmarks.

- The annual profile shows 130% 2025 peaks tapering to current levels.

- DOGE outperforms Ethereum‘s +32% yearly but trails Solana’s +78%.

- Monthly shifts are sharper at 28.1% range than 11.8% weekly swings.

- Sentiment-driven 17% intraday moves accelerate 30-day variations.

- +45.2% YTD reflects resilience post -85% 2022 correction.

Price Predictions

- Average 2026 forecast at $0.2066 with bullish growth above current levels.

- January projections range $0.116–$0.120, signaling short-term consolidation.

- February peaks near $0.151 or +24.5% from the current amid gradual gains.

- Conservative models predict +5% rise to $0.122 over the next 30 days.

- Bullish scenarios target $0.22–$0.30 peaks under favorable catalysts.

- Bearish outlook holds $0.08 support amid supply pressure risks.

- Long-term end-2026 average $0.175 with +43% potential ROI.

- March consensus average $0.208 versus $0.127–$0.289 range.

- Analysts cite sentiment for a wide $0.116–$0.151 monthly forecast span.

Market Rank

- DOGE holds a steady #9 position on CoinMarketCap with $20.55 billion market cap.

- CoinGecko ranks DOGE at #8–#10 among top cryptocurrencies globally.

- Sustained top 10 status reflects $3 billion daily trading interest.

- $20.63 billion cap secures #9 ranking amid meme coin competition.

- Rank stability was maintained despite 11.8% weekly price fluctuations.

- Top-tier visibility drives listings across 200+ global exchanges.

- Rare meme coin in the top 10 outside BTC/ETH dominance.

- #9 globally positions DOGE for institutional investor attention.

- Liquidity context from a $21.4 billion cap supports exchange prominence.

Fully Diluted Valuation

- FDV equals market cap at $36.16 billion with 168.48 billion total supply.

- Theoretical valuation matches $20.73 billion given the unlimited supply model.

- $23.63 billion FDV reflects no token inflation impact versus capped assets.

- 168.48 billion DOGE total supply drives FDV parity with circulating metrics.

- Continuous 5 billion annual issuance shifts FDV higher over time.

- $20.73–$36.16 billion range compares to Bitcoin’s fixed $2 trillion benchmark.

- Inflationary FDV growth warns of value dilution absent demand increases.

- Institutional metrics favor a $23.73 billion scale despite supply expansion.

Exchanges and Markets

- DOGE is listed on 200+ centralized exchanges, including top global CEX platforms.

- Binance dominates with $315.6 million DOGE/USDT daily volume leadership.

- Coinbase, Kraken, and KuCoin support DOGE/USD and DOGE/BTC major trading pairs.

- OKX records $155 million, MEXC $96.8 million in 24-hour DOGE activity.

- High liquidity maintains tight bid-ask spreads across 150+ markets.

- Spot and perpetual futures are available on Bybit and OKX with leverage trading.

- DEX trades via wrapped DOGE on Uniswap and PancakeSwap cross-chain bridges.

- Exchange net inflows signal accumulation during $3 billion volume spikes.

- EDX Markets lists DOGE among institutional-grade digital asset instruments.

Community and Adoption

- Over 5.4 million unique Dogecoin wallet addresses with 152,000 active monthly.

- Active addresses surged 72% recently, surpassing 90 million total holders.

- Retail wallets dominate at 72.3% of addresses, showing broad individual adoption.

- 4,700 wallets hold over 1 million DOGE each, up 12% year-over-year.

- 56% of holders are currently in profit, reflecting strong community conviction.

- 41% long-term holders over 1 year support meme coin resilience narrative.

- 39,000 daily transactions with 1.3 million weekly peak from NFT campaigns.

- 1,200+ online retailers accept DOGE payments via gateways like BitPay.

Where to Buy Dogecoin

- Binance leads with $315.6 million DOGE/USDT volume across 200+ global CEX platforms.

- Coinbase supports direct DOGE/USD purchases via bank transfer and debit/credit cards.

- Kraken offers DOGE/BTC and DOGE/USDT pairs with low-fee accumulation strategies.

- KuCoin provides 150+ DOGE trading pairs, including stablecoin and futures markets.

- OKX records $155 million 24-hour volume for secure self-custody transfers.

- MEXC handles $96.8 million daily with portfolio tracking and DCA tools.

- 200+ custodial exchange wallets versus hardware self-custody security options.

- Regional compliance is required before bank/SEPA deposits on major platforms.

- Bybit enables perpetual futures alongside spot DOGE/USD quick purchases.

Frequently Asked Questions (FAQs)

Dogecoin’s market cap is about $20.6 billion.

The circulating supply is around 168.48 billion DOGE.

DOGE’s price has declined by about ‑4.66% over 7 days.

Some price models indicate a possible low of around $0.1127 in 2026.

Conclusion

Dogecoin remains a dynamic and widely held cryptocurrency with strong liquidity, broad exchange support, and an active global community. Its inflationary supply model and lack of max cap distinguish it from deflationary peers, shaping how traders and holders view long‑term value. DOGE’s adoption extends beyond speculation into payments, microtransactions, and online tipping, though deeper utility in DeFi and enterprise use cases is still developing.

Across markets, price forecasts vary from conservative to bullish ranges, underscoring Dogecoin’s speculative and sentiment‑driven nature. As regulatory clarity and merchant acceptance evolve, DOGE’s role in the crypto landscape will continue to be defined by both its cultural roots and practical use cases.